- Home

- »

- Clinical Diagnostics

- »

-

Biological Safety Testing Products & Services Market Report 2033GVR Report cover

![Biological Safety Testing Products And Services Market Size, Share & Trends Report]()

Biological Safety Testing Products And Services Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Reagents & Kits, Services, Instruments), By Application (Vaccines & Therapeutics, Gene Therapy, Stem Cell), By Test, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-140-5

- Number of Report Pages: 136

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Biological Safety Testing Products & Services Market Summary

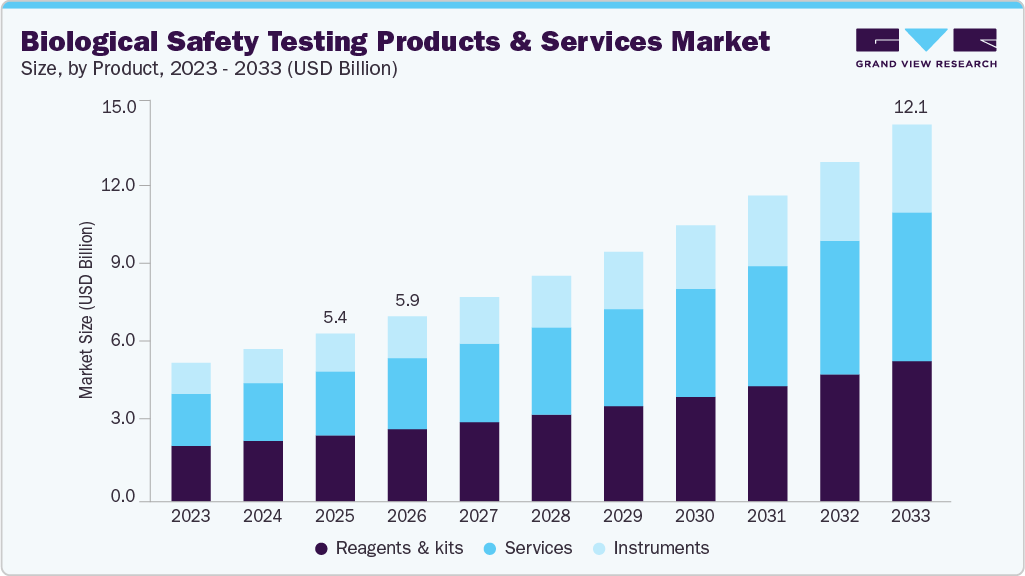

The global biological safety testing products & services market size was estimated at USD 5.38 billion in 2025 and is projected to reach USD 12.09 billion by 2033, growing at a CAGR of 10.69% from 2026 to 2033. The growing prevalence of target diseases and rising production of next-generation biologics by various biotechnology and pharmaceutical organizations are anticipated to boost the biological safety testing products & services industry.

