- Home

- »

- Next Generation Technologies

- »

-

Asset Performance Management Market Size Report, 2033GVR Report cover

![Asset Performance Management Market Size, Share, & Trend Report]()

Asset Performance Management Market (2026 - 2033) Size, Share, & Trend Analysis By Category (Predictive Asset Management, Asset Reliability Management), By Deployment (On Premises, Hosted), By Vertical (Energy & Utilities), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-727-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Asset Performance Management Market Summary

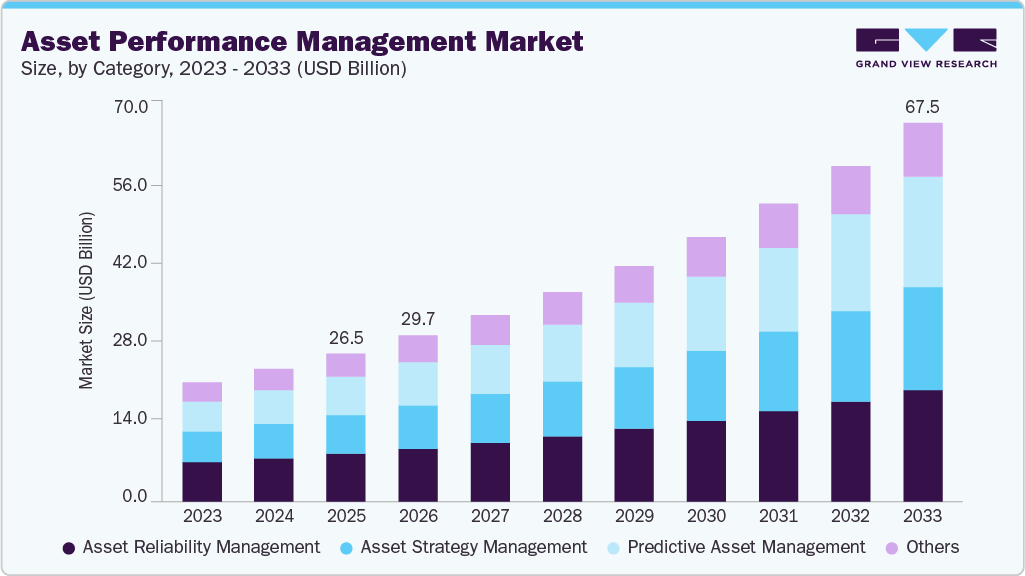

The global asset performance management market size was estimated at USD 26.51 billion in 2025 and is projected to reach USD 67.50 billion by 2033, growing at a CAGR of 12.5% from 2026 to 2033. Due to the need for organizations to maximize asset reliability, reduce maintenance costs, and extend lifecycles in capital-intensive industries where unplanned downtime is increasingly costly.

