- Home

- »

- Communications Infrastructure

- »

-

Broadcast Equipment Market Size, Industry Report, 2033GVR Report cover

![Broadcast Equipment Market Size, Share & Trends Report]()

Broadcast Equipment Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Dish Antennas, Switches), By Technology (Analog Broadcasting, Digital Broadcasting), By Application (Radio, Television), By Region, and Segment Forecasts

- Report ID: GVR-4-68040-659-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Broadcast Equipment Market Summary

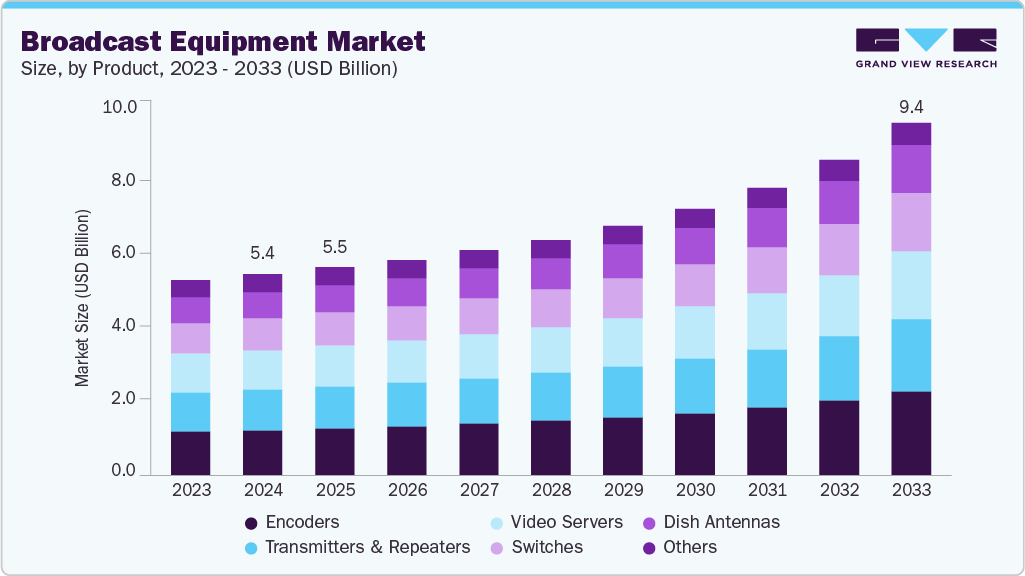

The global broadcast equipment market size was estimated at USD 5.35 billion in 2024 and is projected to reach USD 9.38 billion by 2033, growing at a CAGR of 6.8% from 2025 to 2033. The market is witnessing strong momentum due to the growing appetite for high-definition and ultra-high-definition (UHD/4K) content.

Key Market Trends & Insights

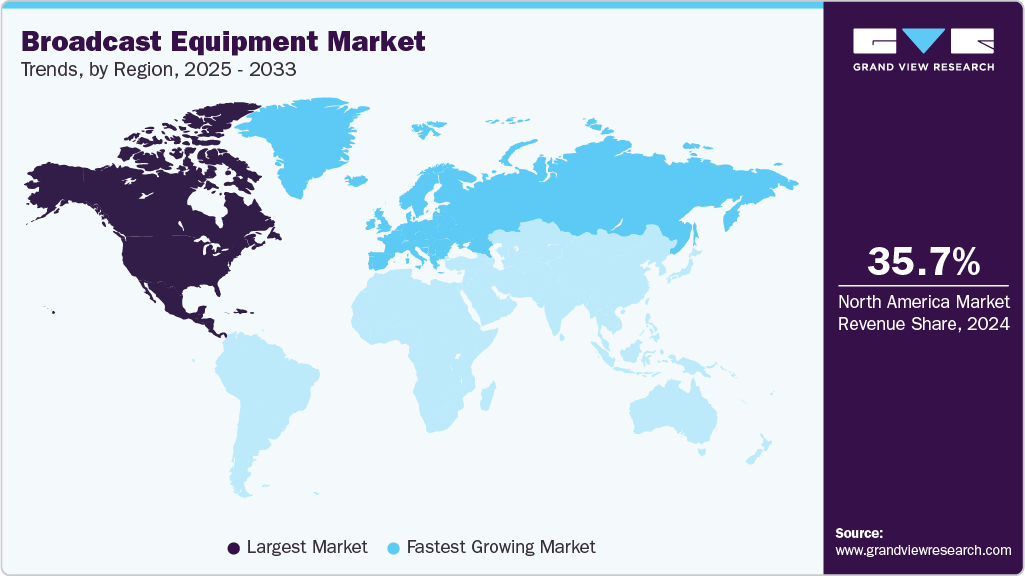

- North America broadcast equipment market accounted for a 35.7% share of the overall market in 2024.