Key Market Trends & Insights

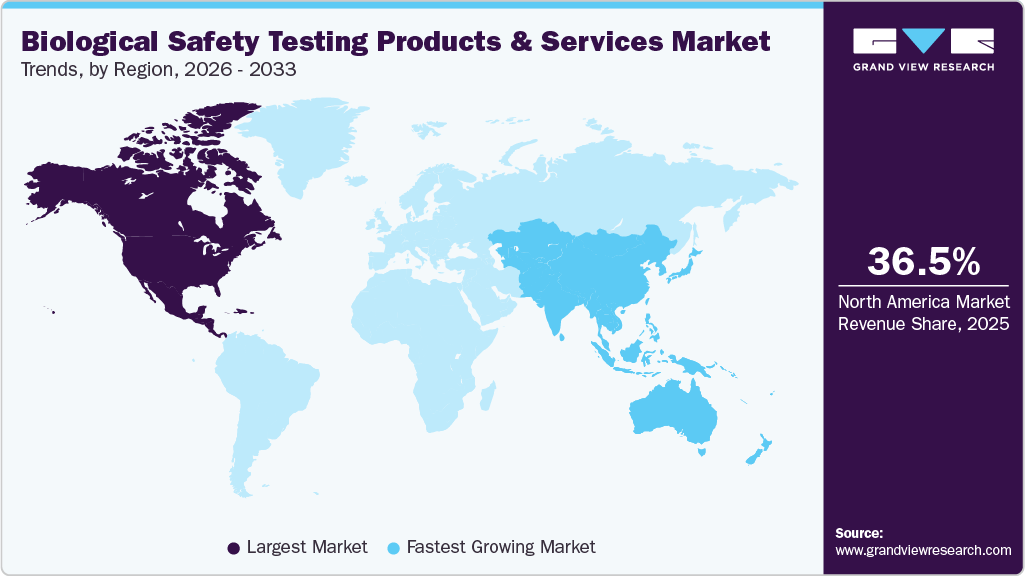

- North America biological safety testing products & services industry held the largest share of 36.47% of the global market in 2025.

- The biological safety testing products & services industry in the U.S. is expected to grow significantly over the forecast period.

- By product, the reagents & kits segment held the largest market share of 39.38% in 2025.

- Based on application, the vaccines & therapeutics segment held the largest market share in 2025.

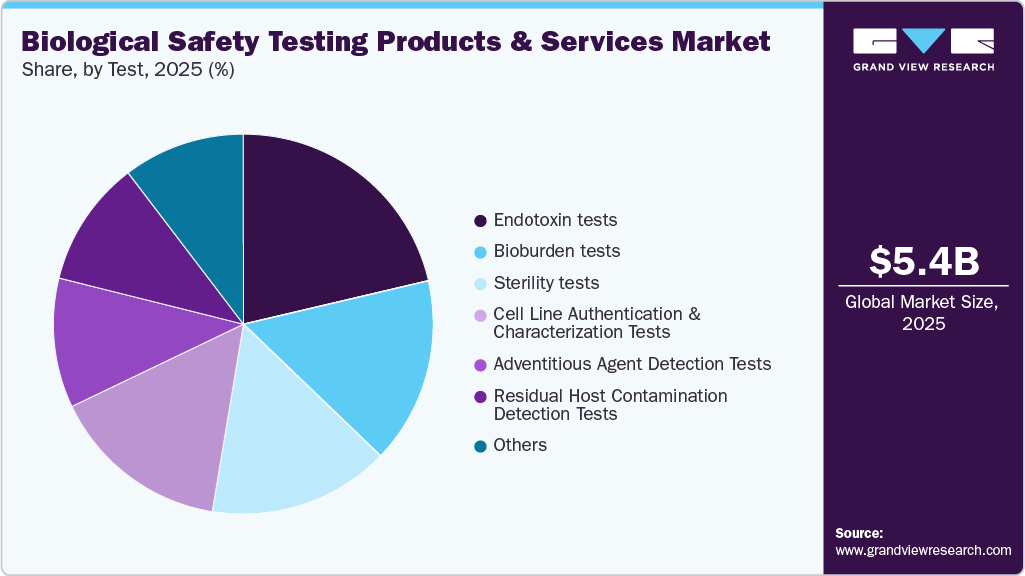

- By test, the endotoxin tests segment held the largest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 5.38 Billion

- 2033 Projected Market Size: USD 12.09 Billion

- CAGR (2026-2033): 10.69%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

The growing demand for biologics has led to an extraordinary increase in the number of biopharmaceutical companies. The rising competition to produce highly effective therapeutic drugs on a large scale has enabled manufacturers to focus on enhancing aspects of industrial processes, including cost-effectiveness and productivity. For instance, in July 2023, Biocon Biologics, an Indian-based organization, announced the launch of the rheumatoid arthritis drug Humira, a biosimilar version of AbbVie in the U.S. at a lower price that would be easily available across the region. Several organizations are thus executing better manufacturing practices involving thorough biological testing at various levels of the production cycle with easy accessibility, thereby fueling the growth of the market.The expansion of the biopharmaceutical and biotechnology sectors is a key driver for the biological safety testing products and services industry. The global growth of biologics, biosimilars, cell and gene therapies, and regenerative medicines is accelerating demand for precise, validated biosafety testing. As regulatory expectations rise and therapeutic pipelines deepen, companies are investing heavily in testing infrastructure, innovation, and partnerships to meet the biosafety needs of evolving biologic modalities. This growth is being reinforced by a wave of capital projects, mergers, and platform developments globally.

