- Home

- »

- Advanced Interior Materials

- »

-

Asia Pacific Reflective Materials Market Size Report, 2030GVR Report cover

![Asia Pacific Reflective Materials Market Size, Share & Trends Report]()

Asia Pacific Reflective Materials Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Tapes & Films, Paints & Inks), By Application (Construction & Roads, Textile), By Country, And Segment Forecasts

- Report ID: GVR-4-68038-122-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

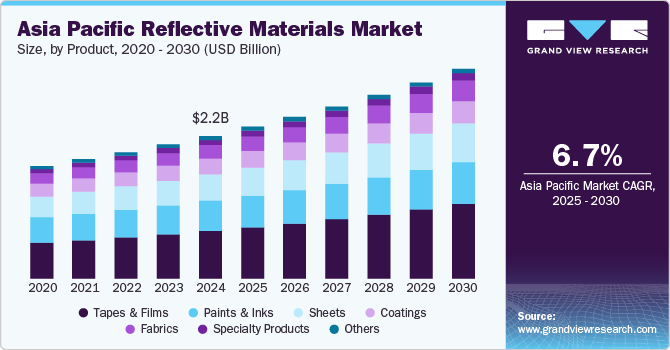

The Asia Pacific reflective materials market size was valued at USD 2.18 billion in 2024 and is projected to grow at a CAGR of 6.7% from 2025 to 2030. The rapid pace of urbanization in regional economies such as China, India, and Indonesia has highlighted the need for improved roadways, signage, and infrastructure, all of which utilize reflective materials for improved visibility and safety, especially in low-light conditions. The region has also witnessed a sharp rise in vehicle ownership rates, aided by improving living standards and the growing popularity of electric vehicles (EVs). This has also increased the occurrence of accidents, strongly emphasizing effective road safety measures. Reflective materials are widely used for road signs, barriers, vehicles, and traffic lights to ensure visibility during night-time driving.

Reflective materials are designed to enhance visibility, especially in low-light conditions, by reflecting light toward its source. They function by using the concept of retro-reflection, which directs light back toward its source. This ensures that reflective surfaces, such as road signs, clothing, or safety gear, appear brightly visible when illuminated by headlights or other light sources. Consequently, the risk of accidents is substantially lowered by informing the driver of activity ahead of them. A large number of roads and highways in Asia Pacific still face issues of inadequate lighting and poor road conditions, which increases the chances of mishaps that can result in deaths and property damage. Road safety experts state that poor lighting or improperly lit roads lead to a 20-25% increase in the risk of accidents. As a result, regional governments and roadway authorities have increased the use of reflective materials such as reflective films, coatings, and paints to address these issues. These solutions are built to withstand various environmental conditions, including exposure to rain, sunlight, extreme temperatures, and humidity while offering high abrasion and wear resistance.

The construction sector has witnessed an accelerated expansion due to the improving economic conditions in notable Asian economies, including China, India, Vietnam, and Indonesia. The development of smart cities and sustainable infrastructure in the region has created new opportunities for using reflective materials. Reflective films, tapes, and paints are being used to enhance the safety of streets and buildings for traffic management, pedestrian safety, and environmental considerations. The well-established electronics industry, led by economies such as China and Taiwan, has also boosted the demand for reflective materials. These products perform an important function by enhancing electronic components' design, efficiency, and functionality, including displays, optical devices, and semiconductor packaging. Reflective coatings are used to backlight displays to improve brightness and energy efficiency. They maximize light output and reduce energy consumption, essential in smartphones, tablets, television screens, and other display devices.

Product Insights

The tapes & films segment accounted for the largest revenue share of 33.2% in 2024 in the Asia Pacific reflective materials industry. Stringent road safety regulations and guidelines by regional governments are expected to sustain a strong demand for these solutions, particularly in automotive and road marking applications. For instance, in November 2024, the transport department in the Indian state of Bihar launched an initiative that mandated the presence of reflective tapes on vehicles. The campaign aimed to minimize the number of road accidents due to foggy conditions common in the region during winter. The expansion of the e-commerce and logistics sectors in Asia Pacific economies has further boosted segment growth. Delivery trucks, cargo, and workers in the logistics sector extensively use reflective materials for enhanced visibility, particularly during night-time operations or in poor weather conditions. Reflective tapes are also used in scaffolding, barriers, and warning signs to improve safety at worksites and construction projects.

