- Home

- »

- Next Generation Technologies

- »

-

Automotive Software Market Size, Industry Report, 2030GVR Report cover

![Automotive Software Market Size, Share & Trends Report]()

Automotive Software Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (ADAS & Safety, Navigation), By Vehicle Type (Passenger Cars, Commercial Vehicle), By Product, By Propulsion Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-149-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Software Market Summary

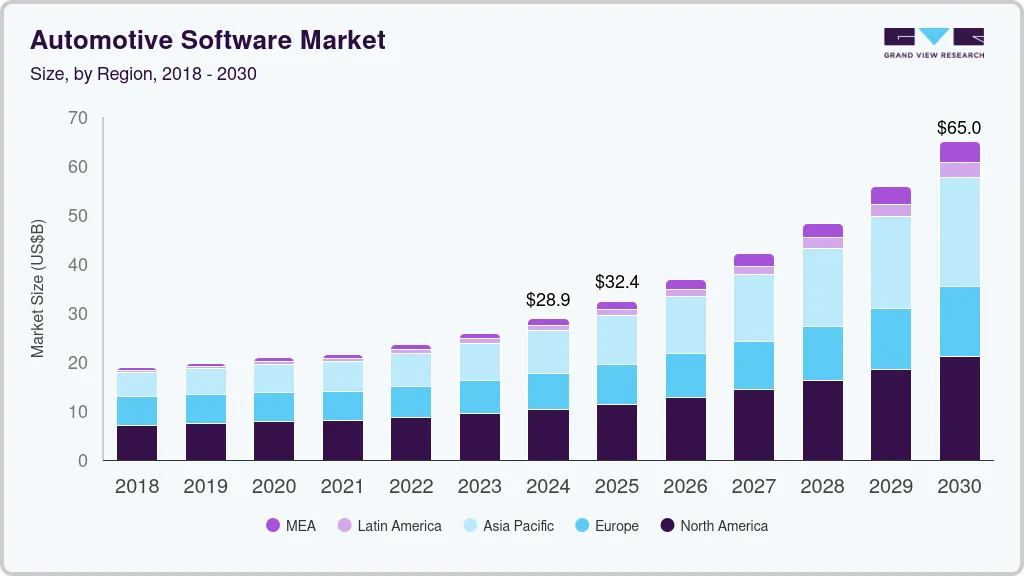

The global automotive software market size was estimated at USD 29.32 billion in 2024 and is projected to reach USD 66.18 billion by 2030, growing at a CAGR of 15% from 2025 to 2030. Automotive software refers to a set of programmable instructions designed for computer-based in-vehicle applications.

Key Market Trends & Insights

- North America automotive software market dominated the global industry with a revenue share of over 35.0% in 2024.

- The automotive software market in Asia Pacific is expected to experience the fastest CAGR during the forecast period.

- Based on application, the ADAS & safety segment dominated the global industry and accounted for a revenue share of over 20.0% in 2024.

- Based on vehicle type, the passenger cars segment held the largest revenue share of this market in 2024.

- Based on product, the software application segment dominated the global automotive software market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 29.32 Billion

- 2030 Projected Market Size: USD 66.18 Billion

- CAGR (2025-2030): 15%

- North America: Largest market in 2024

These applications are essential to the embedded systems of vehicles and encompass functions like body control, infotainment, telematics, comfort, safety features, Advanced Driver Assistance Systems (ADAS), and communication applications. The rising demand for car-to-car communication is expected to drive the global automotive software industry over the forecast period.Automobile manufacturers are continuously focusing on integrating automotive software in vehicles to enhance customer convenience and utility. The increasing popularity of autonomous vehicles has emerged as a significant driver for the automotive software industry, as it promotes the integration required to connect the entire vehicle to a unified system accountable for managing vehicle operations and balance. Additionally, the increased use of the ADAS is also expected to contribute to the growth of the automotive software industry over the forecast period. The advent of 5G technology is another significant development in the automotive software industry. The increasing need for high-speed network connectivity to deliver maximum benefits to end-users creates substantial opportunities for the market.

Modern vehicles are increasingly equipped with connectivity features, such as 4G/5G and Wi-Fi, to enable real-time data exchange, infotainment, remote diagnostics, and over-the-air (OTA) updates. Connected vehicle technology supports vehicle-to-everything (V2X) communication, enhancing traffic safety, navigation, and autonomous driving, which increases the demand for advanced software. Moreover, the development and deployment of autonomous and semi-autonomous vehicles rely on complex software for functions such as sensor fusion, path planning, and object detection. This demand accelerates advancements in artificial intelligence, machine learning, and computer vision technologies within automotive software.

Application Insights

The ADAS & safety segment dominated the global automotive software industry and accounted for a revenue share of over 20.0% in 2024. There is a growing focus on safety in the automotive industry, with customers and regulators moving for safer vehicles. ADAS technologies play a vital role in improving vehicle safety with features like lane-keeping assistance, adaptive cruise control, and collision avoidance. Additionally, customers are increasingly seeking autonomous vehicles with advanced safety features such as ADAS technologies, which are instrumental in reducing the number of accidents and improving road safety.

