- Home

- »

- Automotive & Transportation

- »

-

Automotive Differential System Market, Industry Report, 2033GVR Report cover

![Automotive Differential System Market Size, Share & Trends Report]()

Automotive Differential System Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Open Differential, Locking Differential), By Drive Type (FWD, RWD), By Vehicle Type, By Component, By Propulsion Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-740-3

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Differential System Market Summary

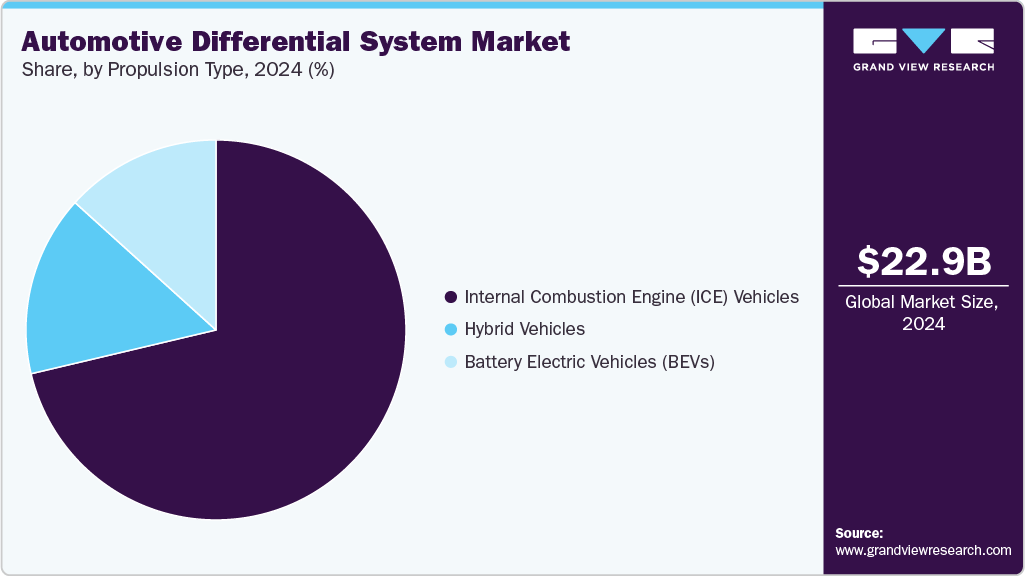

The global automotive differential system market size was estimated at USD 22.95 billion in 2024, and is projected to reach USD 34.33 billion by 2033, growing at a CAGR of 4.7% from 2025 to 2033. This growth is driven by the rising demand for all-wheel-drive (AWD) and four-wheel-drive (4WD) systems in SUVs and off-road vehicles, the increasing integration of advanced differential technologies such as electronic limited-slip differentials (eLSD) and torque vectoring systems in performance and electric vehicles, and the global push toward fuel efficiency and vehicle stability.

Key Market Trends & Insights

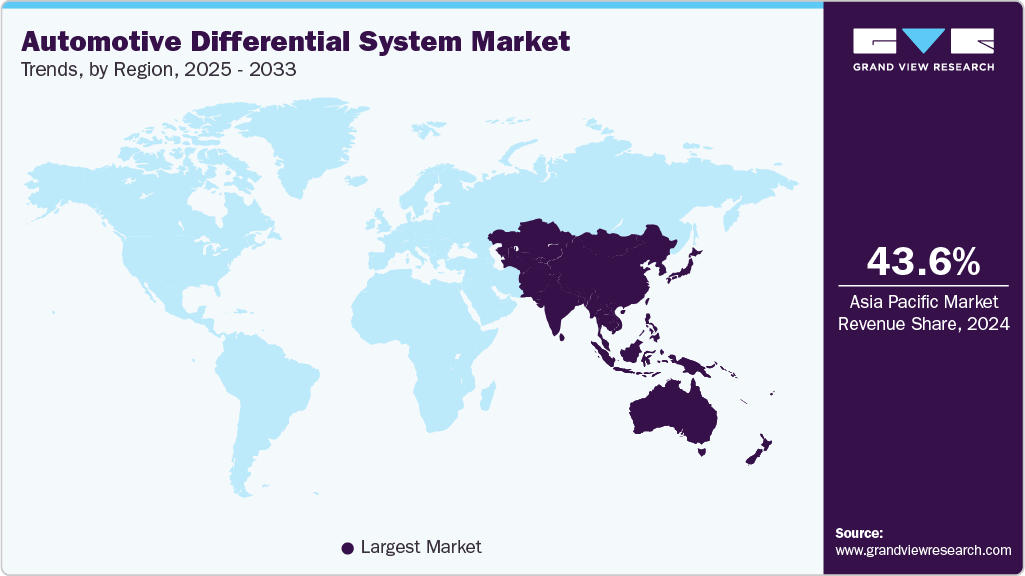

- The Asia Pacific automotive differential system market accounted for a 43.6% share of the overall market in 2024.

