- Home

- »

- Food Additives & Nutricosmetics

- »

-

Beta-carotene Market Size, Share & Growth Report, 2030GVR Report cover

![Beta-carotene Market Size, Share & Trends Report]()

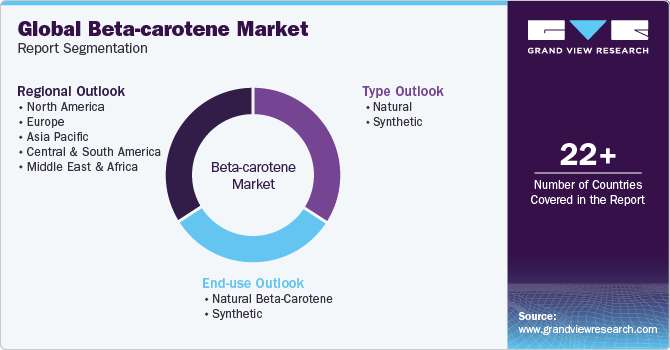

Beta-carotene Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Natural, Synthetic), By End-use (Food & Beverages, Pharmaceutical, Dietary Supplements), By Region (North America, Asia Pacific), And Segment Forecasts

- Report ID: GVR-1-68038-999-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Beta-Carotene Market Summary

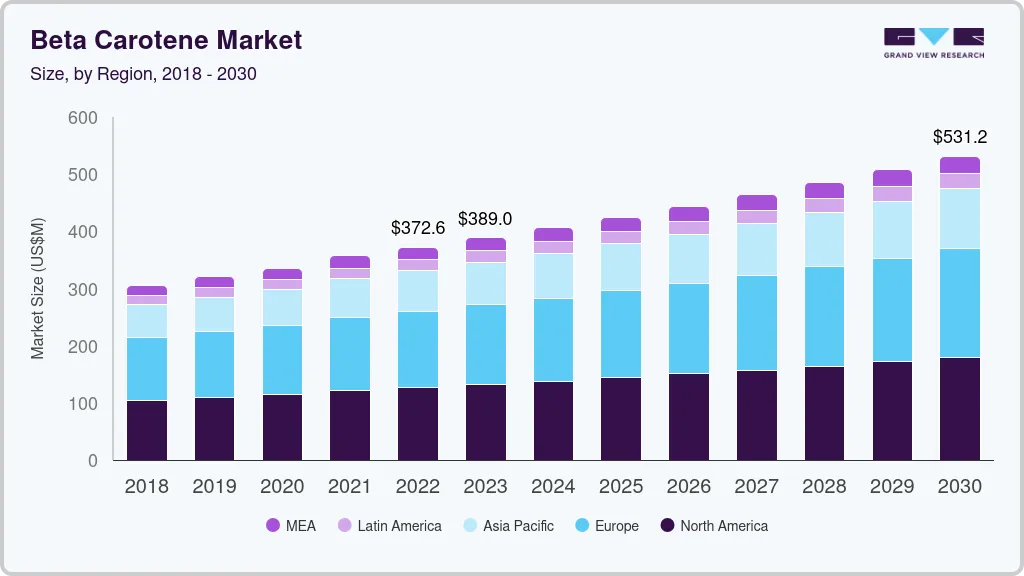

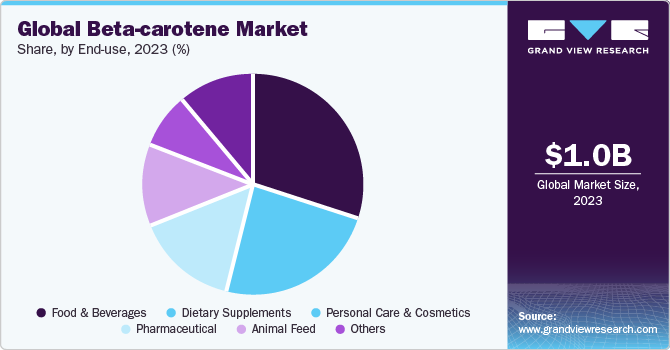

The global beta carotene market size was estimated at USD 1.03 billion in 2023 and is projected to reach USD 1.38 billion by 2030, growing at a CAGR of 4.3% from 2024 to 2030. The growth is attributed to the increasing consumption of beta-carotene in food & beverages, dietary supplements, personal care & cosmetics, and animal feed industries across the globe.

Key Market Trends & Insights

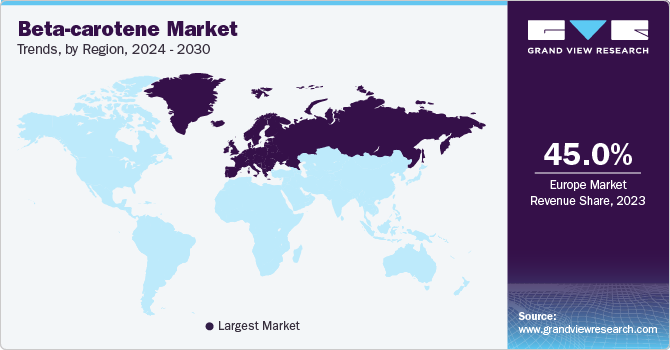

- In terms of region, Europe was the largest revenue generating market in 2023.

