- Home

- »

- Automotive & Transportation

- »

-

Automotive Steering Market Size, Industry Report, 2033GVR Report cover

![Automotive Steering Market Size, Share & Trends Report]()

Automotive Steering Market (2025 - 2033) Size, Share & Trends Analysis By Components (Hydraulic Pump, Steering Column/Rack, Sensors, Electric Motor, Other), By Mechanism, By Vehicle Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-657-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Steering Market Summary

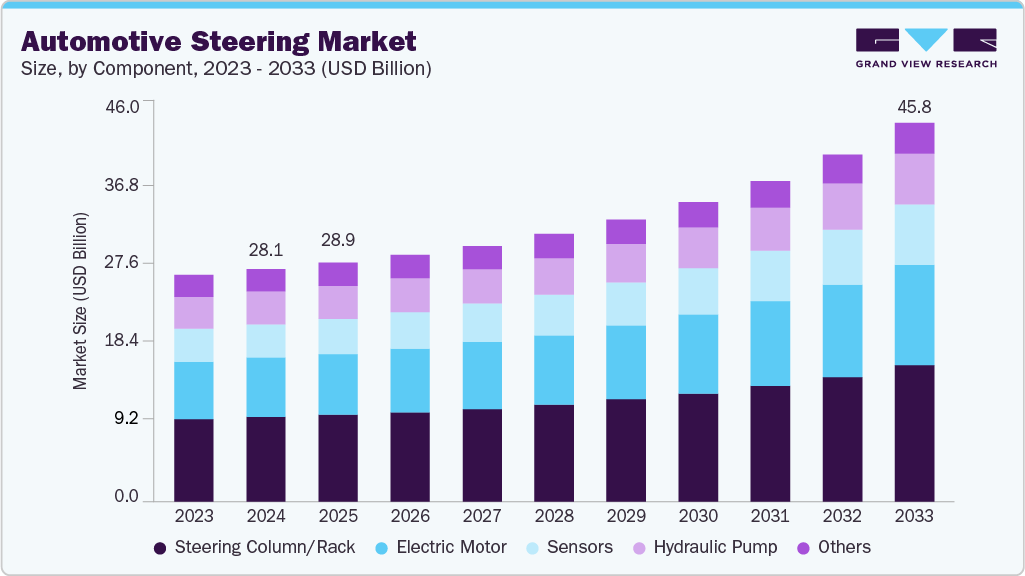

The global automotive steering market size was estimated at USD 28.08 billion in 2024 and is projected to reach USD 45.79 billion in 2033, growing at a CAGR of 5.9% from 2025 to 2033. The market is experiencing significant growth, driven primarily by technological advancements and shifting consumer preferences.

Key Market Trends & Insights

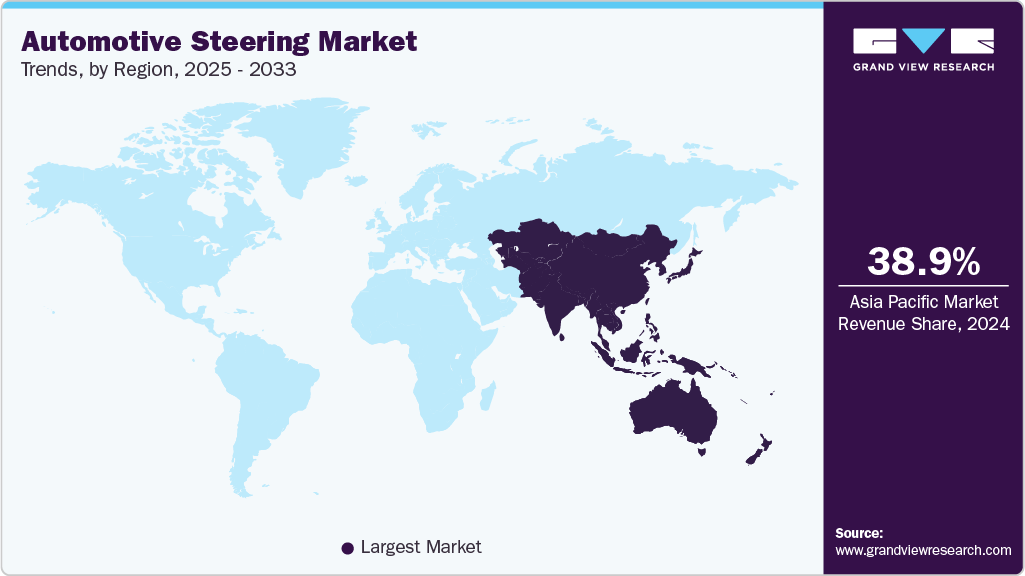

- Asia Pacific dominated the automotive steering industry with the largest revenue share of 38.94% in 2024.

