- Home

- »

- Automotive & Transportation

- »

-

Automotive Predictive Analytics Market Size Report, 2033GVR Report cover

![Automotive Predictive Analytics Market Size, Share & Trends Report]()

Automotive Predictive Analytics Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Software, Services, Hardware), By Application, By Vehicle Type, By End User, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-677-9

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Predictive Analytics Market Summary

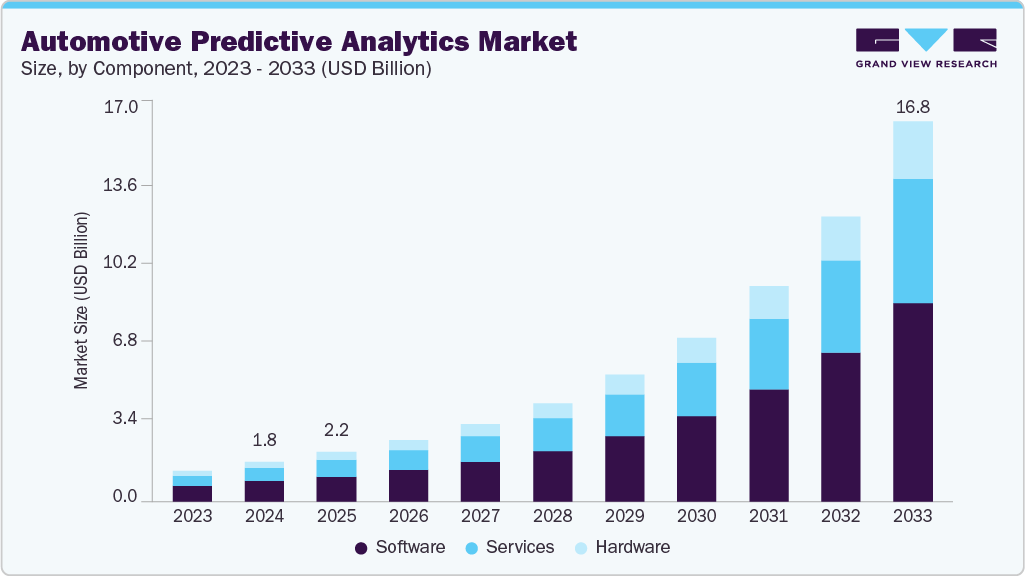

The global automotive predictive analytics market size was estimated at USD 1.77 billion in 2024, and is projected to reach USD 16.81 billion by 2033, growing at a CAGR of 29.1% from 2025 to 2033. This steady growth is attributed to the rising integration of AI and machine learning machine learning in connected vehicles, increasing demand for predictive maintenance solutions, growing adoption of telematics and usage-based insurance models, and the rapid proliferation of electric and autonomous vehicles that rely heavily on real-time data analytics for performance optimization and safety enhancements.

