- Home

- »

- Consumer F&B

- »

-

Asia Pacific Plant-based Meat Market Size, Report, 2030GVR Report cover

![Asia Pacific Plant-based Meat Market Size, Share & Trends Report]()

Asia Pacific Plant-based Meat Market (2024 - 2030) Size, Share & Trends Analysis Report By Source (Soy, Pea, Wheat), By Product (Burgers, Sausages, Patties), By Type, By End-user, By Storage, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-199-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Asia Pacific Plant-based Meat Market Trends

The Asia Pacific plant-based meat market size was estimated at USD 1.37 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 19.7% from 2024 to 2030. Increasing customer interest in plant-based diets, along with the surging alertness for animal life rights through numerous welfare organizations is predicted to fuel the market growth during the forecast period.

Plant-based meat is turning out to be a vital part of a vegan diet. Consumers are predisposed towards veganism for health and moral reasons, while some other users are rooting for vegetarian ingredients in order to avert animal as well as to increase consumption of sustainable food & beverage products. Moreover, soy as a raw material contains of all the usual (nine) amino acids, which are indispensable for the nourishment of the human body. Its capability to boost the water absorption, anti-oxidation, emulsification, solubility, viscosity, and texture of the concluding product is anticipated to augment the demand for soy in plant-based meat products over the coming period.

Different plant-based meat products continue to rise in popularity, which expands and magnifies the category. Furthermore, the demand for plant-based pork, chicken, and seafood is escalating along with plant-based beef. The impressive growth of refrigerated plant-based meat is likely to continue in the upcoming years. It indicates a change in both, product innovation and merchandising tactics in the plant-based industry.

Several organizations such as PETA are actively campaigning to generate cognizance among people regarding animal cruelty during the processing of numerous meat products. For example, PETA India, in April 2021, persuaded KFC, Burger King and McDonald’s to launch vegan food items in order to encourage the consumption of animal cruelty-free products.

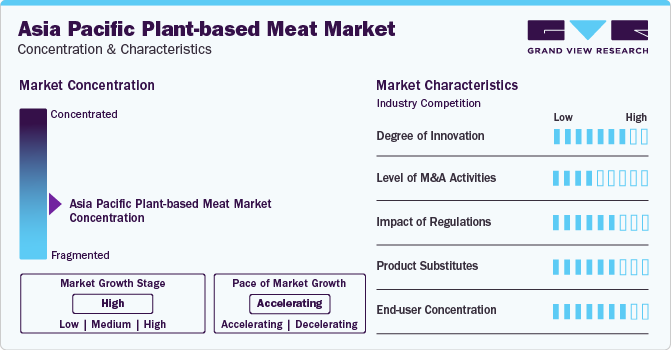

Market Concentration & Characteristics

The market growth stage is high, and the pace of growth is accelerating as plant-based meats have gained popularity globally, especially in Asia Pacific. The degree of innovation is high due to the constant innovations being carried out to achieve a perfect meat-like consistency product, along with its taste and aroma. Many companies are offering a varied portfolio of plant-based products to raise awareness about animal cruelty and stop its consumption.

The demand for plant-based meat from key countries in Asia Pacific such as China, Japan, India and so on encourages companies to involve in mergers and acquisitions to offer enhanced product portfolio to their consumers. Moreover, manufacturers are also required to follow specific protocols set up by regulatory organizations in order to maintain product quality.

There are various product substitutes that can be used. Various kinds of proteins extracted from peas, soy, wheat and so on are largely used. Increased internet penetration coupled with surging alertness among people to eat clean and cruelty-free meals has in turn boosted the demand for plant-based meats and its by-products.

Source Insights

The soy-based meat market accounted for a revenue share of 57.5% in 2023. Soy is a good source of branch amino acids (BCAAs) and is expected to grow over the forecast period on account of its capability to boost exercise performance, recovery from a heavy workout, and build & strengthen muscle mass.

In addition, soy-based meat products not only decrease formulation costs but also display a reduced carbon footprint in contradiction with conventional animal- and dairy-based food products. Increasing demand for the product owing to its boosted convenience, such as enhanced microwave-ability and slice-ability is expected to enhance the overall Asia Pacific plant-based meat market growth. Furthermore, pea-based patties in burgers can be replaced instead of chicken, beef, or even pork patties.

