- Home

- »

- Plastics, Polymers & Resins

- »

-

Blow Molded Plastics Market Size And Share Report, 2030GVR Report cover

![Blow Molded Plastics Market Size, Share & Trends Report]()

Blow Molded Plastics Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Extrusion, Injection, Stretch, Compound), By Product (Polypropylene, Polyethylene, Polystyrene), By Application (Packaging, Medical), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-574-8

- Number of Report Pages: 164

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Blow Molded Plastics Market Summary

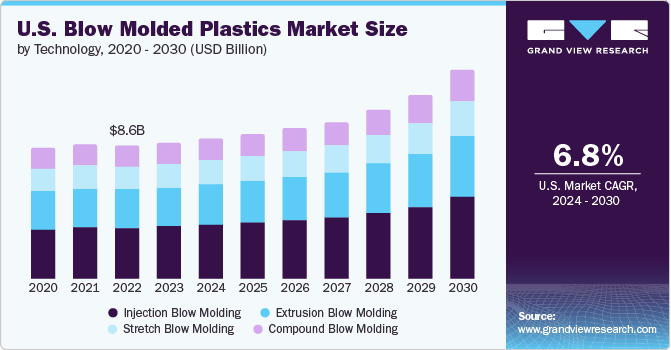

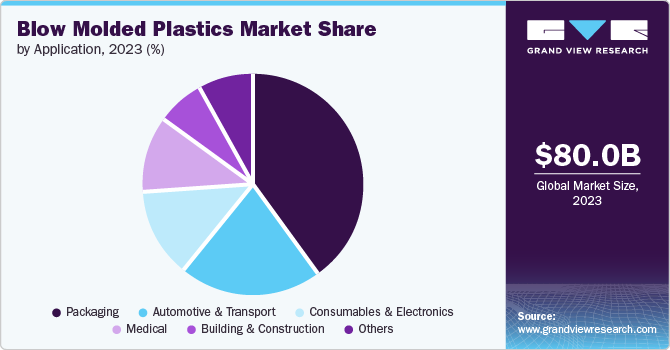

The global blow molded plastics market size was estimated at USD 80,039.7 million in 2023 and is projected to reach USD 121,815.7 million by 2030, growing at a CAGR of 6.2% from 2024 to 2030. The market growth is driven by trends shifting towards replacing glass & metal and increasing investments in the construction industry.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- Country-wise, China is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, injection blow molding accounted for a revenue of USD 28,841.0 million in 2023.

- Injection blow molding is the most lucrative technology segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 80,039.7 million

- 2030 Projected Market Size: USD 121,815.7 million

- CAGR (2024-2030): 6.2%

- Asia Pacific: Largest market in 2023

Blow-molded plastics are widely used for different applications, such as concrete forms of all shapes and sizes, panels, barricades, and traffic markers in the building & construction industry. Industries, such as construction, packaging, and automotive, are the primary industries propelling the demand for blow-molded plastic products and services.

Blow-molded plastics are materials shaped using a manufacturing process called blow molding, where heated plastic is inflated inside a mold to form hollow objects. This method is widely used to create products like bottles, containers, automotive parts, and toys. The process involves melting plastic, injecting it into a mold, and then blowing air into it to expand and take the shape of the mold. Blow-molded plastics are valued for their lightweight, durability, and cost-effectiveness, making them popular in the packaging, automotive, and consumer goods industries.

The growing per capita income around the world is driving the demand for consumer goods packaged using blow-molded plastics, thus promoting the market. According to the World Bank, the Gross National Income (GNI) in 2022 of the U.S. was 77,950 purchasing power parity (PPP) dollars, the UK was 55,210 PPP dollars, and China was 21,250 PPP dollars.

