- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Brazil Dietary Supplements Market, Industry Report, 2030GVR Report cover

![Brazil Dietary Supplements Market Size, Share & Trends Report]()

Brazil Dietary Supplements Market (2025 - 2030) Size, Share & Trends Analysis Report By Ingredients (Vitamins, Botanicals, Minerals), By Form, By Type, By Application, By End Use, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-636-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

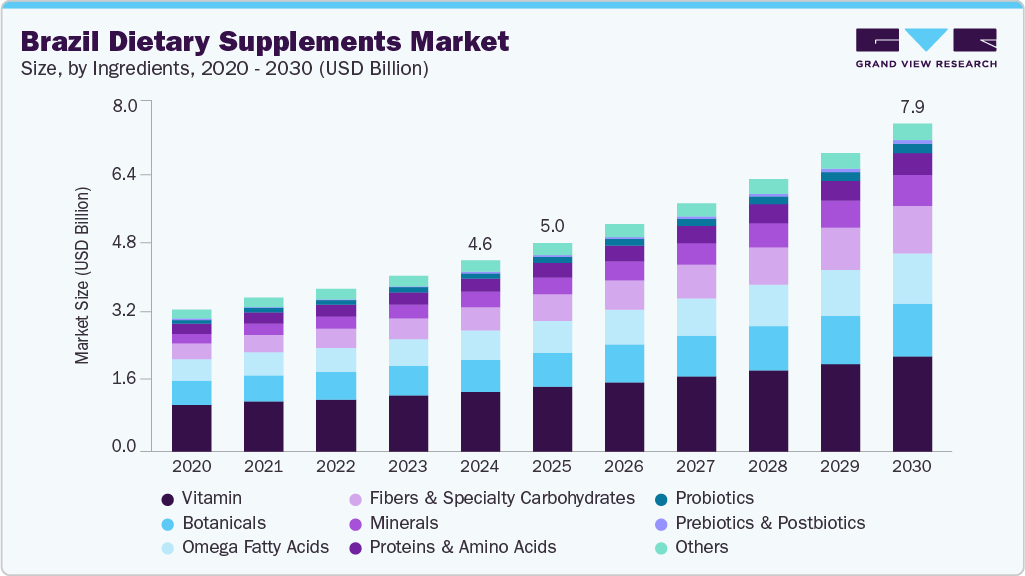

The Brazil dietary supplements market size was estimated at USD 4.62 billion in 2024 and is projected to grow at a CAGR of 9.5% from 2025 to 2030. This is owing to increasing health awareness and an expanding aging population. Consumers are increasingly proactive about maintaining wellness, leading to higher demand for vitamins, minerals, and functional supplements. Older adults, in particular, are turning to products that support bone, heart, and cognitive health. Public health campaigns, media influence, and healthcare provider recommendations further encourage the use of supplements. With Brazil’s population aging steadily, the need for preventative health solutions is rising, making these demographics a significant force behind the market’s ongoing growth and diversification.

Government support and innovation in product formats are expected to drive the growth of Brazil's dietary supplements industry significantly. Regulatory bodies are streamlining ingredient approvals, boosting consumer confidence and encouraging industry expansion. Furthermore, market players are innovating with formats like gummies, powders, gel capsules, and functional beverages to enhance convenience and user experience.

Consumer Insights

Brazilian consumers are becoming increasingly health-conscious, driven by preventive care, fitness, and aging-related health needs. Adults and older populations dominate supplement consumption, while younger consumers show rising interest in wellness products. Vitamins, minerals, immunity boosters, and proteins are popular choices reflecting specific health goals. Traditional offline stores are preferred for trusted guidance, but online channels are also rapidly gaining traction due to convenience and variety. Consumers favor innovative formats like gummies, powders, and natural, plant-based ingredients, signaling a shift toward personalized, convenient, and holistic health solutions in Brazil.

