- Home

- »

- Advanced Interior Materials

- »

-

Automotive Plastic Fasteners Market Size Report, 2030GVR Report cover

![Automotive Plastic Fasteners Market Size, Share & Trends Report]()

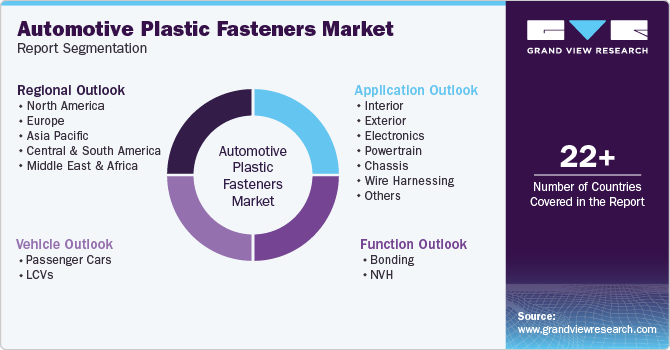

Automotive Plastic Fasteners Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Interior, Exterior, Electronics, Powertrain, Chassis, Wire Harnessing), By Function (Bonding, NVH), By Vehicle (Passenger Cars, LCVs), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-949-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Plastic Fasteners Market Trends

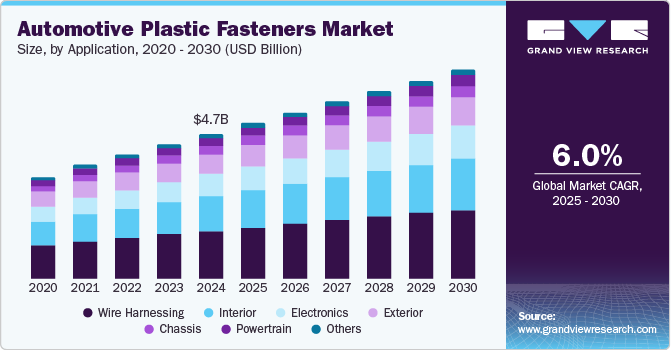

The global automotive plastic fasteners market size was valued at USD 4.66 billion in 2024 and is expected to grow at a CAGR of 6.0% from 2025 to 2030. This is owing to the increasing emphasis on fuel efficiency and emission reduction. As governments worldwide implement stricter regulations to curb carbon emissions, automotive manufacturers are constantly pressured to produce lighter and more fuel-efficient vehicles. Plastic fasteners, being significantly lighter than their metal counterparts, contribute to the overall weight reduction of vehicles, thereby enhancing fuel efficiency and reducing emissions.

Moreover, the cost efficiency associated with plastic fasteners has driven the market growth. In the highly competitive automotive industry, manufacturers have constantly sought ways to reduce production costs without compromising on quality. Plastic fasteners offer a cost-effective alternative to metal fasteners due to their lower material and manufacturing costs. This cost advantage is particularly crucial in the mass production of vehicles, where even small savings per unit can lead to substantial overall cost reductions.

In addition, modern plastic fasteners are engineered to offer high strength, durability, and resistance to various environmental factors such as corrosion and temperature fluctuations. These properties make them suitable for various automotive applications, including interior trim and engine components. For instance, Savino Barbera offers advanced chemically resistant nuts and bolts that feature molded plastic coatings for corrosive environments. The anti-acid thermoplastic coating fully insulates the metal components from any contamination by acidic liquids or vapors. The improved performance characteristics of plastic fasteners have increased their adoption in the automotive industry, propelling market growth.

Furthermore, the growing trend of electric vehicles (EVs) has stimulated the automotive plastic fasteners market. EVs require lightweight components to maximize their range and efficiency. Plastic fasteners, with their lightweight and durable properties, are ideal for use in EVs. Additionally, these fasteners can be easily molded into various shapes and sizes, allowing for greater design flexibility. Such flexibility enables automotive manufacturers to create aesthetically pleasing and customized vehicle interiors and exteriors, catering to the diverse preferences of consumers.

