- Home

- »

- Automotive & Transportation

- »

-

Automotive Infotainment Market Size & Share Report, 2030GVR Report cover

![Automotive Infotainment Market Size, Share & Trends Report]()

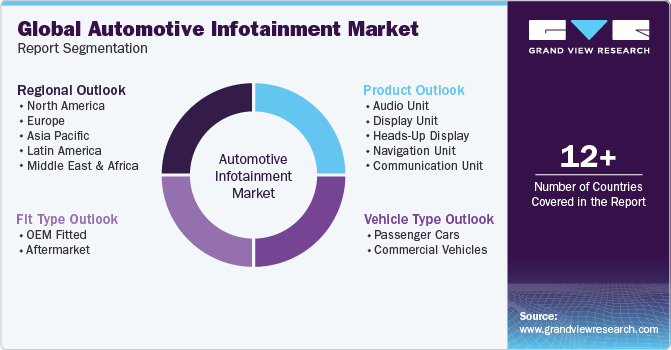

Automotive Infotainment Market Size, Share & Trends Analysis Report By Product Type (Audio Unit, Display Units, Heads-Up Displays & Others), By Fit Type, By Vehicle Type, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-921-0

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Automotive Infotainment Market Trends

The global automotive infotainment market size was valued at USD 14.99 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 9.9% from 2024 to 2030. The continued integration of features such as on-demand music, connectivity to smartphones, and live audio streaming to cater to the growing demand for comfort, safety, and convenience in automobiles is expected to drive the growth of the market over the forecast period. Furthermore, Continued improvements in various infotainment features and the increasing affordability of vehicles are further contributing to the market growth. Additionally, critical automotive manufacturers are focusing on in-cooperation advanced technologies such as driver assistance, augmented reality real-time data collection, and the Internet of Things (IoT) to enhance the functionality of infotainment systems. The addition of these technologies in vehicles is refining drivers’ safety and experience, subsequently driving the demand for the automotive infotainment system.

Automakers are emphasizing the integration of IoT into their automobiles to enhance vehicular end-to-end connectivity. Automotive OEMs are also collaborating with automotive software solution providers to develop low-latency, high-bandwidth solutions capable of withstanding low temperatures and high vibration when installed in light-duty or heavy-duty vehicles. IoT simplifies the accessibility to information for the occupants of the vehicles, thereby enhancing convenience and security during the commute.

Looking forward into the forecast period, major automakers are expected to continue integrating advanced infotainment systems in their newer vehicles. For instance, automakers, such as Nissan Motor Co. Ltd., Mitsubishi Motors Corporation, and Groupe Renault, are considering infotainment systems integrated with Google Inc.'s Android OS for their upcoming models. At the same time, the demand for in-vehicle infotainment is gaining traction in line with the shifting customer preferences and the strong emphasis on seamless smartphone pairing with the system. As such, several vendors are collaborating with technology companies specializing in areas, such as display units, audio units, comprehensive systems, and navigation systems, to introduce innovative automotive infotainment systems. The growing sales of luxury vehicles and the growing consumer preference for dashboard integrated infotainment systems are also creating new opportunities for the growth of the market.

Automobile manufacturers are focusing on incorporating IoT technologies to enable greater end-to-end connectivity of vehicles. With the collaboration of automotive manufacturers with software companies to build high bandwidth and low latency systems, these systems can work in high vibration and low-temperature environments when installed in light or heavy-duty vehicles. IoT increases the ease of accessibility of information for drivers and passengers to make their journey secure and convenient.

Growing emphasis on safety for drivers has brought advancement in technology, as automakers started integrating advanced driver assistance systems (ADAS) and digital monitoring systems (DMS) in cars. Parking assistance and traffic updating feature of ADAS and DMS assists the driver during their journey as these systems are installed in their infotainment system for monitoring and controlling purposes. These technological advancements in driver’s safety are creating a new growth opportunity for the automotive infotainment market.