Brazil consumers increasingly seek supplements tailored to lifestyle and specific health conditions, such as digestive health, mental well-being, and enhancing and maintaining healthy skin. Trust in brand reputation and certification plays a crucial role in purchase decisions. There is a growing demand for clean-label products free from artificial additives. Social media and influencer recommendations heavily influence choices of younger consumers. Packaging convenience and product portability are becoming important factors. In addition, environmental sustainability and ethical sourcing are gaining attention, reflecting a broader consumer shift toward responsible consumption in the dietary supplements space. In April 2024, MuscleTech strengthened its partnership with Trust Group to begin local manufacturing operations in Brazil, aiming to enhance market presence, streamline distribution, and cater more effectively to Brazilian consumers.

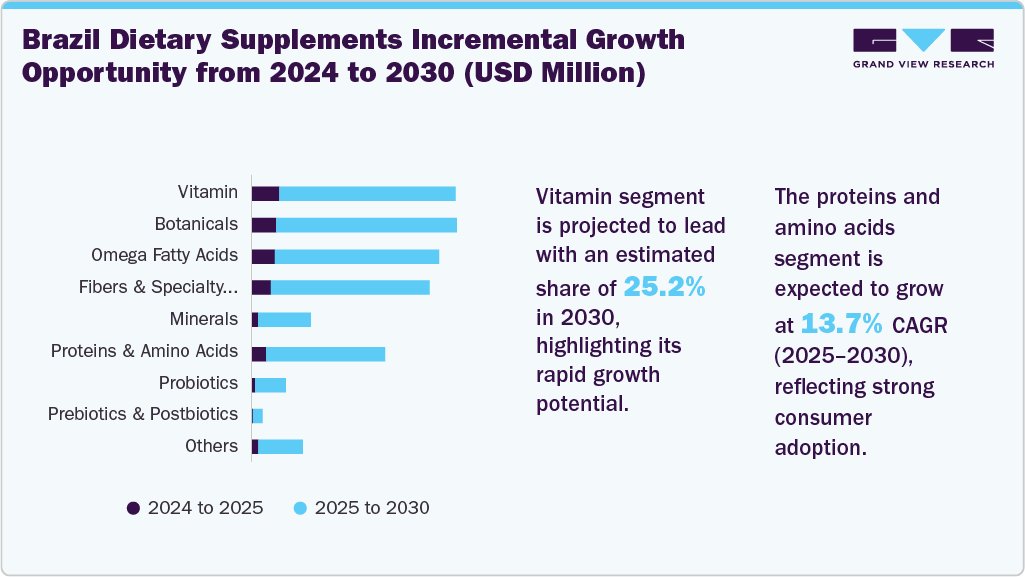

Ingredient Insights

The vitamin segment dominated the market with the largest share of 29.4% in 2024, attributed to rising health consciousness and preventive healthcare trends. Consumers increasingly seek daily multivitamins and targeted supplements like vitamin D, C, and B-complex to boost immunity and energy. Government health campaigns and growing interest in self-care have further fueled demand. Pharmacies and e-commerce platforms offer wide accessibility and product variety. The aging population, along with heightened post-pandemic health awareness, continues to favor the vitamin segment, making it a consumer staple.

The proteins and amino acids segment is projected to be the fastest-growing segment with a CAGR of 13.7% from 2025 to 2030, fueled by increasing fitness culture and demand for muscle recovery and weight management solutions. A surge in gym memberships, influencer-led health trends, and plant-based protein innovations is attracting a wider consumer base. Sports nutrition is no longer niche, with mainstream consumers, including women and older adults, adopting protein supplements for strength and vitality. Growing awareness of personalized nutrition and sustainable protein sources is expected to accelerate market expansion in this dynamic and fast-evolving category.

Form Insights

The tablets segment held the largest revenue share in 2024 due to convenience, extended shelf life, and precise dosage. Consumers favor tablets for vitamins, minerals, and combination supplements because they are portable and easily incorporated into daily routines. Pharmaceutical and nutraceutical companies continue to invest in tablet innovations, enhancing absorption and palatability. The familiarity and trust associated with tablet formats and their strong distribution across drugstores and online channels have made them the go-to choice for a broad demographic, reinforcing their dominance in Brazil’s growing supplement market.