- The automotive steering market in China is the largest in Asia Pacific, primarily due to the country’s high vehicle production volumes, strong domestic demand for passenger and electric vehicles, and supportive government policies promoting EV adoption and intelligent transportation systems.

- By component, the steering column/rack segment held the largest revenue share of 36.30% in 2024.

- By mechanism, the electronic power steering held the largest revenue share of 69.27% in 2024.

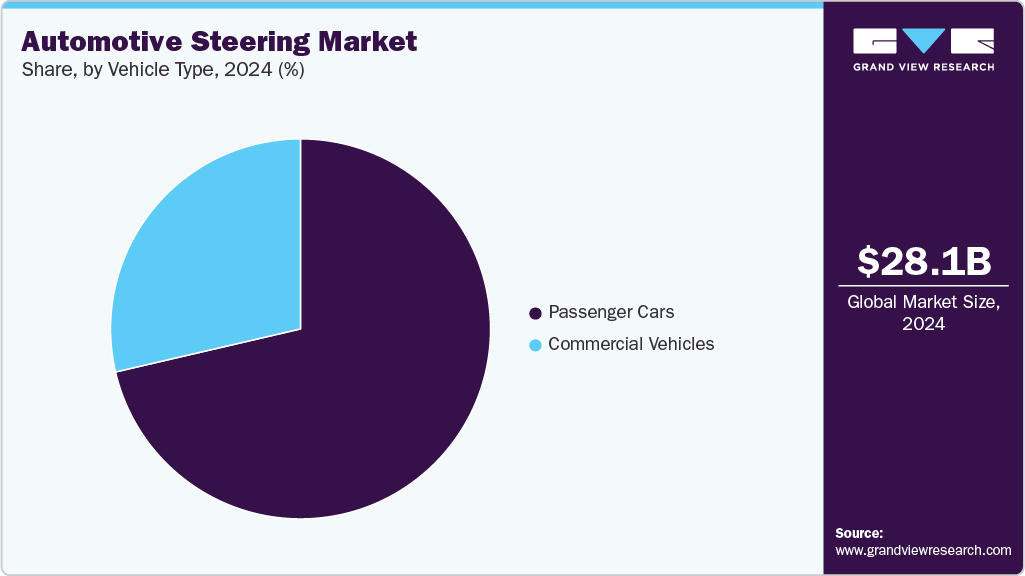

- By vehicle type, the passenger cars segment held the largest revenue share of 71.36% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 28.08 Billion

- 2033 Projected Market Size: USD 45.79 Billion

- CAGR (2025-2033): 5.9%

- Asia Pacific: Largest market in 2024

One of the most impactful developments is the widespread adoption of Electric Power Steering (EPS), which replaces traditional hydraulic systems due to its superior fuel efficiency, reduced emissions, and enhanced driving comfort.In addition, the rise of autonomous and semi-autonomous vehicles is accelerating demand for advanced steering technologies such as steer-by-wire and adaptive steering systems, which integrate seamlessly with Advanced Driver Assistance Systems (ADAS). Innovations like AI-driven predictive steering and commercial vehicles enabled smart steering systems are further transforming the market, offering improved safety and responsiveness.

Rapid electric and hybrid vehicle production growth further accelerates the demand for advanced steering systems. Electric vehicles (EVs), due to their architecture and energy efficiency requirements, benefit significantly from EPS and steer-by-wire systems, which eliminate the need for engine-driven hydraulic pumps. Moreover, the push by governments across regions such as Europe, China, and the U.S. for cleaner mobility solutions is prompting OEMs to invest in lightweight, energy-saving steering technologies that complement the design and efficiency goals of EV platforms.

