- Home

- »

- Advanced Interior Materials

- »

-

Battery Raw Materials Market Size And Share Report, 2030GVR Report cover

![Battery Raw Materials Market Size, Share & Trends Report]()

Battery Raw Materials Market (2024 - 2030) Size, Share & Trends Analysis Report By Battery Type (Lithium-Ion, Lead-Acid), By Material Type, By Application, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-539-7

- Number of Report Pages: 118

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Battery Raw Materials Market Summary

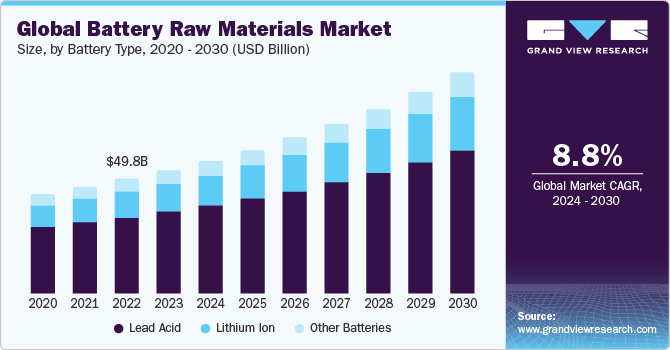

The global battery raw materials market size was estimated at USD 53.55 billion in 2023 and is projected to reach USD 95.75 billion by 2030, growing at a CAGR of 8.8% from 2024 to 2030. is growth is attributed to the growing demand for lithium-ion batteries in the automobile industry, which is driven by the huge demand for electric vehicles.

Key Market Trends & Insights

- Asia Pacific battery raw materials market dominated the market with the largest revenue share of 35.5% in 2023.

- The battery raw materials market in the U.S. accounted for the largest share of 74.9% in North America in 2023.

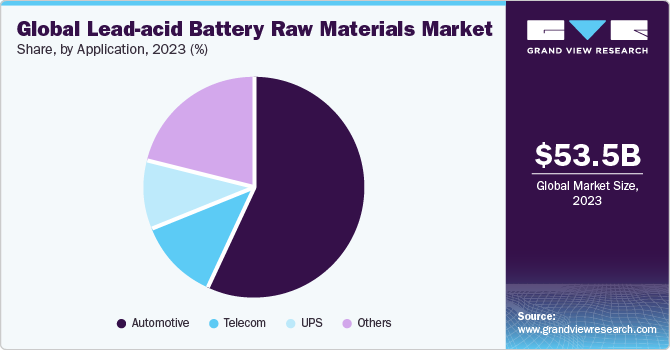

- By battery type, lead acid battery segment was the largest segment and accounted for 66.6% of the global revenue share in 2023.

- By Material, the electrodes segment of lead-acid battery led the material segment and accounted for a revenue share of 81.5% in 2023.

- By application, the automotive application of lead-acid battery has dominated with a revenue share of 56.7% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 53.55 Billion

- 2030 Projected Market Size: USD 95.75 Billion

- CAGR (2024-2030): 8.8%

- Asia Pacific: Largest market in 2023

Additionally, the rising adoption of renewable energy sources, including wind and solar, is expected to fuel demand for energy storage solutions, thereby boosting the market growth. The expansion of portable electronic devices such as laptops and smartphones is also likely to contribute to the growth of battery materials in the coming years. Ongoing technological advancements for improving battery performance, including the adoption of nuclear batteries in the future, are expected to create opportunities for industry growth.

The companies in the battery raw material industry position themselves as the miners and processors of the raw materials which are used as the components of the rechargeable battery used in electric vehicle, consumer electronics, and others. The companies in the domain resort to use of green extraction technologies for reducing the energy and water usage during the processing of materials in order to attract larger consumer base and to protect the environment from degrading effects.

Market Concentration & Characteristics

The industry growth stage is medium and the pace of growth is accelerating. The industry is characterized by the presence of many public companies processing raw materials spread across the globe, providing unique battery components for various end-use application industries. These companies account for a relatively large share of the annual global production of raw materials Industry players compete over innovative techniques and patents acquired to cater to the higher cost advantage of battery raw materials and increase their revenue. Similarly, companies also compete for higher profit margins due to the large-scale volumetric production consumed by the end-use industries.

