- Home

- »

- Biotechnology

- »

-

Microbial Identification Market Size, Industry Report, 2030GVR Report cover

![Microbial Identification Market Size, Share & Trends Report]()

Microbial Identification Market (2025 - 2030) Size, Share & Trends Analysis Report, By Product & Services (Instruments, Consumables, Software & Services), By Technology (Mass Spectrometry, PCR), By Method, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-192-4

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Microbial Identification Market Summary

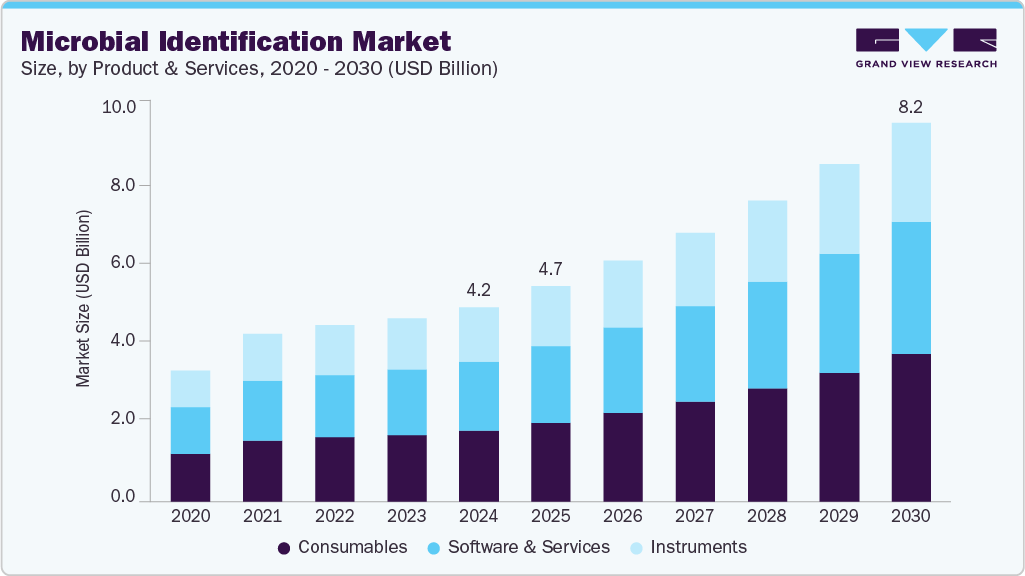

The global microbial identification market size was estimated at USD 4.19 billion in 2024 and is projected to reach USD 8.18 billion by 2030, growing at a CAGR of 11.91% from 2025 to 2030. Rising prevalence of infectious diseases, technological advancements.

Key Market Trends & Insights

- Europe automotive radar market dominated the market 36.02% in 2023.

