- Home

- »

- Automotive & Transportation

- »

-

Automotive Crankshaft Market Size, Industry Report, 2033GVR Report cover

![Automotive Crankshaft Market Size, Share & Trends Report]()

Automotive Crankshaft Market (2025 - 2033) Size, Share & Trends Analysis Report By Crankshaft Type (Forged Crankshaft, Billet Crankshaft), By Material (Steel Alloy, Billet Steel), By Manufacturing Process, By Vehicle Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-676-7

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Crankshaft Market Summary

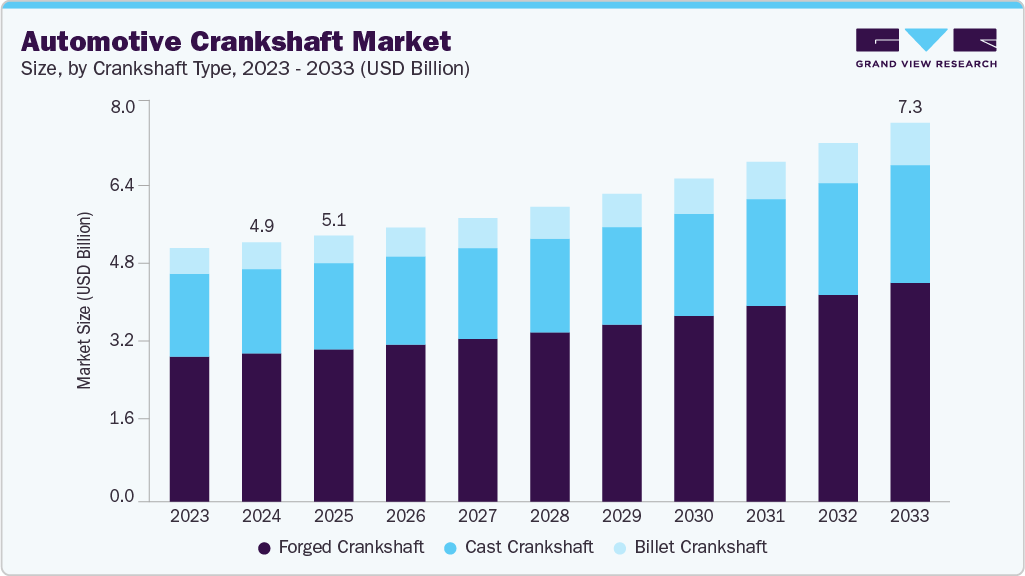

The global automotive crankshaft market size was estimated at USD 4981.1 million in 2024, and is projected to reach USD 7279.4 million by 2033, growing at a CAGR of 4.5% from 2025 to 2033. The automotive crankshaft market is gaining momentum, driven by increasing production of internal combustion engine (ICE) and commercial vehicles in emerging markets, rising demand for lightweight yet high-strength crankshaft materials, and the integration of advanced manufacturing technologies such as precision forging and CNC machining.

