- Home

- »

- Disinfectants & Preservatives

- »

-

Propanol Market Size, Share, Trends & Growth Report, 2030GVR Report cover

![Propanol Market Size, Share & Trends Report]()

Propanol Market (2023 - 2030) Size, Share & Trends Analysis Report By Product by Application (N-propanol, Isopropyl Alcohol), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-724-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Propanol Market Size & Trends

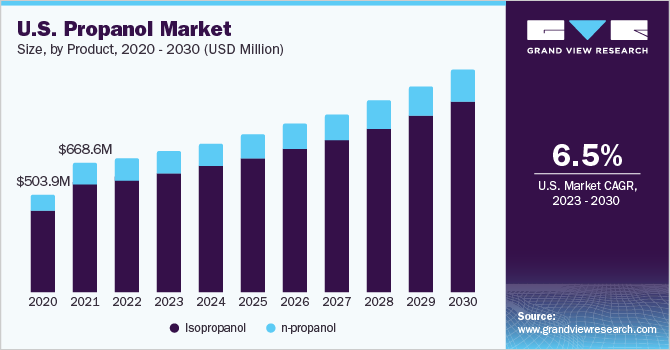

The global propanol market size was valued at USD 3.76 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.6% from 2023 to 2030. This is attributed to its rising utilization as a direct solvent in many end-use industries including coatings, pigments, dyes, fuel additives, and paint additives. Moreover, in the pharmaceutical industry, it is majorly used in the formulation of sanitizers. N propanol and isopropanol possess different properties despite having similar chemical structure. Their unique chemical properties increase the demand for the product owing to their major application in the pharmaceutical and plastic industry.However, n-propanol is typically more expensive than isopropyl alcohol due to the high cost of raw materials.

The pharmaceutical industry has experienced rapid growth over the past ten years, owing to product innovation and rising healthcare spending by emerging economy governments. A significant amount of pharmaceutical industry innovation has been triggered by the increase in chronic diseases. Moreover, the need for hand sanitizers has increased as a result of the COVID-19 pandemic. One of the main components used in the creation of sanitizers is isopropyl alcohol. The market will benefit from the rising trend of preventive healthcare as sales of sanitizers and other related products are anticipated to rise sharply in the coming years.

Isopropyl alcohol and N-propanol are two of the most common industrial solvents used in manufacturing around the world. They are utilized in a variety of products, including cosmetics, adhesives, paints and inks, rubber, and heavy industries like industrial machinery and automotive. They are considered to be an effective solvent due to their low reactivity towards most of the common chemicals & their miscibility with water. It is anticipated that increasing infrastructure spending in growing economies will significantly boost demand for goods like adhesives, paints and coatings, and industrial machinery. It is anticipated that the expansion of these high-value industries will have a positive effect on propanol consumption.

Petrochemicals, as a raw material accounts for the majority of propanol production, hence the environmental concerns over its use have slowed market expansion. In a wide range of applications, green solvents are now replacing petrochemical solvents. Product demand is being hindered by the rapid rate of innovation in products in the green solvent sector. The product demand can be retained through solvent recycling, which is further capable of reducing the detrimental effects of propanol on the ecosystem. Moreover, the companies are involved in the development of new chemical intermediates which can be manufactured using the recovered propanol in order to open up new growth avenues.

Product By Application Insights

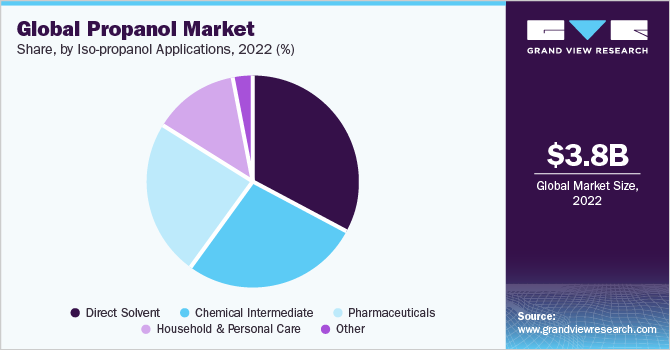

Isopropanol form segment dominated the market with the highest revenue share of 85.9% in 2022. This is due to its expanding use as a solvent, antiseptic and astringent, cleaning agent, solvent, chemical intermediate, and other applications. Moreover, the market demand for isopropyl alcohol has increased due to its antibacterial qualities and low chemical reactivity.

The demand for cleaning agents is increasing steadily in households owing to increasing hygiene awareness among the people. Cleaning agent sales are expanding quickly in emerging economies because of product differentiation and innovative strategies used by manufacturers. The expansion of these products has also benefited from rising disposable incomes. Isopropyl alcohol plays a significant role in these cleaning formulations. As a result, the application market is anticipated to expand steadily.