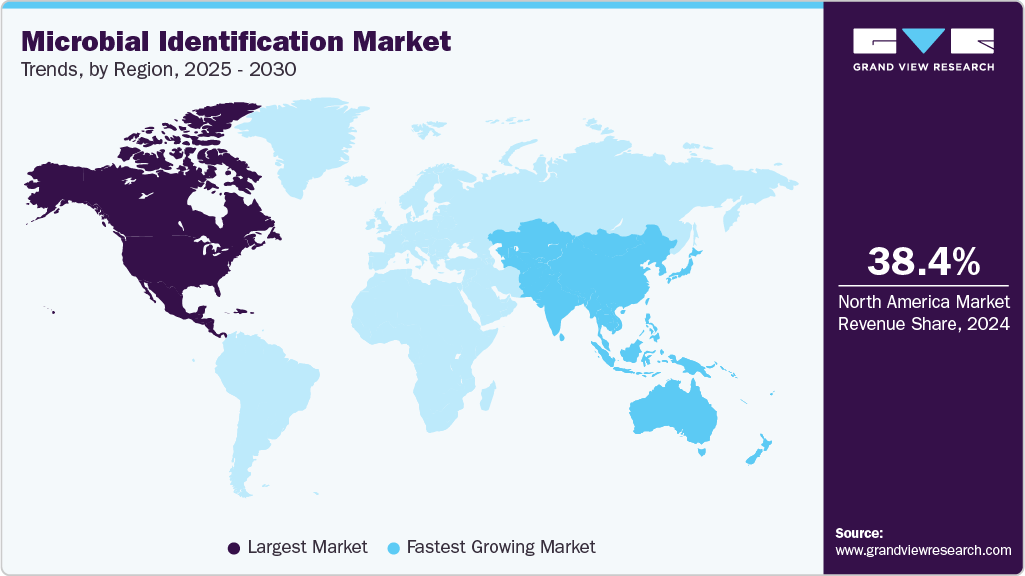

- North America dominated the market with a revenue share of 38.38% in 2024.

- The U.S. microbial identification market is expected to grow significantly over the forecast period.

- By product & services, the consumables segment held the largest market share of 36.60% in 2024.

- By technology, the PCR segment accounted for the largest share at 36.69% in 2024.

- The genotypic methods segment held the largest market share of 42.19% in 2024 and is anticipated to grow at the highest CAGR from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 4.19 Billion

- 2030 Projected Market Size: USD 8.18 Billion

- CAGR (2025-2030): 11.91%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Growing R&D activities,and increasing government investments in the biotechnology & life science sectors are a few factors anticipated to boost the market for microbial identification. Moreover, the rising concern and awareness of food safety and environmental monitoring are projected to further drive the growth of the market from 2025 to 2030. Moreover, the rising concern and awareness of food safety and environmental monitoring are projected to further drive the growth of the market from 2025 to 2030.

Combating Antimicrobial Resistance Through Microbial Identification

Antimicrobial resistance (AMR) refers to the ability of microorganisms to withstand treatments with standard antimicrobial drugs, rendering them ineffective. AMR poses a critical global health threat, leading to increased mortality, prolonged hospital stays, and higher medical costs. Accurate and timely microbial identification is pivotal in addressing AMR by enabling targeted treatment strategies and minimizing the misuse of broad-spectrum antibiotics. As healthcare systems worldwide prioritize antimicrobial stewardship, the demand for precise microbial diagnostics intensifies, driving significant growth in the microbial identification industry.

Advanced microbial identification technologies, such as MALDI-TOF mass spectrometry, PCR-based systems, and next-generation sequencing, offer rapid and reliable pathogen detection. These tools facilitate early and accurate identification of resistant strains, empowering clinicians to make informed therapeutic decisions. Integrating these technologies into routine clinical workflows supports effective infection control, reduces the spread of resistant pathogens, and enhances patient outcomes, making them essential in the global effort to curb AMR.

For instance, the recent Global Research on Antimicrobial Resistance Project forecast, published in The Lancet in September 2024, highlights the alarming future impact of antibiotic resistance. If effective countermeasures are not implemented, bacterial infections resistant to current antibiotics could directly cause over 39 million deaths globally within the next 25 years, with an additional 169 million deaths indirectly linked. By 2050, annual deaths directly and indirectly tied to antimicrobial resistance could rise to 1.91 million and 8.22 million, respectively, representing increases of nearly 68% and 75% from 2022. This escalating health crisis is projected to severely strain global healthcare systems and economies, potentially resulting in annual GDP losses of $1 trillion to $3.4 trillion by 2030.

Government and private sector initiatives to strengthen diagnostic capabilities further accelerate market adoption. International programs, such as the WHO’s Global Action Plan on AMR, urge countries to invest in robust surveillance systems and laboratory infrastructure. As a result, hospitals, diagnostic labs, and research institutions are increasingly deploying microbial identification platforms, reinforcing the market’s vital role in safeguarding public health and preserving the efficacy of existing antimicrobials.

