- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Bran Market Size, Share, Trends & Growth Report, 2030GVR Report cover

![Bran Market Size, Share & Trends Report]()

Bran Market (2023 - 2030) Size, Share & Trends Analysis Report By Source (Wheat, Rice, Corn, Barley), By Application (Food, Animal Feed, Health & Wellness), By Distribution Channel (B2B, B2C), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-091-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bran Market Size & Trends

The global bran market size was estimated at USD 69.56 billion in 2022, expanding at a compound annual growth rate (CAGR) of 8.5% from 2023 to 2030. Factors such as growing consumer awareness towards the importance of a healthy lifestyle and diet coupled with a shift towards the consumption of whole and natural foods are the major factors propelling the demand for bran. Bran is rich in antioxidants, minerals, dietary fiber, and vitamins making it an important ingredient for promoting well-being and digestive health. Furthermore, growing consumer awareness of the health benefits of a high-fiber diet has prompted several companies to incorporate ingredients rich in fiber.

Increasing concerns over the risk of diabetes, heart diseases, and hypertension linked to the consumption of processed foods have led to a rise in the consumption of different types of bran such as corn, rice, wheat, and barley. Additionally, the addition of bran in cereal-based products can improve water absorption and reduce loaf volume in food applications such as bran flakes, pasta, noodles, and biscuits.

Rising consumer interest in digestive health has increased demand for foods rich in dietary fiber and prebiotic fiber. The easy availability of prebiotic fiber and its incorporation into a wide range of applications such as supplements, cereals, bread, and snacks are driving the demand for bran. For example, in January 2023, Puratos, a food manufacturer based in the United States, announced the launch of a new ingredient that offers prebiotic benefits by utilizing fermented AXOS (Arabinoxylan oligosaccharides). This fiber is typically sourced from bran derived from barley, wheat, and rye, and is fermented with lactic acid.

Rising cases of gluten intolerance are boosting the demand for bran derived from gluten-free grains. For instance, as per the National Institute of Health (NIH), close to 2 million in the U.S. suffer from celiac disease. The rising cases of gluten intolerance have compelled companies to explore gluten-free alternatives for food and bakery applications. For example, researchers at the U.S. Department of Agriculture Research Service (ARS) have discovered that sorghum bran (gluten-free grain) provides a nutritional boost to breads and other bakery products while preserving the flavor.

Additionally, the rising demand for nutritious extruded snacks is propelled by the demand for bran in the food and beverage industry. The usage of bran in the production of extruded snacks has a beneficial effect on the nutrient composition of the products as its increases the level of bioactive compounds, fiber, and protein in the products. For example, in March 2020, Kellogg’s announced the launch of an all-bran cereal with prebiotic fiber. The cereal is available in pumpkin seeds, almonds, and original flavor.

Source Insights

The rice bran segment showcased the fastest CAGR of 8.4% during the forecast period. Rice bran has a high caloric content, protein, vital fatty acids, and minerals in its nutritional profile. It contains sufficient nutrients to encourage animal growth, development, and overall health. The rise in the number of research studies and initiatives towards the use of rice bran in animal health is positively impacting the segment’s growth. For instance, a study by North Carolina State University showcased that the usage of stabilized rice bran in the diet of piglets can improve the growth-to-feed ratio and increase the level of benefits without the usage of antibiotics. In terms of source, the market is segmented into wheat, rice, corn, barley, and others.

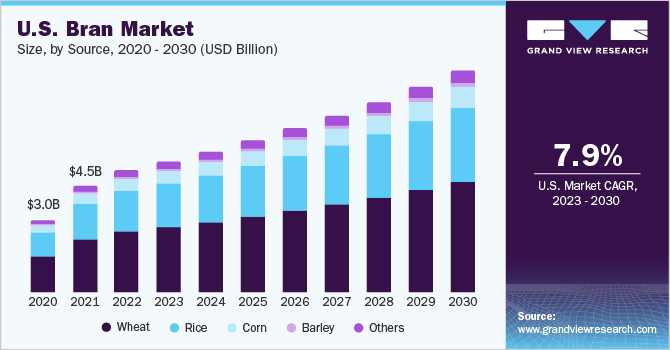

The wheat bran segment holds the largest share of 49.64% in 2022 owing to rising applications of wheat bran in diverse applications. Changing dietary patterns coupled with changes in lifestyle is driving the demand for fiber-rich wheat bran products. Additionally, advances in milling technology and machinery have also boosted the segment. For instance, Choyal Group, a Rajasthan-based provider of flour grinding tools utilizes its patented technology to make flour accessible to companies using its custom ground-to-order tools.