The powders segment is anticipated to grow at the fastest CAGR over the forecast period. Powder-based dietary supplements are gaining traction in Brazil, particularly among fitness enthusiasts, athletes, and health-conscious consumers. Their customizable dosages and faster absorption make them ideal for protein, collagen, and energy blends. Market players are innovating with flavors, functional ingredients, and targeted benefits. With expanding availability in retail and online stores, the powders segment is expected to witness significant growth in the coming years.

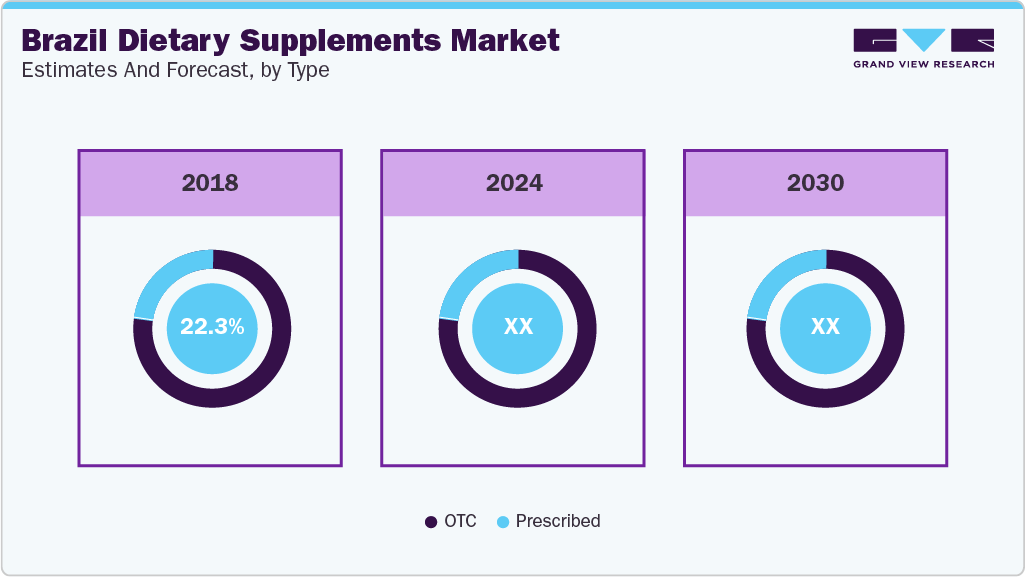

Type Insights

The OTC segment dominated the market in 2024, driven by easy accessibility and growing consumer self-care awareness. OTC supplements, including vitamins, minerals, and general wellness products, are widely available through pharmacies, supermarkets, and online platforms. Convenience, competitive pricing, and diverse product offerings appeal to a broad demographic. Increased health consciousness, an aging population, and the desire for preventive healthcare support sustained demand for OTC supplements. Strong marketing efforts and expanding retail networks further reinforce the dominant position of the OTC segment in the Brazilian dietary supplement industry.

The prescribed segment is expected to grow at the fastest CAGR during the forecast period, propelled by growing medical endorsements. Physicians increasingly recommend supplements tailored to specific health conditions, such as osteoporosis, cardiovascular diseases, and deficiencies. Enhanced clinical evidence and regulatory support boost consumer trust in prescribed supplements. Aging demographics and rising prevalence of chronic diseases encourage medical supervision of supplement intake. Integration of supplements into therapeutic regimens and expanding healthcare access position the prescribed segment for substantial growth in Brazil’s evolving dietary supplements landscape.

Application Insights

The immunity segment held a significant share in 2024 due to heightened health awareness, especially following the COVID-19 pandemic. Consumers increasingly prioritize products that support immune defense, such as vitamin C, zinc, and elderberry supplements. Widespread concerns about respiratory health and infection prevention have boosted demand across all age groups. Easy availability of supplements through pharmacies, online retailers, and supermarkets, combined with strong marketing campaigns and endorsements by healthcare professionals, has solidified the immunity segment’s dominance in Brazil dietary supplements industry.

