- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Soybean Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Soybean Market Size, Share & Trends Report]()

Soybean Market (2024 - 2030) Size, Share & Trends Analysis Report By Nature (GMO, Non-GMO), By Form (Raw, Processed), By End-use (Animal Feed, Industrial Use), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-182-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Soybean Market Summary

The global soybean market size was estimated at USD 193.10 billion in 2023 and is projected to reach USD 258.12 billion by 2030, growing at a CAGR of 4.4% from 2024 to 2030. Soybeans are known for their health benefits, including being a good source of protein, fiber, vitamins, and minerals.

Key Market Trends & Insights

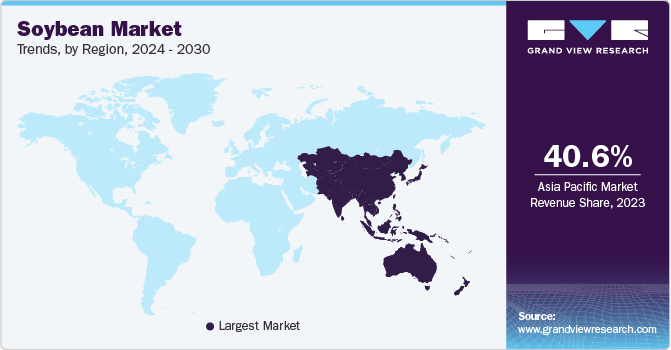

- Asia Pacific dominated the market with a share of 40.6% in 2023

- China held the largest share of in Asia Pacific in 2023.

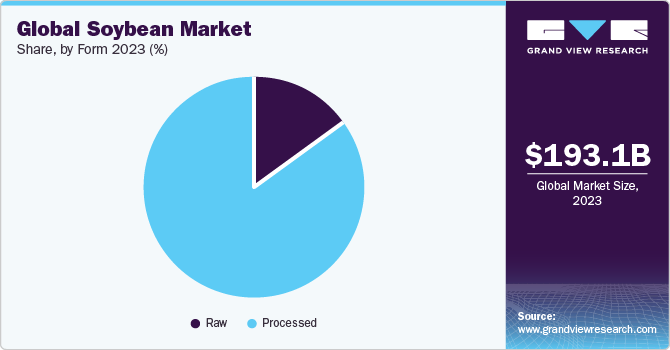

- By form, the processed soybean segment dominated the market with a revenue share of 84.5% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 193.10 Billion

- 2030 Projected Market Size: USD 258.12 Billion

- CAGR (2024-2030): 4.4%

- Asia Pacific: Largest market in 2023

The rising consumer awareness of these benefits drives demand, particularly for products like soy milk, tofu, and protein supplements. Moreover, there's a growing trend towards vegetarian and vegan diets, and a general increase in the consumption of plant-based proteins among omnivores. Soybean, versatile and high-protein legumes, is vital component of many plant-based diets.

The industry has experienced significant growth, driven by nutritional, environmental, economic, and market factors. Soybeans have become increasingly popular due to their high protein content and associated health benefits, including their role in reducing the risk of heart disease and certain cancers. It makes them particularly appealing to vegetarians, vegans, and health-conscious consumers. Additionally, soybeans are processed into products like tofu, soy milk, and meat substitutes, catering to diverse dietary preferences and the growing trend toward plant-based diets.

Environmental considerations also play a crucial role in the market's expansion. Soybeans are perceived as a more sustainable and environmentally friendly protein source than animal-based proteins, requiring less land and water and producing a lower carbon footprint. This aspect aligns with the increasing global awareness and concern for environmental sustainability.

In 2022, the global trade of "Soya beans, whether or not broken" surpassed USD 93 billion. Brazil stood out as the leading exporter, contributing 50% of the global soybean exports. China emerged as a major leading importer, accounting for 70% of the total global imports of this commodity. Key export routes included shipments from Argentina and Brazil to China and from the United States to nations such as China, Egypt, Germany, Japan, and Mexico. Soybeans constituted a significant portion of the total export earnings for countries like Uruguay, Brazil, Paraguay, Togo, Argentina, Bolivia, and Ukraine.

Economically, the market benefits from its use in various industries. Soybeans' demand as a key ingredient in animal feed continues to support the livestock and poultry industries. Furthermore, the importance of soybean oil in biofuel production has grown, positioning soybeans as a critical crop in renewable energy strategies.

Market Concentration & Characteristics

There's substantial innovation in developing genetically modified (GMO) soybean varieties. These advancements include traits for increased yield, drought resistance, pest and disease resistance, and herbicide tolerance. Biotechnology firms continually research and develop new seed varieties to enhance productivity and adaptability to diverse climatic conditions.

Various market players, such as ADM, Willmar International Limited, and Cargill, Inc., are involved in merger and acquisition activities. Through M&A activity, these companies can expand their geographic reach and enter new territories.

