- Home

- »

- Medical Devices

- »

-

Biological Safety Testing Services Market Size Report, 2030GVR Report cover

![Biological Safety Testing Services Market Size, Share & Trends Report]()

Biological Safety Testing Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Services (Sterility Testing Services, Endotoxin Testing Services), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-517-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Biological Safety Testing Services Market Summary

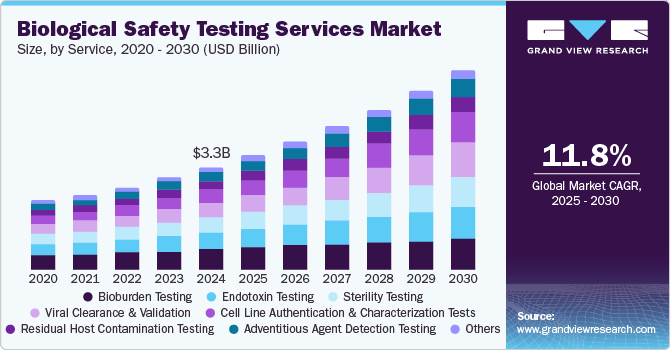

The global biological safety testing services market size was estimated at USD 3.25 billion in 2024 and is projected to reach USD 6.33 billion by 2030, growing at a CAGR of 11.78% from 2025 to 2030. The market growth can be attributed to the increasing adoption of biologics and biosimilars, rising focus on cell and gene therapies, and stringent regulatory requirements for product safety.

Key Market Trends & Insights

- The North America accounted for the largest market share of 33.1% in 2024.

- Based on service, the bioburden testing segment captured the highest market share in 2024.

- Based on application, the vaccine & therapeutics segment dominated the biological safety testing services industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.25 Billion

- 2030 Projected Market USD 6.33 Billion

- CAGR (2025-2030): 11.78%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Moreover, the growing pipeline of biopharmaceutical drugs, coupled with the expansion of contract testing services, has further fueled market demand. Technological advancements such as automation, next-generation sequencing (NGS), and polymerase chain reaction (PCR)-based testing are improving efficiency and accuracy, making safety testing more reliable.

The biopharmaceutical industry has witnessed significant growth in the past few years. According to the data published by Creative Biogene, approximately 3,700 cell and gene therapy products are in pipeline currently with more than 100 approved therapies globally. The growing pipeline of cell and gene therapy products, along with an increasing number of regulatory approvals, is significantly driving the market growth. These advanced therapies require stringent safety assessments to ensure the absence of microbial and viral contaminants. Thus, the growing number of cell and gene therapies product pipelines would boost the demand for these services in the coming year.

In addition, several pharmaceutical and biotechnology companies are increasingly outsourcing their biological safety testing needs to specialized service providers due to the high costs and expertise required for in-house testing. Contract research organizations (CROs) and contract development and manufacturing organizations (CDMOs) play a pivotal role in offering cost-effective and regulatory-compliant testing solutions. This trend is particularly strong in emerging biopharmaceutical companies seeking to streamline operations while focusing on drug development.

Market Concentration & Characteristics

The biological safety testing services industry is witnessing continuous innovation driven by advancements in analytical technologies and automation. The adoption of next-generation sequencing (NGS), real-time polymerase chain reaction (PCR), and high-throughput screening methods has enhanced the precision and efficiency of microbial detection and viral safety assessments.

Mergers and acquisitions (M&A) play a pivotal role in shaping the market, with major players acquiring specialized service providers to expand their capabilities and global reach. Leading companies such as Charles River Laboratories, Merck KGaA, and WuXi AppTec have engaged in strategic acquisitions to enhance their testing portfolios and strengthen their positions in the contract testing space.

Stringent regulatory requirements imposed by agencies such as the FDA, EMA, and ICH are major market drivers, shaping the demand for these services. Regulations mandate rigorous testing for sterility, endotoxins, mycoplasma, and viral contaminants to ensure product safety and compliance. The evolving regulatory landscape, with increasing oversight on cell and gene therapies and biosimilars, has heightened the need for advanced safety testing solutions.