Government-led initiatives aimed at strengthening biosafety and public health infrastructure are expected to significantly boost demand for biological safety testing products and services in the coming years. Many countries are increasing investments in laboratory capacity, disease surveillance, and regulatory frameworks to ensure the safe development of pharmaceuticals, vaccines, and biologics. Programs supporting quality assurance, standardized testing protocols, and rapid pathogen detection are further driving adoption of advanced biosafety technologies. In addition, funding for pandemic preparedness and antimicrobial resistance monitoring is expanding, creating new opportunities for industry growth. As governments prioritize safety and resilience in healthcare systems, the biosafety testing market is projected to experience steady, sustained expansion.

Moreover, the presence of regulatory authorities to enforce significant safety standards is anticipated to boost the adoption of testing tools. For instance, in June 2023, FDA introduced a new guideline that would encourage biosimilar developers to adopt a more cost-effective approach to testing. The FDA guideline, called "BioRationality," aims to promote a more scientifically rational and efficient approach to the development and approval of biosimilars. The new guideline suggests alternative testing methodologies to streamline the development process and reduce costs. Stringent guidelines and recommendations issued by these authorities increase the incorporation of these tools by quality assurance technicians, thus fueling market growth.

Biological safety testing services play a crucial role in verifying the absence of bacterial contaminants and ensuring the safety of vaccines and biopharmaceuticals. These services encompass a range of assessments, including bioburden testing, toxicology testing, and analytical testing. Parameters such as accuracy, linearity, range, and specificity are evaluated to assess the quality of products offered by companies in this field.

Market Concentration & Characteristics

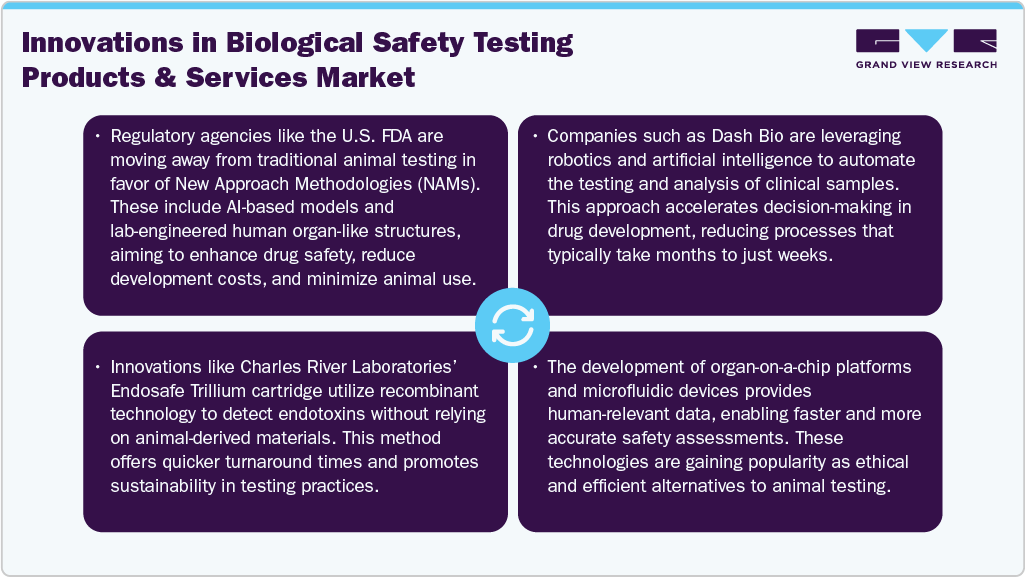

The biological safety testing products and services industry continues to advance through significant technological innovation, particularly with the integration of CRISPR-based tools and next-generation sequencing (NGS) platforms. These technologies enable higher accuracy, faster detection, and improved identification of contaminants in biologics. Their adoption enhances product reliability and supports compliance with stringent regulatory requirements. As biopharmaceutical pipelines grow, demand for these cutting-edge testing solutions is expected to rise steadily across global markets.