- The region held the largest revenue share of 45.0% in 2023.

- In terms of type, the natural segment dominated the market with a revenue share of 31.4% in 2023.

- In terms of end use, the food & beverage segment dominated the market with a revenue share of 30.5% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.03 Billion

- 2030 Projected Market Size: USD 1.38 Billion

- CAGR (2024-2030): 4.3%

- Europe: Largest market in 2023

In the personal care & cosmetics industry, beta carotene is widely utilized due to its antioxidant characteristics and ability to provide a yellow to orange hue to several personal care and cosmetic products. It is a highly effective antioxidant that aids in safeguarding the skin against free radical-induced damage. Unstable molecules, commonly referred to as free radicals, have the potential to elicit premature aging and skin damage.

Beta carotene neutralizes these free radicals, mitigating oxidative stress and abating the likelihood of the manifestation of fine lines, wrinkles, and other signs of aging. The COVID-19 pandemic had a positive impact on the market. This growth is attributed to the product utilization of various nutritional food products as well as other dietary supplements. In addition, the usage of beta-carotene in a wide range of food & beverage products has paved the way for market development. According to the University of California, beta-carotene is viewed as one of the prominent sources of Vitamin A and was included in numerous dietary supplement products during the COVID-19 crisis.

As a result, product demand increased during that period. The U.S. is the largest product consumer in North America with a revenue share of 58.8% in 2022. This is attributed to growing end-use industries in the country. According to Atradius, a credit collection company, the U.S. food & beverage industry witnessed an increase of 3.1% in 2021. In addition, according to an article, the energy drink segment in the U.S. accounted for USD 9.4 billion in 2020 with a growth rate of 2.7% from 2015 to 2020. Thus, this growth is expected to result in the increased use of beta-carotene, for providing color and nutritional properties to beverages over the forecast period.

End-use Insights

The food & beverage segment dominated the market with a revenue share of 30.5% in 2023. Beta-carotene is a popular ingredient in the food industry, used as a natural food colorant and nutritional supplement. It is a naturally occurring pigment, which imparts a unique yellow or orange color to various fruits and vegetables, such as carrots, cantaloupe, apricots, and sweet potatoes. It is used in dairy products, margarine, salad dressings, bakery items, cheese, soft drinks, and energy drinks owing to its attractive color additive properties.

The dietary supplements segment is anticipated to witness considerable growth from 2024 to 2030. Beta-carotene is a commonly used ingredient in dietary supplements as a source of vitamin A, which is an essential nutrient for maintaining a healthy immune system, good vision, and healthy skin. These dietary supplements are available in various forms, such as capsules, tablets, soft gels, and powders. They are marketed as a source of antioxidants, which provide protection against free radicals.

Regional Insights

Europe emerged as the dominant region with a revenue share of 45.0% in 2023. This growth is attributed to the increasing demand for natural ingredients and colorants in food and beverage products, such as energy drinks, confectionary items, carbonated drinks, juices, and baked goods, combined with consumer interest in health and wellness. According to Germany Trade & Invest, the food & beverage industry in Germany witnessed a growth of 8.2% accounting for USD 243.7 billion in 2020. In addition, Germany is Europe’s largest beverage market with average per capita consumption of soft drinks reaching 114.4 liters per year. Moreover, the country witnessed an increase in the demand for non-alcoholic beverages accounting for USD 5.2 billion, with fruit juices witnessing a growth of 48.6%, followed by vitamin, mineral, and energy drinks witnessing a growth of 20.7% in 2020.

Thus, the increasing demand for fruit juices, carbonated drinks, and energy drinks is expected to further drive product demand. North America is also expected to witness significant growth due to the growing awareness about product health benefits, increasing demand for natural coloring agents in the food industry, and rising popularity of dietary supplements. In addition, the trend toward clean labels and natural ingredients has led to increased product demand in North America. Moreover, according to the U.S. Department of Agriculture, Mexico is the 3rd-largest food processor in North America and the 15th-largest in the world. The food & beverage industry in the country witnessed a growth of 4.3%, with a GDP contribution of USD 39.4 billion in 2020. This is expected to provide lucrative growth opportunities for the regional market.

Market Dynamics

In the personal care and cosmetics industry, beta carotene is primarily used on account of its antioxidant properties and its ability to provide a yellow to orange color to various personal care & cosmetic products. It is a potent antioxidant that helps protect the skin from damage caused by free radicals. Free radicals are unstable molecules that can lead to premature aging and skin damage. By neutralizing these free radicals, beta-carotene helps minimize oxidative stress and reduces the risk of fine lines, wrinkles, and other signs of aging. According to the Personal Care Products Council, the global skincare market size is expected to grow from 2019 to 2025 at an average of 24%.

