- Home

- »

- Automotive & Transportation

- »

-

Autonomous Mining Equipment Market, Industry Report 2033GVR Report cover

![Autonomous Mining Equipment Market Size, Share & Trends Report]()

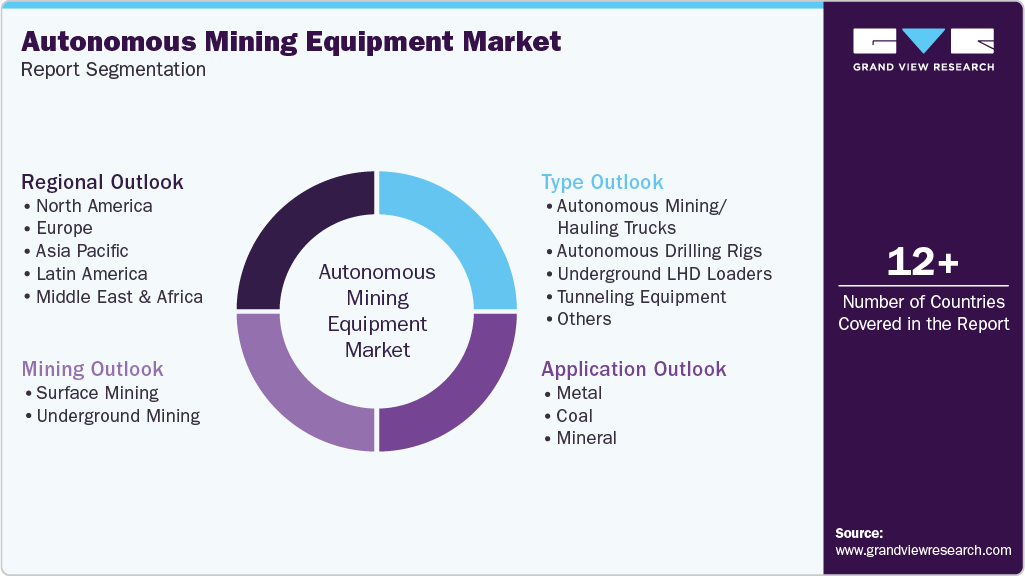

Autonomous Mining Equipment Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Autonomous Drilling Rigs, Underground LHD Loaders), By Mining (Surface Mining, Underground Mining), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-743-7

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Autonomous Mining Equipment Market Summary

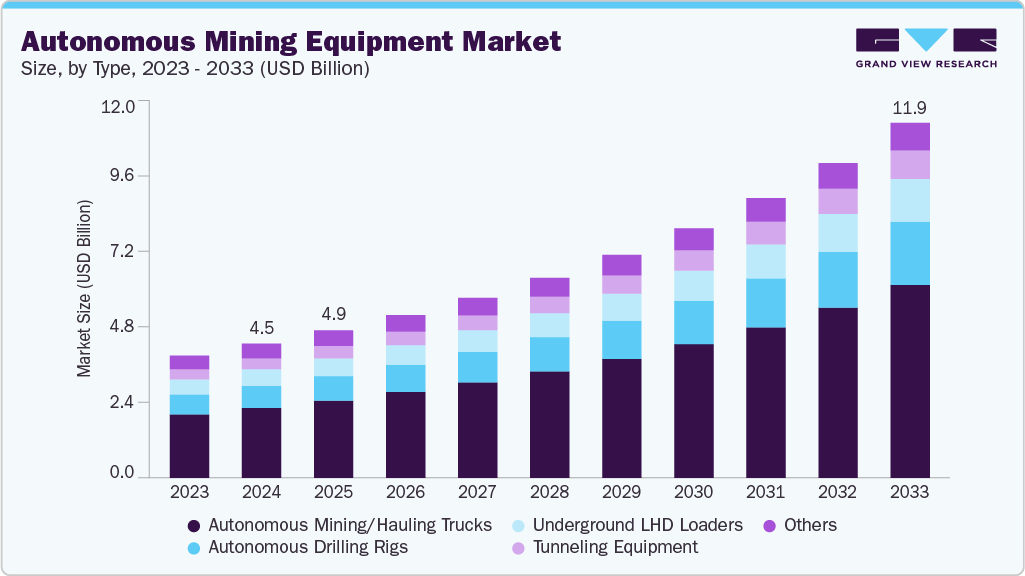

The global autonomous mining equipment market size was estimated at USD 4.48 billion in 2024, and is projected to reach USD 11.86 billion by 2033, growing at a CAGR of 11.6% from 2025 to 2033. The market growth is driven by the increasing demand for operational efficiency, enhanced worker safety, rising labor shortages, and the growing deployment of AI-powered automation in surface and underground mining operations.