Rising Food Safety Demand Fuels the Growth of Microbial Identification Techniques

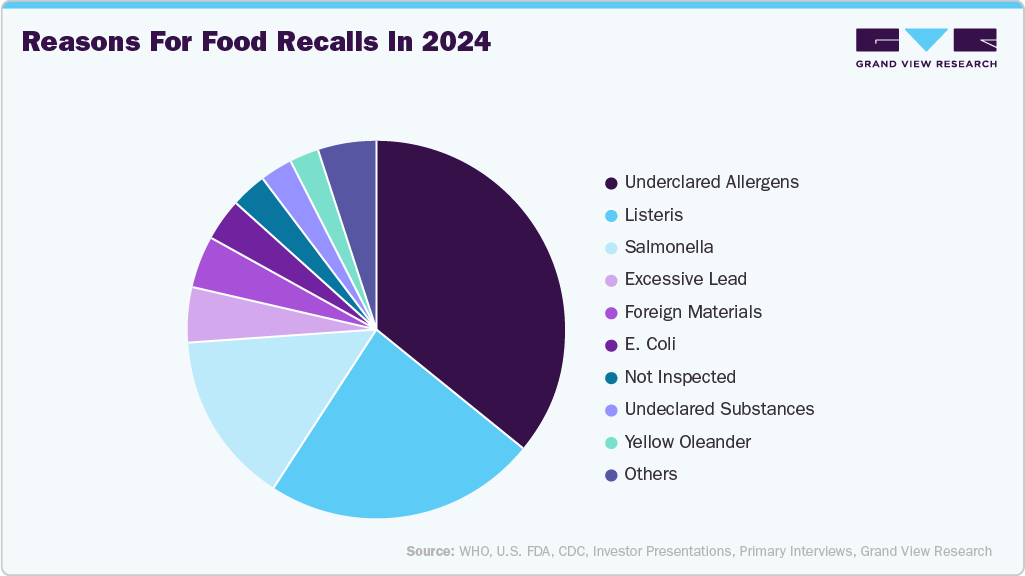

The rise in food safety concerns has significantly propelled the demand for food microbiology testing worldwide, acting as a key driver for the microbial identification industry. Increasing foodborne illnesses, contamination, and non-compliance with labeling regulations have necessitated rigorous testing protocols across the global food supply chain. Regulatory bodies such as the FDA, EFSA, and WHO enforce stringent norms to curb public health risks, pushing food manufacturers to adopt advanced microbial identification solutions. This regulatory push fosters adoption and sets the stage for continuous innovation in rapid and precise testing technologies.

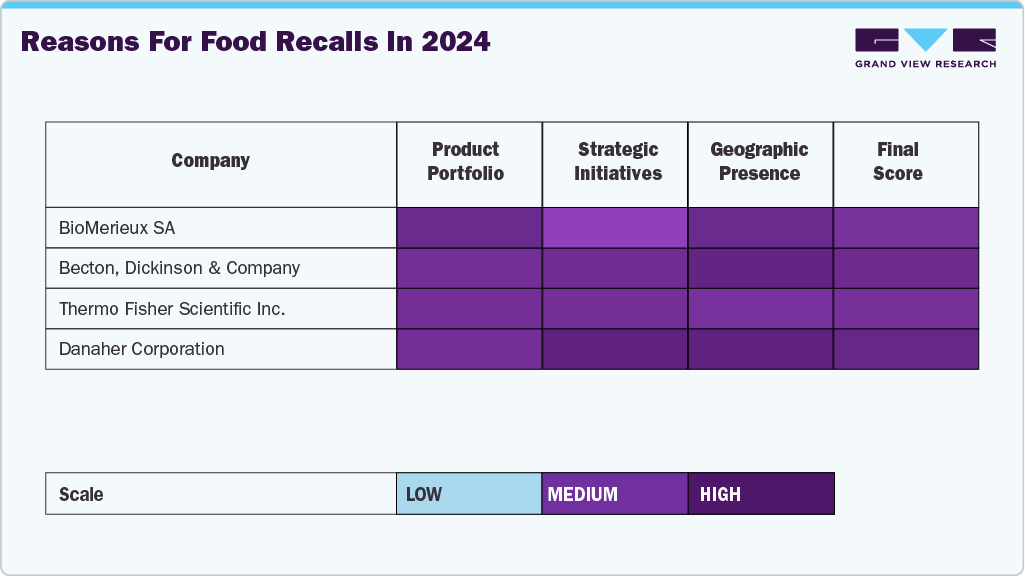

The above chart illustrates the prevalence of various contaminants leading to food recalls, with undeclared allergens and Listeria representing the largest shares. Undeclared allergens alone account for a significant portion of the recalls, indicating a high risk factor and the need for improved detection mechanisms. Listeria, Salmonella, and E. coli are critical pathogens contributing to foodborne outbreaks and product withdrawals, further emphasizing the need for robust microbial identification tools in the food industry. These microbial threats underscore the importance of comprehensive testing systems to ensure product safety and regulatory compliance.

