- Home

- »

- Automotive & Transportation

- »

-

Automotive Electronics Market Size & Share Report, 2030GVR Report cover

![Automotive Electronics Market Size, Share & Trend Report]()

Automotive Electronics Market Size, Share & Trend Analysis Report By Component (Electronic Control Unit, Sensors), By Vehicle Type, By Propulsion, By Application (ADAS, Infotainment), By Sales Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-357-7

- Number of Report Pages: 160

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Technology

Automotive Electronics Market Size & Trends

The global automotive electronics market size was valued at USD 262.60 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 8.8% from 2024 to 2030. The increasing integration and implementation of advanced safety systems such as automatic emergency braking, airbags, parking assistance systems, and lane departure warning to decrease road accidents is expected to favor demand over the forecast period. Moreover, features such as emergency call systems, alcohol ignition interlocks, and accident data recorder systems are rapidly adopted to safeguard in-vehicle passengers and are expected to drive market growth over the forecast period.

The increasing demand for electric vehicles is driving the demand for automotive electronics. Many people are switching from fuel ignited vehicles to electrics vehicles, and this is increasing the demand for systems. It has increased the demand for battery management systems and electric powertrains of electric vehicles. However, apart from the growing demand for electric vehicles, government regulations and funding have also impacted positively the automotive electronics market growth.

Government imposed safety regulations which made automakers around the world improve the safety of vehicles and reduce the number of accidents on the roads, which boosts the demand for automotive electronics. Government safety regulations can also be used to support the development of new technologies, such as electric vehicles, which can improve efficiency and reduce emission from vehicles. For instance, China has laid down regulations focusing on reducing energy consumption of passenger cars and maximizing the sales of new energy vehicles, including plug-in hybrid and fully electric cars. Governments across various countries are providing annual tonnage tax and automobile tax to promote the use of electric vehicles.

Technological advancements have positively impacted the growth of automotive electronics. Advancements in areas such as automotive powertrain electronics, autonomous driving, and connected vehicles. The automotive electronics market forms an essential part of the automotive industry, which provides automakers and goods with efficient and sustainable automotive electronics solutions. The market for automotive electronics is likely to remain focused for industry players and policymakers as urbanization and the demand for automotive vehicles continue to grow.

Parking assistance, electrical suspensions, braking, and steering systems are some of the critical systems incorporated in luxury cars and mid-size cars. Furthermore, the government promotes the adoption of zero-emission vehicles and imposes obligatory safety standards for automotive manufacturers. Governments are also regulating the use of ADAS safety system installations in vehicles. For instance, the New Car Assessment Program mandates advanced active and passive safety systems in China and Europe. Also, the Indian government allows specific low-frequency band usage to help automotive manufacturers use radar-based systems to install ADAS features in vehicles. All these factors are driving the growth of the automotive electronics market.

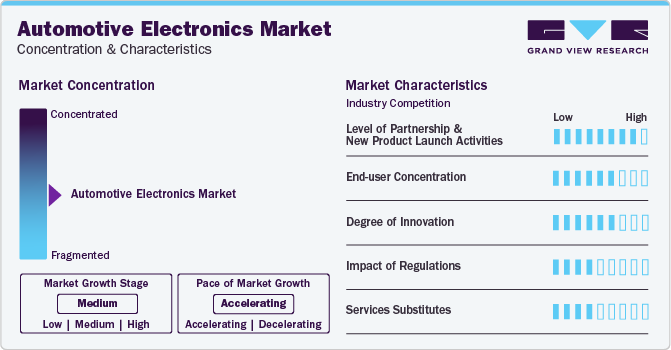

Market Concentration & Characteristics

Industry growth stage is medium, and industry growth pace is accelerating. The demand for automotive electronics is anticipated to rise as the government mandates CO2 emissions and increases usage of modern technologies such as IoT, AI, and cloud networking. Growing demand for electric vehicles, self-driving cars, and cutting-edge automotive technology is expected to boost the demand for automotive electronic components.

The automotive electronics industry is characterized by a high level of partnerships and new product launch activity by the companies. This is due to several factors, including access to technology, or infrastructure to launch innovative and advanced products in the market. Also, to expand their regional reach by leveraging the partner’s existing customer base, distribution channels, allowing companies in the automotive electronics industry to tap into new demographics.

Both governments and industry regulators are focusing on ensuring the safety of automotive electronics component on various parameters, including crashworthiness, fire safety, and compliance with signaling and control systems. There are growing concerns over the environmental impact, particularly the greenhouse gas emissions associated with all type of vehicles. Hence, regulations are being drafted to encourage the use of more energy-efficient and low-emission automotive electronics component.

Automotive electronics form one of the significant components of automobiles. Thus, the replacement of electronics in the automotive industry may pose challenges in the form of design modifications. Furthermore, a recent innovation in technology is expected to increase the automotive electronic substitution rate for the manufacturers since automotive electronics consolidates would solve the purpose of multiple electronics, thereby reducing the average number of electronics used per car. Hence, the differentiated, customized solutions and unavailability of alternatives contribute to the low threat of substitutes.

Buyers are increasingly looking for automotive electronics component tailored to their specific needs. They are demanding customized designs, interiors, and features to meet the evolving needs of passengers and operators.

Component Insights

Current carrying devices segment led the market and accounted for 40.2% in 2023.Current carrying devices are essential components in the automotive industry, as they transmit electrical power and signals throughout the vehicle's electrical system. The demand for current-carrying devices in the component segment is due to the high cost and numerous electronic components used in vehicles, including switches, fuses, connectors, and wiring harnesses.

The sensors segment is anticipated to register the highest growth rate over the forecast period. This growth can be attributed to significantly emerging in the automotive electronics market as most passengers prefer vehicles due to their safety, efficiency, and more connected vehicles. Sensors are used in various automotive applications, including engine management, safety systems, and entertainment systems. Furthermore, several countries' government initiatives and investments for people's safety and security fuel demand for sensors. For instance, in April 2022, the Ministry of Electronics and Information Technology (MeitY) launched the Onboard Driver Assistance and Warning System (ODAWS) product. ODAWS aims to incorporate vehicle-borne sensors to monitor vehicle surroundings and driver propensity to signal visual and acoustic alerts for driver assistance.

Application Insights

The safety systems segment accounted for the largest market revenue share in 2023. The demand for efficient, safe, convenient driving experiences and stringent safety regulations is rising. Manufacturers such as Continental AG, DENSO Corporation, Infineon Technologies AG, and Robert Bosch GmbH are developing safety systems vehicles to cater to the increasing demand for light and heavy commercial vehicles. Factors such as increasing focus on vehicle safety and the rising number of road accidents contribute to the segment's growth. For instance, in March 2023, Hyundai Motor India Limited launched its new Hyundai Verna with a level 2 ADAS system and 65 advanced safety features, and many others. The new Verna would also feature Hyundai’s Smart Sense safety features that would get automated sensing technology with radars, cameras to detect obstacles, and sensors on the road and assist in corrective warnings and actions.

The Advanced Driver Assistance System (ADAS) segment is expected grow at the highest CAGR over the forecast period. Factors such as government regulations requiring safety and growing public knowledge of passenger comfort and safety contribute to the segment's expansion. In addition, customers have an increased preference for the newest technologies as the automobile industry experiences a rise in technological advancements, which improve driver and passenger safety and driving enjoyment. Consumer behavior is significantly impacted by ADAS features like blind spot detection, lane assistance, collision warning, etc. These features are also anticipated to improve the performance of vehicles by decreasing vehicle downtime and warning the owner of any problems with the vehicle.

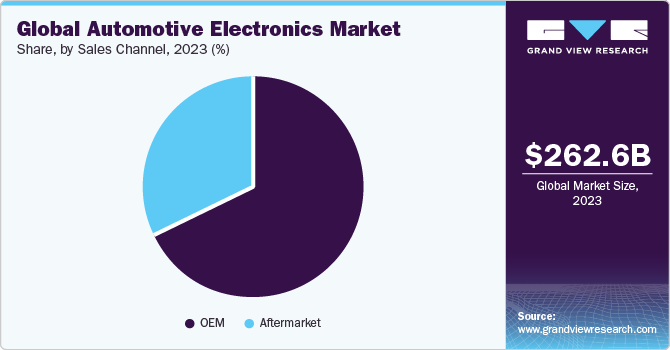

Sales Channel Insights

The OEM segment led the market in 2023. This dominance can be attributed to the increased durability and shelf-life of electronic components. Since electronic components form an integral part of the vehicles, consumers prefer buying them through OEMs in order to obtain genuine parts. Furthermore, with the increase in the design complexity of these electronic components, aftermarket electronic components are expected to account for a lower revenue share over the forecast period.

The aftermarket segment is expected to register a considerable growth over the forecast period. Factors include increasing vehicle age, cost-effective repair options, consumer demand for advanced features, product innovation, and increased online sales. Hence, with the increase in the design complexity of these electronic components, aftermarket electronic components demand will grow over the forecast period.

Regional Insights

The automotive electronics market in North America is expected to register a considerable growth rate from 2024 to 2030. The region is home to several Automotive Electronics companies that are implementing partnership and collaboration initiatives to grow their demographic presence. For instance, in January 2023, U.S. based automotive electronics supplier, announced technology collaboration with semiconductor and software manufacturer Qualcomm for developing advanced automotive cockpit domain controller which is designed to enable automotive companies’ modern cockpits. Through this partnership, the companies are helping the automotive industry to transform to a more intelligent, customized vehicle experience.

