- Home

- »

- Automotive & Transportation

- »

-

APAC E-bikes Market Size And Share, Industry Report, 2030GVR Report cover

![APAC E-bikes Market Size, Share & Trends Report]()

APAC E-bikes Market (2025 - 2030) Size, Share & Trends Analysis Report By Propulsion Type (Pedal Assisted, Throttle Assisted), By Battery Type, By Power, By Application (Trekking, Cargo), By Country, And Segment Forecasts

- Report ID: GVR-4-68039-915-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

APAC E-bikes Market Size & Trends

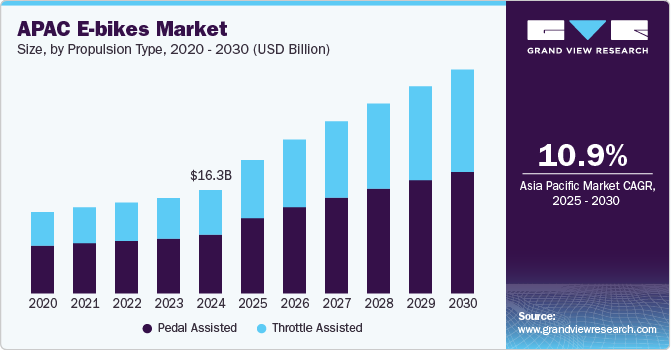

The APAC e-bikes market size was estimated at USD 16.27 billion in 2024 and is expected to grow at a CAGR of 10.9% from 2025 to 2030. The rapid urbanization in the region drives the growth of the market. As cities expand and traffic congestion worsens, e-bikes provide an efficient and cost-effective solution for short to medium commutes. They are often seen as an alternative to traditional scooters and cars, offering greater flexibility in navigating congested streets. This is particularly attractive in densely populated cities where parking and maneuvering large vehicles can be a challenge.

Environmental sustainability also drives the growth of the regional market. With growing awareness of climate change and the harmful effects of vehicle emissions, consumers and governments alike are prioritizing green transportation solutions. E-bikes, being electric, contribute to lowering carbon emissions, reducing air pollution, and addressing environmental concerns. This is particularly important in highly polluted cities. As a result, many local governments are incentivizing the adoption of e-bikes through subsidies, tax incentives, and the creation of bike-friendly infrastructure.

Moreover, technological advancements in battery efficiency and electric motor performance have also made e-bikes more appealing to consumers. Modern e-bikes come with longer battery life, faster charging times, and improved durability, which make them more reliable for daily use. These innovations are crucial in addressing concerns about range limitations, enabling e-bikes to compete with more traditional forms of motorized transport.

In addition, government initiatives across the region are supporting the growth of e-bikes. Several countries have implemented policies to promote electric mobility, offering financial incentives and regulatory support for manufacturers and consumers alike. In China, for example, strict regulations on internal combustion engines in urban areas have driven the adoption of electric two-wheelers, while other nations are following suit with similar measures to reduce their carbon footprints. These factors collectively fuel the expansion of the e-bike market across the Asia Pacific.

However, inadequate charging infrastructure in the region restrains the growth of the market. The convenience and efficiency of e-bikes largely depend on access to charging stations, particularly for users who ride longer distances. Many countries in the region have yet to develop a robust electric vehicle (EV) charging network, which discourages potential buyers from switching to e-bikes. The absence of widespread, easily accessible charging stations makes it difficult for e-bike users to charge their batteries, reducing the appeal of these vehicles.

Propulsion Type Insights

The pedal-assisted segment led the market and accounted for 56.9% of the global revenue in 2024. Urban mobility challenges, such as increasing traffic congestion and limited parking, are fueling the growth of the pedal-assisted e-bikes, often referred to as pedelecs. As cities grow more crowded, commuters are looking for practical and efficient alternatives to cars and public transport. Pedal-assisted e-bikes offer a faster, more convenient option for navigating city streets and avoiding traffic jams.

The throttle-assisted segment is expected to register significant growth from 2025 to 2030. The rise in recreational cycling is driving the growth of the market. Many consumers purchase these e-bikes for weekend rides, exploring scenic routes, or outdoor adventures, as they provide a fun and versatile experience. The ability to switch between manual pedaling and throttle assistance adds to the appeal, allowing riders to enjoy both exercise and motorized assistance when needed.