Key Market Trends & Insights

- The Asia Pacific autonomous mining equipment market held the largest share of 39.0% in 2024.

- The China autonomous mining equipment market is projected to grow over the forecast period.

- By type, the autonomous mining/hauling trucks segment held the largest share of 52.2% in 2024.

- By mining, the surface mining segment held the largest market share in 2024.

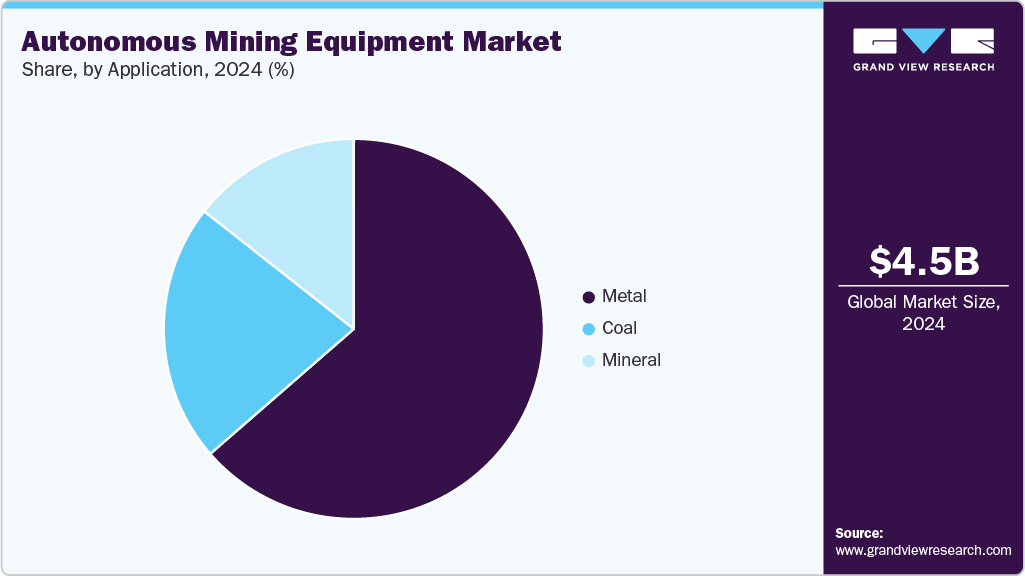

- By application, the metal segment dominated the autonomous mining equipment market in 2024 and is projected to grow at a significant CAGR over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 4.48 Billion

- 2033 Projected Market Size: USD 11.86 Billion

- CAGR (2025-2033): 11.6%

- Asia Pacific: Largest market in 2024

A game-changing trend boosting the autonomous mining equipment industry is the emergence of AI-based critical mineral assessments. In 2024, the U.S. Geological Survey (USGS), in collaboration with DARPA and ARPA‑E, launched the CriticalMAAS initiative. This AI-enabled system drastically reduced mineral resource mapping time from several months to just 2.5 days, supporting fast, data-driven decision-making in resource planning. As demand for critical minerals like lithium, nickel, and rare earths rises, especially for EVs and energy storage, mining companies are increasingly turning to autonomous drills and haul trucks to capitalize on these quickly identified deposits. This data-centric automation workflow is propelling the market growth by aligning exploration with real-time autonomous deployment capabilities.Government-enforced safety regulations are another strong driver boosting the adoption of autonomous mining systems. The U.S. Mine Safety and Health Administration (MSHA) has issued multiple directives emphasizing remote-control technologies, proximity detection systems, and collision avoidance for surface and underground mining equipment. With mobile equipment accounting for a significant percentage of mining injuries, MSHA's advocacy for system-level safety evaluations has led companies to invest in autonomous and semi-autonomous systems to ensure compliance. As a result, the mining industry views automation not just as a technological advancement but as a regulatory necessity, significantly propelling the market forward.

The development of open standards such as OPC UA Companion Specification for Mining, led by the OPC Foundation and supported by the Global Mining Guidelines Group (GMG), is boosting the market by enabling seamless communication between autonomous systems from different manufacturers. These standards are critical for integrating diverse equipment like autonomous haul trucks, loaders, and drills into centralized command systems. By promoting vendor-neutral infrastructure, these frameworks are propelling market growth by encouraging scalable, multi-vendor deployment of autonomous fleets across surface and underground operations.