Key Market Trends & Insights

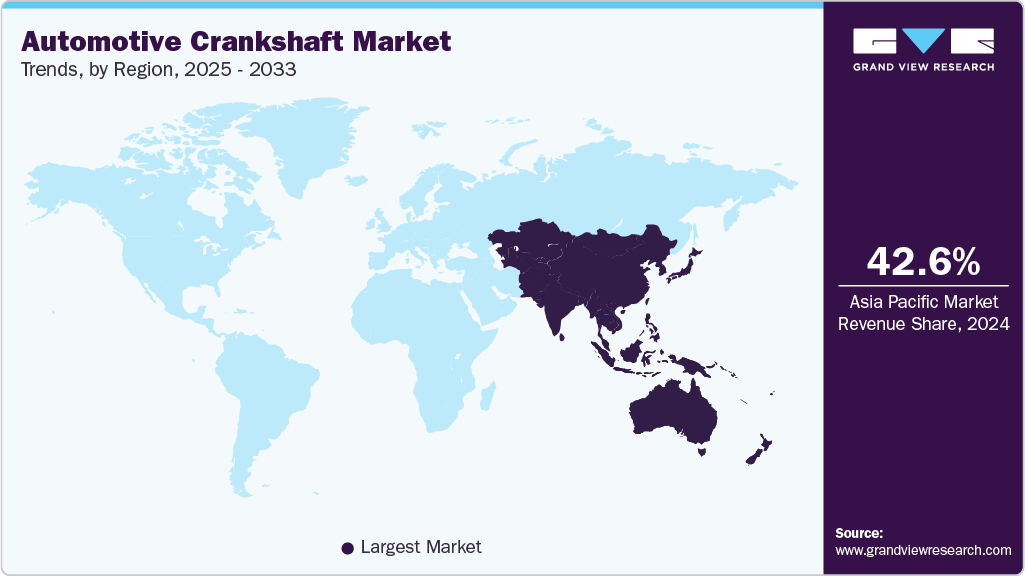

- Asia Pacific automotive crankshaft market accounted for a 42.6% share of the overall market in 2024.

- By material, the steel alloy segment accounted for the largest revenue share of 64.1% in 2024.

- By crankshaft type, the forged crankshaft segment held the largest revenue share in 2024.

- By manufacturing process, the precision forging segment dominated the market in 2024.

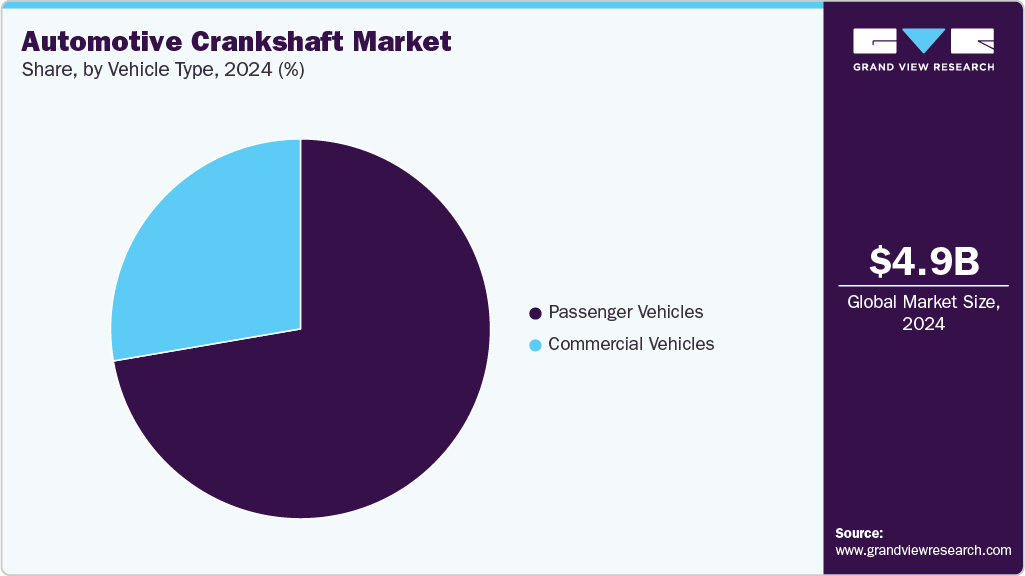

- By vehicle type, the passenger vehicles segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4981.1 Million

- 2033 Projected Market Size: USD 7279.4 Million

- CAGR (2025-2033): 4.5%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

As OEMs focus on improving engine efficiency, durability, and performance, crankshafts are being redesigned with tighter tolerances and enhanced metallurgical properties. Additionally, the adoption of high-performance alloys and surface treatments is helping manufacturers meet evolving regulatory and performance benchmarks. The growing interest in billet crankshafts, particularly for high-performance and prototype electric vehicles, presents a significant opportunity due to their superior fatigue strength and customizability. However, maintaining dimensional accuracy and fatigue resistance across varying loads and materials continues to pose an engineering challenge.The increasing production of internal combustion engines (ICE) and commercial vehicles in emerging markets is significantly driving the demand for automotive crankshafts. Countries including China, Japan, and India are witnessing robust growth in vehicle manufacturing, supported by strong domestic demand and rising export activities. According to the India Brand Equity Foundation, India's annual automobile production in 2023 reached 25.9 million units, with two-wheelers and passenger cars accounting for the majority share. In 2025 (April-September), total vehicle production surpassed 15.6 million units, reflecting the resilience of the automotive sector. This sustained growth in ICE and commercial vehicle output is boosting the need for crankshaft components, as manufacturers scale up to meet both local and global market requirements.

