- Home

- »

- Next Generation Technologies

- »

-

Asset Tracking Market Size & Share, Industry Report, 2030GVR Report cover

![Asset Tracking Market Size, Share, & Trends Report]()

Asset Tracking Market (2025 - 2030) Size, Share, & Trends Analysis Report By Component (Hardware, Software, Services), By Technology (RFID, M2M/IoT, GPS), By Deployment, By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-621-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Asset Tracking Market Summary

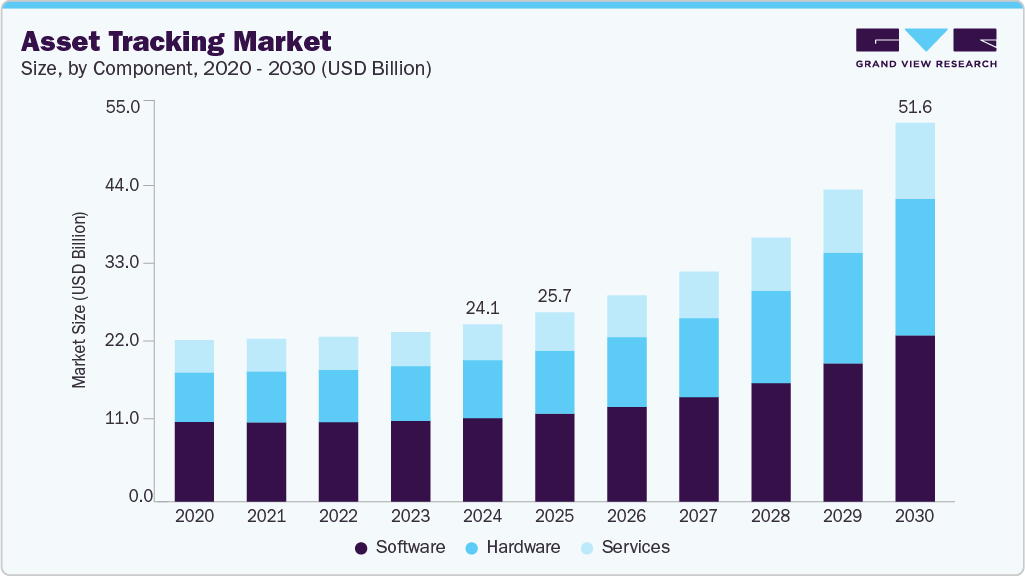

The global asset tracking market size was estimated at USD 24.14 billion in 2024, and is projected to reach USD 51.59 billion by 2030, growing at a CAGR of 14.9% from 2025 to 2030. driven by the global surge in supply chain digitization and operational efficiency demands.