The growing complexity of biologics, biosimilars, and advanced therapies has led to the expansion of these services. Companies are diversifying their offerings to include viral clearance studies, next-generation sterility testing, and genetic stability testing to meet the evolving demands of the industry. Contract testing organizations (CROs and CDMOs) are increasingly expanding their service portfolios to provide end-to-end solutions, catering to small and large biopharmaceutical companies.

The biological safety testing services market is experiencing significant regional expansion, with North America, Europe, and Asia-Pacific emerging as key growth hubs. While North America leads due to a strong biopharmaceutical industry and stringent regulatory framework, Asia-Pacific is witnessing rapid growth driven by increasing biotech investments, expanding contract testing services, and favourable government initiatives.

Service Insights

The bioburden testing services segment captured the highest market share in 2024. The growth is mainly due to its important role in ensuring the sterility and safety of biopharmaceutical products. Bioburden testing is essential for detecting microbial contamination in raw materials, intermediates, and finished products, making it a regulatory requirement for biologics, vaccines, and cell and gene therapies. Moreover, the increasing production of biologics and sterile pharmaceuticals, coupled with stringent regulatory guidelines from agencies like the FDA and EMA, is driving the demand for bioburden testing.

The cell line authentication and characterization tests segment are projected to experience the fastest CAGR during the forecast period, due tothe rising adoption of cell-based therapies, regenerative medicine, and biologics production. In addition, the expansion of research in monoclonal antibodies, personalized medicine, and biosimilars has further heightened the need for comprehensive cell line characterization. In addition, regulatory agencies are enforcing stricter guidelines for cell line authentication to minimize the risks associated with misidentified or contaminated cell cultures further driving the demand for advanced characterization techniques such as short tandem repeat (STR) profiling, karyotyping, and next-generation sequencing (NGS).

Application Insights

The vaccine & therapeutics segment dominated the biological safety testing services industry in 2024. The segment’s growth is mainly driven due to the high demand for rigorous safety assessments in vaccine production and biopharmaceutical therapies. The rapid expansion of vaccine development, particularly in response to emerging infectious diseases and seasonal outbreaks is driving the need for extensive bioburden and sterility testing, and endotoxin assessments. Moreover, the increasing adoption of monoclonal antibodies and recombinant protein therapies is further contributing to the segment growth.

The cell and gene therapy segments are expected to experience the fastest CAGR during the forecast period. The growth is mainly due to the expanding pipeline of advanced therapies and increasing regulatory scrutiny. These therapies involve genetically modified cells, viral vectors, and complex biologics, necessitating specialized safety testing, including viral clearance studies, mycoplasma detection, and cell line authentication. With approximately 3,700 cell and gene therapy products in development globally and more than 100 already approved, the demand for comprehensive safety testing is projected to increase in the coming years.

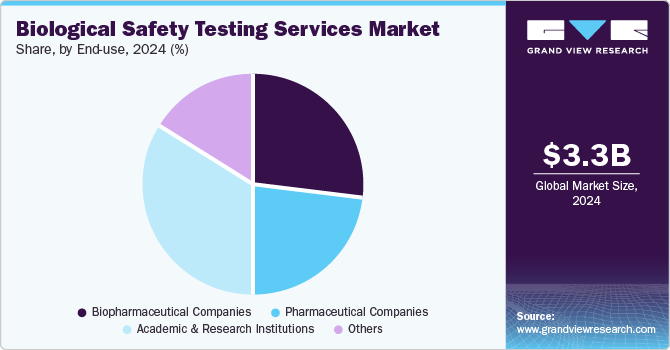

End-use Insights

The biopharmaceutical companies segment dominated the biological safety testing services market in 2024. The growth is due to the increasing production of biologics, biosimilars, and advanced therapies that require stringent safety assessments. Biopharmaceutical companies are constantly developing monoclonal antibodies, vaccines, cell and gene therapies, and other complex biologics, which requires proper sterility evaluations and viral clearance studies. Therefore, with the growing pipeline of biologics and personalized medicines the regulatory agencies are enforcing stricter safety guidelines, further increasing the demand for these services.

The academic and research institutions segment is expected to witness considerable growth in the coming years due to an increasing investments in biomedical research, cell and gene therapy studies, and vaccine development. The universities and research centers are increasingly focusing on innovative drug discovery and preclinical studies which is subsequently increasing the demand for these services to ensure the integrity and safety of experimental biologics. In addition, increasing government funding and collaborations with biopharmaceutical companies are driving the research in regenerative medicine and personalized therapies, necessitating rigorous contamination and sterility testing.