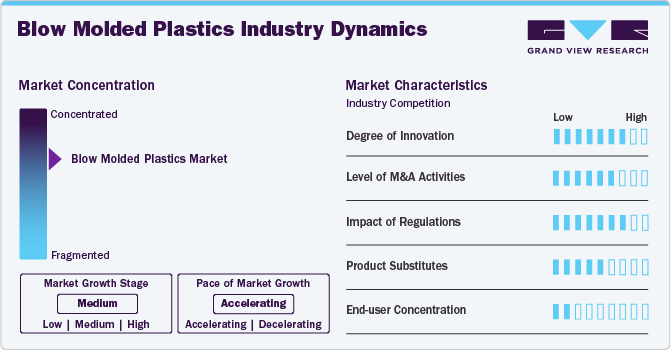

Market Concentration & Characteristics

The blow molded plastics market is moderately consolidated with the presence of key industry players, such as Magna International Inc.; INTERNATIONAL AUTOMOTIVE COMPONENT GROUP S.L.; Berry Global Inc.; Pet All Manufacturing, Inc.; Inpress Plastics Ltd.; Dow Inc.; Comar, LLC; Rutland Plastics Ltd.; The Plastic Forming Company, Inc. These companies often engage in aggressive marketing strategies, R&D initiatives, and M&As to strengthen their market position and expand their product offerings.

The blow-molded plastics market is characterized by a high degree of innovation, driven by the need for more efficient, durable, and sustainable solutions. Companies constantly develop new materials and improve blow molding techniques to enhance product performance and meet diverse industry demands. Innovations include the creation of lightweight yet strong plastic formulations, integration of biodegradable & recyclable materials, and advancements in multi-layer blow molding technology for better barrier properties. This continuous innovation helps manufacturers comply with environmental regulations and offers high-quality, cost-effective products tailored to specific applications in sectors such as automotive, packaging, and construction.

Regulations significantly impact the market, shaping production practices, product designs, and material choices. Environmental regulations, such as those from the U.S. Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA) in the EU, aim to reduce plastic waste and promote recycling, driving manufacturers to develop more sustainable and eco-friendly products. Compliance with these regulations often requires companies to invest in advanced technologies and innovative materials that are recyclable or biodegradable. In addition, health and safety standards set by bodies like the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA) mandate the use of non-toxic materials and processes, particularly for applications in food packaging and healthcare.

Technology Insights

The injection blow molding technology segment accounted for a share of 36.0% in 2023. The cost of an extrusion blow mold is lower than that of an injection blow mold due to the former's lower pressure requirement. The machinery costs are also lower for an extrusion blow mold, which is an added advantage for the process.

Stretch blow molding technology is used for producing high-clarity and high-quality bottles but has limited use in the industry. It is applied for the manufacturing of soda bottles, personal care containers, and household cleaner containers, among others. Stretch blow-molded plastics are produced mainly on customized orders from customers.

Product Insights

The Polyethylene (PE) segment held the largest market share of 16.3% in 2023. PE compounds are commonly used in the packaging and electrical & electronics industries. Major packaging applications of PE compounds include different grades of bottles used for packaging a wide range of products, such as food and chemical products.

Polyethylene Terephthalate (PET) has several applications in the packaging industry, including the manufacture of bottles intended for the packaging of food & beverage products. In this global COVID-19 pandemic situation, the demand for polypropylene and polyethylene terephthalate is expected to grow due to rising demand for face masks, protective gowns, and packaging bottles for hand sanitizers.

Application Insights

Packaging emerged as the leading application segment in terms of revenue share in 2023. The packaging industry is majorly driven by high consumerism in emerging economies. The growth of the packaging industry will likely boost the demand for plastic compounds such as polyethylene and PET in the coming years.

The automotive & transport segment is poised to witness a substantial CAGR over the forecast period. This can be attributed to the industry’s rising need for lightweight materials that can improve fuel efficiency and reduce vehicle emissions. Blow-molded plastics offer a compelling alternative to traditional materials like metal due to their ability to achieve complex shapes, reduce vehicle weight, and enhance design flexibility. Additionally, these plastics provide excellent durability, impact resistance, and corrosion resistance, making them ideal for manufacturing components such as fuel tanks, air ducts, bumpers, and interior trim.

Regional Insights

The blow-molded plastics market in North America held a revenue share of 26.1% in 2023. The growing geriatric population in the region, coupled with well-established healthcare infrastructure, is expected to drive the market. These plastics are commonly used to manufacture medical devices such as containers for storing and dispensing medications, disposable medical instruments, surgical trays, and components for medical equipment.