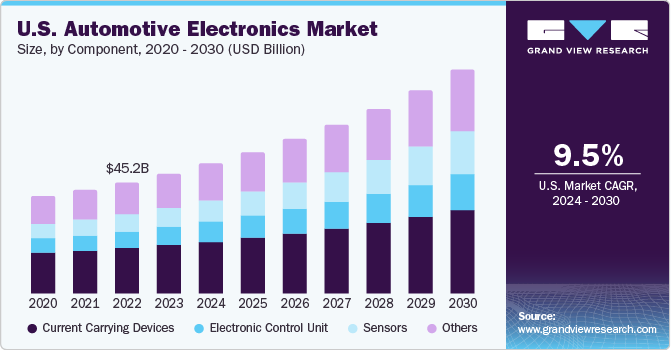

U.S. Automotive Electronics Market Trends

The automotive electronics market in the U.S. is expected to grow at a CAGR of 9.9% from 2024 to 2030. The U.S. automotive industry is experiencing a shift towards connected cars, which are vehicles that are equipped with Internet access and the ability to communicate with other devices, including smartphones, other cars, and even infrastructure. This trend is driving the growth of automotive electronics, as connected cars require sophisticated electronic systems to enable connectivity.

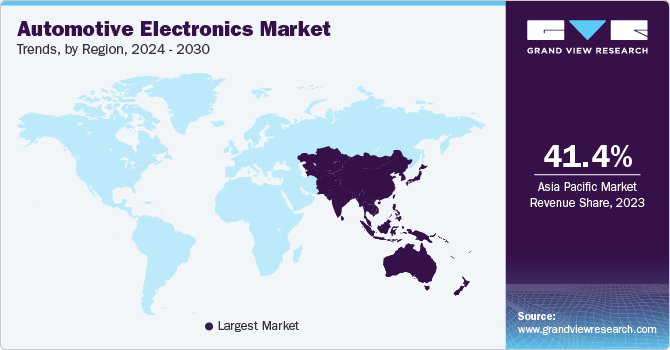

Asia Pacific Automotive Electronics Market Trends

Asia Pacific dominated the automotive electronics market and accounted for 41.4% share in 2023. The growing demand for advanced electronics in vehicles, increasing purchasing power of the consumers, and growing consumer awareness of safety features in the developing countries are the key factors driving the growth in the Asia Pacific region. Automotive manufacturers intend to enhance their production volume by implementing modern manufacturing technology. For instance, Mercedes Benz, General Motors, and Volkswagen shifted their production plants to developing countries. Furthermore, Asia Pacific is home to leading semiconductor suppliers. And easy availability of power electronics components and devices makes Asia Pacific the leading regional market.

The automotive electronics market in China accounted for a 51.3% revenue share of the Asia Pacific in 2023. Government incentives, subsidies, and regulation promoting NEVs have led to a surge in the demand for electric cars is anticipated to drive growth in automotive electronics. Furthermore, China has been investing heavily in autonomous driving technology is witnessing a growth in sensors, LiDAR, radar systems, and AI algorithms.

India automotive electronics market is expected to grow at a CAGR of 8.7% from 2024 to 2030. Rapid advancements in technology have led to the development of new and innovative automotive electronics products, such as infotainment systems, navigation systems, and advanced driver assistance systems (ADAS). This has fueled the growth of the automotive electronics market in India.

The automotive electronics market in Japan is driving demand owing to several initiatives and policies introduced by the government to promote the adoption of EVs, including tax incentives, subsidies, and regulatory measures. The government has set a target of having EVs account for 50% of new car sales by 2030.

Europe Automotive Electronics Market Trends

The automotive electronics market in Europe was values at USD 65.02 billion in 2023. Consumers are increasingly looking for vehicles with advanced connectivity features, such as smartphone integration, navigation, and entertainment systems. As a result, automakers are investing heavily in the development of infotainment systems that can provide these features.

UK automotive electronics market is accounted for a 13.1% revenue share of the Europe in 2023. Growing focus on enhancing vehicle safety through the integration of advanced safety systems such as collision avoidance systems, lane departure warnings, and emergency braking. Such advancements in the safety systems are anticipated to drive the demand for automotive electronics in the U.K.

The automotive electronics market in Germany is expected to grow at a CAGR of 6.7% from 2024 to 2030. The country’s integration into the global automotive supply chain is influencing the adoption of electronic components and technologies to meet international standards and market demands is anticipated to drive the growth of the automotive electronics market in Germany.

France automotive electronics market is projected to grow owing to the growing demand for customized and personalized features in their vehicles. Advanced electronics allowed for tailored in-car experience, including audio unit, navigation unit, and heads-up display are anticipated to drive the growth of the automotive electronics in France.

MEA Automotive Electronics Market Trends

The automotive electronics market in the Middle East and Africa (MEA) region is anticipated to reach USD 17.44 billion by 2030. The demand for connected cars in MEA is on the rise, as consumers increasingly seek vehicles that are equipped with features such as infotainment systems, advanced driver assistance systems (ADAS), and vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication capabilities.

The automotive electronics in Saudi Arabia is driven by growing demand for IoT technologies and integration of sensors in vehicles for monitoring and data collection. This includes sensors for monitoring vehicle health, tire pressure, and other parameters to enhance safety and performance.

Key Companies & Market Share Insights

Some of the key players operating in the market includeDenso Corporation, Robert Bosch GmbH, Xilinx, Inc., Continental AG, Hella GmbH & Co., ZF Friedrichshafen AG, and Infineon Technologies AG.

-

Denso Corporation is an automotive supplier offering electrification, powertrain, mobility, thermal, and electronic systems to carmakers across the globe. The company focuses on developing core technologies in four fields, namely automated driving, electrification, connected driving, and factory automation.

-

ZF Friedrichshafen AG is engaged in delivering active and passive safety technology for commercial vehicles and passenger cars. It operates through seven divisions, namely Car Chassis Technology, Car Powertrain Technology, Industrial Technology, Commercial Vehicle Technology, Active & Passive Safety Technology, e-Mobility, and ZF Aftermarket. The company has a presence in 230 locations across 40 countries globally.

-

Visteon Corporation, Hitachi Automotive Systems Ltd., MotoLink, and iElektron are some of the emerging market participants in the automotive electronics market.

-

Hitachi Automotive Systems Ltd. is engaged in development, manufacturing, sale, as well as service of industrial machines and systems, transportation related components, and automotive components in Japan and globally. It delivers engine management systems such as fuel systems, control units, intake and exhaust systems, ignition systems, engines, and sensors.

- Visteon Corporation is a manufacturer of automotive cockpit electronics such as android based infotainment, instrument clusters telematics, advance driver assistance system, battery management system displays, domain controller. The company also develops mobility technologies based on artificial intelligence, interior sensing, cybersecurity, connected car technology and user experience.

Key Automotive Electronics Companies:

- Continental AG

- DENSO Corporation

- Hella GmbH & Co. Kgaa

- Hitachi Automotive Systems, Ltd.

- Infineon Technologies AG

- Robert Bosch GmbH

- Valeo Inc.

- Visteon Corporation

- Xilinx, Inc.

- ZF Friedrichshafen AG

Recent Developments

-

In March 2023, Infineon Technologies AG expanded its partnership with Delta Electronics, Inc., an energy, and power management company that would deepen its innovative activities to provide higher density and more efficient solutions for the growing market of electric vehicles. With partnership would provide EV drivetrain applications such as on-board chargers, DC-DC converters, and traction inverters, along with a wide range of components such as low-voltage and high-voltage microcontrollers and discrete as well as modulus.

-

In January 2023, ZF Friedrichshafen AG announced the introduction of Smart Camera 6, a next-generation camera for automated driving and safety systems. The main focus of Smart Camera 6 is to fulfill the demand for 3D surround view and Interior Monitoring Systems with the support of Image Processing Module systems.

-

In January 2023, Xilinx, Inc. collaborated with an embedded AI autonomous driving provider, Motovis to provide a solution that combines Motovis’ convolutional neural network (CNN) IP and Zynq system-on-chip (SoC), Xilinx Automotive (XA) platform for forward camera systems' vehicle control and perception in the automotive industry. The aim of the solution is to enhance customers with robust platforms and rapid development.

-

In October 2022, Hitachi Automotive Systems, Ltd. developed a 360-degree stereo vision system with a multi-camera 3D sensing prototype for automated vehicles traveling on road. The prototype is integrated into a single in-vehicle camera system with high accuracy, cost advantage, and high resolution.

