- Home

- »

- Pharmaceuticals

- »

-

Brazil Sports Nutrition Market Size Report, 2022-2030GVR Report cover

![Brazil Sports Nutrition Market Size, Share & Trends Report]()

Brazil Sports Nutrition Market Size, Share & Trends Analysis Report By Product Type, By Application, By Formulation, By Consumer Group (Age Group & Activity), By Distribution Channel, By End Use, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-912-0

- Number of Report Pages: 159

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Healthcare

Report Overview

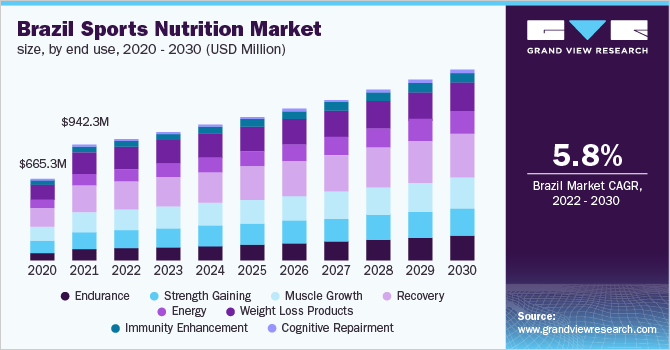

The Brazil sports nutrition market size was valued at USD 942.3 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2022 to 2030. There is a growing prevalence of various lifestyle diseases such as diabetes, cardiovascular diseases, and obesity in Brazil. For instance, according to the International Diabetes Federation, 19.2 million people in Brazil are estimated to suffer from diabetes by 2030. Moreover, according to Brazil’s Ministry of Health, more than half of the Brazilian population was overweight in 2020.

Growing awareness regarding lifestyle diseases and the increasing popularity of preventive medications are increasing the adoption of sports nutrition products. Moreover, a growing number of active lifestyle users adopting sports nutrition products for various applications such as energy and weight management is boosting the market growth potential. Multiple products including gels, bars, RTD drinks, and gummies are easily available for various applications such as pre-workout, post-workout, and during work-out. This, in turn, is driving the adoption of these products.

The COVID-19 pandemic significantly declined the sales of sports nutrition products owing to the closure of gyms and fitness centers. The majority of the consumers in Brazil purchase sports nutrition products based on recommendations by coaches, dieticians, and physical educators. For instance, according to an article published in the Brazil Journal of Nutrition, the main information sources for 36% of the athletes in Brazil were coaches. Moreover, 27.9% of the athletes were dependent on physical educators for supplement consumption.

COVID-19 Brazil sports nutrition market impact: 36.7% decline in revenue growth

Pandemic Impact

Post COVID Outlook

The Brazil sports nutrition market declined by 36.7% from 2019 to 2020. As per earlier projections, the market was expected to be over USD 1 billion in 2020.

In 2021, the market will witness an increase of 41.6% from 2020 due to increasing awareness regarding health and fitness.

Lockdowns and temporary closures of gyms, fitness institutes, and sports training academies resulted in a decline in the adoption of sports nutrition products.

Increasing the adoption of sports nutrition products for energy, immunity enhancement, and weight management by active lifestyle consumers will positively impact the market growth in the near future.

Online sales of sports nutrition products gained traction during the pandemic.

Increasing investments in the industry, along with various strategic initiatives undertaken by key stakeholders, are estimated to increase the adoption of sports nutrition in Brazil.

Thus, the closures of gyms and fitness institutes negatively impacted the adoption of sports nutrition products. Consumers were focused on purchasing essentials due to lockdown, job losses, and economic uncertainty. This, in turn, declined sales of non-essential products such as sports-related goods. However, the pandemic also increased the awareness pertaining to health and physical fitness. Many consumers started consuming supplements to enhance immunity, mental health, and overall health. This, in turn, is estimated to drive the adoption of sports supplements in the near future.

An increasing number of athletes and bodybuilders are adopting supplements due to the benefits such as performance improvement, health improvement, and disease prevention. For instance, according to an article published in the Brazil Journal of Nutrition in 2017, 54.5% of male and 44.4% of female athletes consumed BCAA in Brazil. Additionally, awareness regarding nutrition supplements among Brazilian athletes is growing rapidly. High adoption of supplements such as creatine, protein, bicarbonate, beta-alanine, and caffeine by athletes and bodybuilders is a major parameter driving the market in Brazil.

Brands are offering innovative products using different ingredients and flavors to cater to consumer demand and expand the consumer base. For instance, Probiótica Laboratories Ltda offers Carb Up Energy Beet, a beetroot containing energy drink. Integralmédica Suplementos Nutricionais offers different sports nutrition products in flavors such as vanilla, chocolate, strawberry, banana, cappuccino, coco, grape, cookies and cream, red fruits, coco and chocolate, double chocolate, peanut caramel, passion fruit, and cheesecake.

