- Home

- »

- Medical Devices

- »

-

Biopharmaceutical Third-party Logistics Market Report, 2030GVR Report cover

![Biopharmaceutical Third-party Logistics Market Size, Share & Trends Report]()

Biopharmaceutical Third-party Logistics Market (2025 - 2030) Size, Share & Trends Analysis Report By Supply Chain (Cold Chain Logistics, Non-cold Chain Logistics), By Service Type (Transportation, Warehousing & Storage), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-773-5

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Biopharmaceutical Third-party Logistics Market Summary

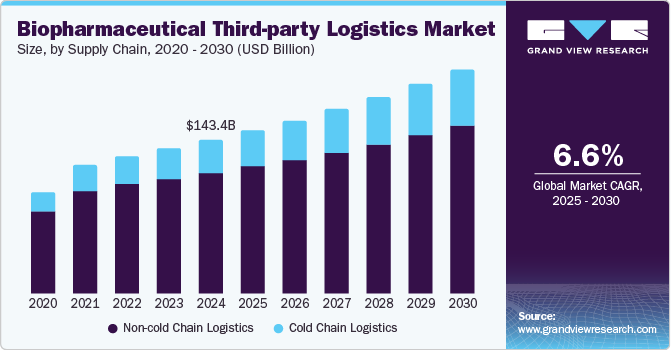

The global biopharmaceutical third-party logistics market size was valued at USD 143.4 billion in 2024 and is projected to grow at a CAGR of 6.58% from 2025 to 2030. The global biopharmaceutical third-party logistics industry presents significant growth opportunities, driven by expanding demand for temperature-sensitive products, technological advancements, and increasing globalization of healthcare.

Key Market Trends & Insights

- North America biopharmaceutical third-party logistics market dominated the global market in 2024 with the largest share of 42.53%.

- By supply chain, the non-cold chain logistics segment dominated the market, accounting for a revenue share of 78.47%.

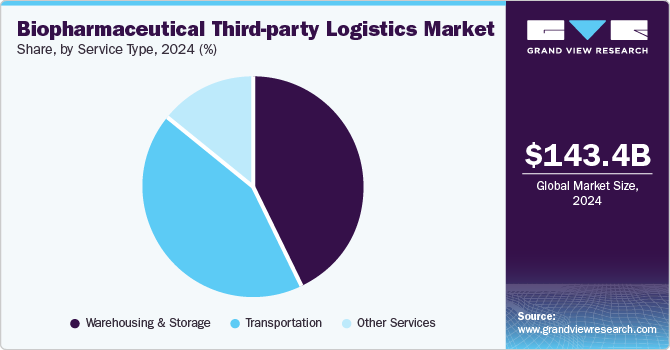

- By service type, the warehousing and storage segment dominated the market, accounting for a revenue share of 43.15%.

Market Size & Forecast

- 2024 Market Size: USD 143.4 Billion

- 2030 Projected Market Size: USD 209.0 Billion

- CAGR (2025-2030):6.58%

- North America: Largest market in 2024

There is an increasing reliance on 3PL providers to manage complex supply chains for biologics, vaccines, and other high-value drugs. As the biopharmaceutical industry continues to innovate, particularly with the rise of biologics and gene therapies, the need for specialized logistics services is increasing. These innovations require advanced cold-chain solutions and stringent regulatory compliance, creating ample opportunity for market growth.

Additionally, technological advancements are one of the major factors for the growth of biopharmaceutical third-party logistics services. Technologies like mobile cloud solutions, warehouse robotics, and data mining have changed the overall third-party logistics space. The adoption of digital technologies such as AI, IoT, and blockchain within the logistics sector also provides opportunities for 3PL providers to enhance transparency, security, and operational efficiency, positioning themselves as critical partners in the biopharmaceutical supply chain. With the help of these advanced technologies, third-party logistics companies can maintain the required temperatures for products during transportation. This will help in reducing complexities in products and human errors.

Most of the biopharmaceutical products are very temperature-sensitive and hence should be stored at required temperatures. These products require a tracking device for monitoring until delivery. Recently, the data logger has introduced InTemp CX400 series mobile app for its pharmaceutical cold chain monitoring products. With the help of this mobile app, users can view temperature data from CX400 loggers. This app contains an alarms system that sends a notification to the user if the temperature of the product is not maintained. These apps are now available on android devices.

Moreover, growing demand for temperature-sensitive products like vaccines, biologics, and blood plasma-based therapies will likely boost demand for cold chain logistics market growth. Biopharmaceuticals often require stringent temperature control across their supply chain from production to distribution to maintain product efficacy. For instance, several vaccines must be kept between 2°C - 8°C, while some biologics require storage at even lower temperatures, sometimes below -20°C. As 3PL providers increasingly invest in advanced temperature-monitoring technology such as IoT-enabled sensors, RFID tags, and data loggers, allowing real-time monitoring and rapid response to potential temperature excursions. Thus, the aforementioned factors position the biopharmaceutical 3PL market for sustained growth in the coming years.