- The automotive differential system industry in China held a dominant position in 2024.

- By Type, the open differential segment accounted for the largest share of 38.7% in 2024.

- By Drive Type, the front-wheel drive (FWD) segment held the largest market share in 2024.

- By Vehicle Type, the passenger cars segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 22.95 Billion

- 2033 Projected Market Size: USD 34.33 Billion

- CAGR (2025-2033): 4.7%

- Asia Pacific: Largest market in 2024

In addition, the electrification of powertrains and the growth of hybrid and electric vehicle (EV) sales fuel demand for differentials compatible with new propulsion architectures. The primary factors propelling the market growth are the rising stringency of government regulations related to fuel efficiency and emissions. Regulatory bodies across developed and emerging economies are mandating automakers to reduce carbon footprints and enhance fuel economy. For instance, the U.S. Department of Energy (DOE) continues to fund advanced vehicle technologies programs that aim to improve energy efficiency in light-duty and heavy-duty vehicles. Differential systems with optimized gear designs and electronic control can minimize power losses and contribute to better fuel economy. As a result, automotive manufacturers are increasingly integrating efficient differential systems into new vehicle models to comply with regulations, thereby boosting the market.Another significant trend boosting the market is the rapid penetration of electric vehicles (EVs) into the mainstream automotive sector. EVs often use dual-motor setups or need advanced torque vectoring, which requires advanced differential technologies. According to the U.S. Department of Energy’s Alternative Fuels Data Center, EV sales have grown exponentially, supported by tax credits, public infrastructure investments, and R&D grants. The demand for software-controlled and electronically actuated differentials is growing within this segment, as these systems help manage torque distribution more precisely in EV platforms. This shift is reshaping drivetrain design and propelling the market growth for differential systems adapted to electrification.

The rising popularity of SUVs and off-road vehicles also propels the market growth, especially for limited-slip and locking differential systems. In the U.S., data from the National Highway Traffic Safety Administration (NHTSA) shows that SUVs account for an increasing share of new vehicle sales. These vehicles require differentials capable of handling rough terrains and steep gradients, particularly in regions with diverse driving environments. Consequently, automakers are expanding their offerings with advanced differential technologies to meet consumer expectations for both on-road comfort and off-road capabilities, thereby boosting the adoption of these systems.

Integrating electronic control systems for vehicle safety is significantly boosting the market. Differential systems today are linked with electronic stability control (ESC), anti-lock braking systems (ABS), and traction control systems (TCS). As per the NHTSA, these safety technologies have become mandatory in many regions and are proven to reduce fatal crashes. Electronically controlled differentials enhance vehicle handling and cornering under varying load conditions, improving safety outcomes. This integration propels market growth by making advanced differentials a core safety component.

Type Insights

The open differential segment accounted for the largest share of 38.7% in 2024. The open differential remains a foundational component in conventional vehicle architectures, especially in entry-level passenger cars. Its simplicity and cost-effectiveness continue to drive its adoption among automakers focused on mass-market affordability. The increasing production of compact and budget vehicles across emerging economies like India and Southeast Asia is propelling the growth of this segment. Moreover, OEMs are leveraging the open differential’s proven reliability and lower maintenance profile to cater to markets where cost sensitivity is high.

Electronic limited slip differential (eLSD) is expected to grow at the fastest CAGR during the forecast period. The growing emphasis on vehicle performance and safety, especially in premium and high-end vehicles, is boosting the demand for electronic limited slip differentials (eLSD). Automakers increasingly integrate eLSDs in electric and hybrid vehicles to enhance traction and torque control. Brands like BMW, Audi, and Mercedes-Benz have already deployed eLSDs in several models, citing benefits in handling dynamics and cornering precision. The rapid adoption of vehicle electrification and ADAS technologies further complements the use of electronically controlled differential systems, propelling market growth in this sub-segment.