The pea segment is anticipated to grow at a CAGR of 21.4% during the forecast period. Peas also provide good texturing properties to plant-based beef, mutton, chicken, and lamb meat products, and thus resulting to upsurge of pea segment in the coming years. They are easily digestible, non-allergic, and non-toxic leading to their surged utilization in meat substitutes. The increasing importance of flexitarian diet owing to the rising awareness among consumers about cardiological issues associated with the consumption of red meat and the surging health and active lifestyle awareness among the masses are projected to fuel the growth of pea segment of plant-based meat market over the forecast period. Pea proteins also help in weight loss, muscle repair, and energy balance leading to their increased consumption globally

Product Insights

Plant-based burgers market accounted for a share of 23.7% in 2023. Ingredients in these burgers attempt to replicate the flavor, aroma, and “bleeding” texture of meat. For instance, Impossible Foods’ product- Impossible Burger- is created with a genetically modified form, imitating the natural heme-iron present in an animal, which gives their burger a unique meaty flavor.

Plant-based sausages market is expected to grow at a CAGR of 21.1% during the forecast period. These sausages are created to replicate the look, texture, sizzle, and satisfaction of conventional pork sausage. Companies such as Beyond Meat and Lightlife Foods, Inc. are offering juicy and meaty substitutes to traditional sausage, which are also devoid of hormones, nitrates, GMOs, nitrites, gluten, and soy.

Type Insights

The plant-based beef market accounted for a share of 28.8% in 2023. In the traditional meat industry, beef has become the key ingredient in numerous products such as patties, as it is filled with animal fats, cholesterol, and protein. In contrast, plant-based beef products establish about the same amount of protein while the other nutrients tend to fluctuate on a product-by-product basis.

Plant-based fish market is projected to grow at a CAGR of 20.9% from 2024 to 2030. People have become alert regarding the benefits of consuming fish protein. Plant-based fish meat is packed with protein and is beneficial for health.

End-user Insights

Demand of plant-based meat from Hotel/Restaurant/Café (HORECA) accounted for a share of 62.8% in 2023. As the popularity of vegan and flexitarian diets is rising, several restaurants, fast food chains, as well as casual dining venues are devoting a section in their menu separately for “meat-free” choices, which is expected to drive the Asia Pacific plant-based meat market growth. Prominent players in the industry are capitalizing on fluctuating consumer preferences and the increasing demand for a more personable, altered service.

Retail is projected to grow at a CAGR of 20.3% during the forecast period.The plant-based meat companies are establishing strong partnerships with various grocery stores to introduce their products to the market. For instance, Impossible Foods expanded its presence in retail channel by collaborating with retail giants such as The Kroger Co in the U.S. The company partnered with Walmart to place its products in over 2000 neighborhood market locations and supercenters and also tied up with several other retail partnerships. The company’s product is also available on the Walmart website.

The company has also partnered with Publix Super Markets to expand its presence in the Southeast by selling the products in 1,200 stores. The company has displayed its products on the retail shelves in the meat section rather than frozen or vegetable food section and by doing so, the company boosted its sales by 23%.

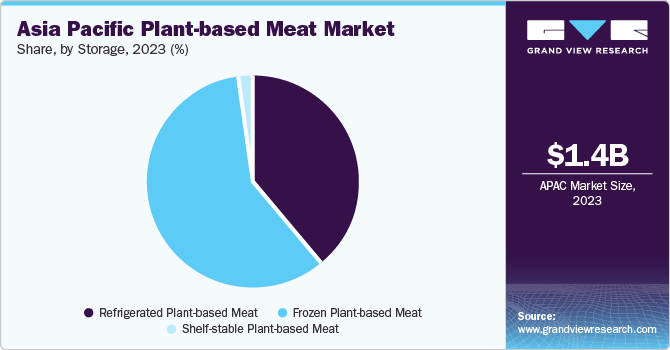

Storage Insights

The frozen plant-based meat market accounted for a share of 59.1% in 2023. The increasing demand for innovative vegetarian products has led to a substantial rise in new product development across chilled, ambient, and frozen segments. This, in turn, offers the customer an extensive range of products and brands, thereby permitting plant-based meat goods to gain enhanced recognition and shelf space.