Today, manufacturers are increasingly focusing on improving fuel efficiency, reducing emissions, and enhancing engine performance. The use of advanced materials such as forged steel, billet steel, and aluminum alloys enables significant weight reduction while maintaining the required strength and durability to withstand high engine loads. Lightweight crankshafts are particularly valuable in performance vehicles, hybrid models, and commercial applications where fuel economy and operational efficiency are critical. For instance, high-performance sports cars and premium vehicles often employ billet steel crankshafts to optimize power-to-weight ratios.

Precision forging enhances the mechanical properties of crankshafts, ensuring greater fatigue resistance and structural integrity, which are essential for modern engines operating under high stress. CNC machining allows for tighter tolerances and complex geometries, resulting in crankshafts that meet stringent OEM specifications. This technological shift supports faster production cycles, cost-efficiency, and customization for diverse vehicle types. For example, high-performance and commercial vehicle manufacturers increasingly adopt precision-forged crankshafts to meet durability and light-weighting requirements, reinforcing the relevance of these technologies in driving market expansion.

Billet crankshafts, machined from a solid piece of high-strength steel, offer superior durability, precision, and performance under extreme conditions, making them ideal for high-horsepower applications and motorsports. Additionally, as automakers and EV start-ups increasingly develop high-performance electric powertrains, billet crankshafts are being explored for hybrid and range-extender applications where strength, weight reduction, and reliability are critical. This trend is opening up new avenues for specialized crankshaft manufacturers targeting niche markets such as racing, luxury sports cars, and next-generation electric or hybrid vehicles seeking enhanced power delivery and efficiency.

Crankshafts are predominantly manufactured using steel alloys, the prices of which have remained volatile due to fluctuations in global commodity markets. For instance, the average global price of steel rose from approximately USD 500 per metric ton in 2020 to over USD 750-800 per metric ton in 2024, significantly impacting manufacturing costs. Additionally, forging processes require substantial energy inputs, particularly in precision forging and heat treatment stages, further adding to operational expenses. These cost pressures are especially challenging for small and mid-sized manufacturers, limiting their competitiveness and scalability in global markets.

Crankshaft Type Insights

The forged crankshaft segment accounted for the largest revenue share of 57.2% in 2024. The superior fatigue strength and cost-effectiveness of forged crankshafts make them the preferred choice for mass-market passenger and commercial vehicles. Their ability to withstand high loads and harsh operating conditions continues to reinforce their dominance in the automotive sector. Factors such as the increasing production of internal combustion engine (ICE) vehicles, rising demand for high-strength and durable crankshaft materials, the widespread use of precision forging technology, and the growing focus on fuel efficiency in heavy-duty and commercial vehicles support the segment growth.

The billet crankshaft segment is expected to grow at the highest CAGR from 2025 to 2033. Billet crankshafts offer superior strength, flexibility in custom designs, and better resistance to stress in high-horsepower applications, making them ideal for racing and specialty vehicles. The segment growth is supported by increasing demand for high-performance engines, the rising adoption of billet crankshafts in motorsport and custom vehicle applications, the use of advanced CNC machining for precision components, and growing R&D in electric vehicle (EV) prototypes requiring bespoke drivetrain solutions.

Material Insights

The steel alloy segment accounted for the largest revenue share in 2024, driven by the increasing production of internal combustion engine (ICE) vehicles, widespread preference for high-strength and cost-effective materials, rising demand for commercial vehicles, and the continued dominance of forged steel in heavy-duty applications. Steel alloy crankshafts offer an optimal balance between durability, fatigue resistance, and manufacturing cost, making them the standard choice across both passenger and commercial vehicle segments.

The billet steel segment is expected to grow at a significant CAGR during the forecast period. Billet steel crankshafts are ideal for applications where strength, customization, and tolerance to extreme stress are paramount, particularly in racing, sports cars, and high-performance commercial vehicles. Factors such as rising demand for performance vehicles, increasing adoption of custom crankshafts in motorsport and aftermarket applications, the need for enhanced durability in high-torque engines, and advancements in CNC machining precision support the segment growth.

Manufacturing Process Insights

The precision forging segment accounted for the largest revenue share in 2024, driven by increasing demand for high-strength, fatigue-resistant crankshafts, the widespread use of forged components in commercial vehicles and heavy-duty engines, advancements in automated forging technologies, and the cost-effectiveness of mass production. Precision forging enables the production of crankshafts with superior mechanical properties, dimensional accuracy, and material utilization efficiency, making it the preferred choice for original equipment manufacturers (OEMs) globally. For instance, Bharat Forge continues to expand its global forging capacity, including precision crankshaft production for ICE and commercial vehicles, reinforcing the market leadership of forged components. The consistent need for durable, high-volume crankshaft production ensures the dominant position of precision forging in the global market.

