- Home

- »

- Homecare & Decor

- »

-

Brazil Kitchenware Market Size, Share, Industry Report, 2033GVR Report cover

![Brazil Kitchenware Market Size, Share & Trends Report]()

Brazil Kitchenware Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Cookware, Bakeware, Tableware), By Application (Residential, Commercial), By Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores), And Segment Forecasts

- Report ID: GVR-4-68040-684-1

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Brazil Kitchenware Market Size & Trends

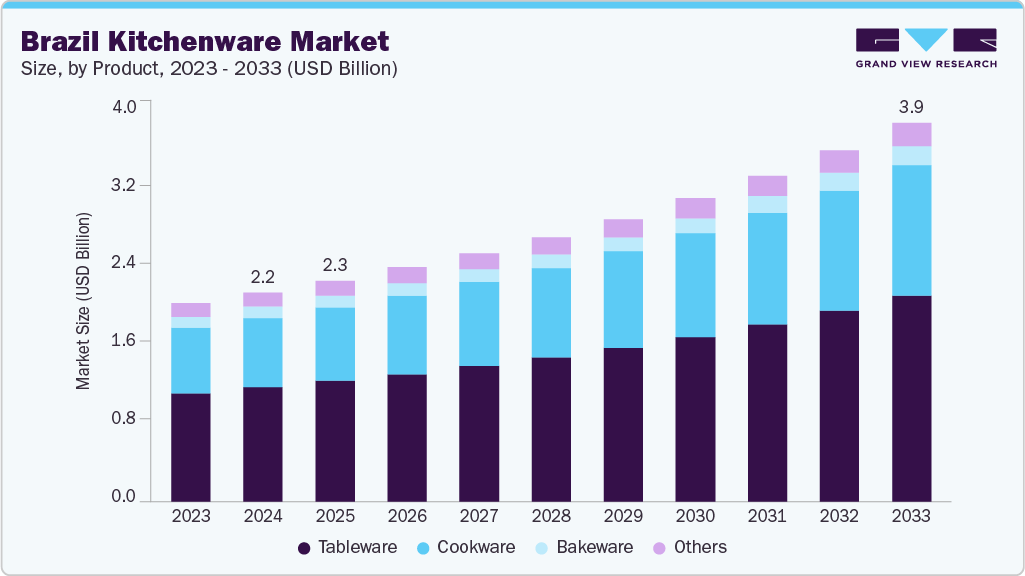

The Brazil kitchenware market size was estimated at USD 2,162.9 million in 2024 and is projected to grow at a CAGR of 7.0% from 2025 to 2033.The kitchenware market in Brazil is experiencing notable growth, driven by a combination of cultural, economic, and lifestyle shifts. Traditional Brazilian cuisine remains a cornerstone of domestic life, and this strong culinary heritage fuels consistent demand for durable and high-quality kitchenware. From cast-iron pans ideal for slow-cooked feijoada to non-stick cookware suitable for healthier preparations, consumers continue to invest in tools that support both everyday cooking and special gatherings. This cultural inclination towards home cooking has been reinforced by a broader return to homemade meals, particularly among urban middle-class families, where cooking also serves as a form of social engagement and personal expression.

In addition, the hospitality and tourism sectors are significant consumers of kitchenware in Brazil. With the growth of tourism and the hospitality industry, there is a steady demand for kitchenware products for use in hotels, restaurants, cafes, and catering services. For instance, in 2023, Brazil's international tourism is on record, with more than 4 million visitors in the first eight months of the year, more than double the number of visitors in 2022. In 2023, international tourists spent USD 6.9 billion in Brazil, which is 39.5% more than in 2022. Thus, the growth of hospitality & tourism further drives the demand for commercial kitchenware market in Brazil.

Urbanization and rising disposable income across Brazil are further propelling the kitchenware industry. As more consumers in cities such as São Paulo and Rio de Janeiro adopt compact lifestyles, there is growing demand for multifunctional and space-saving kitchenware products. Households are increasingly shifting from basic utensils to mid- and high-end cookware and bakeware that offer enhanced durability, design, and functionality.