The prenatal health segment is anticipated to grow at the fastest CAGR from 2025 to 2030, fueled by increased maternal and fetal nutrition awareness. Pregnant women and women planning pregnancy increasingly seek specialized vitamins and minerals like folic acid, iron, and DHA to support healthy development. Rising healthcare initiatives, improved prenatal care access, and greater focus on preventive maternal health contribute to the growth of this segment. Brands are innovating with organic and clean-label prenatal formulas to meet consumer preferences. Growing education on pregnancy wellness and postpartum recovery is expected to contribute to expanding the prenatal health segment.

End Use Insights

The adult segment dominated the market with the largest share in 2024, propelled by increasing health awareness among working-age consumers. Adults seek supplements that support immunity, energy, joint health, and stress management amid busy lifestyles. The segment benefits from diverse product availability, including multivitamins, proteins, and specialty supplements, accessible through pharmacies and online stores. Rising disposable incomes and preventive healthcare trends encourage regular use of supplements. Marketing efforts targeting adults and aging millennials further strengthen the position of this segment in Brazil’s expanding dietary supplements market.

The infant segment is projected to be the fastest-growing segment over the forecast period, attributed to rising parental focus on early childhood nutrition and health. Increased awareness of probiotics, vitamins, and DHA for cognitive and immune development is driving demand. Healthcare professionals recommend supplements to address nutritional gaps in infants’ diets. Moreover, enhanced product safety regulations and innovation in baby-friendly formulations are expected to boost consumer confidence and increase the demand. Expanding pediatric care access and growing e-commerce channels make infant supplements more accessible, positioning this segment for significant expansion in Brazil's dietary supplements industry.

Distribution Channel Insights

Offline distribution channels led the market with the largest share in 2024 due to the strong presence of pharmacies, health stores, and supermarkets across urban and rural areas. Consumers value the in-person consultation, instant product availability, and trust associated with buying from physical stores. Established retail chains often offer bundled deals, promotions, and personalized recommendations. For many consumers, especially older adults, offline shopping ensures product authenticity and immediate access. These factors contribute to the offline segment's continued dominance in Brazil’s growing and health-conscious dietary supplements market.

The online distribution channel segment is anticipated to grow over the forecast period, owing to rising internet penetration, digital payment adoption, and convenience-driven shopping behavior. E-commerce platforms offer vast product variety, easy price comparisons, and doorstep delivery, appealing to tech-savvy and younger consumers. Post-pandemic health awareness has accelerated online supplement purchases. Brands leverage influencer marketing, personalized recommendations, and subscription models to boost engagement. Growing trust in online pharmacies and regulatory improvements are also expected to propel the growth of the online segment in Brazil's dietary supplements industry.

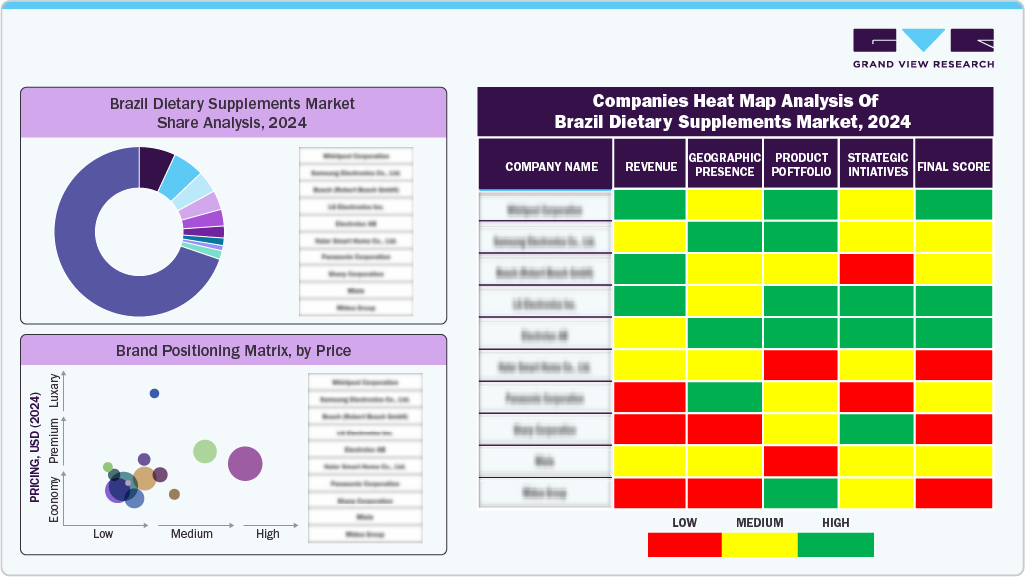

Key Brazil Dietary Supplements Company Insights

Some key companies operating in the market include Goodhealth, RBK Nutraceuticals, Nu Skin, GSK plc., Amway, NOW Foods, DuPont, and Nature's Sunshine Products, Inc.

