- Home

- »

- Advanced Interior Materials

- »

-

Bonded Abrasives Market Size, Share, Industry Report, 2030GVR Report cover

![Bonded Abrasives Market Size, Share & Trends Report]()

Bonded Abrasives Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (Grinding Wheels, Cutting Wheels, Polishing Wheels), By End-use (Automotive, Aerospace, Metalworking), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-546-0

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Bonded Abrasives Market Size & Trends

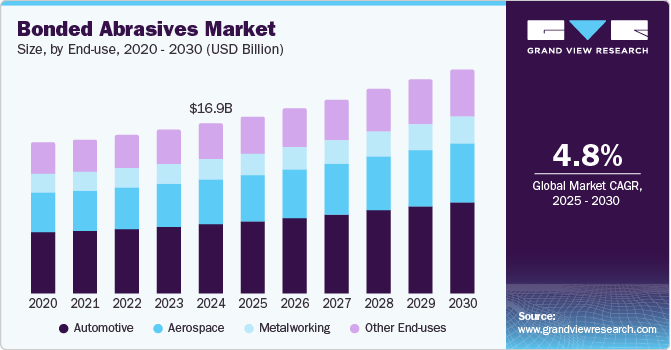

The global bonded abrasives market size was estimated at USD 16.9 billion in 2024 and is expected to grow at a CAGR of 4.8% from 2025 to 2030. The growing demand from the metal fabrication and automotive industries is a significant driver of the global bonded abrasives industry. In the metal fabrication sector, bonded abrasives are widely used for cutting, grinding, and polishing applications, which are essential for manufacturing and maintenance operations. Similarly, in the automotive industry, the increasing production of vehicles and the rising demand for precision components have propelled the need for efficient abrasive solutions. The expansion of these industries, particularly in emerging economies, is further fueling market growth.

The rising demand for bonded abrasives in the construction and aerospace sectors also contributes to market growth. In construction, bonded abrasives are essential for surface preparation, polishing, and material shaping, driven by increasing infrastructure projects worldwide. Meanwhile, in the aerospace industry, the stringent quality standards for aircraft components necessitate high-precision grinding and finishing, boosting the demand for advanced bonded abrasive solutions.

Additionally, the development of eco-friendly and high-performance abrasives is playing a crucial role in market expansion. With growing environmental concerns and strict regulations on hazardous waste disposal, manufacturers are focusing on producing sustainable abrasives that offer high efficiency while reducing environmental impact. The shift towards ceramic and super abrasives, such as cubic boron nitride (CBN) and diamond abrasives, is gaining traction due to their superior durability and cutting capabilities, further driving market demand.

Another key driver is the advancement in manufacturing technologies and increasing automation in industrial processes. The integration of bonded abrasives in automated machinery enhances operational efficiency and precision in grinding and finishing applications. The adoption of computer numerical control machines and robotics in manufacturing processes has increased the use of high-performance bonded abrasives, improving productivity and reducing labor dependency.

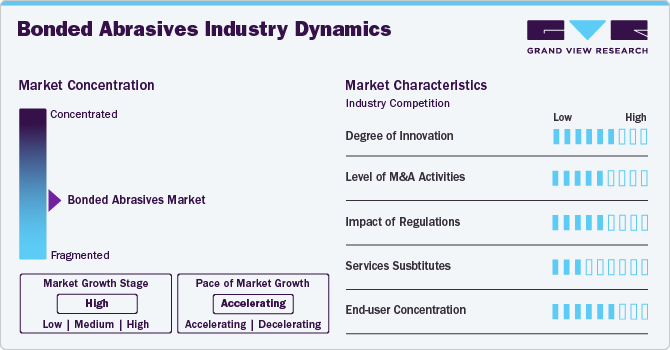

Market Concentration & Characteristics

The global bonded abrasives market is characterized by a moderate to high level of market concentration, with a few dominant players such as 3M, Saint-Gobain, and Tyrolit holding significant shares. The degree of innovation in this market is relatively high, driven by advancements in material science, automation, and precision engineering. Manufacturers are focusing on the development of super abrasives like cubic boron nitride (CBN) and diamond abrasives to enhance cutting efficiency and durability. Furthermore, mergers, acquisitions, and strategic collaborations are prevalent, as companies seek to expand their geographic footprint and technological capabilities. Such activities are particularly evident in sectors like automotive, aerospace, and metal fabrication, where advanced bonded abrasives play a critical role in manufacturing and finishing processes.