Drive Type Insights

The front-wheel drive (FWD) segment held the largest market share in 2024. Front-wheel drive systems dominate the global automotive landscape due to their lightweight nature, manufacturing efficiency, and space-saving design. As automakers strive for fuel efficiency and lower production costs, FWD vehicles are gaining momentum, especially in compact sedans and hatchbacks. The differential system for FWD configurations is relatively simple, leading to reduced maintenance and improved reliability, fueling the segment’s expansion in urban-centric mobility markets.

The all-wheel drive/four-wheel drive (AWD/4WD) segment is expected to grow at the fastest CAGR during the forecast period. The increasing consumer preference for SUVs and crossovers, particularly in North America, Europe, and China, is significantly boosting the AWD/4WD differential systems market. These systems enhance vehicle traction and stability under diverse driving conditions, making them highly desirable in regions with adverse weather or rugged terrain. Furthermore, premium automakers are incorporating torque vectoring and smart AWD systems to differentiate performance-oriented models, accelerating the adoption of advanced differentials in this category.

Vehicle Type Insights

The passenger cars segment dominated the market in 2024, driven by rising global car ownership, urbanization, and shifting consumer lifestyles. Introducing compact and mid-size vehicles with enhanced ride comfort and safety features has led to the widespread integration of efficient differential systems. Moreover, the rising production of electric and hybrid passenger cars creates new opportunities for conventional and electronically controlled differentials.

The off-road Vehicles/SUVs segment is projected to grow at the fastest CAGR over the forecast period. The booming demand for off-road and sport utility vehicles is significantly propelling the growth of robust and performance-oriented differential systems. Consumers across developed and developing markets are increasingly drawn to SUVs' versatility and rugged appeal. To meet the expectations for off-road capabilities, manufacturers are equipping vehicles with locking differentials and torque vectoring systems. Brands like Jeep, Land Rover, and Toyota consistently upgrade their differential systems to deliver improved terrain adaptability, boosting the off-road vehicles segment.

Component Insights

The differential case segment dominated the market in 2024 and is projected to grow at a significant CAGR over the forecast period. As the structural core of the differential assembly, the differential case plays a crucial role in supporting torque transmission and housing essential components. Advancements in metallurgy and the growing focus on weight reduction are driving innovations in differential case design. Manufacturers are adopting high-strength alloys and optimized casting techniques to improve durability while reducing overall weight, attributes essential for fuel economy and performance in modern vehicles.

Differential bearings is projected to grow at the fastest CAGR over the forecast period, owing to the rise in global vehicle production and the need for high-precision components that ensure smoother power transmission. With the increasing adoption of high-performance and electric drivetrains, the demand for low-friction, heat-resistant bearings has surged. Suppliers are focusing on enhancing bearing durability and noise reduction, particularly for EVs and AWD systems, thereby boosting the growth potential of this component sub-segment.

Propulsion Type Insights

The internal combustion engine (ICE) vehicles segment dominated the market in 2024 and is projected to grow at a significant CAGR over the forecast period. Despite the electrification wave, ICE vehicles still represent a dominant share of the global vehicle population, particularly in regions with underdeveloped EV infrastructure. Differential systems for ICE vehicles are continuously evolving with the introduction of advanced materials and lightweight designs to meet stringent emission norms and improve fuel efficiency. Emerging markets in Asia-Pacific and Africa are witnessing steady growth in ICE-powered vehicle sales, propelling demand for conventional differential technologies.

The battery electric vehicles (BEVs) segment is projected to grow at the fastest CAGR over the forecast period. The global push toward carbon neutrality and clean mobility is accelerating the adoption of BEVs, which in turn is transforming the landscape for automotive differentials. While some electric vehicles employ a single-speed transmission, high-performance BEVs and AWD electric models require advanced torque vectoring and dual-motor setups, creating a niche but rapidly growing segment for electronic differentials. The shift towards smart drivetrains with software-controlled torque management is giving rise to the next generation of electric differential systems, positioning this segment as a key driver of innovation in the coming years.

Regional Insights

The North America automotive differential system market accounted for a 19.7% share of the overall market in 2024. The market is gaining momentum in North America as automakers increasingly adopt advanced drivetrain technologies to meet evolving performance and safety standards. The region’s shift toward off-road and performance-oriented vehicles has notably intensified the demand for electronic and torque vectoring differentials. In addition, regulatory support for emissions reduction and local innovation in powertrain engineering drives differential upgrades across OEM fleets. The presence of major drivetrain component manufacturers has further reinforced supply chain stability, propelling the market growth.

