- Home

- »

- Electronic & Electrical

- »

-

Asia Pacific Smart Home Security Camera Market, Industry Report, 2030GVR Report cover

![Asia Pacific Smart Home Security Camera Market Size, Share & Trends Report]()

Asia Pacific Smart Home Security Camera Market Size, Share & Trends Analysis Report By Technology (Wired Camera, Wireless Camera), By Application (Doorbell Camera, Indoor Camera), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-234-0

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

The Asia Pacific smart home security camera market size was estimated at USD 2.59 billion in 2023 and is anticipated to grow at a CAGR of 21.4% from 2024 to 2030. The use of smart home security cameras has increased, which is explained by a rise in local thefts as well as the shown effectiveness of the camera to deter burglaries. Furthermore, the appeal of these cameras is being further boosted by their interaction with the growing smart home ecosystem.

The Asia Pacific smart home security camera market accounted for a share of 30.3% of the global smart home security camera market in 2023.

Significant technological breakthroughs have been pushing the demand for smart home security cameras. Smart cameras are becoming more popular; they alert users to any movements while no one is home. Younger consumers are increasingly purchasing homes, and many homeowners are dissatisfied with conventional gadgets. This situation has accelerated the adoption of new, highly developed smart devices, such as smart locks, lightbulbs, plugs, and home security systems. The growing trend of building "smart homes," which combine convenience and luxury, is driving up demand for smart home security cameras.

Countries in Asia Pacific are heavily surveilled, and China is one of the most covered countries. Globally, there are already 770 million cameras in use, with 54% of these being in China. According to a survey by Comparitech, 16 out of the top 20 most surveilled cities (based on the number of cameras per 1,000 people) are in China. Indore, Hyderabad, and Delhi (all in India) were the only cities outside of China to make the top 20, taking the fourth, twelfth, and sixteenth places, respectively. Delhi, Chennai, Singapore, Seoul, and Mumbai, all feature within the top 20. Delhi and Chennai (India) have more cameras per square mile than any Chinese city. These figures prove that Asia Pacific is a highly lucrative market for smart home security cameras.

China is home to some of the world’s largest makers of video surveillance products, such as Hikvision, Huawei, and Dahua. According to an IHS Markit report, China has 350 million cameras installed, for an estimated one camera for every 4.1 people. The U.S., in comparison, has one for every 4.6 people, with a total of 70 million cameras installed. Taiwan was third in terms of penetration, with one camera for every 5.5 citizens in 2018, followed by the U.K. and Ireland (1:6.5) and Singapore (1:7.1) as of 2019.

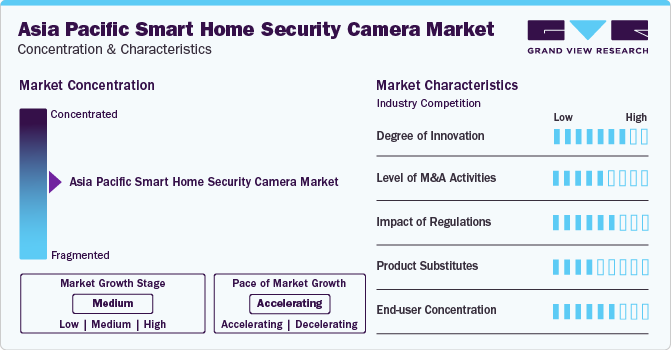

Market Concentration & Characteristics

There is a lot of innovation in the Asia Pacific smart home security camera market, as new techniques and technologies are always being created and released. Innovation in smart home security cameras is influenced by ongoing technical developments, especially in fields like artificial intelligence (AI), machine learning, and image processing. The overall capabilities of security cameras are increased by these technologies, which make features like object detection, facial recognition, and better video analytics possible.

ADT Inc., Brinks Home Security, Wyze Lab, Inc., and SimpliSafe, Inc. are a few of the industry participants engaged in merger and acquisition activity. These businesses can broaden their geographic scope and penetrate new markets through M&A activities.

Regulations and standards governing the privacy of individuals photographed by surveillance equipment are often enforced via regulatory frameworks. Regulations pertaining to smart home security cameras may include requirements for features like user permission methods, facial blurring, or placement restrictions in order to safeguard privacy rights. Both makers and users must abide by privacy rules in order to prevent legal repercussions and guarantee ethical use of surveillance equipment.

The sophisticated features of smart home security cameras, such real-time monitoring and integration with smart home ecosystems, which boost convenience and security, make them essential. Alternatives include webcams, DIY surveillance systems, baby monitors, dummy cameras, smart doorbells without cameras, home automation sensors, outdoor lighting with motion sensors, and traditional security cameras. These substitutes vary in their features and functionalities, meeting different budgets, demands, and preferences in terms of affordability, usability, and functionality.