Automotive Electronics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 283.02 Billion

Revenue forecast in 2030

USD 468.17 Billion

Growth Rate

CAGR of 8.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative Units

Revenue in USD Million and CAGR from 2024 to 2030

Segments Covered

Component, application, vehicle type, propulsion, sales channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Continental AG; DENSO Corporation; Hella GmbH & Co. Kgaa; Hitachi Automotive Systems, Ltd.; Infineon Technologies AG; Robert Bosch GmbH; Valeo Inc.; Visteon Corporation; Xilinx, Inc.; ZF Friedrichshafen AG

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analysts working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of the customization

Global Automotive Electronics Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the automotive electronics market report by component, application, vehicle type, propulsion, sales channel, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Electronic Control Unit

-

Sensors

-

Current Carrying Devices

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

ADAS

-

Infotainment

-

Body Electronics

-

Safety Systems

-

Powertrain Electronics

-

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Two Wheeler

-

Passenger Car

-

Light Commercial Vehicle

-

Heavy Commercial Vehicle

-

-

Propulsion Outlook (Revenue, USD Million, 2018 - 2030)

-

ICE

-

Electric

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

OEM

-

Aftermarket

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the automotive electronics market include Continental AG, Denso Corporation, Aptiv PLC, Robert Bosch GmbH, Altera (Intel Corporation), Broadcom Ltd., HELLA GmbH & Co. KGaA.

b. Key factors that are driving the automotive electronics market growth include rising safety and security concerns, increasing adoption of connected car systems, and growing demand for luxury, hybrid, and electric vehicles.

b. The global automotive electronics market size was estimated at USD 244.95 billion in 2022 and is expected to reach USD 262.60 billion in 2023.

b. The global automotive electronics market is expected to grow at a compound annual growth rate of 8.6% from 2023 to 2030 to reach USD 468.17 billion by 2030.

b. Asia Pacific dominated the automotive electronics market with a share of over 40% in 2022. This is attributable to the rising demand for luxury and hybrid vehicles in the region.

b. The current carrying devices segment accounted for the largest revenue share of around 40% in 2022, in the automotive electronics market.

Table of Contents

Chapter 1 Methodology & Scope

1.1 Market Segmentation & Scope

1.2 Market Definition

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 GVR's Internal Database

1.3.3 Secondary Sources & Third Party Perspectives

1.3.4 Primary Research

1.4 Information Analysis

1.5 Market Formulation & Data Visualization

1.6 Data Validating & Publishing

Chapter 2 Executive Summary

2.1 Market Outlook

2.1 Market Segment Outlook

2.1 Competitive Landscape Outlook

Chapter 3 Market Variables, Trends, & Scope

3.1 Market Lineage Outlook

3.2 Automotive Electronics- Value Chain Analysis

3.3 Automotive Electronics Market Dynamics

3.3.1 Market Drivers Analysis

3.3.2 Market Restraint/Challenge Analysis

3.3.3 Market Opportunity Analysis

3.4 Business Environment Analysis Tool

3.4.1 Automotive Electronics Industry Analysis - PESTLE

3.4.2 Automotive Electronics Industry Analysis - Porter's

Chapter 4 Automotive Electronics Market: Component Estimates & Trend Analysis

4.1 Component Movement Analysis & Market Share, 2023 & 2030

4.2 Market Size & Forecasts and Trends Analysis, 2018 to 2030 for the following:

4.3. Electronic Control Unit

4.3.1 Electronic Control Unit Market Size & Forecasts and Trends Analysis, 2018 to 2030

4.4 Sensors

4.4.1 Sensors Market Size & Forecasts and Trends Analysis, 2018 to 2030

4.5 Current Carrying Devices

4.5.1 Current Carrying Devices Market Size & Forecasts and Trends Analysis, 2018 to 2030

4.6 Others

4.6.1 Other Automotive Electronic Component Market Size & Forecasts and Trends Analysis, 2018 to 2030

Chapter 5 Automotive Electronics Market: Application Estimates & Trend Analysis

5.1 Application Movement Analysis & Market Share, 2023 & 2030

5.2 Market Size & Forecasts and Trends Analysis, 2018 to 2030 for the following:

5.3 ADAS

5.3.1 ADAS Market Size & Forecasts and Trends Analysis, 2018 to 2030

5.4 Infotainment

5.4.1 Infotainment Market Size & Forecasts and Trends Analysis, 2018 to 2030

5.5 Body Electronics

5.5.1 Body Electronics Market Size & Forecasts and Trends Analysis, 2018 to 2030

5.6 Safety Systems

5.6.1 Safety Systems Market Size & Forecasts and Trends Analysis, 2018 to 2030

5.7 Powertrain Electronics

5.7.1 Powertrain Electronics Market Size & Forecasts and Trends Analysis, 2018 to 2030

Chapter 6 Automotive Electronics Market: Vehicle Type Estimates & Trend Analysis

6.1 Vehicle Type Movement Analysis & Market Share, 2023 & 2030

6.2 Market Size & Forecasts and Trends Analysis, 2018 to 2030 for the following:

6.3. Two Wheeler

6.3.1 Two Wheeler Electronics Market Size & Forecasts and Trends Analysis, 2018 to 2030

6.4 Passenger Car

6.4.1 Passenger Car Electronics Market Size & Forecasts and Trends Analysis, 2018 to 2030

6.5 Light Commercial Vehicle

6.5.1 Light Commercial Vehicle Electronics Market Size & Forecasts and Trends Analysis, 2018 to 2030

6.6 Heavy Commercial Vehicle

6.6.1 Heavy Commercial Vehicle Electronics Market Size & Forecasts and Trends Analysis, 2018 to 2030

Chapter 7 Automotive Electronics Market: Propulsion Estimates & Trend Analysis

7.1 Propulsion Movement Analysis & Market Share, 2023 & 2030

7.2 Market Size & Forecasts and Trends Analysis, 2018 to 2030 for the following:

7.3. ICE

7.3.1 ICE Market Size & Forecasts and Trends Analysis, 2018 to 2030

7.4 Electric

7.4.1 Electric Market Size & Forecasts and Trends Analysis, 2018 to 2030

Chapter 8 Automotive Electronics Market: Sales Channel Estimates & Trend Analysis