U.S. Automotive Differential System Market Trends

The automotive differential system market in the U.S. held a dominant position in 2024. The U.S. market is witnessing a steady transformation fueled by rising consumer preference for SUVs and pickup trucks equipped with all-wheel and four-wheel drive configurations. This trend is boosting the adoption of locking differentials and limited-slip differentials for enhanced traction on varied terrains. In parallel, electric drivetrain initiatives are gaining traction in the country, with differential manufacturers increasingly investing in electronically controlled solutions tailored for electric and hybrid drivetrains.

Europe Automotive Differential System Market Trends

The automotive differential system market in Europe was identified as a lucrative region in 2024. Europe remains at the forefront of technological advancement in automotive, strongly emphasizing drivetrain efficiency and reduced carbon emissions. The presence of high-performance car brands and widespread integration of safety-enhancing systems propels the market for advanced differential systems in the region. European OEMs prioritize compact, lightweight, and electronically controlled differentials to align with carbon-neutral goals and stringent emissions regulations. Regulatory backing for EV adoption also reshapes differential designs to suit newer propulsion systems.

Germany automotive differential system market is dominated by luxury and high-performance vehicle production, which continues to drive demand for precision-engineered differential systems. The focus is on integrating torque vectoring and electronically limited-slip differentials in premium sedans and sports cars. The country’s strong automotive R&D ecosystem encourages innovations in mechatronic differentials that balance performance with environmental compliance, boosting the local market’s technological sophistication.

The automotive differential system market in the UK is rising considerably. Electric and hybrid vehicle production investments have bolstered the shift toward smart drivetrain systems, including electronically actuated differential components. Government policies supporting green mobility encourage domestic players to reconfigure drivetrain architectures for low-emission vehicles. This shift reshapes the competitive landscape and pushes differential suppliers to offer more modular and scalable solutions.

Asia Pacific Automotive Differential System Market Trends

The automotive differential system market in Asia-Pacific is experiencing rapid growth and accounts for the largest market share with the fastest growing CAGR during the forecasted period, driven by expanding automobile production and increasing urban mobility solutions. The rapid expansion of the passenger vehicle segment, particularly in emerging economies, is boosting demand for front-wheel drive configurations with standard open differentials. Simultaneously, rising consumer appetite for performance utility vehicles and local regulatory moves toward safety enhancement are fueling the adoption of advanced differentials across the region.

China automotive differential system market is evolving, and the automotive ecosystem fosters widespread differential system upgrades, with a growing inclination toward electric and premium vehicles. Domestic OEMs are increasingly integrating electronically controlled differentials to address efficiency and stability concerns in EVs. The nation’s aggressive EV rollout strategy catalyzes the development of lightweight, intelligent differential systems, aligning with its long-term goals for automotive innovation and energy independence.

The automotive differential system market in India is emerging as a strong, largely driven by the rising penetration of utility vehicles and the growth of the domestic automotive sector. Increasing consumer demand for SUVs and off-road-capable vehicles is creating a surge in the need for robust differentials, especially locking and limited-slip variants. Furthermore, the Make in India initiative is incentivizing local manufacturing and R&D of drivetrain components, fostering a more self-reliant and cost-efficient supply base.

Key Automotive Differential System Company Insights

Some major players in the market include Eaton, Dana Limited, BorgWarner Inc., and ZF Friedrichshafen AG, due to a strong focus on technological advancements, diversified product offerings, and long-standing partnerships with leading automotive OEMs. These companies have established global manufacturing capabilities and invest significantly in R&D to develop advanced differential systems that enhance traction, fuel efficiency, and vehicle safety, which are increasingly critical across conventional and electric powertrain platforms, propelling their leadership in the market.

-

Eaton is a globally recognized power management company that plays a significant role in the market. With a strong emphasis on efficiency, safety, and durability, Eaton offers a diverse range of differential products, including automatic locking differentials, limited-slip differentials (LSDs), and electronic locking differentials. These solutions are widely adopted across light-duty, commercial, and off-road vehicles. Eaton’s differential systems are engineered to optimize traction and improve vehicle stability under varying road conditions. The company has established strong relationships with leading automotive OEMs and focuses heavily on innovation to support modern vehicle architectures, including those transitioning toward electrification. Eaton also invests in R&D to advance smart differential technologies that integrate seamlessly with vehicle electronic systems, propelling its competitive position in the global market.