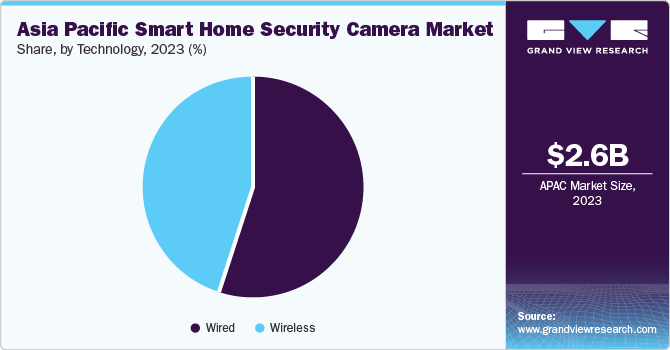

Technology Insights

Wired smart home security cameras market accounted for a revenue share of 55.3% in 2023. Because wired security systems require less maintenance, they are more affordable in the long run. This is why their popularity is growing. Their adoption is mostly being driven by this economic advantage. Because wired systems do not have to worry about problems with WiFi connectivity or battery life, they are more reliable. These cameras record locally and continue to operate even in the event of a WiFi loss, providing continuous surveillance.

Wireless smart home security cameras market is anticipated to grow at a CAGR of 21.5% over the forecast period. Wireless technology-enabled security systems are one of the most significant advancements in home security solutions and IoT, with many homeowners preferring them for effective protection.

Application Insights

The indoor smart home security cameras market accounted for a share of 40.1% in 2023. A rise in theft and break-in cases has increased public awareness of the significance of safeguarding one's home from criminal activities. Because of its many features, such as the ability to send quick messages in the event of theft, trigger alarms, and recognize movement and behavior, indoor smart cameras are widely used in a wide range of applications. These cameras are essential for keeping an eye on houses when occupants are away, whether on vacation or during business hours. They give homeowners peace of mind by letting them monitor the safety of their property and receiving notifications about package deliveries or other unforeseen events.

Doorbell smart home security cameras market is anticipated to grow at a CAGR of 21.9% over the forecast period. The growing desire to live in smart homes, facilitated by rising internet penetration, is positively impacting the demand for doorbell cameras.

Country Insights

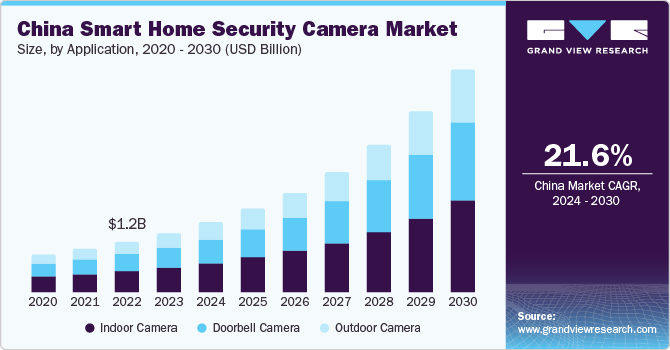

China Smart Home Security Camera Market Trends

China smart home security camera market accounted for a revenue share of 54.4% in 2023. China has built a vast surveillance state that utilizes cameras powered by facial recognition software, including cameras perched on streets, buildings, and lampposts that can recognize and identify individual faces. Chinese tech companies supply artificial intelligence surveillance technology to 63 countries. Of those, 36 have signed onto China’s massive infrastructure project called the Belt and Road Initiative, according to a September report by the Carnegie Endowment for International Peace, a Washington D.C.-based think tank.

Both its production base and the quantity of surveillance cameras in the world are largest in China. Hikvision's ANVPIZ is the greatest home security camera available in China. It is a 5 megapixel PoE Bullet camera with better than 1080p image quality. It has an IP66 rating and can be controlled and accessed remotely from both indoor and outdoor locations. It captures 98 feet of crisp night vision images using infrared technology. The SD card features a built-in microphone for great audio recording and 128GB of storage. In addition, it has ONVIF protocol attached, which allows it to be connected to a third-party network for video access, and H265 compression technology, which may save almost 50% of storage space.

India Smart Home Security Camera Market Trends

India smart home security camera market is expected to grow at a CAGR of 22.1% over the forecast period. According to Forbes data, Delhi has the highest number of surveillance cameras installed, with 1,826.6 cameras per square miles, followed by Chennai and Mumbai. In the aforementioned category, Delhi has been observed to outshine London, Singapore, Moscow, and New York. This presents the home security cameras market in India with strong growth prospects. The most popular doorbell camera installed in India in 2021, according to TechRadar, is Arlo’s Video Doorbell. It is slim and stylish and displays super-detailed footage. The camera’s 180-degree field of view and 1:1 aspect ratio allows to view the full length of the person at the door, including any packages on the ground by their feet. This comes in both wired and wireless versions and can be integrated with Alexa, Google Assistant, and HomeKit.

