- Home

- »

- Plastics, Polymers & Resins

- »

-

Baby Food Packaging Market Size, Industry Report, 2030GVR Report cover

![Baby Food Packaging Market Size, Share & Trends Report]()

Baby Food Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Plastic, Paper, Metal, Glass), By Product (Bags & Pouches, Boxes & Cartons, Cups & Cartons, Stick Pad), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-276-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Baby Food Packaging Market Summary

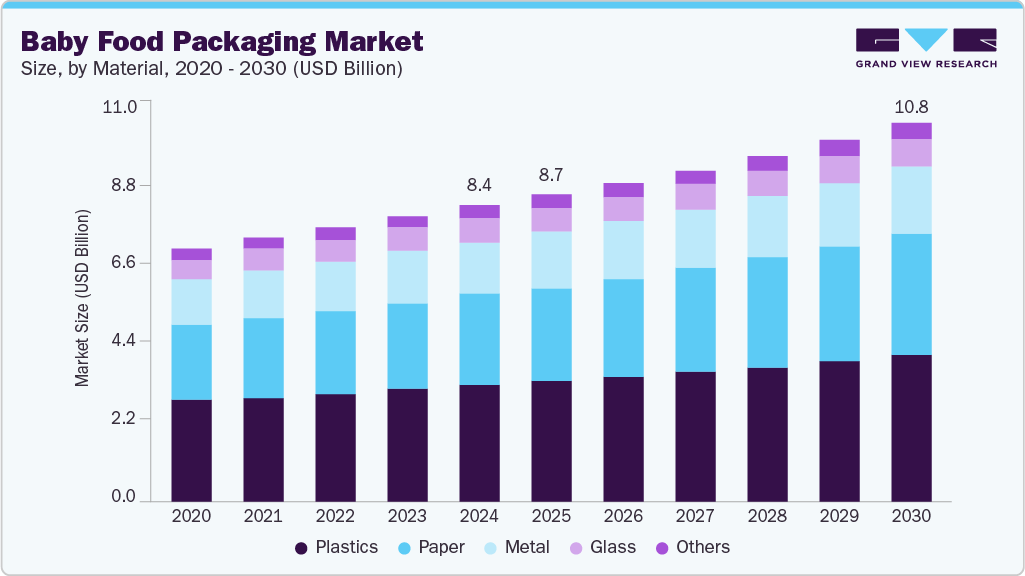

The global baby food packaging market size valued at USD 8.43 billion in 2024 and projected to reach USD 10.79 billion by 2030, growing at a CAGR of 4.3% from 2025 to 2030. The baby food packaging industry is experiencing growth driven by the increasing demand for organic, natural, and additive-free products.

Market Size & Trends:

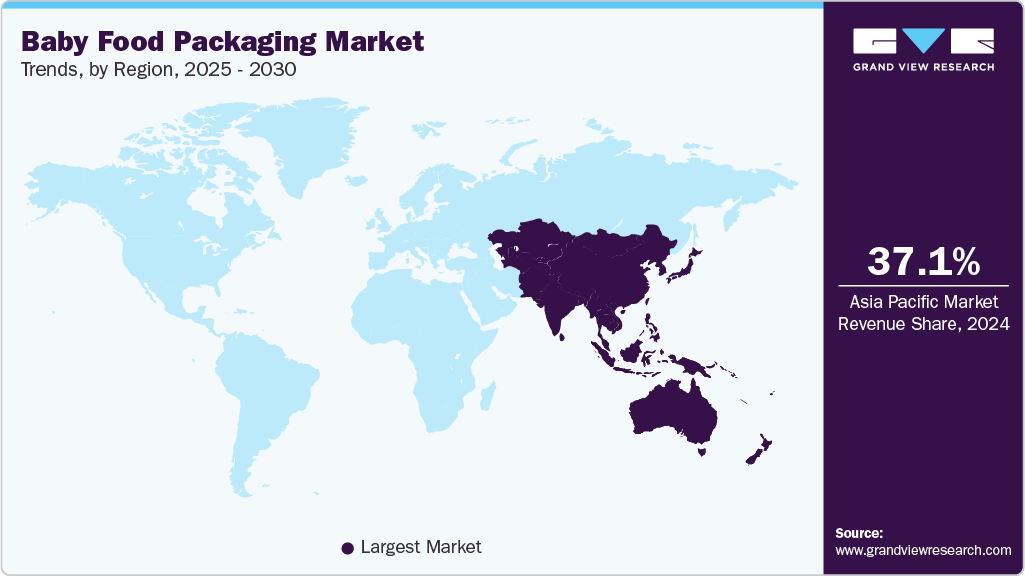

- The Asia Pacific baby food packaging market held a revenue share of 37.1% in 2024.