Moreover, manufacturers are introducing eco-friendly materials such as bamboo, ceramic, and recycled metals to appeal to environmentally conscious consumers. Simultaneously, smart kitchen technologies such as app-connected appliances and energy-efficient cooking tools are gaining traction among tech-savvy urban users. These innovations not only cater to the demand for convenience and aesthetics but also align with the global trend toward sustainable and functional kitchen living, positioning the market for continued growth in the coming years.

Consumer Insights

Consumer insights in the Brazil kitchenware industry reveal diverse preferences shaped by age, income levels, and lifestyle patterns. Among younger urban consumers, especially millennials and Gen Z, there is a marked preference for multifunctional, compact, and aesthetically appealing kitchenware. These groups are drawn to modern materials such as non-stick coated cookware, silicone utensils, and glass containers that combine practicality with visual appeal. Many younger consumers rely on digital platforms for product discovery and are influenced by cooking influencers and social media trends. Their buying behavior often favors convenience, innovation, and eco-friendliness, with increased interest in sustainable products made of bamboo, recycled metal, or ceramic.

Middle-aged consumers, particularly those between 35-55 years, tend to prioritize durability and brand reliability over trendy design. This demographic typically includes working professionals and homemakers who frequently cook at home and invest in long-lasting cookware such as stainless steel or cast-iron products. They often purchase from established brands that offer value, warranties, and quality assurance. These consumers also consider kitchenware as a key element of home improvement and are willing to spend more during seasonal sales or for gift purposes, especially during festive occasions or housewarming events.

In lower-income or rural segments, affordability and basic functionality remain the primary purchase drivers. Consumers in this category often opt for aluminum cookware, simple plastic utensils, or unbranded products due to budget constraints. However, there is a slow but noticeable shift toward better-quality items as awareness grows around health and food safety. Retail formats such as discount stores and street markets remain popular in these regions, although e-commerce is gradually penetrating these areas due to mobile accessibility and promotions. Overall, consumer preferences in Brazil’s kitchenware market are becoming more segmented, with rising aspirations influencing even traditionally price-sensitive groups.

Product Insights

Tableware accounted for a revenue share of about 54.55% of the Brazil kitchenware market in 2024. Brazilian households often host gatherings and family meals, where serving aesthetics play a vital role. As a result, consumers invest in attractive and durable tableware such as ceramic plates, glassware, and cutlery that elevate the dining experience. The demand is especially strong during festive seasons and holidays, when consumers tend to upgrade their dining sets. In addition, rising urbanization and growth in the middle class have expanded demand for contemporary and stylish tableware. The influence of social media, home decor trends, and the growth of the food delivery and home-dining culture have also led consumers to focus more on presentation, further boosting tableware sales.

Demand for cookware is projected to rise at a CAGR of 7.4% from 2025 to 2033 in the Brazil kitchenware industry due to growing consumer interest in home cooking, health-conscious eating habits, and rising disposable income. As more Brazilians prioritize cost-effective, homemade meals, particularly in urban areas, there is increasing demand for high-quality, durable, and non-stick cookware. In addition, the influence of cooking shows, food influencers, and online recipes has encouraged consumers to experiment with various cuisines, prompting purchases of specialized cookware. The rise of nuclear families and modern kitchens also supports the trend toward multifunctional and aesthetically appealing cookware solutions.

Moreover, the integration of technology, such as smart cookware that monitors temperature or connects to recipe apps is attracting tech-savvy users. Sustainability is another key factor, with rising demand for eco-friendly cookware made from recycled metals or ceramic coatings free from harmful chemicals like PFOA or PTFE.

Application Insights

Kitchenware used for residential applications accounted for the revenue share of about 69.74% in Brazil due to the widespread cultural importance of home-cooked meals and daily family dining habits. Brazilian households strongly emphasize preparing traditional dishes at home, which drives consistent demand for cookware, tableware, and utensils. The rise in urban middle-class families, combined with growing health awareness and cost-saving preferences, has further encouraged consumers to cook at home rather than dine out.

Moreover, the popularity of food-related content on social media and digital platforms has inspired more Brazilians to invest in functional and stylish kitchenware, reinforcing demand in the residential segment.

