- Home

- »

- Electronic & Electrical

- »

-

Australia Retail Vending Machine Market Size Report, 2033GVR Report cover

![Australia Retail Vending Machine Market Size, Share & Trends Report]()

Australia Retail Vending Machine Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Snack Vending Machines, Beverages Vending Machines), By Location (Offices, Public Places), By Mode Of Payment (Cash, Cashless), And Segment Forecasts

- Report ID: GVR-4-68040-675-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Australia Retail Vending Machine Market Summary

The Australia retail vending machine market size was estimated at USD 3.36 billion in 2024 and is projected to reach USD 4.64 billion by 2033, growing at a CAGR of 3.5% from 2025 to 2033. In Australia, growth in vending machines is fueled by rising deployment in remote and semi-urban areas where retail access is limited.

Key Market Trends & Insights

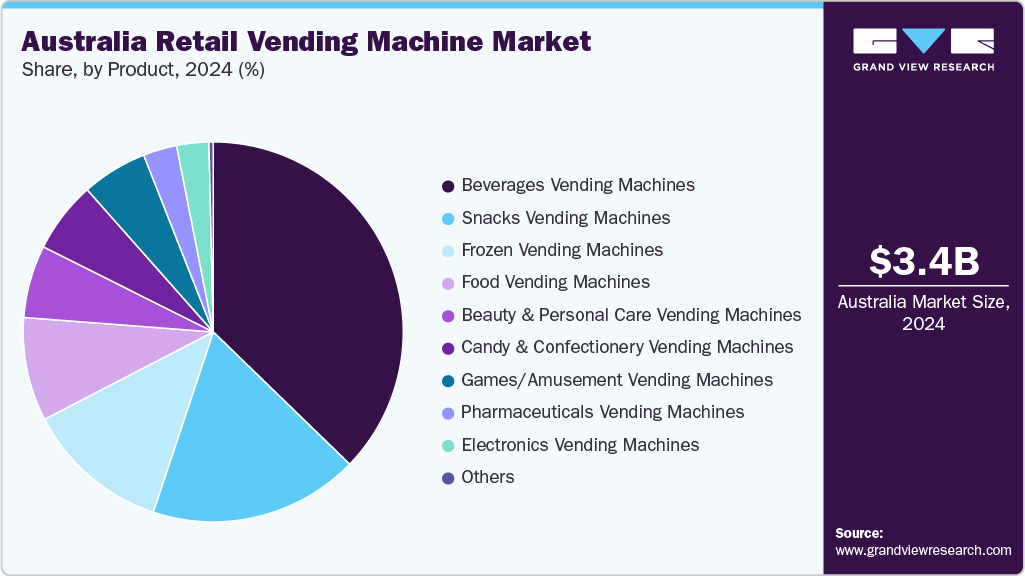

- By product, beverage vending machines accounted for a market share of 37.25% in 2024.