- The U.S. broadcast equipment industry held a dominant position in 2024.

- By product, the encoders segment held the largest share of 22.5% in 2024.

- By technology, the digital broadcasting segment held the largest market share in 2024.

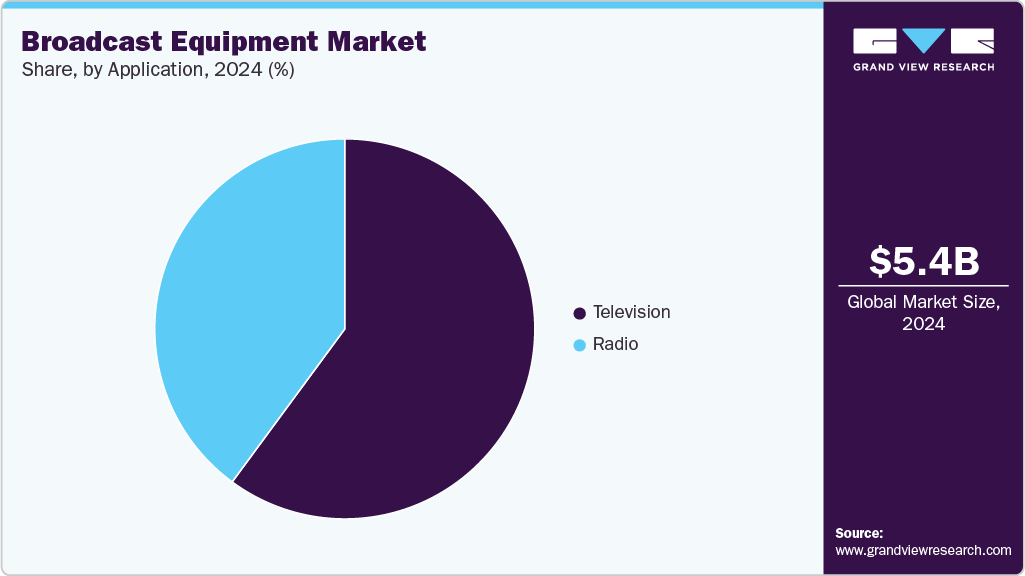

- By application, the television segment dominated the market in 2024

Market Size & Forecast

- 2024 Market Size: USD 5.35 Billion

- 2033 Projected Market Size: USD 9.38 Billion

- CAGR (2025-2033): 6.8%

- North America: Largest market in 2024

Viewers today expect immersive, crystal-clear video quality across platforms, prompting broadcasters to upgrade their infrastructure. This shift has led to widespread investment in advanced encoders, video servers, and cameras capable of supporting higher resolutions. Sports and live event broadcasting especially require precision and clarity, further boosting demand. Broadcasters are also exploring High Dynamic Range (HDR) technology to enhance visual depth and color accuracy. As consumer expectations evolve, so does the pressure to deliver premium-quality visuals.

Traditional broadcast workflows are increasingly giving way to IP-based systems, offering greater flexibility and scalability. By shifting from hardware-centric models to software-defined, IP-enabled environments, broadcasters can reduce operational complexity and costs. This trend is especially relevant in remote and live production settings, where IP infrastructure allows real-time collaboration across geographies. IP-based switches and video routers are becoming core components of modern broadcast studios. As 5G and high-speed connectivity become more prevalent, IP-driven solutions will only gain ground. This transformation is reshaping how content is captured, processed, and distributed.

The explosive rise of OTT platforms such as Netflix, YouTube, and Amazon Prime Video is reshaping the demand curve for broadcast equipment. Unlike traditional broadcasters, OTT players require flexible, cloud-friendly tools that enable fast encoding, transcoding, and delivery of video content across devices. As a result, vendors are developing equipment that supports hybrid workflows, capable of servicing both linear TV and IP-based streaming formats. The need for real-time analytics, adaptive bitrate streaming, and content protection further expands the equipment scope. This evolution has created a parallel demand from broadcasters to remain competitive in a streaming-first world.

The pandemic accelerated a shift toward remote and virtual production, and this trend has now become permanent. Broadcasters are investing in solutions that enable camera control, editing, and switching from offsite locations. This has led to growing adoption of cloud-native broadcast equipment and software, enabling cost-effective and agile production workflows. Virtual studios and augmented reality (AR) overlays are also being integrated to enhance visual storytelling. The need to maintain production continuity without physical studio presence has pushed broadcasters to rethink traditional setups. As the industry matures, remote workflows are proving to be not only feasible but also efficient.