The refrigerated plant-based meat market is expected to grow at a CAGR of 20.6% from 2024 to 2030. Numerous factors contributing to this trend are insufficient supply of meat and concerns regarding the COVID-19 outbreak in meat processing factories.

Country Insights

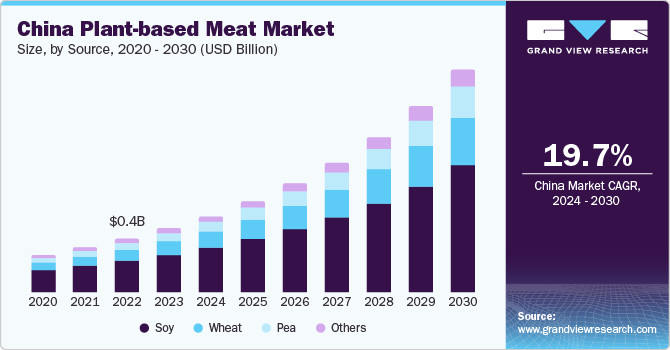

China Plant-based Meat Market Trends

China plant-based meat market accounted for a share of 31.2% in 2023. Prime international pioneers in the plant-based market are companies such as Impossible Foods and Beyond Meat. These players have successfully entered the Chinese market through numerous platforms such as by collaborating with major restaurant chains such as KFC, Starbucks, and Taco Bell. Moreover, China-based players entering the market gain an added advantage, as they know the local tastes and culture, and emphasize on local dishes such as dumplings with pork flavor over beef flavors.

Japan's Plant-based Meat Market Trends

Japan's plant-based meat market is expected to grow at a CAGR of 19.0% over the forecast period. The surging health alertness among consumers is one of the vital reasons for the market growth. Plant-based meat provides several health advantages as it often contains low cholesterol and saturated fats while containing greater protein content. Also, Japan has been progressively acknowledging the environmental effects of animal agriculture, involving greenhouse gas releases and land usage, which is supporting the industry development.

Australia & New Zealand Plant-based Meat Market Trends

The major factor driving the growth of the market in Australia and New Zealand is the changing consumer inclination towards healthier and ecological food choices. Surged cognizance regarding ecological concerns, animal welfare, and health advantages of plant-based diets is boosting demand for plant-based meat. Key food retailers and restaurants are escalating their plant-based offerings, while startups are expanding the market with innovative product offerings.

Key Asia Pacific Plant-based Meat Company Insights

Major players in the market are characterized by robust sales channel partnerships with restaurants and retail chains worldwide for the distribution of their faux meat products.

Key players functioning in the market include:

-

Beyond Meat Inc. - Beyond Meat Inc. is a public company founded in 2009. It is headquartered in California, U.S. The company develops plant-based protein food products. It offers a range of products in ready-to-eat and ready-to-heat forms such as Beyond Beef, Beyond Breakfast Sausage Patties, Beyond Chicken, Beyond Sausage, Beyond Beef Crumbles, Beyond Italian Sausage Crumbles, and Beyond Breakfast Sausage Links. The products are sold in 122,000 food service and retail outlets in more than 80 countries globally.

-

Conagra, Inc. (Gardein Protein International) - Conagra Brands, Inc. is a public company established in 1919 and headquartered in Chicago, U.S. It is a consumer packaged goods food company that operates in various sectors of the food industry with a major focus on the sale of branded, private brands and value-added consumer food, as well ingredients and foodservice items.

-

Kellogg’s Company. (MorningStar Farms) - Kellogg’s Company is a public company. The company was established in 1906 and is headquartered in Michigan, U.S. It manufactures cereal, crackers, cookies, and other packaged foods. Frozen food is marketed under the brand names Morningstar Farms and Eggo. Morningstar Farms sells plant-based meat products and its product portfolio comprises burgers, breakfast, meal starters, Veggitizers, and Incogmeato.

