- Home

- »

- Healthcare IT

- »

-

Biohacking Market Size And Share, Industry Report, 2030GVR Report cover

![Biohacking Market Size, Share & Trends Report]()

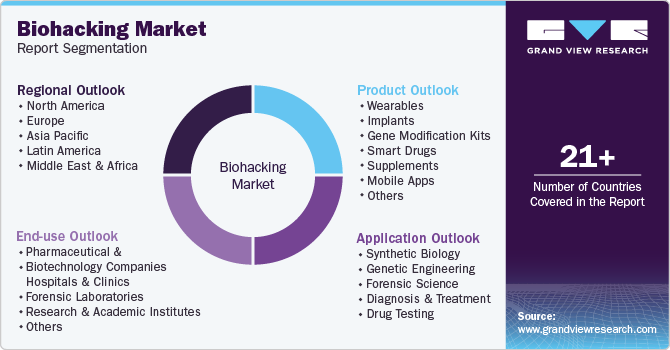

Biohacking Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Wearables, Implants, Smart Drugs, Gene Modification Kits), By Application (Genetic Engineering, Forensic Science, Synthetic Biology), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-479-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Biohacking Market Summary

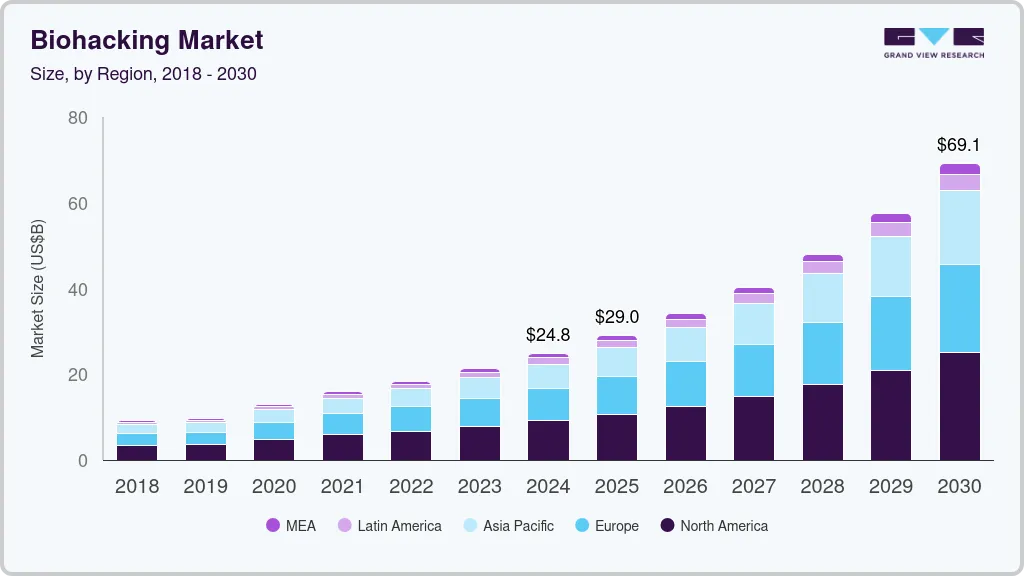

The global biohacking market size was estimated at USD 24.81 billion in 2024 and is projected to reach USD 69.09 billion by 2030, growing at a CAGR of 18.95% from 2025 to 2030. Factors expected to drive the growth of the biohacking industry are the availability of wearable health trackers, genetic testing kits, smart devices, and apps that allow people to track and analyze their biometric data, leading to a more personalized and data-focused biohacking approach.

Key Market Trends & Insights

- The North America biohacking industry dominated in 2024 and accounted for a market share of 36.73%.

- The U.S. biohacking industry dominated globally in 2024.

- Based on product, the wearables segment accounted for a share of 29.76% in 2024.

- Based on application, the diagnosis and treatment segment held the largest revenue share of over 32.15% in 2024.

