- Home

- »

- Automotive & Transportation

- »

-

Global Automotive Axle Market Size & Share Report, 2030GVR Report cover

![Automotive Axle Market Size, Share & Trends Report]()

Automotive Axle Market (2022 - 2030) Size, Share & Trends Analysis Report By Type (Drive, Dead, Lift), By Application (Front, Rear), By Vehicle Type (Passenger Car, LCV, HCV), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-484-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

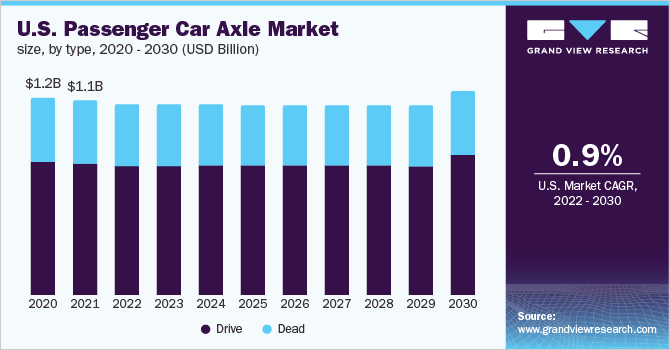

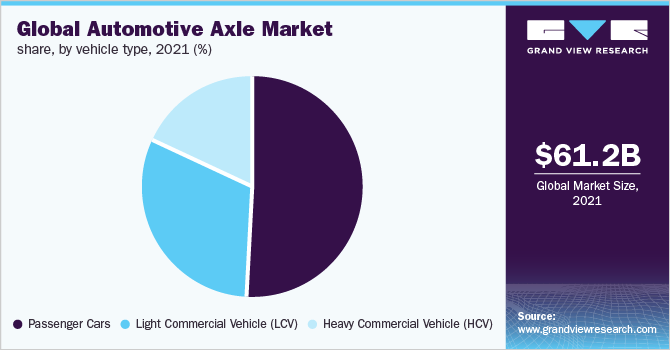

The global automotive axle market size was valued at USD 61.19 billion in 2021 and is projected to register a compound annual growth rate (CAGR) of 1.5% from 2022 to 2030. Factors such as growing demand for heavy duty commercial vehicles such as long trailers used to carry oversize loads and increase in the sales of passenger vehicles in developing economies like Mexico, China, and India are expected to propel the growth of the market. The rising sales of luxury vehicles that demand higher torque and performance are further encouraging market growth. The growing concerns over growing carbon emissions and their environmental repercussions have caused a shift in the consumer’s preference for hybrid and electric vehicles over conventional vehicles.

Governments worldwide are strongly advocating for the adoption of EVs and hybrid vehicles. Thus, a growing inclination towards EV and hybrid vehicles is anticipated to propel market growth. Moreover, the automotive industry is developing technically advanced axle which is lightweight, smaller yet more fuel and performance efficient. The implementation of technological advancement has led to a surge in the adoption of lightweight axles, which provide improved efficiency and contribute to lowering the overall weight of hybrid, EV, and commercial vehicles favoring the market growth. The aftermarket services for replacing and maintaining axles in powertrains are also creating new market opportunities.

COVID-19 has adversely affected industries throughout the globe as the federal authorities imposed strict quarantine measures to curb the spread of the virus. Hospitality, aviation, and automotive were the worst hit among all the industries. The automotive industry suffered a sharp decline in demand due to travel restrictions, disruption in the production and manufacturing of automotive components, and bottlenecks in the supply chain worldwide. Thus, impacting the automotive market negatively. The production and demand for the axle directly depend on the demand for automobiles. However, in 2021 as the lockdowns were being lifted in a phased manner, the demand for automobiles saw a surge which was met with a still disrupted raw material supply chain. Still, the automotive market started showing signs of recovery which also induced recovery in demand for axles used in the applications powertrains.

With the ongoing development, the latest axle innovation for heavy-duty commercial vehicles aims to improve maintenance and performance. The growing trend of vehicle electrification and innovation continues for drive axle coupled with electric powertrain. The trend has led to changes in designing to regenerate torque load needs and including the appropriate axle for the electric application. To meet the greenhouse emission regulations, downsizing, weight reduction, and torque-carrying qualities have been prioritized in drive and steer axle development. Drive axles are developed to have faster ratios to handle bigger axle input torques caused by lowering engine revolutions per minute at highway speeds to aid engine down speeding for line-haul logistics vehicles by road transportation. Also, the increasing use of 612 configurations can be applied for building single drive axles to support engine down speeding and quicker ratios. For instance, steer axle system has improved kinematics with less bump and roll steer being transmitted to the driver through the seat or the steering wheel, which can help reduce driver fatigue.

