- Home

- »

- Medical Devices

- »

-

Biological Skin Substitutes Market Size & Share Report, 2030GVR Report cover

![Biological Skin Substitutes Market Size, Share & Trends Report]()

Biological Skin Substitutes Market Size, Share & Trends Analysis Report By Type (Human Donor Tissue-derived Products, Acellular Animal-derived Products), By Application (Acute Wound, Chronic Wound), By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-040-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Biological Skin Substitutes Market Trends

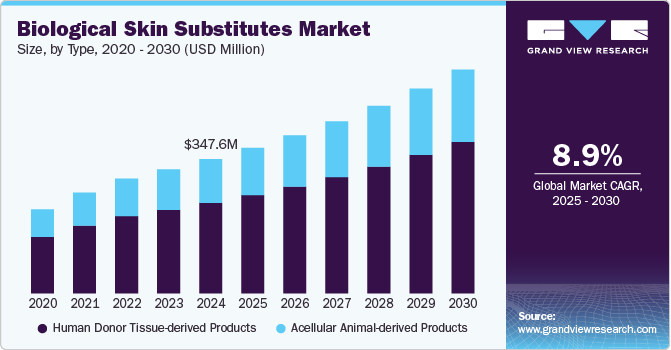

The global biological skin substitute market size was estimated at USD 347.57 million in 2024 and is anticipated to grow at a CAGR of 8.88% from 2025 to 2030. The market is driven by the rising prevalence of chronic wounds, such as ulcers and burn injuries, medical technology advancements, the geriatric population, and surgical procedures. These products are materials used to temporarily or permanently act as an alternative and cover open wounds. They can be made from a variety of biological or biosynthetic materials.

The prevalence of chronic wounds such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers has increased in recent years, which is anticipated to increase the demand for effective treatment options. For instance, according to the data published by Uintah Basin Healthcare in June 2024, there are about 7 million people affected by chronic wounds in America, out of which nearly 2 million people have diabetic foot ulcers. It is noted that among every four families, there is at least one member living with chronic wounds. Moreover, as per the review published by John Wiley & Sons, Inc. in February 2024, venous leg ulcer has a prevalence of 1 %, followed by 22% recurrence of the condition within 3 months, which increases to 78 % in a span of 3 years. This high prevalence upsurges the demand for advanced wound care products, such as biological dermal substitutes, to promote healing & reduce complications associated with chronic wounds and drive the market growth.

The growing burden of trauma across the world is anticipated to fuel the demand for wound care products, including skin substitutes. According to the factsheet the World Health Organization presented in October 2023, approximately 18,000 deaths occur annually, especially in low and middle-income countries. Females are slightly at higher risk of burns, as per recent findings. Furthermore, burns can lead to severe complications, such as infections, scarring, and loss of dermal function, necessitating advanced wound care solutions like biological skin substitutes and thus fueling the adoption.

The advent of innovative dermal substitutes, including bioengineered skin grafts, marks a significant milestone in medical treatments and offers more advantages over conventional materials. Many companies are undertaking studies to provide novel skin substitutes for wound management. For instance, in May 2024, as per the article published by the European Patent Organization, Fertram Sigurjonsson and his team designed a product utilizing fish skin, which offers numerous advantages over other wound-healing products. Such developments in the market will increase revenue in the coming decade

Market Concentration & Characteristics

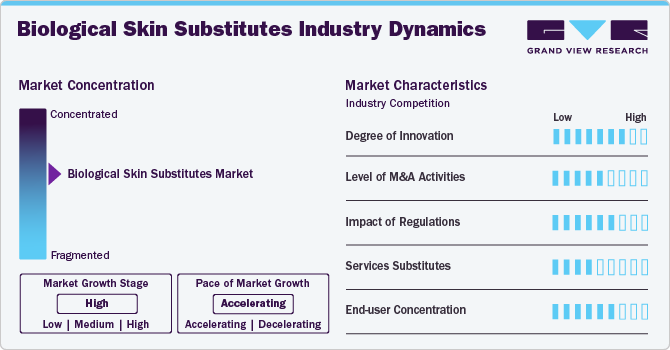

The market growth stage is high, and the pace is accelerating. The market is characterized by high growth due to the increasing prevalence of chronic conditions such as diabetic foot ulcers, venous ulcers, trauma injuries, and others.

The market is experiencing high levels of innovation driven by advancements in procedures, tissue engineering, and novel material technologies. Continuous research and development efforts focus on enhancing product safety, precision, and patient outcomes. Innovations, such as next-generation skin substitutes, address unmet needs, offering more effective treatment options for skin conditions. For instance, in September 2022, MiMedx Group, Inc. launched AXIOFILL, an Extracellular matrix (ECM) derived from human placental tissue useful for surgical recovery procedures.

