- Home

- »

- Homecare & Decor

- »

-

Asia Pacific Luxury Travel Market Size, Share, Report, 2030GVR Report cover

![Asia Pacific Luxury Travel Market Size, Share & Trends Report]()

Asia Pacific Luxury Travel Market (2024 - 2030) Size, Share & Trends Analysis Report By Tour (Customized & Private Vacations, Safari & Adventure), By Age-group (21-30, 41-60), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-199-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Asia Pacific Luxury Travel Market Trends

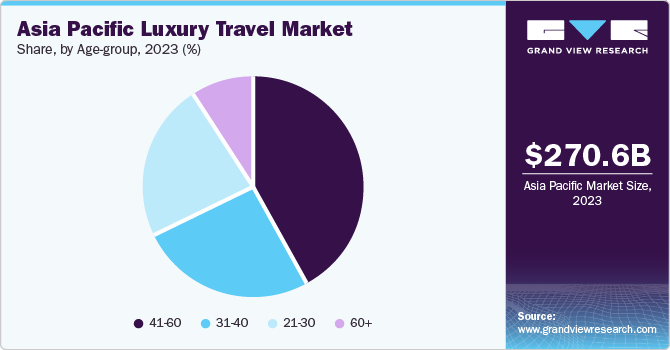

The Asia Pacific luxury travel market size was estimated at USD 270.64 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 8.6% from 2024 to 2030. The growing popularity of tourism among population owing to high spending capacity is anticipated to boost market growth. Furthermore, the rising awareness about the importance of cultural destinations across the region is accelerating the market growth. Presence of luxury resorts, extraordinary sightseeing, tradition & culture, and foods are the attractions points of tourists, which is significantly boost the market growth over the forecast period.

The Asia Pacific travel market accounted for 19.7% share of the global luxury travel market revenue in 2023. Tourism is one of the most important sectors contributing to the region's GDP growth, accounting for 10% of the region’s overall GDP on an average. Increased economic growth, disposable money and free time, political stability, and active tourism promotions, among other things, have all contributed to the rapid expansion of tourism. An increasingly interconnected world, as well as the relaxation of travel restrictions through services such as Visa on Arrival, has increased tourist traffic in Asia Pacific. According to a recent VISA analysis, more than 109 million Asian Pacific households would take at least one foreign travel every year by 2025, a 65% increase from 2015.

Partnerships between the governments and destination management organizations (DMOs) play an important role in driving the tourism industry, as demonstrated by the Thai government's 'We Travel Together' program, which was launched in July 2020 and allows Thai tourists to pay 60% of hotel room rates while the government subsidizes the rest, as well as 40% of the cost of an airline ticket. Singapore is also a notable example of the contingency of government involvement in tourism sustenance, as the country was ranked sixth globally in the Travel and Tourism Competitiveness Report published by WeForum in 2019 as a result of government prioritization, spending on travel and tourism, and marketing effectiveness.

Some of the most dominant types of luxury travel in the region are culinary travel, shopping, and safari and adventure. This region has diverse religions, cultures, and ethnicities in countries such as India, Vietnam, Malaysia, and Thailand. This cultural diversity further increased potential for gastronomy tourism and heritage tourism.The regional festivals celebrated in the region are a key attraction for luxury travelers who plan their trip specifically during the festive season to experience the traditional culture. Some of the most popular cultural, culinary, and shopping destinations in the region include - Hoi An Town, Vietnam; George Town, Malaysia; Inle Lake, Myanmar; Luang Prabang, Laos; Vigan, Philippines and Siem Reap, Cambodia

Market Concentration & Characteristics

The Asia Pacific luxury market is characterized by moderate degree of innovation, with businesses continuously focusing on differentiating themselves through unique experiences and offerings. Increasing need to improve region’s infrastructure and enhance its hospitality sector has driven a significant development in the sector. The government has made initiatives to boost domestic tourism and dissuade potential outbound visitors from taking a trip overseas. Renovation works and tourist management is also playing a vital role in the market growth.

The industry is also characterized by a moderate level of merger and acquisition (M&A) activity by the leading companies. This is due to several factors, supporting government regulations, increased investments by market companies, growing demand to construct tourist attractions across the region.

End-user concentration is a significant factor in the Asia Pacific luxury travel market. Presence of diverse religions, cultures, and ethnicities in countries such as India, Vietnam, Malaysia, and Thailand are attracting huge amount of tourists per year. Furthermore, Consumers in the age groups of 18-32 and 35-50 are the most enthusiastic travelers in the Asia Pacific region as they have the desire to enjoy new travel experiences with their loved ones. Luxury travel offers a wide range of opportunities, particularly for the younger generations, such as camping, glamping, and various adventure-based activities. These tourist attractions are expected to have a positive impact on the market over the forecast period.