Key Market Trends & Insights

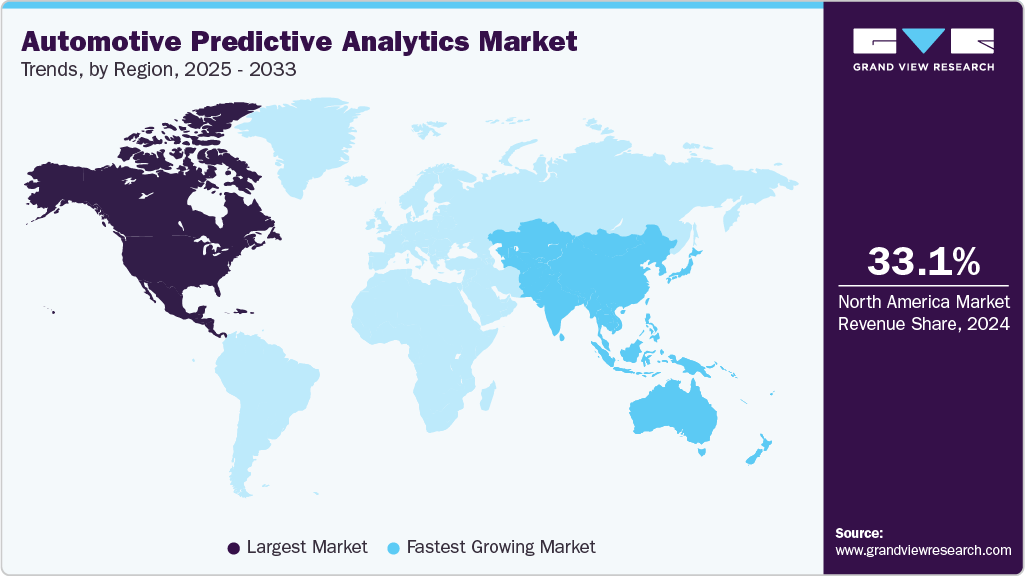

- The North America automotive predictive analytics market accounted for a revenue share of 33.1% in 2024.

- The automotive predictive analytics industry in the U.S. held a dominant position in 2024.

- By component, the software segment accounted for the largest share of 51.7% in 2024.

- By application, the predictive maintenance segment held the largest market share in 2024.

- By vehicle type, the passenger cars segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.77 Billion

- 2033 Projected Market Size: USD 16.81 Billion

- CAGR (2025-2033): 29.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market in 2024

The integration of Vehicle-to-Everything (V2X) communication, particularly Vehicle-to-Vehicle (V2V) and Vehicle-to-Infrastructure (V2I), has played a pivotal role in enhancing predictive decision-making in the automotive space. The U.S. Department of Transportation’s ongoing efforts, such as its Connected Vehicle Pilot Deployment Program, have shown measurable benefits in safety and congestion reduction through real-time data sharing. Vehicles equipped with DSRC (Dedicated Short-Range Communications) or C-V2X technologies can now exchange braking, location, and speed data, enabling predictive systems to anticipate accidents and dynamically reroute traffic. This technological shift is boosting the market for predictive analytics by embedding intelligence into traffic management and in-vehicle systems, with ripple effects across public safety and commercial transport.Government agencies are increasingly utilizing predictive analytics to maintain road safety and reduce accident risks, particularly during extreme weather. A notable example is the Aurora Pooled Fund’s 2024 CVFM (Connected Vehicle Friction Measurement) project, which collects friction data from vehicles to forecast road slipperiness. In states like Iowa and Minnesota, this data is combined with maintenance logs to optimize de-icing and snow removal operations. These developments are propelling the market growth by enabling vehicles to alert drivers of hazardous surfaces before human sensors can even detect them. This is especially valuable for autonomous and electric vehicles, where precision and preemptive responses are mission-critical.

The incorporation of crowdsourced video analytics and in-vehicle camera data is unlocking new predictive insights for infrastructure agencies and OEMs. In 2023, the Michigan Department of Transportation launched a pilot that used dashcam and external sensor data from connected vehicles to monitor pedestrian movement, traffic bottlenecks, and near-collision incidents. These insights allowed local governments to predict high-risk zones and adjust traffic signals or signage preemptively. This convergence of telematics, video feeds, and analytics is boosting the market by offering a multi-modal approach to predictive analysis, not just for vehicles, but for entire transportation ecosystems.

Public agencies are backing the implementation of machine learning and big data to simulate and predict vehicle movement in congested corridors. For instance, the U.S. DOT’s DRIVE CAVAMS program (2021-2024) used Apache Spark and real-time data from connected vehicles on I-405 in Seattle to test predictive traffic flow algorithms. These models accurately projected travel times, congestion buildup, and optimal routing decisions. This public-private collaboration is propelling the market growth by proving the viability of large-scale, AI-enabled traffic analytics, which are increasingly embedded into navigation systems and OEM infotainment platforms.