-

GSK plc offers a wide range of pharmaceuticals, vaccines, and consumer healthcare products. It focuses on preventing and treating diseases in areas like respiratory health, infectious diseases, immunology, and oncology across global markets.

-

Amway offers health, beauty, and home care products through a direct-selling model. Its offerings include dietary supplements, skincare, personal care items, and household solutions. The company promotes wellness and entrepreneurship across over 100 countries.

Key Brazil Dietary Supplements Companies:

- Goodhealth

- RBK Nutraceuticals

- Nature's Sunshine Products, Inc.

- Nu Skin

- GSK plc.

- Amway

- NOW Foods

- DuPont

Recent Developments

-

In July 2024, NXT USA, in partnership with Infinity Pharma Brazil, announced the launch of Digexin in Brazil, under the brand name Motility in Brazil. Made from okra pod and winter cherry root extracts, it supports gut health, digestion, and bowel regularity, while improving stress, sleep, mood, and energy.

-

In February 2024, Kilyos Nutrition expanded its product range in Brazil by introducing Superba Krill oil from Aker BioMarine, aiming to supply the ingredient to leading dietary supplement brands in the country.

Brazil Dietary Supplements Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.62 billion

Revenue forecast in 2030

USD 7.91 billion

Growth rate

CAGR of 9.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Ingredients, form, type, application, end use, distribution channel, country

Country scope

Brazil

Key companies profiled

Goodhealth; RBK Nutraceuticals; Nature's Sunshine Products, Inc.; Nu Skin; GSK plc.; Amway; NOW Foods; and DuPont.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Brazil Dietary Supplements Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Brazil dietary supplements market report based on ingredients, form, type, application, end use, and distribution channel:

-

Ingredients Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (Selenium, Chromium, Copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

OTC

-

Prescribed

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Boomers

-

Male

-

Female

-

-

-

Geriatric

-

Children

-

Infants

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Hypermarkets/Supermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioner

-

Others (Direct to Consumer, MLM)

-

-

Online

-

Amazon

-

Other Online Retail Stores

-

-

Frequently Asked Questions About This Report

b. The Brazil dietary supplements market size was estimated at USD 4.62 billion in 2024.

b. The Brazil dietary supplements market is projected to grow at a compound annual growth rate (CAGR) of 9.5% from 2025 to 2030.

b. The tablets segment held the largest revenue share in 2024 due to convenience, extended shelf life, and precise dosage. Consumers favor tablets for vitamins, minerals, and combination supplements because they are portable and easily incorporated into daily routines. Pharmaceutical and nutraceutical companies continue to invest in tablet innovations, enhancing absorption and palatability. The familiarity and trust associated with tablet formats and their strong distribution across drugstores and online channels have made them the go-to choice for a broad demographic, reinforcing their dominance in Brazil’s growing supplement market.

b. Some prominent players in the Brazil dietary supplements market include Goodhealth; RBK Nutraceuticals; Nature's Sunshine Products, Inc.; Nu Skin; GSK plc.; Amway; NOW Foods; and DuPont.

b. This is owing to increasing health awareness and an expanding aging population. Consumers are increasingly proactive about maintaining wellness, leading to higher demand for vitamins, minerals, and functional supplements. Older adults, in particular, are turning to products that support bone, heart, and cognitive health. Public health campaigns, media influence, and healthcare provider recommendations further encourage the use of supplements. With Brazil’s population aging steadily, the need for preventative health solutions is rising, making these demographics a significant force behind the market’s ongoing growth and diversification.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.