- Home

- »

- Pharmaceuticals

- »

-

Bone Density Supplements Market, Industry Report, 2033GVR Report cover

![Bone Density Supplements Market Size, Share & Trends Report]()

Bone Density Supplements Market (2025 - 2033) Size, Share & Trends Analysis Report By Ingredient (Multi-ingredient, Single-ingredient), By Formulation (Tablets, Capsules), By Consumer Group, By Sales Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-809-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bone Density Supplements Market Summary

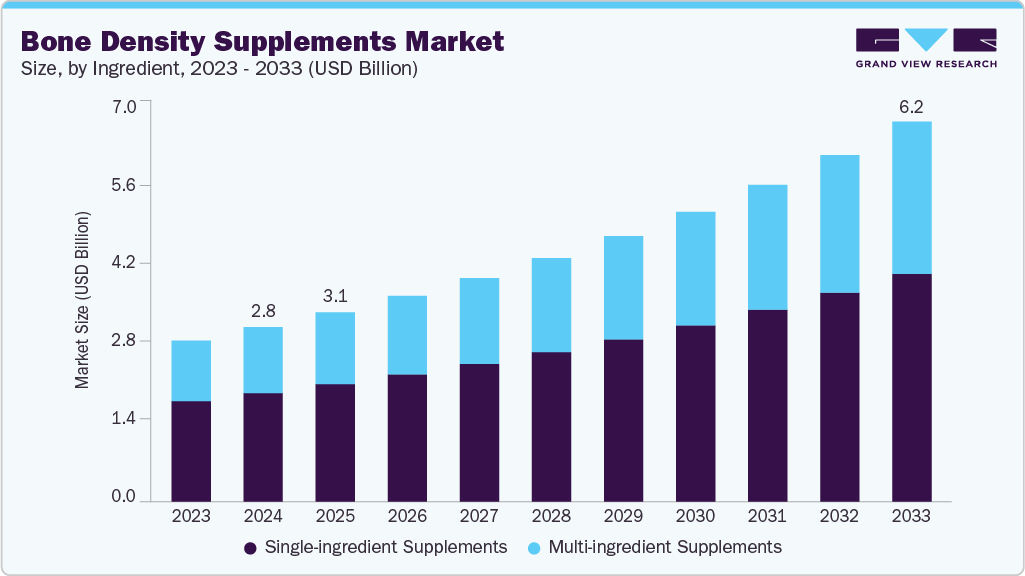

The global bone density supplements market size was estimated at USD 2.83 billion in 2024 and is projected to reach USD 6.17 billion by 2033, expanding at a CAGR of 9.10% from 2025 to 2033. The growing incidence of osteoporosis and other bone-related conditions, combined with increasing awareness of bone health and the global aging population, are the primary factors driving market expansion.

