- Home

- »

- Next Generation Technologies

- »

-

Automotive Finance Market Size, Share, Growth Report 2030GVR Report cover

![Automotive Finance Market Size, Share & Trends Report]()

Automotive Finance Market (2025 - 2030) Size, Share & Trends Analysis Report By Provider (Banks, OEMs), By Finance (Direct, Indirect), By Purpose (Loan, Leasing), By Vehicle (Commercial Vehicles, Passenger Vehicles), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-861-9

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Finance Market Summary

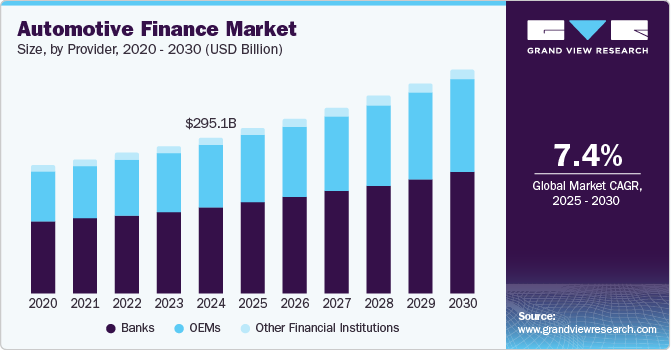

The global automotive finance market size was valued at USD 295.13 billion in 2024 and is projected to reach USD 451.71 billion by 2030, growing at a CAGR of 7.4% from 2025 to 2030. The increasing demand for electric vehicles worldwide is one of the major factors expected to drive market growth. According to the Experian’s State of the Automotive Finance Report: Q2 2024, it experienced a significant rise, reaching 25.35%, compared to 21.14% the previous year and 19.30% in Q2 2022.

Key Market Trends & Insights

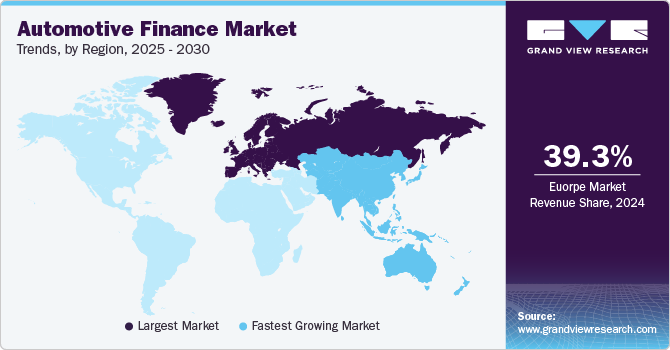

- The Europe automotive finance market dominated and accounted for a 39.3% share of the global revenue in 2024.

- The Germany automotive finance market held a substantial market share in 2024.

- The Asia Pacific automotive finance market is expected to emerge as the fastest-growing regional market over the forecast period.

- Based on provider, the banks segment led the market and accounted for 57.5% share of the global revenue in 2024.

- In terms of finance, the direct segment dominated the market and accounted for significant share of the global revenue in 2024.

Market Size & Forecast

- 2024 Market Size: USD 295.13 billion

- 2030 Projected Market Size: USD 451.71 billion

- CAGR (2025-2030): 7.4%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

The growing importance of captive automotive finance worldwide is creating new opportunities for market growth. Captive finance is a subsidiary of an automaker that provides loans and financial services to the company's customers. The benefits of starting a captive finance company include personalized finance options for customers, and equipment rental programs, among others. The companies such as Honda Finance, Ford, Infiniti, and Nissan are seeing strong growth in captive finance.

The growing importance of cryptocurrency across the automotive finance industry is expected to drive market growth. Various automotive technology providers are adopting cryptocurrency-based payments to enhance their offerings. For instance, in March 2022, CarNow, an automotive industry’s digital retailing company, announced its partnership with Cion Digital, a blockchain orchestration platform. Through this partnership, CarNow will offer auto dealers compliant and fast crypto payment and lending solutions.

Artificial intelligence technology is increasingly being used in the automotive finance sector in order to improve the credit underwriting process, analyze the data, accurately predict whether the applicant can turn delinquent, and thus enhance the approval process. Various automotive artificial intelligence technology providers are making efforts to develop AI-enabled lending platforms. For instance, in October 2021, Upstart, a leading AI lending platform, announced the launch of Upstart Auto Retail software. This software includes AI-enabled financing features which enable the lenders to improve their customer experience.