Regulatory authorities, such as the European Medicines Agency (EMA) and the U.S. Food and Drug Administration (FDA), play a vital role in shaping the market. Stricter requirements for clinical trials and post-market surveillance ensure patient safety and product efficacy but can pose challenges for companies seeking approvals. This provides patients' safety and encourages companies to maintain good standards while developing products.

The market is poised to experience mergers and acquisitions (M&A) activity as companies seek to expand their product portfolios, leverage partnerships, and enter new markets. Established players are acquiring smaller innovators to gain access to cutting-edge technologies, while strategic collaborations are emerging to enhance distribution networks. For instance, in March 2023, BioTissue expanded its distribution and manufacturing facility in Doral, Florida, to meet the growing demand for biologics.

The availability of product substitutes is less; however, it slightly impacts the market, with alternatives such as artificial skin substitute dressings. Although devices like allografts and xenografts are preferred for severe skin conditions, temporary dressings may offer viable solutions in early-stage interventions.

Market players are actively pursuing regional expansion to capitalize on emerging market opportunities. Growth in Asia-Pacific, North America, and Europe is robust, driven by increasing healthcare investments, rising awareness of chronic disorders, and improving access to advanced medical technologies. Companies are also establishing local manufacturing units and forging partnerships with regional distributors to navigate market-specific challenges and regulatory frameworks.

Type Insights

Human donor tissue-derived products held the largest revenue share of around 67.42% in 2024 and is anticipated to be the fastest-growing segment over the forecast period. These products are more common as they are derived from human tissues such as skin, bone, tendons, etc. As humans are a common source, patients’ bodies readily accept and minimize the chance of rejection by the immune system. Extensive research in the field, followed by the introduction of new products in the market, is anticipated to boost the segment growth. For instance, in October 2024, BioLab Sciences launched “Tri-Membrane Wrap,” a triple-layered human tissue allograft constructed from the amniotic membrane, which perfectly protects deep wounds and poorly located areas. This product is designed to be robust and provide optimum tensile strength for easy sutures, thus exhibiting better protectant covering.

The acellular animal-derived products segment is anticipated to grow from 2025 to 2030. These biomaterials created from animal tissues, such as porcine or bovine sources, have undergone decellularization. Due to the absence of cellular components, they support tissue regeneration without triggering an immune response. Several studies are focusing on the effectiveness of acellular animal-derived skin substitutes over other alternatives. For instance, according to the review published in April 2024, acellular fish skin grafts are regarded as more suitable for treating diabetes wounds of different depths. Such positive results from the studies using acellular animal-derived products for wound management are anticipated to boost segment growth in the coming years.

Application Insights

The acute wounds segment dominated the market in 2024. The segment is primarily driven by the increasing incidence of traumatic injuries, burns, and surgical wounds, which require rapid and effective healing solutions. In addition, the growing demand for effective and efficient wound-healing solutions is anticipated to boost the segment growth during the study period. For instance, AlloSkin RT is a human tissue-derived meshed[AP3] [SP4] allograft for dermal and epidermal acute wound healing. Cytal Burn Matrix, derived from a porcine source, is indicated for treating burns. Thus, the availability of both allografts and xenografts for treating acute wounds is expected to contribute to segment growth.

The chronic wounds segment is anticipated to witness fastest growth at a CAGR of 9.13% over the forecast period owing to the increasing prevalence of chronic wounds such as diabetic foot ulcers, venous leg ulcers, pressure ulcers, etc. For instance, according to the article published by Springer Nature Limited[AP3] [SP4] in January 2024, diabetic individuals have a 25% chance to encounter diabetic foot, which increases the risk of amputation. Such conditions attract the focus of physicians to provide better living to patients by using biological skin substitutes. Furthermore, the technological advancements in the development of allografts and xenografts, such as stem cells, growth factors, and other biomaterials, have led to the production of more effective wound-healing solutions for chronic wounds.

End Use Insights

Hospitals held the largest revenue share of around 54.97% in 2024. The segment’s growth can be attributed primarily to the increasing patient pool suffering from severe injuries such as burns, surgical cases, and others. For instance, according to the data published by Stewarts Law LLP in October 2023, around 2, 50,000 [people suffer from burn injuries every year in the UK, out of which 16,000 people are severely burnt and are hospitalized. Majority of the severely burnt patients are children below the age of 5 years. Moreover, according to the article published by the Journal of Burn Care & Research in October 2024, a cohort stu dy was performed to find out that patients who were hospitalized due to burns had a median admission time of 55 hours. Furthermore, hospitals are preferred over other healthcare settings as they provide comprehensive care to patients with complex medical needs. Also, as the number of hospitals is increasing, the segment is expected to contribute more revenue to the biological skin substitute market in the coming years.