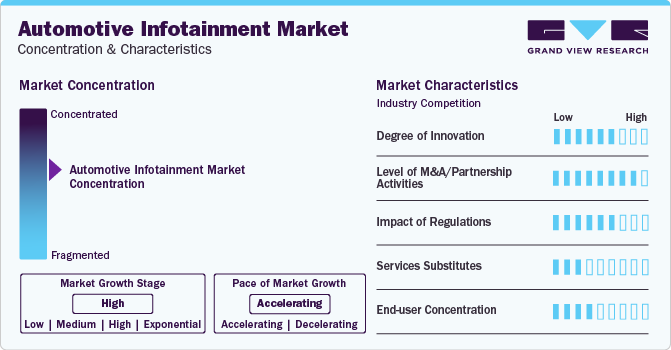

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating. The market is characterized by a high degree of innovation owing to the integration of the latest technologies, such as Internet of Things (IoT), Advanced Driver Assistance Systems (ADAS), and Augmented Reality (AR), to realize various innovative features that can improve drivers' safety and enhance the driving experience.

The automotive infotainment industry is also characterized by a high level of merger & acquisition (M&A) and partnership activity by the market players. This is due to several factors, including launching innovative and advanced products in the market and to maintain strong brand position in the market.

Governments worldwide are prioritizing passenger safety and are hence drafting various laws and regulations focusing on passenger safety. Governments worldwide have made ADAS features in vehicles. The government mandate to install driver safety features such as blind spot detection , collusion warning , adaptive cruise control, rear collusion warning is expected to drive the market growth.

At present, there are hardly any direct or external substitutes for automotive infotainment. However, a significant threat to the market is the emergence and adoption of alternative technologies and solutions that provide similar or enhanced functionalities. Some potential threats of substitute include smartphone integration, voice-activated assistants, and AR Head-up displays, among others.

End-user concentration is a significant factor in the market. The concentration of demand for connected cars creates opportunities for companies that focus on developing advanced infotainment technologies in line with the growing preference for a smart and safe driving experience.

Product Type Insights

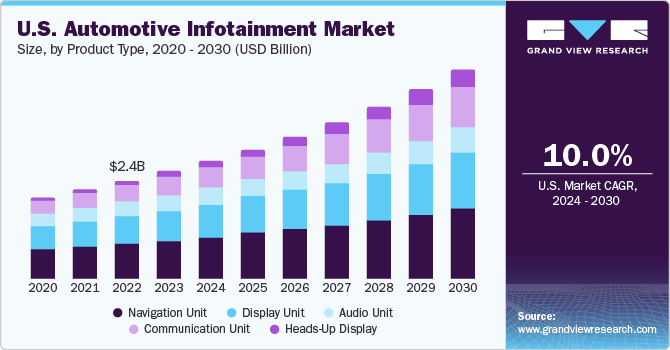

Navigation unit segment led the market and accounted for 37.1% in 2023. Advanced onboard features like 3D navigation, hands-free calling, satellite radio, and media streaming are gaining consumer traction; this motivates automobile manufacturers to install communication units in some of the basic car models launched in the market. Furthermore, the 5G network increases the speed of the real-time data collection and accuracy of communication units, thereby increasing the adoption of infotainment devices in automobiles.

The heads-up display segment is expected to register highest growth rate over the forecast period. This growth can be attributed to the increasing application of Augmented Reality (AR) technology. With the usage of AR, real-time information such as speed, arrow indicators, and warning signals can readily be displayed and analyzed. The heads-up display projects the graphics on the windshield, steering wheels’ details, and assists in parking and barely a glance away from the driver. Thus, heads-up display devices are widely preferred by automobile customers worldwide.

Fit Type Insights

OEM fitted segment accounted for the largest market revenue share of 72.99% in 2023 owing to easy service and low maintenance features. OEM fitted systems are part of the car warranty provided by the manufacturer, preventing customers from paying any extra fee for OE systems, thereby increasing its preference over other aftermarket products while contributing to segmental growth. By adding OEM in automobiles, manufacturers can access the stored data. The collected information can then be utilized by the sales and marketing team of the company for campaigning purposes.

However, the aftermarket segment is expected to witness considerable growth rate for the given forecast period. There are several factors that can potentially contribute to the growth of the segment. Aftermarket automotive infotainment systems tend to cost relatively less compared to OEM-fitted systems. Moreover, aftermarket systems can also be customized according to the customers’ needs and preferences. Aftermarket suppliers offer basic automotive infotainment systems for owners of basic car models. Such systems typically include an audio unit. Aftermarket suppliers may replace the infotainment system with a more advance one within the same price bracket.