Key Market Trends & Insights

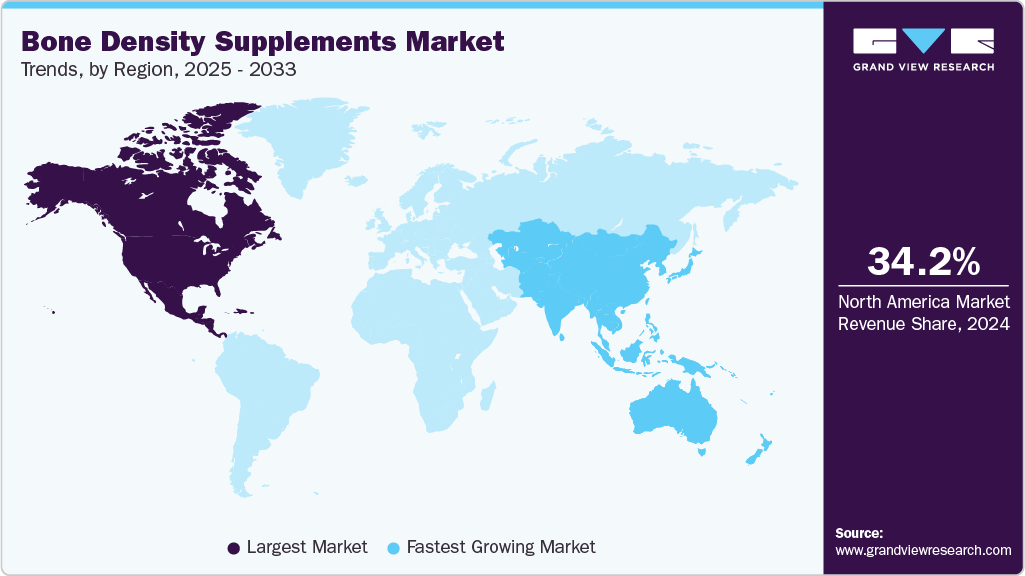

- North America bone density supplements market held the largest share of 34.16% of the global market in 2024.

- The bone density supplements industry in the U.S. is expected to grow significantly over the forecast period.

- By ingredient, the single-ingredient supplements segment held the highest market share of 62.26% in 2024.

- Based on formulation, the tablets segment held the highest market share in 2024.

- By consumer group, the adults segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.83 Billion

- 2033 Projected Market Size: USD 6.17 Billion

- CAGR (2025-2033): 9.10%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Increasing Aging Population

One of the main factors propelling the market is the aging population. Osteoporosis and osteopenia become more common as people age because the natural process of bone deterioration accelerates. Because a decrease in estrogen levels has a major impact on bone mineral density, postmenopausal women are especially vulnerable.

As the number of older adults worldwide continues to rise, an increasing number of people are seeking therapeutic and preventive measures to maintain their bone health. Because life expectancy is higher and people are more aware of age-related health issues, this trend is particularly noticeable in developed areas.

Global Osteoporosis Overview

Category

Key Information

Global Prevalence

Over 200 million people worldwide have osteoporosis.

Age Factor

Incidence increases with age; over 70% of people aged 80+ are affected.

Gender Differences

More common in females than in males. - Developed world: 2-8% of males, 9-38% of females affected.

Fracture Statistics

Approximately 9 million osteoporotic fractures occur globally each year. - 1 in 3 females over 50 will experience a fracture. - 1 in 5 males over 50 will experience a fracture.

Geographical Variation

Higher fracture rates in regions with less sunlight (lower vitamin D levels), compared to areas closer to the equator.

Source: StatPearls, Secondary Research, Grand View Research

The use of bone density supplements is anticipated to increase as governments and healthcare institutions place a greater emphasis on preventive care for age-related conditions. This will position this market segment as a major contributor to the overall market growth throughout the forecast period.

Rising Awareness About Preventive Health

The market for bone density supplements is expanding, largely due to increasing awareness of the importance of preventive healthcare. This change in perspective is especially noticeable among younger and health-conscious populations, who recognize that early intervention through supplementation and nutrition can significantly reduce long-term health risks.

Marketing campaigns and educational initiatives from pharmaceutical companies, health organizations, and supplement brands are also accelerating the use of bone density products. To preserve bone health and prevent age-related deterioration, these campaigns emphasize the importance of essential nutrients, including calcium, vitamin D, magnesium, and vitamin K2. As a result, trends in preventive healthcare are driving a robust and long-lasting demand for bone density supplements worldwide.