This exponential growth in the skincare market can be attributed to increasing skin care product sales as well as rising R&D investments from various manufacturing companies, such as Curology, TULA, SkinMedica, ExoCoBio, ESTEE LAUDER Companies, and Drunk Elephant. Several companies are investing in the skin care industry for new product development as well as increasing their R&D activities, which has paved the way for the application of ingredients, such as beta carotene, in the formulation of skin care products. Such investments by leading beauty companies are expected to create growth opportunities for the market.

Type Insights

Based on type, the market is sub-segmented into natural and synthetic. The natural type segment dominated the market in 2023 with a revenue share of 31.4%. This growth is attributed to the fact that they are derived naturally from fruits and algae thus considered safer compared to synthetic alternatives. Beta-carotene is a natural pigment and antioxidant that is found in a variety of fruits and vegetables, algae, and yeast. It is a member of the carotenoid family, which includes other pigments, such as lycopene and lutein. The algae sub-segment dominated the market with a revenue share of 39% in 2023. Algae is a natural source of this important nutrient that has gained popularity in recent years due to its various health benefits.

Beta-carotene is a carotenoid that can be converted into vitamin A, an essential nutrient for skin, vision, and immune function. Algae are one of the richest sources of beta-carotene, with certain species, such as Dunaliella salina containing particularly high levels. The synthetic segment is expected to witness significant growth from 2024 to 2030. It is a man-made version of the beta-carotene found in plants. It is chemically identical to natural beta-carotene and is widely used as a natural colorant and nutrient in various industries, including food and beverage production. The primary source of synthetic beta-carotene is chemical synthesis in a laboratory. It can also be produced by genetically modified microorganisms, such as yeast and bacteria, which can synthesize beta-carotene from simpler carbon sources.

Key Companies & Market Share Insights

The industry is characterized by intense competition due to the presence of numerous manufacturers and suppliers, both large- and small-scale. The primary focus of key players is on the incorporation of pioneering technology and the development of novel products, whereas the smaller participants primarily deploy pricing strategies to compete. Companies are actively engaging in partnerships, mergers, and innovative product offerings to fortify their market position. For instance, in April 2023, Givaudan announced the acquisition of Amyris Inc.’s major cosmetic ingredient portfolio. This acquisition will help Givaudan strengthen its position in the cosmetic & personal care segment by providing natural and chemical-free cosmetics and personal care products infused with beta-carotene.

Key Beta-carotene Companies:

- AVANSCHEM

- BASF SE

- Central Drug House

- DDW The Color House

- Divi’s Nutraceuticals

- DSM

- E.I.D.–Parry (India) Ltd.

- Foodchem International Corp.

- Food RGB

- Lycored

- Nutralliance

- Otsuka Pharmaceutical Co., Ltd.

- Reliance Private Label Supplements

- San-Ei Gen F.F.I., Inc.

- Sensient Technologies Corp.

- Vinayak Corp.

Beta-carotene Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1073.3 million

Revenue forecast in 2030

USD 1.38 billion

Growth rate

CAGR of 4.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion, volume in tons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

AVANSCHEM; BASF SE; Central Drug House; DDW The Color House; Divi’s Nutraceuticals; DSM; E.I.D. –Parry (India) Ltd.; Foodchem International Corp.; Food RGB; Lycored; Nutralliance; Otsuka Pharmaceutical Co., Ltd.; Reliance Private Label Supplements; San-Ei Gen F.F.I., Inc.; Sensient Technologies Corp.; Vinayak Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Beta-carotene Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global beta-carotene market report based on type, end-use, and region:

-

Type Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Natural

-

Algae

-

Fruits & Vegetables

-

Yeast

-

Others

-

-

Synthetic

-

-

End-Use Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Natural Beta-Carotene

-

Food & Beverages

-

Dietary Supplements

-

Personal Care & Cosmetics

-

Pharmaceutical

-

Animal Feed

-

Other

-

-

Synthetic

-

Food & Beverages

-

Dietary Supplements

-

Personal Care & Cosmetics

-

Pharmaceutical

-

Animal Feed

-

Other

-

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global beta-carotene market size was estimated at USD 1.03 billion in 2023 and is expected to reach USD 1073.3 million in 2024

b. The global beta-carotene market is expected to grow at a compound annual growth rate of 4.3% from 2024 to 2030 to reach USD 1.38 billion by 2030

b. Europe dominated the beta-carotene market with a share of 45% in 2023. This is attributable to the widespread recognition of beta-carotene as a natural and safe ingredient in the cosmetics & personal care industry due to its skin-nourishing properties.

b. Some key players operating in the beta-carotene market include BASF SE, DSM, E.I.D. –Parry (India) Limited, and Foodchem International Corporation among others

b. Key factors that are driving the beta carotene market growth include increasing consumption of beta-carotene in the food & beverages, dietary supplements, personal care & cosmetics, and animal feed industries

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.