- Home

- »

- Advanced Interior Materials

- »

-

Biological Wastewater Treatment Market Size Report, 2030GVR Report cover

![Biological Wastewater Treatment Market Size, Share & Trends Report]()

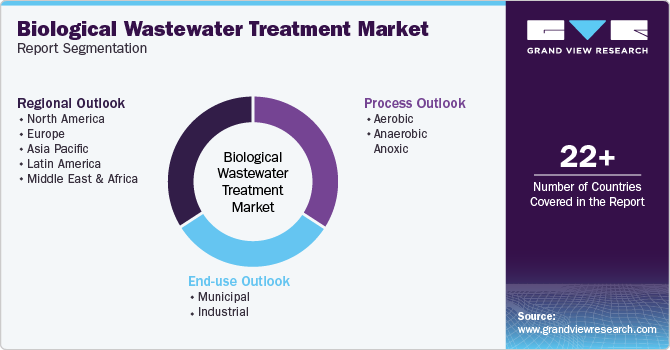

Biological Wastewater Treatment Market (2025 - 2030) Size, Share & Trends Analysis Report By Process (Aerobic, Anaerobic, Anoxic), By End-use (Municipal, Industrial), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68040-506-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Biological Wastewater Treatment Market Summary

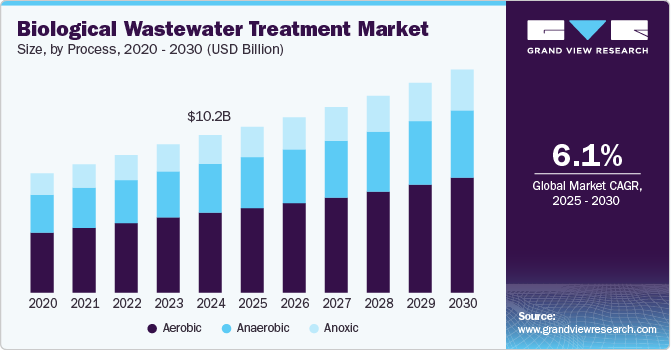

The global biological wastewater treatment market size was estimated at USD 10,224.1 million in 2024 and is projected to reach USD 14,480.5 million by 2030, growing at a CAGR of 6.1% from 2025 to 2030. The growth of the market is primarily driven by increasing urbanization and industrialization, which contribute to higher wastewater generation and create a need for more advanced treatment solutions to manage the escalating volumes effectively.

Key Market Trends & Insights

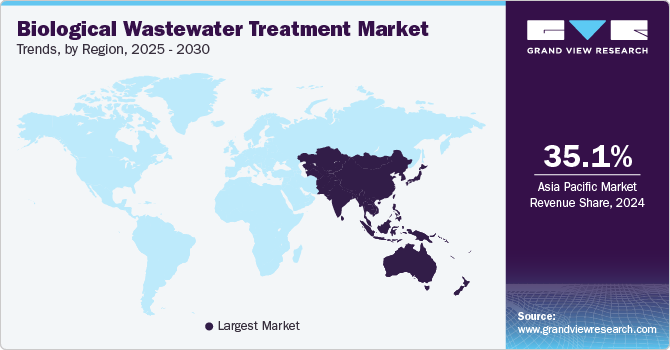

- The Asia Pacific dominated the market in 2024 with revenue share of 35.1% in 2024.

- Based on process, the aerobic segment dominated the market in 2024 by accounting for a share of 50.8%.

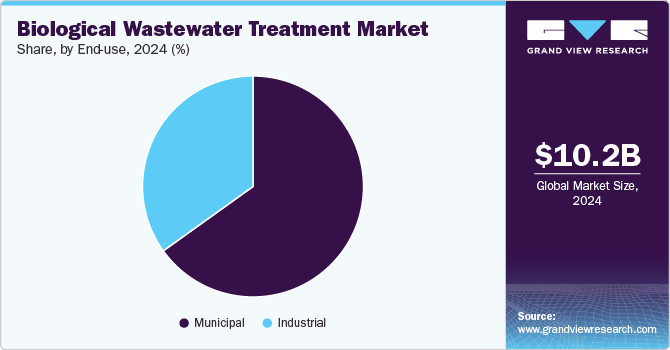

- Based on end-use, the municipal segment is witnessing substantial growth.

