- Home

- »

- Advanced Interior Materials

- »

-

Australia & New Zealand Flooring Market Size Report, 2030GVR Report cover

![Australia & New Zealand Flooring Market Size, Share & Trends Report]()

Australia & New Zealand Flooring Market Size, Share & Trends Analysis Report By Product (Tiles, Wood, Laminate, Natural Stone), By Channel Type (Retail, Commercial), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-091-4

- Number of Report Pages: 75

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

The Australia & New Zealand flooring market size was estimated at USD 4.40 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.3% from 2024 to 2030. Growth in the construction industry in Australia & New Zealand is attributed to the rising commercial and residential construction activities, which is expected to propel the demand for flooring products over the forecast period.

Asia Pacific is one of the largest consumers of floor covering products in the world. Factors, such as increasing investment in affordable housing, smart city construction, upgradation & construction of infrastructure, and investment in tourism sector, are expected to boost demand for floor-covering products in Asian Countries including Australia & New Zealand. Many companies are investing in establishing their presence in Australian and New Zealand markets through acquisition of regional companies and strengthening their position in the industry. For instance, Mohawk Industries, Inc. announced its acquisition of Godfrey Hirst Group.

Carpets, ceramic tiles, porcelain tiles, marble & stones, and vinyl tiles are majorly used flooring types in commercial construction sector in countries in Asia Pacific including Australia and New Zealand. These products are used to enhance overall aesthetics and interiors of non-residential buildings such as offices, commercial complexes, hospitals, hotels, and educational institutions. Positive growth trends of the commercial construction sector in urban areas in developing countries including New Zealand are expected to play a vital role in creating ample scope for the consumption of building materials including floor coverings.

Growing population in Australia & New Zealand also requires various commercial buildings, such as theaters, restaurants, hotels, educational institutions, dormitories & hostels, and hospitals. Hence, with rise in such establishments, demand for flooring products, such as natural stone, wood, and laminate, is also growing rapidly.

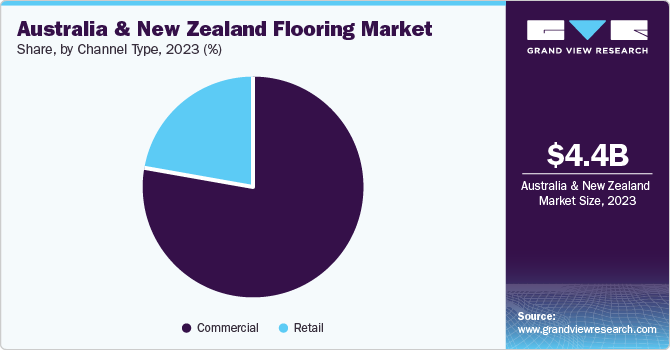

Channel Type Insights

Based on channel type, commercial channel segment led the market with the highest revenue share and is expected to grow at the fastest CAGR of 5.4% from 2024 to 2030. This commercial channel type mainly focuses on purchase of flooring products in bulk to cater to large building projects. For instance, flooring solutions for commercial building structures, such as apartment buildings & complexes, hotels, hostels, hospitals, schools, universities, and shopping complexes, are procured through commercial channel. Bulk purchasing of flooring products helps buyers get discounts, which aids them procure flooring at more affordable prices. Furthermore, the commercial channel is preferred by professional builders and architects, who prefer purchasing products in large quantities.

These builders often establish trade agreements with manufacturers and retailers to secure bulk quantities of flooring solutions at once. Retail flooring segment includes the purchase of flooring products via retail outlets and online websites in smaller quantities. This includes purchases made by homeowners or business owners for residential or small-scale commercial projects. This segment involves both online & offline channels used for product purchases. End-users do not involve any middlemen, such as contractors, to procure flooring products but rather make purchases on their own, in smaller quantities, either from retailers or directly from manufacturers via online portals. Growing construction sector in New Zealand & Australia, along with increasing population, is propelling product demand.

Market Dynamics

Building and construction is one of the fastest-growing industries in Australia & New Zealand, with significant annual spending. Rapid urbanization in developing countries has led to more people shifting to urban areas in search of jobs and better quality of life. Due to this, infrastructural projects, such as residential complexes and apartments, have increased rapidly. This has resulted in the growing demand for flooring solutions across Australia and New Zealand. Moreover, rising consumer disposable income due to rapid globalization and industrialization will support industry growth.

Rapid industrialization in developing countries have resulted in urbanization in these countries, which has increased demand for flooring in residential and commercial buildings worldwide. This is positively influencing the demand for flooring products. Due to increased disposable income in developed nations like Australia, the urban population is actively engaging in renovation and upgrading endeavors for their residences and apartments. Population is more inclined towards selecting construction materials, including flooring, in accordance with prevailing market trends and evolving personal preferences. This trend has had a beneficial impact on the growth and advancement of the flooring market in Australia and New Zealand.