8.1 Sales Channel Movement Analysis & Market Share, 2023 & 2030

8.2 Market Size & Forecasts and Trends Analysis, 2018 to 2030 for the following:

8.3. OEM

8.3.1 OEM Market Size & Forecasts and Trends Analysis, 2018 to 2030

8.4 Aftermarket

8.4.1 Aftermarket Market Size & Forecasts and Trends Analysis, 2018 to 2030

Chapter 9 Automotive Electronics Market: Regional Estimates & Trend Analysis

9.1 Regional Movement Analysis & Market Share, 2023 & 2030

9.2 Market Size & Forecasts and Trends Analysis, 2018 to 2030 for the following:

9.2.1 North America

9.2.1.1 North America Automotive Electronics Market by Component, 2018 to 2030

9.2.1.2 North America Automotive Electronics Market by Application, 2018 to 2030

9.2.1.3 North America Automotive Electronics Market by Vehicle Type, 2018 to 2030

9.2.1.4 North America Automotive Electronics Market by Propulsion, 2018 to 2030

9.2.1.5 North America Automotive Electronics Market by Sales Channel, 2018 to 2030

9.2.1.6 U.S.

9.2.1.6.1 U.S. Automotive Electronics Market by Component, 2018 to 2030

9.2.1.6.2 U.S. Automotive Electronics Market by Application, 2018 to 2030

9.2.1.6.3 U.S. Automotive Electronics Market by Vehicle Type, 2018 to 2030

9.2.1.6.4 U.S. Automotive Electronics Market by Propulsion, 2018 to 2030

9.2.1.6.5 U.S. Automotive Electronics Market by Sales Channel, 2018 to 2030

9.2.1.7 Canada

9.2.1.7.1 Canada Automotive Electronics Market by Component, 2018 to 2030

9.2.1.7.2 Canada Automotive Electronics Market by Application, 2018 to 2030

9.2.1.7.3 Canada Automotive Electronics Market by Vehicle Type, 2018 to 2030

9.2.1.7.4 Canada Automotive Electronics Market by Propulsion, 2018 to 2030

9.2.1.7.5 Canada Automotive Electronics Market by Sales Channel, 2018 to 2030

9.2.2 Europe

9.2.2.1 Europe Automotive Electronics Market by Component, 2018 to 2030

9.2.2.2 Europe Automotive Electronics Market by Application, 2018 to 2030

9.2.2.3 Europe Automotive Electronics Market by Vehicle Type, 2018 to 2030

9.2.2.4 Europe Automotive Electronics Market by Propulsion, 2018 to 2030

9.2.2.5 Europe Automotive Electronics Market by Sales Channel, 2018 to 2030

9.2.2.5 Germany

9.2.2.5.1 Germany Automotive Electronics Market by Component, 2018 to 2030

9.2.2.5.2 Germany Automotive Electronics Market by Application, 2018 to 2030

9.2.2.5.3 Germany Automotive Electronics Market by Vehicle Type, 2018 to 2030

9.2.2.5.4 Germany Automotive Electronics Market by Propulsion, 2018 to 2030

9.2.2.5.5 Germany Automotive Electronics Market by Sales Channel, 2018 to 2030

9.2.2.6 U.K.

9.2.2.6.1 U.K. Automotive Electronics Market by Component, 2018 to 2030

9.2.2.6.2 U.K. Automotive Electronics Market by Application, 2018 to 2030

9.2.2.6.3 U.K. Automotive Electronics Market by Vehicle Type, 2018 to 2030

9.2.2.6.4 U.K. Automotive Electronics Market by Propulsion, 2018 to 2030

9.2.2.6.5 U.K. Automotive Electronics Market by Sales Channel, 2018 to 2030

9.2.2.7 Italy

9.2.2.7.1 Italy Automotive Electronics Market by Component, 2018 to 2030

9.2.2.7.2 Italy Automotive Electronics Market by Application, 2018 to 2030

9.2.2.7.3 Italy Automotive Electronics Market by Vehicle Type, 2018 to 2030

9.2.2.7.4 Italy Automotive Electronics Market by Propulsion, 2018 to 2030

9.2.2.7.5 Italy Automotive Electronics Market by Sales Channel, 2018 to 2030

9.2.2.8 France

9.2.2.8.1 France Automotive Electronics Market by Component, 2018 to 2030

9.2.2.8.2 France Automotive Electronics Market by Application, 2018 to 2030

9.2.2.8.3 France Automotive Electronics Market by Vehicle Type, 2018 to 2030

9.2.2.8.4 France Automotive Electronics Market by Propulsion, 2018 to 2030

9.2.2.8.5 France Automotive Electronics Market by Sales Channel, 2018 to 2030

9.2.2.9 Spain

9.2.2.9.1 Spain Automotive Electronics Market by Component, 2018 to 2030

9.2.2.9.2 Spain Automotive Electronics Market by Application, 2018 to 2030

9.2.2.9.3 Spain Automotive Electronics Market by Vehicle Type, 2018 to 2030

9.2.2.9.4 Spain Automotive Electronics Market by Propulsion, 2018 to 2030

9.2.2.9.5 Spain Automotive Electronics Market by Sales Channel, 2018 to 2030

9.2.2.10 Denmark

9.2.2.10.1 Denmark Automotive Electronics Market by Component, 2018 to 2030

9.2.2.10.2 Denmark Automotive Electronics Market by Application, 2018 to 2030

9.2.2.10.3 Denmark Automotive Electronics Market by Vehicle Type, 2018 to 2030

9.2.2.10.4 Denmark Automotive Electronics Market by Propulsion, 2018 to 2030

9.2.2.10.5 Denmark Automotive Electronics Market by Sales Channel, 2018 to 2030

9.2.2.11 Sweden

9.2.2.11.1 Sweden Automotive Electronics Market by Component, 2018 to 2030

9.2.2.11.2 Sweden Automotive Electronics Market by Application, 2018 to 2030

9.2.2.11.3 Sweden Automotive Electronics Market by Vehicle Type, 2018 to 2030

9.2.2.11.4 Sweden Automotive Electronics Market by Propulsion, 2018 to 2030

9.2.2.11.5 Sweden Automotive Electronics Market by Sales Channel, 2018 to 2030

9.2.2.12 Norway

9.2.2.12.1 Norway Automotive Electronics Market by Component, 2018 to 2030

9.2.2.12.2 Norway Automotive Electronics Market by Application, 2018 to 2030

9.2.2.12.3 Norway Automotive Electronics Market by Vehicle Type, 2018 to 2030

9.2.2.12.4 Norway Automotive Electronics Market by Propulsion, 2018 to 2030

9.2.2.12.5 Norway Automotive Electronics Market by Sales Channel, 2018 to 2030

9.2.3 Asia Pacific

9.2.3.1 Asia Pacific Automotive Electronics Market by Component, 2018 to 2030

9.2.3.2 Asia Pacific Automotive Electronics Market by Application, 2018 to 2030

9.2.3.3 Asia Pacific Automotive Electronics Market by Vehicle Type, 2018 to 2030

9.2.3.4 Asia Pacific Automotive Electronics Market by Propulsion, 2018 to 2030

9.2.3.5 Asia Pacific Automotive Electronics Market by Sales Channel, 2018 to 2030

9.2.3.6 China

9.2.3.6.1 China Automotive Electronics Market by Component, 2018 to 2030

9.2.3.6.2 China Automotive Electronics Market by Application, 2018 to 2030

9.2.3.6.3 China Automotive Electronics Market by Vehicle Type, 2018 to 2030

9.2.3.6.4 China Automotive Electronics Market by Propulsion, 2018 to 2030

9.2.3.6.5 China Automotive Electronics Market by Sales Channel, 2018 to 2030

9.2.3.7 Japan

9.2.3.7.1 Japan Automotive Electronics Market by Component, 2018 to 2030

9.2.3.7.2 Japan Automotive Electronics Market by Application, 2018 to 2030

9.2.3.7.3 Japan Automotive Electronics Market by Vehicle Type, 2018 to 2030

9.2.3.7.4 Japan Automotive Electronics Market by Propulsion, 2018 to 2030

9.2.3.7.5 Japan Automotive Electronics Market by Sales Channel, 2018 to 2030

9.2.3.8 India

9.2.3.8.1 India Automotive Electronics Market by Component, 2018 to 2030

9.2.3.8.2 India Automotive Electronics Market by Application, 2018 to 2030

9.2.3.8.3 India Automotive Electronics Market by Vehicle Type, 2018 to 2030

9.2.3.8.4 India Automotive Electronics Market by Propulsion, 2018 to 2030

9.2.3.8.5 India Automotive Electronics Market by Sales Channel, 2018 to 2030

9.2.3.9 Australia

9.2.3.9.1 Australia Automotive Electronics Market by Component, 2018 to 2030

9.2.3.9.2 Australia Automotive Electronics Market by Application, 2018 to 2030

9.2.3.9.3 Australia Automotive Electronics Market by Vehicle Type, 2018 to 2030

9.2.3.9.4 Australia Automotive Electronics Market by Propulsion, 2018 to 2030

9.2.3.9.5 Australia Automotive Electronics Market by Sales Channel, 2018 to 2030

9.2.3.10 South Korea

9.2.3.10.1 South Korea Automotive Electronics Market by Component, 2018 to 2030

9.2.3.10.2 South Korea Automotive Electronics Market by Application, 2018 to 2030

9.2.3.10.3 South Korea Automotive Electronics Market by Vehicle Type, 2018 to 2030

9.2.3.10.4 South Korea Automotive Electronics Market by Propulsion, 2018 to 2030

9.2.3.10.5 South Korea Automotive Electronics Market by Sales Channel, 2018 to 2030

9.2.3.11 Thailand

9.2.3.11.1 Thailand Automotive Electronics Market by Component, 2018 to 2030

9.2.3.11.2 Thailand Automotive Electronics Market by Application, 2018 to 2030

9.2.3.11.3 Thailand Automotive Electronics Market by Vehicle Type, 2018 to 2030

9.2.3.11.4 Thailand Automotive Electronics Market by Propulsion, 2018 to 2030

9.2.3.11.5 Thailand Automotive Electronics Market by Sales Channel, 2018 to 2030

9.2.4 Latin America

9.2.4.1 Latin America Automotive Electronics Market by Component, 2018 to 2030

9.2.4.2 Latin America Automotive Electronics Market by Application, 2018 to 2030

9.2.4.3 Latin America Automotive Electronics Market by Vehicle Type, 2018 to 2030

9.2.4.4 Latin America Automotive Electronics Market by Propulsion, 2018 to 2030

9.2.4.5 Latin America Automotive Electronics Market by Sales Channel, 2018 to 2030

9.2.4.6 Brazil

9.2.4.6.1 Brazil Automotive Electronics Market by Component, 2018 to 2030

9.2.4.6.2 Brazil Automotive Electronics Market by Application, 2018 to 2030

9.2.4.6.3 Brazil Automotive Electronics Market by Vehicle Type, 2018 to 2030

9.2.4.6.4 Brazil Automotive Electronics Market by Propulsion, 2018 to 2030

9.2.4.6.5 Brazil Automotive Electronics Market by Sales Channel, 2018 to 2030

9.2.4.6 Mexico

9.2.4.6.1 Mexico Automotive Electronics Market by Component, 2018 to 2030

9.2.4.6.2 Mexico Automotive Electronics Market by Application, 2018 to 2030

9.2.4.6.3 Mexico Automotive Electronics Market by Vehicle Type, 2018 to 2030

9.2.4.6.4 Mexico Automotive Electronics Market by Propulsion, 2018 to 2030

9.2.4.6.5 Mexico Automotive Electronics Market by Sales Channel, 2018 to 2030

9.2.4.7 Argentina

9.2.4.7.1 Argentina Automotive Electronics Market by Component, 2018 to 2030