Kitchenware used for commercial applications is estimated to grow at a CAGR of 7.7% over the forecast period, driven by the rapid expansion of the foodservice and hospitality sectors. The rise in restaurants, cafés, hotels, and catering businesses, particularly in urban centers and tourist regions, has fueled the demand for durable, high-capacity, and heat-resistant kitchenware.

Increasing investments in commercial kitchens, cloud kitchens, and institutional foodservice operations are also contributing to this growth. Moreover, the post-pandemic rebound in dining-out culture and events is encouraging foodservice operators to upgrade their kitchen infrastructure, boosting the demand for professional-grade cookware, tableware, and preparation tools across Brazil.

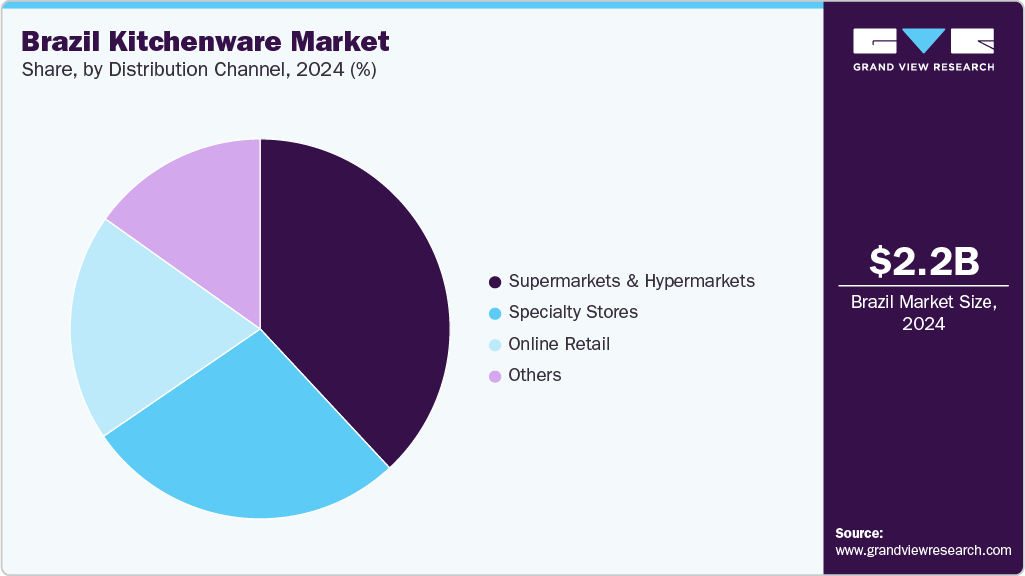

Distribution Channel Insights

Sale of kitchenware through supermarkets and hypermarkets accounted for a revenue share of about 38.07% in 2024.Consumers often choose supermarkets and hypermarkets for kitchenware purchases due to their convenience, wide product selection, and competitive pricing. These one-stop retail destinations allow shoppers to buy groceries and household items in a single trip, saving time and effort. The ability to see, touch, and compare products in person and assistance from in-store staff add to the appeal of physical retail. These stores cater to diverse budgets by offering everything from basic kitchen tools to premium cookware, often accompanied by seasonal deals, bundle offers, and loyalty rewards.

Sale of kitchenware through online retail is expected to grow at a CAGR of 7.7% from 2025 to 2033. Online shopping allows customers to browse and buy anytime, making it especially appealing for busy individuals or those in remote locations. The availability of multiple brands across various price points, exclusive discounts, flash sales, and festive deals appeal to cost-conscious shoppers. Added benefits such as easy returns, doorstep delivery, and secure payment options have further boosted consumer confidence, particularly in the post-pandemic era.

Key Brazil Kitchenware Company Insights

The market includes a mix of established brands and emerging players. Leading companies are proactively adapting to changing trends in kitchenware and expanding their offerings to maintain and strengthen their market position.

-

Groupe SEB is a global leader in cookware and small household appliances, recognized for its diverse portfolio of over 45 brands, including Tefal, Moulinex, Krups, Rowenta, WMF, All-Clad, and Supor. With operations spanning more than 150 countries, the company sells over 344 million products annually, serving a broad and varied consumer base. Its offerings range from kitchen appliances such as coffee makers and blenders to cookware and home care products like vacuum cleaners, irons, and hair dryers.