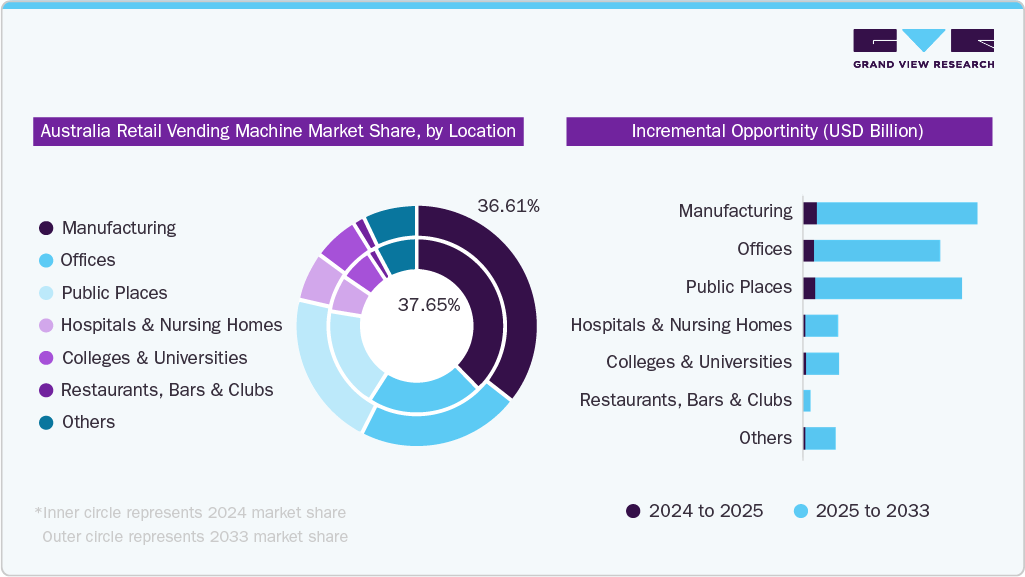

- By location, beverage machines for manufacturing accounted for a market share of 37.65% in 2024.