Key Market Trends & Insights

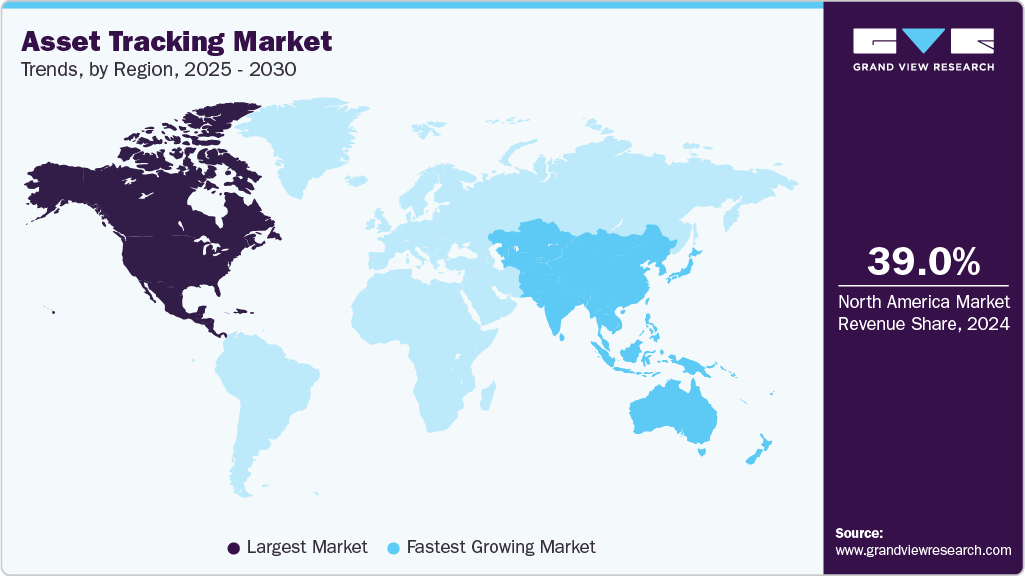

- North America dominated the market and accounted for a revenue share of around 39.0% in 2024.

- The asset tracking market in the U.S. is expected to grow significantly at a CAGR of 14.8% from 2025 to 2030.

- By component, the software segment dominated the market and accounted for the revenue share of over 47.0% in 2024.

- By technology, the RFID (radio-frequency identification) segment dominated the market and accounted for the revenue share of over 31.0% in 2024.

- By deployment, the cloud segment dominated the market and accounted for the revenue share of nearly 62.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 24.14 Billion

- 2030 Projected Market Size: USD 51.59 Billion

- CAGR (2025-2030): 14.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Businesses across industries are adopting IoT-enabled tracking solutions to monitor assets in real-time, reducing losses and optimizing logistics. The rise of e-commerce and omnichannel retail has intensified the need for end-to-end visibility, with companies deploying RFID, GPS, and Bluetooth Low Energy (BLE) tags to track shipments from warehouses to last-mile delivery. The post-pandemic emphasis on resilient supply chains further accelerates adoption, as firms prioritize inventory accuracy and asset utilization analytics to mitigate disruptions.The advancement of wireless connectivity technologies, particularly 5G and LPWAN (Low-Power Wide-Area Network) also contributes to the growth of asset tracking industry. These networks enable seamless, low-latency tracking of high-value assets, such as construction equipment, medical devices, and manufacturing tools, across large geographic areas. The integration of AI and predictive analytics into tracking platforms allows businesses to anticipate maintenance needs and prevent theft or misplacement, enhancing asset lifecycle management. In addition, regulatory compliance requirements in sectors such as pharmaceuticals (DSCSA), aviation (FAA), and automotive (ELD mandates) are pushing organizations to implement audit-ready tracking systems.

The industrial IoT (IIoT) revolution is also fueling growth, with smart factories and warehouses leveraging ultra-wideband (UWB) and sensor fusion technologies for indoor precision tracking. These systems provide centimeter-level accuracy, critical for automated guided vehicles (AGVs), robotic systems, and tool tracking in high-stakes environments. Moreover, sustainability initiatives are prompting firms to adopt asset tracking for circular economy practices, such as monitoring reusable packaging and reducing equipment idle time.

Component Insights

The software segment dominated the market and accounted for the revenue share of over 47.0% in 2024, driven by the increasing need for advanced analytics, real-time visibility, and seamless integration across supply chains. Businesses are shifting from standalone tracking solutions to cloud-based platforms that offer end-to-end asset lifecycle management, enabling predictive maintenance, geofencing, and automated alerts. The rise of AI-powered analytics allows companies to optimize asset utilization, reduce downtime, and improve decision-making, making software a key differentiator in operational efficiency.

The hardware segment is anticipated to grow at a CAGR of 16.7% during the forecast period driven by the need for improved asset utilization and theft prevention is fueling investments in tracking devices. In sectors such as transportation and construction, where assets are highly mobile and valuable, deploying durable and tamper-proof tracking hardware helps organizations maintain control and accountability over their equipment. Moreover, as hardware costs continue to decline due to advancements in semiconductor and sensor technologies, more businesses, including SMEs, can afford to implement these solutions.

Technology Insights

The RFID (radio-frequency identification) segment dominated the market and accounted for the revenue share of over 31.0% in 2024, driven by the declining cost of RFID tags and infrastructure, making the technology accessible to SMEs and large enterprises alike. Advances in chipless RFID and printed antenna designs have reduced tag prices, while cloud-based RFID software eliminates the need for expensive on-premises servers. In addition, regulatory mandates such as the FDA’s UDI (Unique Device Identification) system for medical devices and retailers’ RFID tagging requirements are compelling suppliers to adopt RFID for compliance and supply chain transparency.