9.2.4.7.2 Argentina Automotive Electronics Market by Application, 2018 to 2030

9.2.4.7.3 Argentina Automotive Electronics Market by Vehicle Type, 2018 to 2030

9.2.4.7.4 Argentina Automotive Electronics Market by Propulsion, 2018 to 2030

9.2.4.7.5 Argentina Automotive Electronics Market by Sales Channel, 2018 to 2030

9.2.5 Middle East and Africa (MEA)

9.2.5.1 MEA Automotive Electronics Market by Component, 2018 to 2030

9.2.5.2 MEA Automotive Electronics Market by Application, 2018 to 2030

9.2.5.3 MEA Automotive Electronics Market by Vehicle Type, 2018 to 2030

9.2.5.4 MEA Automotive Electronics Market by Propulsion, 2018 to 2030

9.2.5.5 MEA Automotive Electronics Market by Sales Channel, 2018 to 2030

9.2.5.5 UAE

9.2.5.5.1 UAE Automotive Electronics Market by Component, 2018 to 2030

9.2.5.5.2 UAE Automotive Electronics Market by Application, 2018 to 2030

9.2.5.5.3 UAE Automotive Electronics Market by Vehicle Type, 2018 to 2030

9.2.5.5.4 UAE Automotive Electronics Market by Propulsion, 2018 to 2030

9.2.5.5.5 UAE Automotive Electronics Market by Sales Channel, 2018 to 2030

9.2.5.6 Saudi Arabia

9.2.5.6.1 Saudi Arabia Automotive Electronics Market by Component, 2018 to 2030

9.2.5.6.2 Saudi Arabia Automotive Electronics Market by Application, 2018 to 2030

9.2.5.6.3 Saudi Arabia Automotive Electronics Market by Vehicle Type, 2018 to 2030

9.2.5.6.4 Saudi Arabia Automotive Electronics Market by Propulsion, 2018 to 2030

9.2.5.6.5 Saudi Arabia Automotive Electronics Market by Sales Channel, 2018 to 2030

9.2.5.7 South Africa

9.2.5.7.1 South Africa Automotive Electronics Market by Component, 2018 to 2030

9.2.5.7.2 South Africa Automotive Electronics Market by Application, 2018 to 2030

9.2.5.7.3 South Africa Automotive Electronics Market by Vehicle Type, 2018 to 2030

9.2.5.7.4 South Africa Automotive Electronics Market by Propulsion, 2018 to 2030

9.2.5.7.5 South Africa Automotive Electronics Market by Sales Channel, 2018 to 2030

Chapter 10 Competitive Landscape

10.1 Company Categorization

10.2 Company Heat Map Analysis, 2023

10.3 Company Share Analysis, 2023

10.4 Strategy Mapping

10.5 Company Profiles

10.5.1 CONTINENTAL AG

10.5.1.1 Company Overview

10.5.1.2 Financial Performance

10.5.1.3 Product Benchmarking

10.5.1.4 Strategic Initiatives

10.5.2 DENSO CORPORATION

10.5.2.1 Company Overview

10.5.2.2 Financial Performance

10.5.2.3 Product Benchmarking

10.5.2.4 Strategic Initiatives

10.5.3 Hella Gmbh & Co. Kgaa (Hella)

10.5.3.1 Company Overview

10.5.3.2 Financial Performance

10.5.3.3 Product Benchmarking

10.5.3.4 Strategic Initiatives

10.5.4 Infineon Technologies AG

10.5.4.1 Company Overview

10.5.4.2 Financial Performance

10.5.4.3 Product Benchmarking

10.5.4.4 Strategic Initiatives

10.5.5 Robert Bosch GmbH

10.5.5.1 Company Overview

10.5.5.2 Financial Performance

10.5.5.3 Product Benchmarking

10.5.5.4 Strategic Initiatives

10.5.6 Valeo Inc.

10.5.6.1 Company Overview

10.5.6.2 Financial Performance

10.5.6.3 Product Benchmarking

10.5.6.4 Strategic Initiatives

10.5.7 ZF Friedrichshafen AG

10.5.7.1 Company Overview

10.5.7.2 Financial Performance

10.5.7.3 Product Benchmarking

10.5.7.4 Strategic Initiatives

10.5.8 Hitachi Automotive Systems, Ltd.

10.5.8.1 Company Overview

10.5.8.2 Financial Performance

10.5.8.3 Product Benchmarking

10.5.8.4 Strategic Initiatives

10.5.9 Visteon Corporation

10.5.9.1 Company Overview

10.5.9.2 Financial Performance

10.5.9.3 Product Benchmarking

10.5.9.4 Strategic Initiatives

10.5.10 Xilinx, Inc.

10.5.10.1 Company Overview

10.5.10.2 Financial Performance

10.5.10.3 Product Benchmarking

10.5.10.4 Strategic Initiatives

List of Tables

Table 1 List of abbreviation

Table 2 Electronic control unit market, 2018 - 2030 (USD Million)

Table 3 Sensors market, 2018 - 2030 (USD Million)

Table 4 Current carrying devices market, 2018 - 2030 (USD Million)

Table 5 Others market, 2018 - 2030 (USD Million)

Table 6 ADAS automotive electronics market, 2018 - 2030 (USD Million)

Table 7 Infotainment automotive electronics market, 2018 - 2030 (USD Million)

Table 8 Body electronics market, 2018 - 2030 (USD Million)

Table 9 Safety systems automotive electronics market, 2018 - 2030 (USD Million)

Table 10 Two wheeler electronics market, 2018 - 2030 (USD Million)

Table 11 Passenger car electronics market, 2018 - 2030 (USD Million)

Table 12 Light Commercial Vehicle electronics market, 2018 - 2030 (USD Million)

Table 13 Heavy commercial vehicle electronics market, 2018 - 2030 (USD Million)

Table 14 ICE electronics market, 2018 - 2030 (USD Million)

Table 15 Electric vehicle electronics market, 2018 - 2030 (USD Million)

Table 16 OEM market, 2018 - 2030 (USD Million)

Table 17 Aftermarket, 2018 - 2030 (USD Million)

Table 18 North American automotive electronics market, by country, 2018 - 2030 (USD Million)

Table 19 North American automotive electronics market, by component, 2018 - 2030 (USD Million)

Table 20 North American automotive electronics market, by application, 2018 - 2030 (USD Million)

Table 21 North American automotive electronics, by vehicle type, 2018 - 2030 (USD Million)

Table 22 North American automotive electronics, by propulsion, 2018 - 2030 (USD Million)

Table 23 North American automotive electronics, by sales channel, 2018 - 2030 (USD Million)

Table 24 U.S. automotive electronics market, by component, 2018 - 2030 (USD Million)

Table 25 U.S. automotive electronics market, by application, 2018 - 2030 (USD Million)

Table 26 U.S. automotive electronics, by vehicle type, 2018 - 2030 (USD Million)

Table 27 U.S. automotive electronics, by propulsion, 2018 - 2030 (USD Million)

Table 28 U.S. automotive electronics, by sales channel, 2018 - 2030 (USD Million)

Table 29 Canada automotive electronics market, by component, 2018 - 2030 (USD Million)

Table 30 Canada automotive electronics market, by application, 2018 - 2030 (USD Million)

Table 31 Canada automotive electronics, by vehicle type, 2018 - 2030 (USD Million)

Table 32 Canada automotive electronics, by propulsion, 2018 - 2030 (USD Million)

Table 33 Canada automotive electronics, by sales channel, 2018 - 2030 (USD Million)

Table 34 Europe automotive electronics market, by country, 2018 - 2030 (USD Million)

Table 35 Europe automotive electronics market, by component, 2018 - 2030 (USD Million)

Table 36 Europe automotive electronics market, by application, 2018 - 2030 (USD Million)

Table 37 Europe automotive electronics, by vehicle type, 2018 - 2030 (USD Million)

Table 38 Europe automotive electronics, by propulsion, 2018 - 2030 (USD Million)

Table 39 Europe automotive electronics, by sales channel, 2018 - 2030 (USD Million)

Table 40 Germany automotive electronics market, by component, 2018 - 2030 (USD Million)

Table 41 Germany automotive electronics market, by application, 2018 - 2030 (USD Million)

Table 42 Germany automotive electronics, by vehicle type, 2018 - 2030 (USD Million)

Table 43 Germany automotive electronics, by propulsion, 2018 - 2030 (USD Million)

Table 44 Germany automotive electronics, by sales channel, 2018 - 2030 (USD Million)

Table 45 U.K. automotive electronics market, by component, 2018 - 2030 (USD Million)

Table 46 U.K. automotive electronics market, by application, 2018 - 2030 (USD Million)

Table 47 U.K. automotive electronics, by vehicle type, 2018 - 2030 (USD Million)

Table 48 U.K. automotive electronics, by propulsion, 2018 - 2030 (USD Million)

Table 49 U.K. automotive electronics, by sales channel, 2018 - 2030 (USD Million)

Table 50 France automotive electronics market, by component, 2018 - 2030 (USD Million)

Table 51 France automotive electronics market, by application, 2018 - 2030 (USD Million)

Table 52 France automotive electronics, by vehicle type, 2018 - 2030 (USD Million)

Table 53 France automotive electronics, by propulsion, 2018 - 2030 (USD Million)

Table 54 France automotive electronics, by sales channel, 2018 - 2030 (USD Million)

Table 55 Italy automotive electronics market, by component, 2018 - 2030 (USD Million)

Table 56 Italy automotive electronics market, by application, 2018 - 2030 (USD Million)

Table 57 Italy automotive electronics, by vehicle type, 2018 - 2030 (USD Million)

Table 58 Italy automotive electronics, by propulsion, 2018 - 2030 (USD Million)

Table 59 Italy automotive electronics, by sales channel, 2018 - 2030 (USD Million)

Table 60 Spain automotive electronics market, by component, 2018 - 2030 (USD Million)

Table 61 Spain automotive electronics market, by application, 2018 - 2030 (USD Million)

Table 62 Spain automotive electronics, by vehicle type, 2018 - 2030 (USD Million)

Table 63 Spain automotive electronics, by propulsion, 2018 - 2030 (USD Million)

Table 64 Spain automotive electronics, by sales channel, 2018 - 2030 (USD Million)

Table 65 Denmark automotive electronics market, by component, 2018 - 2030 (USD Million)

Table 66 Denmark automotive electronics market, by application, 2018 - 2030 (USD Million)

Table 67 Denmark automotive electronics, by vehicle type, 2018 - 2030 (USD Million)

Table 68 Denmark automotive electronics, by propulsion, 2018 - 2030 (USD Million)

Table 69 Denmark automotive electronics, by sales channel, 2018 - 2030 (USD Million)

Table 70 Sweden automotive electronics market, by component, 2018 - 2030 (USD Million)

Table 71 Sweden automotive electronics market, by application, 2018 - 2030 (USD Million)

Table 72 Sweden automotive electronics, by vehicle type, 2018 - 2030 (USD Million)