Key industry players such as Merck KGaA, Thermo Fisher Scientific, Inc., and Charles River Laboratories are actively pursuing mergers and acquisitions to strengthen their competitive position. Through strategic M&A, these companies broaden their service portfolios, expand global footprints, and gain access to new customer bases and emerging markets. These collaborations also facilitate technological sharing and operational synergies, which enhance testing capabilities, improve service efficiency, and accelerate overall market growth.

Strict compliance with rigorous safety and quality regulations is a major factor driving the adoption of advanced biological safety testing methodologies. Regulatory bodies such as the FDA and EMA mandate thorough evaluation of biologics to ensure patient safety and product integrity. This necessity compels manufacturers to invest in cutting-edge analytical tools, validated assays, and specialized testing processes. As regulatory expectations grow more stringent, demand for sophisticated testing technologies continues to rise across the biopharmaceutical sector.

The global biological safety testing industry is witnessing rapid expansion, with strong momentum in the Asia-Pacific region. This growth is fueled by increasing pharmaceutical and biotechnology investments, rising R&D activities, and progressive regulatory harmonization across developing economies. Countries such as China, India, South Korea, and Singapore are strengthening their biomanufacturing infrastructure, creating higher demand for reliable safety testing services. As emerging markets prioritize quality standards, regional adoption of advanced biosafety testing technologies continues to accelerate.

Product Insights

On the basis of product, reagents and kits accounted for the largest market share of 39.38% in 2025. The rise of cell and gene therapies has heightened the need for precise, compliant, and scalable safety testing solutions. Standardized kits help ensure regulatory adherence while reducing manual error-especially crucial for CMOs and biotech startups that require plug-and-play testing tools without deep in-house expertise. Innovation continues to drive this segment forward. Lonza’s PYROGENT Ultra Gel Clot kits and Thermo Fisher’s MycoSEQ Mycoplasma Detection Kit offer robust, regulatory-compliant assays. Similarly, recombinant Factor C (rFC) technologies provide sustainable alternatives to traditional LAL-based endotoxin testing.

The instruments segment is expected to grow at the fastest CAGR during the forecast period driven by increasing demand for precise, automated, and high-throughput technologies. As biologics, vaccines, and cell and gene therapies continue to dominate the global pharmaceutical pipeline, the need for sophisticated instrumentation to support complex biosafety testing workflows has become more critical than ever. This segment includes a broad array of equipment such as PCR machines, endotoxin and mycoplasma detection systems, biosafety cabinets, automated microbial identification platforms, and next-generation sequencing (NGS) instruments. One of the key growth drivers is the industry's growing focus on automation and compliance, particularly with data integrity standards like 21 CFR Part 11-making digitally integrated instruments essential for regulatory adherence. Rapid Microbiological Methods (RMMs) are reshaping sterility testing practices. In March 2025, Nelson Labs, a Sotera Health company, expanded its RMM-based sterility testing to three labs across the U.S. and Europe. This advanced approach supports a wide spectrum of medical device and pharmaceutical products, broadening

Application Insights

Vaccine and therapeutics held the largest share, based on application, in 2025, of 24.37%, and is anticipated to grow at the fastest CAGR over the forecast period. The segment’s dominance is attributed to the presence of clearly defined guidelines ensuring the safety of developed vaccines with unaltered therapeutic value and reduced toxicity. In January 2023 BioNTech SE announced their collaboration Memorandum of Understanding with the UK Government, which would help patients by fast-tracking clinical trials for mRNA personalized immunotherapies. The collaboration is anticipated to focus on three things, including cancer immunotherapies, infectious disease, and vaccines, thus, strengthening their presence in the UK. Thus, the growth of this segment is expected to be fueled by the issuance of various guidelines and recommendations by regulatory authorities, such as the U.S. FDA, regarding the characterization and qualification of materials utilized in the production of vaccines for infectious disease indications.