The growth of the market for battery raw materials is driven by increased regulations for the safe handling of hazardous materials in manufacturing, mining, and transportation for human health, and the preservation of the environment. For instance, Lithium batteries, being dangerous in nature, pose risks for safety. However, regulations are helpful for emerging economies to secure the usage, shipping, and disposal of lithium-containing batteries.

The industry exhibits the presence of fewer number of substitutes for raw materials used for lithium-ion and lead-acid batteries. There are companies involved in using innovative materials with different combinations of metals for reduced use of energy. The processing technology used for manufacturing battery materials increases additional charges. In addition, it is seen that the established end-use industry players have a propensity towards using established products which is anticipated to reduce the threat of substitutes in the industry.

Battery Type Insights

Lead acid battery was the largest segment and accounted for 66.6% of the global revenue share in 2023. It is expected to grow at a CAGR of 8.5% over the forecast period. The growth is driven by various factors such as their lower cost of production, established technology, and reliable and robust recycling infrastructure. The lead-acid battery is preferred in industries with critical expenses, including automotive lighting and ignition systems, where durability and cost-effectiveness are essential. In addition, benefits offered by lead-acid batteries, such as longer lifespan and high energy density, are further likely to contribute to industry growth.

Lithium-ion battery material is the fastest-growing segment. The demand for this battery type is rising due to the increasing adoption of electronic vehicles, consumer electronics, and renewable energy storage solutions. Lithium-ion batteries, being essential components in these applications, are significantly driving up demand for materials such as nickel, cobalt, lithium, and graphite. Furthermore, government initiatives aimed at reducing greenhouse gas emissions and promoting clean energy solutions are expected to further boost demand for lithium-ion batteries in the coming years.

Material Insights

The electrodes segment of lead-acid battery led the material segment and accounted for a revenue share of 81.5% in 2023. It is expected to witness significant growth for battery materials over the forecast period. The widespread adoption of lead-acid batteries has boosted demand for electrodes. These electrodes consist of lead oxide and sponge lead, essential components of lead-acid batteries, enabling electrochemical reactions necessary for energy storage and discharge. This segment’s dominance is further fueled by well-established manufacturing processes associated with lead-acid batteries, which have led to efficient production and economies of scale.

The lithium nickel manganese cobalt oxide (NMC) segment of cathode lithium-ion batteries is anticipated to grow at the fastest CAGR over the forecast period. NMC is considered the most precious combination of metals with a continuous discharge of 20 A at 2000mWh. The material is observed to have high specific energy and high specific power. Generally, lithium-ion batteries with cathode material such as NMC are used in power applications and electric vehicles. The material contains one-third of all three components, lowering raw material cost for battery. In addition, due to its low self-heating rate, it is used in electric vehicles. The abundant usage of NCM in cathode and its lower cost are anticipated to drive industry growth over the forecast period.

Application Insights

The automotive application of lead-acid battery has dominated with a revenue share of 56.7% in 2023. Lead-acid batteries have been widely used in automotive applications owing to their reliability, cost-effectiveness, and well-established technology. These batteries are particularly well suited for automotive starting and ignition systems, providing the necessary power to start the engine and support various electrical components. Moreover, established manufacturing processes and distribution networks, making them easily accessible to automotive manufacturers and consumers.

The grid storage application of lithium-ion batteries is expected to grow significantly over the forecast period. As the world is moving towards using renewable energy sources to fulfill energy security, growth has been noted in the grid storage system over forecast period. Grid storage systems use lithium batteries for the storage of power, which is driving industry for battery raw materials over the forecast period.

Regional Insights

The battery raw materials market in North America is expected to witness rapid growth during the forecast period. The North American economy is one of strongest economies in the world, with tightly integrated markets of the U.S., Canada, and Mexico for manufacturing and distributing automotive, electronics, and other supplies. The region is abundant with rich and varied resources wealth, with a substantial percentage of steel, copper, lead, zinc, iron, oil, and others in this region, which is favorable for the establishment of manufacturing facilities for battery raw materials over the forecast period.