Battery Type Insights

The lead-acid battery segment accounted for the largest revenue share in 2024. This can be attributed to the several benefits of lead-acid batteries, including robustness, tolerance to abuse, and low cost. However, the adoption of these batteries is predicted to decline in the near future as they are bulky and discharge rapidly, even without handling heavy loads.

The lithium-ion battery segment is expected to register significant growth from 2025 to 2030. The increasing demand for high-performance batteries drives the growth of the market. Li-ion batteries offer several advantages over traditional lead-acid batteries, including higher energy density, longer life cycles, and faster charging times. E-bikes equipped with Li-ion batteries provide longer ranges on a single charge and better performance, making them more attractive to consumers looking for efficient and reliable urban transportation.

Power Insights

The less than and equal to 250W segment accounted for the largest revenue share in 2024. E-bikes with a power of less than equal to 250W can be driven in the city as well as high and steep areas for recreational as well as fitness purposes. Furthermore, the low power output required by the bikes reduces the need for frequent charging of the vehicle.

The above 250W segment is expected to register significant growth from 2025 to 2030. Consumers are seeking e-bikes that offer higher speed, greater acceleration, and improved hill-climbing ability. While e-bikes with motors below 250W are sufficient for flat terrains and shorter commutes, those with more powerful motors excel in tackling steep inclines and uneven terrain. This enhanced power is particularly attractive to users in hilly regions or those who require longer daily commutes, as it allows for greater comfort and faster travel times.

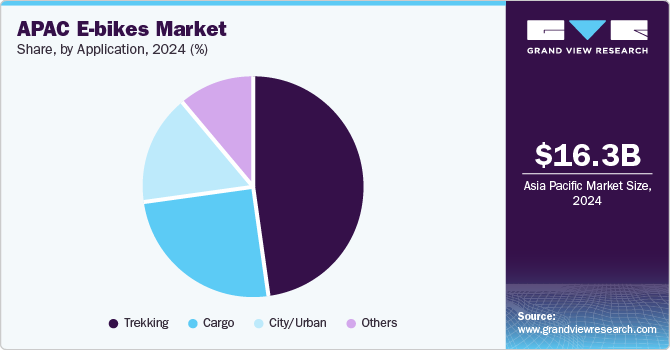

Application Insights

The trekking segment accounted for a significant revenue share in 2024. The growing popularity of outdoor and adventure activities is driving the growth of the market. As more people seek to reconnect with nature and explore scenic landscapes, trekking e-bikes offer a versatile and exciting option for outdoor enthusiasts. Trekking e-bikes allow riders to explore more remote and challenging trails that would otherwise be inaccessible to casual cyclists.

The cargo segment is expected to grow significantly from 2025 to 2030. The increasing demand for e-bikes to carry some luggage from one place to another is expected to support the growth of the segment during the forecast period. Furthermore, the surge in logistics and freight activities in countries including India and China could drive the demand for e-bikes, enhancing the market share.

Country Insights

China E-bikes Market Trends

The China e-bikes market is anticipated to register significant growth from 2025 to 2030. The rising number of manufacturing units and IT companies and the surge in a tech-savvy and urban population in the country are expected to drive growth. Furthermore, the low cost of raw materials and the availability of cheap labor in the country are factors likely to provide lucrative growth opportunities.

India E-bikes Market Trends

The e-bikes market in India is poised for significant growth from 2025 to 2030. Numerous technological improvements, along with an ever-developing charging infrastructure in the country are expected to support market growth over the forecast period as well. The rising demand for eco-friendly transportation and the support offered by government initiatives are anticipated to drive the growth of the Indian e-bike market.

Japan E-bikes Market Trends

The Japan e-bikes market is poised for significant growth from 2025 to 2030. The rise of the aging population in Japan drives the growth of the market. Japan has one of the world’s largest elderly populations, and many older adults seek convenient, low-impact forms of transportation. E-bikes, which provide pedal assistance, are appealing to this demographic because they reduce the physical strain of cycling, making it easier to cover longer distances or navigate hilly terrain. This allows elderly individuals to maintain independence in their daily lives while still enjoying the health benefits of light exercise.

