- Home

- »

- Plastics, Polymers & Resins

- »

-

Biodegradable Cut Flower Packaging Market Report, 2033GVR Report cover

![Biodegradable Cut Flower Packaging Market Size, Share & Trends Report]()

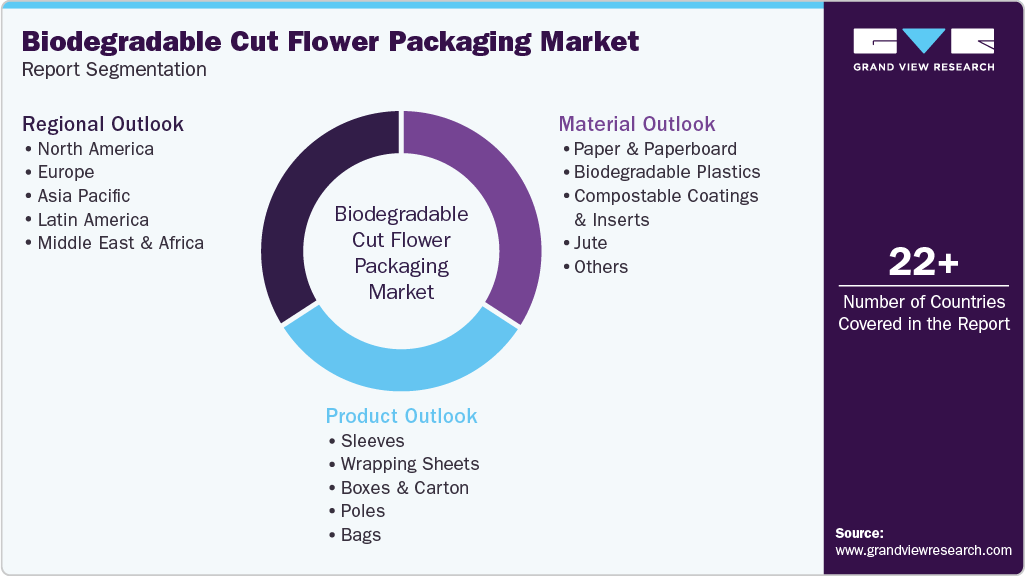

Biodegradable Cut Flower Packaging Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Paper & Paperboard, Biodegradable Plastics, Compostable Coatings & Inserts, Jute), By Product, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-807-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Biodegradable Cut Flower Packaging Market Summary

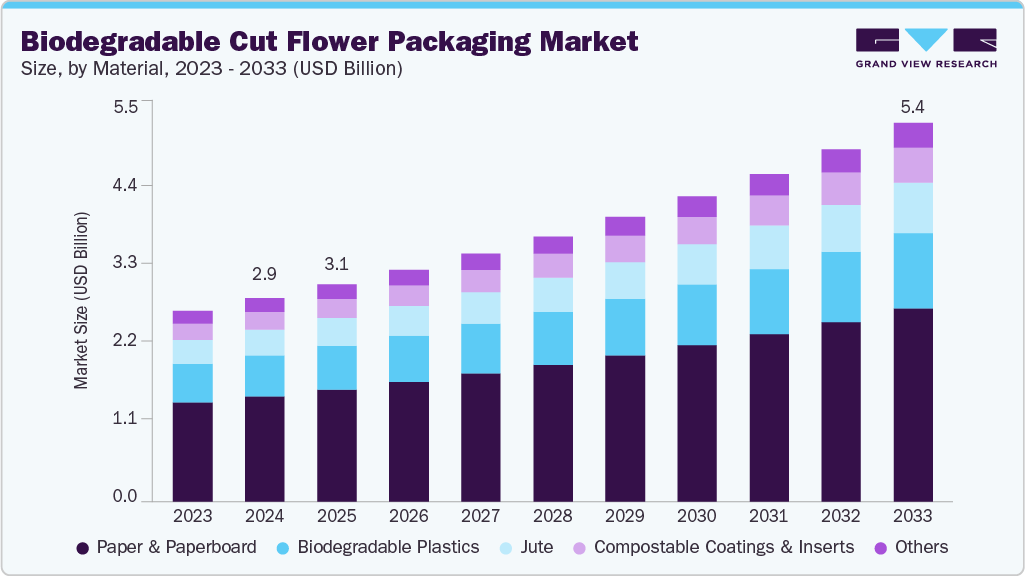

The global biodegradable cut flower packaging market size was estimated at USD 2.88 billion in 2024 and is projected to reach USD 5.37 billion by 2033, growing at a CAGR of 7.2% from 2025 to 2033. The market is driven by increasing consumer demand for sustainable and eco-friendly packaging solutions that reduce plastic waste.

