- Home

- »

- Biotechnology

- »

-

Bioburden Testing Market Size, Share, Industry Report, 2030GVR Report cover

![Bioburden Testing Market Size, Share & Trends Report]()

Bioburden Testing Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Consumables, Instruments), By Test Type, By Application (Raw Material Testing), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-774-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Bioburden Testing Market Size & Trends

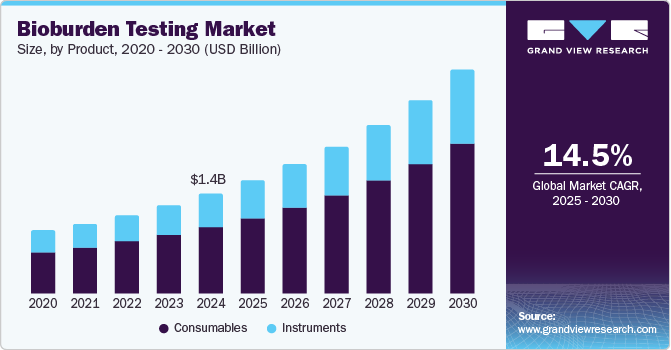

The global bioburden testing market size was estimated at USD 1.44 billion in 2024 and is projected to grow at a CAGR of 14.5% from 2025 to 2030. Growing pharmaceutical, biotechnology, medical device, and food and beverage industries are expected to drive the growth. The rising concerns of consumers regarding food quality are leading to the demand for bioburden testing. In addition, effective quality assurance of pharmaceuticals is essential to reduce the risk and level of uncertainties that may occur in the future to the consumer’s health.

A rise in government initiatives to promote bioburden testing tools is expected to drive the demand. The high risk of microbial contamination and bioburden during pharmaceutical and biologics manufacturing is considered a key factor encouraging governments and private organizations to introduce various biological safety practices. Microbial contamination exerts a huge impact on biologics and pharmaceuticals manufacturing, generally, leading to product variability and significant loss of potency.

Various government authorities are also increasingly involved in issuing guidelines and microbial contamination prevention strategies, which are anticipated to promote bioburden testing and thereby contribute to the market's growth. In addition, several publications released by organizations to promote awareness regarding safety testing tools are broadening the future growth prospects.

Increasing food safety standards have led to a high need for microbiological bioburden testing in the food and beverage industry. Hence, key players are expanding their portfolio in microbial testing tools for food and beverage. For instance, Merck has a ready-to-use (RTU) culture media portfolio to test microbiological bioburden for non-sterile food and beverages.

Increasing R&D investments by prominent companies and research costs are expected to encourage companies to adopt highly efficient biological testing tools to counter the possible losses caused by contamination. For instance, Bristol-Myers Squibb invested in the production of investigational medicine to support clinical trials. Furthermore, regulatory bodies, such as the U.S. Food and Drug Administration (FDA) requires sterilization validation, creating a need for bioburden testing for medical devices.

Product Insights

Consumables dominated the bioburden testing market, accounting for the highest revenue share of 66.4% in 2024. The segment is further divided into culture media, reagents, and kits. Culture media offers essential nutrients for the development and cultivation of microorganisms, making it a pivotal component in bioburden testing. The increasing prevalence of personalized medicine, which relies heavily on diagnostic reagents and kits, is also contributing to the market growth. The frequency and number of samples depend on factors such as sterility assurance levels (SAL), sterilization methods, and environmental controls. As per the AAMI Radiation Sterilization standard (ANSI/AAMI/ISO 11137), 10 samples should undergo bioburden testing during each quarterly dose audit. For products validated under the Industrial Ethylene Oxide Sterilization standard (AAMI/ANSI/ISO 11135), the frequency of bioburden testing depends on the method used during the initial validation process. Typically, products validated using the overkill method require quarterly testing of 3-10 samples, while BI/bioburden method products also need periodic testing, further increasing the need for consumables to support these regular tests and maintain compliance with industry standards.

