- Home

- »

- Advanced Interior Materials

- »

-

Beryllium Market Size, Share, Growth, Industry Report, 2033GVR Report cover

![Beryllium Market Size, Share & Trends Report]()

Beryllium Market (2026 - 2033) Size, Share & Trends Analysis Report By Application (Industrial Components, Aerospace & Defense, Automotive Electronics, Telecommunications Infrastructure, Consumer Electronics), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-224-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Beryllium Market Summary

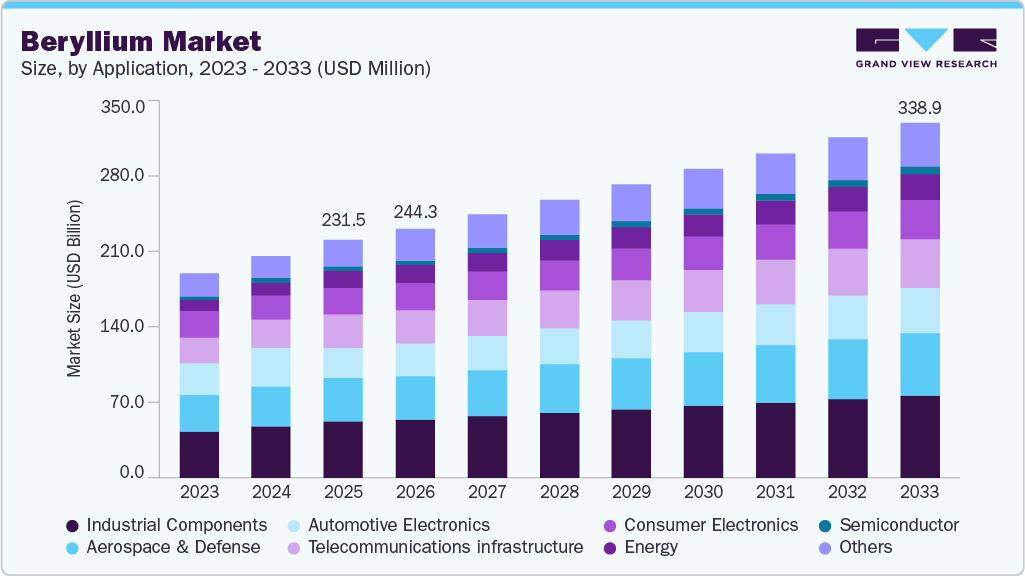

The global beryllium market size was estimated at USD 231.5 million in 2025 and is expected to reach USD 338.9 million by 2033, growing at a CAGR of 6.8% from 2026 to 2033. The increasing demand for high-performance materials in aerospace and defense applications stands as a major growth driver for the beryllium market.