In addition, the gene therapy segment is anticipated to experience substantial growth during the forecast period due to the heightened risk of contamination with residual DNA. The presence of residual DNA is considered a potential risk to the final product due to its high potential for infectivity. Furthermore, mAbs play a vital role in the identification and characterization of critical quality attributes (CQAs) of biopharmaceuticals. These CQAs are specific characteristics that define the product’s safety, purity, and potency. Monoclonal antibodies are used in assays to assess parameters like product-related impurities, degradation products, and host cell proteins, ensuring that the biopharmaceuticals meet the required quality standards. Thus, the demand for monoclonal antibodies (mAbs) in the biological safety testing product and services market is experiencing a significant increase.

Test Insights

Endotoxin tests dominated the market in terms of revenue in 2025, with a market share of 21.33%. One significant regulatory advancement is the approval of Chapter <86> Bacterial Endotoxins Test Using Recombinant Reagents by the USP Microbiology Expert Committee. This chapter permits the use of non-animal-derived reagents for endotoxin testing, supporting the industry’s shift toward more ethical and sustainable testing practices. The chapter is set for early adoption in November 2024 and will become official in May 2025, marking a pivotal step toward modernizing compendial methods while reducing reliance on traditional animal-based reagents like Limulus Amebocyte Lysate (LAL). Technological innovation is another major driver. In January 2024, Charles River Laboratories expanded its endotoxin testing solutions with the launch of the Endosafe Trillium rCR cartridge. This new offering integrates the company’s established Endosafe cartridge platform with its recombinant cascade reagent (rCR), delivering a fully animal-free, efficient, and sustainable testing option. By enhancing speed and efficiency in quality control processes, this innovation aligns with both regulatory expectations and the company’s broader 4Rs sustainability commitments-Replacement, Reduction, Refinement, and Responsibility.

The bioburden tests segment is expected to grow at the fastest CAGR over the forecast period. This can be attributed to the high adoption of these tests to determine the bioburden limit in a wide range of biologics and medical devices. In April 2023, STEMart, a U.S.-based provider, announced the launch of bioburden and sterility testing for medical devices under the regulation of the ISO 11731 technique. Moreover, integrating cutting-edge colorimetric methods and computation has facilitated the rapid generation of results and accurate bioburden quantification. In addition, Bioburden testing helps identify and quantify the microbial load present in these products. By establishing acceptable limits for microbial contamination, bioburden testing assists in mitigating the risk of infection and adverse reactions in patients. Rapid advancements in this segment are further expected to aid in segment growth.

Regional Insights

North America biological safety testing products & services market held the largest share of the global market in 2025, with a market share of 36.47%. The significant market share can be attributed to substantial investments in biotechnology, growing adoption in cancer research, and the advancement of novel biologics, vaccines, and drugs. In addition, increasing research and development (R&D) investments by companies is a key factor driving growth. Furthermore, the market is boosted by major market players undertaking extensive expansion strategies aided by the rising prevalence of chronic diseases in this region is expected to drive the adoption of advanced technologies by researchers and healthcare professionals, thereby expanding the market growth. Moreover, North America has well-established regulatory bodies, such as FDA, which sets stringent guidelines and requirements for biological safety testing. Compliance with these regulations makes it crucial for manufacturers to ensure the safety and quality of their products. Such stringent regulatory environment encourages the adoption of comprehensive biological safety testing, driving market dominance.

U.S. Biological Safety Testing Products & Services Market Trends

The U.S. biological safety testing products & services industry held the largest share in the North American market in 2025 and is maintaining this dominance due to the presence of a robust and highly advanced biopharmaceutical industry in the country, along with a considerable focus on research and development. In addition, the continuous presence of numerous pharmaceutical and biotechnology companies, along with academic and research institutions, generates a sustained demand for rigorous safety testing, further reinforcing the country's leadership in the field.

Europe Biological Safety Testing Products & Services Market Trends

The Europe biological safety testing products and services industry is growing steadily, supported by the rising demand for biologics, expansion of pharmaceutical and biotechnology companies, and strict regulatory guidelines across the region. Countries such as Germany, France, Italy, and the UK have well-established healthcare and biopharmaceutical infrastructures, increasing the demand for biosafety services. Key players operating in this market include Merck KGaA, Thermo Fisher Scientific, Charles River Laboratories, Eurofins Scientific, SGS SA, Sartorius AG, and Lonza Group. These companies offer services such as sterility testing, endotoxin testing, bioburden analysis, and cell line authentication.