Tour Insights

The luxury safari & adventure travel market held a revenue share of 32.27% in 2023.Luxury tents, are commonly known as Glamping. The presence of huge wildlife and national parks boost the popularity and acceptance of tents. A few luxury resorts have commenced business at the foot of the Himalayas for travelers who do not like the idea of camping in the wilderness without the comfort of a home or a hotel. Trends like these are expected to have a positive impact on the luxury travel market in Asia Pacific over the forecast period.

The luxury culinary travel & shopping market is expected to grow with a CAGR of 9.7% from 2024 to 2030 owing to the rising wave of innovative chefs and gastronomers as well as the increasing presence of restaurants serving regional and local cuisines. This has elevated the culinary travel & shopping experience for tourists in Asia Pacific. The region’s culinary ambassadors have been presenting cultural & traditional flavors to the world in an innovative manner and this is attracting more tourists to take on a luxury culinary trip to the country.

Age-group Insights

The participation of travelers between 41 to 60 years (41-60 age group) of age accounted to the market share of 41.67% in 2023. 41-60 travelers are healthy, wealthy, and independent, educated, and have an abundance of leisure time. They have a flexible budget and are becoming tech savvy to get the best deals and prevent hassles while planning luxury travel trips. This age group usually prefer cultural destinations which is boosting the market growth. According to UNESCO, there are 40 World Heritage Sites in India, of which 32 are cultural sites, seven are natural sites, and one is mixed, and another 49 are on the tentative list.

The participation of travelers between 21 to 30 years of age in luxury travel activities estimated to grow at a CAGR of 9.1% from 2024 to 2030.Increasing preference for trips that comprise active outdoor explorations and sightseeing as well as culinary experiences among the 21-30 age group in this region. Moreover, the increase in the income of the population, infrastructural developments, and an increase in the number of regions opening up to tourists due to globalization propel the market growth.

Country Insights

The presence of several tourist destinations such as exotic desserts, high buildings, modern infrastructure, wild life, beaches, and luxury hotels & cafes. Furthermore, increasing celebrity endorsement in the region and growing awareness of tours spots through social media such as Instagram, Facebook, and others are expected to boost market growth over the forecast period.

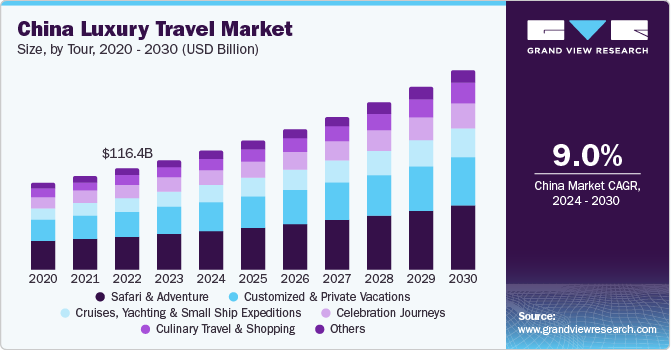

China Luxury Travel Market Trends

Luxury travel market in China has become a rapidly-growing trend over the past few years owing to the continued rise of independent travelers in the country. China accounts for the largest share in the regional market due to the increased spending of Chinese travelers on international trips. According to the United Nations World Tourism Organization (UNWTO), Chinese tourists spent USD 255 billion overseas in 2019, up from USD 10 billion in 2000. Travel has been the most popular activity among the affluent in China, with an increasing number of tourists traveling further away from the mainland and Hong Kong.

India Luxury Travel Market Trends

Luxury travel market in India has emerged as one of the most important hubs for the luxury travel sector. The tourism industry accounts for around 9% of the country's GDP. In 2019, tourism was the country's third-largest foreign exchange earner. The rapidly growing Indian economy offers numerous prospects for business tourism. The World Bank reports that India has surpassed Japan to become the world's third-largest economy in terms of purchasing power parity (PPP). In terms of PPP, India accounts for 6.4% of world GDP. The country's expanding economic climate is a key factor driving the growth and development of the tourism sector.

Key Asia Pacific Luxury Travel Company Insights

Some of the key companies operating in the market include TUI Group, Scott Dun, and Lindblad Expeditions Holdings, Inc.

-

TUI Group is available in more than 140 countries globally. It is available in all major holiday and city destinations and includes services such as excursions, activities, tickets, and transfers. This is done through the Musement and TUI websites and apps, as well as B2B partners, including the world's leading OTAs, tour operators, cruise lines, and travel companies.

