- Home

- »

- Biotechnology

- »

-

Biological Safety Testing Products And Services Market Report 2030GVR Report cover

![Biological Safety Testing Products And Services Market Size, Share & Trends Report]()

Biological Safety Testing Products And Services Market Size, Share & Trends Analysis Report By Product (Reagents & Kits, Services), By Application, By Test Type, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-140-5

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

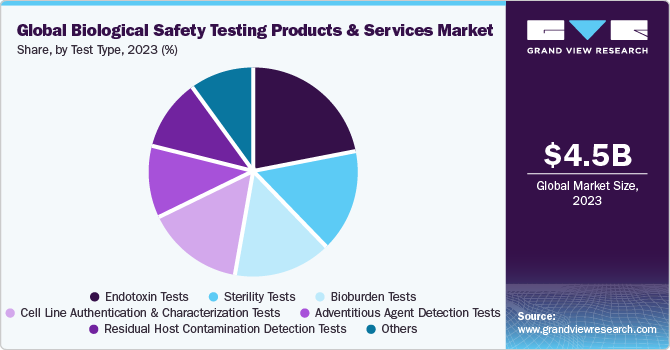

The global biological safety testing products and services market size was estimated at USD 4.57 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 10.7% from 2024 to 2030. The growing prevalence of target diseases and rising production of next-generation biologics by various biotechnology and pharmaceutical organizations are anticipated to boost the market. For instance, in September 2022, Novartis announced its investment of USD 300 million in next-generation biotherapeutics, bolstering the capacity for the early technical expansion of biologics.

The growing demand for biologics has led to an extraordinary increase in the number of biopharmaceutical companies. The rising competition to produce highly effective therapeutic drugs on a large scale has enabled manufacturers to focus on enhancing aspects of industrial processes, including cost-effectiveness and productivity. For instance, in July 2023, Biocon Biologics, an Indian-based organization, announced the launch of the rheumatoid arthritis drug Humira, a biosimilar version of AbbVie in the U.S. at a lower price that would be easily available across the region. Several organizations are thus executing better manufacturing practices involving thorough biological evaluation at various levels of the production cycle with easy accessibility, thereby fueling the growth of the market.

The growing number of government initiatives to stimulate the market is anticipated to propel overall growth over the forecast period. For instance, in June 2022, Pfizer and BioNTech announced their collaboration with the U.S. government to offer additional vaccine supply to control the spread of COVID-19 virus. Thus, government and private organizations are anticipated to enhance underlying biological safety practices in response to the elevated occurrence of microbial contamination and bioburden during the manufacturing of pharmaceuticals and biologics.

The presence of regulatory authorities enforcing stringent safety standards is expected to drive the adoption of testing tools. For instance, in June 2023, the FDA introduced the "BioRationality" guideline, encouraging biosimilar developers to adopt cost-effective evaluation approaches for a more scientifically rational and efficient development and approval process. This guideline proposes alternative evaluation methodologies to streamline development and reduce costs.

Biological safety testing services play a crucial role in verifying the absence of bacterial contaminants and ensuring the safety of vaccines and biopharmaceuticals. These services encompass a range of assessments, including bioburden, toxicology, and analytical testing. Parameters such as accuracy, linearity, range, and specificity are evaluated to assess the quality of products offered by companies in this field.

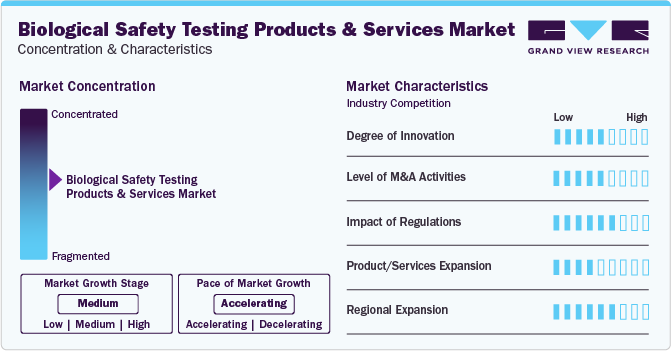

Market Concentration & Characteristics

The biological safety testing product and services market is marked by significant innovation, incorporating advanced technologies like CRISPR and next-generation sequencing for heightened accuracy.

Several market players such as Merck KGaA, Thermo Fisher Scientific, Inc and Charles River Laboratories, are involved in merger and acquisition activities. Through M&A activity, these companies can expand their geographic reach and enter new territories.

Necessitating compliance with rigorous safety and quality standards, drives the adoption of advanced testing methodologies which significantly impact the market.

In the biological safety testing product and services market, potential substitutes include alternative testing methods such as in silico modeling and rapid microbial detection technologies, challenging traditional methods.

The market is expanding globally with a focus on regions like Asia-Pacific, driven by increasing pharmaceutical and biotechnology activities, regulatory harmonization, and the growing importance of safety testing in emerging markets.

