- Home

- »

- Homecare & Decor

- »

-

Bath Bomb Market Size, Share And Trends Report, 2030GVR Report cover

![Bath Bomb Market Size, Share & Trends Report]()

Bath Bomb Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Organic, Synthetic), By Scent (Floral, Fruity, Herbal, Woodsy, Citrus), By Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-428-3

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bath Bomb Market Summary

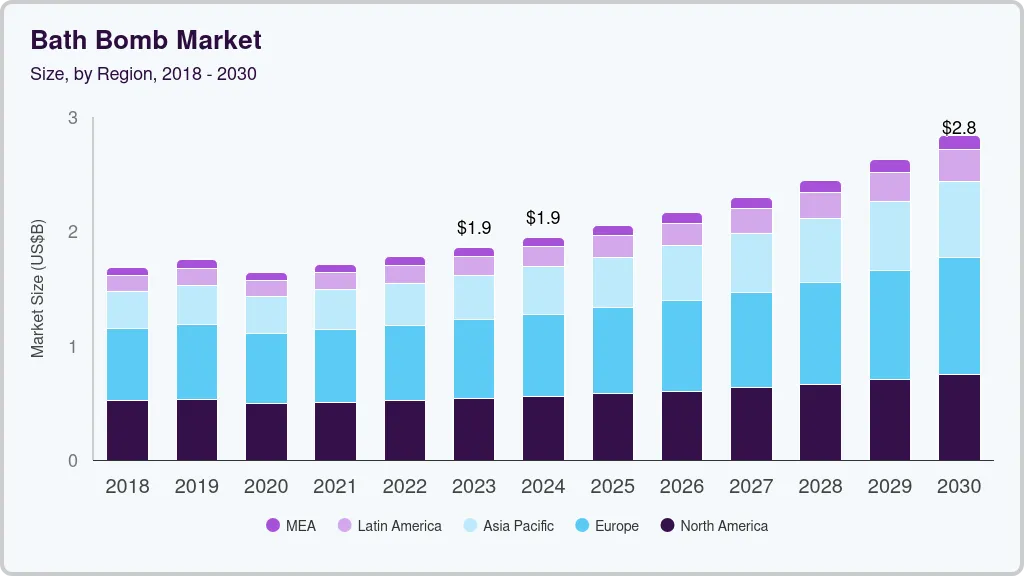

The global bath bomb market size was estimated at USD 1,859.7 million in 2023 and is projected to reach USD 2,837.8 million by 2030, growing at a CAGR of 6.5% from 2024 to 2030. The growing emphasis on self-care and relaxation has significantly bolstered the bath bomb market, positioning the products as an affordable indulgence that elevates the bathing experience.

Key Market Trends & Insights

- In terms of region, Europe was the largest revenue generating market in 2023.

- The bath bombs market in the U.S. accounted for a market share of around 85% in 2023.

- By type, the synthetic bath bomb segment accounted for a share of about 60% in 2023.

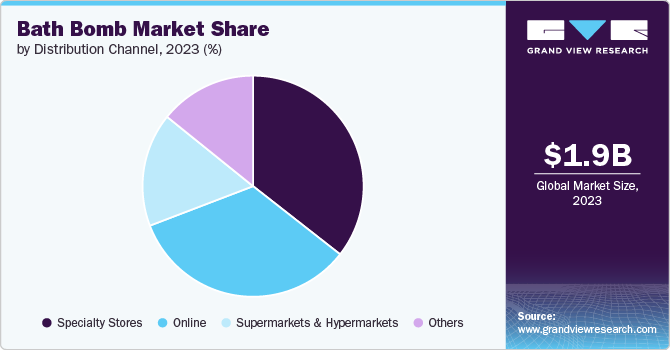

- By distribution channel, the sale of bath bomb through specialty stores accounted for a market share of around 35% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1,859.7 Million

- 2030 Projected Market Size: USD 2,837.8 Million

- CAGR (2024-2030): 6.5%

- Europe: Largest market in 2023

As consumers seek convenient ways to unwind, bath bombs offer a multi-sensory escape with aromatherapy benefits, skin-nourishing ingredients, and a sense of luxury at an accessible price point. This trend has led to a surge in demand across various demographics, especially as people embrace wellness routines and at-home spa experiences, ultimately driving market growth.

Social media platforms like Instagram and TikTok have become key drivers of the bath bomb market by showcasing these products through visually captivating content. The vibrant colors, mesmerizing fizzing effects, and unique patterns appeal to users seeking aesthetically pleasing and shareable moments, which naturally boosts brand visibility and consumer interest. As influencers and users alike post their bath bomb experiences, it amplifies the product’s desirability and spreads awareness. This social media-driven exposure creates viral demand, encouraging more consumers to purchase bath bombs, thus driving market growth through engagement and visual appeal.

Customizable and themed bath bombs have become a significant driver of the market by catering to niche segments like seasonal, holiday, or character-themed products, which adds a layer of personalization and novelty. These unique variations make bath bombs highly appealing as thoughtful and trendy gifts, particularly during special occasions or holidays. Themed products also resonate with specific fandoms or trends, further expanding the consumer base. This customization not only fosters brand loyalty but also encourages repeat purchases as consumers seek out limited-edition or tailored items, boosting sales and diversifying market offerings.