Market Size & Forecast

- 2024 Market Size: USD 10,224.1 Million

- 2030 Projected Market Size: USD 14,480.5 Million

- CAGR (2025-2030): 6.1%

- Asia Pacific: Largest market in 2024

Furthermore, the increasing awareness of water scarcity and the critical need for sustainable water management practices are major drivers of the market’s growth.

With freshwater resources becoming progressively scarce, the emphasis on recycling and reusing treated wastewater has intensified as a practical and sustainable solution. This shift is further supported by advancements in treatment technologies, making it easier to meet stringent quality standards for recycled water.

Market Concentration & Characteristics

The global biological wastewater treatment market remains moderately fragmented, with a combination of large multinational players and smaller regional firms competing for market share. Major companies in the industry focus on providing highly specialized and efficient biological treatment solutions, catering to the diverse needs of municipal, industrial, and commercial sectors. Innovations in the biological treatment market are focused on improving treatment efficiency, enhancing nutrient removal, and expanding the capacity for resource recovery, such as energy generation through biogas. These innovations create significant growth opportunities, when the global demand for sustainable water management practices increases.

Regulatory authorities, including the U.S. Environmental Protection Agency (EPA), the European Union (EU), and various national governments, enforce stringent guidelines and standards concerning water quality, emissions, and treatment processes. To align with these mandates, manufacturers in the biological wastewater treatment market are required to ensure their systems comply with the regulations, contributing to broader environmental sustainability objectives.

Regulations aimed at reducing chemical usage and promoting eco-friendly treatment methods are fostering innovation, prompting companies to invest in biologically driven technologies that minimize environmental impact. With growing concerns over water scarcity, pollution, and climate change, biological wastewater treatment is increasingly recognized as a vital solution to tackle these challenges while supporting the principles of a circular economy.

The competitive landscape is also influenced by the growing trend toward the integration of biological treatment systems with renewable energy solutions and other resource recovery methods. Companies are increasingly collaborating with renewable energy providers, using wastewater treatment facilities to generate biogas or heat, which offers new revenue streams and enhances system sustainability. Additionally, the increasing push for smart technologies is prompting manufacturers to develop treatment systems that offer real-time monitoring and automation capabilities, improving operational efficiency and ease of use. However, the market faces competition from alternative wastewater treatment technologies, including advanced filtration systems and chemical-based treatments. To stay competitive, companies must focus on continuous innovation, comply with evolving regulations, and align their offerings with the increasing demand for eco-friendly, energy-efficient, and cost-effective wastewater treatment solutions.

Drivers, Opportunities & Restraints

Governments across the world are implementing stricter environmental regulations and policies aimed at improving water quality and reducing pollution, further pushing the demand for wastewater treatment technologies. Moreover, technological advancements in the wastewater treatment processes, such as membrane filtration, advanced oxidation, and energy-efficient systems, are also making treatments more effective, affordable, and scalable, which encourages widespread adoption

The biological wastewater treatment market faces challenges related to the complexity of maintaining optimal microbial environments for effective treatment. Fluctuating wastewater quality, due to variations in industrial discharges or seasonal factors, can complicate treatment processes. Additionally, the high initial investment and maintenance costs associated with biological treatment systems, such as activated sludge systems or biofilters, can be a significant barrier for smaller municipalities or industries.

There is a growing opportunity to develop more efficient and cost-effective biological treatment methods, such as membrane bioreactors and integrated fixed-film activated sludge systems. With increasing regulatory pressure and the push for sustainability, biological wastewater treatment offers an opportunity for resource recovery, such as nutrient removal and biogas production, which can further enhance the value proposition for businesses seeking to reduce environmental footprints and lower operational costs.

Process Insights

The aerobic segment dominated the market in 2024 by accounting for a share of 50.8%. The demand for aerobic treatment processes is growing due to their efficiency in treating a wide range of organic pollutants. Aerobic systems, such as activated sludge and aerated lagoons, are favored for municipal and industrial applications due to their ability to achieve high treatment standards, including nutrient removal.

Anaerobic processes, often used for high-strength wastewater such as industrial effluents from food, beverage, and chemical sectors, are gaining popularity due to their ability to produce biogas as a byproduct, which can be used as a renewable energy source. The growing focus on resource recovery, energy generation, and sustainable practices is driving the demand for anaerobic systems.