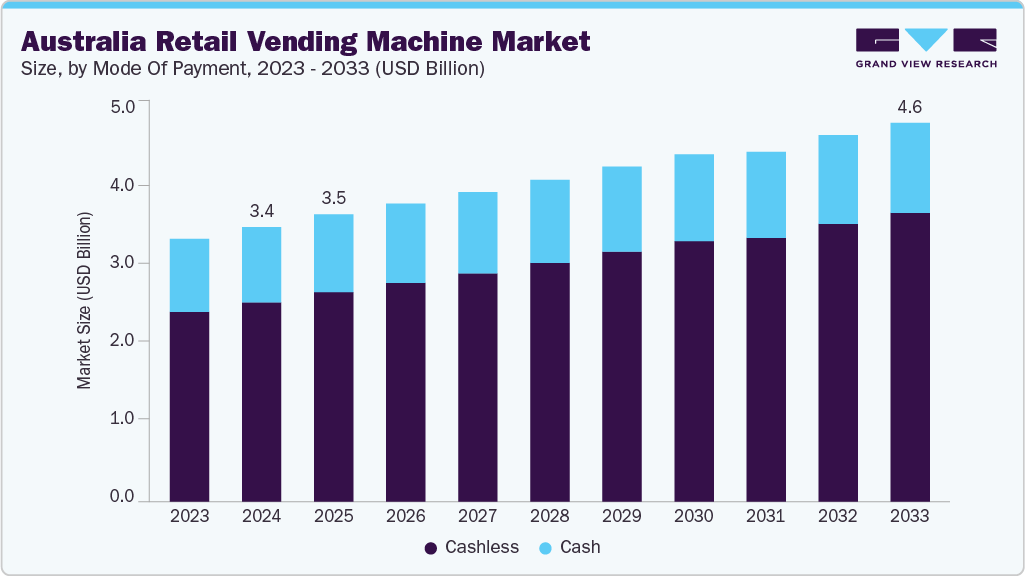

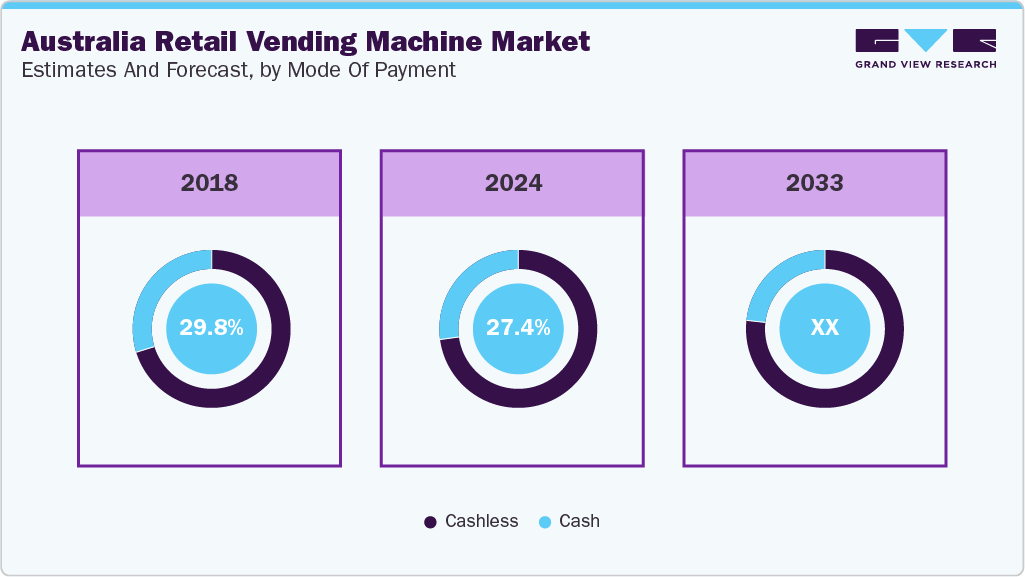

- By mode of payment, the cashless vending machines held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.36 Billion

- 2033 Projected Market Size: USD 4.64 Billion

- CAGR (2025-2033): 3.5%

Labor shortages and high wage costs are also pushing businesses to adopt automated retail solutions. The growth of the vending machine market in Australia is primarily driven by increasing demand for self-service retail in remote and underserved regions, where traditional retail infrastructure is limited. High labor costs and ongoing workforce shortages are encouraging businesses to adopt automated solutions like vending machines to reduce operational expenses. In addition, Australia's tech-savvy population and widespread use of digital payments have accelerated the shift toward smart vending machines equipped with cashless and contactless payment systems. The push for 24/7 accessibility and convenience, especially in high-traffic areas such as airports, universities, and hospitals, further supports market expansion.

The growth of the vending machine market in Australia is significantly driven by increasing demand for convenient, 24/7 retail access in urban and remote regions. As traditional retail stores close earlier or are absent in less populated areas, vending machines provide an efficient solution for consumers seeking on-the-go snacks, beverages, and daily essentials. For example, companies like Food Connect Shed and Open Pantry Co. have deployed smart vending units in regional Queensland and Victoria to cater to areas lacking full-service supermarkets or convenience stores. These machines offer fresh food, healthier options, and local produce, addressing accessibility and dietary trends.

Australia’s rising labor costs and persistent workforce shortages-especially in retail and hospitality sectors-have also accelerated the shift toward automation. Many businesses are turning to vending machines as a cost-effective alternative to staffing full-service counters, particularly in high-footfall zones such as universities, transport hubs, and hospitals. For instance, Vendpro and 24/7 Vending have seen increased demand for machines in education and healthcare institutions where minimizing staff reliance is essential. These machines reduce the need for human labor while ensuring uninterrupted service, a crucial advantage in today’s constrained labor market.

Technological innovation and a digitally fluent population further support vending market expansion in Australia. Smart vending machines with cashless payments, inventory tracking, and interactive displays are becoming standard, aligning with Australians’ preference for fast, touch-free transactions. The adoption of tap-and-go payments and mobile wallets like Apple Pay and Google Pay has made it easier for consumers to engage with vending machines without physical cash. In addition, sustainability features such as energy-efficient cooling systems and recyclable packaging are increasingly influencing purchasing behavior, with eco-conscious offerings from providers like Sno Pro and Vendy gaining traction in urban centers.