Key Market Trends & Insights

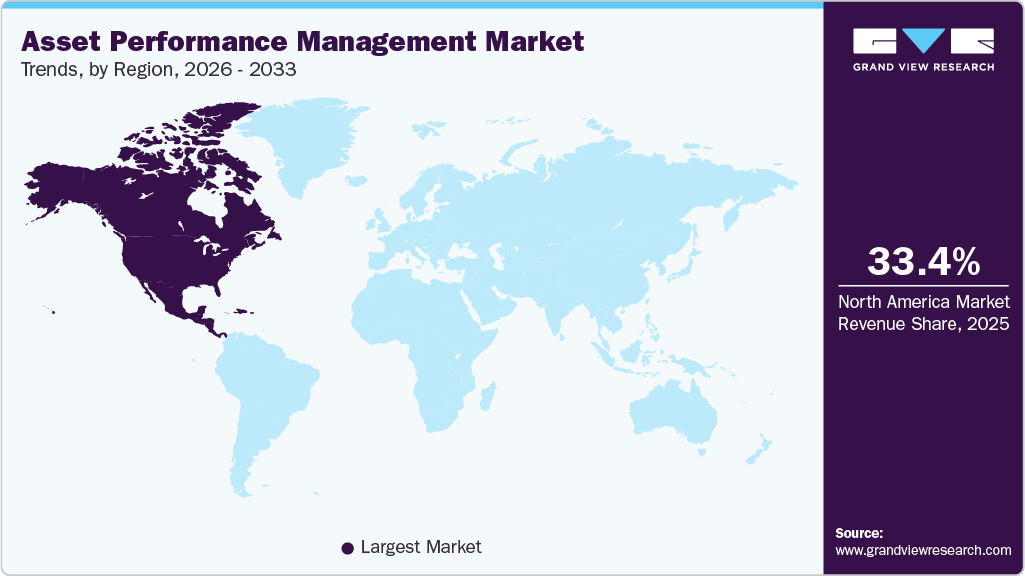

- North America dominated the global asset performance management market with the largest revenue share of 33.4% in 2025.

- The asset performance management industry in the U.S. accounted for the largest market revenue share in North America in 2025.

- By category, the asset reliability management led the market with the largest revenue share of 32.5% in 2025.

- By deployment, the on-premises segment accounted for the largest market revenue share in 2025.

- By vertical, the government & public sector segment is expected to grow at the fastest CAGR from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 26.51 Billion

- 2033 Projected Market Size: USD 67.50 Billion

- CAGR (2026-2033): 12.5%

- North America: Largest market in 2025

Advancements in Industrial Internet of Things (IIoT), AI, machine learning, and big data analytics are enhancing Asset Performance Management (APM) capabilities, with connected sensors and analytics platforms enabling early fault detection, optimized maintenance scheduling, and a shift from reactive to predictive strategies. Aging infrastructure across sectors such as utilities, energy, manufacturing, and transportation, coupled with budget constraints, push companies to use asset performance management to extend asset life, maintain safety, and boost efficiency without large capital investments, while stringent regulatory and safety compliance requirements in industries such as oil & gas, aviation, and pharmaceuticals further drive adoption by ensuring documentation, traceability, and audit readiness.

The asset performance management (APM) market has been evolving continuously in line with the advances in technology and the changing needs of the incumbents of various end-use industries and industry verticals. Several vendors are striking strategic partnerships with end users as part of their efforts to strengthen their foothold in the market. For instance, in February 2025, Avathon, a U.S.-based AI platform provider for industrial operations, partnered with Google Cloud to accelerate AI-driven transformation in manufacturing, energy, retail, and more. The collaboration aims to expand Avathon’s asset performance management, logistics, supply chain, and safety solutions using Google Cloud technology. Together, they will also advance go-to-market efforts and integrate Avathon’s SDK and APIs with Google Cloud services.

Moreover, a significant driver of the asset performance management industry is the growing investments in smart manufacturing and automation. Industries worldwide are embracing Industry 4.0 principles, integrating advanced technologies such as the Industrial Internet of Things (IIoT), artificial intelligence (AI), machine learning (ML), and robotics into their production processes. These technologies enable real-time monitoring, data-driven decision-making, and self-optimizing production systems. APM solutions are a critical component of this ecosystem, as they provide the analytics, predictive capabilities, and asset health insights necessary to keep highly automated facilities operating at peak efficiency.

According to the State of Smart Manufacturing Report 2025 by Rockwell Automation, the survey reveals a rising number of organizations planning to implement AI and machine learning for cybersecurity in the next year, underscoring their increasing importance in bolstering digital security. These technologies are also expected to reshape supply chain management, with about one-third of respondents planning to apply them in this area, and half intending to use them for quality control.

Category Insights

The asset reliability management segment led the market with the largest revenue share of 32.5% in 2025. The asset reliability management segment in the asset performance management industry is experiencing strong growth as industries prioritize reducing unplanned downtime, improving operational efficiency, and extending equipment lifespans. In capital-intensive sectors such as oil & gas, power generation, mining, and manufacturing, asset failures can cause significant financial losses and safety risks, making reliability optimization a top priority.

The predictive asset management segment is anticipated to grow at the fastest CAGR during the forecast period. Economic pressure from high downtime costs and demand for higher asset utilization drives customers to invest in predictive capabilities. Industries with mission-critical equipment face steep financial and safety consequences from failures; the ROI on preventing a single critical outage often justifies predictive solutions. Coupled with supply-chain volatility and the rising cost of critical spares, firms prefer forecasts that optimize inventory and schedule repairs during planned windows.