The fabrics segment is expected to grow at a substantial CAGR from 2025 to 2030 in the Asia Pacific reflective materials industry. Factors including infrastructure development, increasing safety regulations, and the rise of logistics, fashion, and construction industries have helped maintain a substantial demand for these products. Rising vehicle adoption across countries such as China and India has resulted in the widespread incorporation of reflective fabrics in safety apparel. Reflective vests, jackets, and gear for road workers, cyclists, and pedestrians are critical in improving visibility during low-light conditions or poor weather. Continued implementation of regulations geared towards worker safety in industries such as construction, manufacturing, oil & gas, and mining have further created growth avenues for manufacturers of reflective fabrics. Innovations such as micro-prismatic and retro-reflective materials offer better reflectivity, longer lifespan, and more comfort for wearers, increasing their appeal in a wide range of applications.

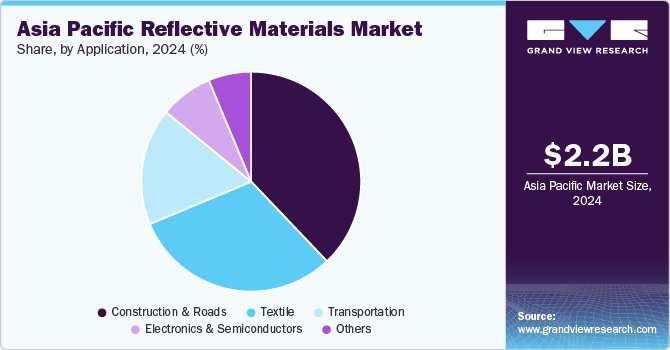

Application Insights

The construction & roads segment emerged with the largest revenue share in the Asia Pacific reflective materials industry in 2024. Solutions such as road marking paints, traffic signs, and barrier coatings are used extensively on roads to improve visibility for vehicles and pedestrians, particularly in low-light conditions. The need for reflective road markings and signage is growing with increasing traffic volumes, especially in fast-growing regions such as Asia Pacific. The construction of extensive highway networks in regional economies is another major market driver. Reflective materials are crucial in large-scale projects to ensure that road signs, lane markings, and hazard indicators are visible to drivers, especially on high-speed roads. The construction sector uses reflective materials on barriers, fencing, and road signs to alert drivers to construction activity, detours, or road closures. This helps minimize accident risks in areas where construction activities may cause obstructions or changes in traffic flow.

The textile segment is anticipated to grow at a significant CAGR during the forecast period, owing to safety regulations, technological advancements, and shifting consumer preferences in fashion, sports, and workwear. Reflective fabrics and materials are used in high-visibility clothing to ensure worker safety in hazardous environments. This includes industries such as construction, road maintenance, mining, manufacturing, and transportation. Furthermore, growing interest in outdoor sports activities has led to a notable rise in demand for reflective materials in sportswear and activewear. Reflective details, such as strips, logos, and patches, are integrated into clothing, footwear, and accessories to ensure safety for people exercising in the early morning or evening.

Country Insights

China accounted for a leading revenue share of 39.0% in the Asia Pacific reflective materials industry in 2024, aided by widespread urbanization in the region, a continued focus on safety initiatives, and industrial growth. The country’s push to develop smart cities involves extensive use of reflective materials in road signs, lighting, and other urban infrastructure to enhance visibility and safety for pedestrians and vehicles, particularly during nighttime and foggy conditions. Moreover, the Chinese government has implemented stringent regulations regarding road safety, mandating the use of reflective materials in traffic signs, vehicle license plates, and vehicles for increased visibility, especially in areas prone to fog and poor lighting. The economy leads in terms of technological advancements in reflective materials, with ongoing research and development focused on creating more durable, cost-effective, and high-performance materials.