Key Market Trends & Insights

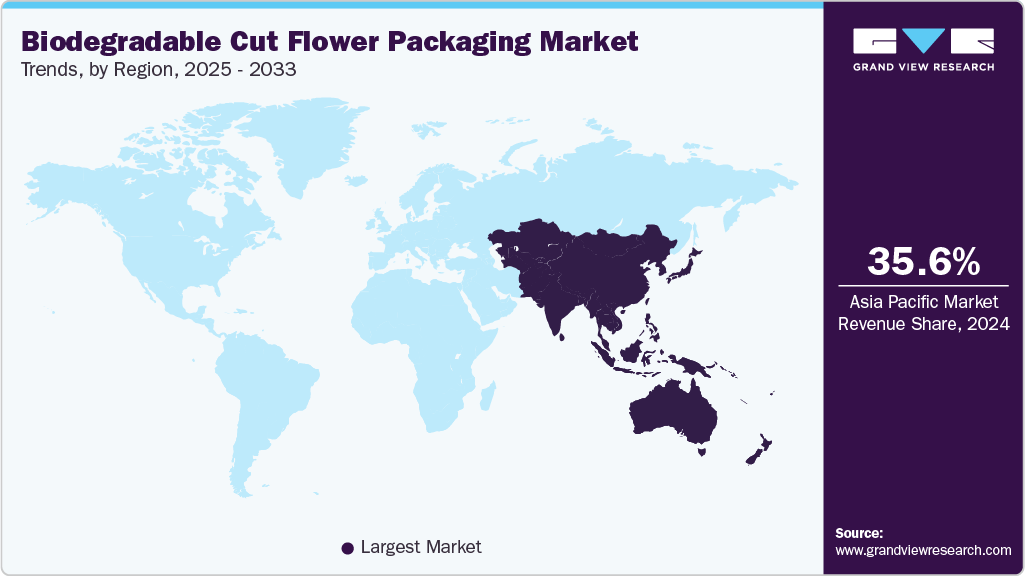

- Asia Pacific dominated the biodegradable cut flower packaging market with the largest revenue share of 35.55% in 2024.

- The biodegradable cut flower packaging market in China is expected to grow at a substantial CAGR of 7.9% from 2025 to 2033.

- By material, the compostable coatings & inserts segment is expected to grow at the fastest CAGR of 8.0% from 2025 to 2033.

- By product, the boxes & carton segment is expected to grow at the fastest CAGR of 7.9% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 2.88 Billion

- 2033 Projected Market Size: USD 5.37 Billion

- CAGR (2025-2033): 7.2%

- Asia Pacific: Largest market in 2024

In addition, government regulations promoting biodegradable materials in packaging further accelerate market growth. Flowers play a vital role in celebrations such as weddings, birthdays, anniversaries, and corporate gatherings, creating consistent demand for attractive and protective biodegradable packaging. The thriving event management and wedding industries, especially in the Asia Pacific and North America, have intensified this need. For example, India’s wedding sector, recognized as the world’s second-largest, hosts nearly 10 million weddings annually, generating an estimated USD 130 billion and ranking among the country’s top industries. This vast market fuels large-scale demand for sustainably packaged cut flowers. Similarly, florists and retailers across Western countries are increasingly opting for biodegradable sleeves, wraps, and boxes that enhance visual presentation while preserving freshness and minimizing environmental impact.The surge in online flower delivery services has become a major growth catalyst for the biodegradable cut flower packaging industry. Leading e-commerce florists, such as 1-800-Flowers, Interflora, and Bloom & Wild, are turning to eco-friendly, temperature-resilient packaging solutions that ensure flowers reach customers in pristine condition. Modern biodegradable packaging incorporates moisture-retentive films, breathable coatings, and protective inserts made from compostable materials to prevent damage during transit. The convenience of doorstep delivery, coupled with optimized logistics and last-mile efficiency, has further increased the circulation of sustainably packaged flowers worldwide, driving the adoption of lightweight, recyclable, and biodegradable packaging alternatives.

Sustainability remains a cornerstone trend shaping the biodegradable cut flower packaging industry. Rising consumer awareness and stringent government regulations aimed at reducing plastic waste have encouraged producers to shift toward compostable, recyclable, and plant-based materials. Paper-based wraps, starch-derived bioplastics, and biodegradable cellophane made from renewable wood pulp are increasingly replacing conventional plastics. European suppliers, for instance, are aligning with the EU’s circular economy objectives by developing fully compostable floral wraps and sleeves. These initiatives not only ensure compliance with environmental directives but also enhance the brand reputation of florists and retailers catering to environmentally conscious consumers.