The UK biological safety testing products and services industry is moderately concentrated, characterized by the presence of leading global and regional players with extensive expertise and diversified service portfolios. Key companies include Merck KGaA (MilliporeSigma), Charles River Laboratories, Eurofins Scientific, and SGS Group. These firms offer comprehensive biosafety testing services such as microbial contamination detection, viral clearance, endotoxin testing, and molecular biology analysis, all essential for regulatory compliance and biologics development.

The Germany biological safety testing products and services industry is experiencing strong growth driven by the expanding biotechnology and pharmaceutical sectors, rising R&D investments, and stringent regulatory demands ensuring product safety. Key players include Merck KGaA, Sartorius AG, Charles River Laboratories, Eurofins Scientific, and Thermo Fisher Scientific. These companies offer viral clearance, sterility testing, endotoxin detection, genetic stability assays, and broad biosafety services. Technological advances, such as Merck’s 2024 Aptegra CHO Genetic Stability Assay, which reduces testing time by 66% and cuts costs by 43%, are enhancing testing efficiency and regulatory compliance.

Asia Pacific Biological Safety Testing Products & Services Market Trends

The Asia Pacific biological safety testing products & services industry is anticipated to grow at a significant CAGR over the forecast period. Factors such as the growth in healthcare spending and rising awareness of the advantages associated with these products are anticipated to contribute to market growth. In addition, the presence of organizations such as the Asia Pacific Biosafety Association, which plays a pivotal role in providing training on biosafety principles and practices to professionals throughout the region, is further expanding growth opportunities in the region.

The biological safety testing products & services industry in Japan is experiencing significant growth driven by the expanding biopharmaceutical and regenerative medicine sectors, alongside stringent regulatory requirements ensuring product safety and efficacy. Key product segments include reagents and testing kits, which are widely used across bioburden, endotoxin, and microbial contamination testing. Among services, bioburden testing remains a major focus, complemented by endotoxin testing, cell line authentication, and mycoplasma detection, all crucial for maintaining the safety of biologics and cell therapies.

The China biological safety testing products and services industry is expanding, driven by increased biopharmaceutical manufacturing and stringent regulatory requirements. This market encompasses viral clearance, sterility testing, endotoxin testing, and cell line characterization products and services. Leading companies offer advanced biosafety testing solutions to ensure product safety and regulatory compliance for biologics, vaccines, and gene therapies. The growing demand for biologics and personalized medicine fuels the adoption of cGMP-compliant testing services, supported by the expansion of bioprocess technical centers and collaborations between global and local firms. Challenges remain in managing high costs and complex regulations.

Latin America Biological Safety Testing Products & Services Market Trends

The Latin America biological safety testing products and services industry is expanding due to growing biopharmaceutical manufacturing and increasing healthcare infrastructure investments. Countries such as Brazil, and Argentina are key contributors, driven by rising demand for biologics, vaccines, and advanced therapies. The market offers vital testing services such as sterility testing, endotoxin detection, viral clearance, and cell line characterization to ensure safety and regulatory compliance. Government efforts to improve biosafety regulations and collaborations between regional and international companies further support market growth. Ongoing advancements in testing technologies and rising focus on healthcare quality position Latin America as an emerging market for biological safety testing products and services.

Middle East And Africa Biological Safety Testing Products & Services Market Trends

The MEA biological safety testing products and services industry is increasingly competitive, driven by expanding pharmaceutical manufacturing, vaccine development, and public health initiatives. Major global players like Thermo Fisher Scientific, Merck, and Charles River lead with advanced safety assays and regulatory-compliant services. Regional competition is intensifying as local labs and healthcare firms invest in biosafety infrastructure and digital diagnostics. Governments across MEA are prioritizing infectious disease preparedness, fostering demand for high-standard testing. Strategic partnerships, mobile labs, and training programs are key to market entry, with innovation, cost-efficiency, and regulatory alignment serving as primary competitive advantages.