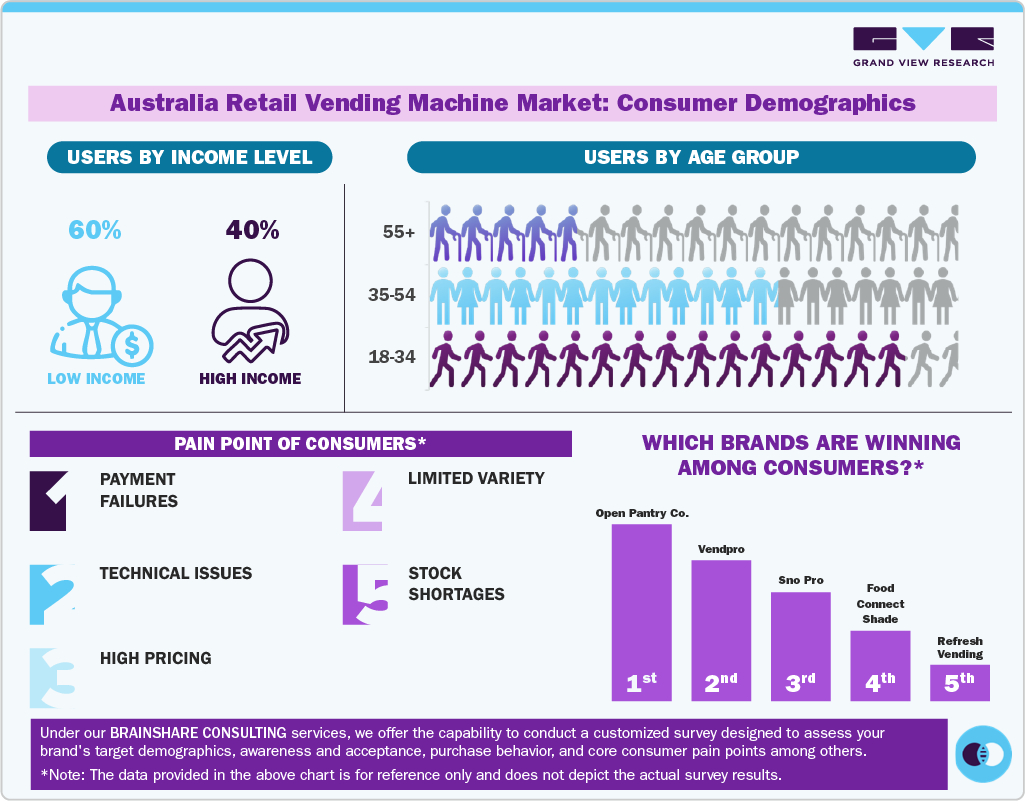

Consumer Insights

In Australia, vending machine usage differs by income level. Low-income users favor machines for affordable, quick-access snacks in public areas, while high-income users engage more with premium, health-focused options found in airports, gyms, and offices. Convenience and accessibility drive both segments, but product expectations vary significantly.

Younger adults (18-35) are the most active users, drawn by tech-friendly, cashless machines. The 35-55 age group uses vending machines mainly in workplaces and hospitals, valuing speed and ease. Older adults (55+) engage less, though improved interfaces and product relevance are slowly increasing adoption.

Consumers face recurring pain points such as limited product variety, high prices for fresh items, technical glitches, stockouts, and inconsistent availability in suburban or regional areas. These issues hinder repeat use and reduce trust, especially in unattended or high-traffic locations.

Brands like Open Pantry Co., Vendpro, Sno Pro, and Food Connect Shed are gaining consumer favor by addressing these gaps. They offer healthier, locally sourced products and smart technology, setting new standards for convenience and quality in Australia's vending landscape.

Product Insights

Beverage vending machines in Australia accounted for a revenue share of 37.25% in 2024. This dominance stems from Australia's warm climate, high demand for on-the-go hydration, and widespread placement of beverage machines in schools, gyms, transport hubs, and offices. The popularity of bottled water, energy drinks, and ready-to-drink coffees fuels this segment. Brands like Sno Pro have introduced refrigerated beverage vending machines offering healthier drink options, aligning with evolving consumer preferences

Snack vending machines in Australia are expected to grow at a CAGR of 3.9% from 2025 to 2033. The growth in snack vending is driven by rising demand for healthier, high-protein, and locally-made snacks, especially among urban millennials and professionals. With more offices, co-working spaces, and fitness centers installing smart snack units, players like Open Pantry Co. and Food Connect Shed are expanding rapidly, offering curated, fresh, and nutritious snack selections beyond traditional chips and chocolates.

Location Insights

Vending machines for manufacturing accounted for a market share of 37.65% in 2024, due to the high concentration of shift-based and round-the-clock workers in Australia's industrial zones. These workers often have limited access to cafeterias or nearby food outlets, especially during night shifts or in remote locations. Vending machines provide an essential solution by offering instant access to meals, snacks, and beverages without disrupting workflows. Manufacturers increasingly install machines stocked with energy bars, sandwiches, and cold drinks to support employee productivity and convenience. Providers like Vendpro and Refresh Vending have tailored their offerings for such environments, with machines built for durability and stocked with calorie-dense or health-conscious options suited for labor-intensive settings.