The M2M/IoT segment is expected to grow at a significant CAGR over the forecast period. The proliferation of low-power, high-efficiency IoT sensors-such as GPS, BLE, and LoRaWAN-enabled devices-has unlocked unprecedented visibility into asset location, condition, and utilization. Industries like logistics, agriculture, and energy are leveraging cellular IoT (4G/5G/NB-IoT) for end-to-end tracking of high-value cargo, heavy machinery, and perishable goods, reducing losses and optimizing operational workflows. As reported in IoT Analytics' 2024 Summer edition of the State of IoT (171 pages), the number of active IoT-connected devices reached 16.6 billion by the end of 2023, marking a 15% year-over-year increase. Projections suggest this figure is expected to reach 40 billion by 2030.

Deployment Insights

The cloud segment dominated the market and accounted for the revenue share of nearly 62.0% in 2024, driven by the integration of advanced technologies such as AI, machine learning, and IoT with cloud platforms. Predictive analytics powered by cloud computing enables businesses to forecast maintenance needs, detect anomalies, and optimize asset routes in real time. The ability to process vast amounts of tracking data in the cloud-without latency-supports automated alerts, geofencing, and compliance reporting, enhancing operational efficiency.

The on-premise segment is expected to grow at a significant CAGR over the forecast period owing to the organizations that prioritize data security, control, and regulatory compliance. Industries such as healthcare, government, defense, and manufacturing often manage sensitive data or operate under strict regulatory environments, making on-premise deployment a preferred choice. These organizations benefit from retaining full control over their infrastructure, ensuring that sensitive asset information remains within internal networks and is not exposed to external cloud-based risks.

Enterprise Size Insights

Thelarge enterprises segment dominated the market and accounted for the revenue share of over 65.0% in 2024, driven by the scale and complexity of operations that demand robust, real-time visibility across assets, equipment, and inventory. Large organizations, spanning industries such as manufacturing, logistics, energy, aviation, and healthcare, manage physical assets distributed across multiple locations.

The SMEs segment is expected to grow at a significant CAGR during the forecast period due to the growing adoption of digital transformation among SMEs is supporting the uptake of asset tracking technologies. As SMEs modernize their operations to compete in increasingly digital marketplaces, they are adopting IoT-enabled tools that provide data insights and automation capabilities. Asset tracking is often among the first investments in this transformation, offering tangible returns in terms of improved operational transparency, customer service, and decision-making.

