- Home

- »

- Renewable Energy

- »

-

Biofuels Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Biofuels Market Size, Share & Trends Report]()

Biofuels Market Size, Share & Trends Analysis Report By Feedstock (Corn, Sugarcane), By Application (Transportation, Aviation), By Form (Solid, Liquid), By Product (Biodiesel, Ethanol), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-729-2

- Number of Report Pages: 220

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Biofuels Market Size & Trends

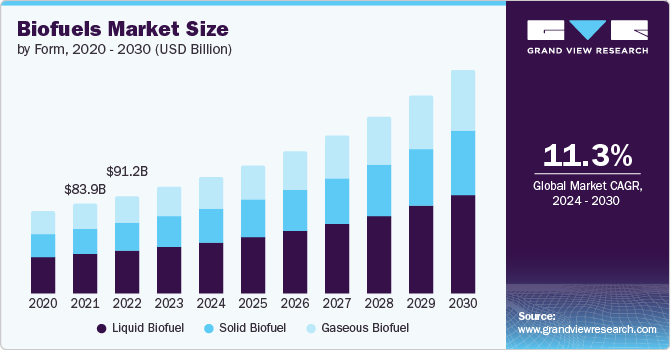

The global biofuels market size was estimated at USD 99.53 billion in 2023 and is expected to grow at a CAGR of 11.3% from 2024 to 2030. The market growth is driven by the high demand for cleaner fuel and increasing governmental regulations for desulphurizing petroleum products. Biofuels are fuels derived from plants, animal waste, or algae. They are considered renewable fuels as the feedstock material utilized can be replenished at a faster rate than conventional fossil fuels. Limited availability of fossil fuel-based resources and rising awareness regarding curbing carbon emissions are some of the factors expected to drive the global market growth.

Also, the presence of various supporting regulatory policies and tax incentives worldwide on the utilization of biofuels is anticipated to enhance biofuel usage, majorly in the transportation sector. The U.S. is the primary revenue contributor to the North America regional market. The U.S. government has initiated several regulations to reduce dependency on conventional fuels and carbon emissions. Significant factors influencing the market growth in the U.S. include favorable regulatory & political support, innovation support (for second & third generation biofuels), and environmental, customer, geopolitical, agricultural, and economic support.

Increasing compliance for biofuels in the region is also supporting the growth of the North America regional market. The U.S. government has initiated several regulations to reduce its dependency on conventional fuels and carbon emissions. However, biofuels are manufactured from sources, such as corn, sugarcane, soybeans, and oil palms, which are food crops. Large-scale utilization of these crops to generate biofuels can create a scarcity of food products made from these crops. It can affect food prices and pose questions regarding food security. This may hinder market growth in some regions or countries.

Drivers, Opportunities & Restraints

Biofuel is an energy-efficient alternative and helps alleviate energy security risks and pollution levels associated with the combustion of fossil fuels. Biofuels can be blended in large quantities with traditional fossil fuels for use in applications, such as transportation. Although biodiesel can replace conventional fuel, its production capacity is not enough to meet the current demand. Thus, the market is highly regulated with various tax incentives in different countries. Governments across the world have introduced various policies and strategies to mitigate the risks associated with climate change. Energy security, rural development, and climate change mitigation are some of the crucial parameters responsible for such policy goals.

Countries, such as Brazil, Germany, and the U.S., have initiated tax incentives to boost biofuel production and ensure a reduction in biodiesel prices at pumps. Furthermore, European countries, such as France, Italy, Germany, Spain, Denmark, and the Czech Republic, are permitting a full tax exemption for a specific volume of biodiesel production.

Biofuel is an energy-efficient solution in the current scenario when the world’s fossil fuels are depleting rapidly. Moreover, biofuel is a clean energy option as fossil fuels emit a high amount of carbon dioxide. However, market penetration also involves several hurdles concerning product commercialization in terms of cost compared to fossil-based fuels, increasing food prices (raw materials for biofuels), and a lack of consumer awareness regarding the use of cleaner energy alternatives in certain parts of the world.

The energy returns on investment (EROI), i.e., net energy gains residing in the finished biofuel produced, are lower than those of petroleum-based fuels. EROI measures the process of production, distribution, and consumption of an energy source for a particular product. Petroleum-based fuel has an EROI of 16, compared to just 5.5 for biodiesel produced from soybeans.

One of the major applications of biofuels (biodiesel) is in the automotive industry, where performance issues are a major concern. Some of these concerns include low fuel efficiency, which leads to a drop in engine power owing to the low energy content of biodiesel. The use of biodiesel also leads to clogging and deposits on the engine. Although using biodiesel lowers carbon emissions in the air, it leads to higher nitrogen oxide emissions.