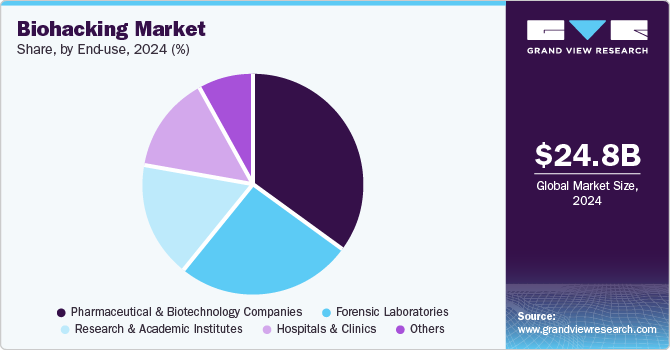

- Based on end-use, pharmaceutical and biotechnology companies segment held the largest market revenue share of 34.83% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 24.81 Billion

- 2030 Projected Market Size: USD 69.09 Billion

- CAGR (2025-2030): 18.95%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Another significant trend in the market that is anticipated to drive the growth of the biohacking industry is the increasing worries regarding lifestyle-related illnesses. Furthermore, many individuals seek methods to enhance their lifespan, prevent or deal with health issues, and optimize their mental and physical abilities.

Biohacking has accelerated the advancement and innovation of cutting-edge products. It combines the characteristics of technology and synthetic biology. Scientists and research individuals conduct laboratory experiments to discover new possibilities in biotechnology, genetic engineering, and molecular biology. Biohackers engage in various body experiments, including tracking heart rate or implanting microchips for managing stress. Biohackers are working on multiple products to investigate the human body.

Among the products available are microchips, innovative drugs, brain sensors, magnetic fingertips, RFID implants, bacterial and yeast strains, body sensors, and health trackers. At present, wearable analytical technological devices are widely available. The current generation holds a favorable attitude towards biohacking and the tools associated with it. Biohacking can be used to monitor heart rate, steps, blood sugar level, body movement, calorie burn, or other data. Hence, it will boost the biohacking industry.

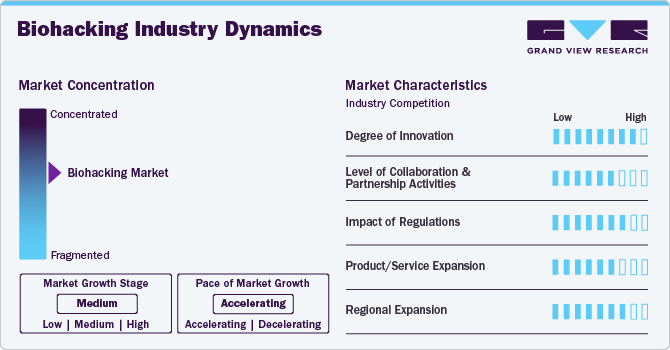

Market Concentration & Characteristics

Innovation is a defining characteristic of the biohacking industry, with rapid advancements in synthetic biology, wearable biosensors, neurostimulation, and do-it-yourself (DIY) genetic engineering. The integration of artificial intelligence, big data, and machine learning is enhancing personalized biohacking solutions, enabling individuals to monitor and optimize their health in real time. Emerging technologies, such as bioelectronic implants and gene-editing kits, are revolutionizing self-experimentation and precision medicine. However, ethical concerns and safety issues surrounding human enhancement and genetic modifications continue to shape regulatory policies and public perception.

Collaboration in the biohacking industry is growing, driven by partnerships between biotech firms, academic institutions, healthcare providers, and open-source biohacking communities. Companies are forming alliances to accelerate research, improve product development, and expand market reach. Crowdsourced innovation platforms and co-development initiatives are fostering cross-industry synergies, enabling rapid technological advancements. In addition, collaborations between biohacking startups and established pharmaceutical firms are facilitating the commercialization of biohacking solutions, particularly in personalized medicine and neurotechnology. However, intellectual property concerns and regulatory barriers sometimes limit the scope of these partnerships.

Regulatory frameworks play a crucial role in shaping the biohacking industry, particularly concerning human genetic modification, wearable biosensors, and self-experimentation practices. Stringent guidelines from agencies such as the FDA, EMA, and local health authorities govern the approval and use of biohacking technologies, influencing product development cycles and market entry. While regulations ensure safety and ethical compliance, they also pose challenges for independent biohackers and startups attempting to commercialize disruptive innovations. In addition, varying regulatory landscapes across regions create complexities for global expansion, prompting companies to navigate compliance strategies carefully.

The biohacking industry is witnessing continuous product and service expansion, driven by consumer demand for personalized health solutions, longevity enhancements, and cognitive optimization. Companies are introducing advanced biohacking kits, smart implants, and AI-powered health monitoring tools to cater to the growing self-optimization movement. The rise of at-home genetic testing and biofeedback devices is expanding market accessibility, allowing individuals to take control of their biological data. In addition, advancements in nutrigenomics and microbiome research are fueling new biohacking-based wellness products and therapeutics, broadening the scope of offerings in the biohacking industry.