Regional Insights

North America accounted for the largest market share of 33.1% in 2024 due to the region’s well-established biopharmaceutical industry, stringent regulatory requirements, and increasing R&D investments in biologics and advanced therapies. The region’s strong presence of key market players, along with the growing focus on cell and gene therapies, is further boosting demand for comprehensive safety testing services.

U.S. Biological Safety Testing Services Market Trends

The biological safety testing services industry in the U.S. is driven due to the significant presence of the FDA’s stringent regulatory framework, continuous innovation in biologics, and significant government funding for life sciences research. Moreover, the rising adoption of biosimilars and an increasing number of clinical trials for novel therapies are also some of the factors driving the country’s market growth.

Europe Biological Safety Testing Services Market Trends

The biological safety testing services industry in Europe is experiencing growth due to the region's expanding pharmaceutical industry and evolving regulatory environment. Moreover, increasing adoption of biosimilars, personalized medicine, and regulatory enforcement by the European Medicines Agency (EMA) is also boosting the demand for these services. The region’s focus on advanced biopharmaceutical manufacturing and quality control is further fueling the demand for these services.

The biological safety testing services market in the UK held a significant share in 2024. The country’s market growth is due to its expanding biotechnology sector, increasing government support for life sciences research, and growing investments in gene and cell therapy development. Moreover, the growing presence of globally recognized research institutions is further contributing to the market expansion.

The France biological safety testing services market’s growthis driven due to increasing government initiatives focused on biopharmaceutical innovation, along with a rising number of biologic drug approvals. These factors are fueling demand for stringent safety assessments, ensuring compliance with evolving regulatory standards and supporting the country’s expanding biotech sector. In addition, the country’s emphasis on expanding biotech startups and partnerships with CROs and CDMOs is also boosting demand for these services.

The biological safety testing services market in Germany is anticipated to grow significantly over the forecast period due to its robust pharmaceutical manufacturing industry. The country’s strong focus on R&D and quality assurance is driving the market growth. Moreover, advanced regulatory standards and increasing adoption of automated testing technologies are also fueling market growth.

Asia Pacific Biological Safety Testing Services Market Trends

The Asia Pacific biological safety testing services industryis projected to grow at the highest CAGR over the forecast period. The growth of the market is mainly due to increasing biopharmaceutical production, rising clinical trials, and government initiatives to strengthen biotechnology research. The demand for cost-effective testing services is further fueling outsourcing to CROs in the region.

The biological safety testing services market in China is expected to grow over the forecast period. The growth is driven due to heavy investments in vaccine production and improving regulatory landscape. Moreover, growing government’s focus on self-sufficiency in biologics manufacturing is further boosting the adoption of these services in the country.

Japan biological safety testing services market is witnessing significant growth over the forecast period. The growth is due to the country’saging population and increasing focus on regenerative medicine and cell therapies. The country’s robust pharmaceutical industry and regulatory advancements in gene therapy are also contributing to market expansion.

India biological safety testing services market is witnessing a considerable growth due to the country’s growing contract research and manufacturing sector, along with its cost-effective biologic production capabilities. Moreover, growing government initiatives to promote biotech innovation and attract foreign investments are further driving the country’s market growth.

Latin America Biological Safety Testing Services Market Trends

The Latin America biological safety testing services industryis projected to grow over the forecast period. The growth in the region is due to increasing investments in vaccine production, improving healthcare infrastructure, and rising collaborations with global biopharma companies. Regulatory advancements are also contributing to market development.

The biological safety testing services market in Brazil is expected to grow over the forecast period due to its strong pharmaceutical industry, government-backed biotech research programs, and growing investments in biosimilar development. The country’s focus on improving regulatory compliance is further driving demand for biological safety testing services.

Key Biological Safety Testing Services Company Insights

Key players in the market are actively expanding their capabilities to meet growing global demand. For instance, in October 2024, Merck inaugurated a new USD 300.9 million biosafety testing facility in Rockville, USA. This 23,000-square-meter facility consolidates biosafety testing, analytical development, and cell bank manufacturing services into a single building, enhancing efficiency and collaboration among scientists.