- The U.S. dominated the regional baby food packaging industry in 2024.

- By material, the plastics segment dominated the market and accounted for the largest revenue share of 39.6% in 2024.

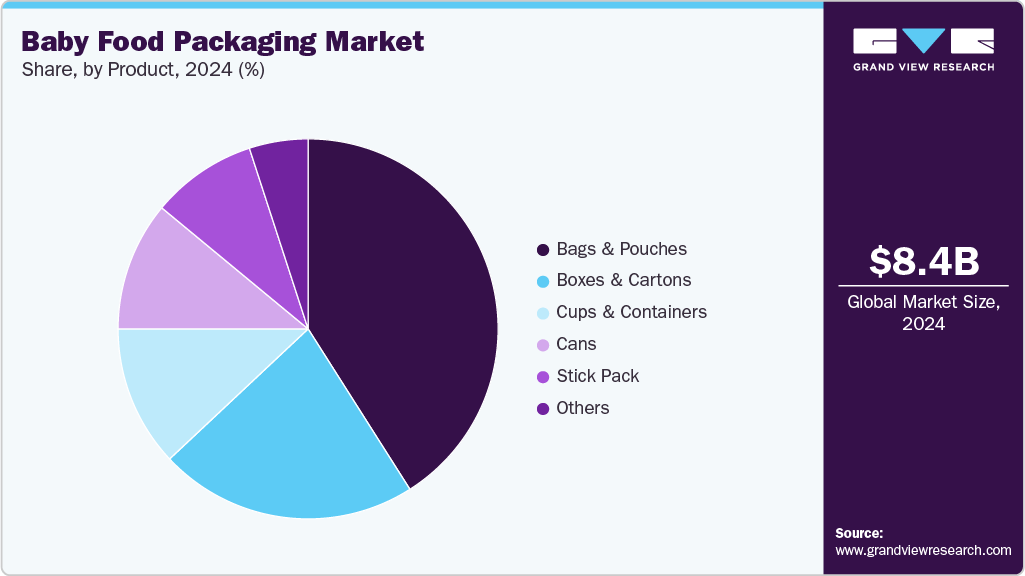

- Based on product, the bags & pouches segment dominated the market and accounted for the largest revenue share in 2024 owing to the busy lifestyles of parents.

Key Market Statistics:

- 2024 Market Size: $8.43 Billion

- 2030 Estimated Market Size: $10.79 Billion

- CAGR: 4.3% (2025-2030)

- Asia Pacific: Largest market in 2024

Packaging innovations are being developed to protect product quality and clearly display essential information such as ingredients, allergen alerts, and nutritional details to meet safety standards and build consumer trust. Additionally, there is a growing market preference for sustainable solutions, leading to higher demand for eco-friendly and biodegradable packaging materials.The growing demand for convenient baby food packaging is largely driven by busy lifestyles. Urbanization and rising disposable incomes are enabling parents to choose high-quality baby food products, which in turn increases the need for advanced and reliable packaging. The popularity of premium baby food is also contributing to the demand for superior packaging materials and innovative designs. Additionally, the rise of e-commerce is influencing packaging solutions to ensure products remain safe and intact during shipping and handling.

Rising birth rates in regions such as the Asia Pacific are driving increased demand for baby food products, including cereals, formulas, purees, and snacks. This trend is supported by factors such as a growing middle-class population, rapid urbanization, and greater awareness of infant nutrition. In response, baby food manufacturers are expanding their offerings to include organic, fortified, and specialized products to meet varied consumer needs. The growth of e-commerce and online retail is also making these products more accessible to families in remote areas. Additionally, government programs focused on improving child health and nutrition in emerging markets are further supporting market expansion, creating greater demand for effective and reliable packaging solutions.