The biohacking industry is expanding globally, with North America and Europe leading in technological advancements and regulatory developments. The U.S., driven by a strong biotech ecosystem and consumer interest in self-experimentation, remains a key market, while European countries emphasize ethical research and regulatory compliance. Asia-Pacific is emerging as a growth hub, with increasing investments in biotechnology, personalized medicine, and digital health solutions. Meanwhile, Latin America and the Middle East are witnessing rising interest in biohacking, driven by improved healthcare infrastructure and growing awareness. However, regional variations in regulatory frameworks and market maturity influence the speed of expansion.

Product Insights

The wearables segment accounted for a share of 29.76% in 2024. Current developments in this market mainly focus on technological progress, such as adding additional health functions, incorporating Artificial Intelligence (AI) for personalized suggestions, and sending live data to healthcare professionals for prompt interventions and better patient results. Health sensors on wearable devices transform the fitness and wellness industry, allowing people to manage their health and well-being.

One popular choice among biohackers is the smartwatch, which tells time and tracks various bioindicators. These sleek devices monitor heart rate, sleep quality, and stress levels, offering a holistic view of one's health. In addition, fitness trackers have gained immense popularity, enabling individuals to monitor their daily steps, calories burnt, and exercise intensity.

Mobile apps and pharmaceutical industries are expected to experience significant growth with a robust CAGR in the coming years. With the rise of digitalization, mobile apps play an increasingly important role in enhancing user health through technological advancements. Mobile applications can monitor water consumption, the daily number of steps taken, and calories expended in collaboration with a wearable device. The rise in popularity of implants is expected to grow even further in the coming years, particularly with companies such as Tesla's Neuralink, a wholly implantable, cosmetically unseen brain-computer chip that allows users to control a computer or mobile device easily.

Application Insights

The diagnosis and treatment segment held the largest revenue share of over 32.15% in 2024 due to the high usage of biohacking practices, such as nootropics and wearable technologies, for body enhancement purposes. With the increase in the popularity of biohacking, many users are now practicing diagnosis to gauge their body performance and then working on improving it with the help of biohacking.

In addition, the key factor driving the market growth is the rise in the adoption of intelligent drugs and genetic modification kits. Biohackers can make data-driven decisions to improve their longevity and overall well-being with this information at their fingertips.

The forensic science segment is expected to register a significant CAGR over the forecast period. The biohacking industry is increasingly influencing forensic science by enabling advanced biomolecular techniques for crime investigation and evidence analysis. DIY biohacking tools, such as CRISPR-based DNA editing and portable sequencing devices, are enhancing forensic capabilities, allowing rapid identification of genetic material at crime scenes. The integration of synthetic biology and biosensors aids in detecting toxins, drugs, and bio-signatures with greater precision. In addition, the rise of biohacker communities and open-source research is accelerating innovation in forensic methodologies, reducing costs, and expanding accessibility to sophisticated investigative tools. However, regulatory scrutiny and ethical concerns over unauthorized genetic modifications remain key challenges.

End-use Insights

Pharmaceutical and biotechnology companies held the largest market revenue share of 34.83% in 2024. The rise of biohacker communities and open-source biology is fostering collaboration, driving cost-effective research, and expediting the development of precision medicines. In addition, advancements in bioinformatics and wearable biosensors are supporting real-time health monitoring and biomarker discovery, enhancing drug efficacy and patient outcomes.

The forensic laboratories segment is expected to register a significant CAGR during the forecast period. Forensic laboratories are increasingly adopting biohacking innovations to enhance crime scene analysis, DNA sequencing, and toxicology testing. Portable gene-editing tools, such as CRISPR and nanopore sequencing, are enabling faster and more precise identification of genetic material, reducing case backlogs and improving investigative accuracy. Advances in synthetic biology and biosensors are aiding in the detection of trace biological evidence, including pathogens, toxins, and illicit substances. In addition, open-source biohacking platforms are fostering collaboration between forensic experts and citizen scientists, driving innovation while reducing costs.