The CNC machining segment is expected to register a notable CAGR from 2025 to 2033, fueled by the rising demand for billet crankshafts in motorsport and performance applications, increasing customization in premium vehicles, advancements in multi-axis machining technologies, and growing adoption in prototype electric vehicle (EV) drivetrains. CNC machining allows for precise, flexible, and small-batch production of complex crankshaft designs that meet the requirements of high-performance and niche vehicle segments.

Vehicle Type Insights

The passenger vehicles segment accounted for the largest revenue share in 2024, driven by the rising global production and sales of passenger cars, growing demand for personal mobility solutions, increasing urbanization, and supportive government policies promoting vehicle replacement and electrification. Strong recovery and sustained growth in major markets such as China, India, and Southeast Asia are fueling this trend. For instance, in October 2024, retail sales of China’s passenger vehicles rose by 11.3% year-on-year, reaching 2.26 million units, according to the State Council of the People’s Republic of China. The resilience of the passenger car market, especially in Asia-Pacific, continues to drive demand for automotive components such as crankshafts, reinforcing the segment's leading position.

The commercial vehicles segment is expected to register a notable CAGR from 2025 to 2033, owing to its expanding role in logistics, infrastructure development, and last-mile delivery services, along with rising demand for heavy-duty and light commercial vehicles in both developed and emerging economies. For instance, according to CEIC Data, commercial vehicle sales in the U.S. reached 12.89 million units in December 2023, up from 11.37 million units in December 2022, reflecting a strong rebound in demand. This continued growth trajectory in commercial vehicle sales is expected to drive the demand for durable and high-performance crankshafts over the forecast period. The segment is further supported by growing investments in e-commerce, construction, and industrial sectors that require efficient transportation solutions.

Regional Insights

The Asia Pacific automotive crankshaft market dominated and accounted for 42.6% of the global revenue share in 2024, driven by expanding vehicle production, the presence of key automakers, and rising demand for commercial and passenger vehicles across emerging economies. The region’s robust manufacturing ecosystem, coupled with supportive government policies and growing middle-class income, is fostering steady automotive growth.

For instance, according to CEIC Data, South Korea’s number of registered vehicles reached 26.33 million units, up from 26.32 million units in January 2025, reflecting sustained demand for new vehicles. This continuous rise in vehicle ownership and production is expected to maintain Asia Pacific’s dominant position in the global automotive crankshaft market over the forecast period.

China automotive crankshaft market held a substantial revenue share in 2024. The market is experiencing rapid growth, driven by expanding vehicle production, supportive government policies, and strong domestic demand. The increasing adoption of advanced manufacturing technologies and the ongoing transition towards cleaner and more efficient vehicle models are further contributing to market expansion. For instance, according to the China Association of Automobile Manufacturers (CAAM), China's total vehicle sales reached 31.44 million units in 2024, marking a 4.5% increase over the previous year. This sustained growth in vehicle sales underscores the rising demand for high-performance automotive components such as crankshafts, reinforcing China’s position as a key market in the global landscape.

Japan automotive crankshaft market held a significant revenue share in 2024. In Japan, the automotive crankshaft market is influenced by the steady presence of global automotive giants, a strong manufacturing base, and sustained domestic vehicle demand. Japan’s role as the fourth-largest automotive market globally and its deep-rooted expertise in precision engineering continue to drive demand for high-quality automotive components, including crankshafts. According to the International Trade Administration (ITA), U.S. Department of Commerce, Japan recorded sales of 3,448,272 new passenger vehicles in 2022, reflecting the resilience of its automotive sector. This consistent market stability, backed by advanced manufacturing capabilities, reinforces Japan’s position as a key contributor to the global crankshaft market.

Europe Automotive Crankshaft Market Trends

The Europe automotive crankshaft market was identified as a lucrative region in 2024. The European market is witnessing significant transformation, driven by rising electric vehicle production, stringent emission regulations, and continuous advancements in lightweight material adoption. The shift towards hybrid and cleaner engine technologies is creating new growth avenues for precision-engineered crankshafts. Also, the region’s strong aftermarket demand for commercial vehicle parts is further supporting market expansion.

