- Home

- »

- Pharmaceuticals

- »

-

Australia Legal Cannabis Market Size, Industry Report, 2030GVR Report cover

![Australia Legal Cannabis Market Size, Share & Trends Report]()

Australia Legal Cannabis Market Size, Share & Trends Analysis Report By Source (Marijuana, Hemp), By Derivative (CBD, THC), By End-use (Medical Use, Recreational Use, Industrial Use), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-472-7

- Number of Pages: 90

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Healthcare

Australia Legal Cannabis Market Trends

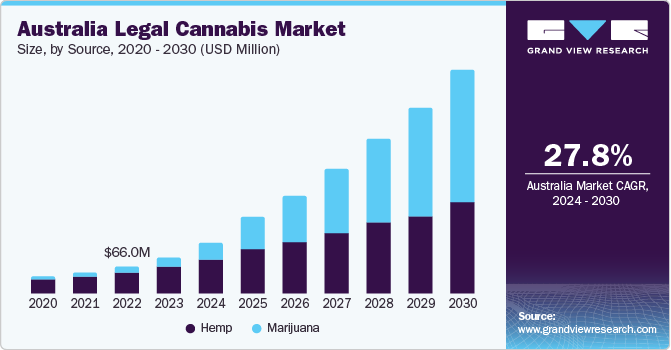

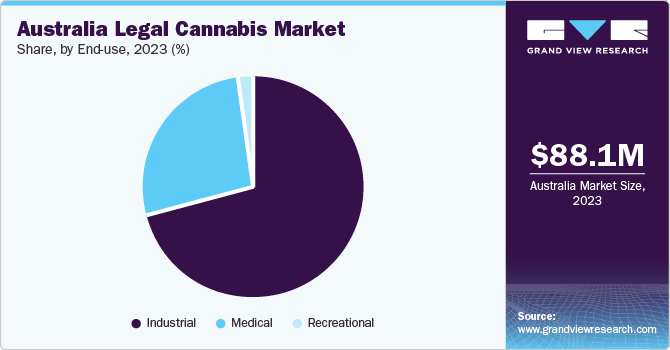

The Australia legal cannabis market size was estimated at USD 88.1 million in 2023 and is anticipated to grow at a CAGR of 27.8% from 2024 to 2030. The industry growth is propelled by the growing awareness of the health benefits of cannabis and the legalization of marijuana, mostly for medical purposes. Furthermore, the increase in medical marijuana output as a result of increasing demands in the pharmaceutical sector is boosting overall growth.

In 2016, the Australian Government legalized cannabis for medicinal purposes in all six states and two territories. The Therapeutic Goods Administration (TGA) regulates the supply of medicinal cannabis in Australia. The legal framework regulating medicinal cannabis is constantly evolving and remains closely monitored. New cannabis legislation was enacted by the Australian government, allowing the Australian Capital Territory (ACT) to acquire and cultivate four plants of cannabis per household for personal use. In October 2023, the Australian Capital Territory (ACT) introduced certain regulations on the use of cannabis. It stated that individuals over 18 years old can own fresh cannabis up to 150 grams or dried cannabis up to 50 grams. This factor is expected to contribute to the cannabis usage in Australia.

The rising use of marijuana, mostly for medical purposes, and the availability of several medicinal cannabis products are boosting market growth as customers adopt cannabis-based treatment. For instance, as of 2023, more than 450 medicinal cannabis products are available in Australia. There are five different categories of cannabis products available such as,

-

Category 1: CBD Medicinal Cannabis Product (CBD >98%)

-

Category 2: CBD Dominant Medicinal Cannabis Product (CBD >60% and <98%)

-

Category 3: Balanced Medicinal Cannabis Product (CBD <60% and >40%)

-

Category 4: THC Dominant Medicinal Cannabis Product (THC 60-98%)

-

Category 5: THC Medicinal Cannabis Product (THC >98%).