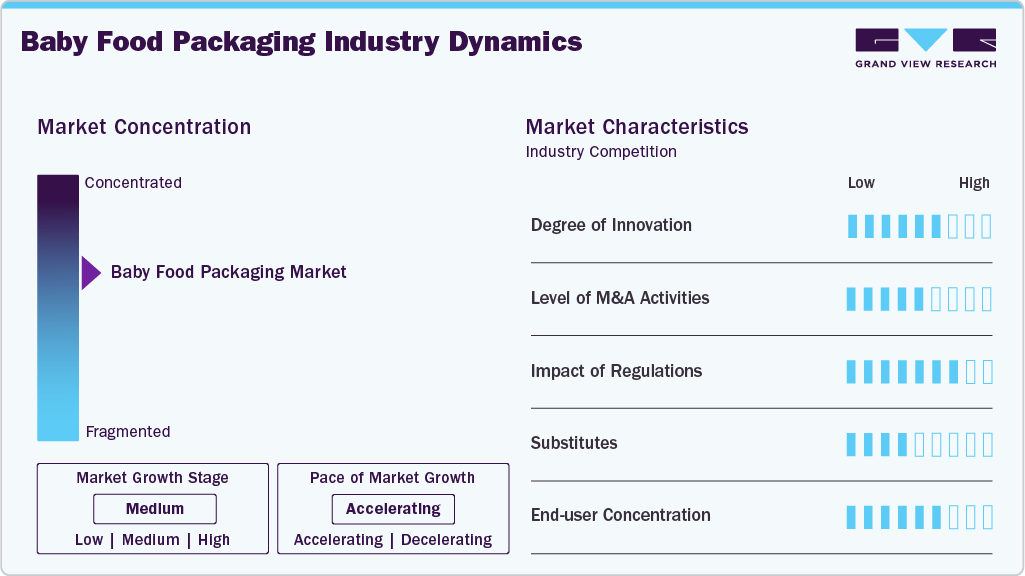

Market Concentration & Characteristics

The global baby food packaging market is witnessing a moderate level of merger and acquisition (M&A) activity among major industry players, primarily driven by the growing demand for sustainable packaging solutions. Packaging and labeling continue to dominate the market, holding the largest share due to their widespread use across various baby food categories, including cereals, formulas, and purees.

Innovation in the industry remains steady, with a focus on enhancing product safety and extending shelf life through the use of eco-friendly materials. These advancements support both convenience and sustainability. Emerging high-tech solutions such as refillable packaging and personalized baby food kits are also gaining attention, addressing the rising need for both environmental responsibility and consumer ease of use.

Technological integration is allowing for the delivery of customized nutritional information, helping parents make informed choices. For example, in October 2024, Switzerland-based Tetra Pak and Lactalis, a France-based dairy corporation launched a new carton package made from certified recycled polymers sourced from used beverage cartons—an important step toward promoting a circular economy within the packaging industry.

Regulations have a moderate to high impact on the baby food packaging industry. Governments worldwide enforce strict standards to ensure the safety, quality, and sustainability of packaging materials used in food products. Packaging that comes into direct contact with baby food must comply with safety regulations that restrict the use of harmful chemicals. This has led to increased investment in research and development of non-toxic, food-safe materials.

In markets like India, regulatory bodies such as FSSAI have introduced comprehensive guidelines that significantly influence packaging practices. These regulations require the use of certified, food-grade materials and proper sealing methods to prevent contamination. Such rules are designed to promote safer, more transparent, and compliant packaging for infant nutrition products, reinforcing consumer trust and product integrity.

Material Insights

The plastics segment dominated the market and accounted for the largest revenue share of 39.6% in 2024. Plastic offers remarkable strength and lightweight, which makes it perfect for the transportation and handling of baby food items. The packaging of plastics plays a vital role in safeguarding baby food from outside impurities, ensuring the high quality of the product and prolonging its freshness. In comparison to materials such as metal and glass, plastic is comparatively cheaper to manufacture and transport, driving its segment growth in the market.

The paper segment is expected to grow at the fastest CAGR over the forecast period. The growing environmental awareness is leading to the expansion of the eco-friendly market. Increasing inclination of consumers' from traditional to eco-friendly packaging products such as paper-based materials is driving the segment growth. Manufacturers are being encouraged to implement sustainable packaging solutions and use paper packaging that boost a brand's image in terms of sustainability and social responsibility.

Product Insights

The bags & pouches segment dominated the market and accounted for the largest revenue share in 2024 owing to the busy lifestyles of parents. Bags and pouches are convenient, lightweight enough for babies to hold, and take less space during transportation, which leads to lower greenhouse gas emissions. Flexible packaging comes with multiple protective layers, preserving food quality. The material withstands sterilization without compromising its integrity.

The cups & containers segment is expected to grow at a significant CAGR over the forecast period. Cups & containers are durable and easy to use and offer easy handling and feeding solutions for busy parents. It facilitates accurate measuring of portions and ensures nutritional balance for babies. The use of sustainable packing solutions attracts environment-conscious consumers. Unique print on cups and containers helps consumers attract and differentiate the product from its competitors. Parents prefer clearly labeled containers; it enhances trust and confidence in the product’s quality, hence driving the segment growth.