Regional Insights

The North America biohacking industry dominated in 2024 and accounted for a market share of 36.73%. The biohacking market in North America is driven by strong investments in biotechnology, a growing consumer base for personalized health solutions, and the presence of leading biohacking companies. Advancements in wearable biosensors, neurotechnology, and genetic engineering tools such as CRISPR are fueling market growth. The increasing adoption of biohacking practices in wellness, anti-aging, and cognitive enhancement is further propelling demand. In addition, support from venture capital firms and innovation hubs in Silicon Valley and beyond is fostering the rapid commercialization of biohacking technologies.

U.S. Biohacking Market Trends

The U.S. biohacking industry dominated globally in 2024 driven by a strong biotech ecosystem, high consumer awareness, and significant R&D investments. The country has a thriving community of biohackers, ranging from DIY enthusiasts to advanced research institutions collaborating on cutting-edge technologies like gene editing, bioelectronic implants, and AI-driven health monitoring. The increasing focus on longevity, cognitive enhancement, and performance optimization is fueling the adoption of biohacking solutions. In addition, partnerships between biotech firms, pharmaceutical companies, and digital health startups are accelerating innovation in the biohacking industry.

Europe Biohacking Market Trends

Europe biohacking industry is expanding due to a growing interest in personalized healthcare, advancements in synthetic biology, and increasing investments in neurotechnology. Countries across the region are emphasizing ethical research and regulatory compliance, balancing innovation with consumer safety. Wearable biosensors, gut microbiome analysis, and nootropics are gaining traction among health-conscious individuals. The rise of government-supported biotech initiatives and collaborative research projects is also driving the biohacking industry growth.

The UK biohacking industry is emerging as a key player, fueled by a strong biotech sector, growing demand for longevity and wellness solutions, and government support for life sciences innovation. London and Cambridge serve as major hubs for biotech startups and research institutions working on biohacking applications, including gene therapy, brain-computer interfaces, and biomarker tracking. Consumer interest in biohacking for mental clarity, fitness optimization, and biofeedback is also on the rise. However, post-Brexit regulatory shifts and compliance challenges affect the ease of market entry and product approval.

France’s biohacking industry is driven by advancements in digital health, nutrigenomics, and wearable biosensors. The country’s strong research ecosystem, particularly in biomedical engineering and synthetic biology, is fostering innovation in biohacking applications. Consumers are increasingly adopting biohacking techniques for lifestyle optimization, while pharmaceutical and biotech companies are exploring partnerships to integrate biohacking tools into mainstream healthcare.

Germany biohacking industry is at the forefront of biohacking innovation in Europe, with a robust medical technology sector and a highly developed research infrastructure. The country’s focus on precision medicine, regenerative therapies, and bioinformatics is driving advancements in the biohacking space. German consumers and professionals are embracing nootropics, performance-enhancing supplements, and biometric tracking for health optimization. Additionally, government funding for biotech startups and academic research is supporting the development of biohacking-related technologies.

Asia Pacific Biohacking Market Trends

The biohacking industry in the Asia Pacific is expanding rapidly due to rising health awareness, increasing adoption of wearable technology, and growing investments in biotech research. Countries such as China, Japan, and India are emerging as key players, leveraging advancements in genomics, AI-driven diagnostics, and bioinformatics. The region is witnessing a surge in biohacking-focused wellness trends, including personalized nutrition and neurostimulation devices. However, regulatory complexities and varying levels of consumer acceptance across different countries impact biohacking industry penetration.

China biohacking industry is growing due to strong government support for biotech innovation, increasing consumer demand for longevity solutions, and advancements in genetic research. The country’s leadership in AI-driven health monitoring and precision medicine is accelerating the adoption of biohacking technologies. Companies and research institutes are actively exploring applications in gene editing, wearable biosensors, and bioelectronic implants.

Japan biohacking industry is a key market driven by its aging population, technological advancements, and a strong focus on health and wellness. The country has a high adoption rate of wearable biosensors, neurofeedback devices, and nutrigenomics-based dietary interventions. Government initiatives supporting precision medicine and biotech innovation are fueling market growth. Japanese companies are also investing in biohacking applications for cognitive enhancement and longevity.

MEA Biohacking Market Trends

The MEA biohacking industry is witnessing a growing interest, driven by increasing investments in healthcare innovation, rising disposable incomes, and a focus on wellness and longevity. Countries in the region are adopting AI-driven health monitoring tools, genetic testing services, and neurotechnology applications. Government-backed biotech initiatives and collaborations with global healthcare companies are fueling the growth of biohacking solutions.