While autonomous systems have historically been concentrated in large-scale operations, the World Bank’s 2024 ASM Framework supports technology infusion into Artisanal and Small-Scale Mining (ASM) through safety reforms, formalization, and sustainable practices. This shift opens new frontiers for modular autonomous systems, especially in regions where infrastructure and manpower challenges exist. By enabling safer working conditions and operational efficiency, these modernization efforts are boosting the autonomous equipment market, particularly in mineral-rich developing nations.

Initiatives funded by the U.S. Department of Energy (DOE) and the National Science Foundation (NSF) have catalyzed the adoption of IoT-enabled smart mining. Through edge computing, sensor fusion, and digital twin simulation platforms, mines now monitor equipment health and operational parameters in real time. These technologies reduce unplanned downtime and extend the life of mining equipment, making the investment in autonomy more economically viable. The convergence of predictive analytics with autonomous operations is propelling market growth by maximizing uptime, reducing operational risk, and enhancing return on investment.

Type Insights

The autonomous mining/hauling trucks segment led the autonomous mining equipment market with the largest share of 52.2% in 2024. The uptake of autonomous mining trucks is rapidly transforming large-scale surface operations, especially in iron ore and coal mining. These trucks are boosting adoption rates due to their ability to operate continuously, reduce labor costs, and improve fuel efficiency. Leading mining firms have expanded autonomous truck fleets in remote sites where skilled labor is scarce. The integration of route optimization, collision avoidance, and remote operation support is enhancing productivity metrics, making these trucks indispensable for long-haul operations.

The autonomous drilling rigs segment is projected to grow at the fastest CAGR over the forecast period. Autonomous drilling rigs are gaining ground in both exploration and production activities as mining companies seek to reduce downtime and improve orebody targeting. These rigs use AI-enabled data systems to enhance drilling accuracy, minimize safety risks, and lower operational variability. Their role in optimizing drill-and-blast cycles and improving fragmentation outcomes is driving their penetration, particularly in metal-rich zones and deep-earth exploration projects.

Mining Insights

The surface mining segment held the largest share of the autonomous mining equipment industry in 2024. Surface mining operations are at the forefront of automation deployment due to easier GPS connectivity, wider workspaces, and fewer operational constraints. The automation of haulage, dozing, and grading equipment in open-pit mines is streamlining production flows and enabling around-the-clock operation. Furthermore, carbon reduction commitments from major miners are accelerating the shift to autonomous systems that reduce idle time and emissions per ton moved, especially in large-scale copper and iron ore sites.

The underground mining segment is projected to grow at the fastest CAGR over the forecast period. Underground mining is experiencing a steady shift toward automation, primarily driven by safety concerns and increasing ore depth. The application of autonomous LHDs, drilling machines, and tele-remote equipment is improving equipment utilization and enabling operations in environments previously considered too hazardous. The use of real-time mapping, environmental sensors, and predictive analytics is supporting automation efforts in narrow-vein and deep-earth operations, where precision and risk reduction are paramount.

Application Insights

The metal segment dominated the autonomous mining equipment market in 2024 and is projected to grow at a significant CAGR over the forecast period. Autonomous equipment is being widely adopted in metal mining, especially for high-demand metals like lithium, copper, and nickel used in batteries and clean energy infrastructure. As miners pursue aggressive extraction targets, autonomous systems are enabling faster cycle times, reduced operating variability, and consistent grade control. These solutions are also essential in maximizing production from remote, high-altitude, or otherwise inaccessible deposits where manual operations are logistically complex.

The mineral segment is projected to grow at the fastest CAGR over the forecast period. In mineral mining, including the extraction of industrial and construction materials, automation is enhancing operational continuity and reducing overall process costs. The repetitive nature of tasks in this segment allows autonomous vehicles and equipment to optimize extraction efficiency while reducing fuel consumption and maintenance overhead. With construction activity surging globally, especially in emerging economies, demand for dependable, low-cost autonomous operations in limestone and aggregate quarries is rising steadily.

Regional Insights

The North America autonomous mining equipment market accounted for a 26.2% share of the overall market in 2024. In North America, the deployment of autonomous mining fleets has seen a notable shift toward interoperability standards. The rise of open autonomous systems, supported by initiatives from the National Institute of Standards and Technology (NIST), is enabling mining operators to integrate autonomous trucks and drilling systems from multiple vendors. This transition is particularly evident in Nevada and Arizona, where copper and gold mines are testing multi-vendor autonomous operations to reduce reliance on proprietary platforms. Additionally, Canada’s Mining Innovation Council continues to support real-time fleet telemetry trials in Arctic conditions, focusing on reliability in extreme cold.