Application Insights

Wire harnessing dominated the market share in 2024 owing to the increasing complexity and integration of automotive electronics. Modern vehicles are equipped with advanced electronic systems, including infotainment, navigation, and driver assistance systems, which require reliable and efficient wire harnesses to function seamlessly. In addition, technological advancements in materials science have led to the development of high-performance plastics that offer superior strength and durability, further driving their adoption in wire harness applications. These materials ensure that the fasteners can withstand the mechanical stresses and thermal variations encountered in automotive applications.

The interior application segment is expected to grow at a CAGR of 6.5% over the forecast period. The market surge can be credited to the cost efficiency of plastic fasteners. They are generally more affordable to produce and install compared to metal fasteners, which makes them an attractive option for automotive manufacturers This cost advantage is particularly important in the highly competitive automotive industry, where manufacturers are constantly seeking ways to optimize their production processes. Additionally, the growing trend of vehicle customization and enhanced aesthetics has boosted the demand for interior plastic fasteners.

Function Insights

The bonding function secured a dominant market share of 81.4% in 2024, owing to the increasing demand for lightweight materials to enhance fuel efficiency and reduce emissions. Plastic fasteners, used in bonding applications, are significantly lighter than metal alternatives, which helps reduce vehicles' overall weight. This weight reduction is crucial for improving fuel economy and meeting stringent emission standards.

The Noise, Vibration, and Harshness (NVH) segment is expected to grow over the forecast period due to increased demand for enhanced in-vehicle comfort and reduced noise levels. As consumers prioritize a quieter and more comfortable driving experience, automotive manufacturers have increasingly focused on materials and components that can effectively minimize NVH. In turn, this has led to an increased demand for plastic fasteners. Additionally, these fasteners offer excellent noise-dampening properties that help manufacturers comply with strict noise pollution standards by reducing the transmission of vibrations and noise throughout the vehicle.

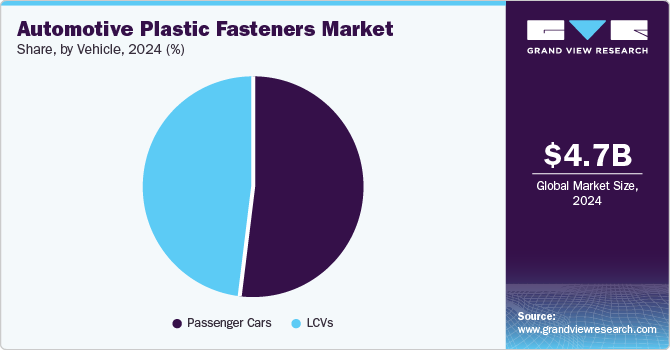

Vehicle Insights

Passenger cars registered the dominant market share of 51.0% in 2024 due to the increasing demand for lightweight materials to enhance fuel efficiency and reduce emissions. Plastic fasteners, being significantly lighter than metal alternatives, contribute to the overall weight reduction of vehicles. In addition, the rising consumer demand for passenger cars, fueled by increasing disposable incomes and urbanization, particularly in emerging economies such as China and India, has propelled the market.

Light Commercial Vehicles (LCVs) are expected to boost at the fastest CAGR during the forecast period with the rapid growth of the e-commerce and logistics sectors. The increasing penetration of the internet and smartphones has led to a surge in online retail sales necessitating efficient and timely delivery services. LCVs, being versatile and fuel-efficient, require plastic fasteners for their lightweight and durable properties.

Regional Insights

The North America automotive plastic fasteners market accounted for 12.3% in 2024 owing to the increasing emphasis on lightweight properties in the automotive industry. As manufacturers strive to improve fuel efficiency and reduce emissions, the market witnessed a concerted effort to replace heavier metal components with lighter plastic alternatives.