Saudi Arabia biohacking industry is investing heavily in biotechnology and precision medicine as part of its Vision 2030 initiative, driving growth in the market. The country is seeing increased adoption of personalized healthcare solutions, bioinformatics, and wearable biosensors. Government support for digital health transformation is fostering innovation in AI-driven diagnostics and neurotechnology.

Kuwait biohacking industry is experiencing gradual growth, supported by rising health awareness, increasing demand for digital health solutions, and government initiatives promoting biotechnology. The adoption of wearable health trackers, biofeedback devices, and nutrigenomics-based interventions is expanding. Collaborations between local healthcare providers and international biotech firms are further driving innovation.

Key Biohacking Company Insights

Key companies are growing their market revenue by launching new products, collaborations and adopting various other strategies.

Key Biohacking Companies:

The following are the leading companies in the biohacking market. These companies collectively hold the largest market share and dictate industry trends.

- Apple Inc.

- The ODIN

- Thync Global Inc.

- Fitbit, Inc.

- Moodmetric

- HVMN Inc.

- Muse (Interaxon Inc.)

- Thriveport, LLC

- TrackMyStack

- OsteoStrong

Recent Developments

-

In October 2023, Muse classified itself as an eligible product for health savings accounts (HSA) and flexible spending accounts (FSA), benefiting customers with health improvements and tax savings. In collaboration with Truemed, they have simplified the payment procedure for customers, guaranteeing a straightforward and effective checkout process with health savings accounts when purchasing the new meditation devices, the Muse 2 Headband or the Muse S Headband.

-

In November 2022, CardieX Limited acquired Blumio, Inc., a Silicon Valley-based company specializing in advanced algorithms and technology for cardiovascular sensors. This acquisition underscores CardieX’s ongoing commitment to investing in cardiovascular health monitoring technologies. Blumio's innovations have the potential to greatly enhance the clinical performance of CardieX's heart health monitoring solutions.

-

In February 2022, SEngine Precision Medicine Inc. and Oncodesign entered into a research collaboration to develop a new personalized cancer treatment. The partnership aims to assess the feasibility of transforming the already identified Nanocyclix inhibitor series into potential drug candidates with clinical efficacy.

Biohacking Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 29.01 billion

Revenue forecast in 2030

USD 69.09 billion

Growth rate

CAGR of 18.95% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; KSA; UAE; South Africa; Kuwait.

Key companies profiled

Apple Inc.; The ODIN; Thync Global Inc.; Fitbit; Inc.

Moodmetric; HVMN Inc.; Muse (Interaxon Inc.)

Thriveport; LLC; TrackMyStack; OsteoStrong

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biohacking Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the biohacking market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Wearables

-

Wearable Neurotech

-

Oura ring

-

Muse Headband

-

Others

-

-

Implants

-

Blood test Implant

-

Circadia implant

-

NFC and RFID tags

-

Others

-

-

Gene Modification Kits

-

Smart Drugs

-

Supplements

-

Mobile Apps

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Synthetic Biology

-

Genetic Engineering

-

Forensic Science

-

Diagnosis & Treatment

-

Drug Testing

-

-

End-use Outlook (Revenue, USD Million, 2018- 2030)

-

Pharmaceutical & Biotechnology Companies

-

Hospitals & Clinics

-

Forensic Laboratories

-

Research & Academic Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

APAC

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global biohacking market size was estimated at USD 24.81 billion in 2024 and is expected to reach USD 29.01 billion in 2025.

b. The global biohacking market is expected to grow at a compound annual growth rate of 18.95% from 2025 to 2030 to reach USD 69.09 billion by 2030.

b. The wearables segment held the largest revenue share of over 29.76% in 2024 in the biohacking market.

b. Some key players operating in the biohacking market include Apple Inc., The ODIN, Thync Global Inc., Fitbit, Inc, Moodmetric, HVMN Inc., Muse (Interaxon Inc.), Thriveport, LLC, TrackMyStack, OsteoStrong

b. Increasing adoption of biohacking practices by consumers, favorable public and private funding, and initiatives by key companies are expected to boost the market growth.

b. The diagnosis and treatment segment held the largest revenue share of over 32.15% in 2024 due to the high usage of biohacking practices, such as nootropics and wearable technologies, for body enhancement purposes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.