The demand for instruments in the bioburden testing market is expected to grow significantly at a CAGR of 14.1% over the forecast period. The segment is further divided into automated microbial identification systems and PCR instruments. The tools provide increased sample processing capabilities, leading to quick testing. Automation reduces the possibilities of contamination and mistakes related to manual processes. The development of new pharmaceuticals and medical devices requires rigorous bioburden testing to deliver the most accurate and efficient result

Test Type Insights

Aerobic count testing led the bioburden testing market, accounting for the largest revenue share of 36.6% in 2024. It is also known as standard plate count or total plate count which is a microbiological technique utilized for counting the overall quantity of living aerobic microorganisms such as yeast and mold. It ensures the overall cleanliness and hygiene of the environment and product as well. Many industries establish precise limits on aerobic bacteria counts to guarantee the safety and quality of their products.

In the food industry, this testing method ensures safety by detecting microbial contamination such as campylobacter, salmonella, escherichia coli, norovirus, and listeria, helping prevent spoilage and extend shelf life. In the pharmaceutical industry, it ensures product sterility and monitors manufacturing hygiene and plays a crucial role in infection control and sanitation monitoring. Many industries establish precise limits on aerobic bacteria counts to guarantee the safety and quality of their products.

The anaerobic count testing segment in the bioburden testing market is expected to grow significantly at a CAGR of 14.7% over the forecast period. It is a microbiological technique used to ascertain the quantity of anaerobic bacteria in the sample provided. The anaerobic bacteria are the type of organisms which survive and flourish in environments devoid of oxygen. The presence of high levels of these bacteria can contaminate the product and indicate spoilage, due to these factors the necessity for this segment rises.

Application Insights

The raw material testing sector dominated the bioburden testing market, with the largest revenue share of 30.4% in 2024. The market growth is driven by the critical role raw materials play in process industries. In addition, these materials are the foundation of the production process, their quality directly impacts the final products. Early detection of defects or inconsistencies in raw materials helps companies avoid significant costs by preventing rework, production delays, and customer complaints. Ensuring the quality of raw materials through testing helps mitigate risks, making it an essential step in maintaining product safety and efficiency. Food and beverage, pharmaceutical, and biotechnology manufacturers are consistently improving the quality of their finished products by conducting thorough bioburden testing on raw materials.

The medical device testing segment is expected to grow significantly at a CAGR of 14.8% over the forecast period. It aids in assessing the overall number of microbes present on medical equipment as a pre-sterilization quality check prior to their ultimate usage or placement. According to the World Health Organization (WHO), approximately 2 million, different kinds of medical devices are available globally, divided into over 7,000 generic device categories. The test on the devices is carried out to determine the durability, cleanliness, and quality of products while being manufactured. Device testing helps in getting optimal performance and better patient outcomes.

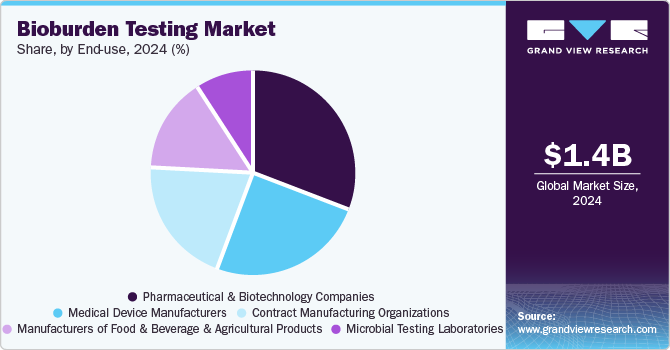

End-use Insights

Pharmaceutical and biotechnology companies dominated the bioburden testing market with the largest revenue share in 2024. The increase in drug production and thriving pharmaceutical and biotech industries are some of the key drivers attributing to the growth of the bioburden testing market. Moreover, growing government support for the pharmaceutical and biotechnology sectors is encouraging the expansion of the market. Between 2012 and 2023, 15,710 medication recalls were launched due to contamination, manufacturing issues, labeling, OOS, and sterility. The FDA mandates that manufacturers adhere to regulations for unapproved drugs, as non-compliance can damage the approval system, harm the NDA patent holder's reputation, and lead to actions such as injunctions or seizures.