The connectivity segment is expected to experience the fastest CAGR from 2025 to 2030. Connectivity has become an extensive feature across various electronic devices, including automobiles. These services enable automotive dealers, fleet operators, and drivers to enhance resource utilization, strengthen safety, automate specific driver functions, and simultaneously gather valuable data related to vehicle performance and road conditions. Connectivity enables vehicles to optimize resource usage, such as fuel, by providing real-time data on traffic conditions and suggesting more efficient routes. It also facilitates predictive maintenance, helping vehicles to remain in optimal working condition.

Vehicle Type Insights

Passenger cars held the largest revenue share of this market in 2024. Passenger cars have seen higher adoption of software services compared to commercial vehicles as passenger cars often come equipped with advanced infotainment systems, driver assistance technologies such as ADAS, and connected services, making them a significant market for automotive software. Countries where the automotive industry is more mature have a robust demand for highly advanced applications. Customers in these regions increasingly strive for vehicles with features such as ADAS, which enhance safety and convenience.

Commercial vehicle segment is projected to grow at the fastest CAGR during the forecast period. The commercial vehicle industry is subject to many regulations, such as those related to safety, emissions, and driver hours. Software solutions help commercial vehicle operators track and ensure compliance with these regulations, which has become increasingly important in many regions. Furthermore, automotive software assists commercial vehicle operators in reducing fuel consumption, maintenance costs, and downtime. These cost-saving benefits have driven the adoption of software solutions in the commercial vehicle industry.

Product Insights

The software application segment dominated the global automotive software market in 2024. Software applications play a critical role in enabling vehicle connectivity and telematics services, including remote vehicle diagnostics, real-time traffic information, and software updates. Also, modern vehicles have become highly complex, integrating various Electronic Control Units (ECUs) and sensors. Software applications are essential for managing and coordinating these components, enabling features like infotainment, navigation, engine control, and ADAS.

The operating system (OS) segment is projected to grow at the fastest CAGR during the forecast period. Automotive OS serves as the foundational software platform for the vehicle's electronic control units and various sub-systems. These operating systems provide the essential framework for coordinating and managing different functions, from powertrain control to infotainment. Modern vehicles require operating systems that can handle safety-critical functions, such as autonomous driving features. These functions demand a high level of reliability and real-time responsiveness, which specialized automotive OS provides.

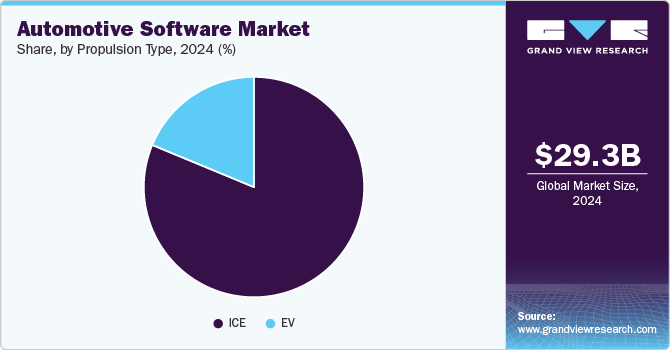

Propulsion Type Insights

The internal combustion engine (ICE) segment dominated the global automotive software industry in 2024. As the automotive industry is rapidly moving toward electrification and autonomous driving, a significant part of the global vehicle fleet still includes ICE vehicles. These vehicles require software for engine management, emission control, transmission control, and other crucial functions. Furthermore, many developing economies continue to rely heavily on ICE vehicles. This diversity in regional markets contributes to the dominance of the ICE segment.

The electric vehicle (EV) segment is expected to witness the fastest CAGR during the forecast period. Increased awareness regarding environmental issues, notably climate change and air pollution, has led to a shift toward cleaner transportation alternatives. Moreover, ongoing advancements in battery technology have resulted in an increased EV range, faster charging times, and reduced costs. These advancements have made EVs more practical and appealing to a wider range of consumers.

Regional Insights

North America automotive software market dominated the global industry with a revenue share of over 35.2% in 2024 and is projected to grow at a significant CAGR over the forecast period. The region has a well-established and robust automotive industry, with a large number of automakers, suppliers, and technology companies. This industry strength drives innovation and the development of software solutions for vehicles. Furthermore, North America is a significant market for EVs and autonomous vehicles. Both of these segments heavily rely on software for powertrain control, battery management, autonomous driving features, and connectivity, which propels the growth of the market in the region.

U.S. Automotive Software Market Trends

The automotive software market in the U.S. dominated the regional industry in 2024. U.S. consumers and regulators are increasingly prioritizing vehicle safety, leading to high adoption of ADAS features such as lane departure warnings, automatic emergency braking, and adaptive cruise control. Moreover, regulatory bodies such as the National Highway Traffic Safety Administration (NHTSA) continue to encourage the integration of ADAS, pushing automotive software development in this country.