End-use Insights

Many industrial applications are adopting biological treatment solutions because they offer an environmentally friendly alternative to chemical-based treatments, helping industries meet stricter environmental regulations while reducing their environmental footprint. The growing focus on sustainability, cost savings, and energy efficiency in industrial operations is leading to greater adoption of anaerobic and hybrid biological treatment systems.

The municipal segment is witnessing substantial growth, fueled by urbanization, population expansion, and the rising demand for safe and sustainable water management solutions. Municipalities are facing growing pressure to comply with increasingly stringent water quality regulations being implemented worldwide. As a result, there is a surge in investments for upgrading infrastructure, adopting advanced treatment technologies, and improving overall water management systems. This shift not only aims to ensure regulatory compliance but also to address concerns over water scarcity and environmental sustainability.

Regional Insights

North America biological wastewater treatment market is primarily driven by stringent environmental regulations and an increasing emphasis on water conservation and wastewater reuse. Both the U.S. and Canada are making significant investments to upgrade aging wastewater infrastructure, resulting in a growing demand for advanced biological treatment technologies.

U.S. Biological Wastewater Treatment Market Trends

In 2024, the U.S. accounted for 68.5% of the North America market share. The U.S. market growth is propelled by strict environmental regulations, such as the Clean Water Act, which require enhanced wastewater treatment processes. Additionally, investments in infrastructure modernization, growing concerns over water scarcity, and a strong focus on sustainability and energy-efficient solutions are further boosting demand.

Europe Biological Wastewater Treatment Market Trends

Europe stands out as one of the most advanced regions in terms of wastewater treatment standards, with a strong focus on sustainability and circular economy practices. The European Union’s rigorous wastewater treatment directives, such as the Urban Waste Water Treatment Directive, are driving substantial investments in biological treatment technologies to ensure compliance with these regulations.

Germany biological wastewater treatment market accounting for 17.4% of the total European revenue share in 2024. This growth is fueled by stringent environmental regulations and the country’s push to implement advanced wastewater treatment solutions in line with EU directives.

Biological wastewater treatment market in the UK is also experiencing growth, supported by stringent wastewater quality standards and a national commitment to reducing environmental impact. Urbanization, combined with the adoption of advanced biological treatment technologies to combat water pollution, is accelerating market demand.

Asia Pacific Biological Wastewater Treatment Market Trends

Asia Pacific dominated the market in 2024 with revenue share of 35.1% in 2024. Asia Pacific is experiencing rapid urbanization and industrialization, which are key factors propelling the growth of the biological wastewater treatment market. The region’s increasing population and expanding industrial activities are creating significant pressure to manage wastewater in an effective and sustainable manner. China and India, in particular, are making substantial investments in wastewater infrastructure to address pollution and improve public health.

China biological wastewater treatment market holds the largest market share in the region, accounting for 37.2% of the overall revenue share. The country’s rapid industrialization, urbanization, and growing pollution concerns drive the demand for biological wastewater treatment solutions.

Biological wastewater treatment market in India is projected to grow at a strong CAGR of 7.9% during the forecast period. India’s growth is driven by rapid industrial expansion, urbanization, and the urgent need to address water pollution. Stricter environmental regulations, coupled with an increasing demand for sustainable wastewater treatment solutions-particularly in agriculture and manufacturing-are key growth drivers.

Middle East & Africa Biological Wastewater Treatment Market Trends

The Middle East and Africa region is experiencing heightened demand for biological wastewater treatment solutions due to the urgent need for effective water management in water-scarce areas. Countries in the Middle East, such as Saudi Arabia and the UAE, are making significant investments in advanced water treatment technologies to secure water availability for both domestic consumption and industrial use.

Latin America Biological Wastewater Treatment Market Trends

In Latin America, the biological wastewater treatment market is growing due to rapid urbanization, industrial expansion, and rising awareness about the environmental consequences of untreated wastewater. Many countries in the region are grappling with water scarcity and are actively seeking sustainable wastewater management solutions. The implementation of more stringent environmental regulations, coupled with the need to improve water quality in both urban and rural areas, is driving the adoption of biological wastewater treatment technologies.

Key Biological Wastewater Treatment Company Insights

Some of the key players operating in the market include Xylem, Inc. and Veolia Environment SA among others.

-

Xylem, Inc is a global water technology company engaged in manufacturing, designing, and servicing of products that primarily cater to the water sector as well as the electric and gas sectors.The company operates in multiple regions, including North America, Latin America, Europe, the Middle East & Africa, and Asia Pacific, with North America and Europe being its key geographical markets.