Application Insights

The food segment is anticipated to hold the largest share of 48.01% in 2022. The rising trend of incorporating fiber-rich grains in baked goods is anticipated to drive the demand for bran in baked goods. The use of bran in baked goods allows manufacturers to improve the fiber content thereby encouraging consumers to increase their fiber intake. By using bran, the bakery industry can provide products that contribute to a healthy diet and address the needs of consumers concerned about fiber consumption. For example, in May 2023, Kirin Holdings partnered with Kellogg’s Japan to introduce a functional food for its All-bran portfolio.

The blend for the functional food contains lactic strain Plasma and dietary fiber derived from wheat bran. The breakfast cereals segment is expected to expand significantly at a CAGR of 9.4% during the forecast period due to growing awareness of the nutritional benefits offered by these products, as well as diverse flavors and ease of usage in meals. In May 2023, Kellogg’s announced the launch of cereal in maple flavor. The breakfast cereal includes vitamins, 16 grams of whole grain, and fiber. In addition, heavy marketing by companies operating in the industry is also creating awareness among consumers thereby associating bran-based products with health and wellness.

Distribution Channel Insights

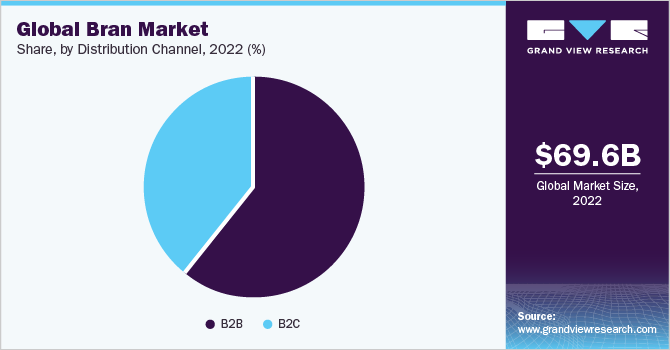

The B2B segment holds the largest share of 61.01% in 2022. The growing demand for healthier food products has encouraged manufacturers in the industry to seek bran to enhance the nutritional profile of their products. In addition, the easy incorporation of bran in snacks, cereals, animal feed, and baked goods drives the demand for bran. Food manufacturers catering to specific dietary needs incorporate bran as an ingredient in their products to meet the requirements of these consumer segments. The distribution channel segment is bifurcated into B2B and B2C segment.

The B2C segment is anticipated to expand at a CAGR of 8.2% during the forecast period. The B2C segment includes online channels, supermarkets, hypermarkets, specialty stores, and other convenience stores. The availability of a wide range of bran products from various brands and suppliers in the online channel has led to an increase in demand. Consumers can easily compare prices, access reviews, and select from a diverse selection of bran options, including different types such as wheat bran or oat bran. This accessibility and variety offered by the online channel play a significant role in driving the demand for bran.

Regional Insights

The Asia Pacific market held a dominant revenue share of 59.05% in 2022 owing to the region’s large production capacity of grains coupled with favorable farming conditions for produce such as wheat, rice, and other grains. Additionally, the growing populace coupled with changing dietary preferences is also influencing the demand for bran derivatives in the region. The demand for rice bran oil in India has surged due to disruptions in oil storage and supply disruptions. In response to the rising urban demand, companies such as Emam, Adani Wilmar, and Cargill's India-based unit have launched their own rice bran oil brands. This demonstrates their recognition of the market potential and their efforts to cater to evolving consumer preferences.

Furthermore, China’s bran market held a revenue share of 15.94% owing to a large consumer base and rising demand for bran-based products. Favorable initiatives by the government coupled with rising consumer demand for healthier oils is promoting the demand for bran in the country. For instance, in 2020 the government created the National Rural Industry Development Plan (2020-2025) to encourage the usage of rice byproducts such as husk, bran, and other derivatives.

The North America bran market is expected to expand at a CAGR of 7.6% from 2022 to 2030, primarily driven by strong market penetration in developed economies like the U.S. and Canada. Consumers in these regions show a willingness to pay higher prices for products made with natural and organic ingredients. Moreover, corn bran is widely utilized as an ingredient in several household applications, further contributing to the market's expansion. The increased usage of corn bran in a variety of applications is a key factor propelling its market growth.

Europe is expected to witness a steady growth rate of 8.2% owing to the increasing consumer awareness and demand for naturally sourced food products. The growing consumption of breakfast cereals and rising awareness towards sustainably sourced ingredients are the primary factors driving the demand for bran in the region. For instance, the introduction of new flavors, textures, and blends of breakfast cereals aims to attract consumers.