Furthermore, government regulations and consumer demand for safer vehicles influence the adoption of steering systems supporting enhanced safety functionalities. Regulatory bodies like the National Highway Traffic Safety Administration (NHTSA) and the European New Car Assessment Programme (Euro NCAP) are pushing for safer vehicle designs, which in turn are encouraging OEMs to integrate steering systems capable of supporting ADAS and emergency maneuverability features.

One of the primary restraints limiting the widespread adoption of advanced steering systems, particularly Electronic Power Steering (EPS) and steer-by-wire technologies, is their high cost and system complexity. Compared to traditional hydraulic steering systems, EPS involves intricate electronics, sensors, actuators, and software components, increasing production costs and vehicle pricing. This cost sensitivity is especially critical in price-conscious markets such as India, Southeast Asia, and parts of Latin America, where consumers often prioritize affordability over advanced features.

Component Insights

In terms of components, the market is classified into hydraulic pumps, steering columns/racks, sensors, electric motors, and others. The steering column/rack segment dominated the overall market, gaining a market share of 36.30% in 2024 and witnessing a CAGR of 5.8% during the forecast period. This dominance can be attributed to its critical role in connecting the steering wheel to the steering mechanism, thereby ensuring accurate control and maneuverability of the vehicle. In addition, technological advancements such as collapsible and adjustable steering columns, as well as their integration with electric power steering systems and safety features like steering angle sensors and energy-absorbing structures, have reinforced their demand across both passenger and commercial vehicles.

The sensors segment is expected to grow fastest at a CAGR of 7.0% throughout the forecast period. This growth is driven by the increasing integration of Advanced Driver Assistance Systems (ADAS) and the shift toward electrification and autonomous driving technologies, which require precise and real-time input from various steering sensors. These include torque sensors, angle sensors, and position sensors that enable accurate steering response, stability control, and seamless interaction with electronic control units (ECUs). As automakers continue to enhance vehicle safety, comfort, and automation levels, the demand for high-performance, intelligent sensor solutions in steering systems is expected to rise significantly, particularly in premium and electric vehicle segments.

Mechanism Insights

In terms of mechanism, the market is classified into electronic power steering (EPS), hydraulic power steering (HPS), and electrically assisted hydraulic power steering. The electronic power steering (EPS) segment dominated the market in 2024 and accounted for a revenue share of 69.27%. This dominance is attributed to the growing preference for EPS over traditional hydraulic systems due to its superior fuel efficiency, reduced maintenance, and compatibility with modern vehicle architectures. EPS eliminates the need for a hydraulic pump, thereby reducing engine load and improving overall vehicle performance. Furthermore, the increasing adoption of electric and hybrid vehicles, where EPS is essential due to the absence of an internal combustion engine, further accelerates segment growth.

The electrically assisted hydraulic power steering segment is anticipated to register significant growth during the forecast period, growing at a CAGR of 5.4% throughout the forecast period. EHPS systems combine hydraulic and electric power steering benefits by using an electric motor to drive the hydraulic pump, rather than relying on engine power. This configuration offers improved fuel efficiency over conventional hydraulic systems while delivering the robust steering force required for heavier vehicles such as SUVs, trucks, and commercial vehicles. The EHPS segment is gaining traction, particularly in transitional vehicle platforms, where full EPS integration may not be feasible due to cost or performance constraints.

Vehicle Type Insights

In terms of vehicle type, the market is classified into passenger cars and commercial vehicles. Among them, the passenger cars segment dominated the market with a share of 71.36% in 2024. The dominance is primarily driven by the high global production and sales volume of passenger vehicles and the rising demand for advanced safety and comfort features among individual consumers. The growing adoption of Electric Power Steering (EPS) systems in passenger cars, particularly compact and mid-sized vehicles, further supports the segment's growth.

The commercial vehicles segment is expected to grow fastest at a CAGR of 6.4% throughout the forecast period. This growth is driven by the rising demand for heavy-duty trucks, buses, and delivery vehicles, especially in logistics, construction, and e-commerce. As fleet operators increasingly prioritize vehicle efficiency, safety, and driver comfort, adopting advanced steering systems such as electrically assisted hydraulic power steering (EHPS) and electronic power steering (EPS) is gaining momentum in the commercial vehicle segment. Moreover, government regulations to improve vehicle safety and reduce emissions are prompting manufacturers to upgrade steering technologies in both light and heavy commercial vehicles.