Regulations concerning the use of pesticides and herbicides, such as glyphosate, directly affect soybean farming practices. These regulations aim to ensure food safety and environmental protection but can impose additional costs and operational challenges for farmers.

Several alternatives to soybeans are suitable for various uses, including dietary consumption, animal feed, and industrial purposes. For human consumption, options like beans, lentils, chickpeas, and peas offer similar protein content and nutrition, making them apt substitutes. In animal feed domain, meals derived from canola, sunflower, and cottonseed serve as replacements for soybean meal. Moreover, the need to avoid soy due to allergies or specific dietary choices like veganism often leads individuals to explore these alternative options.

Form Insights

The processed soybean segment dominated the market with a revenue share of 84.5% in 2023. Soybeans are known for their high protein content, essential amino acids, and various health benefits, including heart health and potentially reduced risk of certain cancers. This nutritional profile makes processed soybean products like tofu, soy milk, and soy protein isolates appealing to health-conscious consumers. The world is witnessing a growing trend towards plant-based diets driven by health, ethical, and environmental concerns. Processed soybean products are excellent meat and dairy alternatives, making them popular among vegetarians, vegans, and those reducing meat consumption.

The raw soybean segment is anticipated to grow at the fastest CAGR during the forecast period. One key factor contributing to this expansion is a diverse range of applications that raw soybeans offer. They are a valuable resource in various industries, including agriculture, food production, and biodiesel production.

Another driving force behind the growth of the raw soybean market is the high protein content in soybeans. This attribute has caught the attention of health-conscious consumers seeking alternative protein sources to meet their dietary needs, particularly vegetarians and vegans.

Regional Insights

North America had a significant market share in 2023. The market is expanding rapidly, owing to a confluence of factors, including agricultural advancements, consumer trends, and policy influences in this region. The versatility of soybeans, used in various products from food items to industrial applications like biofuels and bioplastics, underpins a consistent demand. Agricultural innovations led to improved soybean varieties and more efficient farming techniques, enhancing yields and profitability. Additionally, the growing consumer preference for non-GMO and organic products has led to increase in cultivation of non-GMO soybeans.

Asia Pacific dominated the market with a share of 40.6% in 2023 and is expected to grow at the fastest rate during the forecast period. Asia Pacific region is experiencing robust growth, driven by cultural, economic, and demographic factors. Soybeans have long been a staple in the diets of many Asian countries, with traditional foods like tofu, soy sauce, and miso deeply rooted in regional cuisines. This cultural affinity ensures a steady demand. Additionally, the region's significant population growth amplifies the need for food sources, including soybeans. Economic development across Asia Pacific has led to rising income levels, enabling consumers to diversify their diets with more protein-rich foods derived from soybeans.

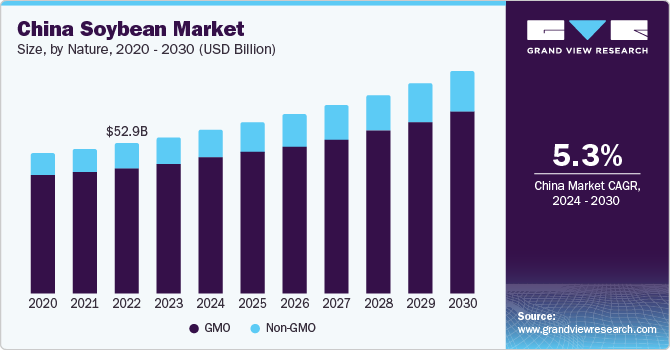

China held the largest share of in Asia Pacific in 2023. China's substantial and growing population and rapid economic development has heightened demand for food, including soybeans, as part of an increasingly diverse and protein-rich diet. Culturally, soybeans hold significant importance in Chinese cuisine, being integral to traditional foods like tofu and soy sauce. This deep-rooted cultural preference ensures a consistent domestic market for soy products. Additionally, with rising health consciousness among Chinese consumers, soybeans are recognized for their nutritional benefits, further propelling their popularity.

Nature Insights

The GMO soybean segment accounted for the largest revenue share of 83.5% in 2023. GMO soybeans are often engineered to be resistant to specific pests and diseases. This trait reduces the loss of crops due to infestation and disease, ensuring more consistent and reliable harvests. GMO soybeans have been genetically engineered for increased yield. This means that farmers can produce more soybeans per acre compared to conventional varieties. The enhanced yield is particularly beneficial in meeting the growing global demand for soybeans.

Non-GMO nature is anticipated to witness the fastest market growth over the forecast period. The association of non-GMO crops with sustainable agricultural practices is a significant factor in their growing popularity. Many consumers and producers are turning to non-GMO alternatives due to concerns about the environmental impact of GMO crops, including potential effects on biodiversity and dependence on specific herbicides. Additionally, the rise in food labeling that clearly marks non-GMO products has heightened consumer awareness, influencing their preferences. Such transparency empowers consumers to make well-informed decisions, frequently guiding them toward choosing non-GMO options.