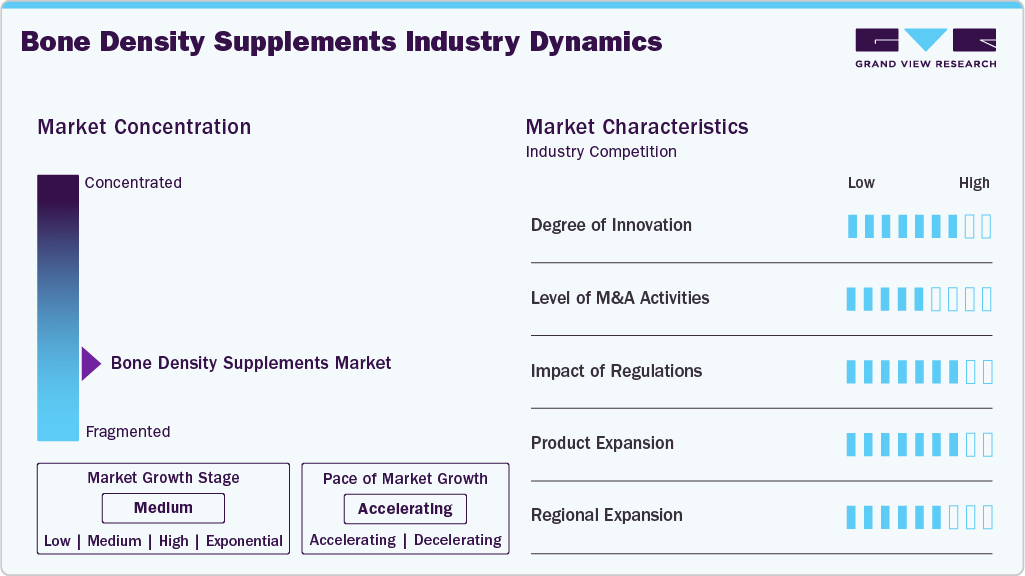

Market Concentration & Characteristics

The bone density supplements industry exhibits high innovation, with companies introducing advanced formulations that include plant-based calcium, collagen peptides, vitamin K2, and probiotics. For instance, in July 2025, Torrent Pharmaceuticals launched Shelcal Total in India, expanding its Shelcal brand with a science-backed, vegetarian, adult nutrition supplement powder targeting bone, joint, and overall health.

As businesses seek to diversify their product lines, strengthen their distribution systems, and expand into new markets, the market for bone density supplements is experiencing a moderate yet steady increase in mergers and acquisitions (M&A) activity. To increase their competitiveness, major players and nutraceutical companies are acquiring smaller brands with innovative formulations or a substantial regional presence. To incorporate cutting-edge ingredients for bone health and enhance research capabilities, mergers and partnerships with biotech companies or ingredient suppliers are also becoming more frequent.

The bone density supplements industry is significantly influenced by regulations, which impact marketing claims, product formulation, and labeling. Product safety, ingredient authenticity, and efficacy validation are ensured by stringent regulations from regulatory agencies such as the U.S. Food and Drug Administration (FDA), the European Food Safety Authority (EFSA), and the Food Safety and Standards Authority of India (FSSAI). Although these frameworks promote openness and consumer confidence, they may also lengthen manufacturers' time to market and raise compliance expenses. All things considered, regulations promote greater product quality and industry standardization, although they may present challenges for new competitors.

As businesses expand their product lines with novel ingredient combinations and fresh delivery methods, the market for bone density supplements is seeing a rapid increase in product growth. To accommodate diverse age groups, lifestyles, and dietary preferences, brands are also expanding into personalized nutrition solutions and functional foods. For instance, in January 2025, Hebrew SeniorLife’s Hinda and Arthur Marcus Institute for Aging Research in the U.S. launched a clinical food trial evaluating Solarea Bio’s probiotic-prebiotic formulation (Bondia/SBD111) for improving bone health in older women.

The bone density supplements industry is expanding regionally as businesses focus on developing nations with aging populations and rising health consciousness. Through distribution agreements, localized product launches, and strategic partnerships, major players are increasing their footprint in the Middle East, Asia-Pacific, and Latin America.

Ingredient Insights

The single-ingredient supplements industry held the largest market share in 2024, driven by increasing consumer awareness of specific deficiencies, such as those in calcium or vitamin D, and rising demand for targeted nutrition. Individuals seeking simpler formulations with fewer additives and personalized health solutions will find these supplements appealing. Moreover, the market is expanding due to the growing number of high-purity, clinically tested single-ingredient products that are more affordable than multi-ingredient blends.

The multi-ingredient supplements segment is expected to grow at the fastest rate during the forecast period, driven by increasing consumer demand for comprehensive bone health solutions that combine essential nutrients. Compared to single-ingredient products, these formulations provide synergistic benefits that enhance bone strength, density, and calcium absorption.