Germany automotive crankshaft market is being shaped by increasing demand for premium vehicles, robust export activities, and technological leadership in automotive manufacturing. Germany’s position as Europe’s largest vehicle producer, with a well-established supply chain for forged and machined components, ensures steady demand for high-performance crankshafts. The country’s push for innovation in internal combustion and hybrid powertrains further strengthens its role in the global market.

The UK automotive crankshaft market is influenced by the steady recovery of automotive production post-pandemic, coupled with growing investments in clean mobility technologies. While the country’s electric vehicle transition gathers pace, demand for crankshafts in commercial vehicles, specialty engines, and performance applications remains resilient. The focus on domestic manufacturing and supply chain localization is expected to support future crankshaft demand in the UK market.

North America Automotive Crankshaft Market Trends

The North America automotive crankshaft market was identified as a lucrative region in 2024. The North American market is being driven by the steady recovery of vehicle production, increasing demand for aftermarket components, and the rising adoption of advanced engine technologies in both passenger and commercial vehicles. The region’s strong focus on maintaining aging vehicle fleets and ensuring parts availability continues to fuel aftermarket crankshaft sales. For instance, in January 2025, Delphi North America, a brand of PHINIA Inc., introduced 56 new parts into its aftermarket portfolio, including multiple first-to-market crankshaft position sensors. These additions enhance service coverage for over 43 million vehicles across the U.S. and Canada, supporting both repair precision and aftermarket availability for critical engine components.

U.S. Automotive Crankshaft Industry Trends

The U.S. automotive crankshaft industry held a dominant position in 2024. The automotive crankshaft market in the U.S. is witnessing significant transformation, driven by steady growth in vehicle parc, rising demand for lightweight forged components, and increasing investments in advanced manufacturing technologies. According to CEIC Data, the U.S. had approximately 283 million registered vehicles in 2022, with passenger car sales rising to 3.1 million units in December 2023, up from 2.86 million units in December 2022. This consistent increase in vehicle production and sales underscores the growing need for crankshafts in both new vehicles and aftermarket applications.

For instance, in June 2024, Bharat Forge Aluminum USA announced a USD 40 million investment to expand its aluminum forging operations in Sanford, North Carolina. The facility, which began operations in 2021, focuses on producing lightweight forged components for premium automotive platforms, utilizing advanced 4,000-ton screw presses and high levels of automation. This strategic investment reflects the industry’s increasing emphasis on precision forging technologies to meet evolving OEM requirements. These developments highlight the U.S. market’s ongoing shift toward high-performance, durable, and lightweight crankshaft solutions, reinforcing its leadership in global automotive manufacturing.

The Canada automotive crankshaft market is witnessing steady growth, supported by the expansion of the country’s automotive aftermarket sector and the increasing average vehicle age, which is driving demand for replacement components such as crankshafts. In Mexico, the automotive crankshaft market is benefiting from rising automotive manufacturing activities, particularly as global OEMs shift production to Mexico to leverage lower labor costs and favorable trade agreements, bolstering demand for crankshaft components in both domestic assembly and export markets.

Key Automotive Crankshaft Company Insights

Some key players operating in the market include Thyssenkrupp AG, Rheinmetall AG, Bharat Forge Ltd, NSI Crankshaft Company, and Kellogg Crankshaft Company.

-

Founded in 1999 and headquartered in Essen, Germany, thyssenkrupp AG is a diversified industrial engineering and steel production company. The company operates through multiple business segments, including automotive components, where it specializes in manufacturing precision forged crankshafts. Thyssenkrupp offers advanced crankshaft solutions for passenger cars and commercial vehicles, utilizing cutting-edge forging and machining technologies to enhance strength, durability, and performance.

-

Founded in 1961 and headquartered in Pune, India, Bharat Forge Ltd is a leading global supplier of automotive components and a flagship company of the Kalyani Group. The company specializes in the design and manufacture of Forged Crankshafts for passenger vehicles, commercial vehicles, and off-highway applications. Bharat Forge leverages precision forging, advanced CNC machining, and materials engineering to produce lightweight, high-strength crankshafts that meet the performance demands of modern engines.