U.S. Battery Raw Materials Market Trends

The battery raw materials market in the U.S. accounted for the largest share of 74.9% in North America in 2023. The region is constituted by many regulations established by agencies on mining, processing, recycling, and transportation of lithium-ion batteries due to risk they pose to human health and environment. The regulations can be listed as hazardous material, such as the U.S. Department of Transportation, among others, which are improving the value chain of the battery raw materials, driving the industry over the forecast period.

The Canada battery raw materials market is expected to grow at a CAGR of 9.2% over the forecast period. Canada is rich in natural resources, including minerals, metals, and salts. It is second in line in the production of nickel, cobalt, and aluminum and fifth in manufacturing of graphite, which is anticipated to drive industry.

Europe Battery Raw Materials Market Trends

The battery raw materials market in Europe is anticipated to grow at a significant rate over the coming years. Europe is forecasted for the arrival of factories dedicated to manufacturing batteries installed in electric cars. The inauguration of factories in this region is focused on shifting car manufacturing to green power-operated vehicles and utilities, which is expected to create opportunities for battery materials in the coming years.

The Germany battery raw materials market accounted for the highest revenue share of 23.9% in 2023. The presence of electric vehicles positively impacts the economy of Germany as, according to the government of Germany, it is planning to discontinue the usage of ICE engines, looking forward to adopting greener fuel for whole country, which is estimated to drive the industry growth for batteries.

The battery raw materials market in the UK is anticipated to grow at a CAGR of 8.4% from 2024 to 2030. The UK has a large influx of lithium-ion battery manufacturers spread across the region producing various components, which is expected to increase demand for battery raw materials over the forecast period.

Asia Pacific Battery Raw Materials Market Trends

Asia Pacific region accounted for a revenue share of 35.5% of the global battery raw materials demand in 2023 owing to factors including robust domestic demand, recovery in the commodity prices, falling poverty rates, and rising labor income. The supply of raw materials between the countries of the region is estimated to be effortless and robust with integrated supply chain operation established in region, which is forecasted to drive the industry growth for battery raw materials over the coming years.

The battery raw materials market in India is expected to grow at a CAGR of 9.5% over the forecast period. The industry is expected to grow with increasing job opportunities, a regularized tax structure, a globally integrated supply chain, and acceptance of foreign direct investments (FDI) and manufacturing facilities. There is an increase noted in spending capacity of citizens of India in consumer electronics and solar panel sectors on account of growing urban population and on account of government directives on using renewable and alternative energies in place of conventional ones, which is anticipated to drive the industry growth over the forecast period.

Central & South America Battery Raw Materials Market Trends

The battery raw materials market in the Central & South America region is expected to witness significant growth over the coming years. A large number of mining companies extract lithium and its compounds in Argentina, Bolivia, and Chile. The mining companies in this region are booming due to increased demand expected from electric car manufacturers. Because of ever-increasing demand for rechargeable batteries, market for its raw materials is anticipated to drive market growth over the forecast period.

The battery raw materials market in Brazil is expected to grow at a CAGR of 8.6% in terms of revenue over forecast period. The growing market of the automotive sector, including electric and hybrid vehicles across the globe, is anticipated to increase demand for raw materials mined in Brazil region by a certain percentage, which is presumed to drive market growth moderately over the forecast period.

Middle East & Africa Battery Raw Materials Market Trends

The battery raw materials market in the Middle East & Africa region is anticipated to grow at a significant rate over the forecast period. A rise was observed in the spending capacity of people of Middle East region on account of lower costs of oil and other commodities in region. Due to increase in spending capacity, there is a higher demand expected in electric vehicle application segment, which is anticipated to drive the market growth for battery raw materials over the forecast period.

The battery raw materials market in Saudi Arabia accounted for the highest revenue share of 19.4% in Middle East & Africa in 2023. The market is characterized by the inclusion of a large number of end-use electronics companies procuring lithium-ion batteries for their sleek design and recharging ability to be used in laptops and notebooks, which is presumed to drive market growth for battery raw materials.

Key Battery Raw Materials Company Insights

Some of the key players operating in industry include Targray, Nichia Corporation, BASF Catalysts LLC, and DuPont.

-

Targray is engaged in the sourcing, storage, transportation, and supply of sustainable materials for solar, renewable fuels, battery, agricultural commodity industry, and carbon trading.