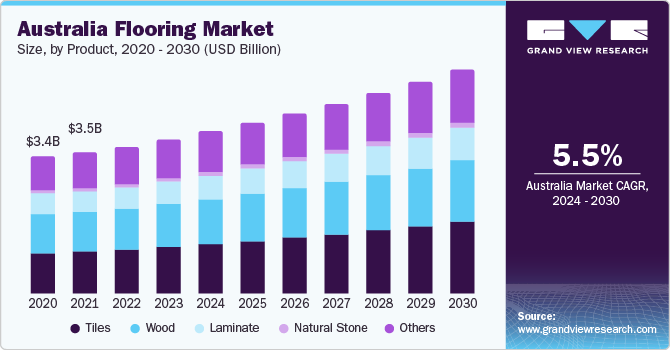

Product Insights

The tiles product segment dominated the market with the largest revenue share of 30.4% in 2023. This tiles segment consists of floor products, such as ceramic tiles, porcelain tiles, vinyl, luxury vinyl tiles (LVT), and linoleum & rubber. Ceramic tiles are primarily of three types, namely glazed tiles, unglazed tiles, and scratch-resistant tiles. Glazed tiles are primarily used in general & wet areas, such as kitchens, bathrooms, and laundry areas, as these tiles have an extra glass-based protective layer, which makes them water and stain-resistant. Scratch-resistant tiles are primarily utilized in high footfall areas, such as landscapes, pathways, parking, and shop floors, to cater to highly stressed usage conditions.

Tile floorings have several advantages over their alternates including sheet and wood floorings. Moreover, tiles are ideal for areas with high footfall as tiles, unlike wooden & laminate floor products, have a longer service life. Hence, with a rise in the number of commercial & institutional buildings, such as malls, shopping complexes, schools, and universities, the demand for tile floorings is also growing. Moreover, they are easier to clean and many of them possess scratch-resistant properties, which keep them aesthetically pleasing for longer periods.

Country Insights

Australian flooring market accounted for the largest revenue share in 2023 and is forecasted to grow at a significant rate over the coming decade. Construction is one of the key industries in Australia. In 2022, Australian construction industry generated over USD 360 billion in revenue, which was about 9% of the country’s GDP. This growth in the construction industry in Australia is attributed to the rising commercial and residential construction activities, which is expected to boost demand for floor products.

Growing rate of remodeling and renovation of commercial and residential spaces in Australia and New Zealand is also expected to propel demand for floorings. Moreover, urban areas in these countries are experiencing a population surge, which has created a higher demand for living and working spaces. This has increased the frequency of redevelopment and refurbishment of building structures to accommodate a larger population. This is likely to benefit the market demand over the coming years.

Key Companies & Market Share Insights

The market is characterized by the presence of a large numbers of key. Many established producers compete based on product quality and pricing to expand their commercial and residential flooring applications. Key players strive for optimal business growth and a stronger market position through a variety of strategies, such as joint ventures, integration through acquisitions, production capacity expansions, promotion of critical product brands, new product developments, and significant investments in R&D activities.

Key Australia & New Zealand Flooring Companies:

- Altro APAC Pty. Ltd.

- Armstrong Flooring Australia

- Sanctuary Makers

- Godfrey Hirst Australia Pty. Ltd.

- HARO Flooring New Zealand

- Roxset Australia

- Antiskid Industries

- Sika Australia

- Bethell Flooring

- Multiblast Flooring Pty. Ltd.

Australia & New Zealand Flooring Market Report Scope

Report Attribute

Details

Revenue forecast in 2024

USD 4.62 billion

Revenue forecast in 2030

USD 6.30 billion

Growth rate

CAGR of 5.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million/billion, volume in million square meters, CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, trends

Segments covered

Product, channel type, region

Country scope

Australia; New Zealand

Key companies profiled

Altro APAC Pty. Ltd.; Armstrong Flooring Australia; Sanctuary Makers; Godfrey Hirst Australia Pty. Ltd.; HARO Flooring New Zealand; Roxset Australia; Antiskid Industries; Sika Australia; Bethell Flooring; Multiblast Flooring Pty. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Australia & New Zealand Flooring Market Report Segmentation

This report forecasts volume & revenue growth at regional and country levels and provides an analysis of the latest trends in each of the segments from 2018 to 2030. For this study, Grand View Research has segmented the Australia & New Zealand flooring market report based on product, channel type, and country:

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Tiles

-

Wood

-

Laminate

-

Natural Stone

-

Others

-

-

Channel Type Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Retail

-

Commercial

-

-

Country Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Australia

-

New Zealand

-

Frequently Asked Questions About This Report

b. The Australia & New Zealand flooring market size was estimated at USD 4.40 billion in 2023 and is expected to reach USD 4.62 billion in 2024.

b. The Australia & New Zealand flooring market is expected to grow at a compound annual growth rate a CAGR of 5.3% from 2024 to 2030 to reach USD 6.30 billion by 2030.

b. The tiles product segment accounted for the largest revenue share in 2023 on account of increasing construction activities in Australia and New Zealand.

b. Some key players operating in the Australia & New Zealand flooring market include Altro APAC Pty Ltd, Armstrong Flooring Australia, Sanctuary Makers, Godfrey Hirst Australia Pty Ltd, HARO Flooring New Zealand, Roxset Australia, ANTISKID INDUSTRIES, Sika Australia, Bethell Flooring, and Multiblast Flooring Pty Ltd.

b. The key factors driving the market growth are the growing industrialization coupled with rapidly growing construction activities in the country.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."