Artificial Intelligence is playing an increasingly pivotal role in broadcast operations. From automated camera tracking to real-time content tagging and speech-to-text conversion, AI is streamlining workflows. Broadcasters are using AI-powered tools to analyze viewer behavior and personalize content delivery, which enhances engagement. In the backend, automation is reducing manual intervention in tasks like asset management and video editing. As broadcasters manage larger volumes of content, intelligent systems offer faster processing and better decision-making support.

Product Insights

The encoders segment dominated the market with a share of 22.45% in 2024. Encoders continue to dominate the market, largely due to the surge in demand for high-resolution video content across traditional and digital platforms. They play a critical role in compressing and converting video signals into efficient formats for transmission and streaming. As broadcasters shift toward 4K and even 8K resolution, advanced encoding technologies like HEVC (H.265) and AV1 are becoming standard. These tools not only reduce bandwidth consumption but also maintain high visual quality, making them essential for both live broadcasting and on-demand services. The rise of OTT platforms and cloud-based workflows has further intensified the need for robust encoding solutions.

The switches segment is expected to grow at a significant CAGR during the forecast period. Switches are emerging as a high-growth segment within the broadcast equipment landscape, particularly as the industry moves away from traditional SDI-based systems toward IP-based production environments. These devices enable efficient signal routing, allowing multiple video and audio sources to be managed dynamically within studios and control rooms. The rise in remote production, live streaming, and virtual events has increased the need for flexible and scalable switching solutions. IP switches, in particular, offer greater integration with cloud platforms and support real-time workflows across distributed teams. As broadcasters modernize their infrastructure to support hybrid production models, the demand for intelligent, low-latency switch systems is accelerating.

Technology Insights

The digital broadcast segment accounted for the largest share in 2024. Digital broadcasting has become the dominant and most rapidly evolving segment in the market, driven by the global shift toward high-quality, spectrum-efficient transmission. It offers significant advantages over analog systems, including superior picture and sound quality, interactive services, and multicasting capabilities. As consumer expectations rise for HD, 4K, and even 8K content across linear TV and streaming platforms, broadcasters are accelerating their adoption of digital broadcast technologies. The growth of IPTV, satellite TV, and digital terrestrial television has further fueled this transition. Digital systems also integrate more easily with cloud and IP-based workflows, making them essential in modern broadcast setups.

The analog broadcast segment is expected to grow at a significant CAGR during the forecast period. Analog broadcasting, once the foundation of television transmission, is now witnessing a gradual decline due to its technological limitations and inefficiency in bandwidth usage. Despite ongoing usage in certain rural or underdeveloped regions where digital infrastructure is not yet fully established, analog systems are increasingly being phased out in favor of more advanced digital alternatives. Its inability to support high-definition content or interactive features has made it less appealing in today’s competitive media landscape. Many governments have initiated digital switchover programs, further accelerating the decline of analog equipment.

Application Insights

The television segment held the largest market share in 2024. Television remains the dominant and fastest-growing application in the market, driven by rising global demand for high-definition video content and live event coverage. The surge in digital TV, OTT streaming, and hybrid broadcasting models has led broadcasters to invest heavily in modern equipment such as 4K encoders, video servers, and IP-based production systems. Viewers are consuming more content across multiple screens, prompting broadcasters to upgrade infrastructure for seamless, cross-platform delivery. Technological innovations such as virtual sets, real-time graphics, and AI-assisted editing are further transforming television production workflows.

The radio segment is expected to register the fastest CAGR during the forecast period. Radio broadcasting, while still relevant in many regions, is experiencing slower growth in the market due to evolving listener habits and the shift toward digital media consumption. Traditional AM/FM radio has seen declining listenership as audiences migrate to streaming audio, podcasts, and satellite radio platforms. As a result, investment in new radio broadcast infrastructure has become limited, with most upgrades focused on digital radio (such as DAB and HD Radio) in select markets. Although radio remains an accessible and low-cost medium, especially in rural and developing areas, its influence is gradually waning.

Regional Insights

The North America broadcast equipment industry dominated globally, and accounted for 35.7% of the global revenue share in 2024. The region’s growth is driven by the presence of major broadcasting corporations, high adoption of digital broadcasting standards, and increasing investments in 4K and IP-based production systems. Furthermore, media companies are collaborating with technology vendors to streamline remote production workflows and expand OTT content delivery. For example, in August 2023, Grass Valley partnered with cloud-native broadcast companies to support live production for U.S. sports events. These advancements, along with the growing consumption of digital content, are fueling demand for next-generation broadcast equipment.