-

Nichia Corporation is a Japan-based manufacturer and distributor of fine chemicals, especially phosphors, such as battery materials, light-emitting diodes (LEDs), calcium chloride, and laser diodes. The company has a presence in various countries, including Japan, the U.S., China, Taiwan, South Korea, Malaysia, Singapore, Indonesia, Thailand, and India.

Celgard LLC and NEI Corporation are some of the emerging participants in the battery raw materials market.

-

Celgard LLC is engaged in the development and manufacturing of high-performance membrane technology. The company has a vast product line includes technical textiles, medical personal protective equipment (PPE), lithium primary and other specialty battery solutions, and lithium-ion batteries. The company has manufacturing facilities in China and U.S.

-

NEI Corporation is a U.S.-based producer and supplier of advanced materials for a wide range of industries. The company’s product portfolio includes battery materials, protective clothing, electrospun mats, heat transfer fluids.

Key Battery Raw Materials Companies:

The following are the leading companies in the battery raw materials market. These companies collectively hold the largest market share and dictate industry trends.

- Targray

- ENTEK

- BASF Catalysts LLC

- DuPont

- Hitachi, Ltd.

- Nichia Corporation

- Mitsubishi Chemical Group Corporation

- Celgard LLC

- Umicore N.V.

- NEI Corporation

Recent Developments

-

In February 2023, ENTEK, a U.S.-based manufacturer of lithium-ion battery separator materials, partnered with Brückner Group USA to expand its production line for battery separator film to support the growing demand for electric vehicles and energy storage systems in the U.S.

-

In December 2023, KPIT Technologies, an India-based independent software integration partner in automobile industry, has launched its sodium (Na)-ion battery technology. This technology is expected to reduce dependency on importing core battery materials. Sodium-ion batteries provide extended lifespan and faster charging capabilities than lithium-ion batteries.

Battery Raw Materials Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 57.72 billion

Revenue forecast in 2030

USD 95.75 billion

Growth rate

CAGR of 8.8% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Battery type, material, application, region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Brazil; Saudi Arabia

Key companies profiled

Targray; ENTEK; BASF Catalysts LLC; DuPont; Hitachi Ltd.; Nichia Corporation; Mitsubishi Chemical Group Corporation; Celgard LLC; Umicore N.V.; NEI Corporation

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Battery Raw Materials Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the battery raw materials market report based on battery type, material type, application, and region:

-

Battery Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Lithium Ion

-

Lead Acid

-

Other Batteries

-

-

Battery Material Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Lithium Ion

-

Cathode Materials

-

Lithium Cobalt Oxide (LCO)

-

Lithium Nickel Manganese Cobalt Oxide (NMC)

-

Lithium Iron Phosphate (LFP)

-

Lithium Manganese Oxide (LMO)

-

Lithium Nickel Cobalt Aluminum (NCA)

-

Anode Materials

-

Natural Graphite

-

Artificial Graphite

-

Amorphous Carbon

-

LTO

-

Si Compounds

-

Separator

-

Others

-

Lead Acid

-

Electrodes

-

Electrolyte

-

Separator

-

Packaging

-

Other Batteries

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Lithium Ion

-

Consumer electronics

-

Automotive

-

Grid storage

-

Others

-

Lead Acid

-

Automotive

-

UPS

-

Telecom

-

Others

-

Other Batteries

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global battery raw materials market size was estimated at USD 53.55 billion in 2023 and is expected to reach USD 57.72 billion in 2024.

b. The global battery raw materials market is expected to grow at a compound annual growth rate of 8.8% from 2024 to 2030 to reach USD 95.75 billion by 2030.

b. Lead-acid battery type segment led the market and accounted for over 66.6% share of the revenue in 2023. The benefits offered by lead-acid batteries, such as longer lifespan and high energy density, are likely to contribute to the market's growth.

b. Some of the key players operating in the battery raw materials market include Targray, ENTEK, BASF Catalysts LLC, DuPont, Hitachi, Ltd., NICHIA CORPORATION, Mitsubishi Chemical Group Corporation, Celgard LLC, Umicore N.V., NEI Corporation.

b. The key factors that are driving the global battery raw materials market include growing demand for lithium-ion batteries from the automobile industry for their use in electric vehicles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.