Furthermore, key players are also developing lightweight, fuel-efficient axles that can carry heavy cargo loads. The axle is being developed considering its scalability for light, medium, and heavy-duty rear-wheel-drive-based pickups. These axles are lightweight and have enhanced cargo capacity due to their reduced size and workhorse. The axle is being designed to be significantly lighter and more efficient than traditional axles. The downsizing of the axle helps in improving vehicle traction, which helps in limiting the risk of wheel slippage while accelerating on ice-covered and wet roadways. The design of axles is also changing due to the evolution of powertrains in automobiles. Manufacturers are focusing on developing faster axles with lower ratios, which will help the engines operate at a slower speed. Many axles are now also including modular motor design, which provides easy service and maintenance accessibility and is scalable due to their motor interchanging capability.

The volatile and fluctuating cost of the raw material required to manufacture automotive axles is a major restraint hampering the growth of the market. The price of metals such as steel, copper, and aluminum are changing rapidly, negatively affecting automotive axle manufacturers' revenue margin. Major automobile manufacturers source the majority of their automotive components from manufacturing hubs such as China. Furthermore, the war between Russia and Ukraine is also inducing fluctuation in the price of metal raw materials, affecting the overall cost of the automotive axle. The high initial cost of technologically advanced and lightweight axles is another major hindrance to market growth. The aftermarket service cost of maintenance and replacement can also prove to be a hefty investment depending on the model of the vehicle and car brand. The expensive aftermarket service has also encouraged the market for counterfeit product sales, which are of low cost and less quality but can compromise the performance of the vehicle and is negatively affect the market growth.

Type Insight

The drive axle type segment dominated the market and accounted for the highest revenue share of over 65.0% in 2021. All-wheel and front-wheel drive axle are gaining popularity among manufacturers and consumers due to their ability to have better traction in different terrains. Moreover, the growing demand for passenger and commercial vehicles in the Asia Pacific, Europe, and North America will further boost the demand for different drive-type axles.

The lift axle type is expected to experience the highest CAGR of 1.8 % during the forecast period. Lift axles are considered ideal for long-haul vehicles used for logistics and carrying a heavy load. The lift axle helps extend the life cycle of brake shoes and tiers, improves the fuel efficiency of the vehicles and reducing the rolling resistance. The lift axle also distributes the weight of the cargo evenly. These factors of lift axle for heavy-duty cargo vehicles is expected to drive its demand for the market.According to the European Economic Community (EEC), the determined load carried by each axle is limited and the suitable liftable axles should automatically be dropped to obtain an adequate load distribution.

Application Insights

The front application axle segment will dominate the market with the highest market share of over 50 % in 2021. The front axle is generally installed in passenger vehicles owing to lesser complexities during the assembly of mid and economy-range segment cars. Furthermore, the increasing usage of all-wheel-drive vehicles like four-wheel-drive, six-wheel-drive, and eight-wheel-drive is expected to encourage the growth of front axle market.

The rear axle segment also held the highest CAGR of 2.0 % over the forecast period. The rising demand for commercial, heavy-duty, and passenger vehicles in Europe and the Asia Pacific, is driving the demand for rear axles in these regions. The player manufacturing rear axle is focusing on providing enhanced cost advantages, safety, and comfort. Moreover, the increasing roadway logistic activities across countries are also favoring the demand for rear axle segment growth.

Vehicle Type Insights

The passenger car segment dominated the market and accounted for the largest revenuie share of over 50.0% in 2021. Factors such as increasing urbanization, growing population, and increasing disposable income worldwide are driving the demand for passenger vehicles. The surge in passenger car production in economies such as Indonesia, India, China, and South Africa is influencing market growth. Furthermore, the application of front-wheel-drive, rear-wheel-drive, and all-wheel drive in many segments of luxury and hybrid passenger cars is expected to provide rapid growth to the segment.

The heavy commercial vehicle segment is projected witness the highest CAGR of 2.0% during the forecast period. The growth of the HCV segment is attributed to the growing logistics industry, especially in the North American and European regions. Moreover, heavy commercial vehicles generally use lift axles, which is another factor favoring the market growth. Many heavy commercial vehicles use six or eight wheel-drive or a larger wheel drive creating prospects for market growth.