Continuous innovation in biodegradable packaging materials and technologies is further strengthening market growth. Manufacturers are developing advanced materials with improved breathability, humidity regulation, and ethylene absorption properties to prolong the freshness of flowers during shipment and storage. Technologies such as modified atmosphere packaging (MAP), anti-fog biodegradable films, and moisture-control components are being integrated into eco-friendly formats. For example, leading Dutch exporters are adopting biodegradable corrugated boxes with built-in hydration systems to maintain bloom vitality during international transport. Such advancements enable suppliers to minimize waste, maintain product integrity, and meet the global demand for sustainable floral packaging solutions.

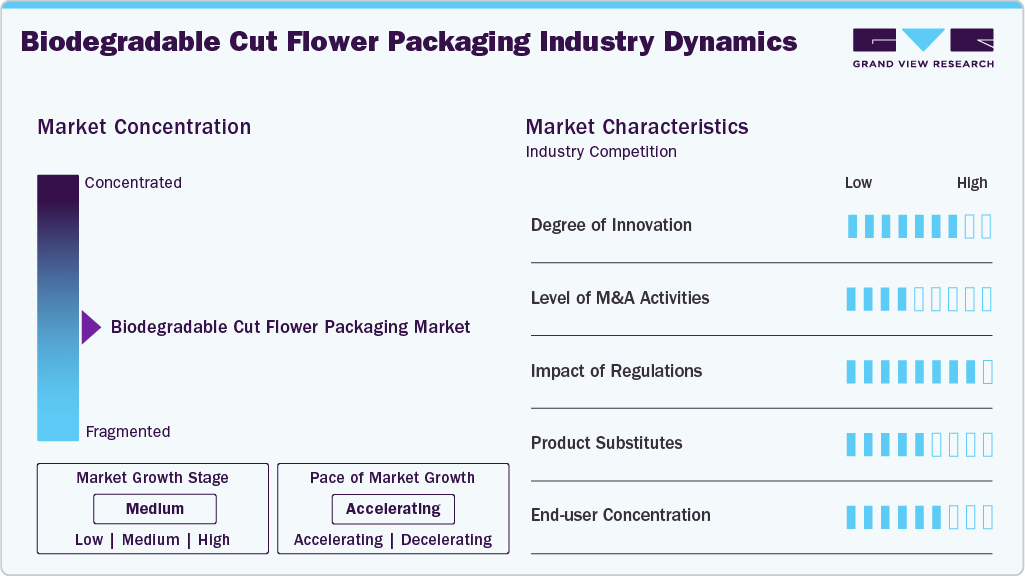

Market Concentration & Characteristics

The industry is primarily driven by a shift toward environmentally responsible packaging solutions. Manufacturers focus on developing biodegradable, compostable, and recyclable materials such as kraft paper, jute, cornstarch-based films, and cellulose wraps. This approach addresses the global movement against single-use plastics and aligns with circular economy principles. Certifications such as FSC (Forest Stewardship Council), EN 13432, and ASTM D6400 are increasingly adopted to assure end users of material sustainability and biodegradability.

Continuous R&D investment defines the competitive nature of this industry. Companies are exploring bio-based polymers, water-soluble coatings, and plant-fiber composites to improve packaging performance and environmental impact. Technologies such as modified atmosphere packaging (MAP) and anti-fog biodegradable films are gaining traction to extend the shelf life of flowers. Collaboration among material scientists, floriculturists, and packaging manufacturers is central to ongoing innovation.

Material Insights

The paper & paperboard segment led the market with the largest revenue share of 51.9% in 2024. Paper and paperboard are among the most widely used materials in this industry due to their eco-friendliness, biodegradability, and ease of customization. They are commonly used in wrapping papers, corrugated boxes, and decorative sleeves that provide aesthetic appeal and sufficient protection during transportation. Kraft paper and coated paperboard are preferred for their strength and printability, allowing florists and retailers to add branding, color, and patterns. Government regulations promoting paper-based alternatives, such as the EU Single-Use Plastics Directive, have further boosted adoption.

The compostable coatings & inserts segment is expected to grow at the fastest CAGR of 8.0% during the forecast period. The compostable coatings and inserts segment in the biodegradable cut flower packaging industry is emerging as a crucial material category, combining functionality with environmental responsibility. Compostable coatings, derived from bio-based polymers such as polylactic acid (PLA), starch blends, or cellulose, are applied to paper and fiber-based packaging to enhance moisture resistance, durability, and barrier performance without compromising biodegradability.