The growing demand for automotive refinancing worldwide is also one of the major factors creating new opportunities for market growth. The demand for refinancing is growing owing to its benefits, such as lower monthly car payments, reduced interest rates, and shortened loan terms. According to the statistics provided by RateGenius, a fintech company, 16% more additional Americans applied to refinance their automotive loans in 2020 as compared to 2019. As many as 17% more additional borrowers refinanced their car loans successfully in 2020 as compared to 2019.

Provider Insights

The banks segment led the market and accounted for 57.5% share of the global revenue in 2024. The banks segment growth can be attributed to the fast-processing features with the necessity for least documentation, in addition to the high-reliability features. Earlier, banks are used to finance only around 70% to 80% of the total vehicle price. However, currently, these banks are offering 100% finance of the vehicle, owing to which customers are showing more interest in purchasing a new car over the used car. The banks are increasingly adopting digital automotive finance in order to meet the changing customer needs across the globe.

The OEMs segment is anticipated to register the highest growth over the forecast period. Automotive OEMs provide better after-sales services due to the availability of identical automobile parts, like that of the vehicle financed, for repair or replacement. Also, OEMs are considered as the future of mobility, owing to their positive impact on new business models. Furthermore, apart from providing products and services, OEMs are also focusing on offering motor vehicle insurance through their captive finance companies.

Finance Insights

The direct segment dominated the market and accounted for significant share of the global revenue in 2024. Consumers are focusing on determining the financing source, which effectively meets their requirements. Consumers directly apply for car loans at the credit union, banks, and other lending companies. Moreover, the customers have complete control over the lending process as this process doesn’t include any third-party salesperson or dealer. In the direct loan process, the consumer requires large amount of time to choose a suitable lender as compared to the indirect loan process.

The indirect segment is anticipated to register the highest growth over the forecast period. The most important benefit of this indirect finance is that it allows customers to take on-site expert advice from independent finance specialists. Also, these specialists ensure that their clients determine the best method to finance a vehicle as and when required. Also, in indirect auto financing, customers can access and search all loans at once. In indirect loan process the control of loan is shared with the dealers and salesperson.

Purpose Insights

The loan segment led the market in 2024. Loans have been a standard process of purchasing an automobile by most of the global population. As the credit environment started to advance, leasing and finance companies had extra funding sources to make accessible to consumers. Moreover, banks and credit unions are targeting customers with low-interest rate loans. The automotive loan companies offer customers services such as a wide network of dealerships, dedicated customers support, and 24/7 access to loan accounts. These offered services enable the lending companies to enhance their customer's experience.

The leasing segment is anticipated to register the highest growth over the forecast period. The segment growth can be attributed to the increasing number of leasing providers in emerging economies, such as India, China, and Japan. The leasing services are offered by both new as well as used cars. The growing trend of digitization is making a massive impact in the automotive leasing industry. Moreover, companies in automobile leasing are enhancing consumer experience and leveraging their profit margins by heavily investing in digitization technologies, such as blockchain.

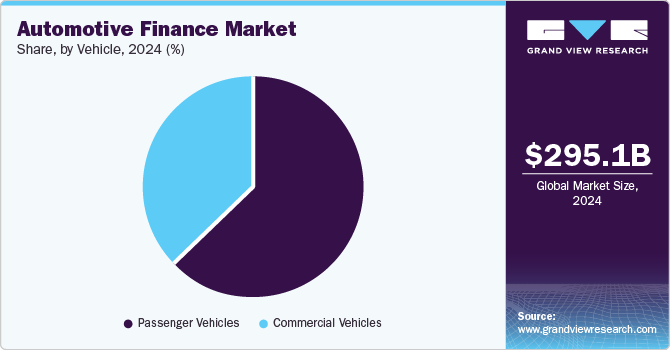

Vehicle Insights

The passenger vehicles segment led the market in 2024. The segment growth can be attributed to the increasing need of mobility due to increased distances between work, home, education, leisure, and shopping facilities. The automotive industry is growing due to the constantly changing customer needs. The need for innovations in safety systems, infotainment systems, advanced driver-assistance systems, telematics, autonomous vehicles, and in-dash controls is increasing, especially in passenger vehicles.

The commercial vehicles segment is anticipated to witness significant growth over the forecast period. As commercial vehicles are expensive in comparison to other vehicles, numerous banks and financial institutions have introduced reasonable loan schemes, which include simple terms and conditions. Moreover, the processing time needed to approve commercial vehicle loans is less in comparison to passenger vehicles. These aforementioned factors are expected to contribute to the segment growth over the forecast period. At the same time, rising demand for light commercial vehicles due to its versatile performance in varied conditions is also driving the segment growth.