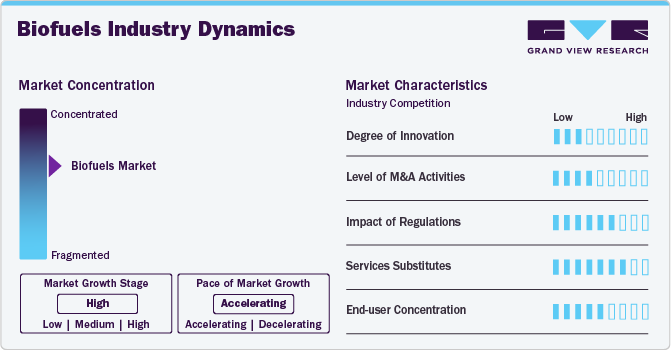

Industry Dynamics

The biofuels market is a rapidly growing sector. The market growth is driven by the increasing pressure on businesses to reduce their global greenhouse gas (GHG) emissions and meet the ambitions of the 2015 Paris Agreement. Emerging technology for biofuel, microalgae, have been tested as a potential feedstock for biofuel generation due to their high energy content, rapid growth rate, low-cost culture methods, and significant capacity for CO2 fixation and O2 addition to the environment. The use of microalgae for biofuel production is desirable all over the world. Though this method is both energy-efficient and environmentally friendly, experts are still looking for an innovation that can increase the yield of microalgae-biofuel from the primary stage to the end product while also shifting the entire process to a cost-effective fuel solution.

However, market penetration also involves several hurdles concerning product commercialization in terms of cost as compared to fossil-based fuels, increasing food prices (raw materials for biofuels), and a lack of consumer awareness regarding the use of cleaner energy alternatives in certain parts of the world.

Form Insights

The liquid biofuel form segment accounted for the largest revenue share of over 43.0% in 2023 owing to the rising focus on energy security and application of liquid biofuels in flexible-fuel vehicles. In addition, bioethanol blending mandates set in various countries have driven the utilization of liquid biofuels. The segment is also estimated toregister the fastest CAGR of 11.5% over the forecast period owing to depleting fossil fuel resources as well as rising awareness regarding environmental protection.

Furthermore, the introduction of regulations and policies in the industry has prompted manufacturers to invest in R&D activities to innovate technology for biofuel production. Gaseous biofuel form was the second-largest segment in 2023 owing to a rise in the adoption of gaseous biofuels in applications, such as transportation fuel and electricity generation. Furthermore, gaseous biofuel is being utilized for cooking gas as it is a greener substitute for liquid petroleum gas (LPG).

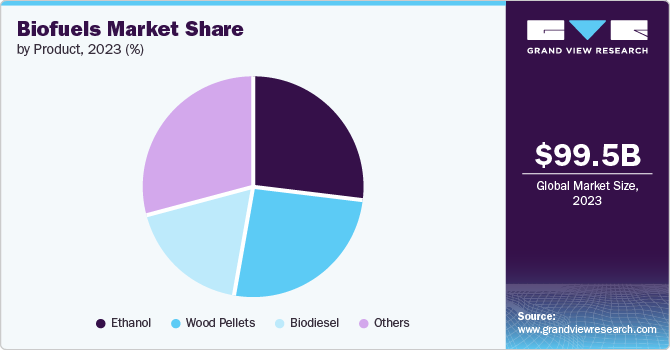

Product Insights

The others segment, which include propanol, butanol, methanol, and biogas, led the market and accounted for the largest revenue share of more than 28.0% in 2023. Owing to the shift in focus of countries toward the use of renewable sources, particularly for electricity generation, has significantly driven global demand for biogas. In addition, the increasing requirement to reduce dependency on fossil fuels is creating lucrative opportunities for the utilization of biogas as fuel in vehicles.

The ethanol segment accounted for the second-largest revenue share in 2023 as a result of rising global temperature due to which many industries have begun to look for alternative energy sources that reduce GHG emissions from their combustion engines. Bioethanol is a potential alternative energy source that can lead the way in reducing GHG emissions.

Feedstock Insights

Based on feedstock, the global industry has been further categorized into corn, sugarcane, vegetable oils, and others. The others segment dominated the global industry in 2023 and accounted for the maximum share of more than 47.0% of overall revenue. This segment includes rice, wheat, and potatoes. Rice straw is used to produce biofuel through both biochemical and thermochemical technologies.