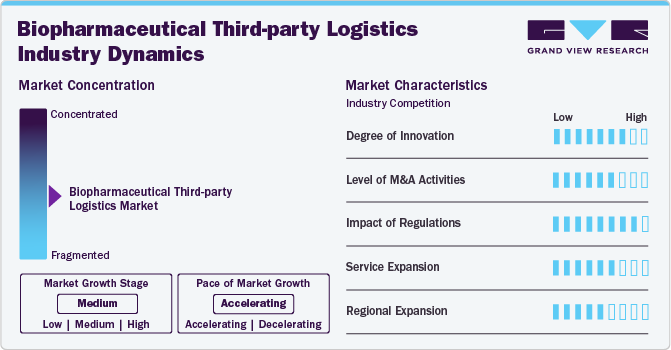

Market Concentration & Characteristics

The biopharmaceutical third-party logistics industry is expected to undergo significant innovation due to the advances in AI, IoT, and blockchain technologies. There is an increasing integration of data analytics and automation into the logistics workflow which has led to improved product visibility and cost reduction while ensuring safe and timely delivery of sensitive products.

There is a notable extent of merger and acquisition activities in the market. Key players are undertaking this strategy to enhance service offerings, improve supply chain efficiency, and meet growing demand for specialized, temperature-sensitive, and time-critical logistics solutions.

Regulations are playing a significant role in shaping the biopharmaceutical third-party logistics market. Regulatory frameworks such as GDP (Good Distribution Practice) and GMP (Good Manufacturing Practice) are driving investments in technology and infrastructure to ensure compliance in the supply chain activities.

Companies involved in the market are undertaking service expansion strategy to widen their portfolio and strengthen market position. The strategy is enabling key players to increase their geographic reach and enhance end-to-end visibility which aids in catering to the growing demand for high-value pharmaceutical shipments.

The industry is undergoing a moderate level of regional expansion due to an expanding customer base in the emerging markets of the Asia Pacific, Latin America, and Middle East and Africa regions. As the biopharmaceutical industry in these regions is expected to expand at a lucrative pace in the coming years, key players are anticipated to adopt the regional expansion strategy to meet the growing demand for third-party logistics services.

Supply Chain Insights

Based on supply chain, the market is segregated into cold chain logistics, and non-cold chain logistics. In 2024, the non-cold chain logistics segment dominated the market, accounting for a revenue share of 78.47%. The high segment growth can be attributed to the surge in biopharmaceutical distribution channels, the need for cost-effective, scalable logistics solutions, and the increase in non-temperature-sensitive biopharmaceutical products handled through 3PL providers. These logistics solutions offer key advantages such as reduced operational costs, broader scalability, and enhanced visibility across the supply chain. With biopharmaceutical companies diversifying their distribution networks, non-cold chain logistics has become essential to handling an expanding array of Stock-Keeping Units (SKUs) that do not require a temperature-controlled environment

The cold chain logistics segment is expected to register a CAGR of 9.40% during the forecast period. The growth is due to rising demand for temperature-sensitive products such as vaccines and blood plasma-related therapies. This segment offers precise temperature control throughout the supply chain from production and storage to transport and delivery and protects drug efficacy and potency. An increase in the adoption of cold chain logistics in both emerging and developed markets is key to supporting the global distribution of vaccines, which, according to estimates, comprise 35-40% of the cold chain logistics market. Such factors are anticipated to drive the segment.

Service Type Insights

Based on Service Type, the market includes transportation, warehousing and storage, and others. Transportation segment is further segmented to air freight, sea freight, and overland. In 2024, the warehousing and storage segment dominated the market, accounting for a revenue share of 43.15%. This growth can be attributed to factors such as increasing need for secure, compliant storage facilities for temperature-sensitive drugs, biologics, and vaccines primarily drives the segment growth. Moreover, Warehousing facilities with specialized cold storage capabilities are essential for preserving the quality and efficacy of drugs that must remain within strict temperature ranges, a key condition for regulatory compliance in markets like North America and Europe.

The transportation segment is anticipated to register a CAGR of 6.63% during the forecast period. The segment is driven by increasing demand for efficient and specialized logistics solutions across biopharmaceutical supply chains. This segment is significant in maintaining the integrity and timely delivery of high-value products, from temperature-sensitive biologics to high-demand generics. Moreover, the growing demand for thorough tracking capabilities to ensure adherence to strict regulatory standards, especially in handling-controlled substances and biologics, is expected to drive segmental growth. Such factors are anticipated to drive the segment growth over the estimated time period.