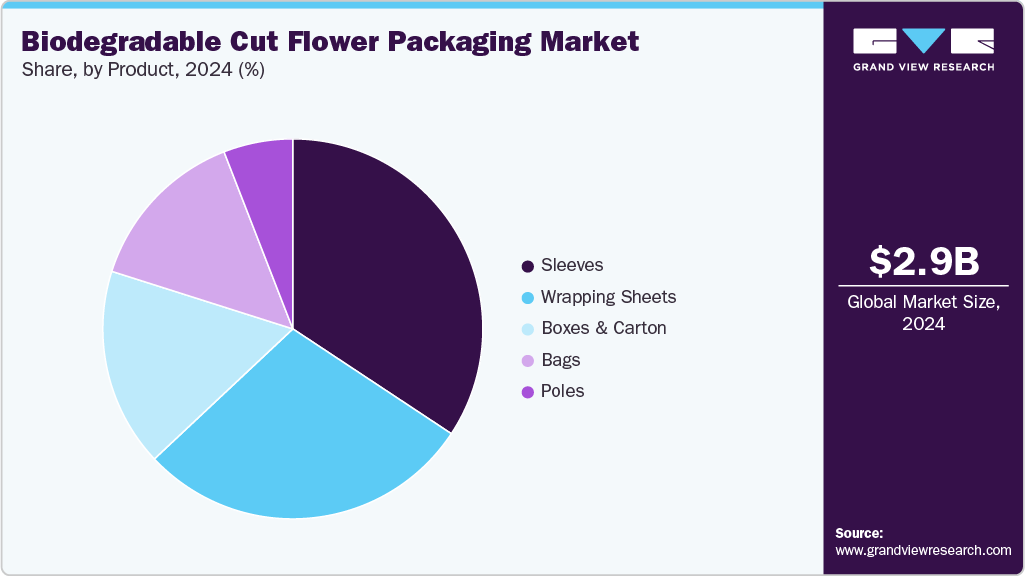

Product Insights

The sleeves segment led the market with the largest revenue share of 35.17% in 2024, primarily due to its convenience, functionality, and visual appeal. Biodegradable flower sleeves, typically made from kraft paper, PLA-coated paper, or compostable biofilms derived from cornstarch and cellulose, are designed to protect stems and petals from damage while maintaining adequate ventilation and moisture balance. Their lightweight and flexible structure makes them ideal for retail display, transportation, and gifting purposes. Florists and retailers prefer sleeves for their ability to combine aesthetic presentation with sustainability, often customizing them with printed branding or water-based inks to enhance shelf appeal.

The boxes & carton segment is projected to grow at the fastest CAGR of 7.9% during the forecast period. This segment is gaining significant traction as a durable and eco-friendly solution for the storage, transport, and presentation of floral products. Made from recyclable and compostable materials such as corrugated kraft paper, molded pulp, and plant-based coatings, these packaging formats offer superior structural strength and protection against mechanical damage, temperature fluctuations, and moisture during long-distance shipping. Biodegradable boxes and cartons are especially favored by flower exporters, online delivery platforms, and event organizers who require bulk packaging that maintains flower freshness and minimizes waste.

Regional Insights

The biodegradable cut flower packaging market in North America growth is supported by strong sustainability commitments, well-established e-commerce flower delivery networks, and advanced packaging technologies. The U.S. and Canada are witnessing rapid adoption of compostable, recyclable, and paper-based packaging due to growing consumer preference for environmentally responsible products. In addition, major retailers such as Whole Foods and Trader Joe’s have replaced conventional plastic floral packaging with kraft paper and biofilm-based alternatives to meet eco-conscious consumer expectations. This trend is reinforced by federal and state-level initiatives promoting waste reduction, such as bans on single-use plastics in states like California and New York.

U.S. Biodegradable Cut Flower Packaging Market Trends

The biodegradable cut flower packaging market in the U.S. accounted for the largest market revenue share in North America in 2024, due to its advanced retail infrastructure, consumer sustainability awareness, and high volume of online flower transactions. The country’s floral market, supported by major e-commerce players such as 1-800-Flowers, FTD, and Teleflora, has increasingly transitioned toward biodegradable and compostable packaging solutions to meet environmental regulations and consumer expectations.