In the biochemical process, a pre-treatment step is required in which, the biological platform reduces elasticity of rice straw by altering interactions of cellulose, hemicellulose, and lignin.The sugarcane segment accounted for the second-largest revenue share in 2023 owing to the production of ethanol from sugarcane. Companies involved in biofuel production are setting up sugarcane as a feedstock in production facilities, which is likely to boost segment growth over the forecast period.

Application Insights

Based on applications, the global industry has been further categorized into transportation, aviation, energy generation, heating, and others. The transportation segment dominated the global industry in 2023 and accounted for the maximum share of over 71.0% of overall revenue. The high share was owing to the suitability of biofuel for transportation as they are relatively energy-dense and easy to distribute using existing infrastructure with only minor modifications.

The aviation application segment is anticipated to register the fastest CAGR from 2024 to 2030 on account of favorable government regulations implemented in various countries. Initiatives like the International Aviation Carbon Offsetting and Reduction Scheme (CORSIA) introduced by the International Civil Aviation Organization (ICAO) are expected to boost the segment growth over the forecasted period.

Regional Insights

The biofuels market in North America dominated the global industry and accounted for the largest revenue share of over 33.0% in 2023. The presence of supporting infrastructure for biofuel production and favorable government policies for the utilization of biofuels in the region will result in the region’s dominant position in the global industry.

U.S. Biofuel Market Trends

The U.S. biofuels market dominated the North America regional market and accounted for a share of over 96.32% in 2023. The U.S. government has initiated several regulations to reduce dependency on conventional fuels and carbon emissions. A significant factor influencing the market growth includes favorable regulatory, political, environmental, customer, geopolitical, agricultural, economic, and innovation support (for second & third-generation biofuels).

The biofuels market in Canada is expected to grow at the fastest CAGR of 11.7% from 2024 to 2030. Canadian federal government has been planning to announce carbon intensity benchmarks and necessitate all provinces to implement carbon pricing resulting in the rise in consumption of biofuels. Provincial and federal-level programs have been initiated to support biofuels consumption across the country.

Europe Biofuels Market Trends

The Europe biofuel market is growing owing to technological advancements and increasing investments in biofuel refineries in the region. Moreover, government initiatives and rising demand for biofuel are driving the region’s growth. The European companies are investing huge capital for the R&D of biofuel production from existing sources and increasing the share of non-food feedstock, which is expected to fuel market growth.

The biofuels market in Germany accounted for the largest share of over 18.8% in 2023. The market is driven by strong demand from German corporations seeking to offset their emissions and meet their sustainability goals.

The Spain biofuel market is expected to progress with a CAGR of 12.4% over the forecast period. Infrastructure for biofuel blending and delivery is an important aspect of market dynamics. For instance, in June 2023, Naturgy, in collaboration with Compost Segrià, Sitra, and Servei de Gestió Ramadera, began processing a new renewable gas plant in Torrefarrera (Lleida), one of the key areas of Spain in terms of agricultural and livestock waste generation. The factory will cost a total of 18 million euros to build.

Asia Pacific Biofuels Market Trends

The biofuel market in Asia Pacific is still in its initial development phase and is expected to witness the fastest growth from 2024 to 2030 due to the high demand for biofuels and growing investments by the public & private sectors for developing biofuel technologies.

The China biofuels market is projected to grow with a significant CAGR from 2024 to 2030. China has 22 fuel ethanol refineries with total domestic ethanol production expected to reach 11.85 billion liters in 2022 from 10.58 billion liters in 2021 and 10.83 billion liters in 2020. The ethanol blending rate of the country is expected to remain low in 2022.

The biofuels market in India held a significant share of over 13.35% in 2023. The Indian government has mandated 10% ethanol blending in petrol, while strict mandates do not govern biodiesel blending. However, such types of blending have been restricted to under 5% over the past few years owing to the country's low production of ethanol and biodiesel.

Central & South America Biofuels Market Trends

The Central & South America biofuels market is projected to grow at a significant rate over the forecast period due to the increasing government initiatives for ensuring energy security and independence.

The biofuels market in Brazil accounted for the largest share of 84.38% in 2023. The investments for the development of biorefineries in Brazil are expected to increase during the forecast period, supporting market growth.

Middle East & Africa Biofuels Market Trends

The Middle East & Africa biofuels market is expected to grow at a significant rate from 2024 to 2030. At present, the contribution of this region in terms of biofuel production is much less. The region is projected to grow at a CAGR of 9.5% from 2024 to 2030; however, several pilot projects for the efficient production of biofuels are in progress, which is anticipated to fuel market growth.