Key Market Trends & Insights

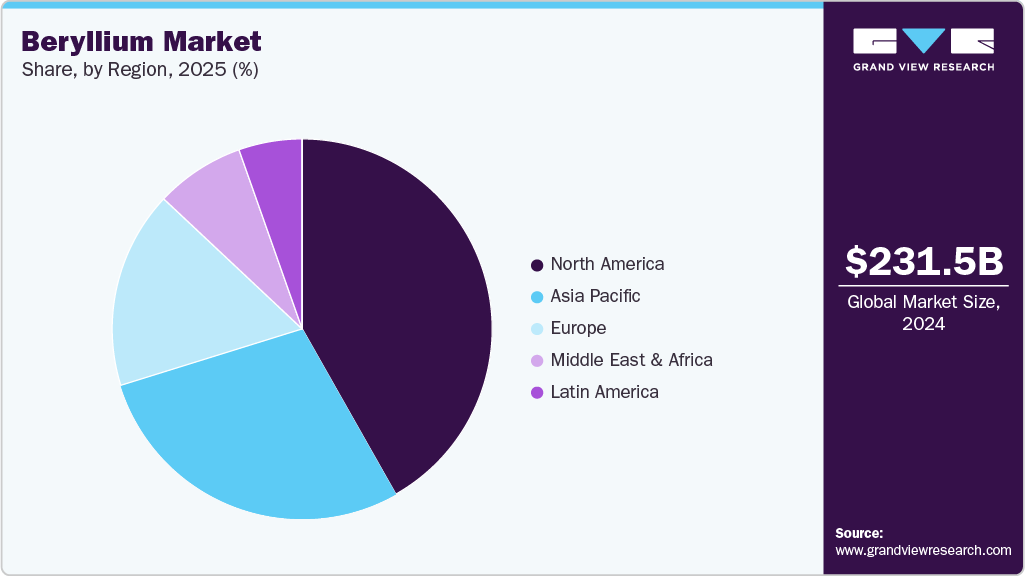

- North America dominated the beryllium market with the largest market revenue share of over 41.0% in 2025.

- The beryllium market in the U.S. is expected to grow at a significant CAGR over the forecast period.

- By application, the semiconductor segment is anticipated to grow at the fastest CAGR over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 231.5 Million

- 2033 Projected Market Size: USD 338.9 Million

- CAGR (2026-2033): 6.8%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Beryllium’s remarkable stiffness, combined with low density, makes it an ideal component in structural parts of aircraft, satellites, and missiles. As global aerospace activity expands with both commercial airline production and defense modernization programs, more beryllium components are required for structural panels, actuators, and precision instruments. This trend draws further strength from the push for fuel efficiency and lightweight design, since beryllium helps reduce overall weight while maintaining mechanical integrity.

The electronics and telecommunications sectors contribute significantly to the beryllium market growth by using beryllium copper alloys in connectors, switches, and other critical components. These alloys deliver excellent electrical conductivity and thermal performance, ensuring reliability in high-frequency and high-speed data applications. As 5G infrastructure deployment accelerates worldwide, demand for advanced interconnects and RF modules increases. Beryllium is vital in meeting stringent performance requirements, particularly where miniaturization and heat dissipation are priorities.

Medical technologies also stimulate demand for beryllium and its alloys, particularly in imaging equipment and precision surgical instruments. Beryllium’s unique properties enable sharper imaging in X-ray systems and other diagnostic devices. Hospitals and clinics expanding their advanced care capabilities drive the procurement of beryllium-containing equipment. Furthermore, growth in minimally invasive procedures spurs the use of specialized tools where material performance directly impacts procedural success and patient outcomes.

The energy sector is another area where beryllium demand is on the rise. In nuclear reactors, beryllium serves as a neutron moderator and reflector, improving the efficiency and safety of fission processes. With investments in both new and refurbished nuclear facilities, the need for reliable moderators grows. At the same time, renewable energy technologies such as wind turbines and solar trackers depend on highly durable electrical contacts and components, where beryllium alloys offer long-term stability and resistance to fatigue under cyclic load.

Ongoing advancements in manufacturing processes and recycling capabilities further support the beryllium market expansion. Improved powder metallurgy and additive manufacturing techniques reduce production costs and enable more complex component designs. Recycling initiatives recover beryllium from obsolete parts, easing supply constraints and making the material more attractive to price-sensitive industries. Collectively, these technological improvements fortify market resilience by broadening the range of applications while reducing environmental and economic barriers to adoption.

Drivers, Opportunities & Restraints

The industry is primarily driven by its exceptional material properties that support critical performance requirements across advanced industries. High stiffness to weight ratio, thermal stability, and excellent electrical conductivity make beryllium indispensable in aerospace, defense, electronics, and nuclear applications. Rising investments in aircraft production, satellite deployment, advanced electronics, and nuclear energy infrastructure continue to strengthen demand. The growing focus on miniaturization, precision engineering, and high-reliability components further reinforces the role of beryllium in next-generation technologies.