Various initiatives promoting sports products are supporting the market growth in Brazil. For instance, in April 2021, Fitness Brasil and International Health, Racquet & Sportsclub Association (IHRSA) signed an agreement of event partnership opportunities up till 2026. This partnership aims to navigate challenges and promote the recovery of the sports and fitness industry post-COVID-19 in Brazil. This, in turn, is estimated to positively impact the market growth in Brazil.

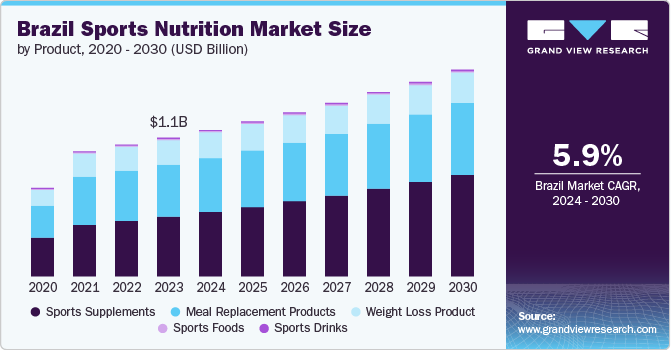

Product Type Insights

Sports supplements held the largest revenue share of over 40.0% in 2021. The high demand for whey proteins is a major parameter fueling the segment growth. Moreover, the increasing popularity of plant-based protein supplements such as soy protein, rice protein, and pea protein supplements is estimated to boost the segment growth in the near future. The adoption of supplements such as vitamins, minerals, and proteins to enhance immunity and maintain health by athletes and active lifestyle users is positively impacting segment growth.

The sports foods segment is expected to expand at a significant growth rate over the forecast period. The availability of a considerable number of sports foods such as bars, waffles, and gels is fueling the segment growth. Additionally, increasing the consumption of protein bars and energy bars as healthy snacking options is fueling the segment growth. Manufacturers are introducing sports foods in innovative flavors to increase consumer demand and product market penetration.

Application Insights

The post-workout segment held the largest revenue share of over 35.0% in 2021. This is attributed to the growing awareness regarding the benefits of post-workout supplements such as increased muscle recovery and rehydration. High consumption of post-workout supplements by athletes and gym-goers is fueling the segment growth. Additionally, the availability of multiple post-workout products that are plant-based is estimated to drive the segment in the near future.

The others application segment is expected to be the fastest-growing application segment during the forecast period. This is attributed to the high demand for weight management products. One of the major factors driving the segment is the high instances of obesity in Brazil. For instance, according to Global Obesity Observatory, 20.3% of the population in Brazil was obese in 2019.

Consumer Group Insights

The adult segment held the largest revenue share of over 65.0% in 2021. It is due to the presence of a large consumer group in this pool. Additionally, increasing health awareness and growing instances of lifestyle disorders are fueling the segment growth. For instance, according to a report published by the World Health Organization in 2018, coronary heart diseases reached 15.6% of total death.

The adult segment is expected to be the fastest-growing segment during the forecast period due to the increasing consumer base for sports nutrition products from athletes and bodybuilders to active lifestyle users. Increasing participation in fitness activities and the adoption of a healthy lifestyle, especially due to the spread of the COVID-19 pandemic, are estimated to fuel the segment growth in the near future. Moreover, the increasing adoption of weight management products by adults is fueling the segment growth.

Consumer Group, By Activity Insights

The light user segment held the largest revenue share of over 70.0% in 2021. An increasing number of millennials are consuming protein bars, energy bars, and RTD drinks, among others, as a healthy snacking option. Moreover, consumers are consuming supplements containing vitamins, minerals, probiotics, and omega-3 fatty acids to maintain health and wellness. All these parameters are fostering segment growth.

Moreover, the light user segment is expected to emerge as the fastest-growing segment during the forecast period. The high demand for supplements from millennials and the geriatric population to enhance energy and weight management is bolstering the segment growth. Additionally, the COVID-19 pandemic has increased the demand for sports supplements improving immunity and mental health. This, in turn, is positively impacting the market growth.

Distribution Channel Insights

The brick and mortar segment accounted for the largest revenue share of over 70.0% in 2021. The presence of a considerable number of retail outlets including specialty stores, small retail stores, fitness institutes, grocery stores, general discount stores, and discount clothing retailers is responsible for the largest market share. Bricker and mortar stores offer benefits such as customer loyalty programs and customer engagement platforms. Moreover, multiple brick-and-mortar stores offer guidance and counseling on supplement consumption. This, in turn, is increasing consumer preference for brick and mortar stores.

The e-commerce segment is expected to grow at a significant rate over the forecast period. The COVID-19 pandemic increased the demand for the online distribution channel owing to the nationwide lockdowns and social distancing norms. Moreover, online retailers are offering multiple discounts and offer to expand their consumer base and increase sales. All these parameters are contributing to the rapid growth of the e-commerce distribution channel segment.

End-use Insights

In 2021, the recovery end-user segment accounted for the largest revenue share of over 20.0%. It is attributed to the growing awareness and adoption of recovery foods and drinks after workouts and increasing spending on supplements. Furthermore, the easy availability of recovery supplements in various formulations and flavors is supporting the market growth. Moreover, the high demand for post-workout supplements is supporting the recovery supplements growth.