U.S. Blow Molded Plastics Market Trends

The U.S. blow molded plastics market led the North America regional market with a revenue share of 42.0% in 2023. The demand for blow-molded plastics across the U.S. is majorly generated by the expanding automotive industry on account of the popularity of electric vehicles (EVs) and a rise in the number of construction activities. The U.S. has witnessed a huge growth in construction projects in recent years.

Blow molded plastics market in canada is experiencing significant growth and is expected to keep pace over the forecast period. The resource and industrial sectors in the country play a crucial role in driving the demand for blow-molded plastics, especially in applications within the mining, oil and gas, and forestry industries. These sectors require durable, corrosion-resistant materials to withstand harsh environmental conditions and rigorous operational demands. Blow-molded plastics provide essential solutions for manufacturing components, such as storage tanks, piping systems, and equipment enclosures, ensuring reliability and longevity in challenging settings.

Europe Blow Molded Plastics Trends

The Europe molded plastics marketis anticipated to grow at a moderate pace during the forecast period due to the growing automobile and construction industries. Blow-molded plastics play a crucial role in construction projects for infrastructure development, including pipes, panels, and insulation materials, supported by technological advancements and sustainability initiatives.

The blow molded plastics market in germany led the Europe regional market in 2023. The market benefits from the strong automotive industry, which drives steady growth and technological advancements in blow-molded plastic products.

UK blow molded plastics market is anticipated to grow at a significant rate over the forecast period. There is a strong emphasis on innovative packaging solutions in the UK, which is driving the adoption of blow-molded plastics in various sectors, such as food and beverage packaging, pharmaceuticals, and personal care products.

Asia Pacific Blow Molded Plastics Trends

The Blow Molded Plastics Market in Asia Pacific was the leading regional market in 2023. Increasing infrastructure spending, coupled with growing automobile demand in countries, such as China, India, Indonesia, and Malaysia, drive the product demand in the region.

China blow molded plastics market dominated the Asia Pacific region in terms of revenue and is expected to keep its dominance over the forecast period, owing to the growing consumer goods industry and its exports. The low cost of labor and the presence of large manufacturing industries are driving the product demand in the country.

The blow molded plastics market in india is expected to grow at a significant CAGR from 2024 to 2030 due to government initiatives, such as “Made in India”, which are empowering local industries to manufacture goods instead of importing. Furthermore, the emerging e-commerce industry is driving the demand for consumer goods, thus promoting the blow-molded plastics market.

Central & South America Blow Molded Plastics Trends

The Central and South America blow molded plastics market growth is driven by rapid industrial expansion across key sectors like mining, agriculture, and manufacturing. These industries rely on durable and cost-effective plastic components for equipment and infrastructure, enhancing operational efficiency and protecting valuable assets from harsh environmental conditions. In addition, increasing investments in infrastructure projects, such as transportation networks and utilities, further propel the market for blow-molded plastics in construction applications.

Middle East & Africa Blow Molded Plastics Trends

The blow-molded plastics market in Middle East and Africa is driven by the region's booming construction sector and its prominent oil and gas industry. For instance, in construction projects, such as the ongoing expansion of transport networks and urban development initiatives in cities like Dubai and Riyadh, blow-molded plastics are indispensable for applications ranging from water management systems to building materials and infrastructure components.

Key Blow Molded Plastics Company Insights

Key companies are adopting several organic and inorganic expansion strategies, such as mergers & acquisitions, new product launches, capacity expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In January, Container Services Inc (CSI), a blow molding company, announced the acquisition of Apex Plastics, a manufacturer of custom single-stage polyethylene terephthalate (PET) and extruded high-density polyethylene (HDPE) packaging solutions. Additionally, CSI launched FirmaPak, a new platform that brings together customer-focused blow molders under one umbrella.

-

In February 2023, Shore Capital Partners, a private equity firm, partnered with Container Services, Inc. (CSI), a custom blow molding company of rigid plastic containers. CSI specializes in producing PET and HDPE blow-molded plastic containers and works with post-consumer recycled plastic resins. Shore Capital intends to utilize CSI's strong team and manufacturing capabilities through this partnership by investing in the company's business development, sales, marketing, and operational infrastructure to drive transformational growth. The firms will also explore opportunities for inorganic growth by acquiring other rigid plastic container manufacturers.