Key Biological Safety Testing Products & Services Company Insights

Market leaders are involved in extensive R&D for manufacturing cost-efficient and technologically advanced testing products. Several strategies, such as mergers & acquisitions, undertaken by these organizations to expand their market presence are anticipated to create significant growth opportunities over the forecast period. For instance, in January 2023, Charles River Laboratories, Inc. acquired SAMDI Tech, Inc, which is a provider of high-throughput screening (HTS) solutions for several drug discovery research. Thus, intensifying its capacity to offer drug discovery and development services.

Key Biological Safety Testing Products & Services Companies:

The following are the leading companies in the biological safety testing products & services market. These companies collectively hold the largest market share and dictate industry trends.

- Charles River Laboratories

- BSL Bioservice

- Merck KGaA (MilliporeSigma)

- Samsung Biologics

- Sartorius AG

- Eurofins Scientific

- SGS Société Générale de Surveillance SA

- Thermo Fisher Scientific Inc.

- BIOMÉRIEUX

- Lonza

Recent Developments

-

In December 2025, EQUASHIELD announced the launch of the EQUASHIELD Safety Platform, an integrated solution combining its industry-leading closed-system transfer device (CSTD) with the Mundus HD automated compounding system and IV Workflow software. This unified platform is designed to minimize risk, enhance operational efficiency, and improve safety for both healthcare professionals and patients.

-

In May 2025, Thermo Fisher introduced the Thermo Scientific 1500 Series Class II, Type A2 Biological Safety Cabinet (BSC), engineered to deliver reliable protection, enhanced user comfort through ergonomic design, and ease of operation. This versatile solution is tailored to meet the demands of routine laboratory work across academic, pharmaceutical, and biotechnology environments.

-

In March 2025, Eurofins expanded its U.S. portfolio by introducing a new ethylene oxide (EtO) sterilization solution, enhancing its capabilities in providing safe and effective sterilization for medical devices.

-

In 2023 January, Samsung Biologics announced that it is constructing its fifth biomanufacturing plant in Songdo, South Korea, expected to be operational by April 2025. This will increase their total biomanufacturing capacity to 784,000 liters.

Biological Safety Testing Products & Services Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 5.94 billion

Revenue forecast in 2033

USD 12.09 billion

Growth rate

CAGR of 10.69% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion/million, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, test, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Sweden; Denmark; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Charles River Laboratories; BSL Bioservice; Merck KGaA (MilliporeSigma); Samsung Biologics; Sartorius AG; Eurofins Scientific; SGS Société Générale de Surveillance SA; Thermo Fisher Scientific Inc.; BIOMÉRIEUX; Lonza

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biological Safety Testing Products & Services Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global biological safety testing products & services market report based on product, application, test, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Reagents & Kits

-

Instruments

-

Services

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Vaccines & Therapeutics

-

Vaccines

-

Monoclonal Antibodies

-

Recombinant Protein

-

-

Blood & Blood-based Products

-

Gene Therapy

-

Tissue & Tissue-based Products

-

Stem Cell

-

-

Test Outlook (Revenue, USD Million, 2021 - 2033)

-

Endotoxin Tests

-

Sterility Tests

-

Cell Line Authentication & Characterization Tests

-

Bioburden Tests

-

Adventitious Agent Detection Tests

-

Residual Host Contamination Detection Tests

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global biological safety testing products and services market size was estimated at USD 5.38 billion in 2025 and is expected to reach USD 5.94 billion in 2026.

b. The global biological safety testing products and services market is expected to grow at a compound annual growth rate of 10.7% from 2026 to 2033 to reach USD 12.09 billion by 2033.

b. North America dominated the biological safety testing products and services market with a share of 36.47% in 2025. This is attributable to the presence of prominent market players undertaking extensive expansion strategies.

b. Some key players operating in the biological safety testing products & services market include Charles River Laboratories International, Inc.; BSL Bioservice Scientific Laboratories GmbH; Lonza Group AG; Milliporesigma; Sartorius Stedim BioOutsource Limited; and Samsung BioLogics.

b. Key factors that are driving the biological safety testing products and services market growth include an increase in the production of new-generation biologics by major pharmaceutical and biotechnology companies and the global prevalence of target diseases.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.