When contrasted with different nations in Asia Pacific, Australia has been a strong advocate of cannabis legalization. For instance, Australia is working on passing a bill to legalize the use of cannabis for recreational purposes. The Legalizing Cannabis Bill 2023 is expected to take place in May 2024. The Legalizing Cannabis Bill 2023, if approved, would modify the federal landscape. It aims to legalize the use of cannabis for recreational purposes in Australia. In addition, the Bill would develop the Cannabis Australia National Agency as a statutory body responsible for the registration of cannabis strains and oversight of cannabis-related activities such as growing, possession, manufacturing, sale, operation of cannabis cafes, and import/export of cannabis products. Such initiatives are expected to boost the growth of the legal cannabis market in Australia.

Market Concentration & Characteristics

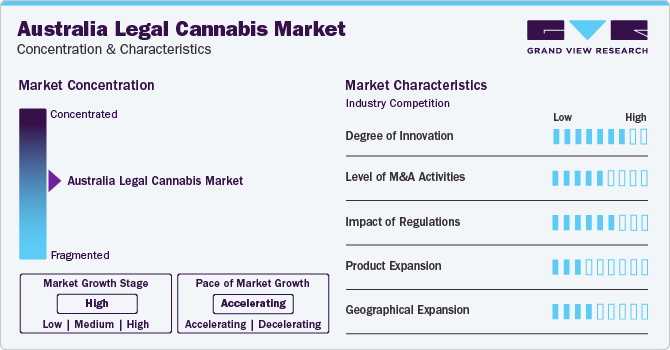

The degree of innovation in the Australia legal cannabis market is moderate. The innovation is attributed to medicinal cannabis being used in cases where patients suffer from severe, persistent symptoms that do not respond adequately to conventional therapies recommended for their condition. In August 2022, the Centre for Medicinal Cannabis Research and Innovation announced the initiation of stage 2 of the clinical trial examining the influence of THC on appetite in terminal cancer patients.

Market players implement diverse business strategies to increase their revenue growth, fostering growth in the Australia legal cannabis market. For instance, in February 2024, Aurora Cannabis Inc., a Canada-based medical cannabis company, acquired approximately 90% equity interest in MedReleaf Australia, a distributor of medical cannabis products in Australia, at an enterprise value of USD 32.6 million to strengthen its presence in Australia.

Regulation for legal cannabis in Australia involves a comprehensive framework that governs the cultivation, manufacturing, distribution, sale, and use of cannabis for medical. In Queensland, the Drugs Misuse Act 1986 (Part 5B) and the Drugs Misuse Regulation 1987 (Part 4) supervise industrial cannabis production. Moreover, in Australia, cannabis cultivation for medicinal use is exclusively authorized by the Commonwealth Narcotic Drugs Act 1967. Furthermore, the Legalizing Cannabis Bill 2023 proposes to legalize the recreational use of cannabis for adults in Australia, which is expected to fuel the market growth.

Key industry participants are directing their efforts toward geographical expansion to seize opportunities within previously unexplored markets. This expansion typically involves the establishment of manufacturing facilities and research and development centers in new regions or through mergers and acquisitions with companies in different locations. For instance, in January 2024, Cronos Group Inc. expanded its distribution network to the Australian market by providing its first delivery of cannabis flowers to Vitura Health Limited, a medicinal cannabis products manufacturer. The company owns approximately 10% of the common shares of Vitura (Cronos Australia).

Source Insights

The hemp segment dominated the market for legal cannabis in Australia and accounted for the highest revenue share of 74.1% in 2023. This can be attributed to the increasing prevalence of ailments such as epilepsy and sleep disorders and increased usage of hemp-based goods, such as hemp CBD and supplements, for their many health advantages. For instance, according to Epilepsy Action Australia, epilepsy was diagnosed in 250,000 people in Australia. Moreover, the growing use of hemp-based products for various industrial purposes and increased demand for green buildings due to environmental degradation are expected to propel the market for hemp-based construction materials over the forecast period.