Table 73 Sweden automotive electronics, by propulsion, 2018 - 2030 (USD Million)

Table 74 Sweden automotive electronics, by sales channel, 2018 - 2030 (USD Million)

Table 75 Norway automotive electronics market, by component, 2018 - 2030 (USD Million)

Table 76 Norway automotive electronics market, by application, 2018 - 2030 (USD Million)

Table 77 Norway automotive electronics, by vehicle type, 2018 - 2030 (USD Million)

Table 78 Norway automotive electronics, by propulsion, 2018 - 2030 (USD Million)

Table 79 Norway automotive electronics, by sales channel, 2018 - 2030 (USD Million)

Table 80 Asia Pacific automotive electronics market, by country, 2018 - 2030 (USD Million)

Table 81 Asia Pacific automotive electronics market, by component, 2018 - 2030 (USD Million)

Table 82 Asia Pacific automotive electronics market, by application, 2018 - 2030 (USD Million)

Table 83 Asia Pacific automotive electronics, by vehicle type, 2018 - 2030 (USD Million)

Table 84 Asia Pacific automotive electronics, by propulsion, 2018 - 2030 (USD Million)

Table 85 Asia Pacific automotive electronics, by sales channel, 2018 - 2030 (USD Million)

Table 86 China automotive electronics market, by component, 2018 - 2030 (USD Million)

Table 87 China automotive electronics market, by application, 2018 - 2030 (USD Million)

Table 88 China automotive electronics, by vehicle type, 2018 - 2030 (USD Million)

Table 89 China automotive electronics, by propulsion, 2018 - 2030 (USD Million)

Table 90 China automotive electronics, by sales channel, 2018 - 2030 (USD Million)

Table 91 Japan automotive electronics market, by component, 2018 - 2030 (USD Million)

Table 92 Japan automotive electronics market, by application, 2018 - 2030 (USD Million)

Table 93 Japan automotive electronics, by vehicle type, 2018 - 2030 (USD Million)

Table 94 Japan automotive electronics, by propulsion, 2018 - 2030 (USD Million)

Table 95 Japan automotive electronics, by sales channel, 2018 - 2030 (USD Million)

Table 96India automotive electronics market, by component, 2018 - 2030 (USD Million)

Table 97 India automotive electronics market, by application, 2018 - 2030 (USD Million)

Table 98 India automotive electronics, by vehicle type, 2018 - 2030 (USD Million)

Table 99 India automotive electronics, by propulsion, 2018 - 2030 (USD Million)

Table 100 India automotive electronics, by sales channel, 2018 - 2030 (USD Million)

Table 101 Australia automotive electronics market, by component, 2018 - 2030 (USD Million)

Table 102 Australia automotive electronics market, by application, 2018 - 2030 (USD Million)

Table 103 Australia automotive electronics, by vehicle type, 2018 - 2030 (USD Million)

Table 104 Australia automotive electronics, by propulsion, 2018 - 2030 (USD Million)

Table 105 Australia automotive electronics, by sales channel, 2018 - 2030 (USD Million)

Table 106 South Korea automotive electronics market, by component, 2018 - 2030 (USD Million)

Table 107 South Korea automotive electronics market, by application, 2018 - 2030 (USD Million)

Table 108 South Korea automotive electronics, by vehicle type, 2018 - 2030 (USD Million)

Table 109 South Korea automotive electronics, by propulsion, 2018 - 2030 (USD Million)

Table 110 South Korea automotive electronics, by sales channel, 2018 - 2030 (USD Million)

Table 111 Thailand automotive electronics market, by component, 2018 - 2030 (USD Million)

Table 112 Thailand automotive electronics market, by application, 2018 - 2030 (USD Million)

Table 113 Thailand automotive electronics, by vehicle type, 2018 - 2030 (USD Million)

Table 114 Thailand automotive electronics, by propulsion, 2018 - 2030 (USD Million)

Table 115 Thailand automotive electronics, by sales channel, 2018 - 2030 (USD Million)

Table 116 Latin American automotive electronics market, by country, 2018 - 2030 (USD Million)

Table 117 Latin American automotive electronics market, by component, 2018 - 2030 (USD Million)

Table 118 Latin American automotive electronics market, by application, 2018 - 2030 (USD Million)

Table 119 Latin American automotive electronics, by vehicle type, 2018 - 2030 (USD Million)

Table 120 Latin American automotive electronics, by propulsion, 2018 - 2030 (USD Million)

Table 121 Latin American automotive electronics, by sales channel, 2018 - 2030 (USD Million)

Table 122 Brazil automotive electronics market, by component, 2018 - 2030 (USD Million)

Table 123 Brazil automotive electronics market, by application, 2018 - 2030 (USD Million)

Table 124 Brazil automotive electronics, by vehicle type, 2018 - 2030 (USD Million)

Table 125 Brazil automotive electronics, by propulsion, 2018 - 2030 (USD Million)

Table 126 Brazil automotive electronics, by sales channel, 2018 - 2030 (USD Million)

Table 127 Mexico automotive electronics market, by component, 2018 - 2030 (USD Million)

Table 128 Mexico automotive electronics market, by application, 2018 - 2030 (USD Million)

Table 129 Mexico automotive electronics, by vehicle type, 2018 - 2030 (USD Million)

Table 130 Mexico automotive electronics, by propulsion, 2018 - 2030 (USD Million)

Table 131 Mexico automotive electronics, by sales channel, 2018 - 2030 (USD Million)

Table 132 Argentina automotive electronics market, by component, 2018 - 2030 (USD Million)

Table 133 Argentina automotive electronics market, by application, 2018 - 2030 (USD Million)

Table 134 Argentina automotive electronics, by vehicle type, 2018 - 2030 (USD Million)

Table 135 Argentina automotive electronics, by propulsion, 2018 - 2030 (USD Million)

Table 136 Argentina automotive electronics, by sales channel, 2018 - 2030 (USD Million)

Table 137 MEA automotive electronics market, by component, 2018 - 2030 (USD Million)

Table 138 MEA automotive electronics market, by application, 2018 - 2030 (USD Million)

Table 139 MEA automotive electronics, by vehicle type, 2018 - 2030 (USD Million)

Table 140 MEA automotive electronics, by propulsion, 2018 - 2030 (USD Million)

Table 141 MEA automotive electronics, by sales channel, 2018 - 2030 (USD Million)

Table 142 UAE automotive electronics market, by component, 2018 - 2030 (USD Million)

Table 143 UAE automotive electronics market, by application, 2018 - 2030 (USD Million)

Table 144 UAE automotive electronics, by vehicle type, 2018 - 2030 (USD Million)

Table 145 UAE automotive electronics, by propulsion, 2018 - 2030 (USD Million)

Table 146 UAE automotive electronics, by sales channel, 2018 - 2030 (USD Million)

Table 147 Saudi Arabia automotive electronics market, by component, 2018 - 2030 (USD Million)

Table 148 Saudi Arabia automotive electronics market, by application, 2018 - 2030 (USD Million)

Table 149 Saudi Arabia automotive electronics, by vehicle type, 2018 - 2030 (USD Million)

Table 150 Saudi Arabia automotive electronics, by propulsion, 2018 - 2030 (USD Million)

Table 151 Saudi Arabia automotive electronics, by sales channel, 2018 - 2030 (USD Million)

Table 152 South Africa automotive electronics market, by component, 2018 - 2030 (USD Million)

Table 153 South Africa automotive electronics market, by application, 2018 - 2030 (USD Million)

Table 154 South Africa automotive electronics, by vehicle type, 2018 - 2030 (USD Million)

Table 155 South Africa automotive electronics, by propulsion, 2018 - 2030 (USD Million)

Table 156 South Africa automotive electronics, by sales channel, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Market research process

Fig. 2 Information procurement

Fig. 3 Automotive electronics market segmentation

Fig. 4 Automotive electronics market snapshot

Fig. 5 Automotive electronics market, 2018 - 2030 (USD Million)

Fig. 6 Automotive electronics market, by component, 2018 - 2030 (USD Million)

Fig. 7 Automotive electronics market, by application, 2018 - 2030 (USD Million)

Fig. 8 Automotive electronics market, by vehicle type, 2018 - 2030 (USD Million)

Fig. 9 Automotive electronics market, by propulsion, 2018 - 2030 (USD Million)

Fig. 10 Automotive electronics market, by sales channel, 2018 - 2030 (USD Million)

Fig. 11 Automotive electronics market, by region, 2018 - 2030 (USD Million)

Fig. 12 Automotive electronics market: Value chain analysis

Fig. 13 Automotive electronics market penetration and growth prospect mapping

Fig. 14 Automotive electronics market: Key company analysis, 2020

Fig. 15 Automotive electronics market: PEST analysis

Fig. 16 Automotive electronics market: PORTER’s analysis

Fig. 17 Automotive electronics market: Component analysis

Fig. 18 Automotive electronics market: Application analysis

Fig. 19 Automotive electronics market: Sales Channel analysis

Fig. 20 Automotive electronics market: Regional analysis

Fig. 21 North America automotive electronics market- key takeaways

Fig. 22 Europe automotive electronics market - key takeaways

Fig. 23 Asia Pacific automotive electronics market- key takeaways

Fig. 24 Latin America automotive electronics market- key takeaways

Fig. 25 MEA automotive electronics market - key takeawaysWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Automotive Electronics Component Outlook (Revenue, USD Million, 2018 - 2030)

- Electronic Control Unit

- Sensors

- Current Carrying Devices

- Others

- Automotive Electronics Application Outlook (Revenue, USD Million, 2018 - 2030)

- ADAS

- Infotainment

- Body Electronics

- Safety Systems

- Powertrain Electronics

- Automotive Electronics Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

- Two Wheeler

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Automotive Electronics Propulsion Outlook (Revenue, USD Million, 2018 - 2030)

- ICE

- Electric

- Automotive Electronics Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

- OEM

- Aftermarket

- Automotive Electronics Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America Automotive Electronics Market, by Component (Revenue, USD Million, 2018 - 2030)

- Electronic Control Unit

- Sensors

- Current Carrying Devices

- Others

- North America Automotive Electronics Market, by Application (Revenue, USD Million, 2018 - 2030)

- ADAS

- Infotainment

- Body Electronics

- Safety Systems

- Powertrain Electronics

- North America Automotive Electronics Market, by Vehicle Type (Revenue, USD Million, 2018 - 2030)

- Two Wheeler

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- North America Automotive Electronics Market, by Propulsion (Revenue, USD Million, 2018 - 2030)

- ICE

- Electric

- North America Automotive Electronics Market, by Sales Channel (Revenue, USD Million, 2018 - 2030)

- OEM

- Aftermarket

- U.S.