The contract manufacturing organizations segment is expected to grow at the fastest CAGR over the forecast period. The increasing demand for specialized expertise is resulting in the need for the requisite skills and resources to conduct bioburden tests with precision and effectiveness. Contract manufacturing organizations offer cost-efficient solutions by utilizing specialized equipment and economies of scale, leading to market growth.

Regional Insights

The North America bioburden testing market dominated the global market and accounted for the largest revenue share of 35.4% in 2024. The rising demand for bioburden testing in North America is driven by the need to prevent contamination in the food and pharmaceutical industries, as it leads in the pharmaceutical industry globally. Failure to implement effective food safety protocols can result in contaminated products, costly recalls averaging USD 10 million, and long-term damage to consumer trust, with 21% of consumers abandoning a manufacturer after a recall. The World Health Organization emphasizes the link between food safety, nutrition, and public health. Poor hygiene and safety standards can also lead to pharmaceutical contamination, affecting product quality, business sustainability, and public safety.

U.S. Bioburden Testing Market Trends

The bioburden testing market in the U.S. led the North American market with the largest revenue share in 2024. In the U.S., foodborne illnesses impact around 48 million people each year, leading to 128,000 hospitalizations and 3,000 deaths, underscoring a major public health concern that is mostly preventable. The FDA Food Safety Modernization Act has transformed the food safety system by shifting the focus from reacting to foodborne diseases to preventing them. The FDA has introduced multiple FSMA regulations, highlighting that ensuring food safety is a collective responsibility throughout the global supply chain. These factors drive the growing demand for bioburden testing to ensure food safety and prevent contamination.

Asia Pacific Bioburden Testing Market Trends

The Asia Pacific bioburden testing market is expected to grow at the fastest CAGR of 15.7% over the forecast period. Increasing healthcare expenditures, improving clinical research infrastructure, and embracing cost-effective and smaller technologies in clinical research are some of the drivers fueling market growth. Countries such as China, India, and South Korea are witnessing rapid growth in their pharmaceutical sectors, leading to increased production of generic drugs and a higher presence of contract manufacturing organizations. This expansion necessitates stringent quality control measures, including bioburden testing, to meet global standards.

China bioburden testing market held a significant revenue share in 2024. The growth is driven by the stringent regulatory oversight of drugs and medical devices by the National Medical Products Administration (NMPA), formerly the CFDA, which ensures safety and compliance. The registration process takes 270-350 days, involving multiple stages such as clinical trial evaluation and approval, further driving the need for better bioburden testing. As one of the largest consumers and producers of food ingredients, including additives, preservatives, and sweeteners, China’s rapidly expanding food and beverage sector also requires rigorous bioburden testing to meet safety standards and ensure product quality.

Europe Bioburden Testing Market Trends

The Europe bioburden testing market held a substantial market share in 2024. A thriving pharmaceutical and biotech industry in Europe drives the demand for bioburden testing to maintain high-quality standards. The rising need for early detection of bioburden issues to protect and safeguard brand reputation, along with consumer safety, is becoming important in the region. The food and drink industry is the largest manufacturing sector in the EU, employing 4.25 million people and processing 70% of EU agricultural produce. As the largest global exporter of food and drink, it significantly contributes to EU GDP. This vital sector's emphasis on food safety and quality drives the growing demand for bioburden testing in Europe.