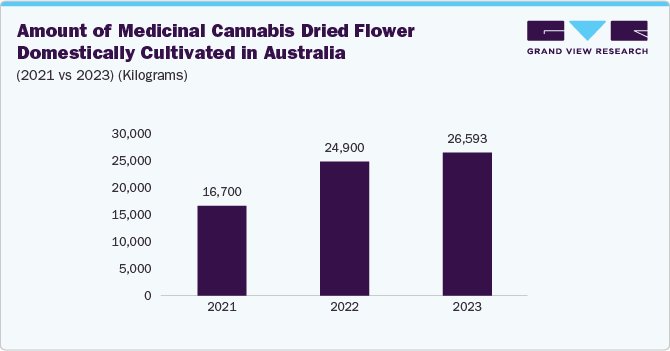

The marijuana segment is expected to grow at the fastest CAGR during the forecast period. The growth is attributed to the therapeutic benefits of marijuana to ease the suffering from illnesses such as cancer, AIDS, multiple sclerosis, glaucoma, seizure disorders, spinal cord injuries, chronic pain, and other disorders. According to the Australian Institute of Health and Welfare, approximately 165,000 cancer cases were diagnosed, resulting in around an 88% increase from 2000. Furthermore, according to the WAAC, in 2023, there were around 29,000 individuals living with HIV, and over 90% getting treated for the same. Moreover, according to the Australian Institute of Health and Welfare, in 2019, 2.7% (600,000 people) of the total Australian population used cannabis for medical purposes. Thus, the increasing number of such disorders is expected to result in increased use of marijuana for medical purposes, further driving the segment's growth.

Derivative Insights

The CBD segment held the largest revenue share of 64.9% in 2023. This can be attributed to the legalization of low-dose CBD products by the Therapeutic Goods Administration (TGA); even though these products have been legalized, they have yet to be approved by the Australian Register of Therapeutic Goods (ARTG). CBD medical products can be imported into Australia through the Authorised Prescriber and Special Access schemes. CBD has been approved for various conditions such as treating epileptic seizures, and nausea caused due to chemotherapy and arthritic pain. According to the Alcohol and Drug Foundation, there are two CBD products approved in Australia, such as nabiximols from the Sativex brand and cannabidiol from the Epidyolex brand.

The others segment is expected to grow at the fastest CAGR during the forecast period. The other segment includes derivatives or components of the cannabis plant, such as flavonoids, terpenes, and other minor cannabinoids. Factors such as increasing research activities, growing adoption of minor cannabinoids, and adoption of various strategies for its distribution are anticipated to propel the segment growth. For instance, in May 2022, Bod Australia (BOD) conducted a study that showed promising outcomes regarding the safety and effectiveness of a cannabigerol (CBG) cannabis extract.

End-use Insights

The industrial application segment dominated the Australia legal cannabis market and accounted for the largest revenue share of 71.2% in 2023. Construction, personal care, food and beverage, automotive, and textile industries are all witnessing an increase in demand for hemp fibers and oil, helping the category grow. Varnishes, fuel, oil paints, putty, solvents, chain-saw lubricants, printing inks, and coatings are all expected to increase demand. Furthermore, hemp can be used as an alternative protein source in food products and as animal feed. Cannabis is rapidly used in non-textile applications to reduce deforestation, pollution, and landfill waste. Cannabis for industrial use in Queensland, Australia, is regulated under the Drugs Misuse Act 1986 (Part 5B) and the Drugs Misuse Regulation 1987 (Part 4).

The recreational segment is expected to grow at the fastest CAGR during the forecast period. The proposed Legalising Cannabis Bill 2023 represents a significant catalyst for the growth of the recreational application segment of Australia's legal cannabis market. If enacted, this legislation would mark a pivotal shift by legalizing the recreational use of cannabis among adults across the country. Such legalization is expected to surge the demand for cannabis products for recreational purposes as consumers gain legal access to a previously prohibited substance. This legislation change could create new opportunities for businesses operating within the cannabis industry while contributing to the segment's growth.