Regulatory frameworks significantly influence the bonded abrasives industry, with stringent environmental and worker safety regulations shaping production methods. Regulations from agencies like OSHA (Occupational Safety and Health Administration) and REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) in the EU drive manufacturers toward safer, eco-friendly abrasives with reduced silica content and lower emissions. The market faces limited service substitutes, as bonded abrasives are essential in precision grinding and cutting applications; however, competition exists from coated abrasives and non-woven abrasives in certain finishing processes. End user concentration is notably high in industries like metalworking, construction, and electronics, with demand patterns aligning with trends in industrial automation and infrastructure development.

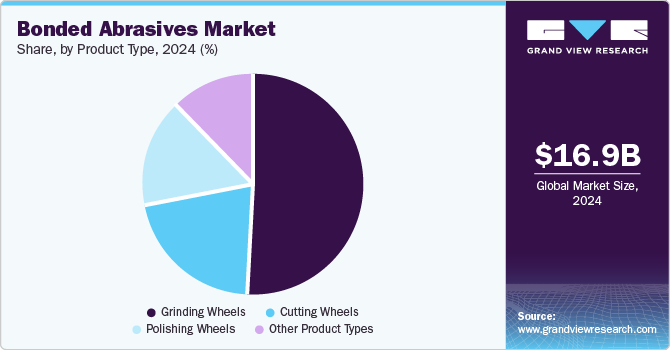

Product Type Insights

The grinding wheels segment led the market and accounted for the largest revenue share of 51.27% in 2024, driven by increasing demand across various industries such as automotive, aerospace, metal fabrication, and construction. A key driver for this segment is the rising adoption of precision grinding in manufacturing to achieve high-performance surface finishing and tight tolerances. As industries shift toward automation and Industry 4.0, the demand for high-efficiency, durable grinding wheels has surged. Additionally, advancements in super abrasives, such as diamond and cubic boron nitride (CBN) grinding wheels, have enhanced cutting speed, longevity, and performance, making them indispensable in high-precision applications.

The polishing wheels segment is expected to significantly at CAGR of 5.1% over the forecast period, driven by increasing demand across industries such as automotive, aerospace, metal fabrication, and electronics. One of the primary drivers is the growing emphasis on precision finishing and surface quality, particularly in the manufacturing sector, where high-performance abrasives are essential for achieving smooth, defect-free surfaces. Additionally, the rise in automation and advanced machining technologies has fueled the adoption of bonded polishing wheels, as they enhance efficiency, consistency, and cost-effectiveness in industrial applications.

End Use Insights

The automotive segment dominated the market and accounted for the largest revenue share of 40.87% in 2024, owing to the increasing demand for precision machining and high-performance finishing applications. The growth of the automotive industry, particularly in emerging economies, has led to a surge in vehicle production, directly influencing the demand for bonded abrasives in grinding, cutting, and surface finishing processes. The rising adoption of electric vehicles (EVs) has further accelerated the need for advanced abrasives capable of machining lightweight materials such as aluminum and composites, which are extensively used in EV manufacturing to improve efficiency and performance. Additionally, the shift toward automated manufacturing processes and Industry 4.0 integration has driven the need for high-precision bonded abrasives that ensure consistent quality and efficiency in automotive component production.

Aerospace segment is expected to grow at the fastest CAGR of 5.0% over the forecast period, driven by the increasing demand for precision-engineered components and advanced manufacturing processes. The aerospace industry requires high-performance materials such as titanium alloys, composites, and superalloys, which necessitate the use of bonded abrasives for grinding, cutting, and finishing operations. The rising production of commercial and defense aircraft, driven by growing air travel demand and military modernization programs, has led to higher consumption of bonded abrasives in component fabrication and maintenance, repair, and overhaul (MRO) activities.

Regional Insights

The North America bonded abrasives industry’s growth is driven by technological advancements in precision manufacturing and automation. The strong presence of the aerospace and defense industries fuels demand for bonded abrasives in turbine blade machining, aircraft maintenance, and composite material processing. The rising adoption of additive manufacturing (3D printing) and advanced CNC grinding machines has further increased the need for high-performance abrasives. Additionally, the growth of the automotive sector, particularly in the production of electric and autonomous vehicles, is stimulating demand for precision grinding and finishing solutions. The construction industry's focus on sustainable and energy-efficient buildings has driven the adoption of bonded abrasives in cutting and polishing concrete, glass, and ceramics.