Vending machines for public places are expected to grow at a CAGR of 4.8% from 2025 to 2033. Increased urban mobility, tourism revival, and demand for 24/7 retail in transport hubs, parks, and city centres are boosting the deployment of vending machines in public areas. The use of AI-powered smart machines with multi-language interfaces and cashless payments enhance accessibility for both locals and visitors. 24/7 Vending and Vendpro have expanded operations in train stations and airports, offering travel essentials, drinks, and snacks.

Mode of Payment Insights

Cashless vending machines accounted for a 72.6% market share in 2024. Australia’s strong digital payment infrastructure and declining use of cash have driven the rapid adoption of cashless vending machines. Consumers prefer tap-and-go, mobile wallets, and contactless cards for speed and hygiene. Newer models from Nayax and Vendpro support multi-payment systems, improving transaction ease and machine management for operators.

The cash vending machine market is expected to grow at a CAGR of 1.9% from 2025 to 2033. Despite the digital shift, cash vending machines maintain relevance in rural areas and older demographics where card adoption is lower. Some remote mining camps, industrial zones, and community spaces still rely on coin and note-operated machines due to network limitations or consumer preference. Legacy providers continue to support this demand with hybrid machines capable of accepting both cash and digital payments.

Vending machines today operate in both cash and cashless formats, with payment modes often aligning with the type of product offered and the location. Cash vending machines remain common for low-cost items such as candy, snacks, and beverages, especially in public places and manufacturing sites. In contrast, cashless machines-accepting cards, mobile payments, or QR codes-are increasingly preferred for higher-value or tech-driven products such as electronics, beauty items, pharmaceuticals, and books, typically found in offices, colleges, and airports. The shift toward cashless vending is especially prominent in urban and high-security locations, where convenience and hygiene are key.

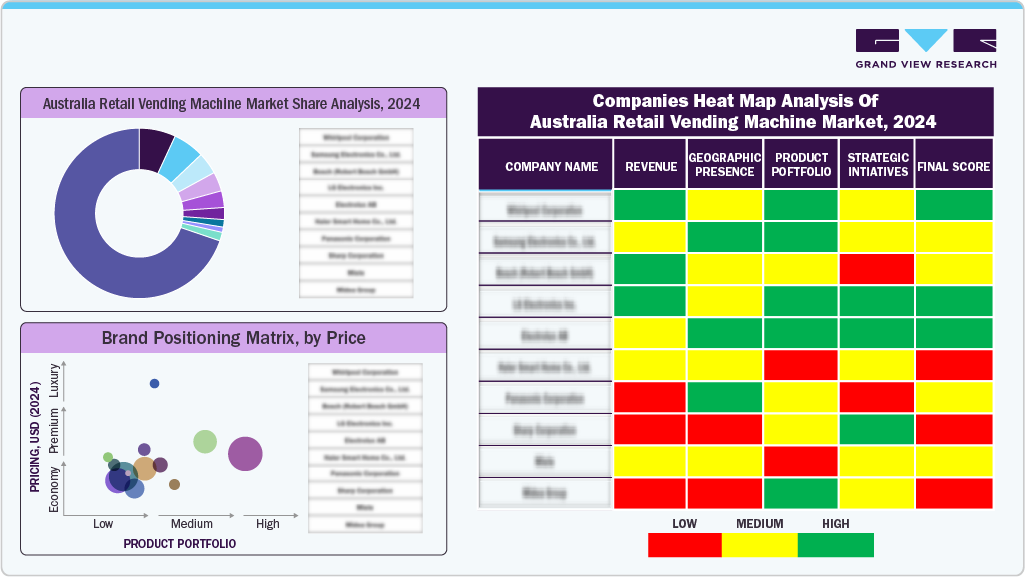

Key Australia Retail Vending Machine Company Insights

The Australia retail vending machine industry features a strong presence of established players that benefit from widespread brand recognition, long-standing industry experience, and strategic placement across high-traffic areas. These companies operate vast machine networks in offices, airports, train stations, hospitals, and industrial zones, allowing them to maintain consistent visibility and consumer reach. Their partnerships with local and international food and beverage brands further enhance product variety and appeal.