Regional Insights

The rise of digital platforms and fintech innovations has made automotive financing more accessible in North America. Consumers now have the ability to apply for loans, compare offers, and complete transactions online, which has streamlined the process and reduced friction. Additionally, fintech companies are leveraging big data and artificial intelligence (AI) to offer personalized financing solutions and quicker approval times. This has made it easier for both consumers and businesses to access credit, even with non-traditional credit histories. The region, particularly the U.S. and Canada, continues to be a major hub for automotive finance, with increasing demand for diverse financing options ranging from loans and leases to subscription models.

U.S. Automotive Finance Market Trends

The U.S. automotive finance market is moving towards electrification, and the demand for financing options for electric vehicles is on the rise. Consumer interest in EVs has surged, supported by federal and state incentives and a growing variety of models available from major automakers. Financing options for EVs, including loans and leases, are becoming more competitive, with lower interest rates and longer terms offered to make these vehicles more affordable. Additionally, the rising price of new vehicles has driven more consumers to seek financing for EVs, which typically have a higher initial purchase price compared to traditional internal combustion engine vehicles.

Europe Automotive Finance Market Trends

The Europe automotive finance market dominated and accounted for a 39.3% share of the global revenue in 2024. The regional market growth can be attributed to the presence of a large number of automotive finance service providers in the region. Numerous market players in the market are focusing on offering their services through mobile and online channels. This initiative is giving these players an edge over traditional players. At the same time, growing demand for electric vehicles in the region is also driving the market growth in the region.

The UK automotive finance market is driven by a combination of economic, consumer, technological, and regulatory factors. Favorable economic conditions, including low interest rates and easing inflationary pressures, have made borrowing more accessible to consumers. Additionally, the post-pandemic economic recovery has boosted disposable income and spending on vehicles. However, the rising cost of living has increased the reliance on financing as a practical solution, allowing consumers to spread payments over time rather than making upfront purchases.

The Germany automotive finance market held a substantial market share in 2024. German consumers are increasingly favoring flexible ownership models such as leasing and subscription services over traditional vehicle purchases. These options allow for lower upfront costs and greater flexibility, aligning with evolving preferences for usage-based mobility solutions.

Asia Pacific Automotive Finance Market Trends

The Asia Pacific automotive finance market is expected to emerge as the fastest-growing regional market over the forecast period. The growing number of favorable government initiatives in economies, such as India, Japan, and China, to promote growth in the automotive industry and maintain consumer interest is expected to create growth opportunities for the regional market growth. At the same time, increasing population in this region is also driving the market growth in the region. Moreover, growing adoption of telematics is also creating new opportunities for the market growth.

The rising demand for automotive finance in China is driven by several interrelated factors, including economic growth and shifting consumer preferences. As incomes increase, more consumers are able to afford vehicles, but the rising cost of vehicles, especially with the introduction of new technologies, has led many to turn to financing options. This makes vehicle ownership more accessible without the need for a large upfront payment. The ongoing urbanization in China has also contributed to the demand for personal vehicles, particularly in major cities where public transportation may not meet individual mobility needs.

India’s automotive finance market is expected to grow at a significant growth rate during the forecast period. Indian consumers are shifting from outright vehicle purchases to more flexible options like leasing and subscription services, driven by a desire for lower initial payments and the ability to upgrade vehicles frequently. Leasing, in particular, has gained traction in both the consumer and corporate segments, providing an affordable alternative to outright vehicle purchases. Additionally, Government incentives aimed at promoting electric vehicles (EVs) and environmentally friendly transportation have stimulated the automotive finance market. Subsidies, tax exemptions, and lower GST rates for EVs have made electric vehicles more affordable and accessible. As India focuses on reducing its carbon footprint, the demand for financing solutions for EVs is expected to grow substantially.

Key Automotive Finance Company Insights

The market is fragmented in nature. The market is in the growth stage, and also the competition is anticipated to intensify over the forecast period. Prominent players are adopting various strategies, such as partnerships, strategic joint ventures, mergers & acquisitions, geographical expansion, to cement their foothold in the market. The emerging subscription business is altering the market dynamics. Industry players are focusing on exploring this subscription business model, as consumer interest is very high in purchasing vehicles. The appeal of subscriptions is fueling higher growth rates in the market. The COVID-19 pandemic has augmented the growth of online and digital channels for business-to-consumer purchases. In reply to these trends, OEMs and industry players have started to virtualize their dealerships or agreements and operate remotely.