Deployment Insights

The on-premises segment accounted for the largest market revenue share in 2025, due to industries with stringent data sensitivity and regulatory requirements. Sectors such as oil & gas, utilities, mining, chemicals, and defense continue to prioritize local data storage because asset telemetry often contains operationally sensitive information. On-premises APM platforms allow these organizations to maintain full control over data governance, audit trails, and cybersecurity protocols, ensuring compliance with national regulations and internal industrial security mandates that restrict cloud usage.

The hosted segment is expected to grow at the fastest CAGR during the forecast period. Businesses are making high investments in cloud-based asset performance management solutions as Software-as-a-Service (SaaS)-based models provide numerous benefits over on-premises software. Growing internet penetration, provision of affordable database storage capacity, and increasing demand for user-friendly software solutions are factors driving the adoption of cloud-based asset performance management in the global market.

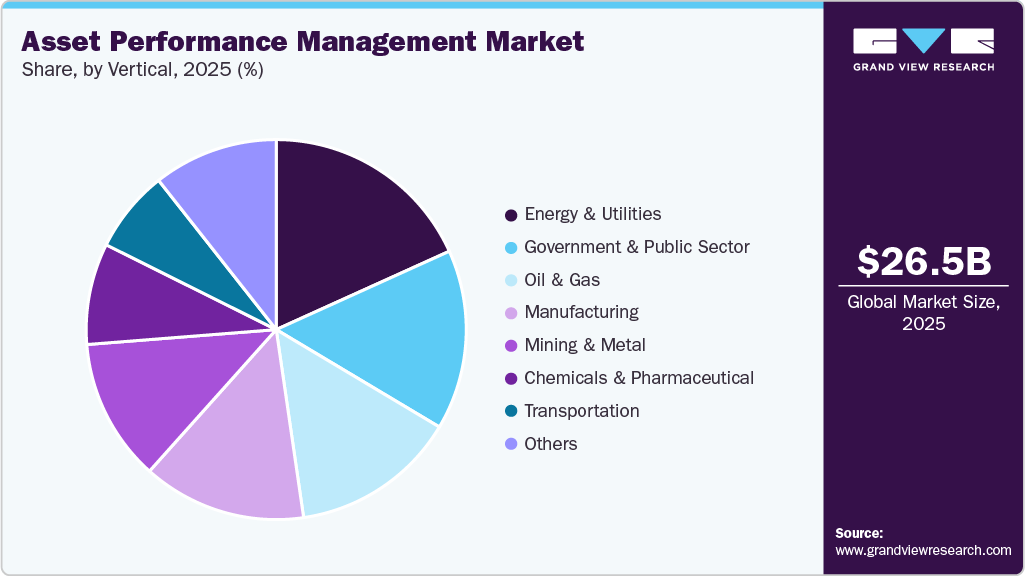

Vertical Insights

The energy & utilities segment accounted for the largest market revenue share in 2025. Companies in the energy and utility sectors are essential to improving the environment by helping in refining, extracting, or producing sources of energy. The need for affordable, dependable, and sustainable energy is growing, and attempts to use clean, renewable energy are essential to reducing carbon emissions. To address these challenges, energy and utility companies need to adopt AI-driven and IoT-driven strategies fueled by data insights.

The government & public sector segment is expected to grow at the fastest CAGR over the forecast period. Government and public sector agencies are increasingly adopting APM solutions to modernize aging infrastructure and improve service reliability. Many public assets, such as water distribution networks, power grids, transportation systems, public buildings, and municipal facilities, are decades old and prone to failures. APM platforms help agencies shift from reactive repairs to data-driven maintenance, enabling proactive planning, faster response times, and extended asset life. This shift is crucial as governments face mounting pressure to ensure uninterrupted public services and reduce the economic impact of system outages.

Regional Insights

North America dominated the global asset performance management market with the largest revenue share of 33.4% in 2025, driven bythe rapid digitalization of industrial operations and the widespread adoption of IoT, AI, and predictive analytics across oil & gas, utilities, and manufacturing sectors. Companies are prioritizing reliability-centered maintenance to offset aging infrastructure and rising costs of downtime.