Formulation Insights

The tablets segment dominated the market with a share of 32.93% in 2024 and is also expected to witness the fastest growth over the forecast period, because of their cost-effectiveness, extended shelf life, ease of dosage, and high stability. Consumers widely prefer tablets for their convenience and precise delivery of nutrients. Moreover, advancements in tablet formulation technologies, such as sustained release and easy-to-swallow coatings, are enhancing user compliance and driving continued market growth.

The capsules segment is expected to grow significantly throughout the forecast period, due to their superior bioavailability, ease of ingestion, and ability to encapsulate both liquid and powder formulations. As Capsules absorb more quickly and have less aftertaste than tablets, consumers are increasingly choosing them. Moreover, the increasing popularity of plant-based and gelatin-free capsules corresponds with the rising demand for vegetarian-friendly and clean-label supplement options.

Consumer Group Insights

The adults segment held the largest share of 49.45% in 2024, primarily due to the rising prevalence of bone density loss caused by sedentary lifestyles, poor dietary habits, and increasing awareness of the importance of preventive bone health. The dominance of this market segment has also been reinforced by the broad availability of targeted formulations that address the nutritional needs of adults.

The geriatric population segment is expected to grow at the fastest rate throughout the forecast period. The need for supplements that promote bone strength, mobility, and fracture prevention is increasing among older adults as life expectancy continues to rise worldwide. Growth in this market is also being driven by increasing healthcare awareness and doctor recommendations for collagen, vitamin D, and calcium supplements.

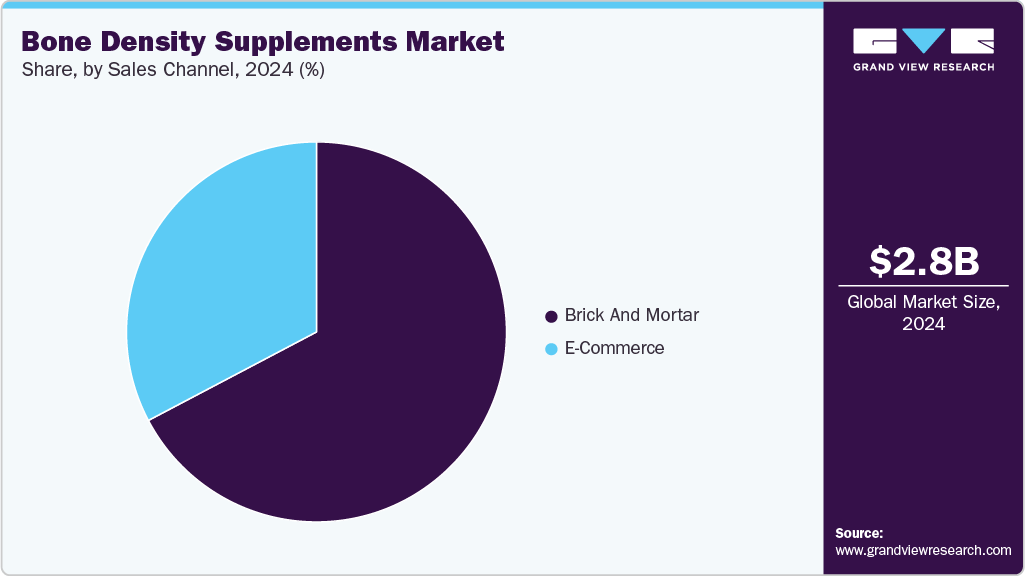

Sales Channel Insights

The brick-and-mortar segment captured the largest market share in 2024, owing to consumers' preference for in-person purchasing, where they can verify product authenticity, seek expert guidance, and compare multiple brands. For bone density supplements, pharmacies and health stores remain reliable sources, particularly for senior citizens.

The e-commerce segment is projected to grow at the fastest rate in the market during the forecast period, driven by the increasing popularity of online retail platforms and rising consumer demand for convenience and home delivery. Younger and tech-savvy consumers are drawn to digital marketplaces because they offer a wider selection of products, straightforward price comparisons, and access to international brands.