U.S. Bonded Abrasives Market Trends

The U.S. bonded abrasives industry is influenced by high investments in industrial automation and digital manufacturing. The country's well-established aerospace and defense sector relies heavily on bonded abrasives for engine component fabrication, turbine finishing, and structural integrity maintenance. The expansion of the EV market, backed by policies like the Inflation Reduction Act (IRA) and the CHIPS Act, has led to increased demand for abrasives in battery cell manufacturing, lightweight material processing, and semiconductor production. The robust construction industry, with large-scale infrastructure projects and urban redevelopment, is another major growth driver.

Asia Pacific Bonded Abrasives Market Trends

Asia Pacific dominated the bonded abrasives industry and accounted for the largest revenue share of about 54.31% in 2024, driven by rapid industrialization and infrastructure development, particularly in emerging economies such as India, China, and Southeast Asia. The growth of the automotive and electronics industries in the region has increased the demand for high-precision bonded abrasives for metalworking, polishing, and grinding applications. Government initiatives such as "Make in India" and "Made in China 2025" are further fueling investments in manufacturing, thereby boosting market expansion. The rising adoption of automation and smart manufacturing in key sectors, including aerospace and shipbuilding, has driven the need for high-performance bonded abrasives

China bonded abrasives market is expected to witness growth during the forecast period. China is the largest consumer and producer of bonded abrasives, driven by expanding manufacturing, construction, and metal fabrication industries. The country's dominant position in steel production has significantly increased demand for bonded abrasives in grinding and cutting operations. The automotive industry, supported by the shift towards electric vehicles (EVs), requires precision abrasives for battery production, lightweight material processing, and advanced coating applications. Additionally, the aerospace and shipbuilding sectors are witnessing robust growth, necessitating high-performance bonded abrasives for precision machining. Government policies such as “Made in China 2025” promote domestic manufacturing and technological self-sufficiency, fostering investments in high-quality abrasives and automation technologies.

Europe Bonded Abrasives Market Trends

The Europe bonded abrasives industry is shaped by strong industrial and environmental regulations, driving the shift toward sustainable and advanced abrasives. The region's automotive industry, especially in Germany, France, and Italy, remains a key driver, with a strong focus on lightweight materials, electric vehicles, and precision engineering. The aerospace and defense sector, supported by companies like Airbus and Rolls-Royce, demands high-precision bonded abrasives for engine components and composite material machining. The construction industry’s emphasis on energy-efficient and green buildings has increased demand for abrasives in glass processing, concrete cutting, and tile finishing.

Germany bonded abrasives market is projected to grow during the forecast period. Germany, as a leading industrial powerhouse, drives the market growth through its advanced manufacturing, automotive, and aerospace sectors. The presence of global automakers like Volkswagen, BMW, and Mercedes-Benz has created a steady demand for bonded abrasives in precision grinding, polishing, and surface finishing. The machinery and metalworking industry, integral to Germany’s economy, further contributes to market expansion. The country’s aerospace industry, led by Airbus and other key players, requires bonded abrasives for turbine blade manufacturing and composite machining. Additionally, Germany's leadership in medical technology has increased demand for abrasives in the fabrication of high-precision surgical instruments and prosthetics.

Central & South America Bonded Abrasives Market Trends

The Central & South America bonded abrasives industry is driven by expanding automotive and metal fabrication industries, particularly in Brazil, Mexico, and Argentina. The growth of construction and infrastructure development, supported by government investments in urbanization and renewable energy projects, is significantly boosting demand. The rising adoption of automation in manufacturing is also increasing the need for high-precision abrasives. The oil and gas sector, particularly in Brazil and Venezuela, requires bonded abrasives for pipeline maintenance and metal surface preparation. Additionally, rising foreign direct investment (FDI) in industrial manufacturing is further strengthening the regional market.

Middle East & Africa Bonded Abrasives Market Trends

The Middle East & Africa bonded abrasives industry is driven by construction mega-projects, such as Saudi Arabia’s NEOM and the UAE’s smart cities initiatives. The oil and gas industry, a major economic driver in the region, heavily relies on bonded abrasives for pipeline maintenance and drilling operations. Growing manufacturing activities in Egypt, South Africa, and Turkey are further fueling demand. Additionally, the rising adoption of automation and industrial machinery is increasing the need for precision abrasives in metalworking applications. The infrastructure boom in African economies is also boosting demand for bonded abrasives in construction-related applications.

Key Bonded Abrasives Company Insights

Some of the key players operating in the bonded abrasives market include NIPPON RESIBON CORPORATION and Carborundum Universal Limited

-

NIPPON RESIBON CORPORATION is a leading manufacturer of bonded abrasives, recognized for its high-performance grinding and cutting solutions. The company focuses on innovation to develop products that enhance productivity and efficiency across various industrial applications. Its product portfolio includes cutting wheels, grinding wheels, flap discs, and flexible grinding wheels designed for metal fabrication, construction, and automotive industries.