With globalization of the food trade, the complexity of food supply chains has increased, raising the risk of contamination at multiple points from production to distribution. This has driven the need for efficient and scalable microbial identification technologies that deliver real-time and high-throughput testing. Manufacturers are turning to automated platforms and molecular diagnostics that ensure accuracy and reduce testing time. This shift aligns with industry trends toward preventative quality control, traceability, and accountability, positioning microbial identification systems as critical enablers of food safety management.

Market players are capitalizing on this growth opportunity by offering specialized solutions tailored for the food industry, including PCR-based assays, next-generation sequencing (NGS), and MALDI-TOF mass spectrometry. These innovations are rapidly being integrated into food safety programs across developed and emerging economies. As food safety becomes integral to brand reputation and regulatory assurance, the market is expected to witness sustained expansion, driven by the evolving landscape of global food microbiology testing.

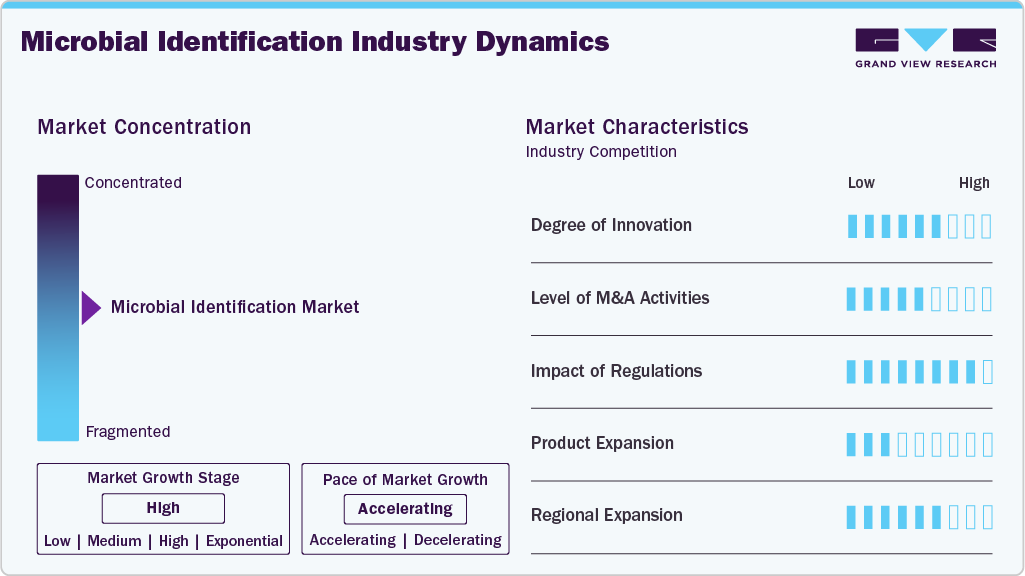

Market Concentration & Characteristics

The microbial identification industry growth stage is high, and the pace of growth is accelerating. The prevalence of infectious diseases continues to be a global concern. As new pathogens emerge and existing ones evolve, there is a growing need for accurate and rapid microbial identification to facilitate timely and effective treatment.

The microbial identification industry is also characterized by a high level of leading players' mergers and acquisitions (M&A) activity. This is due to several factors: the rising focus on increasing the company’s products & services portfolio, the need to consolidate in a rapidly growing market, and the increasing strategic importance of microbiology. Several companies are undertaking this strategy to strengthen their portfolio. For instance, in June 2022, bioMérieux completed the acquisition of Specific Diagnostics for about USD 416.8 million, constituting 3.2 % of the French diagnostic company's market.

Stringent regulations related to the quality and safety of pharmaceuticals, medical devices, and food products have stimulated the microbial identification industry's adoption of microbial identification methods. Government initiatives to control the spread of infectious diseases also play a role in driving market growth.