- U.S. Automotive Electronics Market, by Component (Revenue, USD Million, 2018 - 2030)

- Electronic Control Unit

- Sensors

- Current Carrying Devices

- Others

- U.S. Automotive Electronics Market, by Application (Revenue, USD Million, 2018 - 2030)

- ADAS

- Infotainment

- Body Electronics

- Safety Systems

- Powertrain Electronics

- U.S. Automotive Electronics Market, by Vehicle Type (Revenue, USD Million, 2018 - 2030)

- Two Wheeler

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- U.S. Automotive Electronics Market, by Propulsion (Revenue, USD Million, 2018 - 2030)

- ICE

- Electric

- U.S. Automotive Electronics Market, by Sales Channel (Revenue, USD Million, 2018 - 2030)

- OEM

- Aftermarket

- U.S. Automotive Electronics Market, by Component (Revenue, USD Million, 2018 - 2030)

- Canada

- Canada Automotive Electronics Market, by Component (Revenue, USD Million, 2018 - 2030)

- Electronic Control Unit

- Sensors

- Current Carrying Devices

- Others

- Canada Automotive Electronics Market, by Application (Revenue, USD Million, 2018 - 2030)

- ADAS

- Infotainment

- Body Electronics

- Safety Systems

- Powertrain Electronics

- Canada Automotive Electronics Market, by Vehicle Type (Revenue, USD Million, 2018 - 2030)

- Two Wheeler

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Canada Automotive Electronics Market, by Propulsion (Revenue, USD Million, 2018 - 2030)

- ICE

- Electric

- Canada Automotive Electronics Market, by Sales Channel (Revenue, USD Million, 2018 - 2030)

- OEM

- Aftermarket

- Canada Automotive Electronics Market, by Component (Revenue, USD Million, 2018 - 2030)

- North America Automotive Electronics Market, by Component (Revenue, USD Million, 2018 - 2030)

- Europe

- Europe Automotive Electronics Market, by Component (Revenue, USD Million, 2018 - 2030)

- Electronic Control Unit

- Sensors

- Current Carrying Devices

- Others

- Europe Automotive Electronics Market, by Application (Revenue, USD Million, 2018 - 2030)

- ADAS

- Infotainment

- Body Electronics

- Safety Systems

- Powertrain Electronics

- Europe Automotive Electronics Market, by Vehicle Type (Revenue, USD Million, 2018 - 2030)

- Two Wheeler

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Europe Automotive Electronics Market, by Propulsion (Revenue, USD Million, 2018 - 2030)

- ICE

- Electric

- Europe Automotive Electronics Market, by Sales Channel (Revenue, USD Million, 2018 - 2030)

- OEM

- Aftermarket

- U.K.

- U.K. Automotive Electronics Market, by Component (Revenue, USD Million, 2018 - 2030)

- Electronic Control Unit

- Sensors

- Current Carrying Devices

- Others

- U.K. Automotive Electronics Market, by Application (Revenue, USD Million, 2018 - 2030)

- ADAS

- Infotainment

- Body Electronics

- Safety Systems

- Powertrain Electronics

- U.K. Automotive Electronics Market, by Vehicle Type (Revenue, USD Million, 2018 - 2030)

- Two Wheeler

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- U.K. Automotive Electronics Market, by Propulsion (Revenue, USD Million, 2018 - 2030)

- ICE

- Electric

- U.K. Automotive Electronics Market, by Sales Channel (Revenue, USD Million, 2018 - 2030)

- OEM

- Aftermarket

- U.K. Automotive Electronics Market, by Component (Revenue, USD Million, 2018 - 2030)

- Germany

- Germany Automotive Electronics Market, by Component (Revenue, USD Million, 2018 - 2030)

- Electronic Control Unit

- Sensors

- Current Carrying Devices

- Others

- Germany Automotive Electronics Market, by Application (Revenue, USD Million, 2018 - 2030)

- ADAS

- Infotainment

- Body Electronics

- Safety Systems

- Powertrain Electronics

- Germany Automotive Electronics Market, by Vehicle Type (Revenue, USD Million, 2018 - 2030)

- Two Wheeler

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Germany Automotive Electronics Market, by Propulsion (Revenue, USD Million, 2018 - 2030)

- ICE

- Electric

- Germany Automotive Electronics Market, by Sales Channel (Revenue, USD Million, 2018 - 2030)

- OEM

- Aftermarket

- Germany Automotive Electronics Market, by Component (Revenue, USD Million, 2018 - 2030)

- France

- France Automotive Electronics Market, by Component (Revenue, USD Million, 2018 - 2030)

- Electronic Control Unit

- Sensors

- Current Carrying Devices

- Others

- France Automotive Electronics Market, by Application (Revenue, USD Million, 2018 - 2030)

- ADAS

- Infotainment

- Body Electronics

- Safety Systems

- Powertrain Electronics

- France Automotive Electronics Market, by Vehicle Type (Revenue, USD Million, 2018 - 2030)

- Two Wheeler

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- France Automotive Electronics Market, by Propulsion (Revenue, USD Million, 2018 - 2030)

- ICE

- Electric

- France Automotive Electronics Market, by Sales Channel (Revenue, USD Million, 2018 - 2030)

- OEM

- Aftermarket

- France Automotive Electronics Market, by Component (Revenue, USD Million, 2018 - 2030)

- Italy

- Italy Automotive Electronics Market, by Component (Revenue, USD Million, 2018 - 2030)

- Electronic Control Unit

- Sensors

- Current Carrying Devices

- Others

- Italy Automotive Electronics Market, by Application (Revenue, USD Million, 2018 - 2030)

- ADAS

- Infotainment

- Body Electronics

- Safety Systems

- Powertrain Electronics

- Italy Automotive Electronics Market, by Vehicle Type (Revenue, USD Million, 2018 - 2030)

- Two Wheeler

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Italy Automotive Electronics Market, by Propulsion (Revenue, USD Million, 2018 - 2030)

- ICE

- Electric

- Italy Automotive Electronics Market, by Sales Channel (Revenue, USD Million, 2018 - 2030)

- OEM

- Aftermarket

- Italy Automotive Electronics Market, by Component (Revenue, USD Million, 2018 - 2030)

- Spain

- Spain Automotive Electronics Market, by Component (Revenue, USD Million, 2018 - 2030)

- Electronic Control Unit

- Sensors

- Current Carrying Devices

- Others

- Spain Automotive Electronics Market, by Application (Revenue, USD Million, 2018 - 2030)

- ADAS

- Infotainment

- Body Electronics

- Safety Systems

- Powertrain Electronics

- Spain Automotive Electronics Market, by Vehicle Type (Revenue, USD Million, 2018 - 2030)

- Two Wheeler

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Spain Automotive Electronics Market, by Propulsion (Revenue, USD Million, 2018 - 2030)

- ICE

- Electric

- Spain Automotive Electronics Market, by Sales Channel (Revenue, USD Million, 2018 - 2030)

- OEM

- Aftermarket

- Spain Automotive Electronics Market, by Component (Revenue, USD Million, 2018 - 2030)

- Denmark

- Denmark Automotive Electronics Market, by Component (Revenue, USD Million, 2018 - 2030)

- Electronic Control Unit

- Sensors

- Current Carrying Devices

- Others

- Denmark Automotive Electronics Market, by Application (Revenue, USD Million, 2018 - 2030)

- ADAS

- Infotainment

- Body Electronics

- Safety Systems

- Powertrain Electronics

- Denmark Automotive Electronics Market, by Vehicle Type (Revenue, USD Million, 2018 - 2030)

- Two Wheeler

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Denmark Automotive Electronics Market, by Propulsion (Revenue, USD Million, 2018 - 2030)

- ICE

- Electric

- Denmark Automotive Electronics Market, by Sales Channel (Revenue, USD Million, 2018 - 2030)

- OEM

- Aftermarket

- Denmark Automotive Electronics Market, by Component (Revenue, USD Million, 2018 - 2030)

- Sweden

- Sweden Automotive Electronics Market, by Component (Revenue, USD Million, 2018 - 2030)

- Electronic Control Unit

- Sensors

- Current Carrying Devices

- Others

- Sweden Automotive Electronics Market, by Application (Revenue, USD Million, 2018 - 2030)

