- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Automotive Coatings Market Size, Global Industry Report, 2018-2025GVR Report cover

![Automotive Coatings Market Report]()

Automotive Coatings Market Analysis By Product (Primer, Electrocoat, Basecoat, Clearcoat), By Technology (Waterborne, Solventborne, Powder Coating, UV-Cured), By Application (Metal, Plastic), By End-Use, And Segment Forecasts, 2018 - 2025

- Report ID: 978-1-68038-440-6

- Number of Report Pages: 140

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2015

- Forecast Period: 2016 - 2025

- Industry: Bulk Chemicals

Industry Insights

The global automotive coatings market size was valued at USD 22 billion in 2015 and is predicted to grow significantly over the forecast period owing to the increasing vehicle production. The industry is projected to foresee significant growth as these products enhance the appearance and durability of automobiles and protect them from harsh environmental conditions including acid rain, extreme temperature, UV radiation, and foreign particles.

Increasing automobile production in emerging countries including China, India, Brazil, Mexico, South Korea, and South Africa on account of population growth and rising income levels is expected to aid in market expansion. Moreover, the growing requirement of automotive refinish owing to vehicle maintenance and repair will stimulate the demand for paints & coatings over the upcoming years.

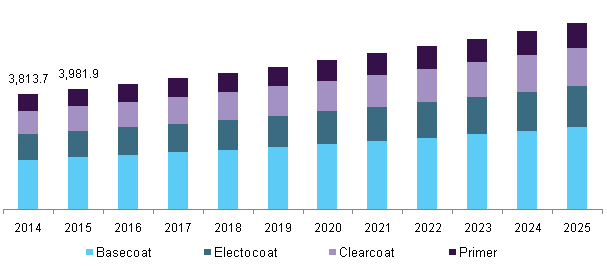

U.S. automotive coatings market revenue, by product, 2014 - 2025 (USD Million)

The key driver for the market is the growing demand for powder coatings. Powder coatings are a solvent-free method for layering surfaces and do not release volatile organic compounds. They are projected to witness a rise on account of environmental and economic benefits. Moreover, increasing demand for electric and hybrid vehicles in light of carbon emissions is expected to fuel the industry size over the upcoming years.

Raw materials used for manufacturing coatings include pigments, additives, binders, and solvents. Volatile prices of titanium dioxide, which is one of the most commonly used raw materials, is anticipated to hamper growth. Moreover, difficulty in sourcing raw materials is expected to serve as a major challenge for manufacturers over the forecast period.

Product Insights

Basecoats dominated the overall industry and accounted for 42.9% of the global revenue share in 2015. These coats are expected to witness substantial growth over the upcoming years as they provide desired color and exterior aesthetics to automobiles.

Electrocoating utilizes electrical current for the deposition of an organic coating from a paint bath onto a part or assembled product. Electrocoats is projected to witness considerable growth over the forecast period owing to advantages such as uniform coating, high operation speed, and applicability to a wide range of materials.

Technology Insights

Solvent-borne was the most widely used technology and is expected to witness sluggish growth over the next nine years. Stringent regulations pertaining to volatile organic compounds emissions and hazardous air pollutants, such as toluene, xylene, ethylbenzene, and methyl ethyl ketone, are anticipated to restrain product demand. In addition, high flammability and toxicity of these products are expected to create challenges for growth in the future.

Powder coatings are projected to witness the fastest volume growth at a CAGR of 6.1% from 2016 to 2025 on account of eco-friendliness and high-quality finishes. Exceptional properties, such as high resistance to corrosion, chipping, and abrasion along with protection from chemicals, moisture, and heat, are likely to spur product demand over the next nine years.

Application Insights

Metal surfaces were the largest segment and accounted for 69.5% of global revenue share in 2015. Predominant consumption of metals for the production of automobiles is expected to have a positive impact on the market. However, volatility in metal prices along with the growing usage of lightweight materials is projected to restrain the application of glazes on metal surfaces.