Significant opportunities exist as emerging technologies broaden the application base of beryllium and its alloys. Expansion of 5G networks, electric vehicles, renewable energy systems, and advanced medical imaging creates new demand for high-performance connectors, sensors, and structural components. Progress in manufacturing methods, such as additive manufacturing and improved alloy development, enables more efficient use of beryllium, opening opportunities in complex and customized components. Recycling and secondary recovery initiatives also present long-term opportunities by improving supply sustainability and cost efficiency.

Despite these positives, the industry faces notable restraints related to health, safety, and regulatory challenges. Exposure risks during mining and processing require strict controls, increasing compliance costs for producers and limiting the entry of new players. Supply concentration and limited global production capacity can lead to price volatility, affecting downstream industries.

Application Insights

The industrial components segment held the revenue share of over 23% in 2025. It represents a core application area within the beryllium market, driven by the metal’s exceptional combination of high stiffness, low density, thermal stability, and resistance to wear. These properties make beryllium and beryllium-containing alloys highly suitable for precision industrial components such as springs, connectors, diaphragms, bushings, and non-sparking tools used in demanding environments.

The semiconductors segment represents a high-value application within the beryllium market, driven by the material’s exceptional thermal conductivity, stiffness, and dimensional stability under extreme operating conditions. In semiconductor manufacturing, beryllium and beryllium-containing alloys are widely used in critical components such as wafer handling tools, vacuum chamber parts, beam windows, and precision alignment fixtures. These components must maintain tight tolerances during high-temperature processing and plasma-based fabrication steps, where conventional metals tend to deform or lose performance.

Regional Insights

North America beryllium marketheld over 41% revenue share of the global beryllium industry, primarily driven by robust demand from the aerospace, defense, and telecommunications sectors. Beryllium's unique properties, including its exceptional stiffness-to-weight ratio, thermal stability, and transparency to X-rays, make it a critical material for high-performance applications. For instance, in aerospace and defense, beryllium is indispensable for satellite components, inertial guidance systems, and fighter jet optics, as seen in its use by major contractors like Lockheed Martin and Raytheon Technologies.

U.S. Beryllium Market Trends

The beryllium market in the U.S. is fundamentally driven by its status as a strategic and critical material for national security and advanced technology. The Department of Defense (DoD) and associated contractors are primary consumers, relying on beryllium's unparalleled properties for mission-critical systems. For example, beryllium is essential in the targeting and surveillance pods of F-35 fighter jets, the mirror assemblies in advanced missile defense satellites like those in the Space-Based Infrared System (SBIRS), and the guidance systems of precision munitions.

Asia Pacific Beryllium Market Trends

The beryllium market in Asia Pacific is experiencing significant growth driven by the twin engines of rapid industrialization and massive investments in electronics manufacturing and telecommunications infrastructure. As the global hub for consumer electronics and semiconductor production, countries like China, Japan, South Korea, and Taiwan generate enormous demand for beryllium-copper alloys. These alloys are critical for manufacturing high-reliability connectors, switches, and miniaturized components in smartphones, laptops, and automotive electronics. A prime example is the proliferation of 5G networks across the region, led by Chinese tech giants like Huawei and ZTE, which requires beryllium-copper for base station components and connectors that ensure signal integrity and thermal management in high-density urban environments.

Europe Beryllium Market Trends

The beryllium market in Europe is primarily driven by the region's world-leading aerospace, nuclear research, and high-performance automotive sectors, underpinned by stringent regulatory standards for safety and reliability. The aerospace industry, with giants like Airbus, Safran, and Rolls-Royce, is a major consumer, utilizing beryllium-aluminum alloys (e.g., AlBeMet) for critical, weight-sensitive structural components in satellites and aircraft, such as the Eurofighter Typhoon's avionics enclosures.

Latin America Beryllium Market Trends

The beryllium market in Latin America is nascent and fundamentally constrained, with limited direct consumption and growth drivers centered almost exclusively on its role as a critical mineral exporter, primarily from Brazil. The region possesses one of the world's largest non-US reserves of bertrandite ore in the state of Minas Gerais, making Brazil a strategic global supplier of raw beryllium hydroxide to the processing facilities in the U.S.

