- Home

- »

- Advanced Interior Materials

- »

-

Automotive Adhesive Tapes Market Size, Share Report, 2030GVR Report cover

![Automotive Adhesive Tapes Market Size, Share & Trends Report]()

Automotive Adhesive Tapes Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Powertrain, Electronics), By Adhesive Chemistry, By Backing Material, By Region, And Segment Forecasts

- Report ID: 978-1-68038-976-0

- Number of Report Pages: 133

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Adhesive Tapes Market Summary

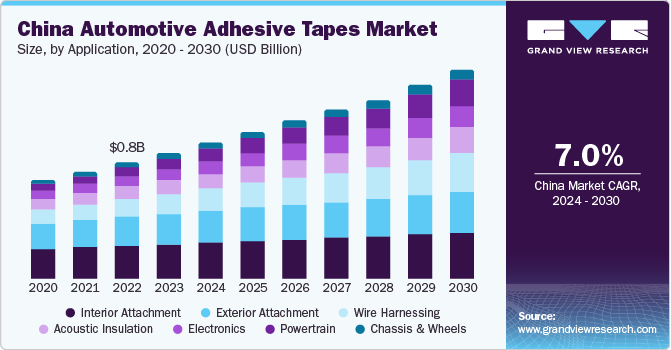

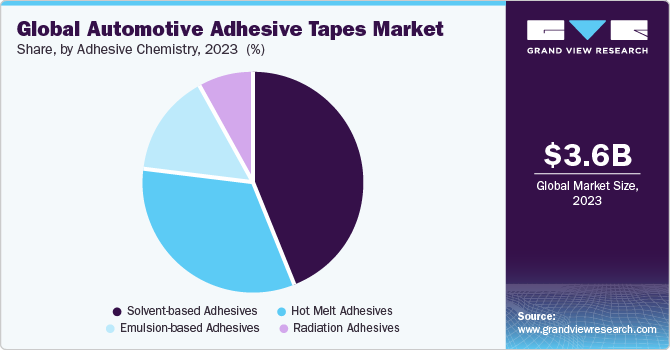

The global automotive adhesive tapes market size was estimated at USD 3.62 billion in 2023 and is projected to reach USD 5.46 billion by 2030, growing at a CAGR of 6.1% from 2024 to 2030. Rapid replacement of nut bolt fasteners to reduce vehicle weight and improve aesthetics is expected to drive the tapes market over the forecast period.

Key Market Trends & Insights

- Europe dominated the market and accounted for about 28% share of revenue share in 2023 and is expected to accelerate at a CAGR of over 5.0% over the forecast period.

- The North America automotive adhesive tapes market is expected to witness a notable CAGR of 4.2% from 2023 to 2030.

- Based on adhesive chemistry, the solvent application segment led the market and accounted for about 44.0% share of the global revenue in 2023.

- In terms of application, the interior attachment application segment led the market and accounted for about 28.1% share of the global revenue in 2023.

Market Size & Forecast

- 2023 Market Size: USD 3.62 Billion

- 2030 Projected Market Size: USD 5.46 Billion

- CAGR (2024-2030): 6.1%

- Europe: Largest market in 2023

- North America: Fastest growing market

The market is likely to witness a growing demand from aftermarket sales as vehicle modifications and performance enhancements are considerably upscaling. Asian economies including Japan, South Korea, China, and India are anticipated to hold the majority of the electric vehicle production shares in the upcoming period. This is supported by a robust manufacturing industry, resource availability, skilled & low labor cost, and the presence of prominent automakers in the region. Technological developments by major automobile manufacturers in Europe and North America are expected to provide momentum to the market.

The market for automotive adhesive tapes is anticipated to grow at a strong growth rate predicted over the projection period, owing to the economic recovery in most emerging countries. The frequent suspension of public transportation, along with the virus's highly infectious nature, fueled demand for passenger automobiles, driving the demand for automotive adhesive tape products. However, unexpected circumstances resulting from the pandemic's third and subsequent waves are reflecting a gloomy picture.

The global automotive market is witnessing switching trends with growing popularity and demand for electric vehicles. Prominent vehicle manufacturers are aiming to comply with environmental standards and emission norms by reducing vehicle pollutants at a significant level. Thus, battery-operated vehicles including cars, mini trucks, and others are gaining popularity across the globe which in turn are expected to positively impact the tapes market.

There has been a positive outlook in the automotive sector across developed markets such as the U.S. to developing markets such as India. Technological developments and performance enhancements in vehicles have led to the installation of specialized components, which is expected to have a positive impact on the automotive tapes market.

The global automotive industry is growing at a rapid pace on account of accelerating technological transformations such as the introduction of no-petroleum-based fuel or hybrid vehicles, autonomous driving, and new mobility services. The industry is expected to witness significant growth owing to the increasing sales and demand in the emerging economies of India, China, and Brazil, thus exhibiting positive growth potential for the tapes industry.