Asia Pacific Biodegradable Cut Flower Packaging Market Trends

Asia Pacific dominated the global biodegradable cut flower packaging market with the largest revenue share of 35.55% in 2024 and is expected to grow at the fastest CAGR of 7.8% during the forecast period. This positive outlook is due to its expanding floriculture industry, rising environmental awareness, and growing consumer inclination toward sustainable lifestyle products. Countries such as India, China, Japan, and South Korea have witnessed a surge in demand for eco-friendly packaging materials across retail and event-based floral markets. The region’s rapidly growing wedding and event management industries, particularly in India and Southeast Asia, create bulk demand for biodegradable sleeves, wraps, and boxes.

The biodegradable cut flower packaging market in China is increasing emphasis on sustainable and innovative packaging solutions is further propelling the market growth. Government initiatives such as the “Green Packaging Standard” and broader circular economy policies have encouraged manufacturers to develop biodegradable films and recyclable paper-based materials tailored for floral applications. The rapid expansion of e-commerce flower delivery platforms such as FlowerPlus and Roseonly has also driven demand for visually appealing, durable, and eco-friendly packaging designs. Supported by its large-scale manufacturing capacity and cost-efficient production base, China has emerged as both a key producer and a global influencer in advancing biodegradable cut flower packaging solutions.

Europe Biodegradable Cut Flower Packaging Market Trends

The biodegradable cut flower packaging market in Europe stands at the forefront, driven by stringent environmental policies, high consumer awareness, and a mature floriculture trade network. The region’s strong regulatory framework, such as the EU Packaging and Packaging Waste Regulation (PPWR) and the European Green Deal, mandates the use of recyclable and compostable materials, compelling manufacturers to innovate in biodegradable solutions. Countries such as the Netherlands, Germany, and UK are major centers of flower production, trade, and export, and they have increasingly integrated biodegradable packaging materials into their supply chains.

Key Biodegradable Cut Flower Packaging Company Insights

The competitive environment of the biodegradable cut flower packaging industry is characterized by a mix of global packaging giants and specialized eco-friendly manufacturers focusing on sustainable innovation and material development. Companies such as DS Smith, Smurfit Kappa, Stora Enso, and Mondi are leading the market by offering recyclable and compostable paper-based sleeves, boxes, and wraps that cater to both retail and export floral packaging needs.

Emerging players and niche firms, including A·ROO Company, Smart Packaging Solutions, Packman Packaging, and Nature-Pack, are differentiating themselves through customization, design aesthetics, and the use of advanced biodegradable films and coatings. Strategic collaborations between packaging producers and floriculture businesses, such as partnerships for developing moisture-resistant and temperature-controlled compostable materials, are becoming increasingly common. The market is moderately fragmented, with competition centered around innovation, sustainability certifications, cost efficiency, and branding capabilities.

Key Biodegradable Cut Flower Packaging Companies:

The following are the leading companies in the biodegradable cut flower packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Smurfit Westrock

- Stora Enso

- DS Smith

- Mondi

- PakFactory

- Tycoon Packaging

- A·ROO Company

- Smart Packaging Solutions

- Nature-Pack

- Packman Packaging

- Flamingo Holland Inc.

- GleePackaging

Recent Developments

-

In November 2025, Koen Pack Americas launched its Ecologic line, a sustainable floral packaging range made from grass paper and post-consumer recycled plastics, aiming to reduce environmental impact while maintaining quality and visual appeal. This initiative reinforces Koen Pack’s commitment to sustainability, innovation, and reliable supply across the floral industry.

-

In October 2025, DS Smith partnered with Queen Flowers to create a recyclable fibre-based bouquet box made from corrugated cardboard. Designed for easy assembly and material efficiency, it maintains flower freshness, reduces transport weight, and is fully recyclable, supporting both branding and sustainability goals.

Biodegradable Cut Flower Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.07 billion

Revenue forecast in 2033

USD 5.37 billion

Growth rate

CAGR of 7.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, product, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Argentina; South Africal; Saudi Arabia; UAE

Key companies profiled

Smurfit Westrock; Stora Enso; DS Smith; Mondi; PakFactory; Tycoon Packaging; A·ROO Company; Smart Packaging Solutions; Nature-Pack; Packman Packaging; Flamingo Holland Inc.; GleePackaging

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biodegradable Cut Flower Packaging Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global biodegradable cut flower packaging market report based on material, product, and region:

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Paper & Paperboard

-

Biodegradable Plastics

-

Compostable Coatings & Inserts

-

Jute

-

Others

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Sleeves

-

Wrapping Sheets

-

Boxes & Carton

-

Poles

-

Bags

-

-

Region Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.