-

Bank of America, headquartered in Charlotte, North Carolina, is one of the leading financial institutions, offering a comprehensive suite of banking, investing, asset management, and financial risk management products and services. Bank of America is a prominent provider of auto loans, catering to individuals and businesses. Its automotive finance offerings include competitive loan rates, flexible terms, and a streamlined purpose process. Customers can finance both new and used vehicles or refinance existing auto loans. The bank also partners with dealerships across the U.S., facilitating point-of-sale financing solutions.

-

Ford Motor Credit Company is an automotive finance company and a wholly-owned subsidiary of Ford Motor Company. The company provides retail financing, offering loans and leases for new and used Ford and Lincoln vehicles, making vehicle ownership more accessible to a broad customer base. For businesses, it delivers commercial financing solutions, including loans, lines of credit, and lease options for fleet management. It operates in various markets worldwide, including North America, Europe, Asia Pacific, and Latin America.

Key Automotive Finance Companies:

The following are the leading companies in the automotive finance market. These companies collectively hold the largest market share and dictate industry trends.

- Ally Financial

- Bank of America

- Capital One

- Chase Auto Finance

- Daimler Financial Services

- Ford Motor Credit Company

- GM Financial Inc.

- Hitachi Capital

- Toyota Financial Services

- Volkswagen Financial Services

Recent Developments

-

In December 2024, Volkswagen Financial Services launched a new initiative allowing customers to lease a bike for one year. This innovative offering is designed to cater to the growing demand for sustainable mobility solutions. The leasing option is available for various bike models, offering flexible terms and conditions to make eco-friendly travel more accessible.

-

In November 2023, Bank of America introduced new digital car-buying and financing tools aimed at streamlining the vehicle purchase process for customers. These tools enable users to search for vehicles, calculate payments, apply for financing, and complete the purchase-all online. The initiative aligns with the growing demand for digital solutions in the automotive industry and reflects the bank’s commitment to enhancing customer convenience. By integrating these features into its platform, Bank of America aims to simplify car buying while providing competitive financing options, catering to a tech-savvy consumer base.

-

In February 2022, Chase Auto Finance launched an integrated car buying and financing platform designed to simplify the vehicle purchasing process for customers. This new platform enables users to browse vehicles, calculate monthly payments, apply for financing, and complete the entire buying process seamlessly, all in one place. By integrating the car-buying experience with financing options, Chase aims to offer a more convenient and efficient way for consumers to purchase cars while securing competitive loan terms.

Automotive Finance Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 315.64 billion

Revenue forecast in 2030

USD 451.71 billion

Growth Rate

CAGR of 7.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Provider, finance, purpose, vehicle, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Ally Financial; Bank of America; Capital One; Chase Auto Finance; Daimler Financial Services; Ford Motor Credit Company; GM Financial Inc.; Hitachi Capital; Toyota Financial Services; Volkswagen Financial Services

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Finance Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the automotive finance market report based on provider, finance, purpose, vehicle, and region.

-

Provider Outlook (Revenue, USD Billion, 2018 - 2030)

-

Banks

-

OEMs

-

Other Financial Institutions

-

-

Finance Outlook (Revenue, USD Billion, 2018 - 2030)

-

Direct

-

Indirect

-

-

Purpose Outlook (Revenue, USD Billion, 2018 - 2030)

-

Loan

-

Leasing

-

Others

-

-

Vehicle Outlook (Revenue, USD Billion, 2018 - 2030)

-

Commercial Vehicles

-

Passenger Vehicles

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive finance market size was estimated at USD 295.13 billion in 2024 and is expected to reach USD 315.64 billion in 2025.

b. The global automotive finance market is expected to grow at a compound annual growth rate of 7.4% from 2025 to 2030 to reach USD 451.71 billion by 2030.

b. Europe dominated the automotive finance market with a share of 39.3% in 2024. This is attributable to the concentration of providers of automotive financial services. Furthermore, the region’s robust advertising industry has led to increased awareness regarding automotive finance schemes among individuals, thereby, increasing the demand for automotive finance in the region.

b. Some key players operating in the automotive finance market include Ally Financial; Bank of America; Capital One; Chase Auto Finance; Daimler Financial Services; Ford Motor Credit Company; GM Financial Inc.; Hitachi Capital; Toyota Financial Services; Volkswagen Financial Services.

b. Key factors that are driving the automotive finance market growth include increasing investments in autonomous vehicles and growing demand for EVs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.