As predictive analytics systems become more data-hungry and interconnected, concerns around privacy and cybersecurity have surged. In 2024, the U.S. General Services Administration (GSA) published a comprehensive framework for managing telematics data collected from federal vehicle fleets. It recommended encryption, anonymization, and secure over-the-air update protocols for all predictive analytics platforms. Simultaneously, the Federal Trade Commission (FTC) has issued guidance on preventing misuse of vehicle geolocation and biometric data. These policy measures are boosting the market by strengthening consumer and regulatory trust in analytics platforms, especially those that rely on cloud-based predictive models and real-time behavioral data.

Component Insights

The software segment led the automotive predictive analytics industry with the largest revenue share of 51.7% in 2024. Software remains the primary enabler in the predictive analytics ecosystem, offering the computational frameworks necessary to process vehicle data at scale. From AI algorithms that assess engine behavior to cloud-based platforms analyzing driver habits, software solutions are becoming deeply integrated into modern automotive systems. The rise of modular software architectures and platform-as-a-service (PaaS) models has made it easier for OEMs to embed predictive capabilities without overhauling existing infrastructure.

The services segment is expected to grow at a significant CAGR during the forecast period. With the increasing complexity of vehicle data ecosystems, services have become essential to deploying and maintaining predictive analytics platforms. Implementation, system integration, and ongoing support services are in high demand, particularly among fleets and OEMs transitioning from traditional maintenance approaches. Customized consulting services also play a vital role in tailoring analytics use cases to individual business objectives, such as warranty cost reduction or driver behavior modeling.

Application Insights

The predictive maintenance segment held the largest share of the automotive predictive analytics industry in 2024. The ability to identify potential component failures before they occur has significantly improved operational efficiency for both consumers and fleet owners. With the growing number of sensors embedded in vehicles and increasing computing power, predictive models have become more accurate, enabling timely service interventions and reducing long-term vehicle wear.

The Vehicle Telematics segment is expected to grow at a significant CAGR during the forecast period. Telematics applications have evolved beyond traditional GPS tracking to include deep data analytics related to vehicle usage, driver behavior, and mechanical performance. Predictive insights derived from telematics data are increasingly used by insurers, maintenance providers, and logistics companies to optimize decision-making. The growing standardization of telematics integration across vehicle platforms supports broader analytics deployment.

Vehicle Type Insights

The passenger cars segment dominated the automotive predictive analytics market in 2024, due to consumer demand for smarter and safer vehicles. Modern vehicles are now equipped with systems that monitor tire pressure, brake wear, and fuel efficiency, often connected to smartphone apps or OEM dashboards. This creates a continuous feedback loop, where data is leveraged not only for maintenance but also for enhancing the driving experience and personalization.

The Electric Vehicles (EVs) segment is projected to grow at the fastest CAGR over the forecast period. EVs are increasingly reliant on predictive analytics for battery management, thermal regulation, and performance forecasting. As battery lifespan and charging behavior are critical factors in EV ownership, predictive tools help drivers and fleet operators plan routes and charging schedules more effectively. The growing share of EVs in new vehicle sales has also encouraged manufacturers to develop analytics platforms specifically designed for electric powertrains.