-

Carborundum Universal Limited (CUMI), part of the Murugappa Group, is a global leader in the bonded abrasives market, offering a comprehensive range of abrasive solutions for industrial applications. The company's product offerings include vitrified and resin-bonded grinding wheels, coated abrasives, and cutting tools designed for metalworking, construction, and automotive sectors. CUMI emphasizes technological advancements to enhance product performance, ensuring precision and efficiency in grinding and finishing operations.

Buffalo Abrasives, Abrasives Manhattan are some of the emerging participants in the bonded abrasives market.

-

Buffalo Abrasives specializes in the development and manufacturing of bonded abrasive products for industrial grinding applications. The company offers a diverse range of vitrified and resin-bonded grinding wheels tailored for industries such as aerospace, automotive, and tool manufacturing.

-

Abrasives Manhattan is a well-established player in the bonded abrasives industry, known for delivering high-precision abrasive solutions for a variety of industrial sectors. The company's product range includes grinding wheels, cutting discs, and polishing abrasives, catering to industries such as metalworking, construction, and machinery manufacturing.

Key Bonded Abrasives Companies:

The following are the leading companies in the bonded abrasives market. These companies collectively hold the largest market share and dictate industry trends.

- Nippon Resibon Corporation

- Carborundum Universal Limited

- Buffalo Abrasives

- Abrasives Manhattan

- Marrose Abrasives

- Grinding Techniques Ltd

- SAK Abrasives Limited

- Sia Abrasives Industries AG

- Flexovit

- Saint-Gobain

Recent Developments

-

In July 2023, Saint-Gobain Abrasives introduced a new range of bonded abrasives specifically developed for the aerospace industry. These products are engineered to fulfil the demands of aerospace applications.

-

In May 2021, Blue Sea Capital made an investment in abrasive technology, a prominent supplier of super abrasive products catering to the dental, aerospace, medical, and industrial sectors, aiming to accelerate the company's market growth.

Bonded Abrasives Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 17.68 billion

Revenue forecast in 2030

USD 22.34 billion

Growth rate

CAGR of 4.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea

Key companies profiled

Nippon Resibon Corporation; Carborundum Universal Limited; Buffalo Abrasives; Abrasives Manhattan; Marrose Abrasives; Grinding Techniques Ltd; SAK Abrasives Limited; Sia Abrasives Industries AG; Flexovit; Saint-Gobain

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

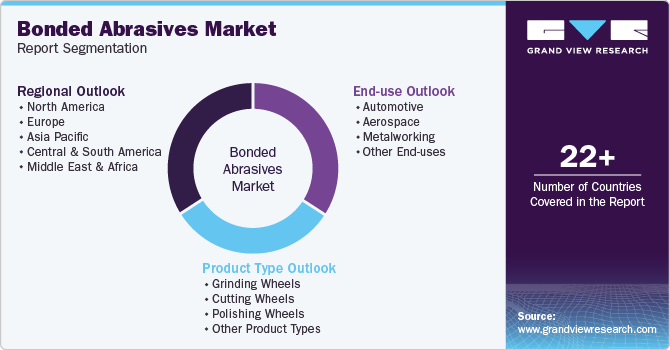

Global Bonded Abrasives Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bonded abrasives market report based on product type, end use, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Grinding Wheels

-

Cutting Wheels

-

Polishing Wheels

-

Other Product Types

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Aerospace

-

Metalworking

-

Other End Uses

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global bonded abrasives market size was estimated at USD 16.9 billion in 2024 and is expected to reach USD 17.68 billion in 2025.

b. The global bonded abrasives market is expected to grow at a compound annual growth rate of 4.8% from 2025 to 2030 to reach USD 22.34 billion by 2030.

b. The grinding wheels segment led the market and accounted for the largest revenue share of 51.27% in 2024, driven by increasing demand across various industries such as automotive, aerospace, metal fabrication, and construction.

b. NIPPON RESIBON CORPORATION, Carborundum Universal Limited, Buffalo Abrasives, Abrasives Manhattan, Marrose Abrasives, Grinding Techniques Ltd, SAK Abrasives Limited, Sia Abrasives Industries AG, Flexovit, and Saint-Gobain are prominent companies in the bonded abrasives market.

b. The key factors driving the bonded abrasives market include rising industrialization, increasing demand from the automotive and aerospace sectors, advancements in manufacturing technology, and growing infrastructure development.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.