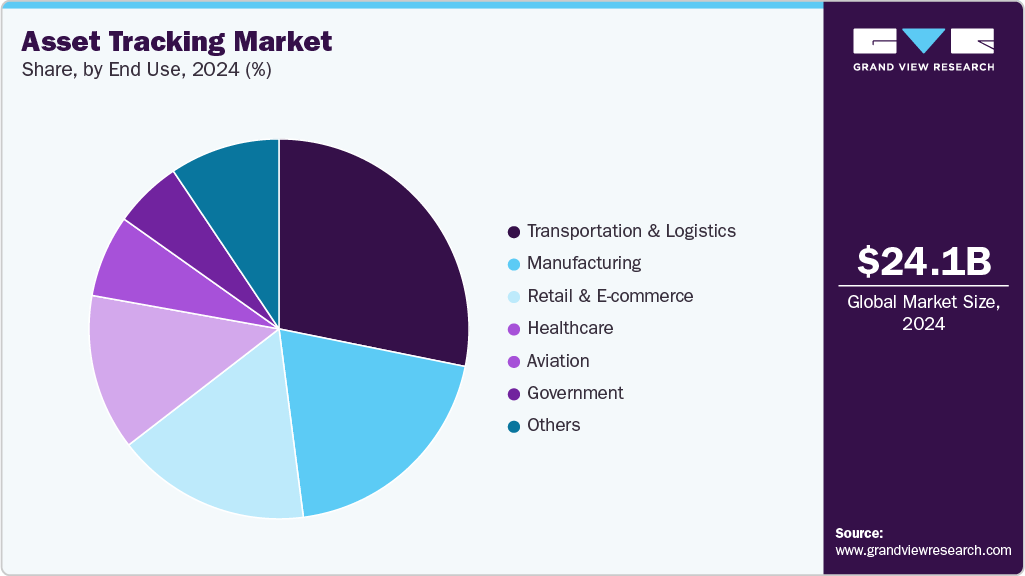

End Use Insights

The transportation & logistics segment dominated the market and accounted for the revenue share of over 28.0% in 2024, driven by the rising demand for fleet optimization and predictive maintenance. For transportation companies, managing large fleets of trucks, vessels, or cargo equipment is resource-intensive and prone to inefficiencies if assets are not properly maintained. Asset tracking systems allow for the monitoring of vehicle health, usage patterns, and fuel consumption, enabling timely maintenance, reducing downtime, and extending asset lifespan.

The retail & e-commerce segment is expected to grow at a significant CAGR over the forecast period due to the surge in online shopping and demand for fast, accurate deliveries. As consumers expect quicker delivery times and real-time updates on their purchases, retailers and e-commerce businesses are under pressure to optimize last-mile logistics and ensure that inventory is tracked accurately across the supply chain. Asset tracking systems, which include GPS, RFID, and barcode scanning technologies, help retailers track products from warehouse to the final destination, enabling seamless order fulfillment and reducing delays.

Regional Insights

North America dominated the market and accounted for a revenue share of around 39.0% in 2024, driven by the region's strong focus on technological innovation and adoption, particularly within industries such as manufacturing, logistics, and retail. The increasing need for real-time asset visibility, improved supply chain efficiency, and operational cost reduction is fueling the demand for asset tracking solutions.

U.S. Asset Tracking Market Trends

The asset tracking market in the U.S. is expected to grow significantly at a CAGR of 14.8% from 2025 to 2030 driven by the rapid advancements in IoT, cloud computing, and AI technologies. These innovations allow businesses to manage vast numbers of assets more efficiently, improving operational visibility, inventory accuracy, and asset utilization. The expanding e-commerce sector, which requires optimized supply chains and last-mile delivery solutions, is a major catalyst for adoption.

Europe Asset Tracking Market Trends

The asset tracking market in Europe is anticipated to register a considerable growth from 2025 to 2030 due to stringent regulatory requirements across various industries such as pharmaceuticals, automotive, and logistics. The European Union’s emphasis on supply chain transparency, product safety, and sustainability has made asset tracking a critical component of businesses' operational strategies.

The UK asset tracking market is expected to grow rapidly in the coming years owing to the country’s rapidly expanding e-commerce sector and increasing demand for efficiency in logistics and supply chains. Retailers are increasingly leveraging asset tracking solutions to optimize inventory management and improve last-mile delivery operations.

The Germany asset tracking market held a substantial market share in 2024. The country’s strong emphasis on Industry 4.0 and automation in manufacturing processes has spurred the adoption of asset tracking solutions to improve operational efficiency, asset utilization, and real-time visibility in factory settings.

Asia Pacific Asset Tracking Market Trends

The Asia Pacific region is projected to emerge as the fastest-growing market, exhibiting a compound annual growth rate (CAGR) of 15.7% from 2025 to 2030, due to the region’s booming e-commerce industry, increasing demand for supply chain optimization, and rapid industrialization. Countries such as India, China, and Southeast Asian nations are seeing a surge in logistics and transportation networks, which are driving the need for real-time tracking solutions.

The Japan asset tracking earbuds market is expected to grow rapidly in the coming years driven by the country’s technological advancements and a strong focus on automation and efficiency. Japan’s robust manufacturing sector, particularly in electronics and automotive industries, relies heavily on asset tracking for managing production lines, inventory, and logistics.

The China asset tracking earbuds market held a substantial market share in 2024, due to the country's large-scale manufacturing and logistics industries. As the exporter, China’s supply chains demand greater efficiency and transparency, leading to the widespread adoption of asset tracking technologies. The government’s focus on Made in China 2025 and its push for digital transformation in manufacturing and logistics are key drivers.