U.S. Broadcast Equipment Market Trends

The U.S. broadcast equipment industry held a dominant position in 2024. The U.S. industry maintained a dominant position in 2024, supported by a tech-savvy population, strong presence of broadcasting conglomerates, and aggressive rollout of IP-based and cloud-native broadcast infrastructure. Television networks and streaming platforms are investing in AI-enabled editing, live UHD transmission, and virtual production technologies to enhance viewer engagement and operational efficiency. Companies like Evertz Microsystems and Harmonic Inc. have expanded their portfolios to include flexible, software-defined solutions.

Europe Broadcast Equipment Market Trends

The Europe broadcast equipment industry was identified as a lucrative region in 2024. The market in Europe remained lucrative in 2024, with countries such as Germany, the UK, and France at the forefront of digital transformation. The adoption of Digital Video Broadcasting (DVB) standards and the transition to IP-based workflows have accelerated across public and private broadcasters. Companies such as Rohde & Schwarz and EVS Broadcast Equipment are leading deployments of modular, scalable broadcast solutions. Despite regulatory constraints like the GDPR influencing data use in audience analytics, European broadcasters are leveraging automation, cloud-based editing, and AI-assisted playout systems to increase efficiency.

The UK broadcast equipment industry is thriving amid significant investment in digital content production and broadcast modernization. The BBC, ITV, and other public broadcasters are upgrading to IP-compatible studios and remote production suites to align with sustainability and cost-efficiency goals.

Asia Pacific Broadcast Equipment Market Trends

The Asia Pacific broadcast equipment industry held a significant share in 2024. Countries such as China, India, Japan, and South Korea are investing heavily in 4K/8K infrastructure and remote production capabilities. The widespread availability of mobile devices, internet connectivity, and growing OTT platforms are pushing broadcasters to adopt agile, cloud-integrated systems. Regional broadcasters are partnering with global tech vendors to deploy scalable encoding, storage, and signal distribution solutions.

The broadcast equipment industry in China held a substantial market share in 2024. Major players like CCTV and state-backed networks are deploying advanced encoding and transmission technologies to meet rising demand for high-quality content across satellite, cable, and internet platforms. The rise of domestic streaming services such as iQIYI, Tencent Video, and Bilibili is also driving infrastructure upgrades.

The broadcast equipment industry in Japan held a significant share in 2024. Japan was among the early adopters of 8K technology, and broadcasters like NHK are leading in trialing next-generation formats. As Japan prepares for upcoming global events and invests in disaster-resilient broadcasting infrastructure, the demand for remote production, AI-based editing tools, and cloud-based workflows is rising.

Key Broadcast Equipment Company Insights

Some of the key companies in the broadcast equipment industry include Harmonic Inc., Cisco Systems, Inc., EVS Broadcast Equipment SA, Grass Valley, Telefonaktiebolaget LM Ericsson, and others. To gain a competitive edge and expand their market share, these players are actively pursuing strategic initiatives such as partnerships with major broadcasters and streaming platforms, acquisitions of niche media technology startups, and integration with IP-based and cloud-native broadcasting ecosystems. These collaborations enable broadcast equipment providers to enhance their technological capabilities by offering AI-driven content automation, real-time signal processing, and advanced video compression solutions.

-

Harmonic is one of the prominent leader in video delivery infrastructure, offering cutting-edge video compression, cloud-native broadcasting, and OTT streaming solutions. The company is at the forefront of the industry's transition toward IP-based workflows, 4K/8K encoding, and software-defined video platforms. It serves top broadcasters, cable operators, and streaming platforms worldwide.

-

Cisco Systems Inc. plays a key role in the digital transformation of broadcast infrastructure, specializing in IP networking, video transport, and media-centric data center solutions. Cisco enables broadcasters to migrate from SDI to IP seamlessly, supporting cloud-scale media delivery and virtualization. Its global reach and strong partnerships with broadcasters make it a market-shaping player.

Key Broadcast Equipment Companies:

The following are the leading companies in the broadcast equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Harmonic Inc.