U.S. Asset Performance Management Market Trends

The asset performance management market in the U.S. accounted for the largest market revenue share in North America in 2025, as enterprises aggressively deploy APM to support large-scale modernization programs within energy grids, transportation networks, and industrial facilities. High regulatory scrutiny around safety, emissions, and operational integrity is pushing asset-intensive industries to adopt real-time monitoring and predictive maintenance tools.

Europe Asset Performance Management Market Trends

The asset performance management market in Europe is expected to register a considerable CAGR from 2026 to 2033, driven by stringent EU sustainability mandates and initiatives aimed at reducing energy consumption, emissions, and unplanned industrial waste. APM solutions enable organizations to maintain compliance while enhancing asset efficiency and lifecycle performance.

The UK asset performance management market is expected to grow at a rapid CAGR during the forecast period, owing to the large-scale upgrades within utilities, rail networks, and public infrastructure. Post-privatization performance standards and regulatory pressure on service reliability compel organizations to adopt predictive asset management strategies.

The asset performance management market in Germany held a substantial market share in 2025, as companies rely on precise asset monitoring to maintain productivity in highly automated industrial environments. The country’s push for Industry 4.0 adoption encourages integration of smart sensors, digital twins, and predictive analytics. Strong focus on minimizing production downtime and optimizing energy-intensive assets further accelerates APM investments.

Asia Pacific Asset Performance Management Market Trends

The asset performance management market in the Asia Pacific held a significant share of the global market in 2025, driven byrapid industrial expansion, urbanization, and infrastructure development. The rising adoption of automation, IIoT, and smart manufacturing across China, India, ASEAN, and Australia is expected to boost market growth. Companies are increasingly deploying APM to enhance equipment reliability, support large-scale industrialization, and lower maintenance costs in highly competitive sectors.

The Japan asset performance management market is expected to grow at a rapid CAGR during the forecast period, driven by the need to manage aging industrial equipment and infrastructure within a mature manufacturing ecosystem. A shrinking workforce and rising labor costs make automation and predictive maintenance essential for operational continuity. Japanese industries also prioritize precision and zero-defect operations, pushing adoption of advanced monitoring technologies, digital twins, and reliability analytics.

The asset performance management market in China held a substantial market share in Asia Pacific in 2025, due to massive industrial modernization under the Made in China 2025 initiative and nationwide investments in smart factories, utilities, and infrastructure. The rapid deployment of IoT sensors, AI-enabled analytics, and cloud platforms enables industries to shift toward predictive and prescriptive maintenance.

Key Asset Performance Management Company Insight

Key players operating in the asset performance management industry are ABB, IBM Corporation, AVEVA Group Limited, Bentley Systems, Incorporated, Rockwell Automation, and Siemens Energy. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Asset Performance Management Companies:

The following are the leading companies in the asset performance management market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Aspen Technology Inc

- AVEVA Group Limited

- Bentley Systems, Incorporated

- DNV

- GE Vernova

- IBM Corporation

- Rockwell Automation

- SAP SE

- SAS Institute, Inc.

- Siemens Energy

Recent Developments

-

In December 2025, IBM Corporation has launched Maximo Condition Insight, an AI-powered upgrade to the Maximo Application Suite that delivers fast, explainable insights to support condition-based maintenance. The new capability enables asset-intensive industries to shift from reactive to prescriptive maintenance, enhancing Maximo’s APM features with a more advanced, real-time view of asset performance, reliability, and risk.

-

In April 2025, AVEVA Solutions Limited partnered with ServiceNow, a U.S.-based software company, to accelerate industrial transformation by using AVEVA’s CONNECT industrial intelligence platform with ServiceNow’s AI-powered Operational Technology Management solutions. The collaboration will unify data, applications, and operations, enabling AI-driven automation, enhanced analytics, and improved workflow efficiency. This combined approach aims to boost productivity, reduce unplanned downtime, optimize production, and empower industrial workforces through streamlined, connected operations.

-

In April 2025, Bentley Systems, incorporated, introduced new asset analytics capabilities in its Blyncsy product, using Google Maps Platform’s Imagery Insights to detect and assess roadway conditions quickly. Announced at Google Cloud Next 2025, the AI-powered solution leverages crowdsourced imagery, Google Street View, and Vertex AI to automate roadway asset inspections, aiding in maintenance and disaster recovery efforts. Building on Bentley’s strategic partnership with Google, the integration aims to help transportation agencies and engineering firms monitor infrastructure more effectively and track condition changes over time.