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. The automotive adhesive tapes industry is dominated by global key players exhibiting long terms supply contracts with major automotive OEMs in the world. These players are employing efforts to expand their product offering through the launch of specialized tapes for each of the subsegment applications in the automotive.

The manufacturers are involved in introduction of new products with use if different techniques and materials. For instance, in April 2021, L&L Products unveiled the launch of T-Link - a new technology product line that includes exceptional engineering thermoplastic resin with advanced adhesive properties. The introduction of T-Link offers automotive manufacturers an advanced adhesive solution combining the features of thermoplastic resins with robust adhesion, thereby facilitating enhanced performance in automotive component production.

There are multiple organizations that pass laws and regulations affecting the automotive adhesive tapes market. These include AFERA- European Association for the Self Adhesive Tape Industry, FINAT-Federation International des Fabricants et Transformations et Thermocollants, and JATMA- Japanese Adhesive Tapes Manufacturers Association.

Automotive manufacturers are aiming to enhance vehicle performance by reducing the overall weight. This has triggered the market for automotive adhesive tapes which is potentially a substitute for other products such as metal fasteners. Therefore, automotive adhesive tapes is expected to witness low levels of substitute threat.

Application Insights

The interior attachment application segment led the market and accounted for about 28.1% share of the global revenue in 2023. This is attributed to the Increasing demand for premium cars with an aesthetically improved environment and enhanced drive performance which in turn is expected to increase the number of components to be fastened in the car interiors.

The demand for adhesive tapes in interior applications is expected to be fueled by the high adhesive strength of the tape coupled with a superior attachment of different materials. Adhesive tapes in vehicle interiors are used in seat heating elements, attachment of foam & fabric on the instrument panel, airbag wrapping & securing, steering wheel wrapping, mounting rubber, and plastic profiles in vehicle interiors.

The electronics application segment is also expected to witness a notable CAGR of 8.4% over the forecast period, due to the rising demand for tapes in automotive electronics such as light assemblies, air conditioning systems, electronic components, interior & exterior lights, battery connectors & wires, sensors, and several other electronic devices.

The introduction of advanced features in car interiors such as the provision of attachments for mobile devices, electronic chargers, air purifiers, connection for portable refrigerators, and other components requires adhesive tapes for fixing and bonding is expected to have a positive impact on the adhesive tapes market.

Adhesive Chemistry Insights

The solvent application segment led the market and accounted for about 44.0% share of the global revenue in 2023. Superior adhesion properties by solvent materials and wide adoption by the automotive OEMs supported product penetration in automotive applications. Solvent-based adhesive technology can be characterized by rubber-based solvents and acrylic solvents.

These types of automotive adhesive tapes are majorly use high-performance solvent-based adhesives that offer superior bonding. Solvent acrylic tapes are accepted for durability and long-term applications in automotive. Moreover, improved performance such as better resistance to chemicals, heat, and water has supported the demand for adhesive technology in automotive tapes.

Emulsion based adhesive tapes segment is also expected to witness the fastest growth at a CAGR of 8.3% on account of superior properties offered by the tapes such as chemical & heat resistance, and performance profile at low cost. These are water-based adhesives that are composed of EVA or acrylic synthetic resin polymers, and vinyl acetate in water, thus having low VOC contents.

Emulsion adhesives share similar characteristics to solvent acrylics but are produced without the use of solvents. This technology is used in adhesive tapes owing to the chemical and heat-resistant properties of the emulsion. The rising concerns about VOC emissions are expected to play a major in driving the demand for emulsion-based adhesive tapes.

Backing Material Insights

The demand for polyvinylchloride as a backing material in automotive adhesive tapes is expected to grow at a fastest rate over the forecast period. Automotive adhesive tapes which use polyvinylchloride as a backing material are highly opted for several applications such as electronic components and insulation. Additionally, polypropylene also held significant revenue share in the market on account of its ability to offer superior strength coupled with resistance to heat, pressure, and moisture.

Regional Insights

Europe dominated the market and accounted for about 28% share of revenue share in 2023 and is expected to accelerate at a CAGR of over 5.0% over the forecast period. This trend is attributed to the high per-vehicle tape content in European brand automotive coupled with rising production of EV/HEV segment vehicles which exhibits a higher penetration of adhesive tapes.

The market is flourished with prominent players operating across the region. More than 300 manufacturing facilities are operating in the region producing cars and trucks. These players are investing heavily in R&D for the development of electric vehicles and hybrid vehicle segments. Moreover, the installation of lightweight components for reducing fuel consumption in a car is expected to increase the penetration of tapes and adhesives.

The North America automotive adhesive tapes market is expected to witness a notable CAGR of 4.2% from 2023 to 2030, owing to the presence of a robust manufacturing base in the U.S. coupled with the rapid growth of the automotive industry in Mexico is likely to augment the demand shortly.

The rising popularity of electric vehicles with advanced features and technologies is expected to augment the market. Investments by Tesla, Inc. in the U.S. to increase the production of electric vehicles and associated modern components for cars are further expected to ascend the demand for adhesive tapes.

