- Home

- »

- Catalysts & Enzymes

- »

-

Beauty & Personal Care Surfactants Market Size, Industry Report, 2025GVR Report cover

![Beauty And Personal Care Surfactants Market Size, Share & Trends Report]()

Beauty And Personal Care Surfactants Market Size, Share & Trends Analysis Report, By Product (Nonionics, Cationics, Amphoterics, Anionics, Others), By Application, By Region, And Segment Forecasts, 2019 - 2025

- Report ID: GVR-2-68038-903-6

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2015 - 2017

- Forecast Period: 2019 - 2025

- Industry: Specialty & Chemicals

Industry Insights

The global beauty and personal care surfactants market size was valued at USD 7.35 billion in 2018 and is estimated to expand at a CAGR of around 6.79% by the end of 2025. It is driven by the rise in demand for sunscreens, bio-based, and anti-aging products. Rising awareness regarding the advantages of skin-friendly products in the personal care industry is anticipated to further fuel the growth.

Rise in product innovations by the key market players including the use of bio-based ingredients has contributed to the product demand. For instance, in April 2018, BASF introduced a new range of personal care products for hair and healthy skin solutions with mild surfactants and natural conditioning elements. Moreover, the rise in the living standards among the working and high-class population is expected to contribute to the product demand, thereby driving the growth of the beauty and personal care surfactants market.

Rising demand from the younger population possesses a huge impact on personal care and beauty products. However, consumers also tend to spend a high amount on skin and hair care products. Moreover, increasing penetration of the global companies such as L'Oréal SA; Colgate-Palmolive Company; Procter and Gamble; Avon Products Inc.; Helen of Troy Limited; Johnson and Johnson; Unilever; and Estee Lauder Companies Inc. provides a boost for the product demand.

The positive impact of social media advertisements, e-commerce channels, and many beauty specialist retailers provide huge growth opportunities to personal care products. The rise in consumer purchasing power and awareness regarding beauty and personal hygiene are anticipated to further drive the product demand. Moreover, the high demand for anti-aging products from Generation X is also projected to drive market growth.

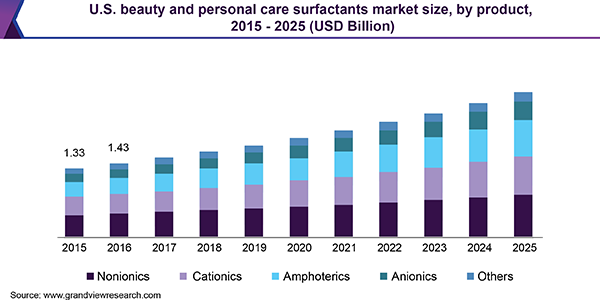

Product Insights

Nonionic held the largest market share of about 32.89% in 2018. The segment is driven by the ability of the product to dissolve the poorly soluble ingredients. This helps it gain significant market share in beauty, skin, and personal care products. Moreover, an increase in demand for waterless products such as cleansers and face wash is projected to drive the growth in near future. For instance, in April 2017, Emami Ltd., launched a waterless face wash called HE On The Go, in advanced grooming category.

Amphoteric product is anticipated to witness the fastest CAGR of 8.77% from 2019 to 2025. Rising application of this product due to its antibacterial, compatibility, low toxicity, and excellent resistance to hard water is expected to propel the growth. The product finds application in the hair care and bath and shower products as it is mild on eyes and skin. Application of the product to enhance the anti-itching and skincare features of shower gels, shampoo, hand soaps, and cleansers among other products is anticipated to further drive the growth.

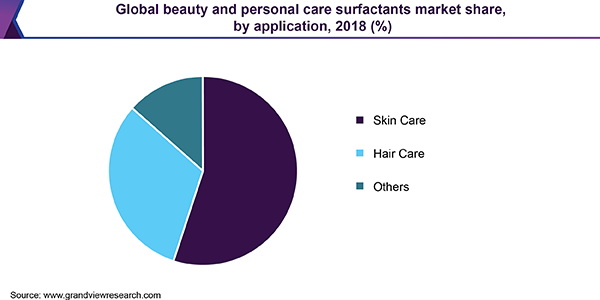

Application Insights

The skincare application held the largest market share of around 54.99% in 2018. The segment is driven by increasing penetration of the retail industry, especially in developing countries such as China and India. However, a rise in demand for anti-aging products among the middle-aged population is also attributed to the market growth. Moreover, changing beauty trends and rising consumer awareness drive growth. For instance, the skin care products market is anticipated to expand at a CAGR of 4.4% reaching around USD 183 billion by 2025. This factor is anticipated to boost the demand for beauty and personal care surfactants in the forthcoming years.

Haircare application is anticipated to expand at the fastest CAGR of around 8.13% over the forecast period. It is driven by a rise in hair related problems along with the changing trends in the fashion industry. Moreover, the rise in product developments due to grey hair problems, especially in developing countries provides a significant growth opportunity for the market. Rise in innovations in natural and herbal ingredients provided in the hair care category is also expected to drive the growth. For instance, Procter & Gamble provides a green tea and cucumber conditioner under the green essences category extracted from natural and herbal ingredients.

Regional Insights

In terms of value, Asia Pacific held the largest market share of about 37.44% in 2018. The rise of application sectors such as hair and care products due to the growing aged population is anticipated to boost the demand for beauty and personal care surfactants. Rising demand for anti-aging products along with the rise in the working population and disposable income in personal care applications is anticipated to drive the growth. In China, disposable personal income grew at a rate of 15% from the year 2001 to 2016. The increasing purchasing power and preference for effective beauty products are expected to drive the application of surfactants in beauty care.

North America is expected to register the highest CAGR of 8.20% over the forecast period, on account of rising demand for personal care products. Growing consumer awareness regarding grooming and personal well-being is anticipated to propel the demand for various skin and hair care products in the region. In the U.S., personal care products for hair, skin, and oral hygiene was valued at USD 128.16 billion in 2015 and is estimated to expand at a CAGR of 4.50% over the forecast period.

Beauty and Personal Care Surfactants Market Share Insights

Rising demand for products such as natural materials leads to the increase in product innovations and advancements, thereby fueling the market growth. The market is identified by several strategic activities, such as acquisitions and mergers, and product innovations, capacity expansions, initiated by the key manufacturers such as BASF, Akzo Nobel, Kao Corporation, Stepan Company, Rhodia, Clariant, Evonik Industries, and Croda International.

Key players are focusing on expanding their presence to obtain greater market share. The strategic partnerships and joint ventures with buyers to introduce new applications and products are projected to remain a critical success factor over the forecast period. Manufacturers are also likely to focus on promotional activities and brand endorsements owing to the rising influence of social media endorsements and e-commerce.

Report Scope

Attribute

Details

The base year for estimation

2018

Actual estimates/Historical data

2015 - 2017

Forecast period

2019 - 2025

Market representation

Revenue in USD Billion & CAGR from 2019 to 2025

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Country Scope

U.S., Germany, U.K., China, India, Brazil, South Africa

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2025. For this study, Grand View Research has segmented the global beauty and personal care surfactants market report based on the product, application, and region:

-

Product Outlook (Revenue, USD Billion, 2015 - 2025)

-

Nonionic

-

Cationic

-

Amphoteric

-

Anionics

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2015 - 2025)

-

Skin Care

-

Hair Care

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2015 - 2025)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."