Vehicle Type Insights

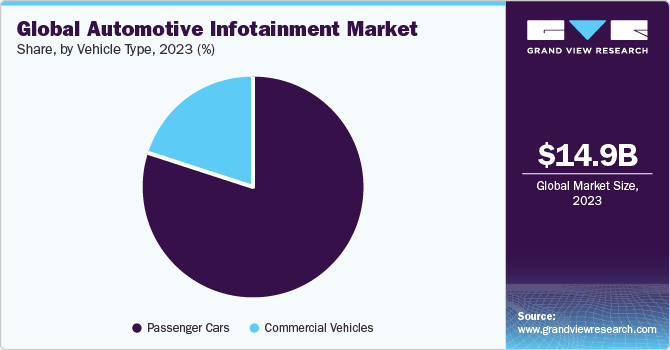

Passenger cars segment led the market with a revenue share of 79.60% in 2023. A higher share of the passenger care segment is attributed to the increased adoption of luxury cars by consumers concentrated in developing nations.

Luxury cars offer more technology and safety features, with cabin comforts requiring advanced infotainment systems. Automobile manufacturers provide subscription-based services, better sales, and financing options to customers, making these factors contributors to luxury car sales. Furthermore, companies such as Uber & OLA are trying to make long drives more comfortable and entertaining by making passenger vehicles more interactive and hand-free, thereby maintaining a significant market share.

The commercial vehicles segment is expected to register a considerable growth rate over the forecast period. The increasing demand for commercial vehicles and the strong emphasis automotive companies are putting on including vehicle-to-vehicle communications in commercial vehicles to facilitate efficient fleet management are expected to boost the demand for automotive infotainment systems for commercial vehicles. Vendors are integrating their respective infotainment systems for commercial vehicles with IoT technology to enable end-to-end connectivity between vehicles as part of the ADAS and DMS to aid commercial fleet operators in managing their fleets efficiently.

Regional Insights

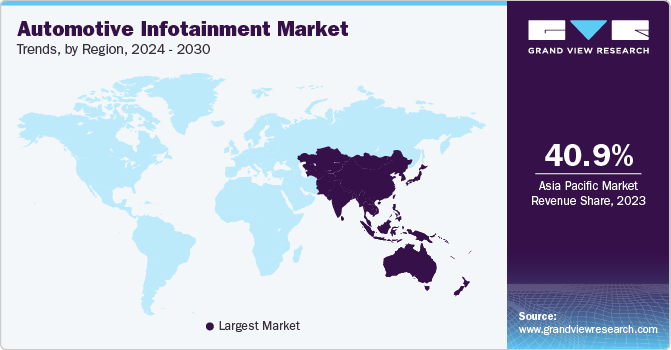

Asia Pacific dominated the market and accounted for 40.9% share in 2023. This growth can be attributed to the growing sales and production of passenger cars in the region. The increasing income levels and high demand for automobiles have resulted in the growth of luxury and mid-sized premium cars segments in the region. The demand for in-car entertainment systems is expected to soar in the APAC region as the traction for electric vehicle is also gaining ground in the region. Some major benefits of in-car entertainment systems include increased connectivity, improved user experience, hands-free operation, and a variety of entertainment options.

Europe holds a considerable share in the global automotive infotainment industry due to the presence of prominent automobile manufacturers. Major automakers work closely with global software companies to launch advanced infotainment systems. The product launch will increase the company's revenue share and maintain its dominance over other competitors in the world. The demand for advanced in-car infotainment systems has increased as a result of the rapid adoption of cloud technology in vehicles that is driving the regional growth. The infotainment market in particular, as well as the automotive industry as a whole, is moving towards cloud technology; this is a key factor in the development of in-vehicle infotainment. The industry is expanding due to the simple user interface of in-car infotainment systems that combine cellphones for a variety of functions.

Key Companies & Market Share Insights

Some of the key players operating in the market include Harman International; Panasonic Corporation; Alps Alpine Co., Ltd.; Continental AG; and Visteon Corporation.

-

Harman International is engaged in continuous innovation in developing advanced infotainment solutions. The company’s portfolio includes technologies such as connected car solutions, navigation systems, and in-car audio systems. Furthermore, the company has established strong relationships with OEMs in automotive industry.