The microbial identification industry is expanding its product range due to technological advancements, rising demand for rapid diagnostics, regulatory compliance needs, and increased applications across pharmaceuticals, food safety, and environmental monitoring, driving innovation and market growth opportunities.

Regional expansion is vital in accelerating the growth of the global microbial identification industry. This is attributed to increased healthcare infrastructure, rising R&D investments, broader market access, and growing demand for advanced diagnostics across emerging and developed economies.

Product & Services Insights

The consumables segment held the largest market share of 36.60% in 2024. Consumables in the market include items like culture media, reagents, and test kits that must be frequently replenished. Laboratories and research facilities require a constant supply of these consumables to perform microbial identification tests. This consistent need for replacement generates a steady revenue stream for manufacturers and suppliers. For instance, in August 2023, Lovibond’s test kits are tailored for industrial applications. Due to the rising importance of water resources and the legal mandates governing their responsible management, Lovibond aims to offer complete solutions that can effectively address specific needs and facilitate precise, effortless water analyses. These launches are anticipated to fuel the growth of the segment.

The software & services segment is anticipated to grow at the highest CAGR from 2025 to 2030. Software solutions have become increasingly important in the field of microbial identification. Advanced data analytics, including machine learning and artificial intelligence, are used to analyze and interpret the data generated during microbial identification processes. This can lead to more accurate and efficient results, critical in various applications, such as clinical diagnostics, food safety, and environmental monitoring. Thus, anticipated to fuel the growth of the segment for the microbial identification industry over the forecast period.

Technology Insights

The PCR segment held the largest market share of 36.69% in 2024. Owing to the high precision, speed, and versatility in detecting and identifying microorganisms. PCR enables the amplification of specific DNA sequences, making it highly sensitive and capable of detecting even trace amounts of microbial DNA. Moreover, it is widely used in clinical diagnostics, research laboratories, and various industries for microbial identification due to its ability to quickly and accurately identify pathogens, playing an essential role in disease diagnosis, food safety, and environmental monitoring. In August 2022, Bruker Corporation announced the advancements to its dominant MALDI Biotyper (MBT) platform and introduced novel multiplex PCR infectious disease assays, leveraging its exclusive LiquidArray technology. Thereby propelling the growth of the segment.

The next-generation sequencing segment is anticipated to grow at the highest CAGR from 2025 to 2030. NGS technologies enable the sequencing of entire genomes, allowing for highly accurate species identification, even at the strain level. This level of granularity is acute in various applications, including clinical diagnostics, epidemiology, and research. In January 2023, Charles River introduced Accugenix Next Gen Sequencing for Bacterial Identification and Fungal Identification, a novel sequencing solution integrated into the Accugenix portfolio of microbial testing services. Thus, anticipated to fuel the growth of the segment for the market over the forecast period.

Method Insights

The genotypic segment held the largest market share of 42.19% in 2024 and is anticipated to grow at the highest CAGR from 2025 to 2030. Genotypic methods, including DNA sequencing and fingerprinting techniques, offer high accuracy and specificity. They can identify microorganisms at the genetic level, often providing more precise results than phenotypic methods. Moreover, genotypic methods are used in various applications, including clinical diagnostics, epidemiological studies, environmental assessments, and microbial diversity research. This wide range of applications has contributed to the growth of the segment in the market.

Moreover, the growing adoption of precision medicine, which involves tailoring medical treatments to each patient's characteristics, has increased the demand for genotypic identification. Understanding the genetic makeup of microorganisms is crucial for personalized treatment plans. Thus, it is anticipated that the growth of the segment for the microbial identification industry will be fueled over the forecast period.

Application Insights

The clinical diagnostics segment held the largest market share of 24.48% in 2024. Due to the rising prevalence of infectious diseases, the segment is anticipated to fuel the growth of the segment. Moreover, the advancements in molecular biology techniques, such as PCR and next-generation sequencing, are projected to significantly improve the speed and accuracy of microbial identification in clinical settings. These advancements and the rising prevalence of infectious diseases are anticipated to impel the growth of clinical diagnostics segments for better efficiency and accessibility. Thereby anticipating the growth of the market from 2025 to 2030.