Key Asset Tracking Company Insights

Key players operating in the asset tracking industry are ASAP Systems, Samsara Inc., Asset Panda, Verizon, Trimble Inc., and Qualcomm Technologies Inc. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In January 2025, Verizon unveiled two new solutions aimed at improving fleet safety, driver behavior, and overall operational performance. The Extended View Cameras provide nearly 360-degree coverage by incorporating rear, side, and cargo views, enhancing situational awareness. In addition, the customizable Driver Vehicle Inspection Report (DVIR), available through the Verizon Connect Reveal platform, streamlines regulatory compliance and maintenance workflows. These offerings equip fleet managers with robust tools to better protect vehicles, drivers, and the communities they operate in.

-

In January 2025,Trimble Inc. announced the expansion of its partnership with Qualcomm Technologies, Inc. to advance high-precision positioning solutions for automated vehicles, including passenger cars and heavy-duty trucks. As part of the collaboration, Trimble’s ProPoint Go positioning engine to be integrated into Qualcomm Technologies, Inc.’s 5G Modem-RF Gen 2 of Snapdragon Auto, a component of the Snapdragon Digital Chassis. This integration aims to deliver positioning accuracy of 10 cm.

-

In June 2024, Samsara Inc. introduced the enterprise-level Asset Tag, developed to address the growing need for tracking smaller, high-value assets. Utilizing the Samsara Network, this new device enhances asset visibility by providing real-time location data for essential equipment and tools. The solution aims to help organizations reduce downtime caused by misplaced or stolen items, lower related expenses, and streamline inventory control processes.

Key Asset Tracking Companies:

The following are the leading companies in the asset tracking market. These companies collectively hold the largest market share and dictate industry trends.

- Actsoft.com

- ASAP Systems

- Asset Panda

- AT&T Inc.

- Fleet Complete

- GigaTrak (P&T Solutions Inc.)

- OnAsset Intelligence Inc.

- Qualcomm Technologies Inc.

- Samsara Inc.

- Spireon Inc.

- Tenna

- Trimble Inc.

- Verizon

- Wasp Barcode Technologies

Asset Tracking Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 25.75 billion

Revenue forecast in 2030

USD 51.59 billion

Growth rate

CAGR of 14.9% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, technology, deployment, enterprise size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Actsoft.com; ASAP Systems; Asset Panda; AT&T Inc.; Fleet Complete; GigaTrak (P&T Solutions Inc.); OnAsset Intelligence Inc.; Qualcomm Technologies Inc.; Samsara Inc.; Spireon Inc.; Tenna; Trimble Inc.; Verizon; Wasp Barcode Technologies; Zebra Technologies Corp.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Asset Tracking Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global asset tracking market report based on component, technology, deployment, enterprise size, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

RFID (Radio-Frequency Identification)

-

M2M/IoT

-

GPS

-

Barcode

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

SMEs

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Transportation & Logistics

-

Manufacturing

-

Healthcare

-

Retail & E-commerce

-

Aviation

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global asset tracking market size was estimated at USD 24.14 billion in 2024 and is expected to reach USD 25.75 billion in 2025.

b. The global asset tracking market is expected to grow at a compound annual growth rate of 14.9% from 2025 to 2030 to reach USD 51.59 billion by 2030.

b. The asset tracking market in North America held a significant share of nearly 39.0% in 2024, driven by ]the region's strong focus on technological innovation and adoption, particularly within industries like manufacturing, logistics, and retail.

b. Some key players operating in the asset tracking market include Actsoft.com, ASAP Systems, Asset Panda, AT&T Inc., Fleet Complete, GigaTrak (P&T Solutions Inc.), OnAsset Intelligence Inc., Qualcomm Technologies Inc., Samsara Inc., Spireon Inc., Tenna, Trimble Inc., Verizon, Wasp Barcode Technologies, Zebra Technologies Corp.

b. Key factors driving the asset tracking market growth include the global surge in supply chain digitization and operational efficiency demands. Businesses across industries are adopting IoT-enabled tracking solutions to monitor assets in real-time, reducing losses and optimizing logistics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.