Key Blow Molded Plastics Companies:

The following are the leading companies in the blow molded plastics market. These companies collectively hold the largest market share and dictate industry trends.

- Magna International, Inc.

- INTERNATIONAL AUTOMOTIVE COMPONENTS GROUP, S.L. (IAC Group)

- Berry Global, Inc.

- Pet All Manufacturing, Inc.

- Inpress Plastics Ltd.

- Dow, Inc.

- Comar, LLC

- Rutland Plastics Ltd.

- The Plastic Forming Company, Inc.

- Agri-Industrial Plastics

- Garrtech Inc.

- Creative Blow Mold Tooling

- North American Plastics, Ltd.

- Machinery Center, Inc.

- Custom-Pak, Inc.

- APEX Plastics

- INEOS Group

- LyondellBasell Industries Holdings B.V.

- Exxon Mobil Corporation

- Gemini Group, Inc.

Blow Molded Plastics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 81.13 billion

Revenue forecast in 2030

USD 121.82 billion

Growth rate

CAGR of 7.0% from 2024 to 2030

Base Year

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Technology, product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France, Italy; China; India; Japan; Brazil; Argentina; GCC Countries; and South Africa

Key companies profiled

Magna International Inc.; INTERNATIONAL AUTOMOTIVE COMPONENT GROUP S.L.; Berry Global Inc.; Pet All Manufacturing, Inc.; Inpress Plastics Ltd.; Dow Inc.; Comar, LLC; Rutland Plastics Ltd.; The Plastic Forming Company, Inc.; Agri-Industrial Plastics; Garrtech, Inc.; Creative Blow Mold Tooling; North American Plastics, Ltd.; Machinery Center, Inc.; Custom-Pak Inc.; APEX Plastics; INEOS Group; LyondellBasell Industries Holdings B.V.; Exxon Mobil Corporation; and Gemini Group, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Blow Molded Plastics Market Report Segmentation

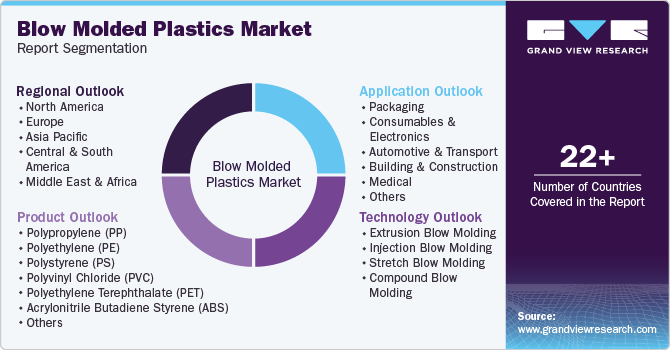

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the blow molded plastics market report based on technology, product, application, and region:

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Extrusion Blow Molding

-

Injection Blow Molding

-

Stretch Blow Molding

-

Compound Blow Molding

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polypropylene (PP)

-

Acrylonitrile Butadiene Styrene (ABS)

-

Polyethylene (PE)

-

Polystyrene (PS)

-

Polyvinyl Chloride (PVC)

-

Polyethylene Terephthalate (PET)

-

Polyamide (PA)

-

Polyamide 6

-

Polyamide 66

-

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Consumables & Electronics

-

Automotive & Transport

-

Building & Construction

-

Medical

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

GCC Countries

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the blow molded plastics market growth include shift in trends towards a replacement of glass & metal and growing construction spending in an emerging market.

b. The global blow molded plastics market size was estimated at USD 80.04 billion in 2023 and is expected to reach USD 81.13 billion in 2024.

b. The global blow molded plastics market is expected to grow at a compound annual growth rate of 7.0% from 2024 to 2030 to reach USD 121.81 billion by 2030.

b. The polyethylene segment dominated the blow molded plastics market with a share of 16.3% in 2023. This is attributed to the rising demand from packaging, automotive, and electrical & electronics application.

b. Some key players operating in the blow molded plastics market include Magna International Inc., IAC Group, Berry Global Inc., Pet All Manufacturing Inc., Inpress Plastics Ltd, Comar, LLC, Rutland Plastics Ltd, The Plastic Forming Company, Inc., and Agri – Industrial Plastics Company.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.