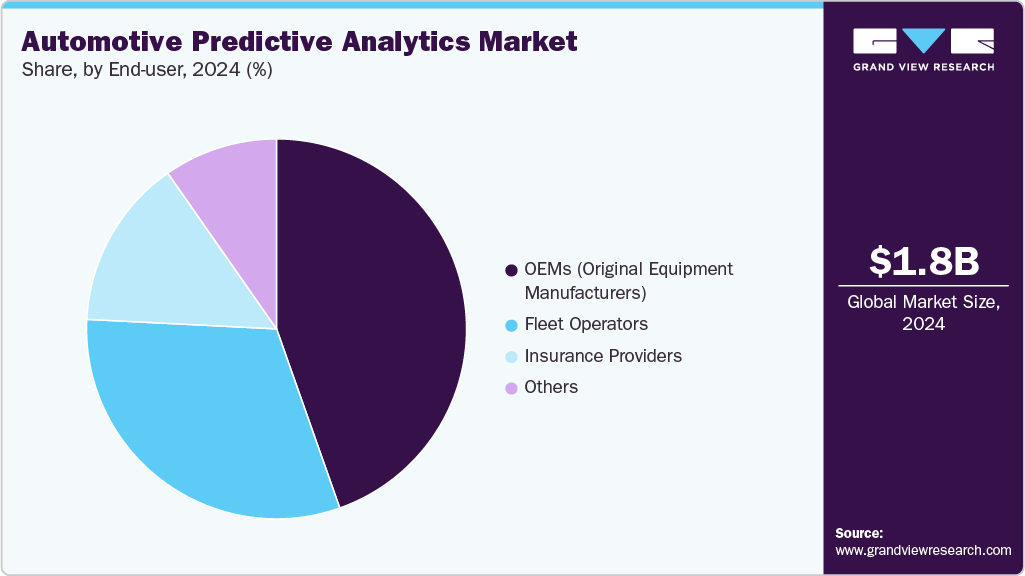

End User Insights

The OEMs (Original Equipment Manufacturers) segment dominated the automotive predictive analytics market in 2024 and is projected to grow at a significant CAGR over the forecast period. OEMs are integrating predictive analytics into both product development and after-sales strategies. Applications range from analyzing warranty claim patterns to monitoring component quality during production. Additionally, many OEMs are embedding analytics engines directly into infotainment and telematics systems, allowing them to collect user data and refine vehicle performance post-delivery. This internal usage of analytics supports more adaptive vehicle designs and service models.

The fleet operators segment is projected to grow at the fastest CAGR over the forecast period. Fleet operators have embraced predictive analytics to increase asset utilization, improve safety, and manage costs. By leveraging historical and real-time data, fleet managers can schedule maintenance more effectively, monitor driver behavior, and minimize unexpected downtime. The combination of GPS data, telematics input, and environmental conditions allows for more informed decision-making, which is particularly valuable in logistics, ride-hailing, and public transportation services.

Regional Insights

The North America automotive predictive analytics market dominated with the largest revenue share of 33.1% in 2024, and is projected to grow at a significant CAGR over the forecast period. North America has emerged as a leading hub for predictive analytics in the automotive space, primarily due to substantial federal support for connected vehicle technologies. According to the U.S. Department of Transportation, as of September 2022, over USD 800 million has been invested across state-level pilot programs aimed at testing V2X communication, real-time traffic prediction, and intelligent transportation systems. As of 2024, more than 38 states are actively deploying V2X-based safety features and predictive algorithms that enable traffic forecasting and incident avoidance. These government-backed programs have laid the groundwork for scalable analytics platforms integrated directly into vehicle systems and public road infrastructure.

U.S. Automotive Predictive Analytics Market Trends

The U.S. automotive predictive analytics industry held a dominant position in 2024.In the U.S., public institutions have taken a leadership role in shaping the future of predictive mobility. The Volpe Center’s study on Transportation in the Age of AI and Predictive Analytics outlined the way machine learning is being embedded into vehicle systems to enhance crash prediction, vehicle diagnostics, and traffic forecasting. Federal agencies, such as the NHTSA and the Vehicle Research and Test Center in Ohio, are also focusing on the safety validation of predictive electronic systems, especially those involving software-defined vehicles and autonomous functions. These initiatives have positioned the U.S. as a foundational market where government policy actively enables automotive predictive innovation.

Europe Automotive Predictive Analytics Market Trends

Across Europe, the adoption of predictive analytics is largely shaped by national AI strategies and regional transport policies. The UK government’s AI Barometer (2021) highlights the growing influence of predictive analytics in traffic management, logistics, and connected mobility. Governments are not only investing in data infrastructure but also strengthening regulatory oversight around algorithmic safety, cybersecurity, and data governance. This regulatory clarity is fostering a favorable environment for automotive manufacturers and analytics providers to scale intelligent systems.

The Germany automotive predictive analytics market is witnessing a progressive shift toward predictive vehicle technologies, largely driven by government support for autonomous mobility, connected infrastructure, and AI-based safety systems. As part of the Federal Ministry for Digital and Transport’s (BMDV) ongoing "Digital Testbed Autobahn" initiative, predictive analytics is being trialed on highways like the A9 to simulate real-time vehicle communication, traffic prediction, and system self-diagnosis. This initiative enables automotive manufacturers and tech firms to validate AI-driven features such as adaptive cruise prediction, predictive lane-change safety, and maintenance alerts.