Key Biofuels Company Insights

Global industry is highly competitive with key participants involved in R&D. Constant innovations done by vendors have become one of the most important factors for companies to succeed in the market. Currently, the market is witnessing an influx of investments against the backdrop of favorable policies and economic support from the governments of major economies. Several companies are making inroads into sustainable aviation fuels (SAF). According to IEA’s World Energy Investment report, oil & gas companies expended USD 11 billion in 2022, to acquire transport biofuel and biogas companies. Additionally, refining companies accounted for nearly 80% of total renewable diesel production capacity.

Key Biofuels Companies:

The following are the leading companies in the biofuels market. These companies collectively hold the largest market share and dictate industry trends.

- Archer Daniels Midland Company

- Green Plains Inc.

- Petrobras

- Valero Energy Corp.

- Alto Ingredients Inc.

- Gevo Butamax Advanced Biofuels LLC

- Wilmar International Ltd.

- Renewable Energy Group, Inc.

- Bunge North America, Inc.

- Royal Dutch Shell Plc

- CropEnergies AG

- Air Liquide

- Scandinavian Biogas Fuels International AB

- Abengoa

Recent Developments

-

In July 2023, Equilon Enterprises LLC, a subsidiary of Shell Plc and Green Plains Inc. entered into a technological collaboration to use Shell Fiber Conversion Technology (SFCT) with Fluid Quip Technologies’ precision separation and processing technology. This strategic partnership is expected to add significant value to Green Plains Inc.’s biorefinery platform

-

In July 2023, Petrobras announced to begin testing the performance of a B24 bio bunker fuel blend. This fuel blend is being used to fuel a ship, located at the Rio Grande (RS) Terminal and chartered by Transpetro with 573,000 liters of fuel to be filled in the vessel

-

In July 2023, Gevo, Inc. entered into a Master Services Agreement (MSA) with a subsidiary company of McDermott International, Ltd. to provide front-end engineering and early planning services for Gevo’s development of multiple sustainable aviation fuel facilities in North America

Biofuels Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 109.08 billion

Revenue forecast in 2030

USD 207.87 billion

Growth rate

CAGR of 11.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

July 2024

Quantitative units

Revenue in USD million/billion, volume in thousand TOE, CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, product, application,feedstock, region

Country scope

North America; Europe; Asia Pacific; Middle East & Africa; Central & South America

Key companies profiled

Archer Daniels Midland Company; Green Plains Inc.; Petrobras; Valero Energy Corp.; Alto Ingredients Inc.; Gevo; Butamax Advanced Biofuels LLC; Wilmar International Ltd.; Renewable Energy Group, Inc.; Bunge North America, Inc.; Royal Dutch Shell Plc; CropEnergies AG; Air Liquide; Scandinavian Biogas Fuels International AB; Abengoa

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biofuels Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global biofuels market report based on form, product, application, feedstock, and region:

-

Form Outlook (Volume, Thousand TOE; Revenue, USD Billion, 2018 - 2030)

-

Solid Biofuel

-

Liquid Biofuel

-

Gaseous Biofuel

-

-

Product Outlook (Volume, Thousand TOE; Revenue, USD Billion, 2018 - 2030)

-

Biodiesel

-

Ethanol

-

Wood Pellets

-

Others

-

-

Application Outlook (Volume, Thousand TOE; Revenue, USD Billion, 2018 - 2030)

-

Transportation

-

Aviation

-

Energy Generation

-

Heating

-

Others

-

-

Feedstock Outlook (Volume, Thousand TOE; Revenue, USD Billion, 2018 - 2030)

-

Corn

-

Sugarcane

-

Vegetables Oils

-

Other

-

-

Regional Outlook (Volume, Thousand TOE; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

The Netherlands

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Indonesia

-

Thailand

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global biofuels market was estimated at USD 99.53 billion in 2023 and is projected to reach USD 109.08 billion in 2024.

b. The global biofuels market is expected to witness a compound annual growth rate of 11.3% from 2024 to 2030 to reach USD 207.87 billion by 2030.

b. Liquid biofuels was the largest segment of the total market, with a revenue share of 43.96% in 2023 owing to ethanol blending mandates set by various countries globally.

b. Some key players operating in the biofuels market include Archer Daniels Midland Company, Green Plains, Wilmar International, Algenol, Pacific Ethanol Inc, and Bunge Limited.

b. Key factors driving the growth of the biofuels market include rise in environmental concerns to curb carbon emissions and to switch to cleaner and renewable fuels to attain sustainable development.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."