-

Meyer International Holdings Limited is a prominent global manufacturer and distributor of cookware and kitchenware, with a strong presence in over 30 countries. Its extensive brand portfolio features well-known names such as Circulon, Anolon, Farberware, Rachael Ray, Ruffoni, and BonJour. Meyer offers various products, including tri-ply stainless steel cookware, nickel-free Japanese steel utensils, pre-seasoned cast iron pans, ceramic-coated cookware, and advanced nonstick solutions.

Key Brazil Kitchenware Companies:

- Target Brands, Inc.

- Newell Brands

- Groupe SEB

- Meyer International Holdings Limited

- Tramontina

- The Vollrath Company, LLC

- Lifetime Brands

- Hamilton Beach Brands Holding Company

- Cuisinart

- OXO International, Ltd.

Recent Developments

-

In May 2025, a striking new butterfly-themed cutlery set was introduced in Brazil, featuring knife and fork handles sculpted like tropical butterfly wings. This collection blends artistic design with ergonomic functionality and eco-conscious materials such as recycled 18/10 stainless steel and bamboo-handled pieces. Positioned as premium tableware ideal for gifting or upscale dining, the sets tapped into Brazil’s wellness and social media lifestyles, becoming a hit among design-savvy consumers and hospitality venues.

-

In February 2025, Tramontina, a Brazil-based kitchenware manufacturer and Indian precision manufacturing firm Aequs announced a joint venture to establish a cookware manufacturing facility in India. This collaboration aims to combine Aequs's advanced manufacturing capabilities with Tramontina's extensive cookware production expertise, catering to domestic and international markets. The partnership is expected to bolster India's manufacturing sector and expand Tramontina's global footprint.

Brazil Kitchenware Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2,284.9 million

Revenue forecast in 2033

USD 3,921.8 million

Growth rate (Revenue)

CAGR of 7.0% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel

Country scope

Brazil

Key companies profiled

Target Brands, Inc.; Newell Brands; Groupe SEB; Meyer International Holdings Limited; Tramontina; The Vollrath Company, LLC; Lifetime Brands; Hamilton Beach Brands Holding Company; Cuisinart; OXO International, Ltd.

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Brazil Kitchenware Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Brazil kitchenware market report by product, application, and distribution channel.

-

Brazil Kitchenware Market Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Cookware

-

Pots & Pan

-

Pressure Cooker

-

Microware Cookware

-

-

Bakeware

-

Tins & Trays

-

Cups

-

Molds

-

Pans & Dishes

-

Rolling Pin

-

Others

-

-

Tableware

-

Dinnerware

-

Flatware

-

Stemware

-

-

Others

-

Cooking Racks

-

Cooking Tools

-

-

-

Brazil Kitchenware Market Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

-

Brazil Kitchenware Market Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Online Retail

-

Others

-

Frequently Asked Questions About This Report

b. The Brazil kitchenware market was estimated at USD 2,162.9 million in 2024 and is expected to reach USD 2,284.9 million in 2025.

b. The Brazil kitchenware market is expected to grow at a compound annual growth rate of 7.0% from 2025 to 2033 to reach USD 3,921.8 million by 2033.

b. Tableware products accounted for the largest share of about 54.55% of the Brazil kitchenware market in 2024. This demand is fueled by changing lifestyles, higher disposable incomes, and shifting consumer preferences toward both aesthetic appeal and functional design.

b. Some of the key players in the Brazil kitchenware market is Target Brands, Inc.; Newell Brands; Groupe SEB; Meyer International Holdings Limited; Tramontina; The Vollrath Company, LLC; Lifetime Brands; Hamilton Beach Brands Holding Company; Cuisinart; OXO International, Ltd.

b. The Brazil kitchenware market is driven by a growing preference for home cooking, influenced by post-pandemic habits, health awareness, and cost-saving needs. Urbanization and the rise of smaller households are boosting demand for compact, multifunctional, and space-saving kitchen tools.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.