Key Companies & Market Share Insights

The key players in the industry are investing in understanding the emerging subsegment application in automotive. In addition, they are also trying to understand the key specifiers and selection criteria for tapes for these new applications to gauge the expected market potential in the future and employ their growth strategies accordingly.

-

In July 2023, Berry Global launched a next-gen version of its flagship Formifor insulation compression films by combining over 30% of recycled materials. The use of recycled content in the film is projected to contribute toward sustainability efforts in automotive manufacturing.

-

In April 2023, Berry Global Group, Inc. commenced the expansion of one of its significant manufacturing facilities for stretch films in Lewisburg, Tennessee. The facility is planned to be completed by early 2024 and it will support the proliferating demand for the company’s sustainable, highest-performing stretch films, which also include adhesive tapes for diverse industries.

-

In February 2023, L&L Products, Inc., announced its plans to expand its production footmark in the Village of Romeo, Michigan for accommodating the automobile industry’s finished goods. The project is anticipated to confirm the continued business growth of the company in Michigan.

Key Automotive Adhesive Tapes Companies:

The following are the leading companies in the automotive adhesive tapes market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these automotive adhesive tapes companies are analyzed to map the supply network.

- L&L Products, Inc.

- Sika Automotive AG

- The 3M Company

- Nitto Denko Corporation

- Lida Industry Co, Ltd.

- ThreeBond Co., Ltd.

- PPG Industries

- ABI Tape Products

- Adchem Corporation

- Avery Dennison Corporation

- Saint Gobain

- Berry Plastics

- tesa SE

- Lintec Corporation

Automotive Adhesive Tapes Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.83 billion

Revenue forecast in 2030

USD 5.46 billion

Growth rate

CAGR of 6.1% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in Million Square Meters, Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Volume Forecast, Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

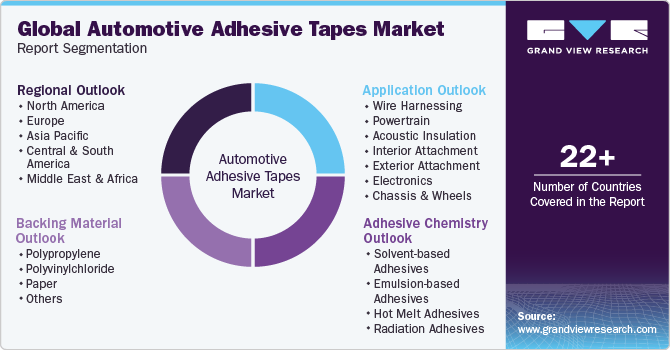

Application, adhesive chemistry, backing material, region

Regional scope

North America, Europe, Asia Pacific, Rest of World

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, South Africa

Key companies profiled

L&L Products, Inc., Sika Automotive AG, The 3M Company, Nitto Denko Corporation, Lida Industry Co, Ltd., ThreeBond Co., Ltd., PPG Industries, ABI Tape Products, Adchem Corporation, Avery Dennison Corporation, Saint Gobain, Berry Plastics, tesa SE, Lintec Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Adhesive Tapes Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the automotive adhesive tapes market on the basis of application, adhesive chemistry, backing material, and region:

-

Application Outlook (Volume, Million Square Meters, Revenue, USD Billion; 2018 - 2030)

-

Wire Harnessing

-

Powertrain

-

Acoustic Insulation

-

Interior Attachment

-

Exterior Attachment

-

Electronics

-

Chassis & Wheels

-

-

Adhesive Chemistry Outlook (Volume, Million Square Meters, Revenue, USD Billion; 2018 - 2030)

-

Solvent-based Adhesives

-

Emulsion-based Adhesives

-

Hot Melt Adhesives

-

Radiation Adhesives

-

-

Backing Material Outlook (Volume, Million Square Meters, Revenue, USD Billion; 2018 - 2030)

-

Polypropylene

-

Polyvinylchloride

-

Paper

-

Others

-

-

Regional Outlook (Volume, Million Square Meters, Revenue, USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

- Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive adhesive tapes market size was estimated at USD 3.43 billion in 2022 and is expected to reach USD 3.63 billion in 2023.

b. The global automotive adhesive tapes market is expected to grow at a compound annual growth rate of 6.0% from 2023 to 2030 to reach USD 5.47 billion by 2030.

b. Interior attachment application segment dominated the automotive adhesive tapes market with a share of 28.8% in 2022. This is attributed aesthetically improved environment and enhanced drive performance

b. Some of the key players operating in the automotive adhesive tapes market include L&L Products, Inc., Sika Automotive AG, The 3M Company, Nitto Denko Corporation, Lida Industry Co, Ltd., ThreeBond Co., Ltd., PPG Industries, ABI Tape Products, Adchem Corporation, Avery Dennison Corporation, Saint Gobain, Berry Plastics, tesa SE, Lintec Corporation

b. The key factors that are driving the automotive adhesive tapes market include rising trend of using advanced functional materials in automotive to enhance the aesthetics and improve performance, rising production of electric and hybrid electric vehicles that exhibit high penetration of adhesive tapes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.