The pharmaceuticals segment is anticipated to grow at the highest CAGR from 2025 to 2030. The pharmaceutical industry is involved in developing treatments and vaccines for emerging infectious diseases. Accurate and rapid microbial identification is essential during epidemic outbreaks, which has been a significant driver for the pharmaceutical sector. Thus, the rising prevalence of infectious diseases is anticipated to fuel the growth of the segment for the market over the forecast period.

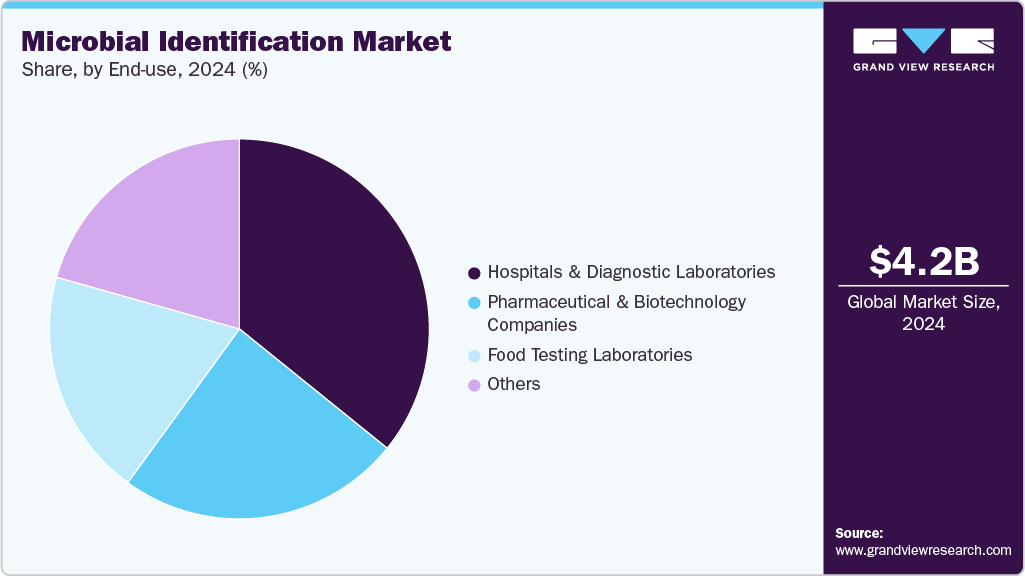

End Use Insights

Based on the end use, the market is segmented into pharmaceutical & biotechnology companies, hospitals & diagnostic laboratories, food testing laboratories, and others. The hospitals & diagnostic laboratories segment held the largest market share of 35.81% in 2024. Owing to the high patient volume and diverse clinical scenarios, the demand for microbial identification services is consistent, thereby anticipated to fuel the segment's growth. Moreover, the necessity for rapid, accurate identification of pathogens further solidifies the market share of hospitals and diagnostic laboratories in the microbial identification industry.

The pharmaceutical and biotechnology companies segment is anticipated to grow at the highest CAGR over the forecast period. The pharmaceutical and biotechnology sectors play an important role in developing treatments and vaccines for emerging infectious diseases. Rapid and precise microbial identification is essential in the early detection and containment of outbreaks, such as the COVID-19 pandemic. Hence, it is anticipated to significantly drive the segment's growth from 2025 to 2030.

Competitive Scenario

The global microbial identification industry is witnessing heightened competition driven by rapid technological advancements and increasing demand across multiple end use sectors, such as pharmaceuticals, healthcare, food safety, and environmental monitoring. Companies strive to differentiate themselves through innovation in identification platforms, enhanced automation, faster turnaround times, and greater accuracy. Strategic collaborations, mergers and acquisitions, and geographic expansions are prevalent as firms aim to strengthen their global footprint and capabilities.

Integrating artificial intelligence, machine learning, and genomic sequencing technologies into microbial identification systems is a key trend shaping the competitive landscape. These advancements enable more precise and real-time pathogen detection, improving clinical diagnostics and quality control efficiency. Players increasingly invest in R&D to develop next-generation solutions that align with stringent regulatory standards and evolving industry needs.