Key Asia Pacific Smart Home Security Camera Company Insights

ADT Inc., Vivint Smart Home, Inc., Nest Labs, and Samsung Electronics Co, Ltd. are some of the dominant players operating in the market.

-

Vivint Smart Home, Inc. provides a range of smart home devices, including locks, lights, cameras, thermostats, smoke and carbon monoxide detectors, garage door control, car protection, and security sensors. In addition, they offer comprehensive home systems, featuring in-home consultations, professional installations, and ongoing support services.

-

ADT Inc. operates and markets across three reportable segments such as operates through Commercial, Consumer and Small Business, and Solar segments.

-

Samsung Electronics Co, Ltd. operates at several facilities across North America, Asia Pacific, Europe, and Central & South America. It has reached more than 74 markets through direct sales and distributors.

Skylinkhome, Frontpoint Security Solution, LLC and Xiaomi Inc. are some of the emerging market players functioning in smart home security camera sector.

- Xiaomi Inc.’s product range is diverse, extending from smartphones to televisions, wearable items, and a variety of smart home products within its Internet of Things and Xiaomi Smart Home ecosystems.

Key Asia Pacific Smart Home Security Camera Companies:

- Vivint Smart Home, Inc.

- ADT Inc.

- SimpliSafe, Inc.

- Brinks Home Security

- Xiaomi Inc.

- Skylinkhome

- Wyze Lab, Inc.

- Blink

- Samsung Electronics Co, Ltd.

- Frontpoint Security Solution, LLC

Recent Developments

-

In May 2023, ADT launched its ADT's Smart Home security system, which includes an upgraded feature-rich outside Wi-Fi camera. Its two-way audio capability allows you to converse with others who are close to the camera. In low light, the camera records HD video in full color and has night vision capabilities.

-

In March 2023, ADT and Google worked together to launch ADT Self Setup, a do-it-yourself home security system. With this cutting-edge bundle, customers may choose from a variety of Google smart home devices to improve home security. The ADT+ smartphone app and all of the selected devices work together smoothly to give users complete assistance for their home security needs.

Asia Pacific Smart Home Security Camera Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.10 billion

Revenue forecast in 2030

USD 9.82 billion

Growth rate

CAGR of 21.4% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Technology, application, country

Regional scope

Asia Pacific

Country scope

China, India, Japan, South Korea, Australia & New Zealand

Key companies profiled

Vivint Smart Home; ADT Inc.; SimpliSafe; Brinks Home Security; Xiaomi Inc.; Skylinkhome; Samsung Electronics Co; Frontpoint Security Solution; Wyze Lab Inc.; Blink

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Smart Home Security Camera Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific smart home security camera market report based on technology, application, and country:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Wired

-

Wireless

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Doorbell Camera

-

Indoor Camera

-

Outdoor Camera

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

China

-

India

-

Japan

-

South Korea

-

Australia & New Zealand

-

Frequently Asked Questions About This Report

b. The Asia Pacific smart home security camera market size was estimated at USD 2.59 billion in 2023 and is expected to reach USD 3.10 billion in 2024.

b. The Asia Pacific smart home security camera market is expected to grow at a compounded growth rate of 21.4% from 2024 to 2030 to reach USD 9.82 billion by 2030.

b. The indoor smart home security cameras market accounted for a share of 40.1% in 2023. A rise in theft and break-in cases has increased public awareness of the significance of safeguarding one's home from criminal activities. Because of its many features, such as the ability to send quick messages in the event of theft, trigger alarms, and recognize movement and behavior, indoor smart cameras are widely used in a wide range of applications. These cameras are essential for keeping an eye on houses when occupants are away, whether on vacation or during business hours.

b. Some key players operating in the Asia Pacific smart home security camera market include Vivint Smart Home; ADT Inc.; SimpliSafe; Brinks Home Security; Xiaomi Inc.; Skylinkhome; Samsung Electronics Co; Frontpoint Security Solution; Wyze Lab Inc.; Blink

b. Key factors that are driving the Asia Pacific smart home security camera market growth include the use of smart home security cameras has increased, which is explained by a rise in local thefts as well as the shown effectiveness of the camera to deter burglaries. Furthermore, the appeal of these cameras is being further boosted by their interaction with the growing smart home ecosystem.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."