-

Scott Dunn tour portfolio includes wildlife and safari, bucket list vacations, Antarctic expeditions, special occasions, learning vacations, honeymoon, and skiing. It offers tours for families, friends, and couples to regions such as Asia, Africa, Europe, Latin America, Indian Ocean, Australasia, and Antarctica.

Travel Edge, Butterfield & Robinson, Inc., andMicato Safaris are some of the other companies in the Asia Pacific travel market,

-

Butterfield & Robinson, Inc. designs journeys to various places in the world with a combination of lodgings, access, wines and food, and experienced guides. The trips combine active adventure with cultural immersion at top-notch global destinations. The options include biking, walking, family, golf, and multi-active itineraries, plus an unmatched custom trip planning division that features experts whose knowledge covers the globe.

-

Micato Safarisis a privately held company and a renowned provider of luxury tour and travel services. The company offers luxury African safaris and custom-crafted Africa and India trips. The company offers tour experiences and lodgings in destinations throughout East Africa, Southern Africa, and India. The company is a Nine-Time Winner of Travel & Leisure’s award for #1 World’s Best Safari Outfitter Travel & Leisure Hall of Fame.

Key Asia Pacific Luxury Travel Companies:

- TUI Group

- Lindblad Expeditions Holdings, Inc.

- Thomas Cook (India) Limited (Fairfax Financial Holdings Limited)

- Scott Dunn

- Abercrombie & Kent USA, LLC

- Exodus Travels Limited

- Travel Edge, Inc. (Navigatr Group)

- Butterfield & Robinson, Inc.

- Geographic Expeditions, Inc.

- Micato Safaris

Recent Developments

-

In December 2022, TUI Group’s TUI Care Foundation launched the TUI Colourful Cultures Programme to protect the cultural heritage of Kenya and Turkey. This is a significant way of protecting the natural environment and empowering lives in these travel destinations, building on the potential of tourism as a force for good

-

In October 2022, Lindblad Expeditions announced the name of its next generation all-suite National Geographic Islander II at the Galápagos Islands. The ship features a Science Hub for guests to observe the exploration and conservation work carried out by the scientists on board.

Asia Pacific Luxury Travel Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 292.36 billion

Revenue forecast in 2030

USD 479.13 billion

Growth rate

CAGR of 8.6% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Tour, age-group, country

Regional scope

Asia Pacific

Country scope

India; Japan; China; Sri Lanka; Indonesia

Key companies profiled

TUI Group; Lindblad Expeditions Holdings, Inc.; Thomas Cook (India) Limited (Fairfax Financial Holdings Limited); Scott Dunn; Abercrombie & Kent USA, LLC; Exodus Travels Limited; Travel Edge, Inc. (Navigatr Group); Butterfield & Robinson, Inc.; Geographic Expeditions, Inc.; Micato Safaris

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Luxury Travel Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific luxury travel market report based on tour, age-group, and country:

-

Tour Outlook (Revenue, USD Billion, 2018 - 2030)

-

Customized & Private Vacations

-

Safari & Adventure

-

Cruises, Yachting & Small Ship Expeditions

-

Celebration Journeys

-

Culinary Travel & Shopping

-

Others

-

-

Age-group Outlook (Revenue, USD Billion, 2018 - 2030)

-

21-30

-

31-40

-

41-60

-

60+

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

Asia Pacific

-

India

-

Japan

-

China

-

Sri Lanka

-

Indonesia

-

-

Frequently Asked Questions About This Report

b. The Asia Pacific luxury travel market size was estimated at USD 270.64 million in 2023 and is expected to reach USD 292.36 million in 2024.

b. The Asia Pacific luxury travel market is expected to grow at a compound annual growth rate of 8.6% from 2024 to 2030 to reach USD 479.13 million by 2030.

b. Luxury safari & adventure travel dominated the Asia Pacific luxury travel market with a share of more than 46.2% in 2023. A few luxury resorts have commenced business at the foot of the Himalayas for travelers who do not like the idea of camping in the wilderness without the comfort of a home or a hotel. Trends like these are expected to have a positive impact on the luxury travel market in Asia Pacific over the forecast period.

b. Some key players operating in the Asia Pacific luxury travel market include TUI Group; Lindblad Expeditions Holdings, Inc.; Thomas Cook (India) Limited (Fairfax Financial Holdings Limited); Scott Dunn; Abercrombie & Kent USA, LLC; Exodus Travels Limited; Travel Edge, Inc. (Navigatr Group); Butterfield & Robinson, Inc.; Geographic Expeditions, Inc.; Micato Safaris

b. Key factors that are driving the Asia Pacific luxury travel market growth include the growing popularity of tourism among the population owing to high spending capacity is anticipated to boost market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.