U.S. Automotive Plastic Fasteners Market Trends

The automotive plastic fasteners market in the U.S. is expected to be driven by the growing demand for electric vehicles (EVs) and hybrid vehicles over the forecast period. These vehicles rely heavily on lightweight components to maximize their range and efficiency. Plastic fasteners, with their lightweight and durable properties, are ideal for use in EVs and hybrids.

Asia Pacific Automotive Plastic Fasteners Market Trends

The Asia Pacific automotive plastic fasteners market held 54.9% of the global revenue share in 2024. The rapid expansion of the automotive industries in countries including China, India, Japan, and South Korea has significantly fueled the demand. The rising production of vehicles, particularly EVs, has boosted the demand for lightweight components including plastic fasteners. Additionally. These components are cost-effective compared to their metal counterparts, offering reduced manufacturing costs. Their corrosion resistance lowers maintenance needs, contributing to long-term cost savings for automotive manufacturers.

Europe Automotive Plastic Fasteners Market Trends

The automotive plastic fasteners market in Europe held considerable share in 2024. The market growth can be credited to the advancements in plastic materials technology. Modern plastic fasteners offered By OECHSLER AG, Heinze Gruppe, and MoldTecs, are engineered to offer high strength, durability, and resistance to various environmental factors such as temperature fluctuations and corrosion. These properties make them suitable for a wide range of automotive applications, including interior trim and engine components.

Key Automotive Plastic Fasteners Company Insights

Leading manufacturers have fueled growth by leveraging technological innovations, forming strategic partnerships, and boosting production capacities. These companies have increasingly concentrated on diversifying their product lines, optimizing supply chains, and addressing increasing consumer demand across multiple sectors.

Key Automotive Plastic Fasteners Companies:

The following are the leading companies in the automotive plastic fasteners market. These companies collectively hold the largest market share and dictate industry trends.

- Essentra Components

- ITW

- Avery Dennison

- Panduit

- Nifco Inc.

- BAND-IT

- SABIC

- DuPont

- Bossard Group

- MW Industries

- Stanley Black & Decker

- PennEngineering

- Bossard Group

Recent Developments

-

In September 2024, ARaymond announced its expansion into the pneumatic systems sector for commercial vehicles. The company aims to offer a comprehensive range of connectors, fasteners, and tubes designed for essential vehicle systems, including braking and suspensions.

-

In April 2024, TR Fastenings announced the launch of Plas-Tech 30-20, developed by the company’s technical engineering team. The new product features an optimized thread profile, enhancing performance across a wide range of plastic materials.

-

In September 2023, MW Components acquired Elgin Fastener Group, a manufacturer specializing in fasteners. This strategic move aims to enhance the company’s US-based manufacturing capabilities, enabling the provision of metal and fastener components and achieving global distribution.

Automotive Plastic Fasteners Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.00 billion

Revenue forecast in 2030

USD 6.70 billion

Growth rate

CAGR of 6.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, volume in billion units, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, vehicle, function, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Taiwan, South Korea, Brazil, Argentina, South Africa, Saudi Arabia

Key companies profiled

Essentra Components, ITW, Avery Dennison, Panduit, Nifco Inc., BAND-IT, SABIC, DuPont, Bossard Group, MW Industries, Stanley Black & Decker, PennEngineering, Bossard Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Plastic Fasteners Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive plastic fasteners market report based on application, vehicle, function, and region.

-

Application Outlook (Revenue, USD Million, Volume in Billion Units, 2018 - 2030)

-

Interior

-

Exterior

-

Electronics

-

Powertrain

-

Chassis

-

Wire harnessing

-

Others

-

-

Vehicle Outlook (Revenue, USD Million, Volume in Billion Units, 2018 - 2030)

-

Passenger cars

-

LCVs

-

-

Function Outlook (Revenue, USD Million, Volume in Billion Units, 2018 - 2030)

-

Bonding

-

NVH

-

-

Regional Outlook (Revenue, USD Million, Volume in Billion Units, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Taiwan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.