Regional Insights

Asia Pacific led the overall market in 2024, with a market share of 38.94%. This dominance can be attributed to the region’s high vehicle production volumes, rapidly expanding automotive industry, and growing consumer demand for technologically advanced and fuel-efficient vehicles. Countries such as China, Japan, India, and South Korea are major automotive manufacturing hubs, supported by strong domestic markets, favorable government policies, and substantial investments in electric vehicle development. Moreover, rising urbanization, infrastructure development, and increasing disposable incomes further accelerate vehicle ownership across emerging Asian economies, boosting the demand for modern and reliable steering systems.

China Automotive Steering Market Trends

The automotive steering market in China holds the largest share in the Asia Pacific market, driven by its position as the world’s largest automotive producer and consumer. The country’s robust manufacturing infrastructure, strong domestic demand, and early adoption of electric vehicles (EVs) and advanced driver-assistance systems (ADAS) have accelerated the integration of advanced steering technologies such as electronic power steering (EPS) and steer-by-wire systems.

India automotive steering marketis expected to grow significantly, owing to the growing middle class, urbanization, and increasing disposable income boost demand for passenger and commercial vehicles. The government’s push for infrastructure development and last-mile connectivity further drives commercial vehicle sales, directly increasing the demand for advanced steering systems. In addition, stringent emission norms (BS6) and the need for fuel efficiency are accelerating the transition from Hydraulic Power Steering (HPS) to Electric Power Steering (EPS). EPS systems reduce engine load, improving fuel economy and reducing CO₂ emissions, making them a preferred choice for automakers.

North America Automotive Steering Market Trends

The automotive steering market in North America is expected to grow at a CAGR of 5.8% throughout the forecast period. The market is well-established and technology-driven, led by strong vehicle production, particularly in the U.S. and Mexico. The electrification of commercial fleets, rising demand for light trucks and SUVs, and government initiatives promoting clean transportation contribute to the region's growth. North America is also at the forefront of autonomous vehicle development, further supporting the need for precise and responsive steering technologies.

The U.S. automotive steering market is the rising demand for pickup trucks, SUVs, and light commercial vehicles, which require more robust and responsive steering systems. Unlike many global markets prioritizing compact cars, the U.S. consumer preference leans heavily toward larger vehicles for personal and commercial use. This trend fuels the adoption of electrically assisted hydraulic power steering (EHPS) and high-capacity electronic power steering (EPS) systems that offer enhanced control and comfort in larger vehicle platforms. Moreover, the increasing popularity of off-road and towing-capable vehicles pushes automakers to focus on steering technologies that ensure precision handling under heavier loads and varied terrain.

Europe Automotive Steering Market Trends

The automotive steering market in Europe represents a mature and technologically advanced market, with high adoption rates of ADAS, autonomous driving features, and electrification across passenger and commercial vehicle segments. Countries like Germany, France, and the UK lead in automotive innovation, fostering demand for steering systems that support precision handling, safety, and driver comfort. The widespread presence of premium and luxury vehicle manufacturers, along with stringent regulatory standards related to emissions and road safety (such as Euro NCAP), is pushing the integration of EPS, steer-by-wire, and sensor-driven steering technologies. Furthermore, Europe’s strong focus on sustainability and green mobility accelerates the transition from hydraulic to electric and hybrid steering systems, making the region a key player in driving future innovations.

The UK automotive steering marketis growing significantly over the forecast period. The UK’s commitment to phasing out internal combustion engine vehicles by 2035 has led to significant investments in EV manufacturing and related components, including advanced steering technologies. Moreover, premium automakers and Tier 1 suppliers in the region support ongoing innovation and integration of ADAS-compatible steering systems. Despite economic uncertainties, the market remains resilient due to continuous R&D and a strong regulatory push for cleaner and safer mobility.

Key Automotive Steering Company Insights

Some of the leading automotive steering providers globally included in the study are Showa Corporation, Nexteer Automotive Corporation, NSK Ltd, JTEKT Corporation, Robert Bosch GmbH, among others. Companies operating in the market are actively investing in research and development (R&D) to improve their steering technologies' efficiency, precision, and sustainability. Key areas of innovation include the development of steer-by-wire systems, advanced sensor integration, and electronic control units (ECUs) that enable adaptive and responsive steering performance. Manufacturers increasingly incorporate artificial intelligence (AI), Internet of Things (IoT), and cloud-based diagnostics to enhance steering accuracy, enable remote monitoring, and support predictive maintenance. Furthermore, steering systems are designed to work seamlessly with ADAS and autonomous driving platforms, leveraging real-time data processing and geospatial intelligence for optimal vehicle control. These advancements aim to deliver safer, more connected, and energy-efficient steering solutions that meet evolving regulatory standards and consumer expectations.