U.S. Autonomous Mining Equipment Market Trends

The U.S. autonomous mining equipment industry held a dominant position in 2024. Within the U.S., autonomous haulage is being used increasingly in brownfield mine expansions. For instance, the U.S. Geological Survey (USGS) reported that mine operators in Utah and New Mexico have begun converting legacy dump trucks into semi-autonomous vehicles using modular retrofit kits. This has led to an improvement in daily tonnage moved without major capital expenditure. The Mine Safety and Health Administration (MSHA) has also begun drafting preliminary safety guidance for remote-operated equipment, aiming to standardize protocols across state boundaries.

Europe Autonomous Mining Equipment Market Trends

Europe holds a substantial share of the autonomous mining equipment industry. Europe is at the forefront of incorporating autonomous mining as a sustainability enhancer. Backed by Horizon Europe funding, Scandinavian and Baltic countries are embedding autonomy within climate-neutral mining targets. Several iron ore mines in Sweden and Finland are using autonomous load-haul-dump (LHD) systems underground to reduce diesel emissions and worker exposure to particulate matter. Moreover, the European Raw Materials Alliance (ERMA) is prioritizing autonomy as a strategic pillar for rare earth extraction in Eastern Europe.

The Germany autonomous mining equipment market is expected to grow over the forecast period. Germany has emerged as a testing hub for underground autonomous operations, particularly in decommissioned hard coal mines being repurposed for pilot programs. The Federal Institute for Geosciences and Natural Resources (BGR) has partnered with local universities to simulate autonomous fleet operations in controlled environments. These programs focus heavily on data analytics and communication systems that allow autonomous machinery to adapt to high-variability underground conditions.

The autonomous mining equipment market in the UK is expected to grow over the forecast period. The UK has begun utilizing autonomous mining equipment in post-industrial land redevelopment projects, especially in Wales and northern England. The British Geological Survey (BGS) has identified these sites as suitable for small-scale lithium and rare earth extraction, where autonomous drills are being deployed for early-phase geotechnical assessments. These trials emphasize reducing the environmental footprint while restoring economic utility to former mining regions.

Asia Pacific Autonomous Mining Equipment Market Trends

Asia Pacific continues to lead the global autonomous mining equipment industry, holding the largest market share of 39.0% in 2024 and is growing at the fastest CAGR during the forecasted period. In APAC, large-scale deployment of autonomous mining fleets is closely aligned with infrastructure-driven mineral demand. Australia and Southeast Asia continue to dominate surface mining autonomy, while new entrants like Vietnam and the Philippines are experimenting with semi-autonomous underground operations. Regional initiatives under ASEAN are exploring cross-border knowledge sharing on digital mining integration, including training programs for autonomous system maintenance and remote operations.

The China autonomous mining equipment market is projected to grow over the forecast period. China's focus on domestic technology development in autonomous mining has intensified following global chip shortages. The Ministry of Industry and Information Technology (MIIT) launched pilot zones for smart mining in Inner Mongolia and Shanxi, where autonomous trucks are paired with 5G-enabled control towers. These trials emphasize reducing foreign dependency and enhancing real-time fleet coordination. China's emphasis is on homegrown AI systems for predictive maintenance and automated navigation in high-volume coal and rare earth mines.

The autonomous mining equipment market in Japan is projected to grow during the forecast period. Japan is leveraging its robotics expertise to introduce autonomous equipment into precision mining applications. The Ministry of Economy, Trade and Industry (METI) is supporting consortia focused on deep-sea rare earth extraction using remotely operated and autonomous submersibles. Meanwhile, terrestrial mining operations in Hokkaido are being retrofitted with compact autonomous drills designed to operate on steep gradients, addressing Japan’s geographic mining challenges.

The India autonomous mining equipment market is anticipated to grow over the forecast period. India's public-sector mining giants, such as Coal India and NMDC, have started pilot programs to integrate autonomous drilling and truck fleets in iron ore and coal fields. The Ministry of Mines, in collaboration with IITs, is researching AI algorithms tailored for high-humidity conditions prevalent in eastern India. Additionally, the government's "Digital Mines" mission is targeting autonomous system rollout in the Jharkhand and Odisha belts, focusing on maximizing extraction efficiency with minimal workforce expansion.