-

Continental AG invest significantly in research & development to stay at the forefront of emerging trends and technologies in infotainment. The company offer integrated solutions with connectivity features, navigation solutions, and advanced human-machine interface technologies that enhance the overall in-car experience.

-

PATEO, OVO Automotive, and CY Vision are some of the emerging market participants in the automotive infotainment market.

-

OVO Automotive is a cloud-based app platform provider for connected cars. The app is easy to integrate, install and provide enterprise grade security and privacy.

-

CY Vision is engaged in developing 3D display technology that deliver augmented reality experience to meet the challenges of difficult vehicular environments. Collaboration and partnerships with automotive manufacturers, technology companies, or industry leaders may provide the company with the leverage to expand its presence in the automotive infotainment sector.

Key Automotive Infotainment Companies:

- Alpine Electronics

- Clarion Co., Ltd.

- Continental AG

- Delphi Automotive PLC

- Denso Corporation

- Harman International

- JVC KENWOOD Corporation

- Panasonic Corporation

- Pioneer Corporation

- Visteon Corporation

Recent Developments

-

In October 2023, Alps Alpine Co., Ltd. partnered with DSP Concepts, Inc., an audio processing solution provider, to provide customers with sound technology. Through the partnership, a former company used Audio Weaver audio system development platform of DSP to develop next generation audio products.

-

In July 2023, Pioneer Corporation announced R&D expansion plan in India. By expanding R&D facility in India the company focus of acceleration developing innovative products in the mobility field and to cater the growth in Indian automotive market.

-

In February 2023, Continental AG announced the launch of Driver Identification Display equipped with integrated camera for biometric driver identification. The Driver Identification Display, the first inside automotive display in the world that supports contactless, highly secure identification and deters fraud and theft, is designed to identify the driver. TrinamiX created and patented the technology on which integrated facial authentication is based. It combines a novel sort of liveness detection with facial recognition to confirm the user's identification.

-

In January 2023, Visteon Corporation partnered with Qualcomm Technologies to develop integrated cockpit domain controller technology together. The technology is developed using Visteon’s SmartCore software powered by Snapdragon cockpit platforms for software-defined vehicles.

Automotive Infotainment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 16.40 billion

Revenue forecast in 2030

USD 28.93 billion

Growth Rate

CAGR of 9.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative Units

Revenue in USD Billion and CAGR from 2024 to 2030

Regional scope

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

Country scope

U.S., Canada, Germany, U.K., Spain, China, Japan, India, Australia, South Korea, Brazil, Mexico, UAE, Saudi Arabia, South Africa

Segments Covered

Product type, fit type, vehicle type, and region

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

15% free customization scope (equivalent to 5 analysts working days)

If you need specific market information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

Global Automotive Infotainment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive infotainment market report by product type, fit type, vehicle type, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Audio Unit

-

Display Unit

-

Heads-Up Display

-

Navigation Unit

-

Communication Unit

-

-

Fit Type Outlook (Revenue, USD Million, 2018 - 2030)

-

OEM Fitted

-

Aftermarket

-

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Cars

-

Commercial Vehicles

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive infotainment market size was estimated at USD 14.99 billion in 2023 and is expected to reach USD 16.40 billion in 2024.

b. The global automotive infotainment market is expected to grow at a compound annual growth rate of 9.9% from 2024 to 2030 to reach USD 28.93 billion by 2030.

b. Asia Pacific dominated the market and accounted for 40.9% share in 2023. This growth can be attributed to the growing sales and production of passenger cars in the region. The increasing income levels and high demand for automobiles have resulted in the growth of luxury and mid-sized premium cars segments in the region.

b. Some key players operating in the automotive infotainment market include Continental AG, Harman International, Panasonic Corporation, Alpine Electronics, Denso Corporation, Pioneer Corporation, Visteon Corporation, Clarion Co., Ltd., Delphi Automotive PLC, and JVC KENWOOD Corporation.

b. Key factors that are driving the automotive infotainment market growth include the growing demand for safety, improved comfort, and convenience in vehicles, which includes facilities such as smartphone integration, on-demand music, live audio streaming, and various other entertainment services.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."