The outpatient facilities segment is expected to grow at the highest CAGR from 2025 to 2030. These include ambulatory surgery centers and specialty facilities outside the hospital. The advantages associated with outpatient facilities, including shorter procedure time, comparatively low cost, and same-day discharge compared to hospitals, are anticipated to support the segment growth in the coming years. The growing number of outpatient facilities is expected to boost the segment growth.

Regional Insights

North America biological skin substitute market dominated the global marker with a revenue share of 41.25% in 2024 owing to the increasing demand for Advanced Wound Care (AWC) products and the rising incidence of burn injuries & chronic wounds. The market is dominated by a few major players, including companies such as Integra LifeSciences Corporation, Smith+Nephew, Stryker, and 3M. These companies and other organizations are investing heavily in R&D to improve the quality and efficacy of their products. For instance, as per the news published in January 2024, MTF Biologics- a non-profit organization has awarded a funding of more than USD 930,000 to six different organizations under its 2023 Innovation in Allograft Translational Research Grant Program. Such grants will further expand the allograft technology and support the growth of North America's biological skin substitute market in the coming years.

U.S. America Biological Skin Substitute Market Trends

The U.S. biological skin substitute market held the largest share of North America region in 2024, driven by the increasing burden of chronic diseases. The growth in this region is supported by consistent research and product launches that increase the product portfolio in the sector and drive market growth biological skin substitutes. For instance, in September 2023, MiMedx Group, Inc., headquartered in the U.S., announced the launch of EPIEFFECT, a skin substitute product under its AWC products portfolio. Such developments and strategic activities in the region accelerate market growth.

The biological skin substitute market in Canada is anticipated to grow significantly over the forecast period. The country's healthcare coverage and compulsory insurance enable the adoption of advanced technologies. Many government organizations and other institutions undergo strategic activities to educate more people about new technologies and emphasize several wound management techniques and biological skin substitutes. For instance, according to the data presented in WoundsCanada.ca. on October 2024, the Wounds Canada National Hybrid Conference is going to be held in October 2024, which brings together various expert healthcare professionals to support healthcare professionals who treat wounded patients. Such meetings influence healthcare education and are expected to give rise to new ideas in the biological skin substitute market, further increasing market growth in the region.

Europe Biological Skin Substitute Market Trends

The Europe biological skin substitute market is driven by the increasing geriatric population in the region, growing incidences of chronic diseases, and increasing demand for innovative treatments for skin wounds, burns, and other dermatological conditions. For instance, according to the data extracted from Eurostat published in February 2024, 21.3% of the European population was 65 years old or more in January 2023. This large geriatric population increases the chances of chronic disorders such as diabetes and further boosts the market growth.

The biological skin substitute market in Germany contributed to a significant revenue share in the European market in 2024 owing to a rapid increase in diabetic population in the country; for instance, as per the article published in the journal Diabetologia in February 2024, it is projected that the number of patients having type 2 diabetes would increase by 54% to 77% by 2040 in Germany. In addition, 16% of deaths that occur in the country are caused due to diabetes. This increasing prevalence of chronic diseases will further increase the market demand and propel market growth during the forecast period.

Asia Pacific Biological Skin Substitute Market Trends

The Asia Pacific biological skin substitutes market is experiencing rapid growth due to the rising prevalence of skin-related disorders, chronic diseases, and trauma patients. Rapid economic growth in the region is expected to drive the demand for innovative, improved technologies and attempts to create treatments and products suitable for managing wounds. Improving healthcare infrastructure in the highly populous nations in APAC, such as India, China, and Japan, is providing potential market opportunities and attracting stakeholders to expand their portfolios in the Asia Pacific market.

For instance, as per the study reported in the Chinese Journal of Traumatology, approximately 1.7% of patients in China require hospitalization due to chronic wounds, with the majority being individuals aged 40-60 years old (31%) and 60-80 years old (38%). Rising geriatric population, increased life expectancy, and significant presence of nonprofit organizations, such as the Japan Society for Surgical Wound Care, the Japanese Society for Wound Healing, and the Japanese Society for Burn Injuries, are further contributing to market growth in Asia Pacific region.

Latin America Biological Skin Substitutes Market Trends

The biological skin substitute market in Latin America is experiencing significant growth, primarily driven by growing investments and increasing free-trade agreements with major countries, such as the U.S., Canada, Japan, & several European countries. Due to the lower costs of medical treatments in the region and the availability of advanced treatment options at reasonable prices, medical tourism is anticipated to rise in the coming years. This will create lucrative opportunities for market growth in the region.