Key Companies & Market Share Insights

Competition among companies is expected to be intense in the global bran market, primarily due to the presence of numerous players in the industry. In response to changing consumer trends, several companies are expanding their product portfolios to gain a competitive advantage. Key players in the market include Riceland Foods, Inc., Wilmar International Limited, Archer Daniels Midland Company, Hindustan Animal Feeds, Astra Alliance, Siemer Milling Company, Didion Inc., Grain Millers Inc., Grain Processing Corporation, and others.

Bran manufacturers are placing significant emphasis on research and development (R&D) and technological advancements to create new products that align with market trends such as non-GMO and organic preferences. Their aim is to offer cost-effective, high-quality products that cater to evolving consumer demands. Additionally, market participants are actively engaging in strategies such as forming joint ventures, pursuing mergers and acquisitions, and establishing partnerships. For instance, in March 2022, Ardent Mills announced the opening of its state-of-the-art facility in Florida. The facility will produce whole wheat, bread flour, and high-gluten cake. Some of the prominent players in the global bran market include:

-

Ardent Mills

-

Riceland Foods, Inc.

-

Wilmar International Limited

-

Archer Daniels Midland Company

-

Hindustan Animal Feeds

-

Astra Alliance

-

Siemer Milling Company

-

Didion Inc.

-

Grain Millers Inc.

-

Grain Processing Corporation

Bran Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 75.46 billion

Revenue forecast in 2030

USD 133.17 billion

Growth rate

CAGR of 8.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilo tons, revenue in USD billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand, South Korea; Brazil; Argentina, South Africa, UAE

Key companies profiled

Ardent Mills; Riceland Foods, Inc.; Wilmar International Limited; Archer Daniels Midland Company; Hindustan Animal Feed; Astra Alliance; Siemer Milling Company; Didion Inc.; Grain Millers Inc; Grain Processing Corporation

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bran Market Report Segmentation

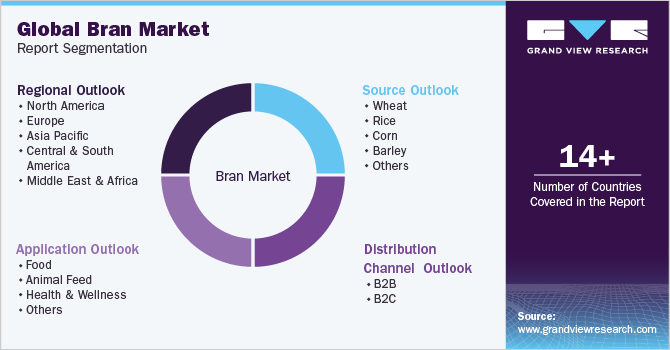

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global bran market report on the basis of source, application, distribution channel, and region:

-

Source Outlook (Volume, Kilo Tons; Revenue, USD Billion, 2017 - 2030)

-

Wheat

-

Rice

-

Corn

-

Barley

-

Others

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Billion, 2017 - 2030)

-

Food

-

Bakery Goods

-

Breakfast Cereals

-

Pasta & Noodles

-

Oil

-

Others

-

-

Animal Feed

-

Health & Wellness

-

Others

-

-

Distribution Channel Outlook (Volume, Kilo Tons; Revenue, USD Billion, 2017 - 2030)

-

B2B

-

B2C

-

Online

-

Hypermarkets/Supermarkets

-

Specialty Stores

-

Others

-

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global bran market size was estimated at USD 69.56 billion in 2022 and is expected to reach USD 75.46 billion in 2023.

b. The global bran market is expected to grow at a compound annual growth rate of 8.5% from 2022 to 2030 to reach USD 133.17 billion by 2030.

b. The Asia Pacific market held a dominant revenue share of 59.05% in 2022 owing to the region’s large production capacity, driven by favorable conditions and agricultural practices.

b. Some of the key market players in the bran market are Ardent Mills ,Riceland Foods, Inc , Wilmar International Limited , Archer Daniels Midland Company , Hindustan Animal Feeds, Astra Alliance, Siemer Milling Company, Didion Inc., Grain Millers Inc, and Grain Processing Corporation

b. The rising popularity of plant-based diets has boosted the market growth. The growing food service sector, improved production efficiency, and enhanced supply chain infrastructure have increased the popularity of Bran in diverse applications.

b. India’s Bran market is expected to grow at the fastest CAGR of 10.4% from 2022 to 2030, driven by increasing awareness of Bran 's nutritional benefits, and the shift towards vegetarian/vegan diets

b. The U.S. Bran market dominated the North America market with a revenue share of 74.6% in 2022. Growing awareness of the nutritional benefits and versatility of bran has led to a rising demand among consumers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.