The automotive predictive analytics market in the UK has demonstrated clear governmental support for automotive AI and predictive mobility. The Centre for Connected and Autonomous Vehicles (CCAV) works closely with OEMs and AI vendors to ensure data accountability and algorithmic transparency. The UK government has also highlighted traffic modeling, predictive maintenance, and route optimization as key opportunities within the broader logistics and transport AI ecosystem. This institutional backing ensures that analytics is not only deployed effectively but also regulated in a way that builds public trust.

Asia Pacific Automotive Predictive Analytics Market Trends

The Asia Pacific automotive predictive analytics industry is expected to grow at the fastest CAGR from 2025 to 2033. The Asia-Pacific region is rapidly evolving into a key adopter of automotive predictive analytics, fueled by public investment in smart mobility infrastructure, connected vehicle ecosystems, and electrification initiatives. Governments across APAC are focusing on reducing urban congestion, enhancing road safety, and improving fleet efficiency using AI-driven platforms. Projects such as smart city rollouts in Singapore, EV policy mandates in South Korea, and autonomous driving zones in China and Japan have created fertile ground for real-time data analytics. Additionally, APAC’s dominance in EV production and battery manufacturing is accelerating demand for predictive solutions around battery health diagnostics, charging behavior analytics, and range optimization. As urban centers modernize traffic systems and integrate vehicle telematics, predictive analytics is becoming essential to supporting AI-enabled mobility in both public and private sectors.

The China automotive predictive analytics market is expected to grow over the forecast period. China is aggressively pushing the boundaries of intelligent transportation and predictive automotive systems through its New Infrastructure Plan and Vehicle-Road-Cloud Integration strategy. As outlined by the Ministry of Industry and Information Technology (MIIT), pilot cities such as Beijing, Shanghai, and Wuhan are deploying Intelligent Connected Vehicle (ICV) networks that combine edge computing, high-definition maps, and V2X communication. These systems enable real-time analytics for collision prediction, dynamic routing, and predictive maintenance in both passenger and commercial fleets. Furthermore,

The automotive predictive analytics market in Japan is anticipated to grow during the forecast period. Japan is advancing the adoption of predictive automotive technologies through its commitment to connected infrastructure, autonomous driving, and vehicle safety innovation. Under the supervision of the Ministry of Land, Infrastructure, Transport and Tourism (MLIT), Japan has designated several Advanced Mobility Testing Corridors, notably in Tokyo and Aichi prefectures, where OEMs test AI-powered prediction models for traffic forecasting, pedestrian behavior analysis, and accident avoidance.

Key Automotive Predictive Analytics Company Insights

Some of the major players in the automotive predictive analytics market include IBM; SAP SE; SAS Institute Inc.; Microsoft; and Oracle. These companies provide scalable platforms capable of processing massive volumes of real-time vehicle data, supporting applications such as predictive maintenance, driver behavior analysis, and fleet optimization. Their advanced software suites include machine learning models, digital twins, and IoT integration, enabling automotive OEMs and fleet operators to gain actionable insights, reduce downtime, and enhance operational efficiency. Additionally, their long-standing relationships with global automotive manufacturers allow them to co-develop tailored solutions that address the specific demands of connected and autonomous vehicles, making them critical enablers of data-driven transformation in the mobility ecosystem.

-

IBM is a leading provider of AI-driven analytics platforms tailored for the automotive industry, particularly in the realm of predictive maintenance, connected mobility, and operational forecasting. Through its Watsonx and IBM Cloud Pak solutions, IBM enables real-time analysis of streaming vehicle data, supporting applications such as component wear prediction, route optimization, and failure diagnostics. The company also partners with OEMs to deploy edge-to-cloud intelligence, allowing vehicles to process sensor data locally and integrate with broader cloud systems for predictive insights. IBM’s decades of experience in enterprise analytics, combined with recent investments in AI governance, make it a key enabler of scalable, trustworthy predictive solutions for autonomous driving systems, smart manufacturing, and supply chain resilience within the automotive sector.