- ADAS

- Infotainment

- Body Electronics

- Safety Systems

- Powertrain Electronics

- Sweden Automotive Electronics Market, by Vehicle Type (Revenue, USD Million, 2018 - 2030)

- Two Wheeler

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Sweden Automotive Electronics Market, by Propulsion (Revenue, USD Million, 2018 - 2030)

- ICE

- Electric

- Sweden Automotive Electronics Market, by Sales Channel (Revenue, USD Million, 2018 - 2030)

- OEM

- Aftermarket

- Sweden Automotive Electronics Market, by Component (Revenue, USD Million, 2018 - 2030)

- Norway

- Norway Automotive Electronics Market, by Component (Revenue, USD Million, 2018 - 2030)

- Electronic Control Unit

- Sensors

- Current Carrying Devices

- Others

- Norway Automotive Electronics Market, by Application (Revenue, USD Million, 2018 - 2030)

- ADAS

- Infotainment

- Body Electronics

- Safety Systems

- Powertrain Electronics

- Norway Automotive Electronics Market, by Vehicle Type (Revenue, USD Million, 2018 - 2030)

- Two Wheeler

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Norway Automotive Electronics Market, by Propulsion (Revenue, USD Million, 2018 - 2030)

- ICE

- Electric

- Norway Automotive Electronics Market, by Sales Channel (Revenue, USD Million, 2018 - 2030)

- OEM

- Aftermarket

- Norway Automotive Electronics Market, by Component (Revenue, USD Million, 2018 - 2030)

- Europe Automotive Electronics Market, by Component (Revenue, USD Million, 2018 - 2030)

- Asia Pacific

- Asia Pacific Automotive Electronics Market, by Component (Revenue, USD Million, 2018 - 2030)

- Electronic Control Unit

- Sensors

- Current Carrying Devices

- Others

- Asia Pacific Automotive Electronics Market, by Application (Revenue, USD Million, 2018 - 2030)

- ADAS

- Infotainment

- Body Electronics

- Safety Systems

- Powertrain Electronics

- Asia Pacific Automotive Electronics Market, by Vehicle Type (Revenue, USD Million, 2018 - 2030)

- Two Wheeler

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Asia Pacific Automotive Electronics Market, by Propulsion (Revenue, USD Million, 2018 - 2030)

- ICE

- Electric

- Asia Pacific Automotive Electronics Market, by Sales Channel (Revenue, USD Million, 2018 - 2030)

- OEM

- Aftermarket

- China

- China Automotive Electronics Market, by Component (Revenue, USD Million, 2018 - 2030)

- Electronic Control Unit

- Sensors

- Current Carrying Devices

- Others

- China Automotive Electronics Market, by Application (Revenue, USD Million, 2018 - 2030)

- ADAS

- Infotainment

- Body Electronics

- Safety Systems

- Powertrain Electronics

- China Automotive Electronics Market, by Vehicle Type (Revenue, USD Million, 2018 - 2030)

- Two Wheeler

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- China Automotive Electronics Market, by Propulsion (Revenue, USD Million, 2018 - 2030)

- ICE

- Electric

- China Automotive Electronics Market, by Sales Channel (Revenue, USD Million, 2018 - 2030)

- OEM

- Aftermarket

- China Automotive Electronics Market, by Component (Revenue, USD Million, 2018 - 2030)

- Japan

- Japan Automotive Electronics Market, by Component (Revenue, USD Million, 2018 - 2030)

- Electronic Control Unit

- Sensors

- Current Carrying Devices

- Others

- Japan Automotive Electronics Market, by Application (Revenue, USD Million, 2018 - 2030)

- ADAS

- Infotainment

- Body Electronics

- Safety Systems

- Powertrain Electronics

- Japan Automotive Electronics Market, by Vehicle Type (Revenue, USD Million, 2018 - 2030)

- Two Wheeler

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Japan Automotive Electronics Market, by Propulsion (Revenue, USD Million, 2018 - 2030)

- ICE

- Electric

- Japan Automotive Electronics Market, by Sales Channel (Revenue, USD Million, 2018 - 2030)

- OEM

- Aftermarket

- Japan Automotive Electronics Market, by Component (Revenue, USD Million, 2018 - 2030)

- India

- India Automotive Electronics Market, by Component (Revenue, USD Million, 2018 - 2030)

- Electronic Control Unit

- Sensors

- Current Carrying Devices

- Others

- India Automotive Electronics Market, by Application (Revenue, USD Million, 2018 - 2030)

- ADAS

- Infotainment

- Body Electronics

- Safety Systems

- Powertrain Electronics

- India Automotive Electronics Market, by Vehicle Type (Revenue, USD Million, 2018 - 2030)

- Two Wheeler

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- India Automotive Electronics Market, by Propulsion (Revenue, USD Million, 2018 - 2030)

- ICE

- Electric

- India Automotive Electronics Market, by Sales Channel (Revenue, USD Million, 2018 - 2030)

- OEM

- Aftermarket

- India Automotive Electronics Market, by Component (Revenue, USD Million, 2018 - 2030)

- Australia

- Australia Automotive Electronics Market, by Component (Revenue, USD Million, 2018 - 2030)

- Electronic Control Unit

- Sensors

- Current Carrying Devices

- Others

- Australia Automotive Electronics Market, by Application (Revenue, USD Million, 2018 - 2030)

- ADAS

- Infotainment

- Body Electronics

- Safety Systems

- Powertrain Electronics

- Australia Automotive Electronics Market, by Vehicle Type (Revenue, USD Million, 2018 - 2030)

- Two Wheeler

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Australia Automotive Electronics Market, by Propulsion (Revenue, USD Million, 2018 - 2030)

- ICE

- Electric

- Australia Automotive Electronics Market, by Sales Channel (Revenue, USD Million, 2018 - 2030)

- OEM

- Aftermarket

- Australia Automotive Electronics Market, by Component (Revenue, USD Million, 2018 - 2030)

- South Korea

- South Korea Automotive Electronics Market, by Component (Revenue, USD Million, 2018 - 2030)

- Electronic Control Unit

- Sensors

- Current Carrying Devices

- Others

- South Korea Automotive Electronics Market, by Application (Revenue, USD Million, 2018 - 2030)

- ADAS

- Infotainment

- Body Electronics

- Safety Systems

- Powertrain Electronics

- South Korea Automotive Electronics Market, by Vehicle Type (Revenue, USD Million, 2018 - 2030)

- Two Wheeler

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- South Korea Automotive Electronics Market, by Propulsion (Revenue, USD Million, 2018 - 2030)

- ICE

- Electric

- South Korea Automotive Electronics Market, by Sales Channel (Revenue, USD Million, 2018 - 2030)

- OEM

- Aftermarket

- South Korea Automotive Electronics Market, by Component (Revenue, USD Million, 2018 - 2030)

- Thailand

- Thailand Automotive Electronics Market, by Component (Revenue, USD Million, 2018 - 2030)

- Electronic Control Unit

- Sensors

- Current Carrying Devices

- Others

- Thailand Automotive Electronics Market, by Application (Revenue, USD Million, 2018 - 2030)

- ADAS

- Infotainment

- Body Electronics

- Safety Systems

- Powertrain Electronics

- Thailand Automotive Electronics Market, by Vehicle Type (Revenue, USD Million, 2018 - 2030)

- Two Wheeler

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Thailand Automotive Electronics Market, by Propulsion (Revenue, USD Million, 2018 - 2030)

- ICE

- Electric

- Thailand Automotive Electronics Market, by Sales Channel (Revenue, USD Million, 2018 - 2030)

- OEM

- Aftermarket

- Thailand Automotive Electronics Market, by Component (Revenue, USD Million, 2018 - 2030)

- Asia Pacific Automotive Electronics Market, by Component (Revenue, USD Million, 2018 - 2030)

- Latin America

- Latin America Automotive Electronics Market, by Component (Revenue, USD Million, 2018 - 2030)

- Electronic Control Unit

- Sensors

- Current Carrying Devices

- Others

- Latin America Automotive Electronics Market, by Application (Revenue, USD Million, 2018 - 2030)

- ADAS

- Infotainment

- Body Electronics

- Safety Systems

- Powertrain Electronics

- Latin America Automotive Electronics Market, by Vehicle Type (Revenue, USD Million, 2018 - 2030)

- Two Wheeler

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Latin America Automotive Electronics Market, by Propulsion (Revenue, USD Million, 2018 - 2030)

- ICE

- Electric

- Latin America Automotive Electronics Market, by Sales Channel (Revenue, USD Million, 2018 - 2030)

- OEM

- Aftermarket

- Brazil

- Brazil Automotive Electronics Market, by Component (Revenue, USD Million, 2018 - 2030)

- Electronic Control Unit

- Sensors

- Current Carrying Devices

- Others

- Brazil Automotive Electronics Market, by Application (Revenue, USD Million, 2018 - 2030)

- ADAS

- Infotainment

- Body Electronics

- Safety Systems

- Powertrain Electronics

- Brazil Automotive Electronics Market, by Vehicle Type (Revenue, USD Million, 2018 - 2030)

- Two Wheeler

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Brazil Automotive Electronics Market, by Propulsion (Revenue, USD Million, 2018 - 2030)

- ICE

- Electric

- Brazil Automotive Electronics Market, by Sales Channel (Revenue, USD Million, 2018 - 2030)

- OEM

- Aftermarket