Shifting customer preferences toward compact, user-friendly, and cost-effective systems further influences market dynamics. As a result, companies are focusing on expanding their product portfolios and enhancing customer support services to retain a competitive advantage. Regulatory compliance and certifications also play a critical role in product acceptance, compelling firms to invest in quality assurance and continuous improvement initiatives.

The competitive landscape features a mix of established market leaders such as bioMérieux, Thermo Fisher Scientific, and Becton, Dickinson and Company, known for their comprehensive product offerings and global presence. At the same time, emerging players like Biolog Inc., Shimadzu Corporation, and various regional innovators are gaining traction by introducing novel technologies and targeting niche markets. This dynamic interplay between established and rising firms fosters a robust and evolving industry ecosystem.

Regional Insights

North America dominated the market and accounted for 38.38% share in 2024. This is attributed to the increasing prevalence of infectious diseases, the presence of key market players, and a well-established healthcare infrastructure. In January 2022, BD secured FDA 510(k) clearance for the BD Kiestra IdentifA system, an automated platform specifically engineered to streamline the microbiology bacterial identification testing sample preparation process. Moreover, due to the rising concerns regarding food safety, the government and regional authorities are using microbial identification techniques to identify and trace microbes in food products. For instance, according to a June 2022 article in PubMed, various federal, state, and local organizations play distinct roles in formulating, executing, and upholding food safety regulations in the U.S. Hence, ensuring effective collaboration among all these bodies is essential to ensure food safety. These factors are thus anticipated to fuel the growth of the market in the region.

U.S. Microbial Identification Market Trends

The microbial identification market in the U.S. is expected to grow over the forecast period due to presence of large number of market players present in U.S. which are undergoing various strategic initiatives such as collaborations and partnerships.

Europe Microbial Identification Market Trends

The Europe microbial identification market was identified as a lucrative region in this industry. This is attributed to strong government support and advancements in research infrastructure.

The microbial identification market in the UK is expected to grow over the forecast period due to the increasing prevalence of infectious diseases and a growing emphasis on diagnostic accuracy. The demand for clinical microbiology products and services has also increased.

The microbial identification market in France is expected to grow over the forecast period due to the presence of key manufacturers such as bioMérieux SA and their growth in strategic initiatives.

The microbial identification market in Germany is expected to grow over the forecast period due to the substantial number of providers offering messenger RNA therapeutics and initiatives undertaken to expand the scope of these tools.

Asia Pacific Microbial Identification Market Trends

Asia Pacific is anticipated to witness significant growth in the market from 2024 to 20230. The increasing prevalence of infectious diseases and economic growth of countries like India and China have led to increasing investments in pharmaceutical and biotechnology companies, as well as healthcare and other industries. This has driven the demand for microbial identification solutions, thus fueling the growth of the segment.

The microbial identification market in China is expected to grow over the forecast period, driven by increasing awareness of infectious diseases, rising healthcare expenditure, and advancements in diagnostic technologies.

The microbial identification market in India is expected to grow over the forecast period, as growing investments by private and foreign entities can help provide effective tests at lower costs. For instance, in June 2020, Combating Antibiotic-Resistant Bacteria Biopharmaceutical Accelerator (CARB-X) awarded an investment grant to Module Innovations, an India-based company.

The microbial identification market in Japan is expected to grow over the forecast period due to growing strategic initiatives, such as collaborations, mergers and acquisitions, and product launches, to increase market share. In August 2022, the government of Japan collaborated with the United Nations Office for Project Services to support Indonesia by delivering essential equipment, personal protective equipment, and medical supplies.

Middle East and Africa Microbial Identification Market Trends

The Middle East and Africa (MEA) microbial identification market is experiencing steady growth driven by expanding healthcare infrastructure, increasing food safety regulations, and rising awareness of infectious disease control. Governments and the private sector are investing in advanced diagnostic technologies to improve public health outcomes. Additionally, the growing pharmaceutical and biotechnology industries in the region further boost demand for reliable microbial identification systems. Strategic collaborations and regional partnerships also accelerate market penetration and technological adoption across MEA.