Product Insights

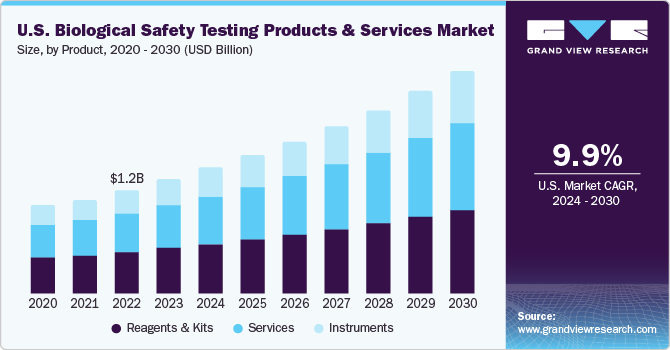

The reagents and kits segment held a leading revenue share of over 39.9% in 2023. Reagents are major components in biological safety testing and hence are extensively used in research and clinical laboratories. These reagents are antibiotics, attachments & matrix factors, biological buffers, freezing & dissociation reagents, and miscellaneous reagents. Rapid advancements and modifications in the formulation of reagents and kits are expected to increase their adoption by laboratory technicians, especially in toxicology assessment. Additionally, the increasing demand for high-throughput testing has contributed to the popularity of reagents and kits.

The instruments segment is expected to show lucrative growth through 2030 due to rising demand for instruments in biological safety testing laboratories. Additionally, the increasing regulatory pressure on biopharmaceutical companies to adhere to safety guidelines drives the demand for instruments. They play a crucial role in conducting biological assays, including toxicology and bioburden tests.

Moreover, the market is witnessing a rising demand for specialized biological safety testing, such as genetic testing, cell-based assays, and flow cytometry. These testing methods require specific instruments to carry out the procedures accurately and efficiently. The increasing adoption of personalized medicine and targeted therapies also contributes to the demand for instruments that are suitable for specialized testing needs.

Application Insights

The vaccines & therapeutics segment accounted for the largest revenue share in 2023. This dominance is attributed to the presence of clearly defined guidelines ensuring the safety of developed vaccines with unaltered therapeutic value and reduced toxicity. In January 2023, BioNTech SE announced their collaboration Memorandum of Understanding with the UK Government, which would help patients by fast-tracking clinical trials for mRNA personalized immunotherapies.

This collaboration is anticipated to focus on three things, including cancer immunotherapies, infectious disease, and vaccines, thus, strengthening their presence in the UK. Thus, the growth of this segment is expected to be fueled by the issuance of various guidelines and recommendations by regulatory authorities, such as the U.S. FDA, regarding the characterization and qualification of materials utilized in the production of vaccines for infectious disease indications.

The gene therapy segment is estimated to register the fastest CAGR through 2030due to the heightened risk of contamination with residual DNA. The presence of residual DNA is considered a potential risk to the final product due to its high potential for infectivity. Furthermore, mAbs play a vital role in the identification and characterization of critical quality attributes (CQAs) of biopharmaceuticals. These CQAs are specific characteristics that define the product’s safety, purity, and potency.

Monoclonal antibodies are used in assays to assess parameters like product-related impurities, degradation products, and host cell proteins, ensuring that the biopharmaceuticals meet the required quality standards. Thus, the demand for monoclonal antibodies (mAbs) in the biological safety testing products & services market is experiencing a significant increase.

Test Type Insights

The endotoxin tests segment dominated the market in 2023 with a significant revenue share. This share can be attributed to the rising usage of these tests in various areas, such as the manufacturing and producing drugs to reduce the threat of endotoxins. In August 2022, Lonza announced the launch of Nebula Multimode Reader, the first qualified reader for use in the company’s recombinant endotoxin, turbidimetric, and chromogenic detection methods.

The accessibility of several types of endotoxin tests, such as turbidimetric method, gel clot endotoxin testing, and USP chromogenic endotoxin testing, which are designed for different requirements, is likely to boost segment growth. In addition, endotoxin testing plays a crucial role in ensuring patient safety by preventing the release of pyrogen-contaminated products into the market. Manufacturers prioritize patient safety by implementing rigorous endotoxin testing protocols, thereby driving the demand for these tests.

The bioburden tests segment has been anticipated to show lucrative growth over the forecast period.This can be attributed to the high adoption of these tests to determine the bioburden limit in a wide range of biologics and medical devices. In April 2023, STEMart, a U.S.-based provider, announced the launch of bioburden and sterility testing for medical devices under the regulation of the ISO 11731 technique. Moreover, integrating cutting-edge colorimetric methods and computation has facilitated the rapid generation of results and accurate bioburden quantification. Rapid advancements in this segment are further expected to aid in segment growth.