Key Autonomous Mining Equipment Company Insights

Some of the major players in the autonomous mining equipment market include Caterpillar, Komatsu Ltd., Hitachi Construction Machinery Co., Ltd., Epiroc AB, and Sandvik AB, due to their strong portfolios of autonomous and semi-autonomous solutions, continuous investment in R&D, strategic collaborations with mining operators, and proven track records in deploying advanced mining technologies across large-scale operations worldwide.

-

Epiroc AB is a leading global provider of equipment and services for the mining and infrastructure industries. Spun off from Atlas Copco in 2018, the company specializes in developing innovative drill rigs, rock excavation tools, and automation and digitalization solutions designed to enhance productivity, safety, and sustainability in mining operations. Epiroc is at the forefront of autonomous and battery-electric equipment, working closely with major mining companies to enable remote operations and reduce carbon emissions. With a strong global presence and a focus on innovation, Epiroc continues to play a key role in shaping the future of underground and surface mining.

-

Sandvik AB is a global engineering company specializing in advanced equipment and tools for the mining, construction, and manufacturing industries. Headquartered in Sweden, the company operates through multiple business areas, including Sandvik Mining and Rock Solutions and Sandvik Rock Processing Solutions. Sandvik is known for its high-performance autonomous mining equipment, digital mining technologies, and commitment to sustainability. With decades of experience, Sandvik focuses on enhancing productivity and safety through innovation in automation, electrification, and data analytics, making it a key player in the transformation of the global mining sector.

Key Autonomous Mining Equipment Companies:

The following are the leading companies in the autonomous mining equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Caterpillar

- Komatsu Ltd.

- Hitachi Construction Machinery Co., Ltd.

- Epiroc AB

- Sandvik AB

- Liebherr Group

- AB Volvo

- BELAZ-HOLDING

- XCMG Group

- Sany Group

Recent Developments

-

In April 2025, Epiroc secured its largest-ever contract to deliver fully autonomous and battery-electric surface drill rigs, Pit Viper 271 E and SmartROC D65 BE, to Fortescue Metals Group in Western Australia. These rigs will be remotely operated from Perth, with an anticipated savings of 35 million liters of diesel annually. The contract is valued at approximately AUD 350 million over a five-year period.

-

In November 2023, Sandvik signed a Letter of Intent (LoI) with SSAB to procure fossil-free steel for its autonomous mining equipment portfolio, including loaders and trucks. This initiative aligns with Sandvik’s commitment to developing emission-free and sustainable mining solutions.

Autonomous Mining Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.93 billion

Revenue forecast in 2033

USD 11.86 billion

Growth rate

CAGR of 11.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, mining, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Caterpillar; Komatsu Ltd.; Hitachi Construction Machinery Co., Ltd.; Epiroc AB; Sandvik AB; Liebherr Group; AB Volvo; BELAZ-HOLDING; XCMG Group; Sany Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Autonomous Mining Equipment Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global autonomous mining equipment market report based on type, mining, application, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Autonomous Mining/Hauling Trucks

-

Autonomous Drilling Rigs

-

Underground LHD Loaders

-

Tunneling Equipment

-

Others

-

-

Mining Outlook (Revenue, USD Million, 2021 - 2033)

-

Surface Mining

-

Underground Mining

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Metal

-

Coal

-

Mineral

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global autonomous mining equipment market size was estimated at USD 4.48 billion in 2024 and is expected to reach USD 4.93 billion in 2025.

b. The global autonomous mining equipment market size is expected to grow at a significant CAGR of 11.6% to reach USD 11.86 billion in 2033.

b. Asia Pacific held the largest market share of 39.0% in 2024. In APAC, large-scale deployment of autonomous mining fleets is closely aligned with infrastructure-driven mineral demand.

b. Some of the players in the autonomous mining equipment market are Caterpillar, Komatsu Ltd., Hitachi Construction Machinery Co., Ltd., Epiroc AB, Sandvik AB, Liebherr Group, AB Volvo, BELAZ-HOLDING, XCMG Group, and Sany Group.

b. The key driving trend in the autonomous mining equipment market is the shift toward safety, efficiency, and sustainability through automation. Mining companies are rapidly adopting AI, IoT, and advanced sensor-based systems to reduce human exposure to hazardous environments, address labor shortages, cut operational costs, and enable 24/7 productivity. Rising demand for critical minerals, stricter ESG and safety regulations, and pressure to reduce emissions further accelerate adoption, while digitalization and Industry 4.0 integration make autonomous mining equipment central to the future of mining operations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.