Key Bioburden Testing Company Insights

Key companies in the global bioburden testing market include Charles River Laboratories, Merck KGaA, SGS SA, and WuXi AppTec, among others. Major companies in the bioburden testing market stay competitive by continually innovating testing technologies, ensuring compliance with evolving global regulations, and expanding their product offerings. They focus on providing accurate, efficient testing solutions for industries such as pharmaceuticals, food, and healthcare. Strategic partnerships, investments in R&D, and geographical expansion also help them meet the increasing demand for quality and safety assurance worldwide.

-

Charles River Laboratories is a contract research organization (CRO) that provides comprehensive services to the pharmaceutical, biotechnology, and medical device industries. It offers services such as drug discovery, development, and manufacturing solutions. Furthermore, it provides vital expertise in areas such as bioburden testing, toxicology, and microbiology, helping clients ensure the safety, efficacy, and quality of their products.

-

Merck KGaA offers cutting-edge solutions in biopharmaceuticals, laboratory services, and materials for electronics, automotive, and other industries. It develops advanced laboratory technologies and advances research in areas such as cancer, autoimmune diseases, and neurological disorders.

Key Bioburden Testing Companies:

The following are the leading companies in the bioburden testing market. These companies collectively hold the largest market share and dictate industry trends.

- Charles River Laboratories

- Merck KGaA

- SGS SA

- WuXi AppTec

- BD

- North American Science Associates Inc.

- Nelson Laboratories, LLC

- Thermo Fisher Scientific Inc.

- BIOMÉRIEUX

- Pacific Biolabs

Recent Developments

-

In October 2024, Glenmark Pharmaceuticals Europe Ltd recalled Cyanocobalamin 50 mcg Tablets, batch 17231510A, as a precaution due to out-of-specification results for unknown impurities found during routine stability testing. The affected stock was quarantined, and suppliers returned it using the approved process. Immediate action was taken to halt supply and ensure proper recall.

Bioburden Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.64 billion

Revenue forecast in 2030

USD 3.22 billion

Growth rate

CAGR of 14.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, test type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Charles River Laboratories; Merck KGaA; SGS SA; WuXi AppTec; BD; North American Science Associates Inc.; Nelson Laboratories, LLC; Thermo Fisher Scientific Inc.; BIOMÉRIEUX; Pacific Biolabs

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bioburden Testing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bioburden testing market report based on product, test type, application, end-use, and region:

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Consumables

-

Culture Media

-

Reagents and Kits

-

-

Instruments

-

Automated Microbial Identification Systems

-

PCR Instruments

-

-

-

Test Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Aerobic Count Testing

-

Anaerobic Count Testing

-

Fungi/Mold Count Testing

-

Spore Count Testing

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Raw Material Testing

-

Medical Device Testing

-

In-Process Material Testing

-

Sterilization Validation Testing

-

Equipment Cleaning Validation

-

-

End-use Outlook (Revenue, USD Million; 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

Medical Device Manufacturers

-

Contract Manufacturing Organizations

-

Manufacturers of Food & Beverage and Agricultural Products

-

Microbial Testing Laboratories

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global bioburden testing market size was estimated at USD 1.44 billion in 2024 and is expected to reach USD 1.64 billion in 2025.

b. The global bioburden testing market is expected to grow at a compound annual growth rate of 14.49% from 2025 to 2030 to reach USD 3.22 billion by 2030.

b. North America dominated the bioburden testing market with a share of 35.41% in 2024. This is attributable to rise in R&D investments by pharmaceutical and biotechnology industries, development of new biologics, vaccines, and drugs in U.S., and technological advancements.

b. Some key players operating in the bioburden testing market include Charles River Laboratories International, Inc.; SGS SA; Merck KGaA; Becton, Dickinson and Company; Wuxi Apptec; North American Science Associates Inc.; Nelson Laboratories, LLC; Biomérieux SA; Thermo Fisher Scientific; and Pacific Biolabs.

b. Key factors that are driving the market growth include growing pharmaceutical, biotechnology, medical device, and food and beverage industries and rise in government initiatives to promote bioburden testing tools.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.