Key Biological Safety Testing Services Companies:

The following are the leading companies in the biological safety testing services market. These companies collectively hold the largest market share and dictate industry trends.

- Charles River Laboratories International, Inc.

- Lonza Group Ltd.

- Merck KGaA

- SGS SA

- Eurofins Scientific

- WuXi AppTec

- Thermo Fisher Scientific Inc.

- Sartorius AG

- Toxikon Corporation

- bioMérieux SA

Recent Developments

-

In October 2024, SGS SA announced to expand its biopharmaceutical testing services to address the increasing global demand for large-molecule drug development. This initiative strengthens its support for biologics across various stages, including cell bank safety assessment, product characterization, method development, and final product release.

-

In August 2024, SGS SA announced the launch of a specialized services in North America, reinforcing its commitment to supporting the growing demand for biologics and advanced therapies. These services focus on large molecule bioanalysis, pharmacokinetics, immunogenicity, and biomarker analysis, catering to the expanding pipeline of monoclonal antibodies, gene therapies, and cell-based therapeutics.

-

In May 2023, Charles River Laboratories entered into a partnership agreement with Wheeler Bioto establish and operate a RightSource Laboratory, an embedded quality control (QC) testing facility designed to streamline and accelerate biologics development. This initiative aims to provide in-house, GMP-compliant biological safety testing for early-stage biopharmaceutical companies, reducing time-to-market for innovative therapeutics.

Biological Safety Testing Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.62 billion

Revenue forecast in 2030

USD 6.33 billion

Growth rate

CAGR of 11.78% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Charles River Laboratories International, Inc.; Lonza Group Ltd.; Merck KGaA; SGS SA; Eurofins Scientific; WuXi AppTec; Thermo Fisher Scientific Inc.; Sartorius AG; Toxikon Corporation; bioMérieux SA

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

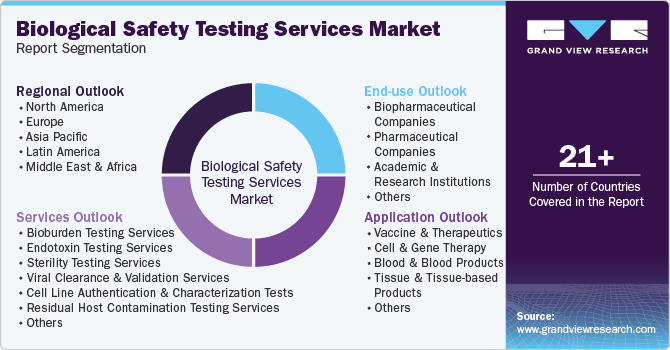

Global Biological Safety Testing Services Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the biological safety testing services market on the basis of service, application, end-use, and region:

-

Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Bioburden Testing Services

-

Endotoxin Testing Services

-

Sterility Testing Services

-

Viral Clearance and Validation Services

-

Cell Line Authentication and Characterization Tests

-

Residual Host Contamination Testing Services

-

Adventitious Agent Detection Testing Services

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Vaccine & Therapeutics

-

Monoclonal Antibodies

-

Vaccines

-

Recombinant Protein

-

-

Cell and Gene Therapy

-

Blood & Blood Products

-

Tissue & Tissue-based Products

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Biopharmaceutical Companies

-

Pharmaceutical Companies

-

Academic and Research Institutions

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global biological safety testing services market size was estimated at USD 3.25 billion in 2024 and is expected to reach USD 3.62 billion in 2025.

b. The global biological safety testing services market is expected to grow at a compound annual growth rate of 11.78% from 2025 to 2030 to reach USD 6.33 billion by 2030.

b. North America dominated the biological safety testing services market with a share of 33.1% in 2024. This is attributable to the region’s well-established biopharmaceutical industry, stringent regulatory requirements, and increasing R&D investments in biologics and advanced therapies.

b. Some key players operating in the biological safety testing services market include Charles River Laboratories International, Inc., Lonza Group Ltd., Merck KGaA, SGS SA, Eurofins Scientific, WuXi AppTec, Thermo Fisher Scientific Inc., Sartorius AG, Toxikon Corporation, bioMérieux SA

b. Key factors that are driving the market growth include increasing adoption of biologics and biosimilars, rising focus on cell and gene therapies, and stringent regulatory requirements for product safety.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.