India is anticipated to advance at the highest CAGR in the regional reflective materials market from 2025 to 2030. The economy has witnessed a sharp rise in the number of initiated projects, including highways, urban roads, bridges, and airports, owing to the government’s focus on building new infrastructure to support urbanization. This has necessitated the use of safety gear and solutions such as reflective tapes and coatings to protect both workers and citizens from accidents. Moreover, increasing environmental concerns in the country have compelled the promotion of reflective materials as part of sustainability initiatives to reduce energy consumption, improve road safety, and reduce environmental impacts. Increasing investments in awareness campaigns regarding road and workplace safety have further enabled the recognition of reflective materials as a key tool in enhancing safety.

Key Asia Pacific Reflective Materials Company Insights

Some of the key companies involved in the Asia Pacific reflective materials industry include 3M, SK microworks Solutions, and Daoming Optics and Chemical, among others.

-

3M is an American multinational organization that offers solutions to a range of industries, including automotive, consumer goods, electronics, safety, government, and transportation, among others. In the safety segment, the company offers products and services focusing on facility safety, road safety, water quality, and worker health & safety. 3M has a range of offerings for road safety and roadway applications, including reflective panels, pavement markings, inks and additives, and reflective sheeting.

-

SK Microworks Solutions specializes in developing and producing advanced film and display materials. The company produces high-functional materials and optical films used in various applications, particularly in the display technology sector. Under the optical films segment, SK Microworks offers multi-functional display films, diffusers, reflective films, and low-reflective films for vehicles, among other solutions.

Key Asia Pacific Reflective Materials Companies:

- 3M

- AVERY DENNISON CORPORATION

- SK microworks Solutions

- Daoming Optics and Chemical Co.,Ltd.

- Changzhou Hua R Sheng Reflective Material Co., Ltd.

- Yeshili NEW Materials Co.,Ltd

- CHINASTARS

- REFLOMAX Co., Ltd.

- Asian Paints PPG Pvt. Ltd.

- Paiho Group

- NIPPON CARBIDE INDUSTRIES CO., INC.

- Coats Group plc

- Zhejiang YGM Technology Co., Ltd.

Recent Developments

-

In September 2024, YGM inaugurated its Reflective Materials Research Institute in Shanghai, China, to bring innovative solutions to the reflective materials segment. The company would leverage the region's research and technological capabilities while also undertaking collaborations with major academic institutes and technology firms. This is expected to enable YGM to improve the safety performance of its products and adhere to sustainability standards.

-

In May 2024, Reflomax announced the launch of the Wall Guide (WG) ultra-wide-angle reflective sheeting to improve road visibility for drivers and enhance road safety. The WG solution returns headlamp light to drivers at ultra-wide angles not provided by conventional technologies, thus boosting visibility in the driving direction during both day and night. The solution was displayed at Intertraffic Amsterdam 2024.

Asia Pacific Reflective Materials Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.32 billion

Revenue forecast in 2030

USD 3.21 billion

Growth Rate

CAGR of 6.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, country

Country scope

China; India; Indonesia; Sri Lanka; Bangladesh; Cambodia; Vietnam

Key companies profiled

3M; AVERY DENNISON CORPORATION; SK microworks Solutions; Daoming Optics and Chemical Co.,Ltd.; Changzhou Hua R Sheng Reflective Material Co., Ltd.; Yeshili NEW Materials Co.,Ltd; CHINASTARS; REFLOMAX Co., Ltd.; Asian Paints PPG Pvt. Ltd.; Paiho Group; NIPPON CARBIDE INDUSTRIES CO., INC.; Coats Group plc; Zhejiang YGM Technology Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, countryal & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Reflective Materials Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific reflective materials market report based on product, application, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Fabrics

-

Sheets

-

Paints & Inks

-

Tapes & Films

-

Coatings

-

Specialty Products

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Textile

-

Construction & Roads

-

Transportation

-

Electronics & Semiconductors

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

China

-

India

-

Indonesia

-

Sri Lanka

-

Bangladesh

-

Cambodia

-

Vietnam

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.