Regional Insights

North America biopharmaceutical third-party logistics market dominated the global market in 2024 with the largest share of 42.53%. This can be attributed to the growing demand for biologics and pharmaceutical drugs, emerging investments in research and development for new drugs, and increasing focus on cold chain logistics. In addition, the presence of established market players and an increasing number of clinical trials are anticipated to drive market growth. Furthermore, third-party logistics play a significant role in therapies that combat complex diseases and ideally require the management of varying temperature profiles and stability changes throughout different stages of the logistics lifecycle. Moreover, well-planned regulatory, funding policies and developed healthcare infrastructure are some of the major factors supporting the region’s growth

U.S. Biopharmaceutical Third-party Logistics Market Trends

The U.S. accounts for the highest share of the North America biopharmaceutical third-party logistics market owing to the presence of several biopharmaceutical companies and logistics firms in the country. Besides, the demand for biopharmaceutical third-party logistics is growing in the U.S. due to the increasing sales of generic drugs, biologics, vaccines, and other drugs, as well as healthcare sector reforms favoring generics. Moreover, a robust cold chain transportation system (e.g., between 2°C to 8°C & ultra-low temperatures as low as -70°C) and the biopharmaceutical sector characterized by a well-developed R&D infrastructure, stringent regulatory system, and rising investments in novel drug discovery & development are expected to drive the market.

The biopharmaceutical third-party logistics industry in Canada is driven by owing to the high potential for R&D activities. Additionally, third-party logistics certainly support understanding the complex requirements of specialty and biopharma products, further mitigating risks, streamlining processes, and maximizing the success of therapies' commercialization. Such factors are expected to drive the country’s growth. For instance, in November 2023, Innomar Strategies announced the opening of a third-party logistics center in Canada. The company's 92,000-sq-ft, GMP-compliant facility will enable its offering of logistics storage, including quality assurance & importation services.

Europe Biopharmaceutical Third-party Logistics Market Trends

Europe biopharmaceutical third-party logistics industry is driven by growing advancements in technology, increasing number of clinical trials, and presence of key players offering third-party logistics. Additionally, the market is driven by the presence of well-established biopharmaceutical companies, growing prevalence of diseases, increasing biologics & vaccine supply, growing innovation of new drugs, and the expansion of new facilities.

The Germany biopharmaceutical third-party logistics industry accounts for the highest share of the Europe market, owing to technological advancements, enhanced clinical team expertise, increased demand for vaccines, biologics & other biopharmaceutical drugs, and low labor costs support the demand for third-party logistics & have increased competitiveness in the global market.

The biopharmaceutical third-party logistics market in the UK is driven by the increasing trend of outsourcing among biopharmaceutical companies, increasing supply chain requirements for biopharmaceutical products supply, growing R&D initiatives, excellent drug innovation, and a rising number of clinical trials being undertaken to address the challenges posed by various diseases.

Asia Pacific Biopharmaceutical Third-party Logistics Market Trends

Asia Pacific is expected to grow at a CAGR of 7.60% during the forecast period owing to the changing market dynamics, the prevalence of chronic diseases, rising healthcare expenditure, an increasing number of outsourcing projects, growing research and development activities, and technological advancements. Besides, high-quality biopharmaceutical drug commercialization is getting complex with the changing regulatory dynamics and supply chain volatility, which has led to rise in requirement for third-party logistics to address evolving needs such as storage and advanced logistics facilities.

The demand in Japan's biopharmaceutical third-party logistics industry is steadily increasing, driven by significant progress in drug development, increased pipeline drug candidates, cost-effectiveness, and a proactive approach to competitive manufacturing techniques.

The biopharmaceutical third-party logistics industry in China is driven by a growing number of clinical trials, increasing demand for temperature-controlled logistics, increasing focus on quality assurance, growing establishment of specialized cold storage facilities and distribution centers, and growing transportation networks equipped with advanced temperature monitoring and control systems. Such factors are anticipated to drive the market.

The India biopharmaceutical third-party logistics market is expected to grow during the forecast period. Increasing investment by biopharmaceutical third-party logistics companies in the country and logistic advantages drives the market growth. For instance, in August 2023, SPARX Logistics mentioned its two new offices in Mumbai and Ahmedabad. This expansion will strengthen the company's footprint and reinforce the company's international network, which spans over 60 offices in nearly 25 countries. Such factors are expected to drive the market growth.