Some emerging players operating are:

-

Quorn - Quorn is a private company producing meat-free frozen foods. The company was established in 1995 and is headquartered in North Yorkshire, UK. Its frozen food products include patties, beef-style burgers, chicken-style naked cutlets, chicken-style nuggets, garlic and herb cutlets, meat-free meatballs, and vegan products.

-

Impossible Foods Inc. - Impossible Foods Inc., a private company, was established in 2011 and is headquartered in California, U.S. It offers meat, chicken, and fish from plants. The company provides various kinds of plant-based meat products, such as burgers, sausage, chicken nuggets, pork, and meatballs, in various countries including Hong Kong, the U.S., Canada, Singapore, and Macau.

Key Asia Pacific Plant-based Meat Companies:

- Beyond Meat

- Impossible Foods Inc.

- Conagra, Inc. (Gardein Protein International)

- Quorn

- Kellogg NA Co. (MorningStar Farms)

- Tofurky

- OmniFoods

- GoodDot

- Maple Leaf Foods (Field Roast & Maple Leaf)

- Vegetarian Butcher

Recent Developments

-

In February 2023, Impossible Food launched an extension to its plant-based chicken product portfolio. They presented three new items such as spicy chicken nuggets, spicy chicken patties, and chicken tenders, all carefully created from plant-based ingredients.

-

In 2022, ITC worked towards the demand for meatless Meat in India by publicizing the development of plant-based meat products. They launched patties and vegan burgers that imitate the flavor of the chicken. This move offers ITC access to India's prime market for plant-based meat alternatives and caters to the increasing demand for sustainable and moral food choices.

Asia Pacific Plant-based Meat Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.64 billion

Revenue forecast in 2030

USD 4.82 billion

Growth rate

CAGR of 19.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Source, product, type, end-user, storage

Regional scope

Asia Pacific

Country scope

China; Japan; Australia & New Zealand

Key companies profiled

Beyond Meat; Impossible Foods Inc.; Conagra, Inc. (Gardein Protein International); Quorn; Kellogg NA Co. (MorningStar Farms); Tofurky; OmniFoods; GoodDot; Maple Leaf Foods (Field Roast & Maple Leaf)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Plant-based Meat Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the Asia Pacific plant-based meat market report based on source, product, type, end-user, storage, and country:

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Soy

-

Pea

-

Wheat

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Burgers

-

Sausages

-

Patties

-

Nuggets, Tenders & Cutlets

-

Grounds

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Chicken

-

Pork

-

Beef

-

Fish

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

HORECA (Hotel/Restaurant/Café)

-

-

Storage Outlook (Revenue, USD Million, 2018 - 2030)

-

Refrigerated Plant-based Meat

-

Frozen Plant-based Meat

-

Shelf-stable Plant-based Meat

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

China

-

Japan

-

Australia & New Zealand

-

Singapore

-

Thailand

-

South Korea

-

Frequently Asked Questions About This Report

b. The Asia Pacific plant-based meat market size was estimated at USD 1.37 billion in 2023 and is expected to reach USD 1.64 billion in 2024.

b. The Asia Pacific plant-based meat market is expected to grow at a compound annual growth rate of 19.7% from 2024 to 2030 to reach USD 4.82 billion by 2030.

b. The China plant-based meat market accounted for a share of 31.2% of the Asia Pacific market in 2023. Key players in the plant-based market, such as Impossible Foods and Beyond Meat, have successfully entered the Chinese market through numerous platforms, including collaborations with major restaurant chains such as KFC, Starbucks, and Taco Bell.

b. Some key players operating in the Asia Pacific plant-based meat market include Beyond Meat, Impossible Foods Inc., Conagra, Inc. (Gardein Protein International), Quorn, Kellogg NA Co. (MorningStar Farms), Tofurky, OmniFoods, GoodDot, and Maple Leaf Foods (Field Roast & Maple Leaf).

b. Key factors that are driving the market growth include increasing customer interest in plant-based diets, along with the surging alertness for animal life rights through numerous welfare organizations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.