Key Australia Legal Cannabis Company Insights

Key players are engaging in new product development, partnership, and merger & acquisition strategies to increase their market share. For instance, in October 2023, AgriFutures Australia, a Research and Development Corporation, invested USD 2.5 million over five years to conduct research into four key areas such as hemp primary production, hemp seeds and varieties, hemp sustainability, and hemp products. Market players such as Zelira AusCann Group Holdings Ltd.; and others dominated the market. These key players have been supplying cannabis for medicinal purposes. Furthermore, emerging players, including ECOFIBRE and Bod Australia are undertaking several partnerships and research studies to promote cannabis-based medicines.

Key Australia Legal Cannabis Companies:

- Cann Group Limited

- Zelira Therapeutics

- AusCann Group Holdings Ltd.

- Bod Australia

- Althea Group

- ECOFIBRE

- Botanix Pharmaceuticals

- EPSILON

- Little Green Pharma

- Incannex

Recent Developments

-

In February 2024, Peak Processing Solutions, an Althea Group Holdings subsidiary, signed an agreement with Collective Project to produce 6 cannabis-based beverage products based on contract manufacturing.

-

In January 2024, Althea Group Holdings Limited, a manufacturer and distributor of cannabis-based products, launched two new products, Althea THC10, and Althea CBD3:THC2, and expanded its softgel capsule product range.

-

In June 2023, Cann Group Limited signed an agreement with Levin Health Pty Ltd., to supply cannabis flowers to Levin to meet the production of cannabis based products.

Australia Legal Cannabis Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 123.9 million

Revenue forecast in 2030

USD 540.6 million

Growth rate

CAGR of 27.8% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, derivative, end-use

Country scope

Australia

Key companies profiled

Cann Group Limited; Zelira Therapeutics; AusCann Group Holdings Ltd.; Bod Australia; Althea Group; ECOFIBRE; Botanix Pharmaceuticals; EPSILON; Little Green Pharma; Incannex

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Australia Legal Cannabis Market Report Segmentation

This report forecasts revenue growth and provides at country level an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the Australia legal cannabis market report based on source, derivative, and end-use:

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Marijuana

-

Flower

-

Oil And Tinctures

-

-

Hemp

-

Hemp CBD

-

Supplements

-

Industrial Hemp

-

-

-

Derivative Outlook (Revenue, USD Million, 2018 - 2030)

-

CBD

-

THC

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical

-

Cancer

-

Chronic Pain

-

Depression And Anxiety

-

Arthritis

-

Diabetes

-

Glaucoma

-

Migraine

-

Epilepsy

-

Multiple Sclerosis

-

AIDS

-

Amyotrophic Lateral Sclerosis

-

Alzheimer’s Disease

-

Post-traumatic Stress Disorder (PTSD)

-

Parkinson's Disease

-

Tourette Syndrome

-

Others

-

-

Recreational

-

Industrial

-

Frequently Asked Questions About This Report

b. The Australia legal cannabis market size was estimated at USD 88.1 million in 2023 and is expected to reach USD 123.9 million in 2024.

b. The Australia legal cannabis market is expected to grow at a compound annual growth rate of 27.8% from 2024 to 2030 to reach USD 540.6 million by 2030.

b. Hemp dominated the Australia legal cannabis market with a share of 74.1% in 2023. This is attributable to the increased number of patients consuming hemp-based products such as hemp CBD and supplements for various health benefits.

b. Some key players operating in the Australia legal cannabis market include AusCann Group Holdings Pty Ltd; Cann Group Ltd; Bod Australia; Zelira Therapeutics; Althea Group Holdings Limited; THC Global Group Limited; MGC Pharmaceuticals Ltd; and Ecofibre Limited.

b. Key factors that are driving the Australia legal cannabis market growth include the increasing legalization of marijuana for adult and medical use and the high consumption rate in the country.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."