Key Beryllium Companies Insights

Key players operating in the beryllium market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth. Some of the key players operating in the market include American Elements, American Beryllia Inc. among others.

-

American Beryllia Inc., a subsidiary of Materion Corporation, is a preeminent, fully integrated global leader in the manufacturing and supply of advanced beryllium oxide (BeO) ceramic materials and components. Founded with deep roots in defense and aerospace, the company has evolved into a critical supplier for the most demanding high-reliability applications where exceptional thermal management is paramount.

-

American Elements is a globally recognized manufacturer and supplier of engineered and advanced materials, operating as a vast catalog-based corporation with a product portfolio exceeding 15,000 items. Founded in 1997 and headquartered in Los Angeles, California, the company operates more as a diversified materials science conglomerate than a beryllium specialist. Its business model is built on vertical integration, controlling processes from ore sourcing through advanced material production, and a vast global supply chain network.

Key Beryllium Companies:

The following are the leading companies in the beryllium market. These companies collectively hold the largest market share and dictate industry trends.

- American Beryllia Inc

- American Elements

- Aviva Metals

- Belmont Metals Inc

- Charter Dura-Bar, Inc.

- China Beryllium Copper Alloy Co Ltd

- IBC Advanced Alloys Corp

- Materion Corporation

- NGK Metals Corporation

- Ulba Metallurgical Plant

Recent Developments

- In January 2024, Materion Corporation expanded its manufacturing capabilities for proprietary AlBeCast aluminum-beryllium products at its flagship facility in Elmore, Ohio. The expansion specifically enhanced the company's investment casting capacity to meet growing demand from aerospace, defense, and precision industrial equipment industries, leveraging Materion's position as the world's only mine-to-mill integrated beryllium producer.

Beryllium Market Report Scope

Report Attribute

Details

Market definition

The market represents total consumption of beryllium in various applications.

Market size value in 2026

USD 244.3 million

Revenue forecast in 2033

USD 338.9 million

Growth rate

CAGR of 6.8% from 2026 to 2030

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue and volume forecast, company ranking, competitive landscape, flit factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Russia; Turkey; China; India; Japan; South Korea; Australia; Brazil; Saudi Arabia

Key companies profiled

Materion Corporation, Ulba Metallurgical Plant, IBC Advanced Alloys Corp, NGK Metals Corporation, American Beryllia Inc, Belmont Metals Inc, American Elements, China Beryllium Copper Alloy Co Ltd, Aviva Metals, Charter Dura Bar, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Beryllium Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global beryllium market report on the basis of application, and region.

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Industrial Components

-

Aerospace & Defense

-

Automotive Electronics

-

Telecommunications Infrastructure

-

Consumer Electronics

-

Energy

-

Semiconductor

-

Others

-

-

Regional Outlook (Volume, Kil0tons; Revenue, USD Million, 2021-2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Russia

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global beryllium market size was estimated at USD 231.5 million in 2025 and is expected to reach USD 244.3 million in 2026.

b. The global beryllium market is expected to grow at a compound annual growth rate of 6.8% from 2026 to 2033 to reach USD 338.9 million by 2033.

b. The industrial components segment dominated the beryllium market with a revenue share of nearly 23% in 2025.

b. Some of the key vendors of the global beryllium market are Materion Corporation, Ulba Metallurgical Plant, IBC Advanced Alloys Corp, NGK Metals Corporation, American Beryllia Inc, Belmont Metals Inc, American Elements, China Beryllium Copper Alloy Co Ltd, Aviva Metals, Charter Dura Bar, among others

b. The key factors that are driving the beryllium market include growing demand from aerospace and defense applications, increasing use of beryllium copper alloys in electronics and telecommunications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.