Regional Insights

Asia Pacific dominated the automotive axle market and accounted for the largest revenue share of 50.2% in 2021. The Asia Pacific is home to major automobile markets such as China, India, and Japan, where the demand is increasing for passenger and commercial vehicles driving the market growth of automotive axles. Technologically advanced axle, which is lightweight, has more traction, is fuel-efficient, and uses different material such as carbon fiber, are being installed in vehicles to improve their performance further driving the market growth. There is a strong presence of major automotive axle manufacturers such as Hyundai Transys Inc., which will also boost market growth in the Asia Pacific region.

In North America, the market is expected to exhibit the highest CAGR of 1.9 % during the forecast period. The growth of the axle market in the North America can be credited to the growing demand for commercial and luxury vehicles in the region. The presence of key manufacturers such as DANA Incorporated, Meritor Inc and American Axle & Manufacturing, Inc., and the widespread adoption of All-Wheel-Drive is further driving the market growth in the region.

Key Company And Market Share Insights

The market has the presence of local players operating in the respective national market. The market players have built a strong distribution and supplier network, a comprehensive portfolio, and an established presence in emerging economies. These companies also focus on innovating new technologies for automotive axles by investing heavily in research and development.

The growing popularity of electric and autonomous vehicles is offering lucrative production and supplier contract opportunities to the major players. For instance, in 2021, Dana Incorporated initiated the production of the eS9000r e-Axle of the Spicer Electrified Zero-6 e-Axles for the market launch of Freightliner Custom Chassis Corporation (FCCC) all-electric medium-duty last-mile delivery vehicle - MT50e. Similarly, in the same year, Meritor Inc announced that they had made a supply agreement with Beijing Foton Daimler Automotive Co. Ltd. (BFDA) to produce a custom variant of its single rear-drive and long-haul tandem axle for the Daimler AG’s heavy-duty on-highway tractors which are being produced at Beijing, China by BFDA.

Some of the prominent players in the global automotive axle market include:

-

American Axle & Manufacturing, Inc.

-

Dana Incorporated

-

Daimler AG

-

GNA Group

-

Meritor Inc.

-

ZF Friedrichshafen AG

-

Melrose Industries PLC

-

Talbros Engineering Limited

Automotive Axle Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 61.98 billion

Revenue forecast in 2030

USD 69.58 billion

Growth Rate

CAGR of 1.5% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative Units

Revenue in USD Million and CAGR from 2022-2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, vehicle type, region

Regional scope

North America; Europe; Asia Pacific; Rest of the World

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; India; Japan; South Korea

Key Company Profiled

American Axle & Manufacturing, Inc. Dana Incorporated; Daimler AG; GNA Group; Meritor Inc.; ZF Friedrichshafen AG; Melrose Industries PLC; Talbros Engineering Limited

Customization scope

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive axle market based on type, application, vehicle type, and region:

-

Type Outlook (Volume, Thousand Units, Revenue, USD Million, 2018 - 2030)

-

Drive

-

Dead

-

Lift

-

-

Application Outlook (Volume, Thousand Units, Revenue, USD Million, 2018 - 2030)

-

Front

-

Rear

-

-

Vehicle Type Outlook (Volume, Thousand Units, Revenue, USD Million, 2018 - 2030)

-

Passenger Cars

-

Light Commercial Vehicle (LCV)

-

Heavy Commercial Vehicle (HCV)

-

-

Regional Outlook (Volume, Thousand Units, Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Rest of the World

-

Frequently Asked Questions About This Report

b. The global automotive axle market size was estimated at USD 61.19 billion in 2021 and is expected to reach USD 61.98 billion in 2022.

b. The global automotive axle market is expected to grow at a compound annual growth rate of 1.5% from 2022 to 2030 to reach USD 69.58 billion by 2030.

b. Asia Pacific dominated the automotive axle market with more than 50% of the market share in 2021. This is attributable to the demand the automotive axle in China which is mainly driven by the rapid growth of the automotive sector in the country.

b. Some key players operating in the automotive axle market include American Axle & Manufacturing, Inc.; Dana Incorporated; Daimler AG; GNA Group; Meritor, Inc.; ZF Friedrichshafen AG; Melrose Industries PLC; and Talbros Engineering Limited.

b. Key factors that are driving the automotive axle market growth include increasing automotive production across the globe, along with rising consumer preference for hybrid and luxury vehicles with advanced technology.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.