Middle East and Africa Biological Skin Substitutes Market

The Middle East and Africa biological skin substitute market is experiencing significant growth, primarily driven by growing investments and increasing free-trade agreements with major countries, such as the U.S., Canada, Japan, & several European countries. Due to lower costs of medical treatments in the region, and availability of advanced treatment options at reasonable prices, medical tourism is anticipated to rise in the coming years. This will create lucrative opportunities for market growth in the region.

The biological skin substitute market in Saudi Arabia is growing due to growing geriatric population, increasing number of surgeries, and severe injuries in the region. Various unmet healthcare needs in low-income countries in the region increase the demand for better treatment options. Saudi Arabia is focusing on technological advancements such as the digitalization of the healthcare industry through AI, big data, cloud computing, and others. These advancements are resulting in shorter hospital stays and a rise in the number of surgical procedures, driving the demand for wound care supplies.

Key Biological Skin Substitute Company Insights

Key market players are focusing on research studies to bring innovative types of biological skin substitutes, growth strategies, and collaborations. For instance, MiMedx Group, Inc. c formed an agreement with TELA Bio, Inc. in March 2024 to acquire the rights to commercialize bovine-derived collagen matrix particulates for exudating wound management.

Key Biological Skin Substitute Companies:

The following are the leading companies in the biological skin substitute market. These companies collectively hold the largest market share and dictate industry trends.

- Organogenesis Inc.

- Integra LifeSciences Corporation

- Smith+Nephew

- Tissue Regenix

- MIMEDX Group, Inc.

- Essity Aktiebolag (publ))( Essity Health & Medical)

- Stryker

- Vericel Corporation

- 3M

- BioTissue

Recent Developments

- In October 2023, Tissue Regenix obtained authorization from the Irish Health Products Regulatory Authority (HPRA), which permitted it to set up a logistics hub in Ireland and distribute its allograft products in Europe, to facilitate market expansion.

- In May 2023, BioTissue entered in to a partnership with Dakota Lions Sight & Health to expand the birth tissue donation program in several hospitals and provide them an opportunity to donate placenta, which in turn increases the chances to develop and utilize placental derived dermal substitutes for regenerative treatments.

Biological Skin Substitute Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 376.90 million

Revenue forecast in 2030

USD 579.08 million

Growth rate

CAGR of 8.88% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2030

Report Coverage

Revenue, competitive landscape, growth factors, and trends

Segments Covered

Type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Organogenesis Inc.; Integra LifeSciences Corporation; Smith+Nephew; Tissue Regenix; MIMEDX Group, Inc.; Essity Aktiebolag (publ))( Essity Health & Medical); Stryker; Vericel Corporation; 3M; BioTissue

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biological Skin Substitute Market Report Segmentation

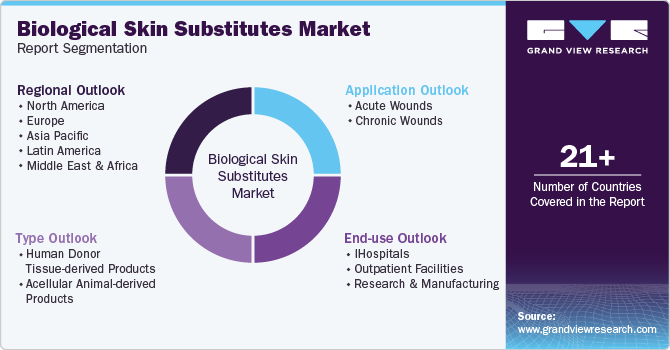

This report forecasts revenue growth at global, regional and country levels and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global biological skin substitute market report based on the type, application, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Human Donor Tissue-derived Products

-

Acellular Animal-derived Products

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Acute Wounds

-

Chronic Wounds

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

Research & Manufacturing

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global biological skin substitute market was valued at USD 347.57 million in 2024 and is expected to reach USD 376.90 million by 2025.

b. The global biological skin substitute market is estimated to grow at a compound annual growth rate (CAGR) of 8.88% from 2025 to 2030 to reach USD 579.08 million by 2030.

b. North America dominated the biological skin substitute market and accounted for the largest revenue share of 41.25% in 2024. This can be attributed to the highly developed healthcare infrastructure and increased allocation of funds for research and development.

b. Some key players operating in the biological skin substitutes market include Organogenesis Inc., Integra LifeSciences Corporation, Smith+Nephew, Tissue Regenix, MIMEDX Group, Inc., Essity Aktiebolag (publ))( Essity Health & Medical), Stryker, Vericel Corporation, 3M, BioTissue

b. The Increasing prevalence of chronic wounds and the rising number of burn & trauma cases are expected to drive the market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."