-

Showa Corporation, established in 1938 and headquartered in Gyoda, Saitama Prefecture, is a Japanese automotive components manufacturer specializing in steering systems, suspension components, and shock absorbers. It is a subsidiary of Hitachi Astemo. The company develops and supplies power steering systems, electronic power steering (EPS), and related components primarily for passenger and motorcycle applications.

-

Nexteer Automotive Corporation is a motion control technology company specializing in advanced steering and driveline systems. Headquartered in Auburn Hills, Michigan (U.S.), It has a strong global presence with engineering centers, manufacturing facilities, and customer support services across North America, Europe, and Asia Pacific.

Key Automotive Steering Companies:

The following are the leading companies in the automotive steering market. These companies collectively hold the largest market share and dictate industry trends.

- ZF Friedrichshafen AG

- Showa Corporation

- Nexteer Automotive Corporation

- NSK Ltd

- JTEKT Corporation

- Robert Bosch GmbH

- Hyundai Mobis CO., Ltd

- Thyssenkrupp Presta

- Mando Corporation

- Sona Corporation

Recent Developments

-

In April 2025, Nexteer Automotive Corporation announced the launch of high-output column-assist electric power steering (HO CEPS), a powerful addition to its steering portfolio that delivers up to 110 Nm of assist torque, compared to the standard 40-95 Nm range. This advancement enables the system to support larger, heavier vehicles such as SUVs and entry-level EVs, while preserving steering precision, efficiency, and cost-effectiveness.

-

In September 2022, Hyundai Mobis CO., Ltd launched its advanced dual actuator rear wheel steering system to enhance vehicle maneuverability and driving dynamics. The system delivers a 25% reduction in turning radius, significantly improving urban drivability, particularly in tight spaces and congested parking environments. In addition, it enhances high-speed stability and ride comfort during cornering, elevating overall driving performance.

Automotive Steering Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 28.86 billion

Revenue forecast in 2033

USD 45.79 billion

Growth rate

CAGR of 5.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, mechanism, vehicle type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Showa Corporation; Nexteer Automotive Corporation; NSK Ltd; JTEKT Corporation; Robert Bosch GmbH; Hyundai Mobis CO., Ltd; Thyssenkrupp Presta; Mando Corporation; Sona Corporation; ZF Friedrichshafen AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Steering Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global automotive steering market based on component, mechanism, vehicle type, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Hydraulic Pump

-

Steering Column/Rack

-

Sensors

-

Electric Motor

-

Others

-

-

Mechanism Outlook (Revenue, USD Million, 2021 - 2033)

-

Electronic Power Steering (EPS)

-

Hydraulic Power Steering (HPS)

-

Electrically Assisted Hydraulic Power Steering

-

-

Vehicle Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Passenger Cars

-

Commercial Vehicles

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive steering market size was estimated at USD 28.08 billion in 2024 and is expected to reach USD 28.86 bllion by 2025.

b. The global automotive steering market is expected to grow at a compound annual growth rate of 5.9% from 2025 to 2033 and is expected to reach USD 45.79 billion by 2033.

b. The electronic power steering (EPS) segment dominated the market with a market share of 69.27% in 2024. This dominance is primarily driven by the increasing shift from traditional hydraulic systems to EPS, owing to its numerous advantages including improved fuel efficiency, lower maintenance, and compatibility with modern electronic vehicle architectures.

b. Some of the key players are Showa Corporation; Nexteer Automotive Corporation; NSK Ltd; JTEKT Corporation; Robert Bosch GmbH; Hyundai Mobis CO., Ltd; Thyssenkrupp Presta; Mando Corporation; Sona Corporation; and ZF Friedrichshafen AG.

b. The market growth can be attributed to the increasing adoption of Electronic Power Steering (EPS) systems, the rising integration of Advanced Driver-Assistance Systems (ADAS), and the global shift toward electric and hybrid vehicles, all of which require precise, efficient, and intelligent steering solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.