The Kuwait microbial identification market is growing due to increasing healthcare investments and stricter food safety regulations. Rising demand for accurate diagnostics in clinical and industrial settings is driving the adoption of advanced technologies, and government initiatives are further supporting market development.

Key Microbial Identification Company Insights

Key players operating in the microbial identification market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling market growth

Key Microbial Identification Companies:

The following are the leading companies in the microbial identification market. Collectively, they hold the largest market share and dictate industry trends.

- bioMérieux SA

- Becton, Dickinson and Company

- Thermo Fisher Scientific Inc.

- Bruker Corporation

- Danaher Corporation

- Qiagen N.V.

- Charles River Laboratories

- Wickham Micro Limited

- VWR International LLC. (Avantor Inc.)

- Shimadzu Corporation

- Merck KGaA

- Eurofins Scientific SE

- Biolog Inc

Recent Developments

-

In May 2025, ABL Diagnostics expanded the verification of its DeepChek solution on additional MGI next-generation sequencing (NGS) platforms, aiming to enhance microbiology genotyping capabilities and support more accurate and scalable infectious disease analysis.

-

In May 2025, Concerto Biosciences completed the Skin Universe Project (SUP) data acquisition phase, the most extensive empirical microbe interaction dataset worldwide. The company uses this data to train an AI model of microbial ecology and develop targeted dermatology and skincare products.

-

In April 2025, Biotia announced a joint development agreement with Mayo Clinic to advance precision medicine in infectious disease diagnostics by combining the Mayo Clinic's clinical expertise with Biotia's advanced microbial analytics platform for faster and more accurate diagnostic solutions.

Microbial Identification Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.66 billion

Revenue forecast in 2030

USD 8.18 billion

Growth rate

CAGR of 11.91% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & services, technology, method, application, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada, Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

bioMérieux SA; Becton; Dickinson and Company; Thermo Fisher Scientific Inc.; Bruker Corporation; Danaher Corporation; Qiagen N.V.; Charles River Laboratories; Wickham Micro Limited; VWR International LLC. (Avantor Inc.); Shimadzu Corporation; Merck KGaA; Eurofins Scientific SE; Biolog Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Microbial Identification Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global microbial identification market report based on product & services, technology, method, application, end use, and region.

-

Product & Services Outlook (USD Million; 2018 - 2030)

-

Instruments

-

Mass Spectrometers

-

PCR Systems

-

Microarrays

-

Others

-

-

Consumables

-

Reagents & Kits

-

Plates & Media

-

-

Software & Services

-

Identification Services

-

Culture Collection Services

-

Assay Validation Services

-

-

-

Technology Outlook (USD Million; 2018 - 2030)

-

Mass Spectrometry

-

PCR

-

Microarrays

-

Next Generation Sequencing

-

Others

-

-

Method Outlook (USD Million; 2018 - 2030)

-

Phenotypic Methods

-

Genotypic Methods

-

Proteotypic Methods

-

-

Application Outlook (USD Million; 2018 - 2030)

-

Clinical Diagnostics

-

Pharmaceuticals

-

Food & Beverage Testing

-

Environmental Application

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical and Biotechnology Companies

-

Hospitals and Diagnostic Laboratories

-

Food Testing Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global microbial identification market size was estimated at USD 4.19 billion in 2024 and is expected to reach USD 4.66 billion in 2025.

b. The global microbial identification market is expected to grow at a compound annual growth rate of 11.91% from 2025 to 2030 to reach USD 8.18 billion by 2030.

b. North America dominated the global microbial identification market with a share of 38.38% in 2024. This is mainly attributed to the increasing prevalence of infectious diseases, presence of key market players, and well-established healthcare infrastructure.

b. Some key players operating in the microbial identification market include bioMérieux SA, Becton, Dickinson and Company, Thermo Fisher Scientific Inc., Bruker Corporation, Danaher Corporation, Qiagen N.V., Charles River, Wickham Micro Limited, VWR International LLC. (Avantor Inc.), Shimadzu Corporation, Merck KGaA, Eurofins Scientific SE, and Biolog Inc.

b. Key factors driving the market growth include the rising prevalence of infectious diseases and technological advancements in the quality control market space.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.