Key APAC E-Bikes Company Insights

Some key companies in the market include Aima Technology Group Co. Ltd., Merida Industry Co. Ltd, and others. Organizations are focusing on increasing the customer base to gain a competitive edge in the industry. Therefore, prominent players are taking numerous strategic initiatives, such as partnerships, mergers, and acquisitions with other major companies.

-

Aima Technology Group Co., Ltd. specializes in the research, development, manufacturing, and sales of electric bicycles and related products. The company operates multiple production lines with an annual output exceeding 2 million units, catering to both domestic and international markets. It offers a diverse range of electric mobility products, primarily focusing on electric bicycles, electric mopeds, and electric motorcycles.

-

Merida Industry Co. Ltd. is a manufacturer of bicycles with a strong global presence in over 77 countries.Merida specializes in various types of bicycles, including mountain bikes, road bikes, and electric bicycles, catering to diverse consumer needs.

Key APAC E-Bikes Companies:

- Accell Group N.V.

- AIMA Technology Group Co., Ltd.

- Giant Manufacturing Co. Ltd.

- Merida Industry Co. Ltd

- Pedego Electric Bikes

- Pon.Bike

- Rad Power Bikes LLC

- Trek Bicycle Corporation

- Yadea Group Holdings Ltd

- Yamaha Motors Company

Recent Developments

-

In September 2024, DAEWOO India partnered with eBikeGo, a prominent electric mobility platform, to revolutionize the personal electric mobility market over the next five years. This strategic collaboration aims to develop and launch a new range of electric bikes specifically designed for urban commuters, combining DAEWOO's global expertise with eBikeGo's innovative manufacturing capabilities.

-

In September 2024, Gojek partnered with Selex Motors to expand its electric motorbike initiative in Vietnam, introducing Selex Camel electric motorbikes into its services, including GoRide, GoFood, and GoSend.The Selex Camel models are equipped with battery-swapping technology, allowing drivers to exchange depleted batteries at over 70 stations across Hanoi and Ho Chi Minh City in just two minutes. This collaboration aims to enhance the sustainability of Gojek's operations while supporting the company's commitment to transitioning its fleet to 100% electric vehicles by 2030.

APAC E-bikes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 21.03 billion

Revenue forecast in 2030

USD 35.27 billion

Growth rate

CAGR of 10.9% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Propulsion type, battery type, power, application, country

Regional scope

Asia Pacific

Country scope

China; India; Japan

Key companies profiled

Accell Group N.V.; AIMA Technology Group Co., Ltd.; Giant Manufacturing Co. Ltd.; Merida Industry Co. Ltd; Pedego Electric Bikes; Pon.Bike; Rad Power Bikes LLC; Trek Bicycle Corporation; Yadea Group Holdings Ltd; Yamaha Motors Company

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

APAC E-bikes Market Report Segmentation

The report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the APAC e-bikes market report based on propulsion type, battery type, power, application, and country.

-

Propulsion Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Pedal Assisted

-

Throttle Assisted

-

-

Battery Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Lithium-ion Battery

-

Lead-acid Battery

-

-

Power Outlook (Revenue, USD Million, 2018 - 2030)

-

Less than and Equal to 250W

-

Above 250W

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

City/Urban

-

Trekking

-

Cargo

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Frequently Asked Questions About This Report

b. The global APAC e-bikes market size was estimated at USD 16.27 billion in 2024 and is expected to reach USD 21.03 billion in 2025.

b. The global APAC e-bikes market is expected to grow at a compound annual growth rate of 10.9% from 2025 to 2030 to reach USD 35.27 billion by 2030

b. Pedal assisted segment dominated the APAC e-bikes market with a share of 56.9% in 2024.

b. Some key players operating in the APAC e-bikes market include Accell Group N.V., Giant Manufacturing Co. Ltd., AIMA Technology Group Co. Ltd., Pedego Electric Bikes, Merida Industry Co. Ltd, Pon.Bike, Trek Bicycle Corporation, Rad Power Bikes LLC, Yadea Group Holdings Ltd., and Yamaha Motor Company

b. Key factors that are driving the APAC e-bikes market growth include a surge in awareness about the harmful effects of vehicles that run on fossil fuels is also encouraging this trend. Additionally, governments emphasize constructing bicycle-friendly streets, thereby encouraging individuals to choose bicycles as a key mode of commute

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.