-

PTC plays a pivotal role in the automotive predictive analytics ecosystem by offering software platforms that connect digital product development with real-time operational data. Its flagship solutions, such as ThingWorx and Windchill+, empower automotive manufacturers to build digital twins of components and vehicles, simulate performance, and apply predictive analytics for maintenance planning and product lifecycle optimization. PTC’s recent collaborations with global automotive suppliers have helped accelerate the shift to cloud-based predictive diagnostics, particularly in areas like drivetrain efficiency, thermal system monitoring, and fleet asset management. The company’s strength lies in its ability to blend IoT, augmented reality, and AI-powered analytics into a unified ecosystem that helps OEMs and Tier 1s transform vehicle data into proactive decision-making.

Key Automotive Predictive Analytics Companies

The following are the leading companies in the automotive predictive analytics market. These companies collectively hold the largest market share and dictate industry trends.

- IBM

- SAP SE

- Cloud Software Group, Inc.

- Continental AG

- Microsoft

- NXP Semiconductors

- Oracle

- PTC

- Robert Bosch GmbH

- SAS Institute Inc.

- ZF Friedrichshafen AG

Recent Developments

-

In May 2025, during its Think 2025 conference, IBM demonstrated Watsonx-powered real-time analytics by transforming streaming sensor data from a Formula 1 race car into personalized insights. These edge-to-cloud intelligence demonstrations mirror the demands of automotive systems-processing high-frequency data (like temperature, pressure, and telemetry) to support predictive diagnostics, performance tuning, and safety analytics.

-

In April 2025, PTC and Schaeffler deepened their strategic partnership by transitioning to Windchill+, PTC’s cloud-based PLM (Product Lifecycle Management) platform that incorporates AI-enhanced tools. This move enables Schaeffler-an industrial and automotive systems supplier-to accelerate predictive maintenance cycles, streamline product development, and run cloud-powered analytics across vehicle components and subsystems.

Automotive Predictive Analytics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.18 billion

Revenue forecast in 2033

USD 16.81 billion

Growth Rate

CAGR of 29.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, application, vehicle type, end user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

IBM; SAP SE; Cloud Software Group, Inc.; Continental AG; Microsoft; NXP Semiconductors; Oracle; PTC; Robert Bosch GmbH; SAS Institute Inc.; ZF Friedrichshafen AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Predictive Analytics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global automotive predictive analytics market report based on component, application, vehicle type, end user, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Software

-

Services

-

Hardware

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Predictive Maintenance

-

Vehicle Telematics

-

Driver & Behavior Analytics

-

Fleet Management

-

Warranty Analytics

-

Others

-

-

Vehicle Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Passenger Cars

-

Commercial Vehicles

-

Electric Vehicles (EVs)

-

-

End User Outlook (Revenue, USD Million, 2021 - 2033)

-

OEMs (Original Equipment Manufacturers)

-

Fleet Operators

-

Insurance Providers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive predictive analytics market size was estimated at USD 1.77 billion in 2024 and is expected to reach USD 2.18 billion in 2025.

b. The global automotive predictive analytics market size is expected to grow at a significant CAGR of 29.1% to reach USD 16.81 billion in 2033.

b. North America held the largest market share of 33.1% in 2024. North America has emerged as a leading hub for predictive analytics in the automotive space, primarily due to substantial federal support for connected vehicle technologies.

b. Some of the players in the Automotive Predictive Analytics market are IBM, SAP SE, Cloud Software Group, Inc., Continental AG, Microsoft, NXP Semiconductors, Oracle, PTC, Robert Bosch GmbH, SAS Institute Inc., and ZF Friedrichshafen AG.

b. The key driving trend in the automotive predictive analytics market is the rapid integration of advanced machine learning and AI-driven predictive maintenance systems within connected and ADAS-equipped vehicles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.