Regional Insights

North America bone density supplements market held the largest share of 34.16% of the global market in 2024, due to factors such as an aging population, the increasing incidence of osteoporosis, and growing consumer awareness of preventive healthcare. Companies in the region are focusing on innovative formulations with enhanced bioavailability and clean-label ingredients to meet the evolving preferences of consumers.

U.S Bone Density Supplements Market Trends

The bone density supplements market in the U.S. is experiencing rapid growth due to the rising prevalence of osteoporosis, an aging population, and increased awareness of the importance of bone health. To increase consumer trust and engagement, U.S. companies are focusing on clinically validated products and utilizing digital platforms for personalized nutrition and supplement tracking.

Europe Bone Density Supplements Market Trends

The bone density supplements market in Europe is growing due to the increasing demand for high-quality, clinically supported products, and preventive healthcare initiatives are driving steady market growth. Strict laws ensure safety and transparency, while partnerships between manufacturers and researchers drive innovation in plant-based calcium and bioavailable vitamin D.

The UK bone density supplements market is growing due to increasing awareness of osteoporosis and vitamin D deficiency, which is driving demand for bone-supporting supplements and fortified foods, supported by robust e-commerce growth.

The bone density supplements market in Germany is expected to experience significant growth, driven by a robust healthcare infrastructure and high consumer awareness of dietary supplementation. The presence of established pharmaceutical and nutraceutical manufacturers also supports research-driven product launches, further strengthening market growth.

Asia Pacific Bone Density Supplements Market Trends

The bone density supplements market in the Asia Pacific is expanding with the fastest CAGR of 11.14%, driven by urbanization, aging populations, and rising health awareness. Demand is supported by the increased emphasis on calcium and vitamin D intake in nations like China, Japan, and India. In response to the region's demand for natural, practical health solutions, local players are offering reasonably priced, locally sourced, herbal-based products, such as those containing ashwagandha and soy isoflavones. For instance, in July 2023, Oriflame India launched two Wellosophy health supplements-Iron Complex and Calcium with Vitamin D and Magnesium, developed in Sweden to support women’s health and bone density in India.

China bone density supplements market is growing as preventive healthcare initiatives and integration of traditional medicine are boosting supplement diversity and trust.

The bone density supplements market in Japan is experiencing significant growth, driven by continuous innovation in bioavailable calcium and vitamin K2 products, supported by extensive clinical research, which is strengthening Japan's position as a leader in the Asia Pacific bone density supplement landscape.

MEA Bone Density Supplements Market Trends

The bone density supplements market in the Middle East and Africa is growing with rising awareness of bone disorders and vitamin D deficiency. Increased healthcare investments, educational programs, and the expansion of retail and online channels are driving the adoption of these solutions.

Kuwait bone density supplements market is at an early stage. The growing collaboration among healthcare providers, research institutions, and nutraceutical companies is expected to strengthen the regional market outlook further and drive innovation in bone density supplementation.