- Telefonaktiebolaget LM Ericsson

- Grass Valley

- Cisco Systems Inc

- Datum Systems

- OMB Broadcast

- EVS Broadcast Equipment SA

- Clyde Broadcast

- Global Invacom Group Limited

- Sencore

Recent Developments

-

In April 2024, Hollyland Technology launched the Pyro Series, a new line of wireless video transmission systems, with the Pyro H as its first product. The Pyro H features dual-band 2.4 GHz and 5 GHz technology, offering a transmission range of up to 1,300 feet with only 60ms latency. It supports one transmitter to four receivers, allowing real-time, multi-user monitoring with modes for either stability or high-definition output. Designed for ease of use, it includes HDMI input, smart product scanning, USB-C/DC/NP-F power options, and plug-and-play UVC streaming. Capable of transmitting 4K and Full HD video, the Pyro H targets diverse applications including film, live events, broadcast, and houses of worship.

-

In February 2024, VMware announced that DISH Wireless has deployed VMware Telco Cloud Service Assurance across its Boost Wireless Network for real-time 5G network monitoring and automation. The solution enables DISH’s Network Operations Center (NOC) to oversee over 20,000 cell sites, offering tools like automated cell site topology discovery, multi-site monitoring, and AI-driven alarm management. These capabilities help the team isolate issues, maintain deployment continuity, and enhance network performance without manual intervention. DISH is also testing integration with ServiceNow to streamline service ticketing.

Broadcast Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.53 billion

Revenue forecast in 2033

USD 9.38 billion

Growth rate

CAGR of 6.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Harmonic Inc.; Telefonaktiebolaget LM Ericsson; Grass Valley; Cisco Systems Inc; Datum Systems; OMB Broadcast; EVS Broadcast Equipment SA; Clyde Broadcast; Global Invacom Group Limited; Sencore

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

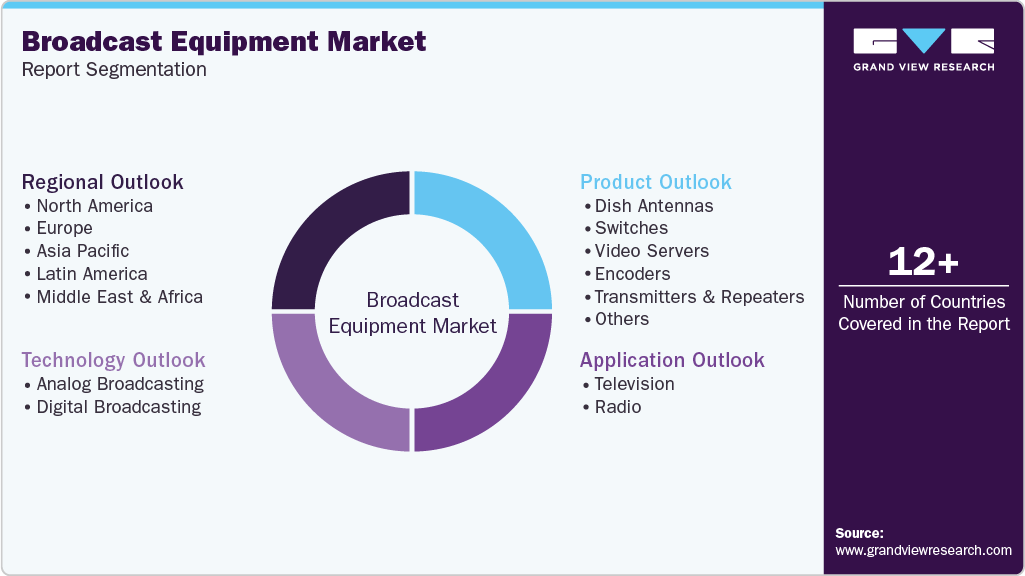

Global Broadcast Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global broadcast equipment market report based on product, technology, application, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Dish Antennas

-

Switches

-

Video Servers

-

Encoders

-

Transmitters and Repeaters

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Analog Broadcasting

-

Digital Broadcasting

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Television

-

Radio

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

United Arab Emirates (UAE)

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global broadcast equipment market size was estimated at USD 5.35 billion in 2024 and is expected to reach USD 5.53 billion in 2025.

b. The global broadcast equipment market size is expected to grow at a significant CAGR of 6.8% to reach USD 9.38 billion in 2033.

b. The North America market accounted for 35.7% which is the largest share of the overall market in 2024. The region’s growth is driven by the presence of major broadcasting corporations, high adoption of digital broadcasting standards, and increasing investments in 4K and IP-based production systems.

b. Some of the key companies in the broadcast equipment market include Harmonic Inc., Telefonaktiebolaget LM Ericsson, Grass Valley, Cisco Systems Inc, Datum Systems, OMB Broadcast, EVS Broadcast Equipment SA, Clyde Broadcast, Global Invacom Group Limited, and Sencore.

b. The growth of the market is attributed to the growing demand for high-definition and IP-based content transmission across live and on-demand platforms.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.