Asset Performance Management Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 29.67 billion

Revenue forecast in 2033

USD 67.50 billion

Growth rate

CAGR of 12.5% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

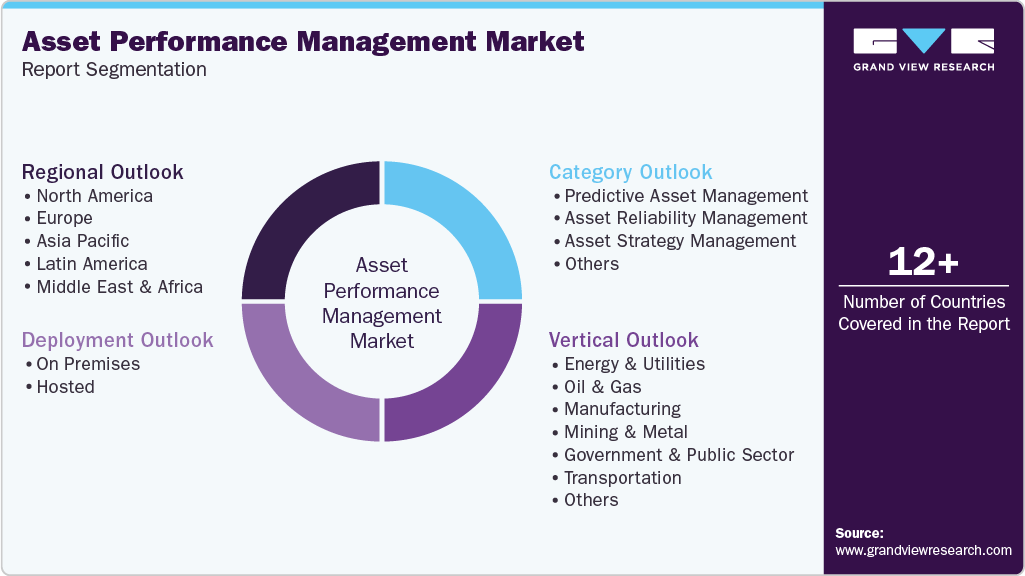

Segments covered

Category, deployment, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

ABB; Aspen Technology Inc.; AVEVA Group Limited; Bentley Systems; Incorporated; DNV; GE Vernova; IBM Corporation; Rockwell Automation; SAP SE; SAS Institute, Inc.; Siemens Energy

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Asset Performance Management Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global asset performance management market report based on category, deployment, vertical, and region:

-

Category Outlook (Revenue, USD Billion, 2021 - 2033)

-

Predictive Asset Management

-

Asset Reliability Management

-

Asset Strategy Management

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

On Premises

-

Hosted

-

Public Cloud

-

Private Cloud

-

-

-

Vertical Outlook (Revenue, USD Billion, 2021 - 2033)

-

Energy & Utilities

-

Oil & Gas

-

Manufacturing

-

Mining & Metal

-

Government & Public Sector

-

Transportation

-

Chemicals & Pharmaceutical

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global asset performance management market is expected to grow at a compound annual growth rate of 12.5% from 2026 to 2033 to reach USD 67.50 billion by 2033.

b. North America dominated the global market with the largest revenue share of over 33.0% in 2025, driven by the rapid digitalization of industrial operations and the widespread adoption of IoT, AI, and predictive analytics across the oil & gas, utilities, and manufacturing sectors.

b. Some of the key players operating in asset performance management include ABB, Aspen Technology Inc., AVEVA Group Limited, Bentley Systems, Incorporated, DNV, GE Vernova, IBM Corporation, Rockwell Automation, SAP SE, SAS Institute, Inc., Siemens Energy

b. The emergence of the fourth industrial revolution (Industry 4.0) has encouraged the adoption of Internet of Things (IoT) technologies, such as industrial sensors, across several industry verticals. The growing adoption of industrial sensors has enabled the rapid deployment of APM solutions.

b. The global asset performance management market size was estimated at USD 26.51 billion in 2025 and is expected to reach USD 29.67 billion in 2026.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.