N-propanol is primarily employed in the manufacture of chemical intermediates. The market demand for n-propanol is being driven by its application as a primary alcoholic beverage. It is primarily employed in the production of acetylated chemicals and alkyl halides. These chemicals are furthered use in the manufacturing of specialty chemicals and the pharmaceutical industry.

The direct solvent application segment of isopropanol dominated the market with a revenue share of 33.2% owing to increasing application in dyes, soaps, antifreeze, lacquer formulations, window-cleaning agents, and other products.

Regional Insights

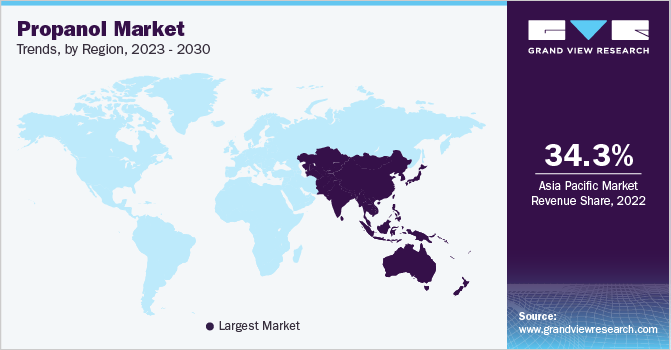

Asia Pacific region dominated the product market with the highest revenue share of 34.3% in 2022. This is attributed to the rapid industrial growth in countries such as India; China & South Korea. One of the key factors influencing the consumption of products is the rising infrastructure spending combined with the existence of a strong pharmaceutical industry in the region.

The product demand in Europe is increasing owing to its end-use application in different industries like specialty chemicals and pharmaceuticals. Since 2022, consumption has been growing quickly because of the increased demand for sanitizers. Large-scale consumption of isopropyl alcohol has led to a shortage of the chemicals. In order to efficiently manufacture isopropyl alcohol, many businesses in the area are streamlining their raw material supply.

Germany is one of the leading countries in Europe in the production of propanol. The presence of companies such as Oxea Gmbh & INEOS is increasing production capacities to keep up with the rising demand. In order to support the production of disinfectant products, n-propanol production has increased.

Key Companies & Market Share Insights

Major industry participants in the propanol market are investing in R&D activities to explore new applications for propanol. The demand for bio-based chemicals is anticipated to increase due to the strict regulatory standards in North America and Europe. Market participants are making investments in integrated facilities to produce end-use goods. To cut production costs, some industry participants are also implementing forward integration strategies through partnerships whereas some of the players have increased their production capacities in order to meet the increasing demand of the product. For instance, in April 2020, Oxea Gmbh tripled its supply of n-propanol across Europe to meet the rising demand for hand sanitizers and disinfectants. Some prominent players in the global propanol market include:

-

Shell Chemicals

-

ExxonMobil

-

BASF SE

-

Dow Inc.

-

Sasol Limited

-

Eastman Chemical Company

-

Tokuyama Corporation

-

Lyonellbasell

-

Solvay

-

Mitsui Chemicals Inc.

-

KH Chemicals

-

Dairen Chemical Corporation

Propanol Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.96 billion

Revenue forecast in 2030

USD 6.25 billion

Growth rate

CAGR of 6.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product by application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Netherlands; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Market Players

Shell Chemicals; ExxonMobil; BASF SE; Dow Inc.; Sasol Limited; Eastman Chemical Company; Tokuyama Corporation; Lyonellbasell; Solvay; Mitsui Chemicals Inc.; KH Chemicals; Dairen Chemical Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Propanol Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global propanol market report based on product by application and region:

-

Product By Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Isopropanol

-

Direct Solvent

-

Chemical Intermediate

-

Pharmaceuticals

-

Household and personal care

-

Other

-

-

n-propanol

-

Chemical Intermediate

-

Direct Solvent

-

Others

-

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global propanol market size was estimated at USD 3.76 billion in 2022 and is expected to reach USD 3.96 billion in 2023.

b. The global propanol market is expected to grow at a compound annual growth rate of 6.6% from 2023 to 2030 to reach USD 6.25 billion by 2030.

b. Asia Pacific dominated the propanol market with a share of 34.3% in 2022. This is attributable to rapid industrial growth in countries such as India; China & South Korea.

b. Some key players operating in the propanol market include Shell Chemicals, ExxonMobil, BASF SE, Dow Inc., Sasol Limited, Eastman Chemical Company, Tokuyama Corporation, Lyonellbasell, Solvay, Mitsui Chemicals Inc., KH Chemicals, Dairen Chemical Corporation

b. Key factors that are driving the market growth include rising utilization in solvents and disinfectants

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.