Application on plastic parts and surfaces is expected to gain importance owing to lightweight, design flexibility, corrosion resistance, cost reduction, greater durability, and recyclability. Furthermore, increasing usage of carbon fiber and composites in vehicle manufacturing will stimulate industry demand over the forecast period.

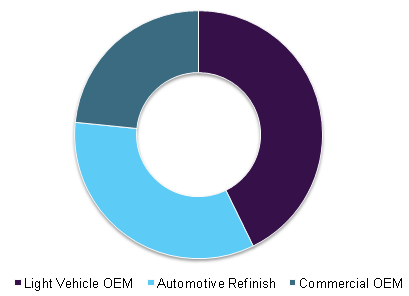

End-Use Insights

Light vehicle OEM was the largest end-use segment of the market and was valued at USD 9.4 billion in 2015 and is likely to foresee significant growth on account of the growing demand for passenger cars in emerging countries including India, Brazil, China, Singapore, and Thailand. In addition, population growth, rapid urbanization, and increasing per capita income will aid in market expansion.

Global automotive coatings market revenue share, by end-use, 2015 (%)

The Automotive refinish market is anticipated to foresee rapid growth in light of increasing demand for used vehicles. In addition, the rising number of accidents in Asia Pacific and Central & South America, especially in the hilly regions is expected to drive industry growth over the upcoming years.

Regional Insights

Asia Pacific was the largest market with 56.5% of the volume share in 2015 and the trend is expected to continue on account of increasing vehicle manufacturing in the region. The automotive sector of Asia Pacific is driven by rising sales and production in countries including China, Japan, India, South Korea, and Thailand.

China is expected to foresee strong growth owing to its large automobile production base. China was the largest producer of automobiles and is likely to remain the leading manufacturer on account of economic labor in the country. Moreover, the relocation of manufacturing bases by companies such as Volkswagen, Audi, Honda, Nissan, Toyota, Hyundai, Skoda, and Fiat to China owing to the availability of affordable workforce is anticipated to drive the market demand.

Europe is expected to witness steady growth over the upcoming years on account of increasing vehicle manufacturing in countries including Germany, Sweden, Italy, France, the UK, and the Czech Republic. In addition, growing population coupled with rising income levels is likely to stimulate the demand over the forecast period.

Competitive Insights

The industry is highly competitive in nature with major manufacturers involved in continuous R&D activities and product development. Participants including Axalta Coating Systems, BASF, PPG Industries, Nippon Paint, Kansai Paint, and AkzoNobel dominate the industry. Other players include Sherwin-Williams Company, KCC Paint, Bayer AG, Arkema SA, Beckers Group, Cabot Corporation, Berger Paints, Eastman Chemical Company, Valspar Corporation, Clariant AG, Deft, Inc., Jotun A/S, Royal DSM, Lord Corporation, and Solvay S.A.

Report Scope

Attribute

Details

Base year for estimation

2015

Actual estimates/Historical data

2014 - 2015

Forecast period

2016 - 2025

Market representation

Volume in Kilo Tons, Revenue in USD Million & CAGR from 2016 to 2025

Regional scope

North America, Europe, Asia Pacific, Central & South America & MEA

Country scope

The U.S., Germany, China, India, Brazil

Report coverage

Volume &Revenue forecast, company share, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts volume and revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the automotive coatings market on the basis of product, technology, application, end-use, and region:

-

Product Outlook (Volume, Kilo Tons; Revenue, USD Million; 2014 - 2025)

-

Primer

-

Electrocoat

-

Basecoat

-

Clearcoat

-

-

Technology Outlook (Volume, Kilo Tons; Revenue, USD Million; 2014 - 2025)

-

Waterborne Coatings

-

Solventborne Coatings

-

Powder Coatings

-

UV-cured Coatings

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million; 2014 - 2025)

-

Metal Parts

-

Plastic Parts

-

-

End-use Outlook (Volume, Kilo Tons; Revenue, USD Million; 2014 - 2025)

-

Light Vehicle OEM

-

Commercial Vehicle OEM

-

Automotive Refinish

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million; 2014 - 2025)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

MEA

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."