Regional Insights

North America holds a significant market revenue share in the global baby food packaging industry. The region recently saw an increase in birth rate by 1% in the year 2024, indicating an increase in demand for baby food products. Higher disposable incomes in countries such as the U.S. and Canada are contributing to increased demand for packaged baby food products. Strict regulations and compliance standards in these regions help ensure the safety of ingredients, and clear labeling is required, promoting transparency for consumers. Additionally, modern packaging features—such as QR codes and nutrition tracking tools—are enhancing customer engagement and building trust by providing easy access to detailed product information.

U.S. Baby Food Packaging Market Trends

The U.S. dominated the regional baby food packaging industry in 2024. With increasingly busy and sedentary lifestyles, there is a rising demand for convenient, easy-to-use baby food products that meet essential nutritional needs. Packaging plays a key role in maintaining product freshness and extending shelf life by using suitable materials. Features such as resealable, portable, and microwavable packaging offer added convenience, making feeding easier for parents. Ensuring proper nutrition through well-packaged baby food is especially important for supporting children’s immunity, as they are more vulnerable to illnesses during early development.

Europe Baby Food Packaging Market Trends

The Europe baby food packaging market is experiencing strong growth, driven by regulatory and consumer shifts toward sustainability. The European Union has implemented strict regulations aimed at reducing single-use plastics, increasing recycling rates, and encouraging the adoption of reusable packaging solutions. Retailers are also expected to support customer-owned reusable containers, reinforcing a shift toward more environmentally responsible packaging practices.

Within the baby food segment, breakfast cereals play an important role in infant nutrition. They contribute to a higher intake of carbohydrates and dietary fiber while helping reduce total fat consumption. Additionally, regular consumption of fortified cereals is associated with a lower risk of micronutrient deficiencies, particularly in nutrients such as calcium, folate, vitamin B6, magnesium, and zinc. Breakfast cereals also promote the inclusion of key food groups like fruits and dairy, supporting better overall nutrition for growing children. These factors highlight the need for effective and informative packaging that preserves quality and communicates nutritional benefits to parents.

Asia Pacific Baby Food Packaging Market

The Asia Pacific baby food packaging market held a revenue share of 37.1% in 2024. The growth of the region is driven by increased urbanization and busier lifestyle. The shift in consumer habits and a growing understanding of the significance of nutrition in infancy is attributed to the market growth.

The baby food packaging market in China is growing, and the inclination towards organic baby food products is one of the growth factors. Modern lifestyle demands the use of formula as a convenient feeding option. China’s population has seen a spike in 2024 with a 0.38% increase per thousand from previous years, implying an increase in demand for baby food products in the country.

Key Baby Food Packaging Company Insights

Some of the key companies in the baby food packaging industry include Gerber Packaging, Heinz Baby Food, Nestle S.A., Piramal Glass and others. Organizations have been tactically implementing various expansion plans such as mergers and acquisitions, strengthening of online presence, production enhancement and new product launches to gain a competitive advantage.

-

Nestlé offers a range of products such as coffee, tea, candy, bottled water, baby food, dairy products, frozen foods, cereals, snacks, pet food, medical nutrition, and other products.

-

Heinz offers baby cereals products with different flavors such as multi-grain, vegetable pasta, oats, blueberry porridge and other products.

Key Baby Food Packaging Companies:

The following are the leading companies in the baby food packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Gerber Packaging

- Heinz Baby Food

- Nestle S.A.

- Piramal Glass

- Amcor

- AptarGroup

- Ball Corporation

- Owens-Illinois, Inc.

- Tetra Pak International S.A.

- Berlin Packaging

Recent Developments

-

In December 2024, Tetra Pak received the 'Resource Efficiency' Award at the Sustainable Packaging News Awards. The company developed paper-based barrier innovation in aseptic cartons; this development minimizes the carbon footprint of packaging by up to one-third and increases the paperboard content to 80%.

Baby Food Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.74 billion

Revenue forecast in 2030

USD 10.79 billion

Growth rate

CAGR of 4.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, product, region

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, South Korea, Thailand, Indonesia, Australia, Malaysia, Brazil, Argentina, South Africa, Saudi Arabia, UAE

Key companies profiled

Gerber Packaging; Heinz Baby Food; Nestle S.A.; Piramal Glass; Amcor; AptarGroup; Ball Corporation; Owens-Illinois, Inc.; Tetra Pak International S.A. Berlin Packaging.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Baby Food Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global baby food packaging market report based on material, product, and region.

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Plastics

-

Paper

-

Metal

-

Glass

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Bags & Pouches

-

Boxes & Cartons

-

Cups & Containers

-

Stick Pack

-

Cans

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

Indonesia

-

Australia

-

Malaysia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.