Europe Automotive Software Market Trends

The automotive software market in Europe is expected to grow over the forecast period. The European Union's Road Safety and Environmental Goals have mandated more safety features and lower emissions, leading to increased investment in software solutions for vehicle systems such as Advanced Driver Assistance Systems (ADAS) and eco-driving technologies. Moreover, EU Green Deal initiatives and regulations are pushing automakers to shift toward electric mobility, thus increasing the need for EV-specific software solutions.

Asia Pacific Automotive Software Market Trends

The automotive software market in Asia Pacific is expected to experience the fastest CAGR during the forecast period. The substantial technological progress witnessed in this region plays a key role in driving the surging demand for automotive software in the region. Furthermore, the growing embrace of technological innovations has further propelled the demand for automotive software solutions. The region has a substantial and growing population, which provides a large customer base for automotive manufacturers and is expected to fuel the growth of the automotive software industry.

Key Automotive Software Company Insights

Some key companies in the automotive software industry include Robert Bosch GmbH and Continental AG, and others. These two companies play a crucial role in the automotive software industry by developing advanced driver assistance systems (ADAS), autonomous driving solutions, and connected vehicle software.

-

Robert Bosch GmbH offers one of the most comprehensive automotive software portfolios, covering everything from powertrain solutions to telematics, safety, and cybersecurity. Its offerings address a wide range of automotive needs, positioning it as a one-stop shop for OEMs.

-

Continental AG focuses on embedded and connected software solutions essential for modern automotive functions like infotainment, OTA (over-the-air) updates, and cybersecurity. The company develops scalable, high-performance software has made them integral to next-generation, software-defined vehicles.

Key Automotive Software Companies:

The following are the leading companies in the automotive software market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services, Inc.

- Aptiv

- BlackBerry Limited

- Continental AG

- Cox Automotive

- Dassault Systemes

- NVIDIA Corporation

- Robert Bosch GmbH

- Siemens

- Sonatus, Inc.

Recent Developments

-

In September 2024, SDVerse, an automotive software provider for B2B businesses, launched the B2B Automotive Software Marketplace, a software-defined vehicle. The marketplace provides robust matchmaking features and product discovery, allowing vendors to display their software capabilities while enabling buyers to search, communicate securely, compare products side by side, and choose the most suitable software products to fulfill their requirements.

-

In March 2024, Arm Limited, an automotive technology company, launched Armv9-based technologies, integrated into the automotive sector, allowing the industry to harness the advanced AI, security, and virtualization features of this latest generation of Arm architecture. The company introduced new Arm Automotive Enhanced (AE) processors, which combine advanced Armv9 technology with server-class performance, offering significant benefits for AI-driven applications in automotive use cases.

-

In March 2024, General Motors, an electric vehicle supplier, collaborated with Wipro Limited, a technology services company, and Magna International Inc., an automotive supplier, to develop SDVerse, a B2B sales platform for automotive software. This platform is designed to transform the sourcing and procurement process for automotive software by offering a matchmaking hub for buyers and sellers of embedded automotive software.

Automotive Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 32.96 billion

Revenue forecast in 2030

USD 66.18 billion

Growth rate

CAGR of 15.0% from 2025 to 2030

Base year estimation

2024

Actual data

2017 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, vehicle type, product, propulsion type, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Amazon Web Services, Inc.; Aptiv; BlackBerry Limited; Continental AG; Cox Automotive; Dassault Systemes; NVIDIA Corporation; Robert Bosch GmbH; Siemens; and Sonatus, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global automotive software market report based on application, vehicle type, product, propulsion type, and region:

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

ADAS & Safety

-

Infotainment

-

Navigation

-

Autonomous Driving

-

Engine & Transmission

-

Smart Diagnostics & Predictive Maintenance

-

In-car Voice Assistance

-

Connectivity

-

Others

-

-

Vehicle Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Passenger Vehicles

-

Commercial Vehicles

-

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

OS

-

Middleware

-

Software Application

-

-

Propulsion Type Outlook (Revenue, USD Million, 2017 - 2030)

-

ICE

-

EV

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive software market size was estimated at USD 29.32 billion in 2024 and is expected to reach USD 32.96 billion in 2025.

b. The global automotive software market is expected to grow at a compound annual growth rate of 15.0% from 2025 to 2030 to reach USD 66.18 billion by 2030.

b. North America dominated the automotive software market with a share of 35.2% in 2024. North America has a well-established and robust automotive industry, with a large number of automakers, suppliers, and technology companies. This industry strength drives innovation and the development of software solutions for vehicles.

b. Some key players operating in the automotive software market include Amazon Web Services, Inc.; Aptiv; BlackBerry Limited; Continental AG; Cox Automotive; Dassault Systemes; NVIDIA Corporation; Robert Bosch GmbH; Siemens; and Sonatus, Inc.

b. Key factors that are driving the automotive software market growth include the rising demand for car-to-car communication, and advancements in autonomous vehicles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.