Key players in the bath bomb market, such as Lush, Da Bomb, and Pearl Bath Bombs, are focusing on innovation, sustainability, and branding to stay competitive and drive market growth. Companies are expanding product lines with unique formulations, like CBD-infused or skin-benefiting bath bombs, while also embracing eco-friendly packaging to appeal to environmentally conscious consumers. Brands are leveraging social media for viral marketing, collaborating with influencers, and launching limited-edition and themed products to create excitement and anticipation. By tapping into consumer desires for personalization, wellness, and sustainability, these strategies are expanding the bath bomb market's reach and fostering consistent demand.

Type Insights

Synthetic bath bomb accounted for a share of about 60% in 2023. The demand for synthetic bath bombs is driven primarily by affordability, vibrant colors, and long-lasting fragrances, which appeal to a broad consumer base. Synthetic ingredients allow manufacturers to create more intense visual effects, such as bold colors and intricate patterns, at a lower cost, making these bath bombs accessible to a wider audience. Additionally, synthetic additives help prolong the shelf life and enhance the fizzing action, which adds to the overall appeal for consumers looking for a visually engaging and aromatic bath experience. These factors contribute to the growing popularity of synthetic bath bombs, particularly among price-sensitive buyers seeking fun and indulgence without compromising on aesthetics.

The demand for organic bath bomb is anticipated to grow at a CAGR of 8.1% from 2024 to 2030. As people become more conscious of the ingredients in their personal care products, they seek bath bombs made with natural, chemical-free, and eco-friendly components that are gentle on the skin and the environment. Organic bath bombs, often enriched with essential oils and plant-based ingredients, appeal to those looking for a more holistic and nourishing self-care experience. Additionally, the rise in environmental awareness encourages consumers to choose products with biodegradable packaging and ethical sourcing, further boosting demand for organic alternatives in the bath bomb market.

Scent Insights

Fruity scent bath bomb accounted for a market share of about 25% in 2023. Fruity fragrances, such as watermelon, berry, and tropical notes, are popular for their invigorating and uplifting qualities, which make bath time feel more refreshing and enjoyable. Additionally, fruity bath bombs often evoke a sense of indulgence and playfulness, aligning well with consumers' desires for a fun and relaxing escape. The combination of sensory benefits, along with the appeal of bright, lively colors, solidifies the popularity and continued demand for fruity bath bombs in the market.

The demand for citrus bath bomb is anticipated to grow at a CAGR of 7.9% from 2024 to 2030. Citrus fragrances, such as lemon, orange, and grapefruit, are known for their ability to stimulate the senses, boost alertness, and provide a revitalizing bath experience. Additionally, citrus bath bombs often appeal to consumers for their bright, cheerful colors and their association with cleanliness and vitality. This combination of sensory benefits, coupled with the perceived health and wellness advantages of citrus ingredients, drives the increasing popularity and demand for citrus bath bombs.

Distribution Channel Insights

The sale of bath bomb through specialty stores accounted for a market share of around 35% in 2023. Specialty stores often provide a carefully selected range of bath bombs with distinctive features, such as artisanal craftsmanship, exclusive formulations, or premium ingredients, which appeal to customers seeking high-quality or niche items. These stores also create a personalized shopping experience with knowledgeable staff and tailored recommendations, enhancing customer satisfaction, likely driving the segment growth.

The sale of bath bomb through online is expected to grow at a CAGR of 7.7% from 2024 to 2030.Online platforms offer the ease of shopping from home, allowing consumers to explore and purchase bath bombs at any time without the constraints of physical store hours. The ability to access detailed product descriptions, customer reviews, and high-quality images helps buyers make informed choices. Additionally, online retailers often provide a broader selection of bath bombs, including exclusive or limited-edition items, which can attract enthusiasts and collectors.

Regional Insights

North America bath bombs market accounted for a market share of around 29% in 2023 in the global market. The bath bomb market in North America is driven by a growing emphasis on self-care and wellness, coupled with a strong consumer preference for personalized and indulgent bath experiences.Additionally, the region's robust retail infrastructure, including specialty stores, major retailers, and online platforms, facilitates widespread availability and access to diverse bath bomb options, likely favoring the growth of the market in North America.

U.S. Bath Bombs Market Trends

The bath bombs market in the U.S. accounted for a market share of around 85% in 2023 in the North American market. Companies like Lush have significantly impacted this market by offering a wide range of bath bombs with unique formulations, vibrant colors, and appealing scents that cater to various preferences. Lush’s emphasis on fresh, high-quality ingredients and eco-friendly practices aligns with consumer demand for wellness-oriented and sustainable products. Additionally, the influence of social media and effective marketing strategies help amplify brand visibility and drive sales. This blend of consumer trends, innovative product offerings, and strategic marketing propels the growth of the bath bomb market in the U.S.