Key Automotive Crankshaft Companies:

The following are the leading companies in the automotive crankshaft market. These companies collectively hold the largest market share and dictate industry trends.

- Thyssenkrupp AG

- Rheinmetall AG

- Bharat Forge Ltd

- NSI Crankshaft Company

- Kellogg Crankshaft Company

- Tianrun Crankshaft Co. Ltd.

- Maschinenfabrik Alfing Kessler GmbH

- Sandvik AB

- Crower Cams & Equipment Co., Inc.

- Arrow Precision Ltd

Recent Developments

-

In March 2025, Nissan’s 1.5L Variable Compression Turbo (VC-Turbo) engine, featured in the new X-Trail, was awarded “Engine of the Year” at the car&bike Awards. The engine is the first in India to offer variable compression ratios ranging from 8:1 to 14:1, enabled through a complex mechanical system involving multi-link crankshaft components, control arms, and actuators.

-

In February 2025, Thyssenkrupp Polysius signed a Letter of Intent with Sweden’s SaltX to co-develop fully electrified, emission-free production facilities using Electric Arc Calciner (EAC) technology. While primarily aimed at lime and cement, the collaboration reflects Thyssenkrupp’s broader commitment to decarbonizing industrial processes, with potential implications for greener crankshaft manufacturing under its automotive operations.

-

In November 2023, Dart Machinery launched high-performance 4340 billet crankshafts for the Toyota 2JZ engine platform. Engineered for over 2000 HP applications, these crankshafts are precision-machined, heat-treated, and stress-relieved to ensure durability in high-boost environments, reinforcing the growing demand for billet crankshafts in motorsport and performance vehicle applications.

-

In May 2023, Monedero reaffirmed the success of its OM471LA crankshaft for Mercedes-Benz commercial vehicles, originally launched in 2021. Developed using advanced reverse engineering and OEM collaboration, the product offers a high-quality, cost-competitive aftermarket alternative to original Mercedes references and has become one of Monedero’s best-selling components as of 2022.

Automotive Crankshaft Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5110 million

Revenue forecast in 2033

USD 7279.4 million

Growth rate

CAGR of 4.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report Coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Crankshaft type, material, manufacturing process, vehicle type, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

Thyssenkrupp AG; Rheinmetall AG; Bharat Forge Ltd; NSI Crankshaft Company; Kellogg Crankshaft Company; Tianrun Crankshaft Co. Ltd.; Maschinenfabrik Alfing Kessler GmbH; Sandvik AB; Crower Cams & Equipment Co., Inc.; Arrow Precision Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Crankshaft Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global automotive crankshaft market report based on crankshaft type, material, manufacturing process, vehicle type, and region.

-

Crankshaft Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Forged Crankshaft

-

Cast Crankshaft

-

Billet Crankshaft

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Steel Alloy

-

Cast Iron

-

Billet Steel

-

Other Materials

-

-

Manufacturing Process Outlook (Revenue, USD Million, 2021 - 2033)

-

Precision Forging

-

Casting

-

CNC Machining

-

Heat Treatment & Surface Finishing

-

-

Vehicle Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Passenger Vehicles

-

Commercial Vehicles

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive crankshaft market size was estimated at USD 4.98 billion in 2024 and is expected to reach USD 7.28 billion in 2033.

b. The global automotive crankshaft market is expected to grow at a compound annual growth rate of 4.5% from 2025 to 2033 to reach USD 7.28 billion by 2033.

b. The Asia Pacific automotive crankshaft market accounted for 42.6% of the global share in 2024, driven by expanding vehicle production, the presence of key automakers, and rising demand for commercial and passenger vehicles across emerging economies. The region’s robust manufacturing ecosystem, coupled with supportive government policies and growing middle-class income, is fostering steady automotive growth.

b. Some key players operating in the automotive crankshaft market include Thyssenkrupp AG, Rheinmetall AG, Bharat Forge Ltd, NSI Crankshaft Company, Kellogg Crankshaft Company, Tianrun Crankshaft Co. Ltd., Maschinenfabrik Alfing Kessler GmbH, Sandvik AB, Crower Cams & Equipment Co., Inc., Arrow Precision Ltd

b. Key factors that are driving the market growth include increasing production of internal combustion engine (ICE) and commercial vehicles in emerging markets, rising demand for lightweight yet high-strength crankshaft materials, and the integration of advanced manufacturing technologies such as precision forging and CNC machining.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.