Key Biopharmaceutical Third-party Logistics Company Insights

The market players operating across the biopharmaceutical third-party logistics are seeking to enhance their customer base, production capacities, and market presence with the adoption of in-organic strategic initiatives such as service launches, partnerships & agreements, expansions, mergers & acquisitions, and others to increase market presence & revenue and gain a competitive edge drives the market growth. Hence, growing strategic initiatives are expected to boost the market share of prominent players operating across the market. For instance, in January 2024, Alcami Corporation announced the opening of a 65,000 ft² pharma storage and services facility in North Carolina. The new facility will offer ambient/controlled room temperature storage services, adding to the GMP storage facilities network in North America.

Key Biopharmaceutical Third-party Logistics Companies:

The following are the leading companies in the biopharmaceutical third-party logistics market. These companies collectively hold the largest market share and dictate industry trends.

- DHL International GmbH

- SF Express

- FedEx

- United Parcel Service of America, Inc.

- Cencora, Inc

- DB Schenker

- Kuehne and Nagel

- Kerry Logistics Network Limited

- Agility Public Warehousing Company K.S.C.P.

Recent Developments

-

In October 2024, United Parcel Service of America, Inc. company launched its cross-docking facility in India for healthcare. It has global freight forwarding capabilities & can hold/sort 7 pallets (+2 to +8°C), 15 pallets (+15°C to +25°C), and 50 pallets under uncontrolled ambient conditions.

-

In February 2024, FedEx mentioned its FedEx Life Science Center in India, supporting the clinical trial logistics & storage requirements of healthcare customers in Indian market & those shipping to India from across the globe.

-

In August 2023, FedEx Express and, one of the express transportation companies, mentioned its collaborations with the Gyeongsangbuk-do provincial government to support businesses, such as SMEs who are looking to expand their presence into biopharmaceuticals, semiconductors, automobile manufacturing and wireless communication devices market.

Biopharmaceutical Third-party Logistics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 152.0 billion

Revenue forecast in 2030

USD 209.0 billion

Growth rate

CAGR of 6.58% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Supply chain, service type, region

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

DHL International GmbH; SF Express; FedEx; United Parcel Service of America, Inc.; Cencora, Inc.; DB Schenker; Kuehne and Nagel; Kerry Logistics Network Limited; Agility Public Warehousing Company K.S.C.P.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

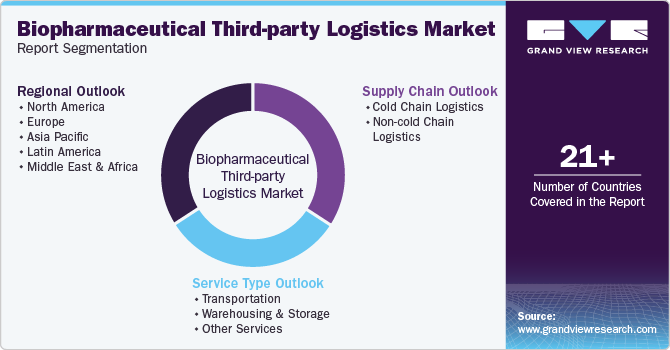

Global Biopharmaceutical Third-party Logistics Market Report Segmentation

This report forecasts revenue growth at the regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the biopharmaceutical third-party logistics market report based on supply chain, service type, and region:

-

Supply Chain Outlook (Revenue, USD Million, 2018 - 2030)

-

Cold Chain Logistics

-

Non-cold Chain Logistics

-

-

Service Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Transportation

-

Air Freight

-

Sea Freight

-

Overland

-

-

Warehousing and Storage

-

Other Services

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global biopharmaceutical third-party logistics market size was estimated at USD 143.4 billion in 2024 and is expected to reach USD 152.0 billion in 2025.

b. The global biopharmaceutical third-party logistics market is expected to grow at a compound annual growth rate of 6.58% from 2025 to 2030 to reach USD 209.0 billion by 2030.

b. North America dominated the biopharmaceutical third-party logistics market with a share of 42.53% in 2024. This can be attributed to the growing demand for biologics and pharmaceutical drugs, emerging investments in research and development for new drugs, and increasing focus on cold chain logistics. Besides, rising demand for temperature-controlled logistic services to transport biologics in various regions is expected to drive the market

b. Some key players operating in the biopharmaceutical third-party logistics market include DHL International GmbH, SF Express, FedEx, United Parcel Service of America, Inc., Cencora, Inc, DB Schenker, Kuehne and Nagel, Kerry Logistics Network Limited, and Agility Public Warehousing Company K.S.C.P. among others

b. Key factors driving the biopharmaceutical third-party logistics market growth include growing technological advancements in logistics and increasing distribution networks of biopharmaceutical companies to improve their sales. In addition, the rising adoption of automated storage and retrieval systems in emerging countries, rising demand for cold chain logistics, and the trend of shifting from small molecule drugs to biopharmaceuticals, mainly vaccines and biologics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.