Regional Insights

North America dominated the overall market with a revenue share of 35.13% in 2023. This region’s significant market share can be attributed to substantial investments in biotechnology, growing adoption in cancer research, and the advancement of novel biologics, vaccines, and drugs. Additionally, increasing research and development (R&D) investments by companies is a key factor driving growth. Furthermore, the market is boosted by major market players undertaking extensive expansion strategies aided by the rising prevalence of chronic diseases in this region is expected to drive the adoption of advanced technologies by researchers and healthcare professionals, thereby expanding the market growth.

The U.S. held the largest share in the North American market in 2023 and is maintaining this dominance due to the presence of a robust and highly advanced biopharmaceutical industry in the country, along with a considerable focus on research and development. Additionally, the continuous presence of numerous pharmaceutical and biotechnology companies, along with academic and research institutions, generates a sustained demand for rigorous safety testing, further reinforcing the country's leadership in the field.

The Asia Pacific region is anticipated to grow at the fastest CAGR during the forecast period. Factors such as the growth in healthcare spending and rising awareness of the advantages associated with these products are anticipated to contribute to market growth. Additionally, the presence of organizations such as the Asia Pacific Biosafety Association, which plays a pivotal role in providing training on biosafety principles and practices to professionals throughout the region, is further expanding growth opportunities in the region.

Within the Asia Pacific region, Japan held the largest market share in 2023. The country has made substantial investments in research and development activities, fostering innovations in biotechnology and pharmaceuticals. This commitment to cutting-edge research and technology positions Japanese companies at the forefront of biological safety product development and services.

Key Companies & Market Share Insights

-

Charles River Laboratories offers a comprehensive range of biological safety testing products & services solutions, including antibody production assays and tumorigenicity testing to ensure the safety of biological products.

-

Merck KGaA provides biosafety testing services, such as lot release testing and viral clearance studies, to ensure the safety of biopharmaceutical products.

-

BSL Bioservice offers a wide range of biological safety and activity testing services to support drug discovery projects in various development phases, including batch release and pharmacopoeia testing.

Key Biological Safety Testing Products And Services Companies:

- Charles River Laboratories

- BSL Bioservice

- Merck KGaA

- Samsung Biologics

- Sartorius AG

- Eurofins Scientific

- SGS Société Générale de Surveillance SA

- Thermo Fisher Scientific Inc.

- BIOMÉRIEUX

- Lonza

Recent Developments

-

In May 2023, Merck KGaA announced that it would be allocating a significant investment of USD 37.7 million for biosafety testing at its Glasgow and Stirling sites in Scotland, with the goal of strengthening the company's global testing capacity

-

In January 2023, Charles River Laboratories, Inc. acquired SAMDI Tech, Inc., a company specializing in high-throughput screening (HTS) solutions. This acquisition aims to enhance drug discovery processes by leveraging SAMDI Tech's technologies to expedite the identification of potential drug candidates

-

In September 2022 , Thermo Fisher Scientific, Inc. unveiled the Thermo Scientific 1500 Series Biological Safety Cabinet (BSC), crafted to meet requirements of a wide range of laboratories. This innovative system offers protection against biological hazards and contaminations

Biological Safety Testing Products And Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.07 billion

Revenue forecast in 2030

USD 9.30 billion

Growth rate

CAGR of 10.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, test type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Charles River Laboratories; BSL Bioservice; Merck KGaA (MilliporeSigma); Samsung Biologics; Sartorius AG; Eurofins Scientific; SGS Société Générale de Surveillance SA; Thermo Fisher Scientific Inc.; BIOMÉRIEUX; Lonza

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biological Safety Testing Products & Services Market Report Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global biological safety testing products and services market report based on product, application, test type, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Reagents & Kits

-

Instruments

-

Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Vaccines & Therapeutics

-

Vaccines

-

Monoclonal Antibodies

-

Recombinant Protein

-

-

Blood & Blood-based Products

-

Gene Therapy

-

Tissue & Tissue-based Products

-

Stem Cell

-

-

Test Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Endotoxin Tests

-

Sterility Tests

-

Cell Line Authentication & Characterization Tests

-

Bioburden Tests

-

Adventitious Agent Detection Tests

-

Residual Host Contamination Detection Tests

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Frequently Asked Questions About This Report

b. The global biological safety testing products and services market size was estimated at USD 4.57 billion in 2023 and is expected to reach USD 5.07 billion in 2024.

b. The global biological safety testing products and services market is expected to grow at a compound annual growth rate of 10.7% from 2024 to 2030 to reach USD 9.31 billion by 2030.

b. North America dominated the biological safety testing products and services market with a share of 35.13% in 2023. This is attributable to the presence of prominent market players undertaking extensive expansion strategies.

b. Some key players operating in the biological safety testing products & services market include Charles River Laboratories International, Inc.; BSL Bioservice Scientific Laboratories GmbH; Lonza Group AG; Milliporesigma; Sartorius Stedim BioOutsource Limited; and Samsung BioLogics.

b. Key factors that are driving the biological safety testing products and services market growth include an increase in the production of new-generation biologics by major pharmaceutical and biotechnology companies and the global prevalence of target diseases.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."