Asia Pacific Bath Bombs Market Trends

The bath bomb market in Asia Pacific accounted for revenue share of around 20% of global revenue in 2023. Rising disposable incomes and an expanding middle class in countries like China, India, and Southeast Asian nations have led to increased spending on personal care and luxury bath products. There's a growing awareness of self-care and wellness practices, particularly among younger urban consumers, driving the market growth. Additionally, the region's rich tradition of bathing rituals, such as Japanese onsen culture, provides a cultural foundation for embracing innovative bath products, including bath bomb.

Europe Bath Bombs Market Trends

The Europe bath bomb market is expected to grow a CAGR of 6.1% from 2024 to 2030. Europeans, particularly in countries like the UK, Germany, and France, are increasingly seeking luxurious yet sustainable bath experiences. The demand for natural, organic, and cruelty-free ingredients has surged, with consumers willing to pay premium prices for high-quality, ethically sourced bath bombs.European consumers also value innovative and unique products, driving companies to create bath bombs with unusual scents, colors, and added benefits like skin nourishment or aromatherapy. A prime example of a company capitalizing on these trends is Lush Cosmetics, a UK-based brand known for its handmade, ethically sourced bath bombs. Lush has gained a cult following for its creative designs, vibrant colors, and commitment to sustainability.

Key Bath Bomb Company Insights

The bath bomb market is highly competitive, characterized by the presence of established global brands and emerging regional players. Major companies like Lush, Bath & Body Works, and The Body Shop lead the market with extensive product lines, innovative designs, and strong brand recognition. Meanwhile, emerging brands and direct-to-consumer startups offer niche, customizable, and organic options appealing to specific consumer segments. The market is also influenced by trends such as eco-friendliness, sustainability, and personalization, which drive companies to innovate and cater to evolving consumer preferences. This dynamic competition fosters a continually evolving market with a broad spectrum of offerings and growing opportunities for differentiation.

Key Bath Bomb Companies:

The following are the leading companies in the bath bomb market. These companies collectively hold the largest market share and dictate industry trends.

- Lush Cosmetics

- Da Bomb

- Bomb Cosmetics

- The Village Company.

- Bath & Body Works Direct, Inc.

- Dr Teal's

- Oliver Rocket

- Level Naturals

- Biocrown Biotechnology Co., Ltd.

- Napa Soap Company

Recent Developments

-

In August 2024, Lush Cosmetics celebrated World Bath Bomb Day by introducing a digitally enhanced bathing experience and new CBD-infused bath products. The company's innovative approach includes integrating augmented reality (AR) technology, allowing customers to interact with their bath bombs in a novel way. Additionally, Lush launched a line of CBD bath bombs aimed at providing extra relaxation and skin benefits. This blend of technology and wellness highlights Lush's commitment to pushing the boundaries of the bath bomb experience while catering to the growing demand for CBD-infused personal care products.

-

In August 2024, Lush Cosmetics announced a strategic shift in its retail approach by entering Ulta Beauty stores. This move marks a significant change in Lush's retail strategy, expanding its presence beyond its own branded stores and website. By partnering with Ulta, Lush aims to reach a broader audience and enhance its visibility in the beauty market. The collaboration is expected to provide customers with increased access to Lush's popular products, including its bath bombs, skincare, and other personal care items, while aligning with Ulta's extensive distribution network and customer base.

Bath Bomb Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.95 Billion

Revenue forecast in 2030

USD 2.84 Billion

Growth rate

CAGR of 6.5% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, scent, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; & Middle East & Africa

Country scope

U.S; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; Brazil; Argentina; Saudi Arabia; and South Africa

Key companies profiled

Lush Cosmetics; Da Bomb; Bomb Cosmetics; The Village Company; Bath & Body Works Direct, Inc.; Dr Teal's; Oliver Rocket; Level Naturals; Biocrown Biotechnology Co., Ltd.; Napa Soap Company

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bath Bomb Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the bath bomb market report based on type, scent, distribution channel, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic

-

Synthetic

-

-

Scent Outlook (Revenue, USD Billion, 2018 - 2030)

-

Floral

-

Fruity

-

Herbal

-

Woodsy

-

Citrus

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global bath bomb market was estimated at USD 1.86 billion in 2023 and is expected to reach USD 1.95 billion in 2024.

b. The global bath bomb market is expected to grow at a compound annual growth rate of 6.5% from 2024 to 2030 to reach USD 2.84 billion by 2030.

b. Europe dominated the bath bomb market with a share of around 36% in 2023. The bath bomb market in Europe is driven by a combination of strong self-care culture, a preference for natural and eco-friendly products, and the appeal of indulgent, luxury bath experiences.

b. Key players in the bath bomb market are Lush Cosmetics; Da Bomb; Bomb Cosmetics; The Village Company; Bath & Body Works Direct, Inc.; Dr Teal's; Oliver Rocket; Level Naturals; Biocrown Biotechnology Co., Ltd.; and Napa Soap Company.

b. Key factors that are driving the bath bomb market growth include increasing consumer demand for self-care products, the popularity of unique and customizable options, and the trend towards natural, organic, and eco-friendly ingredients.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.