Competition in the market is fueled by innovation, with companies increasingly adopting smart technologies such as AI-powered inventory tracking, real-time analytics, and digital payment integration.

Companies are aligning their marketing and product development efforts accordingly as consumer expectations evolve, particularly around convenience, nutrition, and sustainability. Investments in targeted promotions, data-driven product curation, and regional customization help brands stay relevant. The market’s competitive dynamics are shaped not only by pricing and scale but also by how well players adapt to changing consumer behaviors and workplace needs.

Key Australia Retail Vending Machine Companies:

- Vendpro

- 24/7 Vending

- Royal Vending

- Ausbox Group

- SnoPro

- Open Pantry Co.

- Refresh Vending

- Smart Vending Machines

- Food Connect Shed

- Benleigh Vending Systems

Recent Developments

- In February 2022, Aldi Australia introduced a novel pizza vending machine, a first of its kind, that dispenses fresh, gourmet pizzas. This innovative technology, capable of producing 450 pizzas daily, cooks restaurant-quality pizzas in just two minutes. The machine, called "Pizzabot," features a transparent front, allowing customers to watch their pizzas being prepared and packaged by the robotic system. The Pizzabot, designed and manufactured in Australia, is exclusively available at the Aldi Corner Store in North Sydney

Australia Retail Vending Machine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.52 billion

Revenue forecast in 2033

USD 4.64 billion

Growth rate (revenue)

CAGR of 3.5% from 2025 to 2033

Actuals

2018 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, location, mode of payment

Key companies profiled

Vendpro; 24/7 Vending; Royal Vending; Ausbox Group; SnoPro; Open Pantry Co.; Refresh Vending; Smart Vending Machines; Food Connect Shed; Benleigh Vending Systems

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Australia Retail Vending Machine Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the Australia retail vending machine market report based on product, location, and mode of payment.

-

Product Outlook (Revenue, USD Million, 2018 - 2033)

-

Beverages Vending Machines

-

Hot Beverage Vending Machines

-

Cold Beverage Vending Machines

-

-

Snack Vending Machines

-

Food Vending Machines

-

Frozen Vending Machines

-

Tobacco Vending Machines

-

Games/Amusement Vending Machines

-

Beauty & Personal Care Vending Machines

-

Candy & Confectionery Vending Machines

-

Pharmaceuticals Vending Machines

-

Electronics Vending Machines

-

Book & Magazine Vending Machines

-

-

Location Outlook (Revenue, USD Million, 2018 - 2033)

-

Manufacturing

-

Offices

-

Colleges & Universities

-

Hospitals & Nursing Homes

-

Restaurants, Bars & Clubs

-

Public Places

-

Others

-

-

Mode of Payment Outlook (Revenue, USD Million, 2018 - 2033)

-

Cash

-

Cashless

-

Frequently Asked Questions About This Report

b. The Australia retail vending machine market size was estimated at USD 3.36 billion in 2024 and is expected to reach USD 3.52 billion in 2025.

b. The Australia retail vending machine market is expected to grow at a compound annual growth rate (CAGR) of 3.5% from 2025 to 2033 to reach USD 4.64 billion by 2033.

b. Beverage vending machine accounted for a revenue share of 27.25% in 2024, due to their high demand in transit hubs, workplaces, and public areas where quick, on-the-go refreshment is essential.

b. Some key players operating in the Australia retail vending machine market include Vendpro; 24/7 Vending; Royal Vending; Ausbox Group; SnoPro; Open Pantry Co.; Refresh Vending; Smart Vending Machines; Food Connect Shed; Benleigh Vending Systems

b. Some key players operating in the Australia retail vending machine market include Vendpro; 24/7 Vending; Royal Vending; Ausbox Group; SnoPro; Open Pantry Co.; Refresh Vending; Smart Vending Machines; Food Connect Shed; Benleigh Vending Systems

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.