Endurance is anticipated to be the fastest-growing end-use segment during the forecast period. Increasing participation in endurance sports is supporting segment growth. Some of the ingredients used in endurance supplements include caffeine, creatinine, beta-alanine, L-carnitine, branched chained amino acids, glutamine, and citrulline. Moreover, botanical ingredients such as beet juice and ashwagandha are gaining traction due to their endurance benefits.

Formulation Insights

The powder segment held the largest revenue share of over 40.0% in 2021 owing to the high consumption of protein powder. For instance, according to an article published in the Brazil Journal of Nutrition in 2017, 54.4% of male athletes consumed whey protein. Moreover, 44.4% of female athletes consumed whey protein. High consumption of whey protein powder is supporting the segment growth.

The gummies segment is expected to emerge as the fastest-growing formulation segment during the forecast period. The availability of healthy gummies in various flavors is supporting the market growth. Additionally, many consumers are suffering from pill fatigue. Such consumers are looking for alternatives such as gummies, thereby fueling the segment growth.

Key Companies & Market Share Insights

Mergers & acquisitions, collaborations, and flavor differentiation are among the key strategies adopted by the key companies for gaining a competitive edge in the market. For instance, in January 2020, Nutry, a company based in Brazil, launched a post-workout protein bar in vanilla flavor. The bar consists of ingredients such as BCAAs, whey protein, minerals, and vitamins. Some prominent players in the Brazil sports nutrition market include:

-

Abbott

-

PepsiCo

-

The Coca-Cola Company

-

MusclePharm

-

Glanbia

-

Integralmédica Suplementos Nutricionais S/A

-

Max Titanium

-

Universal Nutrition

-

Probiótica Laboratories Ltda.

Brazil Sports Nutrition Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 993.1 million

Revenue forecast in 2030

USD 1,560.2 million

Growth Rate

CAGR of 5.8% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, application, formulation, consumer group (age group and activity), distribution channel, end-use

Country scope

Brazil

Key companies profiled

Abbott; PepsiCo; The Coca-Cola Company; MusclePharm; Glanbia; Integralmédica Suplementos Nutricionais S/A; Max Titanium; Universal Nutrition; Probiótica Laboratories Ltda.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research, Inc. has segmented the Brazil sports nutrition market report into product type, application, formulation, consumer group (age group and activity), distribution channel, and end use:

-

Product Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Sports Supplements

-

Protein Supplements

-

Animal-based

-

Whey

-

Casein

-

Egg

-

Fish

-

Others

-

Plant-based

-

Soy

-

Spirulina

-

Pumpkin Seed

-

Hemp

-

Rice

-

Pea

-

Others

-

-

Vitamins

-

Minerals

-

Amino Acids

-

Probiotics

-

Omega -3 Fatty Acids

-

Carbohydrates

-

Detox Supplements

-

Electrolytes

-

Others

-

-

Sports Drinks

-

Isotonic

-

Hypotonic

-

Hypertonic

-

-

Sports Foods

-

Protein Bars

-

Energy Bars

-

Protein Gels

-

-

Meal Replacement Products

-

Weight Loss Products

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Pre-workout

-

Post-workout

-

Weight Loss

-

Others

-

-

Formulation Outlook (Revenue, USD Million, 2017 - 2030)

-

Tablets

-

Capsules

-

Powder

-

Softgels

-

Liquid

-

Gummies

-

-

Consumer Group Outlook (Revenue, USD Million, 2017 - 2030)

-

Children

-

Adult

-

Geriatric

-

-

Consumer Group by Activity Outlook (Revenue, USD Million, 2017 - 2030)

-

Heavy Users

-

Light Users

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Brick and Mortar

-

Specialty Stores

-

Small Retail Stores

-

Fitness Institutes

-

Grocery Stores

-

General Discount Stores

-

Discount Clothing Retailers

-

-

E-commerce

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Endurance

-

Strength Gaining

-

Muscle Growth

-

Recovery

-

Energy

-

Weight Management

-

Immunity Enhancement

-

Cognitive Repairment

-

Frequently Asked Questions About This Report

b. The Brazil sports nutrition market size was estimated at USD 942.3 million in 2021 and is expected to reach USD 993.1 million in 2022.

b. The Brazil sports nutrition market is expected to grow at a compound annual growth rate of 5.8% from 2022 to 2030 to reach USD 1.56 billion by 2030.

b. Sports supplements segment dominated the Brazil sports nutrition market and accounted for the largest revenue share of 41.9% in 2021.

b. Some key players operating in the Brazil sports nutrition market include Abbott, PepsiCo, the Coca Cola Company, MusclePharm,. Glanbia, Integralmédica Suplementos Nutricionais S/A, Max Titanium, Universal Nutrition, and Probiótica Laboratories Ltda.

b. Key factors that are driving the Brazil sports nutrition market growth include growing adoption of supplements and increasing awareness on health.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."