End-use Insights

The animal feed segment accounted for the largest revenue share of 72.2% in 2023. Soybeans are known for their high protein content, making them an excellent source of essential amino acids for animals. Protein is a crucial nutrient for the growth and development of livestock, poultry, and aquaculture species. Soybean meal, a byproduct of soybean oil extraction, is rich in protein and commonly used in animal feed formulations. In addition to protein, soybeans are rich in other essential nutrients such as energy, fiber, vitamins, and minerals. This nutrient density ensures that animals receive a well-balanced diet when soybeans are included in their feed.

The food & beverages segment is anticipated to witness the fastest market growth over the forecast period. Soybeans are associated with numerous health benefits, including heart health, bone health, and potential cancer risk reduction. Products like tofu, tempeh, and soy milk are nutritious choices, attracting health-conscious consumers. Additionally, there is a rising trend in plant-based diets driven by health, environmental, and ethical considerations. Soybeans are a versatile plant-based protein source that can create various meat alternatives, dairy substitutes, and other plant-based products.

Key Companies & Market Share Insights

-

Willmar International Limited, ADM, and The Scoular Company are some of the dominant players operating in the market.

-

Willmar International Limited is known for its involvement in trading and distribution of various agricultural and commodity products.

-

ADM has a global presence with significant operations in various regions, including North America, Europe, Asia Pacific, and Middle East & Africa.

-

Louis Dreyfus Company andBunge Limited are some emerging market players in the market.

-

Louis Dreyfus Company has a global presence with significant operations in various regions, including North America, Europe, Asia Pacific, and the Middle East & Africa.

Key Soybean Companies:

- Clarkson Grain Company

- Willmar International Limited

- SLC Agrícola

- Glencore

- ADM

- The Scoular Company

- Cargill, Incorporated

- Bunge Limited

- Louis Dreyfus Company.

- Kohinoor Feeds & Fats Pvt. Ltd.

- Ag Processing, Inc.

Recent Developments

-

In November 2023, Cargill’s integrated soybean crush and refined oils facility in Sidney, Ohio wrapped up the expansion and modernization project, which came online in September. This improved facility is intended to serve farmers better and fulfill the growing soy product demands across feed, food, and renewable fuel markets.

-

In November 2021, Ag Processing, Inc. (AGP) expanded soybean processing in Sergeant Bluff, Iowa, with a USD 72 million investment. The expansion benefited soybean producers in Iowa, South Dakota, Nebraska, and Minnesota by creating better markets for their products. AGP is seeking USD 1.5 million in state and local funding for the project.

Soybean Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 199.63 billion

Revenue forecast in 2030

USD 258.12 billion

Growth rate

CAGR of 4.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Nature, form, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy Spain, China; India; Japan; Indonesia; Australia & New Zealand; Brazil; South Africa

Key companies profiled

Clarkson Grain Company; Willmar International Limited; SLC Agrícola; Glencore; ADM; The Scoular Company; Cargill, Incorporated; Bunge Limited; Louis Dreyfus Company; Kohinoor Feeds & Fats Pvt. Ltd; Ag Processing, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Soybean Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global soybean market report based on nature, form, end-use, and region:

-

Nature Outlook (Revenue in USD Billion, 2018 - 2030)

-

GMO

-

Non-GMO

-

-

Form Outlook (Revenue, USD Billion, 2018 - 2030)

-

Raw

-

Processed

-

-

End-Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Food & Beverages

-

Animal Feed

-

Industrial Use

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Asia Pacific

-

China

-

India

-

Japan

-

Indonesia

-

Australia & New Zealand

-

Central & South America

-

Brazil

-

Middle East & Africa

- South Africa

-

Frequently Asked Questions About This Report

b. The global soybean market size was estimated at USD 193.10 billion in 2023 and is expected to reach USD 199.63 billion in 2024.

b. The global soybean market is expected to grow at a compounded growth rate of 4.4% from 2024 to 2030 to reach USD 258.12 billion by 2030.

b. GMO soybean segment accounted for the largest revenue share of 83.5% in 2023. GMO soybeans are often engineered to be resistant to specific pests and diseases. This trait reduces the loss of crops due to infestation and disease, ensuring more consistent and reliable harvests. GMO soybeans have been genetically engineered for increased yield.

b. Some key players operating in soybean market include Clarkson Grain Company, Willmar International Limited, SLC Agrícola, Glencore, ADM, The Scoular Company, Cargill, Incorporated, Bunge Limited, Louis Dreyfus Company, Kohinoor Feeds & Fats Pvt. Ltd, Ag Processing Inc.

b. Soybeans are known for their health benefits, including being a good source of protein, fiber, vitamins, and minerals. The rising consumer awareness of these benefits drives demand, particularly for products like soy milk, tofu, and soy protein supplements. Moreover, there's a growing trend towards vegetarian and vegan diets, as well as a general increase in the consumption of plant-based proteins among omnivores. Soybeans, being a versatile and high-protein legume, are a key component of many plant-based diets.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.