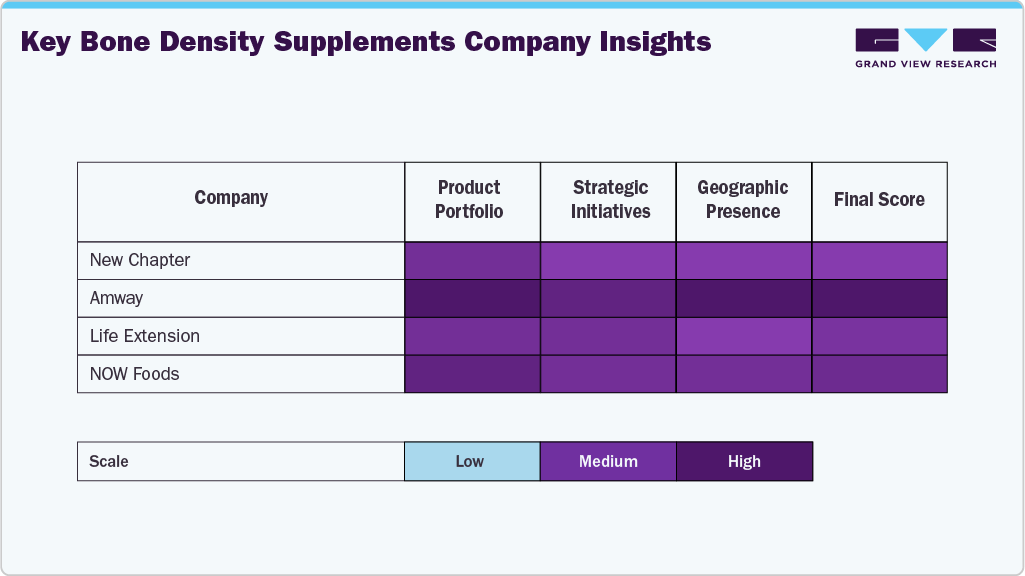

Key Bone Density Supplements Company Insights

The bone density supplements industry is characterized by the presence of several well-established players that maintain strong market positions through diverse product portfolios, scientific validation, and strategic brand positioning. Leading companies such as New Chapter, Nature Made, Nature’s Bounty, Amway, and Life Extension have built substantial market share by offering clinically supported formulations designed to enhance bone health and prevent age-related bone loss.

Companies like Thorne, Solgar Inc., Pure Encapsulations, LLC, Glanbia plc, and NOW Foods are expanding their footprint by focusing on premium, clean-label, and science-backed supplements that cater to the growing demand for personalized nutrition. The bone density supplements industry is witnessing a dynamic convergence of established nutraceutical giants and innovative wellness brands.

Key Bone Density Supplements Companies:

The following are the leading companies in the bone density supplements market. These companies collectively hold the largest market share and dictate industry trends.

- New Chapter

- Nature Made

- Nature's Bounty

- Amway

- Life Extension

- Thorne.

- Solgar Inc.

- Pure Encapsulations, LLC.

- Glanbia plc

- NOW Foods

Recent Developments

-

In October 2025, U.S.-based Amway announced a USD 12 million investment in India to expand retail stores, boost exports, and strengthen local manufacturing and distribution networks over the next five years.

-

In August 2025, Wellness Innercell expanded into the Indonesian market by launching its flagship health supplement, “Joint Care,” on home shopping channels to strengthen its presence in Southeast Asia.

-

In August 2025, India-based Rasayanam launched its advanced Vitamin D3+K2Vitals supplement, featuring plant-based D3 and patented K2VITAL DELTA from Balchem, USA, to enhance bone strength and cardiovascular health.

Bone Density Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.08 billion

Revenue forecast in 2033

USD 6.17 billion

Growth rate

CAGR of 9.10% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Ingredient, formulation, consumer group, sales channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

New Chapter; Nature Made; Nature's Bounty; Amway; Life Extension; Thorne; Solgar Inc.; Pure Encapsulations, LLC.; Glanbia plc; NOW Foods

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bone Density Supplements Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global bone density supplements market report based on ingredient, formulation, consumer group, sales channel, and region:

-

Ingredient Outlook (Revenue, USD Million, 2021 - 2033)

-

Multi-ingredient Supplements

-

Single-ingredient Supplements

-

Calcium Supplements

-

Magnesium Supplements

-

Vitamin D Supplements

-

Collagen Supplements

-

Others

-

-

-

Formulation Outlook (Revenue, USD Million, 2021 - 2033)

-

Tablets

-

Capsules

-

Powders

-

Softgels

-

Others

-

-

Consumer Group Outlook (Revenue, USD Million, 2021 - 2033)

-

Children

-

Adults

-

Pregnant Women

-

Geriatric Population

-

-

Sales Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Brick And Mortar

-

Direct Selling

-

Chemists/Pharmacies

-

Health Food Shops

-

Hypermarkets

-

Supermarkets

-

-

E-Commerce

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.