-

Veolia Environnement S.A. is a multinational corporation engaged in providing comprehensive solutions for water, waste, and energy management. The company operates across three core business segments: water management, waste management, and energy management, offering integrated services to improve environmental sustainability across various industries worldwide.

Key Biological Wastewater Treatment Companies:

The following are the leading companies in the biological wastewater treatment market. These companies collectively hold the largest market share and dictate industry trends.

- Veolia Environment SA

- Xylem Inc.

- Aquatech International

- Ecolab Inc.

- Pentair plc

- Samco Technologies Inc.

- DAS Environment Expert GmbH

- Calgon Carbon Corporation

- Evoqua Water Technologies LLC

- Condorchem Envitech SL

- United Utilities Group plc

- Aqwise

- RF Wastewater

- Oxygen Solutions

- 3M

- Entex Technologies

- Envirocare

- Huber SE

- Bluewater Bio Limited

Recent Developments

-

In August 2024, Ilim Group announced it is nearing completion of the largest KLB Mill in Ust-Ilimsk, which will be the first in Russia's pulp and paper sector to implement a two-stage biological wastewater treatment system. This facility is set to produce 600,000 tons of kraftliner annually, contributing to Ilim's goal of reaching 4.6 million tons of finished products by 2025. The new facility will have a maximum capacity of 3,500 cubic meters per hour and will utilize advanced technologies, including the innovative MBBR radial bioreactor. This approach enhances the efficiency and reliability of wastewater treatment at the mill, marking a significant advancement for the Russian pulp and paper industry.

-

In August 2022, Veolia Water Technologies launched Ecosim, an ultra-compact biological wastewater treatment system designed for small to medium-sized facilities like hotels and remote communities. This innovative system utilizes a patented hybrid technology combining rotating biological contactor (RBC) and Moving Bed Biofilm Reactor (MBBR) methods, making it up to 300% more compact than its predecessor, Ecodisk.

Biological Wastewater Treatment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10,762.1 million

Revenue forecast in 2030

USD 14,480.5 million

Growth rate

CAGR of 6.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Process, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; India; Japan; Australia; South Korea; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

Veolia Environment SA; Xylem Inc.; Aquatech International; Ecolab Inc.; Pentair plc; Samco Technologies Inc.; DAS Environment Expert GmbH; Calgon Carbon Corporation; Evoqua Water Technologies LLC; Condorchem Envitech SL; United Utilities Group plc; Aqwise; RF Wastewater; Oxygen Solutions; 3M; Entex Technologies; Envirocare; Huber SE; Bluewater Bio Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biological Wastewater Treatment Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global biological wastewater treatment market based on process, end-use, and region:

-

Process Outlook (Revenue, USD Million, 2018 - 2030)

-

Aerobic

-

Anaerobic

-

Anoxic

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Municipal

-

Industrial

-

Manufacturing

-

Pharmaceuticals & Chemicals

-

Power & Energy

-

Pulp & Paper

-

Others

-

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global biological wastewater treatment market size was estimated at USD 10,224.1 million in 2024 and is expected to reach USD 10,762.1 million in 2025.

b. The biological wastewater treatment market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.1% from 2025 to 2030 to reach USD 14,480.5 million by 2030.

b. The municipal segment dominated the market in 2024, accounting for 65.1% of the market share. The need for efficient wastewater treatment systems to protect public health, improve water reuse, and address the rising volumes of wastewater in urban areas is pushing the adoption of biological treatment solutions. Additionally, the growing awareness of the benefits of wastewater recycling and resource recovery (such as energy generation and nutrient recycling) is spurring further investment in biological treatment technologies.

b. Some of the key players operating in the market are Veolia Environment SA, Xylem Inc., Aquatech International, Ecolab Inc., Pentair plc, Samco Technologies Inc., DAS Environment Expert GmbH, Calgon Carbon Corporation, Evoqua Water Technologies LLC, Condorchem Envitech SL, United Utilities Group plc, Aqwise, RF Wastewater, Oxygen Solutions, 3M, Entex Technologies, Envirocare, Huber SE, and Bluewater Bio Limited.

b. Key factors driving the biological wastewater treatment market include stringent environmental regulations and the increasing focus on sustainability, resource recovery, and energy efficiency in wastewater management. Additionally, the growing need for effective water treatment in both municipal and industrial sectors fuels market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.