-

BorgWarner Inc. is a prominent manufacturer of innovative and sustainable mobility solutions, including advanced differential systems tailored for internal combustion engine (ICE) vehicles and electrified powertrains. The company is highly regarded for its expertise in torque management systems and offers a wide portfolio encompassing open differentials, electronic limited-slip differentials (eLSDs), and torque vectoring technologies. BorgWarner’s differential systems are engineered to enhance vehicle handling, fuel efficiency, and safety under dynamic driving conditions. With a strategic focus on eMobility, the company has increasingly integrated smart differential technologies into electric drive modules. Its global manufacturing footprint and strong collaboration with top-tier automotive brands enable BorgWarner to adapt rapidly to market demands, boosting its presence in the evolving automotive drivetrain industry.

Key Automotive Differential System Companies:

The following are the leading companies in the automotive differential system market. These companies collectively hold the largest market share and dictate industry trends.

- Eaton

- Dana Limited

- BorgWarner Inc.

- ZF Friedrichshafen AG

- GKN Automotive Limited

- American Axle & Manufacturing, Inc.

- JTEKT Corporation

- Linamar Corporation

- HYUNDAI WIA CORP.

- Musashi Seimitsu Industry Co., Ltd.

Recent Developments

-

In April 2025, at Auto Shanghai 2025 in Shanghai, China, Eaton unveiled the EV Truetrac helical-gear limited-slip differential designed specifically for electric pickups and SUVs; the unit’s micro-geometry tuning maintains film strength in low-viscosity EV oils, noise-optimized tooth profiles silence gear mesh, and the reinforced architecture manages the instantaneous high-torque loads characteristic of battery-electric drivetrains.

-

On July 31, 2024, in Auburn Hills, Michigan, USA, BorgWarner issued a press release announcing multi-year contracts with three global automakers, GAC Motor (production underway), an unnamed East-Asian OEM (SOP 2025) and a European premium brand (SOP 2026), for its scalable Electric Cross Differential (eXD), a core element of the company’s electric Torque Management System that delivers wheel-by-wheel torque vectoring to improve traction, cornering stability and energy efficiency across a broad range of BEVs.

Automotive Differential System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 23.71 billion

Revenue forecast in 2033

USD 34.33 billion

Growth rate

CAGR of 4.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, drive type, vehicle type, component, propulsion type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Eaton; Dana Limited; BorgWarner Inc.; ZF Friedrichshafen AG; GKN Automotive Limited; American Axle & Manufacturing, Inc.; JTEKT Corporation; Linamar Corporation; HYUNDAI WIA CORP.; Musashi Seimitsu Industry Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Differential System Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global automotive differential system market report based on type, drive type, vehicle type, component, propulsion type, and region:

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Open Differential

-

Limited Slip Differential (LSD)

-

Locking Differential

-

Torque Vectoring Differential

-

Electronic Limited Slip Differential (eLSD)

-

-

Drive Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Front-Wheel Drive (FWD)

-

Rear-Wheel Drive (RWD)

-

All-Wheel Drive/Four-Wheel Drive (AWD/4WD)

-

-

Vehicle Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Passenger Cars

-

Light Commercial Vehicles (LCVs)

-

Heavy Commercial Vehicles (HCVs)

-

Off-Road Vehicles/SUVs

-

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Differential Case

-

Differential Gears

-

Pinion & Side Gears

-

Differential Bearings

-

Others

-

-

Propulsion Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Internal Combustion Engine (ICE) Vehicles

-

Hybrid Vehicles

-

Battery Electric Vehicles (BEVs)

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive differential system market size was estimated at USD 22.95 billion in 2024 and is expected to reach USD 23.71 billion in 2025.

b. The global automotive differential system market size is expected to grow at a significant CAGR of 4.7% to reach USD 34.33 billion in 2033.

b. Asia Pacific held the largest market share of 43.6% in 2024, driven by expanding automobile production and increasing urban mobility solutions. The rapid expansion of the passenger vehicle segment, particularly in emerging economies, is boosting demand for front-wheel drive configurations with standard open differentials.

b. Some of the players in the automotive differential system market are Eaton, Dana Limited, BorgWarner Inc., ZF Friedrichshafen AG, GKN Automotive Limited, American Axle & Manufacturing, Inc., JTEKT Corporation, Linamar Corporation, HYUNDAI WIA CORP., and Musashi Seimitsu Industry Co., Ltd..

b. The key driving trend in the Automotive Differential System market is the rapid shift toward electrification and the adoption of advanced electronic differential technologies, which offer precise, real-time torque distribution, enhanced traction, stability, and integration with EV and hybrid powertrains and ADAS features

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.